III. Model specification of

willingness to pay

To measure WTP, this paper uses the contingent valuation

method consisting of directly asking respondents the amount they are disposed

to pay for a potential scenario of improving local leadership aiming for

instance at fighting against its disappearance or to anticipate its damageable

parts. It is an enquiry-based method frequently used to measure the monetary

value on non-market environmental good and services (Djemaci, 2010). Here, the

method is set on a referendum enquiry.

The method «contingent valuation» requires that

replies recorded follow a bidding scenarios process. Proposed scenarios are

possible but not certain to occur since they vary from an individual to

another. Contingent valuation entails a change in the notable's utility that

can be monetary valued and obtained by the maximum amount that a respondent

accepts to forgo for achieving a given good. Le Gall-Ely (2010) views CVM as a

surveying method helping to capture some psychological price. In such a case,

deems Le Gall-Ely (2010), biases are higher resulting from an overestimation of

WTP. However, previous scholars suggest that questions referring to starting

price have yielded more considerable results than open-ended questions

(Donaldson et al., 1997) cited by Dror, Radermacher and Koren et al. (2006).

«Take-it-or-leave-it» method is basically viewed as a dichotomous

trade-off on suggested amounts. In fact, Dong et al. (2004) deemed that

variance in responses results from some extent from the selection by

respondents. The biding game consisting of presenting several prices varying

from relatively higher to lower prices and the respondent choses if he is ready

to pay a given set biding price, a process realized on all alternatives until

the respondent accepts the bid.

Moreover, the interval regression method was applied to assess

WTP in various WTP assessment studies. In that boat it is used to estimate

hypothetical values of the real goods or/and services (Lang, 2010). The method

as developed by Hanemann is advised when the correlation coefficient exceeds

0,7 (Alberini, 1995) instead of the bivariate probit model initially

established to measure WTP. It is set on the response between the first and the

second bid (Corso et al., 2013; Labii, 2015).

As dummy questions are asked in the survey, it is suggested an

amount to an individual. If the individual accepts to disburse under that

price, a higher amount is directly advanced for his trade-off. On the other

hand, if he rejected the first bid, then a lower amount is immediately proposed

under his trade-off.

Furthermore, based on how the model was specified by Corso et

al. (2013) when assessing the benefits of preventing child maltreatment death

in Ecuadorian population and, also, its adoption by Labii (2015);the current

research model evolves as follows:

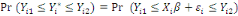

The WTP value,  of of   individual is translated by the model individual is translated by the model   where where   is a random disturbing term and normally distributed with a mean zero

(hypothetical) and is a random disturbing term and normally distributed with a mean zero

(hypothetical) and   corresponds to individual respondent characteristics. As corresponds to individual respondent characteristics. As   is not direclty observed, the respondent's WTP interval location lies

between both bounds is not direclty observed, the respondent's WTP interval location lies

between both bounds  . Then, the corresponding likelihood contribution becomes: . Then, the corresponding likelihood contribution becomes:

(1) (1)

When an upper bound is unknown, that is the right-censored

data is unknown; the likelihood affected is

(2) (2)

Whereas when a lower bound (left-censored), a lower bound is

set at zero and the likelihood contribution is:

(3) (3)

From there is taken out a summarizing situation of all

possibilities to be registered over the bids. Four patterns are classified from

the dichotomous trade-off: «Yes» to both the first and the second

question (Y, Y), «Yes» to the first question and «No» to

the second proposing a higher amount(Y,N); «No» to the first and

«Yes» to the second (N,Y), in case the lower value, and

«No» to both values (N,N).

Scenarios imply the following likelihood distribution

according to measuring WTP. But before proceeding, let's assume an individual

to whom is fist propose an amount to whom is fist propose an amount  . If admitted, a higher amount . If admitted, a higher amount   is again proposed. In contrast, if the first was not accepted, a lower

amount is again proposed. In contrast, if the first was not accepted, a lower

amount   is then advanced. is then advanced.

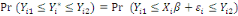

Ø When both answers are positive, that is to say that

the individual  's willingness to payis higher than 's willingness to payis higher than   Differently said, the superior bound is unknown; data are

right-censured and the likelihood ( Differently said, the superior bound is unknown; data are

right-censured and the likelihood (  ) noticed that their WTP to be located in the interval is ) noticed that their WTP to be located in the interval is

Ø If then the first answer is positive and the second

negative (accounting for the upper bound), willingness to pay is located

between the lower bound   and the upper bound. And the associated likelihood is given by and the upper bound. And the associated likelihood is given by

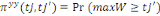

Ø Therewith, if the first answer is no and the second

no to both bids, one's willingness to pay is under   and the likelihood to and the likelihood to

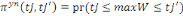

Ø At last, when the individual   answers no to the first and yes to the second, it means his maximum WTP

is located between answers no to the first and yes to the second, it means his maximum WTP

is located between   and and   In the context, the likelihood of locating WTP in the interval is given

by In the context, the likelihood of locating WTP in the interval is given

by   . .

|