Annexes

Cours de société :ALLIANCE

|

Colonne1

2016-04-04

|

Colonne2

505

|

dividende

|

Colonne4

-1.94%

|

|

2016-05-02

|

500

|

|

-0.99%

|

|

2016-06-01

|

500

|

35

|

7.00%

|

|

2016-07-04

|

475

|

|

-5.00%

|

|

2016-08-01

|

465

|

|

-2.11%

|

|

2016-09-05

|

465

|

|

0.00%

|

|

2016-10-04

|

465

|

|

0.00%

|

|

2016-11-03

|

470

|

|

1.08%

|

|

2016-12-05

|

465

|

|

-1.06%

|

|

2017-01-02

|

465

|

|

0.00%

|

|

2017-02-01

|

465

|

|

0.00%

|

|

2017-03-01

|

465

|

|

0.00%

|

|

2017-04-03

|

450

|

|

-3.23%

|

|

2017-05-02

|

445

|

|

-1.11%

|

|

2017-06-05

|

445

|

45

|

10.11%

|

|

2017-07-03

|

400

|

|

-10.11%

|

|

2017-08-02

|

420

|

|

5.00%

|

|

2017-09-04

|

420

|

|

0.00%

|

|

2017-10-02

|

420

|

|

0.00%

|

|

2017-11-02

|

420

|

|

0.00%

|

|

2017-12-04

|

420

|

|

0.00%

|

|

2018-01-02

|

420

|

|

0.00%

|

|

2018-02-05

|

420

|

|

0.00%

|

|

2018-03-05

|

420

|

|

0.00%

|

|

2018-04-02

|

425

|

|

1.19%

|

|

2018-05-03

|

425

|

|

0.00%

|

|

2018-06-04

|

430

|

|

1.18%

|

|

2018-07-02

|

430

|

45

|

10.47%

|

|

2018-08-01

|

395

|

|

-8.14%

|

|

2018-09-03

|

410

|

|

3.80%

|

|

2018-10-02

|

420

|

|

2.44%

|

|

2018-11-04

|

420

|

|

0.00%

|

|

2018-12-02

|

426

|

|

1.43%

|

|

2019-01-02

|

427

|

|

0.23%

|

|

2019-02-03

|

429

|

|

0.47%

|

|

2019-03-03

|

449

|

|

4.66%

|

|

2019-04-02

|

431

|

|

-4.01%

|

|

rendement

|

|

|

0.08%

|

|

variance

|

|

|

0.17%

|

|

ecart type

|

|

|

4.14%

|

103

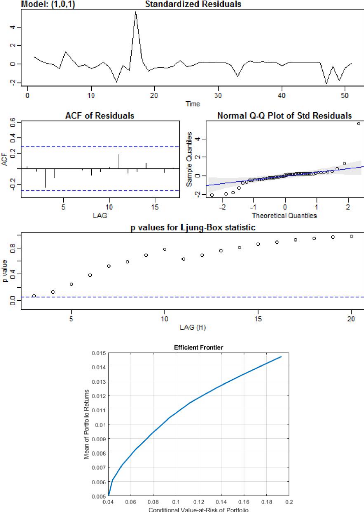

En utilisant les instruction de R : Les

cours:

>rouiba=c(365,375,375,375,370,360,380,380,375,370,360,355,355,345,315,315,300,390,370,370,350,350,335,3

35,335,330,325,325,325,325,325,325,320,300,300,300,300,300,300,300,295,295,295,295,295,295,295,266,266,

240,240,235)

>time_series=ts(rouiba,start = 2015,end = 2019,frequency=12)

>plot(time_series)

>time_series = ts(biopharm,

start=2016,end=2019,frequency=12) >plot(time_series , main= `biopharm

`,xlab= `year', ylab='cours')

biopharm

2016 2017 2018 2019

Time

Test de dickey-fuller surdzindex :

>library(urca)

>r=diff(log(dzindex))

>x=ur.df(r,type='trend',lag=1);summary(x)

############################################### # Augmented

Dickey-Fuller Test Unit Root Test #

###############################################

Test regression trend

Call:

lm(formula = z.diff ~ z.lag.1 + 1 + tt + z.diff.lag)

Residuals:

Min 1Q Median 3Q Max

-0.068868 -0.019320 -0.004815 0.010043 0.136536

Coefficients:

Estimate Std. Error t value Pr(>|t|)

|

(Intercept) 2.449e-03

|

9.864e-03

|

0.248 0.805

|

|

|

|

|

z.lag.1 -9.712e-01

|

2.107e-01

|

-4.610 3.21e-05 ***

|

|

|

|

|

tt 4.274e-05

|

3.272e-04

|

0.131 0.897

|

|

|

|

|

z.diff.lag -5.160e-02

|

1.466e-01

|

-0.352 0.726

|

|

|

|

|

Signif. codes: 0 `***'

|

0.001 `**'

|

0.01 `*' 0.05 `.' 0.1

|

`

|

'

|

1

|

Residual standard error: 0.03334 on 46 degrees of freedom

Multiple R-squared: 0.515, Adjusted R-squared: 0.4834

104

F-statistic: 16.28 on 3 and 46 DF, p-value: 2.381e-07 Value of

test-statistic is: -4.6102 7.0895 10.6341

|

Critical values for test statistics:

1pct 5pct 10pct

|

|

tau3

|

-4.04 -3.45

|

-3.15

|

|

phi2

|

6.50

|

4.88

|

4.16

|

|

phi3

|

8.73

|

6.49

|

5.47

|

Test de dickey-fuller sur ROUIBA :

>rouiba=c(365,375,375,375,370,360,380,380,375,370,360,355,355,345,315,315,3

00,390,370,370,350,350,335,335,335,330,325,325,325,325,325,325,320,300,300,

300,300,300,300,300,295,295,295,295,295,295,295,266,266,240,240,235)

>r=diff(log(rouiba))

>x=ur.df(r,type='trend',lag=1);summary(x)

############################################### # Augmented

Dickey-Fuller Test Unit Root Test #

###############################################

Test regression trend

Call:

lm(formula = z.diff ~ z.lag.1 + 1 + tt + z.diff.lag)

Residuals:

Min 1Q Median 3Q Max

-0.092416 -0.015044 -0.000449 0.015047 0.257674

Coefficients:

Estimate Std. Error t value Pr(>|t|)

|

(Intercept) 0.0006850

|

0.0145024

|

0.047 0.963

|

|

|

|

|

z.lag.1 -1.1186352

|

0.2343856

|

-4.773 1.95e-05 ***

|

|

|

|

|

tt -0.0004370

|

0.0005008

|

-0.873 0.387

|

|

|

|

|

z.diff.lag -0.1067734

|

0.1480586

|

-0.721 0.475

|

|

|

|

|

Signif. codes: 0 `***'

|

0.001 `**'

|

0.01 `*' 0.05 `.' 0.1

|

`

|

'

|

1

|

Residual standard error: 0.04844 on 45 degrees of freedom

Multiple R-squared: 0.6304, Adjusted R-squared: 0.6058 F-statistic: 25.59 on 3

and 45 DF, p-value: 8.206e-10

Value of test-statistic is: -4.7726 7.6036 11.3987

|

Critical values for test statistics:

1pct 5pct 10pct

|

|

tau3

|

-4.04 -3.45

|

-3.15

|

|

phi2

|

6.50

|

4.88

|

4.16

|

|

phi3

|

8.73

|

6.49

|

5.47

|

Test de dickey-fuller sur SAIDAL:

>SAIDAL=c(560,560,560,560,570,575,585,605,580,635,640,660,640,640,640,635,6

40,640,640,640,600,600,600,600,600,600,640,635,665,665,665,665,660,660,660,

660,660,640,620,620,620,620,620,580,580,605,605,635,635,635,610,609)

r=diff(log(SAI))

>x=ur.df(r,type='trend',lag=1);summary(x)

############################################### # Augmented

Dickey-Fuller Test Unit Root Test #

105

############################################### Test regression

trend

Call:

lm(formula = z.diff ~ z.lag.1 + 1 + tt + z.diff.lag)

Residuals:

Min 1Q Median 3Q Max

-0.068347 -0.007393 -0.000309 0.007837 0.072081

Coefficients:

Estimate Std. Error t value Pr(>|t|)

|

(Intercept) 0.0100816

|

0.0084123

|

1.198 0.237019

|

|

|

|

|

z.lag.1 -0.9566756

|

0.2242311

|

-4.266 0.000101 ***

|

|

|

|

|

tt -0.0003302

|

0.0002823

|

-1.170 0.248285

|

|

|

|

|

z.diff.lag -0.1701993

|

0.1493245

|

-1.140 0.260402

|

|

|

|

|

Signif. codes: 0 `***'

|

0.001 `**'

|

0.01 `*' 0.05 `.' 0.1

|

`

|

'

|

1

|

Residual standard error: 0.02734 on 45 degrees of freedom

Multiple R-squared: 0.5882, Adjusted R-squared: 0.5607 F-statistic: 21.42 on 3

and 45 DF, p-value: 9.084e-09

Value of test-statistic is: -4.2665 6.1067 9.1494

|

Critical values for test statistics:

1pct 5pct 10pct

|

|

tau3

|

-4.04 -3.45

|

-3.15

|

|

phi2

|

6.50

|

4.88

|

4.16

|

|

phi3

|

8.73

|

6.49

|

5.47

|

prevision de la serie NC-ROUIBA

>sarima.for(r,n.ahead=12,p=1,d=0,q=1)

$pred

Time Series:

Start = 52

End = 63

|

Frequency = 1

|

|

|

|

|

|

[1]

|

0.003725608

|

-0.018144936

|

-0.001074932

|

-0.014398105

|

-0.003999341

|

[6]

|

-0.012115598

|

-0.005780842

|

-0.010725132

|

-0.006866104

|

-0.009878083

|

[11]

|

-0.007527227

|

-0.009362075

|

|

|

|

|

$se

Time Series: Start = 52 End = 63

Frequency = 1

|

|

|

|

|

|

[1]

|

0.04563118

|

0.04648744

|

0.04700142

|

0.04731179

|

0.04749987

|

0.04761408

|

[7]

|

|

0.04768352

|

0.04772577

|

0.04775150

|

0.04776716

|

0.04777670

|

0.04778251

|

|

>library(quantmod) >getSymbols("AMZN", from =

"2000-01-01", to = "2019-01-01", src = "yahoo",

adjust = TRUE)

106

GOOGLE >getSymbols("GOOG", from = "1980-12-01", to =

"2018-12-31", src = "yahoo",

adjust = TRUE) >plot(Cl(GOOG))

FACEBOOK

1 ) Importer les données : >Library (quantmod)

>getSymbols("FB", from = "2012-05-01", to = "2018-12-31", src = "yahoo",

>plot(Cl(FB))

107

NC4-ROUIRAI

SPA

|

ETATS FINANCIERS 31.12.2918

|

~a

|

COMPTE DE RESULTATS PERIODE DU 01.01.2018 AU

31.12.2018

CHIFFRES EXPRIMES EN DINARS

|

NOTE

|

31.12.2018

|

31.12.2017

|

|

Chiffre d'affaires

|

6.1

|

5 936 615 369

|

5 659 391 237

|

|

Variation stocks produits finis et en-cours

|

6.2

|

( 164 687 788)

|

260 096 158

|

|

Production immobilisée

|

|

|

|

|

Subventions d'exploitation

|

|

|

|

|

PRODUCTION DE L'EXERCICE

|

|

5 771 927 581

|

5 919 487 396

|

|

Achats consommés

|

6.3

|

(3 618 612 603)

|

(3 607 011 260)

|

|

Services extérieurs et autres consommations

|

6.4

|

( 926 986 537)

|

(1 129 603 933)

|

|

CONSOMMATION DE L'EXERCICE

|

|

(4 545 599 140)

|

(4 736 615 193)

|

|

VALEUR AJOUTEE D'EXPLOITATION

|

|

1 226 328 441

|

1 182 872 203

|

|

Charges de personnel

|

6.5

|

( 711 630 826)

|

( 722 931 844)

|

|

Impôts taxes et versements assimilés

|

6.6

|

(50 733 316)

|

(54 753 822)

|

|

EXCEDENT BRUT D'EXPLOITATION

|

|

463 964 299

|

405 186 536

|

|

Autres produits opérationnels

|

6.7

|

89 892 128

|

47 099 948

|

|

Autres charges opérationnelles

|

6.8

|

( 127 735 114)

|

( 138 477 963)

|

|

Dotations aux amortissements et aux provisions

|

6.9

|

(534682928)

|

(744037721)

|

|

Reprise sur pertes de valeur et provisions

|

|

49 028 820

|

3 247 456

|

|

RESULTAT OPERATIONNEL

|

|

( 59 532 796)

|

( 426 981 745)

|

|

Produits financiers

|

6.10

|

21 728 182

|

15 082 804

|

|

Charges financières

|

6.11

|

( 290 470 023)

|

( 375 831 347)

|

|

RESULTAT FINANCER

|

|

( 268 741 841)

|

( 360 748 543)

|

|

|

|

|

|

RESULTAT ORDINAIRE AVANT IMPÔTS

|

|

( 328 274 637)

|

( 787 730 288)

|

|

Impôts exigibles sur résultat ordinaires

Impôts différés sur résultats ordinaires

Total des produits des activistes ordinaires

|

5

|

985

|

53 238 671

815 381

|

6

|

070

|

85

120 037

037 641

|

|

Total des charges des activités

ordinaires

|

(6

|

260

|

851

|

347)

|

(6

|

772

|

647

|

891)

|

|

|

|

|

|

|

|

|

|

|

RESULTAT NET DES ACTIVITES ORDINAIRES

|

(

|

275

|

035

|

966)

|

(

|

702

|

610

|

250)

|

|

|

|

|

|

|

|

|

|

|

RESULTAT NET DE L'EXERCICE

|

(

|

275

|

035

|

966)

|

(

|

702

|

610

|

250)

|

108

109

|

|