Even if the tools developed by both consortia and private

exchanges do overlap each over, it is necessary to identify the most

appropriate tools. As a matter of fact, it seems that Consortia are more

appropriate when it is possible to leverage technology costs across companies

in a given industry. In addition, they better suit companies when

cross-enterprise collaboration is needed to capture one given process benefits

such as airline spare parts inventories, collaborative planning or

forecasting.

Private exchanges are more appropriate when the company

benefit from a competitive advantage such as Boeing's product development

functionality. Private exchanges must also be considered when there is no

consortia put in place or when the consortia does offer the desired tools such

as DaimlerChrysler's supply chain networking tool.

4.1 Sustainability of Industry-sponsored marketplaces

and private exchanges

Industry-sponsored marketplaces and private exchanges seem to

be both sustainable. As a matter of fact, consortia and private exchanges have

developed or develop value-creating and customer-ready functionalities.

However, the success of these functionalities greatly depends upon the ability

to gain participants adoption and value demonstration.

Three key factors support the case for the sustainability of

industry-sponsored marketplaces. Firstly, the industry players must consider

that industry-sponsored marketplaces will create functionality vital to the

future of their industry. Secondly, industry-sponsored marketplaces have

learned from the failure of the public e-marketplaces and should not make

similar mistakes. Thirdly, industry-sponsored marketplaces are morphing their

models to respond to market requirements.

Industry-sponsored marketplaces can be considered as cheap as

a group. They usually focus on few key products in order to control technology

costs. They often hire more staff after the implementation of the exchange in

order to gain incremental revenues. The industry and systems expertise

developed combined with close partnerships with customers, results in tailored

made functionalities. Industrysponsored marketplaces learned from the public

marketplaces that they must control the burn rate, create real value while

minimizing the disruption brought about by change.

It seems that two years ago consortia were reduced to

off-line buying groups which only purpose was to aggregate the purchase volume

of several companies and then negotiating better pricing from suppliers. Today,

several consortia, including Covisint, do not aggregate purchasing volume

across.

As consortia main goal is to meet its client requirements,

they did not adopt an inflexible business model, but rather what we can call a

morphing model. As a matter of fact, they are setting the product development

plans, which are meeting their member needs. They also adjust their pricing

models, tailor customer service processes and levels to the requirements of

buyers and suppliers. For instance, Covisint develops and maintains broader

functionality dedicated to several value chain processes which are critical to

the automotive industry.

Even if private exchanges are developed and managed by large

and powerful companies, that does not grant success. As a matter of fact,

private exchanges have to compete for capital, best people and the top

management support. They must also have enough time to demonstrate the return

on investment and value created.

It seems that, development costs of the more complex

functionality should be covered by the savings obtained through the purchasing

functionnality (e.g reduced prices through auctions, reduced administrative

costs from catalogs, automated process flow tools). However, the cost savings

appear in the budgets of the business units purchasing goods while development

costs fall into the e-business organization's cost center. Consequently, it is

still difficult to demonstrate that these savings cover the development costs

of a complex functionality.

In order to survive, private exchanges must create value,

ensures the top management support, partner with business unit managers to

drive internal and external adoption. They must also make sure that they

continue to meet the needs of the business units

In order to justify embarking on an investment in exchange

functionality, either through a consortia or internally through a private

exchange, it is critical to understand the value-creation potential of an

exchange. It is impossible to outline a specific set of instructions for this

assessment, as exchanges vary as much as the companies and/or industries they

serve. We can, however, outline the key issues that must be addressed in such

an analysis.

Understanding of the value-creation potential of an exchange

is key to both consortia and private exchange. Firstly, it is essential to

determine to which processes the exchange should be dedicated. Then, it must be

showed that the exchange addressed the process in the best manner. Secondly,

value metrics must be provided. Thirdly, a comparison must be made between the

value provided and the development and management costs of the exchange. This

demonstration must help to evaluate if the exchange represents a profitable

investment opportunity.

4.2 Identification of the processes to be

addressed

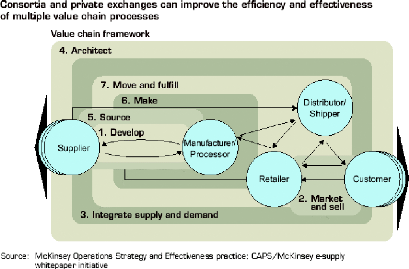

In order to find out the value of an exchange, it is

essential to understand what value chain processes it will address. The above

scheme outlines the value chain processes that exchanges can address. It also

gives a list of the key value chain processes and sub processes that exchanges

may be dedicated to. When the company wants to join one existing consortia, it

is easy to determine if it meets the value chain processes. Indeed, the

consortia provides some existing functionality and a development plan for

future tools.

When creating a consortia or a private exchange, it is

essential to define the processes that should be addressed through the

exchange. At first, purchasing should be considered as it is a key process,

which does not require significant industry customization. As a consequence,

purchasing tools can be chosen quickly and installed. Then, they can generate

savings that can help to fund further exchange development.

Identification of the key industry's key pain points helps to

identify other processes.(see the above scheme). Pain points should be defined

as the process, which significantly impact costs, quality, or product value

from the customer point of view. For instance, Aeroxchange address a key pain

point of the aerospace industry, as the industry holds 55 billion dollars in

inventory. Aeroxchange allows spare parts inventory visibility. It facilitates

the finding of the right part faster for unscheduled maintenance. Thus, it

reduces administrative costs of finding and required inventory levels.

Therefore, airlines are impacted by Aeroxchange as if maintenance is quicker,

the number of delayed and cancelled flights decrease.

When the processes are identified, it is essential to

determine how well the processes can be addressed. We can say that companies

must evaluate the scope of this assessment. First of all, the company needs to

know if the consortia or software address the complete value chain or only

narrow segments of the process. If the consortia or software address only

narrow segments of the process, it is important to know if it addresses the

industry pain points. In fact, few companies provide tools which address all

the aspects of a given supply chain process. However, it does not mean that the

available tools are not valuable. It means that the first stage is to focus on

the most important components of the process and then to build out

functionality over time.

It is also important to consider how well the consortia or

software chosen address the process or subprocesses. In fact, most of the

software available have been developed with a generic manufacturing industry in

mind. Consequently, the software available must be considered as a starting

point from which companies can develop their solutions. That is the reason why

the functionality assessment should be detailed enough to identify the gaps

between the tool and the deployment which should be created by the user. For

instance, Aeroxchange was obliged to work with Oracle in order to incorporate

the needs of the

airline industry into the Oracle inventory management software.

Indeed, Aeroxchange needed to provide data on the part, its location, its owner

and its condition (new, refurbished, or requiring repair).

4.3 Value metrics to be adressed

In order to evaluate the value created by an exchange, it is

essential to understand the value of creation levers. The value levers, which

can be addressed by the exchange include revenue, costs, assts, risk, cycle

times, quality and customer services.

To assess the value created by an exchange, companies must

identify the functionality provided or to be provided in terms of the value

chain processes and sub processes. Then, for each sub process, companies must

identify the value creation levers that will be addressed.

For instance, a reverse auction tool will address "establish

terms," a sub process of the sourcing process, by allowing a company to request

bids from suppliers and receive bids resulting in a final offer at the end of

the auction period. In addition, the tool will help analyze the bids as well,

though the degree to which the tool can accomplish this depends on its ability

to incorporate non-price variables (product quality and functionality, delivery

time, payment terms, etc.) into its ranking of suppliers.

Additionally, the auction tool can be expected to address the

cost lever - reducing the purchase price of goods through increasing supplier

competition - and the cycle time lever - reducing the time it takes for price

negotiations to be finalized. To quantify the value of the auction tool, it is

necessary to estimate the impact on each of these value creation levers.

Savings in the range of 2 to 85 percent have been reported on reverse auctions.

Spend categories have been auctioned without achieving savings as well. A

reasonable approach to quantifying this value would be to assume for a spend

category that your organization has not yet auctioned and plans to, that

savings would approximate those achieved by other companies who have used the

tools to source the same or similar spend categories.

Additional savings from the short cycle time of negotiation

could arise from reduced use of procurement function resources or on-time

delivery of a commodity that would otherwise be late and cause production

downtime. Savings of this type should only be included in analysis if there is

a reasonable likelihood that they would be avoided through use of the tool.

Once the Sources of Value Framework has been used to estimate

the value of each exchange tool, you are ready for the next step in assessing

the value of the exchange - comparing costs to benefits.

4.4 Comparison between the development and management

costs

The costs of the exchange include:

- Software purchase and/or development, - Systems

integration,

- Project management,

- Staff training

- Change management costs.

Software and/ or development costs are obvious. In addition,

in order to transfer information from ERP or legacy systems, systems

integration costs are need. In order to ensure the exchange development project

management costs are also required.

Training costs are important as the staff must learn how to

use the tool. They must also understand the benefits of the tools in order to

change their work procedures smoothly. Change management costs should include

internal and external communication. The communication campaign must present

the benefits of the exchange, the analysis and the implementation steps

required to transition processes. As change management is a real challenge, it

must not be underestimated.

.

The above list of costs should help to identify the key cost

components. Obviously, this list is not exhaustive. For instance, private

exchanges will need to consider the costs of getting suppliers on board and

subsidizing their systems integration until they buy into the exchange's value

proposition.

4.5 The best practices

· Change process: the compulsory

partnership

In order to successfully manage the adoption of exchange

tools by companies or within an industry, leadership, communication and

implementation are essential. To that purpose, a partnership must be built

between the exchange, investor executives, and trading partner executive. This

partnership should allow to get the vision of the most appropriate tool, its

adoption and usage. Thus, it requires a clear, broad and targeted communication

on the exchange objectives and successes. Detailed implementation planning and

execution must be done, both within the exchange and between investors and

trading partners. Active members must believe that improving supply chain

efficiency and effectiveness is critical to their firm's longterm

competitiveness. The CEO needs to communicate this vision internally within his

or her organization and externally to suppliers and the broader business

community. Once the vision has been communicated, the CEO should set the

expectations within their organization that exchange functionality will be

leveraged as much as possible. The exchange should be used regularly rather

than selectively, unless there is a compelling reason not to use it. Lastly,

the CEO will need to approve exchange funding due to the magnitude of the

investment.

The next set of partners that consortia and private exchanges

should seek is senior management. Functional and business unit senior

executives have several rolls in managing the change process. They should

reinforce the CEO's vision that the exchange is key to the company's

competitiveness, and they should extend this vision into concrete goals and

guidelines for exchange use. Goals can be in terms of transaction volume

managed by the exchange or the number of employees who should be given access

to use the exchange for purchasing or other functions. Formal guidelines should

be developed to prescribe use of the exchange for functions that can be

executed through its tools more efficiently than through offline or through

other tools. Incentives for both executives in relevant roles and other

personnel within functions impacted by exchange tools should reinforce the

outlined goals.

Senior management must also play a key role in change

management. In order to drive participation, senior management should use its

personnel networks both within and outside the organisation. Internally,

managers should be reached out in order to ensure that they understand exchange

plans and functionality. Managers must also be actively involved in the setting

of tool requirements and improvement opportunities. Outside the company, senior

executives should communicate on the value created by exchange tools.

It seems that the senior executives must sit on the board of

the exchange in order to be highly involved in the development and evolution of

the exchange. As a matter of fact, they are responsible for the function that

the exchange is enabling. Consequently, they are able to set development

priorities and provide high-level functionality requirements. In addition, they

are directly able to ensure that exchange tools are used by their

organization.

In order to ensure that implementation plans are rolled out

effectively, middle-management level must be highly involved. The

middle-management level should help to map out the impact of exchange tools on

the current processes and operations. This input is critical as it should help

the exchange team to detail the tool requirements and therefore plan the

necessary organizational changes. Consequently, we can say that the exchange

team partnership with middle management is compulsory.

· A solid business model

Obviously, Consortia must adhere to basic business rules.

However, we must underline that the previous public e-marketplace business

model was to spend equity fast in order to achieve growth and boost IPO

valuations. As this model is no longer in practice, consortia must develop a

solid business model, which meet the needs of the investing companies and

trading partners.

In order to meet investor needs, the consortia must develop

appropriate tools, add value beyond the tools and provide quality customer

service. To that purpose, members should shape the planned functionality

portfolio, the development road map and the key requirements for each tool. The

members of the consortia or the corporate senior members should follow sessions

focused on this issue in order to list their requirements. Indeed, it should

ensure that the tools put in place meet the needs of the organizations. In

addition, work sessions with suppliers should help to identify key

functionalities from the supplier perspective. These various points of view

should ensure a timely implementation and adoption of the tools.

However, in the case of less complex functionality or

specific solutions, it is not necessary to acknowledge the opinion of all the

members. The decision making process should be speed when the number of points

of view is reduced. For instance, a sourcing event based on the spend of 4 to

6

participants may not achieve the purchase volume that a

broader group purchase would, but may facilitate developing a more narrow set

of specifications for a bid. The savings can still be significant, and

furthermore, demonstrated savings from aggregated sourcing events can be

replicated for other members.

· Adding value beyond the tools

The automation of processes and the transparency of

information provided by both consortia and private exchanges result in greater

efficiency and effectiveness of the value chain activities. Thus, they create

value. That is the reason why exchanges have recruited functional, industry and

systems experts. To that regard, it seems that consortia can leverage their

expertise in order to generate incremental revenue beyond the tools and round

out their service offerings. For instance several consortia complement auction

and eRFx tools with strategic services. To that purpose, sourcing industry

experts were hired. They were enabled to determine the most appropriate spend

categories through the understanding of the supply markets for identified

categories. They finally recommended the best sourcing event, which reduce the

total cost of the category.

Exchanges have also developed systems groups with knowledge

of the industry's systems and how to integrate them with other systems. The

systems groups expertise was used to "productize" the integration process to

enhance margins, and to provide consulting on a broader range of industry

systems issue. As revenue generation is not the key goal of private exchanges,

adding value beyond the tools remains important to ensure that business units

and trading partners have the support they need to implement exchange tools.

· Customer service

Customer service is essential as it can drive the adoption

and the transaction volume. It includes training, help desk, systems

integration and "consulting" services. Training implies the creation of

selfguided on-line modules, FAQs and on-site product overview sessions. The

help desk must provide responsive support. It means that it must provide

consistent quality in handling basic questions. Systems integration must ensure

that both buyers and sellers are brought on-line in a coordinated fashion. In

order to back up the other elements of customer service, deep functional,

industry or systems expertise is needed.

· Focusing on the value proposition

In order to create value and to drive adoption, the exchange

must focus on the needs of both buyers and sellers. This focus is even

important for private exchanges as the trading partners who have an expertise

of the processes organization might ensure that the exchanges tools create

value and drive out cost.

Providing security of pricing information, non-public trading

relationships and easy integration into the exchange are the basic ways to

provide value. They are compulsory when it comes to gain the participation of

trading partners.

Lastly, pricing should be in line with value capture. If the

investors will capture most of the benefits of current exchange tools, they

should pay for most of the costs. Many exchanges are charging trading partners

little if at all for either tool usage or integration (via a low-cost means

such as browser). In addition,

exchanges often provide value-added tools for trading partners.

For instance, they might encourage suppliers to use auction and eRFx tools to

reduce their costs.

· The burn rate management

In order to manage the burn rate, many exchanges focus on a

portfolio of functionality rather than trying to cover the entire industry

supply chain. They consider a few key tools, which were essential across their

membership base, their firm and the trading partners. They also make a balance

between the tools, which allows "quick wins" and "big wins".

As a matter of fact, quick wins such as auctions and eRFx

generate near-term member value, adoption and near-term revenue. Unlike "quick

wins", "big wins" are important tools which often focus on the industry pain

points. As well as quick wins they drive substantial value but they take longer

to develop and roll out. The balance between quick and big wins is essential as

they complete each of other. "Quick wins" revenues should fund day-to-day

operations and the more complex technology development. "Big wins" should

create value for the participants and sustain value beyond the impact of the

"quick win" tools.

In order to manage technology costs efficiently, it is also

interesting to partner with the best technology provides. They can help to

bring the products live faster through leveraging pre-existing tools.

Control of the burn rate also implies the control of the

costs of integration. Most of the consortia managed it through the development

of a portfolio of integration options such as browser-reliant or full-scale

system integration. These integration options are essential as they drive both

trial and adoption. As a matter of fact, suppliers are not willing to pay for

full integration when they participate to an auction. In addition, consortia

members often want to try some basic functionality before committing to the

cost of full integration. However, founding members in the need for specialized

tools will want deep systems integration, which allows to capture greater

functionality and cost savings.

Staffing costs is part of the burn rate control. It is quite

difficult to control these staffing costs while creating and quickly rolling

out multiple tools. That is the reason why a clear strategy must be put in

place. This strategy must focus on near-term functionality objectives meaning

that the staff must meet these needs quickly and efficiently. The staff must be

hired in response to revenue growth and not in preparation for it.

· Review of the internal processes

Review of the internal processes and reengineering of these

processes must be done before the implementation of an exchange. As a matter of

fact, process efficiency can not be reach if exchange tools are supposed to

leverage internal processes.

For example, DaimlerChrysler's pilot supply chain management

tool does not simply distribute forecast information to Tier 1 suppliers,

replacing and enriching the information previously sent via EDI. It

simultaneously sends forecast information to suppliers throughout the supply

chain. This process change addresses the delays that occurred at each stage in

the supply chain and limited the quality and timeliness of information received

by lower-tier suppliers.

For instance, DaimlerChrysler had to work with the suppliers

piloting this tool to develop the suppliers' processes for using this forecast

information. The use of the forecast information is a challenge

because while the forecast could help the suppliers to order

materials earlier and schedule operations more efficiently, DaimlerChrysler may

only account for 5 percent of the suppliers' sales and other customers do not

provide similar forecasts. While process reengineering is not easy, it is vital

to creating step function improvement in the key metrics.

According to the above demonstration, it is obvious that

consortia and private exchanges create value. The range of opportunities

offered by the exchanges is wide and consistent, it can highly impact an

organization's bottom line. However, organizations must keep in mind that

exchanges require substantial resources in terms of planning, execution, and

continuous development.

During the past several years, B2B Web-based operations have

evolved from simple sources of supplier information to online marketplaces,

with many buyers and many sellers, all focused on the industry's offerings.

Exchanges were designed to match those buyers and sellers more efficiently and

to lower their overhead costs via paperless operations.

The proliferation in recent months of business-to-business

(B2B) exchanges for the aerospace industry is symptomatic of the growing

interest in Web-based marketplaces that link buyers and sellers directly,. On

the other hand, B2B exchanges are increasingly becoming tools to achieve

specific corporate goals--such as increasing sales, improving customer service

and cutting back on excess inventory. E- commerce is supposed to eliminate

non-value-added activity. According to the chairman and chief executive officer

of the Boeing Company, electronic transactions translate into a 25 percent

surge in productivity.

5.1 Exostar, the BAE Systems, Boeing, Lockheed Martin

and Raytheon emarketplace

Boeing comprehended more than 20 disparate procurement

systems operating independently in over 50 global sites and over 8,000

worldwide trading partners. Furthermore, millions of transactions were

conducted annually through EDI and XML technologies, and more than 40 unique

supply chain and financial business processes. That is the reason why Boeing

required a comprehensive, secure and highly scalable integration solution. To

that purpose, Boeing conducted a detailed analysis and evaluation of whether

they should develop middleware as a core competency or outsource to a third

party with an established competency. They finally choose to launch Exostar.

BAE Systems, Boeing, Lockheed Martin and

Raytheon, which are among the world's leading aerospace and defense

manufacturers are known to be tough competitors. They collectively have more

than 37,000 suppliers and $71 billion in commercial and government sales.

However, facing the growing pressures of market globalization and cost

reductions, it became clear that the aerospace industry was in the need for a

mechanism to share costs and facilitate higher levels of collaboration to boost

efficiency and effectively compete. Consequently, the foursome later joined by

Rolls-Royce, launched Exostar, an electronic business-to-business marketplace

for trading everything from jet engines to wing assemblies to paper clips.

Owned and operated by the five founding partners as a separate

company, Herndon, Virginiabased Exostar provides a secure yet open environment

for trade and collaboration, yielding transactional efficiencies and supply

chain synergies.

Through Exostar, vendors can provide computer-aided drawings

or other documents to prime contractors. For the supplier, Exostar eliminates

the need to establish a separate conduit for each team member. For the prime

contractor, Exostar provides a space to collaborate with suppliers outside its

own firewall.

Operating as a managed service, Exostar's solution encrypts a

document so that it can be opened only by those who hold its encryption key,

usually the integrator and the collaborating suppliers. Conversely, only

Exostar itself has access to the logs of who opened what material, so the paper

trail cannot be compromised. Identities of participants are verified through an

independent managed public key infrastructure service from VeriSign Inc.,

Mountain View, Calif., according to Jeff Nigriny, Exostar's chief security

officer.

Exostar maintains detailed background information on each user

and a 1 2-month record of every file being accessed, what changes were made, by

who and allows no one person or company (even at Exostar) to have complete

access to all the data.

To create this highly secure environment in real time,

Exostar's Herndon, VA.-based staff turned to Needham, Mass.-based PTC for its

collaboration system--the underpinnings of the site. It hired @stake, a

security company to incorporate additional security. Exostar also licensed

security software from a number of vendors including Netegrity, which

authenticates who the participants are; Webex, which offers Web

conference systems based on secure socket layer; and eVincible,

which encrypts data as it travels between networks and while it is stored on a

server. It turned to Symantec to protect its network from viruses and it

enlisted the services of Maven, a company which continually fakes hacker

attacks into the system looking for weak points.

Rolls Royce, which won the contract to build the Trent 900

engine for Airbus's new 550-person A380 jet liner, recently put Exostar to the

test. It used Exostar's electronic collaboration service so that its engineers

could share CAD patterns and project management systems with other design

engineers at Fiat-Avio, Goodrich Corporation, Hamilton Sundstrand, Honeywell,

and Volvo.

When the project began, Rolls Royce appointed a manager who

logged onto the system to start a session. Then, Verisign verified the project

manager's identity and authority to work on the project. Verisign gave the

project manager a password and a digital certificate--a type of cyber passport

to verify online identity. The certificate resided on the manager's computer so

it was only possible to access the system from that computer. The manager then

invited others to join the project and he specified the level of access to

which each user was entitled.

Once that was completed the partners were ready to share

information. While the engineers--located from Derby, England to Chandler,

Arizona--worked on the same document using their personal digital certificates

for verification, the file itself was encrypted with a 128-bit key.

After the session ended, the file was then sent to Exostar's

data center, which provides high levels of physical and network security. Then,

when another project member wanted to access the file for revisions, it was

encrypted again before traveling over the Internet to his desktop, where it

remained encrypted until the engineer with the authorized key opens it.

Indeed, today Exostar has over 11,000 members who think it's

worth it. RRob Savidge, the chief engineer for the Rolls-Royce Trent 900,

estimates that by collaborating over the Web, Rolls Royce saved as much as 60%

on its travel budget, reduced project management errors by up to 50% and cut

the product development cycle time by up to 40%. And so far, no

break-ins.--Niall McKay

Exostar architecture is open so that the members can join

without extensive investments in internal technology and processes. In

addition, sensitive information is encrypted, according to industry standards

Electronic auctions is one option available to the exchange users.

Consequently, small businesses are enabled to register and make their products

available to everyone who is connected. One of the Exostar objectives is to

make suppliers participating as active community partner, to enhance

competition and to develop opportunities for small businesses. As it is best to

have as many companies as possible, Exostar does not impose any exclusivity

requirements on companies wishing to do business on the site. From the supplier

perspective, Exostar represents the opportunity to get into the aerospace

market. As a matter of fact, as soon as the supplier products meet the

government certification requirements, the supplier is eligible to participate

in Exostar. As small manufacturers which are producing unique and specialized

items do not have a lot of visibility, they should benefit from e-market

places.

Boeing also created the eBuy Program which

enables the aerospace supply chain to align itself with Exostar. First of all,

all the players (e. g Boeing employees, suppliers, partners) benefit from a

significant reduction of paper use through the use of the new Web-based

products. For instance, the Boeing Commercial Airplanes unit expects the saving

of 10,000 feet of paper per year after the full implementation of all the

e-business activities.

SourcePass is the Exostar online

auction system dedicated to procurement transactions. In 2002,

SourcePass helps Boeing business units to realize an average savings of 32

percent over traditional negotiation techniques.

The Enterprise Supplier Portal, which

belongs to the eBuy program is a secure business-tobusiness Web site. It allows

suppliers to get information quickly and efficiently. Consequently, it reduces

costs and increases productivity. 18,000 suppliers can access the portal.

Transaction Services allows the information to move faster and

more efficiently between Boeing and its suppliers. This data "pipeline" manages

the incoming and outgoing information from 22 business systems which support

supplier management and payment processes.

SupplyPass consists in a paperless

purchase order. It allows the suppliers to receive, acknowledge and

manage the incoming orders. Consequently, Boeing procurement groups are enable

to avoid the delivery of "hard copies" (paper copies) and therefore to reduce

the cost of delivering procurement transactions.

ForumPass is a Boeing Supplier

Web-based virtual team room. It allows to streamline communication and

therefore to reduce variability and cycle time. For instance, the Boeing 7E7

used ForumPass during the beginning design phase of an airplane

The Boeing Enterprise Supplier Tool is a single source of

enterprise supplier data. It includes information such as the diversity reports

(addresses, contact names...), reports (payment, diversity reports), corporate

agreements and data analytics.

It seems obvious that the Boeing eBuy program highly impacts

the aerospace procurement employees and their work processes. All the tools

described above allow Boeing and its suppliers to develop new business models.

These new business model goals are to simplify tasks, to increase productivity

and to standardize. As a matter of fact, this is resulting in the evolution of

the "old procurement process" which was considered as complex, fragmented,

cumbersome and costly. To that purpose, Boeing hopes to reduce significantly

its 18 procurement systems to only four or five.

Over the years, Boeing's four major businesses have built

different procurement systems which were using different software. Boeing's

business units connection with its various suppliers was a kind of messy

spaghettilike tangle of lines. Instead of one unilateral replacement, Boeing

decided to perform a measured connection to Exostar. This Exostar connection

plan use XLM-based standards.

The access to Exostar simply requires a browser, Internet

connection and a security password. This easy access presents several

advantages for both Boeing and its suppliers. From the Boeing perspective, it

provides links to legacy system and cut the number of procurement system. In

addition,

through the use of a supplier profile database, Boeing is

allowed to do the strategic evaluation of supplier data.

As Exostar uses XML rather than complicated electronic data

interchange (EDI) formats, more suppliers can access the exchange at lower

cost. Unlike XML, EDI are expensive as they require suppliers to put money into

the batch. XML only requires the use of a browser. Using Exostar and XML,

different units of Boeing can use the same interface to connect to suppliers.

Accounting, inventory, shipping and racking systems all benefit from the XML

use

5.2

MyAircraft.com

The aerospace industry has inventories worth about $50

billion, mostly in spare parts. But the annual demand for new spares and

repairs amounts to about $30 billion. Consequently, Inventory improvement is

one of the main motivation when joining an exchange.

One of the most viable competitors emerging today is

MyAircraft.com, launched by industry

powerhouses United Technologies Corp., Honeywell, and i2 Technologies. These

firms collectively have about $25 billion in annual revenue. Like Exostar,

MyAircraft.com is an independent

company created to provide an electronic exchange for airlines, manufacturers

and suppliers aerospace after-market parts and services. The BFGoodrich Company

recently announced it will became a partner.

MyAircraft.com site offers products

from parent companies United Technologies and Honeywell. But new capabilities

will be added for supply chain management and technical data handling. The site

will earn revenues from transaction fees and technical publication subscription

sales.

It is important to note that neither Exostar nor MyAircraft plan

to impose exclusivity requirements to companies wishing to do business on their

sites.

5.3 Exostar and MyAircraft potential risks

In order to gain the participation of other companies,

Exostar and MyAircraft promote the openness of their systems. They do not want

to be perceived as exclusive clubs. However, other industry players consider

the risk of anti-trust issues if some companies find out that access to certain

exchanges are restricted. To that regard, Exostar argues that the system was

secured through legal advice. MyAircraft considers that its main objective is

inventory management and the automation of supplier-buyer transactions.

Other industry players think that there is much more to

achieve growth in the industry than having an e-market place or other kind of

Web sites. For instance, Messier-Dowty (SNECMA Group) as a Web exchange

dedicated to selling parts and a larger site dedicated to electronic business

transaction. The Messier- Dowty company uses Internet as a customer-service

tool but does not view the Web exchange as an increasing sales tool. They still

believe in the face-to-face contact, meaning that if you do not meet the

customers in person, you loose market-share. From that perspective, E-business

is just a tool.

5.4 The GE Aircraft Engines position toward

Exostar

One of the industry's most prominent firms has already

experienced success with its own e- business site. General Aircraft Engines has

assigned 300 employees to the Web Center. The airlines or maintenance shops

which would like to gain access to the Web Center must be pre-approved by GEA.

The pre-approved companies can buy spare parts, research technical publications

and remotely diagnose the condition of specific equipment. It means that they

can receive information on the status of an engine while the engine is in

flight.

While the Customer Web Center performs the "selling" function,

GEA has a Supplier Web Center for its 1,200 suppliers. As the "buying" side of

GE's Web operation has automated many tasks, about 200 positions in the

purchasing department were thus eliminated.

Having 1,200 suppliers on the supply chain Web Center allows

GE to do forecasting, scheduling, part shipments, drawings, quality control

documents. GEA was used to spend a million-and-a-half dollars shipping

blueprints to customers. Now, they pull drawings off the web and print them out

themselves. When there is no value added in a task, you can automate that and

eliminate people associated with it.

GEA also plans to launch a site for military customers.

Military customers will have access to spare parts, product support and

component repair status. Even if most of the content material on GEAE's sites

is proprietary or sensitive, they do not have any top-secret information on the

Web. However, commercial and military customers have their data stored

separately and cannot access that data unless they are authorized.

GEA decided not to participate in Exostar. As a matter of

fact, the volume of the GE company as a whole is as big or bigger than the

volume of the Exostar founding members combined. In addition, while

concentration in aerospace may cause antitrust issues, there will be no

antitrust risk by combining the GE companies.

Furthermore, GEA does not want tot get tied up with five

companies in a big bureaucratic structure. As GEA belongs to a 120 billion

dollar company, it has got enough leverage, focus and expertise to drive its

own e-marketplace.

From the GEA perspective, participating in Exostar would mean

to source the same goods and being charged the same prices by vendors. Sharing

purchasing power with other companies should lead to a competitive advantage

lost. With regard to cost control benefits, GEA estimates that they do not need

it from Exostar as they already have their own cost control.

According to GEA top management, the aviation and aerospace

industries challenge is to better manage the interface between product

manufacturers and the airlines themselves so that the customers get more

benefits and gain productivity.

As every company is affected by what other exchanges are

doing, the development of standards throughout the B2B exchange universe will

be a top priority. There are all kinds of exchanges which all tackling it from

different perspectives. GEA wants to stay GE-branded, give its customers

state-of-the-art functionality and be fast to market, building de facto

standards.

GE's status as one of the world's three major engine

manufacturers means that, no matter what exchanges are out there, GE will be a

player. Obviously, exchanges which are becoming intermediaries, cannot survive

without GE. Consequently, there is no rush for GE to get in these exchange but

they won't allow these exchanges to take over their relationship with their

customers.

GEAE's top competitor, Pratt & Whitney, is affiliated

with

MyAircraft.com. Pratt & Whitney

is owned by United Technologies. The third major engine maker, Rolls-Royce,

announced it is launching an e- business portal called "aeromanager," which

will provide tailor-made fleet management solutions to the aviation industry.

The portal is a joint venture with San Diego-based Science Applications

International Corporation.

It is unlikely that all the exchanges currently in business

will survive in the long term. For instance, one of those exchanges, AviationX,

appears already to have folded. Phone calls to AviationX offices in Arlington,

Va., were not returned.

Some aerospace industry players believe that there is no room

in the industry for more than one exchange, but that there will be dropouts as

time goes on. Another exchange that was scheduled to begin operations in the

summer of 2000 is

Aerospan.com, an e-business site for

the aviation transportation industry. The company predicted it would help boost

airline profitability by 26 percent.