Pour l'assurance non-vie nous choisissons

d'investir selon l'allocation proposée dans le deuxième

scénario, en effet un coefficient de variation de 14%

contre celle des 30% pour le premier scénario.

15

TABLE DES FIGURES

FIGURE 3 - Distribution des NAV selon

les deux scénarios

Pour l'assurance vie on choisi

également le deuxième scénario, ce choix est motivé

par la valeur du NAV de 93,01 contre -12,08,

ce choix est renforcé également par une

interprétation graphique en effet la première distribution est

plus aplati par rapport à la deuxième ce qui implique que notre

investissement est plus risqué et plus étalé ainsi on peut

expliquer aussi ce choix par la volatilité élevée du

marché donc les assureurs recourent vers les obligations pour se

couvrir.

Les résultats réalisés n'impliquent pas

de se limiter aux décisions fournies par le code, en effet :

· Un modèle est l'outil d'approximation et d'aide

à la décision, certes son utile mais reste est limité : on

peut renforcer le choix par d'autres outils

· Un assureur est exposé aux différents

risques, il n'est pas évident de corréler entre eux : on peut

modéliser des corrélations au sein d'un GSE par les

méthodes des vraies semblances et les copules

· Mesurer les différents degrés d'aversion

de risque : utiliser les fonctions d'utilité (Von Neuman Morgenstein)

16

Synthesis note

1. Introduction

Asset-liability management constitutes an organizational

manual in insurance companies for measuring, analyzing and managing the risks

inherent in the activity.

A forward-looking view of this fact becomes essential in

order to ensure sufficient capital to meet future commitments. In life

insurance, savings contracts provide for a certain number of financial

guarantees such as the TMG, revaluation rate in return for a

premium and risks such as mortality and redemption for to do so, the insurer

must:

· Prevent an investment strategy.

· Set an optimal allocation of these interest

generators.

· Treat his assumptions under different scenarios so

that he is capable for any deviation from the market.

In non-life insurance, the premium paid must fully cover the

risk taken out, in particular risks that last in the long term such as

annuities following bodily injury in the automobile or annuities following a

medical error in health insurance in this context. the insurer must study:

· The different financial scenarios, allowing to choose

one of the different managed asset allocations according to the S / P ratio.

· The impact of changing the S / P ratio.

· The impact of excess claims.

Insurance companies are therefore highly dependent on the

economic situation of the market, this factor is an inherent element of the

activity since the insurer is committed to:

· Provide active-passive interaction.

· Choose an optimal asset allocation that meets the

needs of policyholders and shareholders.

· Respect a regulatory and accounting framework.

Hence the need for an ALM (Asset Liability Management) model

in order to project the flows of assets and liabilities and forecast the

evolution of the activity of the company in the long term.

2. Une analyse des résultat obtenus

We are working on both sides of insurance: life and non-life

insurance with the aim of providing decision support tools.

17

TABLE DES FIGURES

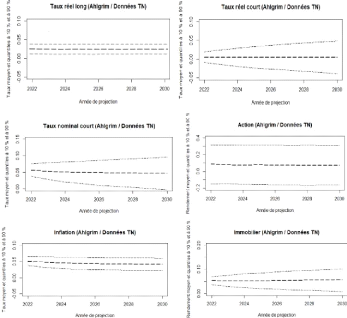

We begin to project our macroeconomic variables: the

inflation index, the stock yield, the real estate yield, the real long rate,

the real short rate and the nominal and real zero-coupon prices.

This projection constitutes the driving force of this thesis

entitled "Application of the generators of economic scenarios in ALM

for the insurance companies", it is ensured as indicated by its name

by the GSE in particular the reference model AHLGRIM et al . : a model which

requires data available at the level of the Tunisian market of which the latter

responds to the constraint that it requests singled out compared to the other

model (WILKIE, BRENNAN AND XIA in our study) by the real estate index which

constitutes a pillar of investment in Tunisian insurers and simplicity of

implementation. We obtain the following results:

These outputs are used in the following for :

· Project the balance sheet, the

technical income statement and cash flow

statement.

· Calculate the Best Estimate and the

NAV.

· Analyze the different asset

allocations.

18

TABLE DES FIGURES

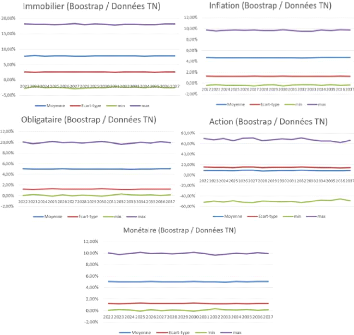

For the projection (in non-life insurance), we rely on

boostrapping techniques in order to resample a new scenario

each time.

In non-life insurance, we have analyzed the evolution of own

funds according to two economic scenarios, the distribution of the first of

which is defined by: 15% in money market, 15% in equities, 10% in real estate

and 50% in bond.

The allocation proposed for the second scenario is as

follows: 20% in money market, 30% in equities, 20% in real estate and 20% in

bonds.

For life insurance we find the following two histograms of the

NAV distribution: The first scenario of which is defined by the following

allocation:

· 80% in equity.

· 20% in bounds.

For the second scenario, we propose the opposite case (80 %

in bonds and 20 % in shares (curve below)).

3. Conclusion

For the non-life insurance we choose to

invest according to the allocation proposed in the second scenario, in fact a

coefficient of variation of 14 % against that

of the 30 % for the first scenario thus this choice is

reinforced by a graphic interpretation: equity at the end of the period is

higher than the first amount invested at the initial.

19

TABLE DES FIGURES

For the life insurance we also choose the

second scenario, this choice is motivated by the value of the NAV of

93,01 against -12,08, this choice is also

reinforced by a graphic interpretation in fact the first distribution is more

flattened compared to the second which implies that our investment is more

risky and more spread out so we can also explain this choice by the high

volatility of the market therefore the insurers resorts green bonds to

hedge.

The results achieved do not imply limiting oneself to the

decisions provided by the code, in fact:

· A model is an approximation and decision-aid tool,

certainly useful but these are limited: we can reinforce the choice by

other tools.

· An insurer is exposed to different risks, it is not

easy to correlate between them: we can model correlations

within a GSE by the likelihood methods and

them copulas.

· A person averse to risk and seek to hedge is not

capable of generating more return: we resort to utility functions in

microeconomics to reinforce the degree of risk aversion.