BIBLIOGRAPHIE

Ouvrage

1. BOURBONNAIS, R., Econométrie, 9e

édition, duo, 2015, paris.

2. BIKAI, J. et KENKOUO G. Analyse et évaluation de

canaux de transmission de la politique monétaire dans la CEMAC :

une approche SVAR, 2015.

3. CLERG D., l'inflation, paris, syros, 1994.

4. STOCK J.H. et M.W. WATSON, Forecasting Inflaction,

Journal of Monetary Economics, Vol. 44, 1999.

5. M. Freedman, le recours aux indicateurs et à

l'indice de condition monétaire at Canada, banque du Canada, 1996.s

6. DIARISSO et SAMBA, les conditions monétaires

dans l'UEMOA : confection d'un indice communautaire, BCAO, note

information et statistique N°501

7. AGENOR P. R. (2008), «

ciblage d?inflation et définition d?objectifs monétaires : quels

critères de choix pour les pays en développement ? »,

Quatrième colloque BCEAO - Universités - centres de recherche :

politique monétaire et stabilité des prix dans l?UEMOA :

contraintes et défis, volume II - intervention orale,

août.

8. ALLEGRET J. et GOUX J. (2003),

« Trois essais sur les anticipations d?inflation »,

in Documents de travail - Working Papers n°03-01, GATE, Mai.

Note de cours

9. BOLITO, R., cours de la macroéconomique,

FSEG, UNIKIS, L1 économie, 20162017,

10. LUBANZA, N. cours d'informatique, FSEG, UNIKIS, L1

économie, 20162017,

Mémoire et article

11. Caleb MUKADI « RDC : l'inflation n'est

que monétaire ? », article, 2010

12. LIOTO GANDI,l'analyse de quelques aspects de la

politique monétaire de la banque centrale du Congo et ses effets sur

l'économie nationale, FSEG, UPLG, 2010

13. Henry N. MUGANZA Les indicateurs avances de

l'inflation en RDC, article, 2014

14. NGANDU LISIMO, la politique de l'autorité face

à la dépréciation du CDF : enjeux et

conséquences, FSEG, UNIKIN, 2014

Webographie

Besoin de financement

http://www.fao.org/tiews/french/basedocs/DRCen,

STM. Consulté en Août 2018, 15h18,

Annexes

Analyses de la stationnarité des variables

|

Null Hypothesis: D(LINF) has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-6.846802

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-2.632688

|

|

|

5% level

|

|

-1.950687

|

|

|

10% level

|

|

-1.611059

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

Null Hypothesis: D(LIMP) has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-4.893660

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-2.632688

|

|

|

5% level

|

|

-1.950687

|

|

|

10% level

|

|

-1.611059

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

Null Hypothesis: D(TCH) has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-3.116378

|

0.0028

|

|

Test critical values:

|

1% level

|

|

-2.632688

|

|

|

5% level

|

|

-1.950687

|

|

|

10% level

|

|

-1.611059

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

Null Hypothesis: D(TC) has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-5.622891

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-2.632688

|

|

|

5% level

|

|

-1.950687

|

|

|

10% level

|

|

-1.611059

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

Null Hypothesis: D(LMM) has a unit root

|

|

|

Exogenous: Constant

|

|

|

|

Lag Length: 0 (Automatic - based on SIC, maxlag=9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-4.304575

|

0.0017

|

|

Test critical values:

|

1% level

|

|

-3.632900

|

|

|

5% level

|

|

-2.948404

|

|

|

10% level

|

|

-2.612874

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(LMM,2)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 08/05/19 Time: 22:42

|

|

|

|

Sample (adjusted): 1982 2016

|

|

|

|

Included observations: 35 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(LMM(-1))

|

-0.721380

|

0.167584

|

-4.304575

|

0.0001

|

|

C

|

0.686993

|

0.279786

|

2.455425

|

0.0195

|

|

|

|

|

|

|

|

|

|

|

|

Null Hypothesis: DB has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 9 (Automatic - based on SIC, maxlag=9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-7.202242

|

0.0000

|

|

Test critical values:

|

1% level

|

|

-4.339330

|

|

|

5% level

|

|

-3.587527

|

|

|

10% level

|

|

-3.229230

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(DB)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 08/05/19 Time: 22:44

|

|

|

|

Sample (adjusted): 1990 2016

|

|

|

|

Included observations: 27 after adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

DB(-1)

|

-1.973067

|

0.273952

|

-7.202242

|

0.0000

|

|

D(DB(-1))

|

1.432773

|

0.243098

|

5.893806

|

0.0000

|

|

D(DB(-2))

|

1.091097

|

0.207194

|

5.266068

|

0.0001

|

|

D(DB(-3))

|

0.963881

|

0.192016

|

5.019807

|

0.0002

|

|

D(DB(-4))

|

0.466411

|

0.173752

|

2.684351

|

0.0170

|

|

D(DB(-5))

|

0.663322

|

0.158320

|

4.189760

|

0.0008

|

|

D(DB(-6))

|

0.347596

|

0.130985

|

2.653713

|

0.0181

|

|

D(DB(-7))

|

0.338270

|

0.120890

|

2.798154

|

0.0135

|

|

D(DB(-8))

|

0.199186

|

0.113300

|

1.758039

|

0.0991

|

|

D(DB(-9))

|

0.254166

|

0.100655

|

2.525112

|

0.0233

|

|

C

|

-18.38841

|

2.469483

|

-7.446258

|

0.0000

|

|

@TREND("1980")

|

0.566357

|

0.078976

|

7.171217

|

0.0000

|

|

|

|

|

|

|

|

|

|

|

Estimation du VECM

|

Vector Error Correction Estimates

|

|

|

|

|

|

Date: 08/05/19 Time: 22:50

|

|

|

|

|

|

Sample (adjusted): 1982 2016

|

|

|

|

|

|

Included observations: 35 after adjustments

|

|

|

|

|

Standard errors in ( ) & t-statistics in [ ]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cointegrating Eq:

|

CointEq1

|

CointEq2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINF(-1)

|

1.000000

|

0.000000

|

|

|

|

|

|

|

|

|

|

|

|

|

LIMP(-1)

|

0.000000

|

1.000000

|

|

|

|

|

|

|

|

|

|

|

|

|

LMM(-1)

|

0.318820

|

1.284899

|

|

|

|

|

|

(0.10672)

|

(0.38209)

|

|

|

|

|

|

[ 2.98731]

|

[ 3.36278]

|

|

|

|

|

|

|

|

|

|

|

|

|

TCH(-1)

|

-0.003897

|

-0.021216

|

|

|

|

|

|

(0.00554)

|

(0.01982)

|

|

|

|

|

|

[-0.70389]

|

[-1.07044]

|

|

|

|

|

|

|

|

|

|

|

|

|

TC(-1)

|

-0.283792

|

-2.629368

|

|

|

|

|

|

(0.36508)

|

(1.30706)

|

|

|

|

|

|

[-0.77734]

|

[-2.01166]

|

|

|

|

|

|

|

|

|

|

|

|

|

DB(-1)

|

-2.185389

|

-7.330622

|

|

|

|

|

|

(0.33504)

|

(1.19950)

|

|

|

|

|

|

[-6.52282]

|

[-6.11140]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Error Correction:

|

D(LINF)

|

D(LIMP)

|

D(LMM)

|

D(TCH)

|

D(TC)

|

D(DB)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CointEq1

|

-0.435236

|

-0.093057

|

-0.153170

|

-12.61859

|

0.277037

|

1.493157

|

|

(0.19453)

|

(0.05160)

|

(0.14986)

|

(10.5378)

|

(0.55417)

|

(0.65492)

|

|

[-2.23732]

|

[-1.80355]

|

[-1.02209]

|

[-1.19746]

|

[ 0.49991]

|

[ 2.27991]

|

|

|

|

|

|

|

|

|

CointEq2

|

0.119401

|

0.022104

|

0.072730

|

3.705481

|

-0.106624

|

-0.368716

|

|

(0.05181)

|

(0.01374)

|

(0.03991)

|

(2.80629)

|

(0.14758)

|

(0.17441)

|

|

[ 2.30477]

|

[ 1.60865]

|

[ 1.82240]

|

[ 1.32042]

|

[-0.72249]

|

[-2.11408]

|

|

|

|

|

|

|

|

|

D(LINF(-1))

|

-0.034012

|

-0.007593

|

0.215557

|

3.528189

|

-0.507492

|

-0.537826

|

|

(0.16978)

|

(0.04503)

|

(0.13079)

|

(9.19706)

|

(0.48366)

|

(0.57160)

|

|

[-0.20032]

|

[-0.16861]

|

[ 1.64808]

|

[ 0.38362]

|

[-1.04927]

|

[-0.94092]

|

|

|

|

|

|

|

|

|

D(LIMP(-1))

|

-0.911977

|

-0.047692

|

-1.014450

|

-18.27883

|

-0.656052

|

0.313726

|

|

(0.73558)

|

(0.19510)

|

(0.56665)

|

(39.8457)

|

(2.09544)

|

(2.47640)

|

|

[-1.23981]

|

[-0.24445]

|

[-1.79025]

|

[-0.45874]

|

[-0.31309]

|

[ 0.12669]

|

|

|

|

|

|

|

|

|

D(LMM(-1))

|

-0.205367

|

0.087210

|

-0.584333

|

-7.364135

|

1.796277

|

-0.236775

|

|

(0.21516)

|

(0.05707)

|

(0.16575)

|

(11.6549)

|

(0.61292)

|

(0.72435)

|

|

[-0.95449]

|

[ 1.52821]

|

[-3.52546]

|

[-0.63185]

|

[ 2.93070]

|

[-0.32688]

|

|

|

|

|

|

|

|

|

D(TCH(-1))

|

-0.006934

|

0.000861

|

-0.004662

|

0.329762

|

0.021207

|

0.008050

|

|

(0.00366)

|

(0.00097)

|

(0.00282)

|

(0.19849)

|

(0.01044)

|

(0.01234)

|

|

[-1.89236]

|

[ 0.88602]

|

[-1.65158]

|

[ 1.66134]

|

[ 2.03158]

|

[ 0.65259]

|

|

|

|

|

|

|

|

|

D(TC(-1))

|

0.026633

|

0.045647

|

-0.001082

|

2.112184

|

-0.179168

|

-0.159208

|

|

(0.08816)

|

(0.02338)

|

(0.06791)

|

(4.77558)

|

(0.25114)

|

(0.29680)

|

|

[ 0.30209]

|

[ 1.95214]

|

[-0.01593]

|

[ 0.44229]

|

[-0.71341]

|

[-0.53641]

|

|

|

|

|

|

|

|

|

D(DB(-1))

|

-0.173019

|

-0.011904

|

0.051192

|

2.233979

|

0.024549

|

-0.066002

|

|

(0.05991)

|

(0.01589)

|

(0.04615)

|

(3.24547)

|

(0.17068)

|

(0.20171)

|

|

[-2.88781]

|

[-0.74910]

|

[ 1.10915]

|

[ 0.68834]

|

[ 0.14384]

|

[-0.32722]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.527301

|

0.356940

|

0.717608

|

0.220793

|

0.388093

|

0.309929

|

|

Adj. R-squared

|

0.404749

|

0.190221

|

0.644395

|

0.018776

|

0.229450

|

0.131022

|

|

Sum sq. resids

|

31.17491

|

2.193088

|

18.50040

|

91476.30

|

252.9856

|

353.3359

|

|

S.E. equation

|

1.074535

|

0.285001

|

0.827768

|

58.20662

|

3.061019

|

3.617529

|

|

F-statistic

|

4.302684

|

2.140968

|

9.801659

|

1.092942

|

2.446335

|

1.732346

|

|

Log likelihood

|

-47.63750

|

-1.187196

|

-38.50562

|

-187.3614

|

-84.27757

|

-90.12409

|

|

Akaike AIC

|

3.179285

|

0.524983

|

2.657464

|

11.16351

|

5.273004

|

5.607091

|

|

Schwarz SC

|

3.534794

|

0.880491

|

3.012972

|

11.51902

|

5.628512

|

5.962599

|

|

Mean dependent

|

-0.071632

|

0.069858

|

0.954778

|

28.86579

|

0.001414

|

0.174857

|

|

S.D. dependent

|

1.392742

|

0.316711

|

1.388112

|

58.76088

|

3.487110

|

3.880678

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Determinant resid covariance (dof adj.)

|

7427.043

|

|

|

|

|

|

Determinant resid covariance

|

1565.274

|

|

|

|

|

|

Log likelihood

|

-426.7039

|

|

|

|

|

|

Akaike information criterion

|

27.81165

|

|

|

|

|

|

Schwarz criterion

|

30.47796

|

|

|

|

|

|

Number of coefficients

|

60

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTIMATION DU VECM PARTIEL

|

Vector Error Correction Estimates

|

|

|

|

|

|

Date: 08/05/19 Time: 22:53

|

|

|

|

|

|

Sample (adjusted): 1982 2016

|

|

|

|

|

|

Included observations: 35 after adjustments

|

|

|

|

|

Standard errors in ( ) & t-statistics in [ ]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cointegration Restrictions:

|

|

|

|

|

|

A(5,1)=0, A(5,2)=0, A(4,1)=0,

A(4,2)=0

|

|

|

|

|

Convergence achieved after 13 iterations.

|

|

|

|

|

Not all cointegrating vectors are identified

|

|

|

|

|

LR test for binding restrictions (rank = 2):

|

|

|

|

|

Chi-square(4)

|

7.408943

|

|

|

|

|

|

|

Probability

|

0.115792

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cointegrating Eq:

|

CointEq1

|

CointEq2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINF(-1)

|

0.135154

|

1.080568

|

|

|

|

|

|

|

|

|

|

|

|

|

LIMP(-1)

|

-0.065817

|

-0.284635

|

|

|

|

|

|

|

|

|

|

|

|

|

LMM(-1)

|

-0.036364

|

-0.002718

|

|

|

|

|

|

|

|

|

|

|

|

|

TCH(-1)

|

0.000582

|

0.001162

|

|

|

|

|

|

|

|

|

|

|

|

|

TC(-1)

|

0.159596

|

0.477164

|

|

|

|

|

|

|

|

|

|

|

|

|

DB(-1)

|

0.185231

|

-0.297400

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Error Correction:

|

D(LINF)

|

D(LIMP)

|

D(LMM)

|

D(TCH)

|

D(TC)

|

D(DB)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CointEq1

|

-0.307701

|

0.044611

|

-1.145553

|

0.000000

|

0.000000

|

-1.257164

|

|

(0.17083)

|

(0.04689)

|

(0.12549)

|

(0.00000)

|

(0.00000)

|

(0.48083)

|

|

[-1.80122]

|

[ 0.95131]

|

[-9.12897]

|

[NA]

|

[NA]

|

[-2.61457]

|

|

|

|

|

|

|

|

|

CointEq2

|

-0.477418

|

-0.099468

|

-0.084522

|

0.000000

|

0.000000

|

1.577814

|

|

(0.16964)

|

(0.04657)

|

(0.12461)

|

(0.00000)

|

(0.00000)

|

(0.47747)

|

|

[-2.81436]

|

[-2.13603]

|

[-0.67830]

|

[NA]

|

[NA]

|

[ 3.30452]

|

|

|

|

|

|

|

|

|

D(LINF(-1))

|

-0.008570

|

-0.010442

|

0.228379

|

1.948111

|

-0.463815

|

-0.541302

|

|

(0.16473)

|

(0.04519)

|

(0.12771)

|

(9.35011)

|

(0.48850)

|

(0.57017)

|

|

[-0.05203]

|

[-0.23108]

|

[ 1.78831]

|

[ 0.20835]

|

[-0.94946]

|

[-0.94938]

|

|

|

|

|

|

|

|

|

D(LIMP(-1))

|

-0.880694

|

-0.024345

|

-0.903234

|

-8.395955

|

-1.009086

|

0.061399

|

|

(0.69271)

|

(0.19003)

|

(0.53703)

|

(39.3189)

|

(2.05424)

|

(2.39765)

|

|

[-1.27138]

|

[-0.12811]

|

[-1.68191]

|

[-0.21353]

|

[-0.49122]

|

[ 0.02561]

|

|

|

|

|

|

|

|

|

D(LMM(-1))

|

-0.245998

|

0.089470

|

-0.615863

|

-6.289098

|

1.749578

|

-0.210394

|

|

(0.21168)

|

(0.05807)

|

(0.16411)

|

(12.0153)

|

(0.62774)

|

(0.73269)

|

|

[-1.16212]

|

[ 1.54069]

|

[-3.75281]

|

[-0.52343]

|

[ 2.78709]

|

[-0.28716]

|

|

|

|

|

|

|

|

|

D(TCH(-1))

|

-0.007312

|

0.000959

|

-0.004735

|

0.372707

|

0.019770

|

0.007569

|

|

(0.00351)

|

(0.00096)

|

(0.00272)

|

(0.19937)

|

(0.01042)

|

(0.01216)

|

|

[-2.08167]

|

[ 0.99567]

|

[-1.73896]

|

[ 1.86943]

|

[ 1.89804]

|

[ 0.62254]

|

|

|

|

|

|

|

|

|

D(TC(-1))

|

0.057861

|

0.044894

|

0.020566

|

1.261324

|

-0.157738

|

-0.189693

|

|

(0.08875)

|

(0.02435)

|

(0.06880)

|

(5.03733)

|

(0.26318)

|

(0.30717)

|

|

[ 0.65199]

|

[ 1.84398]

|

[ 0.29892]

|

[ 0.25040]

|

[-0.59936]

|

[-0.61754]

|

|

|

|

|

|

|

|

|

D(DB(-1))

|

-0.173808

|

-0.011641

|

0.051149

|

2.391184

|

0.023341

|

-0.067600

|

|

(0.05808)

|

(0.01593)

|

(0.04502)

|

(3.29650)

|

(0.17223)

|

(0.20102)

|

|

[-2.99275]

|

[-0.73068]

|

[ 1.13602]

|

[ 0.72537]

|

[ 0.13552]

|

[-0.33629]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.554601

|

0.351772

|

0.730513

|

0.193841

|

0.375165

|

0.312692

|

|

Adj. R-squared

|

0.439128

|

0.183713

|

0.660646

|

-0.015164

|

0.213171

|

0.134501

|

|

Sum sq. resids

|

29.37443

|

2.210715

|

17.65493

|

94640.36

|

258.3304

|

351.9213

|

|

S.E. equation

|

1.043044

|

0.286144

|

0.808632

|

59.20472

|

3.093185

|

3.610280

|

|

F-statistic

|

4.802835

|

2.093143

|

10.45576

|

0.927449

|

2.315917

|

1.754813

|

|

Log likelihood

|

-46.59644

|

-1.327288

|

-37.68702

|

-187.9564

|

-84.64345

|

-90.05389

|

|

Akaike AIC

|

3.119796

|

0.532988

|

2.610687

|

11.19751

|

5.293911

|

5.603080

|

|

Schwarz SC

|

3.475304

|

0.888496

|

2.966195

|

11.55302

|

5.649419

|

5.958588

|

|

Mean dependent

|

-0.071632

|

0.069858

|

0.954778

|

28.86579

|

0.001414

|

0.174857

|

|

S.D. dependent

|

1.392742

|

0.316711

|

1.388112

|

58.76088

|

3.487110

|

3.880678

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Determinant resid covariance (dof adj.)

|

7605.360

|

|

|

|

|

|

Determinant resid covariance

|

1602.854

|

|

|

|

|

|

Log likelihood

|

-430.4083

|

|

|

|

|

|

Akaike information criterion

|

28.02333

|

|

|

|

|

|

Schwarz criterion

|

30.68964

|

|

|

|

|

|

Number of coefficients

|

60

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

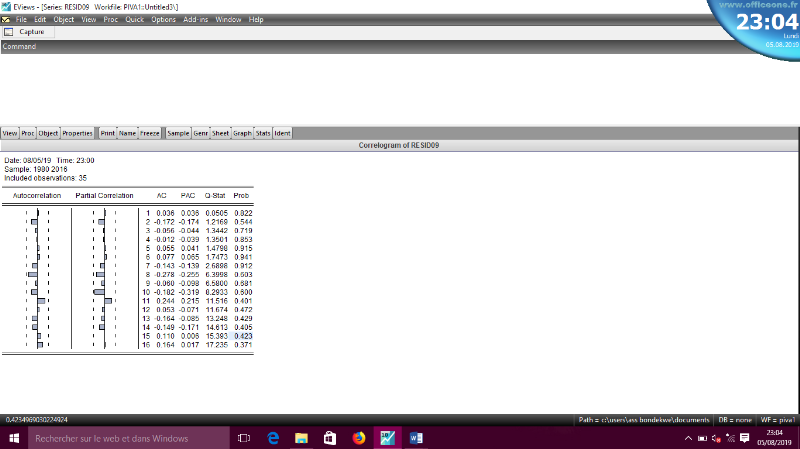

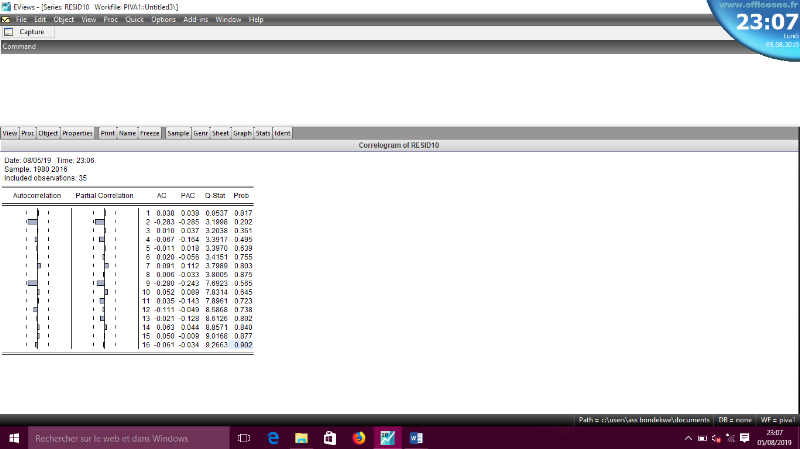

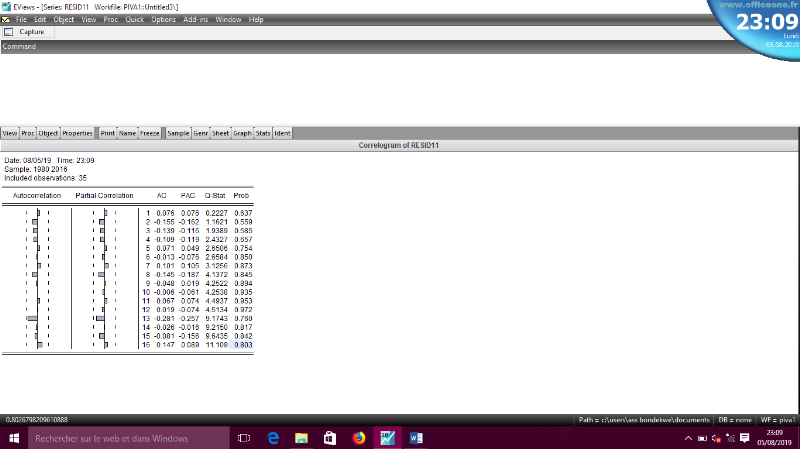

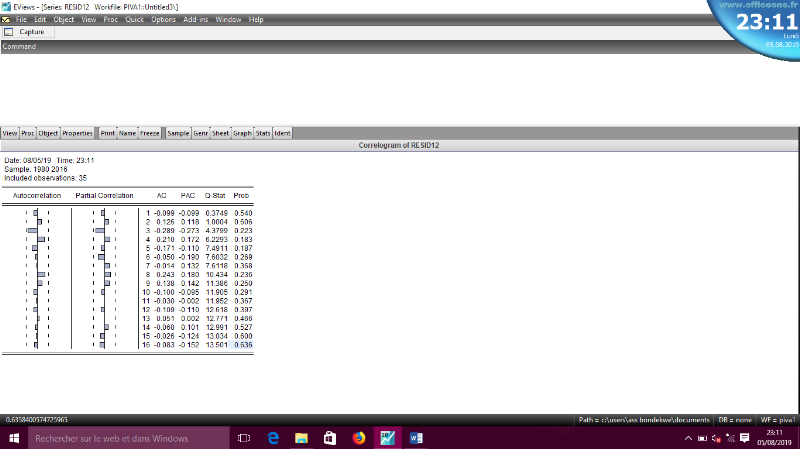

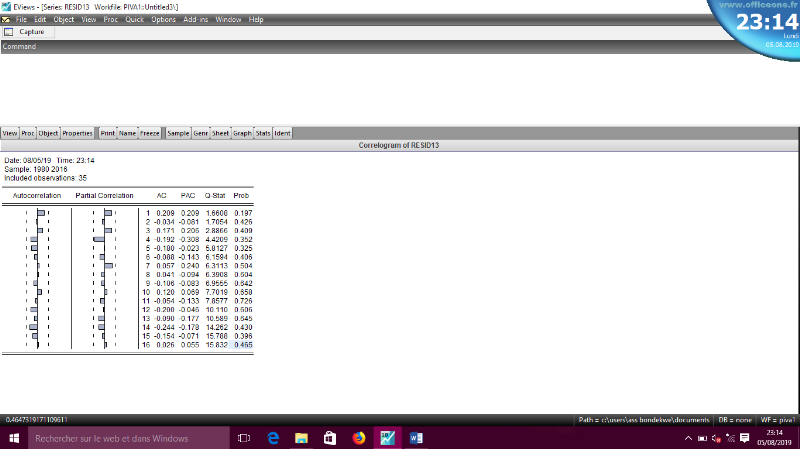

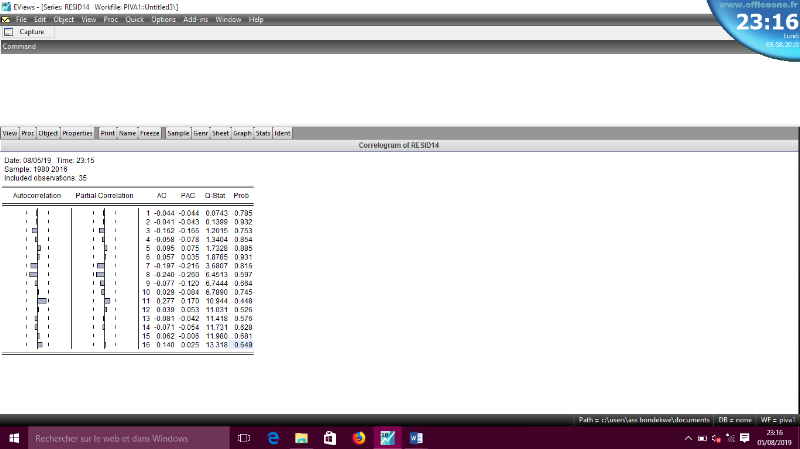

TEST DE BRUITS BLANCS

RESIDUS DE LA PREMIERE EQUATION

RESIDUS DE LA DEUXIEME EQUATION

RESIDUS DE LA TROISIEME EQUATION

RESIDUS DE LA QUATRIEME EQUATION

RESIDUS DE LA CINQUIEME EQUATION

RESIDUS DE LA SIXIEME EQUATION

|