Annexes B : Estimation du modèle

spécifié

Tableau n°12 : Estimation du modèle de

long terme

|

Dependent Variable: LPIBR

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 05/11/21 Time: 21:21

|

|

|

|

Sample: 1990Q1 2019Q4

|

|

|

|

Included observations: 120

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

29.26741

|

2.434853

|

12.02019

|

0.0000

|

|

LCREDB

|

-0.007962

|

0.121226

|

-0.065682

|

0.9477

|

|

LTDIR

|

0.349928

|

0.170758

|

2.049261

|

0.0427

|

|

LTINFL

|

-0.064758

|

0.090008

|

-0.719472

|

0.4733

|

|

EXPORTNET

|

3.05E-06

|

2.41E-07

|

12.63630

|

0.0000

|

|

LTCHOM

|

-1.949013

|

0.496361

|

-3.926607

|

0.0001

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.848452

|

Meandependent var

|

20.03133

|

|

Adjusted R-squared

|

0.841805

|

S.D. dependent var

|

2.820315

|

|

S.E. of regression

|

1.121744

|

Akaike info criterion

|

3.116353

|

|

Sumsquaredresid

|

143.4473

|

Schwarz criterion

|

3.255728

|

|

Log likelihood

|

-180.9812

|

Hannan-Quinn criter.

|

3.172954

|

|

F-statistic

|

127.6474

|

Durbin-Watson stat

|

0.346739

|

|

Prob(F-statistic)

|

0.000000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tableau n°12 : Estimation du modèle de

court terme

|

Dependent Variable: D(LPIBR)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 05/11/21 Time: 21:37

|

|

|

|

Sample (adjusted): 1990M02 2019M12

|

|

|

Included observations: 359 afteradjustments

|

|

|

HAC standard errors & covariance (Bartlett kernel, Newey-West

fixed

|

|

bandwidth =

6.0000)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

C

|

-0.013670

|

0.018240

|

-0.749453

|

0.4541

|

|

D(LCREDB)

|

-0.116672

|

0.184634

|

-0.631911

|

0.5279

|

|

D(LTDIR)

|

0.291131

|

0.274652

|

1.060000

|

0.2899

|

|

D(LTINFL)

|

0.021062

|

0.068286

|

0.308431

|

0.0079

|

|

D(LTCHOM)

|

-0.651303

|

0.660129

|

-0.986631

|

0.3245

|

|

RESIDU(-1)

|

-0.215375

|

0.014053

|

-15.32591

|

0.0047

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.819785

|

Meandependent var

|

-0.015037

|

|

Adjusted R-squared

|

0.806468

|

S.D. dependent var

|

0.381610

|

|

S.E. of regression

|

0.372639

|

Akaike info criterion

|

0.880156

|

|

Sumsquaredresid

|

49.01740

|

Schwarz criterion

|

0.945058

|

|

Log likelihood

|

-151.9880

|

Hannan-Quinn criter.

|

0.905965

|

|

F-statistic

|

4.489228

|

Durbin-Watson stat

|

1.994010

|

|

Prob(F-statistic)

|

0.000558

|

Wald F-statistic

|

0.313486

|

|

Prob(Wald F-statistic)

|

0.904783

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annexes C : Validation du modèle

1. Test d'autocorrélation des erreurs

Tableau n°13: Breusch-Godfrey Serial Correlation LM

test.

|

|

|

|

|

|

|

|

|

|

|

|

|

F-statistic

|

0.003125

|

Prob. F(2,351)

|

0.9969

|

|

Obs*R-squared

|

0.006392

|

Prob. Chi-Square(2)

|

0.9968

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

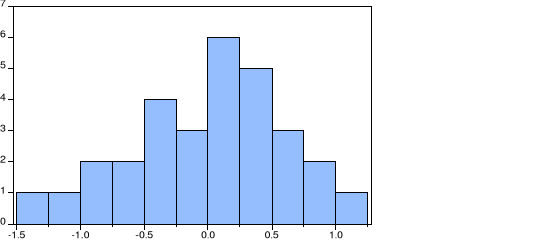

Graphique 1 : Test de normalité de Jarque-Bera des

résidus

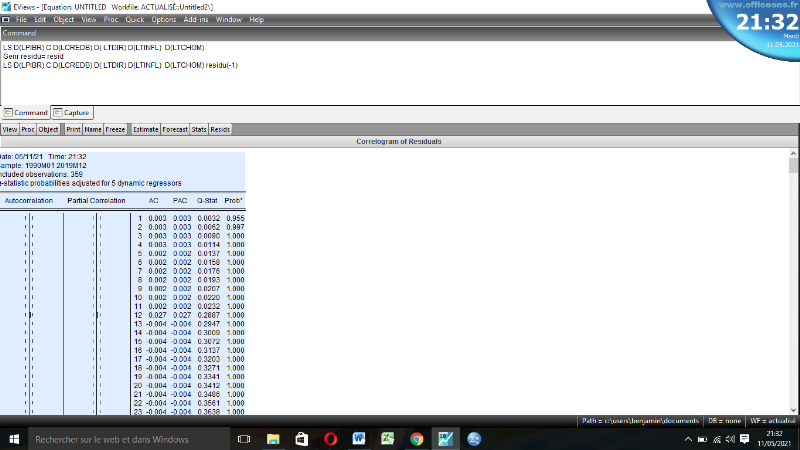

Tableau 2 : Corrélogramme des résidus

après estimation du modèle

2. Hétéroscédasticité des

erreurs

Tableau 15 : Test d'ARCH

|

|

|

|

|

|

|

|

|

|

|

F-statistic

|

0.003828

|

Prob. F(1,356)

|

0.9507

|

|

Obs*R-squared

|

0.003849

|

Prob. Chi-Square(1)

|

0.9505

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Tests de stabilité du modèle

spécifié

Tableau 16 : Test RESET de Ramsey de spécification

du modèle

|

Ramsey RESET Test

|

|

|

|

Equation: UNTITLED

|

|

|

|

Specification: D(LPIBR) C D(LCREDB) D( LTDIR) D(LTINFL)

D(LTCHOM)

|

|

RESIDU(-1)

|

|

|

|

Omitted Variables: Squares of fitted values

|

|

|

|

|

|

|

|

|

|

|

|

|

Value

|

Df

|

Probability

|

|

|

t-statistic

|

0.019498

|

352

|

0.9845

|

|

|

F-statistic

|

0.000380

|

(1, 352)

|

0.9845

|

|

|

Likelihood ratio

|

0.000388

|

1

|

0.9843

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

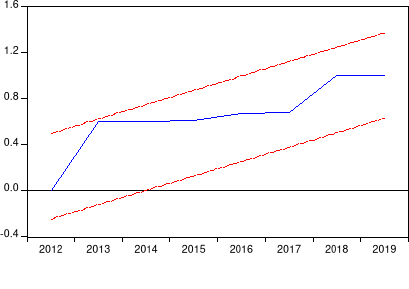

Graphique n°2: Test CUSUM des carrés

stabilité du modèle

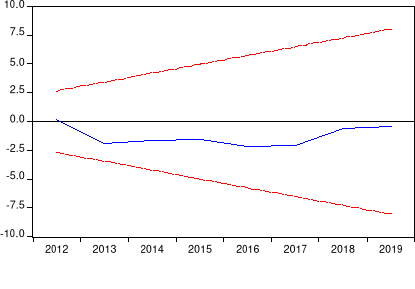

Graphique n°3: Test CUSUM de stabilité du

modèle

|