A. QED

Proof of Proposition 1: By Lemma 1, a strategy profile forms a

subgame perfect equilibrium if and only if there is no profitable one shot

deviation from that strategy at any stage in the game.

Our candidate equilibrium, me-M, is that, for any CUT , miners

chain their block to the most recent block in the original chain.

To prove that this is a Markov perfect equilibrium we now show

that, in any state wt, any miner prefers to follow the equilibrium, and chain

his block to the most recent one in the original chain, rather than engaging in

a one shot deviation, chaining his block to another block, B, at time T, and

then reverting to the equilibrium strategy.

To do so, consider three cases, whose probabilities are

independent of the miners' actions (since they reflect the distributions of

independent Poisson processes whose intensities are exogenous)

27

Proof of Proposition 2: Denote by n(T) the index of the last

block solved by time T, by Bn(T) the corresponding block and by I f

the first time at which the sunspot variable is above 1 -- E and f <

n(T).

Our candidate equilibrium strategy profile, a* , specifies the

following:

a) Before the fork: If T < T f , miners chain

their block to the most recent block in the original chain.

b) At the fork inception: If T Tf , or T > T

f and cut does not include an edge (Bn(Tf) f, Bk+l), with k >

n(T), miners chain their block to

c) After the fork: If T > T f and WT includes

an edge Bk+l), with k > n(T f ), miners chain

their block to

the most recently solved block in the chain including (Bn(Tf) f, Bk*+l), (with

k* = min{k n(T f )

s.t. there exists an edge (Bn(Tf) f, Bk+l)}), whose index is the

index of its parent plus one or, if such a block does not exist, to B/c* +1.

Note that if all miners follow a* , their behaviour on the

equilibrium path is as described in Proposition 2. To prove that this is a

Markov perfect equilibrium, we need to prove that a miner does not have a

profitable one shot deviation from o*. We hereafter consider the three cases

a), b) and c) in turn.

a) Before the fork: Bearing in mind that miner's actions

don't affect the occurrence of the sunspot, at all times before T/ the proof of

a) operates along the same line as the proof of Proposition 1.

b) At the fork inception: Compare m's expected gain if he

follows the equilibrium strategy (chaining his block to Bn(Tf) f) to his

expected gain from deviating once by chaining his block to # and then reverting

to the equilibrium strategy. As earlier, the only relevant case is when the

next event is that m solves If he had chained to B, then he expects that at

later stages no miner (including himself) will chain any block to since he

anticipates the equilibrium strategy to be followed. Consequently, his reward

for mining attached to B is 0 (and therefore less than his gain if he had

followed the equilibrium). Moreover, as before, his expected payoff from

previously solved blocks as well as from future blocks, is unaffected by which

block he has just mined.

58

29

c)

59

After the fork: If T > Tf , Condition 2 holds

and the new chain exists, then miners m < K chain their block to the last

block on the new chain, while miners m > K chain their block to the last

block on the original chain.

d) After the fork off-path: Suppose there are two consecutive

times T and T' such that Condition 2 holds at T but not at T'. Note that this

can only happen after a deviation from the strategy prescribed in b) and c)

where BH is either chained to the last block on the new chain (or Bn(Tf) f) by

a miner m > K or chained to the last block on the original chain by a miner

m < K. The equilibrium strategy then prescribes that miners exclude BT'.

More precisely, suppose BT/ was chained to the original chain by m < K. Then

at and after H, miners m < K chain their block to the last block on the new

chain. At T/ miners m > K chain their block to the last block solved by time

T on the original chain, B} and do so until a new block BnewO is

solved and chained to B O After Bneu,O is solved, miners

m > K chain their block to the last block on the chain that contains (Bn(T)

O BnewO ) that preexists all chains that contain (B n(T)

O BnewO ). This chain then replaces the original chain in

Condition 2. Symmetrically, if Bf/ was chained to the new chain by m > K,

then at and after T', miners m > K chain their block to the last block on

the original chain, while miners m < K exclude BT/ by mining from the last

block solved by time T on the new chain, and then mining from the chain that

originates from that fork. This chain then replaces the new chain in Condition

2.

As will become explicit below, the specification of the

equilibrium strategy in states described in d) is useful to rule out certain

types of deviations. Note that if the state is as described in d) and all

miners play the equilibrium strategy, then the expected payoff of a miner, say

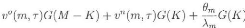

m < K, at T1 is

which is exactly his expected payoff at T under the equilibrium

strategy described in b) and c). This also holds for miners m > K.

We need to prove that a miner does not have a profitable one

shot deviation from a*. We hereafter consider each of the cases above in

turn.

31

Hence, one can set E so that, Pr(T f < z Iw z and

correspondingly the gain from reducing the likelihood of a fork via a

deviation, is arbitrarily close to 0.

Next consider the second effect. If miner m solves but this block

is not on the original chain, no further block will be chained to it, since all

miners henceforth will follow a*. Hence the expected payoff for this block is

0. If instead m was following the equilibrium strategy when he solved

the expected payoff from this block is strictly positive.

Overall, the first effect, which reflects the maximum gain from a

one shot deviation can be set arbitrarily close to 0, while the second effect,

which reflects the cost of a one shot deviation, is bounded away from 0. Hence,

there is no profitable one shot deviation.

b) c) At or after the fork:

1) Consider first a deviation by a miner m > K.

Any deviation other than chaining to the last block on the new

chain is ruled out by similar arguments as in Proposition 1. Hence we just have

to check that rn, prefers to chain his block to the last block on the original

chain, rather than to the last block on the new chain. As in the previous

60

proofs, this one shot deviation affects rn's payoff only if the

next stopping time T/ corresponding to two possible events: either m solves his

block, or zrn occurs.

(i) Suppose miner m solves a block at T', i.e., IVm(T/) --

Nm(T) = 1. If Condition 2 is still true at T', since every miner, including m,

reverts to the equilibrium strategy from T' on, the only impact of the

deviation is that m earns G(K) for block Bn(T/) instead of G(M -- K) under the

equilibrium strategy. If Condition 2 is not true at T', the only impact of the

deviation is that m earns 0 for block Bn(T') instead of G(M -- K) under the

equilibrium strategy. Indeed both under the equilibrium strategy and the

deviation, his expected payoff at T' is his expected payoff at T plus the

reward he receives for block Bn(T'), which is 0 under the deviation when

Condition 2 does not, hold since from d) no miner will ever chain a block to

Bn(T/) .

(ii) Suppose miner 'm, is hit, by a liquidity shock at, T',

i.e., zm, = T'. Then his payoff under the deviation is

33

Last, see that inequality (1) in Condition 1 guarantees that

(2) and (3) cannot be satisfied jointly for the same miner m.

d) After the fork off-path

Suppose is as described in d) and consider a deviation by miner m

before block is solved. If m chains his block to Bn(TI) and the next event is

not that m solves his block, then his deviation is irrelevant. If the next

event is that he solves his block, then the only impact of the deviation is

that m earns 0 for this block, since all miners play the equilibrium strategy

going forward so that no

miner will ever chain his block to

Suppose that miner m deviates and chains his block to a block

that was solved before Bn(+). Then, as above, the only relevant deviations are

for a miner m K to mine a block chained to the last block on the original chain

solved by time T or for m > K to mine a block chained to the last block on

the new chain solved by time T. By construction, the payoffs from these

deviations and from adhering to the equilibrium strategy are identical to the

payoffs derived in b) and c). Furthermore, given that no miner chains his block

to Bn(T') which therefore yields 0 to the miner who solved it, a deviation is

not profitable if Condition 2 holds when block Bn(T') is substracted from

miners' vested interests vo (m, H) and on (m, H), that is, if v

o (m, T) and on (m, T) are such that Condition 2 holds,

which is true.

Finally, consider a deviation by miner m after block Bn(T0+1 is

solved, then the state is such that Condition 2 holds, hence, from b) and c),

there is no profitable one shot deviation. QED

|