Le point de départ de cette méthode

réside dans l'existence d'une relation théorique que les

paramètres considérés doivent satisfaire. L'idée de

base est qu'il faut choisir les estimateurs des paramètres de telle

sorte qu'ils soient le plus proches de la relation théorique. Ces

estimateurs sont choisis pour minimiser la distance pondérée

entre les valeurs théoriques et les valeurs observées.

Autrement, on introduit un ensemble de

paramètres auxiliaires, facilement estimables, et l'on estime les

paramètres du modèle à partir de ces estimatuers

auxiliaires.

Toutefois, s'il on retient un nombre important des

paramètres auxiliaires que des paramètres

d'intérêts, cela devrait améliorer la précision des

estimateurs des moments.

Notons que l'estimateur GMM (Generalized method of moments)

est robuste au sens où il ne nécessite pas des informations

particulières sur la vraie distribution des erreurs.

L'estimateur GMM consiste en une restriction sur les moments,

appelée conditions d'orthogonalité :

E (W', X,) = 0 (1)

Où W' est un vecteur des paramètres auxiliaires,

X, un vecteur des paramètres d'intérêts et un vecteur des

paramètres inconnus.

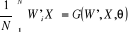

En notant G (X, W, ) la contrepartie empirique de (1), il

vient :

(2)

L'estimateur GMM de est tel que la moyenne empirique G (X,

W', ) soit aussi proche de zéro. Cet estimateur est alors la valeur de

qui minimise la fonction critère suivante :

G' (X, W',) A G ( X, W',) (3)

Où A est une matrice de pondération, de poids ou

de distance.

Si le système est juste identifié, le nombre des

paramètres d'intérêts égale celui des

paramètres auxiliaires, la fonction critère (3) est

minimisée pour la valeur de vérifiant : G (X, W', ) = 0

Signalons que de très nombreuses méthodes

d'estimation sont des cas particuliers de la méthode des moments

généralisés. Ainsi, l'estimateur des moindres

carrés ordinaires est un cas particulier de l'estimateur GMM en posant

que les variables endogènes et exogènes ne sont pas

corrélées avec le terme résiduel.

2. Outputs des estimations

Tableau 6: estimation de within avec

dette/pib

|

Dependent Variable: TXCROIS

|

|

Method: Least Squares

|

|

Date: 01/14/06 Time: 13:17

|

|

Sample(adjusted): 2 200

|

|

Included observations: 196

|

|

Excluded observations: 3 after adjusting endpoints

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

C

|

18.85207

|

7.695677

|

2.449696

|

0.0153

|

|

LPNBHAB(-1)

|

-2.762817

|

0.901151

|

-3.065877

|

0.0025

|

|

TEXCH

|

0.041704

|

0.030377

|

1.372874

|

0.1715

|

|

APD

|

0.000917

|

0.003519

|

0.260655

|

0.7947

|

|

LTXPOP

|

2.375701

|

1.907803

|

1.245255

|

0.2147

|

|

SERVEXP

|

0.005483

|

0.043105

|

0.127198

|

0.8989

|

|

TXINV

|

0.470486

|

0.104114

|

4.518945

|

0.0000

|

|

DEFICIT

|

0.434792

|

0.136100

|

3.194656

|

0.0017

|

|

OPEN

|

-0.064350

|

0.049735

|

-1.293850

|

0.1974

|

|

LDEPIB

|

-0.577571

|

2.351299

|

-0.245639

|

0.8062

|

|

LDEPIB2

|

-0.933932

|

1.139759

|

-0.819412

|

0.4137

|

|

D1

|

3.555428

|

3.423063

|

1.038669

|

0.3004

|

|

D2

|

-0.451753

|

3.037599

|

-0.148720

|

0.8819

|

|

D3

|

-1.935853

|

2.539689

|

-0.762240

|

0.4469

|

|

D4

|

0.666388

|

2.934215

|

0.227109

|

0.8206

|

|

D5

|

0.172904

|

2.941162

|

0.058788

|

0.9532

|

|

D6

|

-1.176215

|

2.935830

|

-0.400641

|

0.6892

|

|

D7

|

2.794441

|

3.400393

|

0.821800

|

0.4123

|

|

D8

|

-4.933572

|

3.635712

|

-1.356975

|

0.1765

|

|

D9

|

-0.513478

|

2.986656

|

-0.171924

|

0.8637

|

|

R-squared

|

0.275222

|

Mean dependent var

|

1.842857

|

|

Adjusted R-squared

|

0.196979

|

S.D. dependent var

|

7.585411

|

|

S.E. of regression

|

6.797395

|

Akaike info criterion

|

6.767407

|

|

Sum squared resid

|

8132.006

|

Schwarz criterion

|

7.101908

|

|

Log likelihood

|

-643.2059

|

F-statistic

|

3.517530

|

|

Durbin-Watson stat

|

2.006632

|

Prob(F-statistic)

|

0.000005

|

Tableau 7: estimation de within avec

dette/exportation

|

Dependent Variable: TXCROIS

|

|

Method: Least Squares

|

|

Date: 01/14/06 Time: 13:18

|

|

Sample(adjusted): 2 200

|

|

Included observations: 196

|

|

Excluded observations: 3 after adjusting endpoints

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

C

|

21.04443

|

14.65775

|

1.435721

|

0.1529

|

|

LPNBHAB(-1)

|

-2.735285

|

0.904724

|

-3.023338

|

0.0029

|

|

TEXCH

|

0.041395

|

0.030352

|

1.363813

|

0.1744

|

|

APD

|

0.000945

|

0.003519

|

0.268665

|

0.7885

|

|

LTXPOP

|

2.379889

|

1.907609

|

1.247577

|

0.2138

|

|

SERVEXP

|

0.005458

|

0.043098

|

0.126648

|

0.8994

|

|

TXINV

|

0.467935

|

0.104138

|

4.493412

|

0.0000

|

|

DEFICIT

|

0.434998

|

0.136058

|

3.197142

|

0.0016

|

|

OPEN

|

-0.061663

|

0.049817

|

-1.237803

|

0.2174

|

|

LDEXP

|

-1.733347

|

2.285464

|

-0.758422

|

0.4492

|

|

LDEXP2

|

-0.368872

|

1.178106

|

-0.313106

|

0.7546

|

|

D1

|

3.637165

|

3.420753

|

1.063264

|

0.2891

|

|

D2

|

-0.390532

|

3.036333

|

-0.128620

|

0.8978

|

|

D3

|

-1.895929

|

2.539590

|

-0.746549

|

0.4563

|

|

D4

|

0.743085

|

2.935547

|

0.253134

|

0.8005

|

|

D5

|

0.212515

|

2.938622

|

0.072318

|

0.9424

|

|

D6

|

-1.096113

|

2.935062

|

-0.373455

|

0.7093

|

|

D7

|

2.904663

|

3.396796

|

0.855119

|

0.3936

|

|

D8

|

-4.856862

|

3.629710

|

-1.338086

|

0.1826

|

|

D9

|

-0.486829

|

2.983761

|

-0.163160

|

0.8706

|

|

R-squared

|

0.275430

|

Mean dependent var

|

1.842857

|

|

Adjusted R-squared

|

0.197209

|

S.D. dependent var

|

7.585411

|

|

S.E. of regression

|

6.796422

|

Akaike info criterion

|

6.767120

|

|

Sum squared resid

|

8129.677

|

Schwarz criterion

|

7.101622

|

|

Log likelihood

|

-643.1778

|

F-statistic

|

3.521192

|

|

Durbin-Watson stat

|

2.007274

|

Prob(F-statistic)

|

0.000005

|

Tableau 8:Estimation GMM avec dette/pib

|

Dependent Variable: TXCROIS

|

|

Method: Generalized Method of Moments

|

|

Date: 01/18/06 Time: 09:31

|

|

Sample(adjusted): 3 181

|

|

Included observations: 179 after adjusting endpoints

|

|

No prewhitening

|

|

Bandwidth: Fixed (4)

|

|

Kernel: Bartlett

|

|

Convergence achieved after: 10 weight matricies, 11 total coef

|

|

iterations

|

|

Instrument list: D(TXCROIS) D(LPNBHAB(-1)) D(TEXCH) D(LTXPOP)

|

|

D(APD) D(SERVEXP) D(DEFICIT) D(TXINV) D(OPEN)

D(LDEPIB)

|

|

D(LDEPIB2)

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

C

|

29.44941

|

16.89479

|

1.743106

|

0.0831

|

|

LPNBHAB(-1)

|

-4.336943

|

1.938552

|

-2.237207

|

0.0266

|

|

TEXCH

|

0.006446

|

0.041848

|

0.154026

|

0.8778

|

|

LTXPOP

|

2.064860

|

2.613222

|

0.790159

|

0.4305

|

|

APD

|

0.005453

|

0.002065

|

2.641009

|

0.0090

|

|

SERVEXP

|

-0.151259

|

0.101448

|

-1.491007

|

0.1378

|

|

DEFICIT

|

0.228554

|

0.181099

|

1.262038

|

0.2087

|

|

TXINV

|

0.571036

|

0.160461

|

3.558730

|

0.0005

|

|

OPEN

|

-0.035450

|

0.064594

|

-0.548820

|

0.5839

|

|

LDEPIB

|

-1.408378

|

5.037171

|

-0.279597

|

0.7801

|

|

LDEPIB2

|

-0.565325

|

2.258483

|

-0.250312

|

0.8027

|

|

R-squared

|

0.119854

|

Mean dependent var

|

1.770391

|

|

Adjusted R-squared

|

0.067464

|

S.D. dependent var

|

6.070426

|

|

S.E. of regression

|

5.862083

|

Sum squared resid

|

5773.154

|

|

Durbin-Watson stat

|

1.710482

|

J-statistic

|

0.045428

|

Tableau 9: Estimation GMM avec dette/export

|

Dependent Variable: TXCROIS

|

|

Method: Generalized Method of Moments

|

|

Date: 01/18/06 Time: 09:32

|

|

Sample(adjusted): 3 181

|

|

Included observations: 179 after adjusting endpoints

|

|

No prewhitening

|

|

Bandwidth: Fixed (4)

|

|

Kernel: Bartlett

|

|

Convergence achieved after: 12 weight matricies, 13 total coef

|

|

iterations

|

|

Instrument list: D(TXCROIS) D(LPNBHAB(-1)) D(TEXCH) D(LTXPOP)

|

|

D(APD) D(SERVEXP) D(DEFICIT) D(TXINV) D(OPEN) D(LDEXP)

|

|

D(LDEXP2)

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

C

|

33.81051

|

24.60346

|

1.374218

|

0.1712

|

|

LPNBHAB(-1)

|

-4.470962

|

1.959561

|

-2.281613

|

0.0238

|

|

TEXCH

|

0.008734

|

0.041198

|

0.211999

|

0.8324

|

|

LTXPOP

|

2.133572

|

2.581795

|

0.826391

|

0.4098

|

|

APD

|

0.005301

|

0.002003

|

2.647066

|

0.0089

|

|

SERVEXP

|

-0.147657

|

0.102043

|

-1.447013

|

0.1498

|

|

DEFICIT

|

0.213474

|

0.180485

|

1.182783

|

0.2386

|

|

TXINV

|

0.582907

|

0.161716

|

3.604503

|

0.0004

|

|

OPEN

|

-0.054244

|

0.066484

|

-0.815901

|

0.4157

|

|

LDEXP

|

-2.176813

|

4.542123

|

-0.479250

|

0.6324

|

|

LDEXP2

|

-0.132237

|

2.568427

|

-0.051486

|

0.9590

|

|

R-squared

|

0.124803

|

Mean dependent var

|

1.770391

|

|

Adjusted R-squared

|

0.072708

|

S.D. dependent var

|

6.070426

|

|

S.E. of regression

|

5.845578

|

Sum squared resid

|

5740.692

|

|

Durbin-Watson stat

|

1.719906

|

J-statistic

|

0.045930

|

|

Dependent Variable: TXINV

|

|

Method: Least Squares

|

|

Date: 01/20/06 Time: 22:10

|

|

Sample: 1 200

|

|

Included observations: 200

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

C

|

-13.06925

|

5.126555

|

-2.549325

|

0.0116

|

|

AIDE

|

0.001213

|

0.002471

|

-2.490712

|

0.0342

|

|

LPNBHAB

|

4.761445

|

0.590170

|

8.067921

|

0.0000

|

|

SERVEXP

|

-0.011298

|

0.030338

|

2.372409

|

0.0370

|

|

OPEN

|

0.172154

|

0.031111

|

5.533475

|

0.0000

|

|

LDEPIB

|

-7.155756

|

1.523858

|

-4.695816

|

0.0000

|

|

LDEPIB2

|

2.611271

|

0.747353

|

3.494028

|

0.0006

|

|

D1

|

4.959196

|

2.115953

|

2.343717

|

0.0202

|

|

D2

|

0.206611

|

2.012250

|

0.102677

|

0.9183

|

|

D3

|

4.753549

|

1.666340

|

2.852688

|

0.0048

|

|

D4

|

3.683322

|

1.939713

|

1.898900

|

0.0591

|

|

D5

|

0.501738

|

1.993377

|

0.251703

|

0.8016

|

|

D6

|

4.029906

|

1.909829

|

2.110088

|

0.0362

|

|

D7

|

11.26193

|

2.094612

|

5.376617

|

0.0000

|

|

D8

|

11.48801

|

2.344449

|

4.900088

|

0.0000

|

|

D9

|

2.385389

|

1.992298

|

1.197305

|

0.2327

|

|

R-squared

|

0.735212

|

Mean dependent var

|

17.32150

|

|

Adjusted R-squared

|

0.713626

|

S.D. dependent var

|

9.222285

|

|

S.E. of regression

|

4.935210

|

Akaike info criterion

|

6.107286

|

|

Sum squared resid

|

4481.558

|

Schwarz criterion

|

6.371151

|

|

Log likelihood

|

-594.7286

|

F-statistic

|

34.05964

|

|

Durbin-Watson stat

|

2.206456

|

Prob(F-statistic)

|

0.000000

|

|

Dependent Variable: TXINV

|

|

Method: Least Squares

|

|

Date: 01/20/06 Time: 22:11

|

|

Sample: 1 200

|

|

Included observations: 200

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

C

|

-41.28530

|

9.746545

|

-4.235891

|

0.0000

|

|

AIDE

|

0.001228

|

0.002474

|

-2.496247

|

0.0320

|

|

LPNBHAB

|

4.758744

|

0.591126

|

8.050309

|

0.0000

|

|

SERVEXP

|

-0.011315

|

0.030377

|

2.372493

|

0.0370

|

|

OPEN

|

0.171222

|

0.031179

|

5.491518

|

0.0000

|

|

LDEXP

|

5.166659

|

1.497983

|

3.449076

|

0.0007

|

|

LDEXP2

|

-3.539599

|

0.762927

|

-4.639501

|

0.0000

|

|

D1

|

4.903493

|

2.117539

|

2.315656

|

0.0217

|

|

D2

|

0.150129

|

2.013271

|

0.074570

|

0.9406

|

|

D3

|

4.730356

|

1.668171

|

2.835655

|

0.0051

|

|

D4

|

3.658096

|

1.943219

|

1.882492

|

0.0613

|

|

D5

|

0.441447

|

1.993969

|

0.221391

|

0.8250

|

|

D6

|

3.980266

|

1.911292

|

2.082500

|

0.0387

|

|

D7

|

11.19431

|

2.095342

|

5.342473

|

0.0000

|

|

D8

|

11.42606

|

2.345772

|

4.870918

|

0.0000

|

|

D9

|

2.340733

|

1.993862

|

1.173969

|

0.2419

|

|

R-squared

|

0.734529

|

Mean dependent var

|

17.32150

|

|

Adjusted R-squared

|

0.712887

|

S.D. dependent var

|

9.222285

|

|

S.E. of regression

|

4.941571

|

Akaike info criterion

|

6.109862

|

|

Sum squared resid

|

4493.118

|

Schwarz criterion

|

6.373727

|

|

Log likelihood

|

-594.9862

|

F-statistic

|

33.94045

|

|

Durbin-Watson stat

|

2.210681

|

Prob(F-statistic)

|

0.000000

|

LES STATISTIQUES DESCRIPTIVES

|

APD

|

DEFICIT

|

DEPIB

|

DEPIB2

|

DEXP

|

DEXP2

|

OPEN

|

PNBHAB

|

SERVEXP

|

TEXCH

|

TXCROIS

|

TXINV

|

TXPOP

|

|

Mean

|

227.7450

|

-5.155500

|

86.48500

|

2445.040

|

394.1650

|

109.4400

|

57.10000

|

752.1500

|

18.16400

|

89.58835

|

1.786000

|

17.32150

|

2.705000

|

|

Median

|

183.5000

|

-4.250000

|

68.00000

|

1035.500

|

321.5000

|

46.50000

|

50.00000

|

297.5000

|

14.00000

|

89.50000

|

2.100000

|

14.90000

|

3.000000

|

|

Maximum

|

2034.000

|

6.100000

|

243.0000

|

46099.00

|

2147.000

|

589.0000

|

160.0000

|

5100.000

|

112.0000

|

180.3000

|

34.40000

|

59.70000

|

15.00000

|

|

Minimum

|

35.00000

|

-26.90000

|

16.00000

|

45.00000

|

67.00000

|

2.000000

|

5.000000

|

80.00000

|

0.100000

|

7.900000

|

-50.20000

|

1.800000

|

-21.00000

|

|

Std. Dev.

|

200.0568

|

4.874729

|

59.02593

|

4626.440

|

299.3147

|

144.2802

|

25.43017

|

1094.666

|

15.37000

|

20.02649

|

7.551785

|

9.222285

|

2.024467

|

|

Skewness

|

4.699553

|

-1.058228

|

1.085566

|

5.640847

|

2.076604

|

1.811527

|

1.409821

|

2.488725

|

2.378966

|

0.485244

|

-0.758504

|

1.613233

|

-6.960521

|

|

Kurtosis

|

36.94112

|

4.883159

|

3.228515

|

45.93284

|

9.861182

|

5.247823

|

5.538105

|

8.092166

|

12.30248

|

6.260334

|

16.08036

|

6.363473

|

101.8979

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jarque-Bera

|

10336.19

|

66.88059

|

39.71695

|

16420.88

|

536.0412

|

151.4936

|

119.9364

|

422.5430

|

909.7834

|

96.43019

|

1444.977

|

181.0253

|

83121.61

|

|

Probability

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Observations

|

200

|

200

|

200

|

200

|

200

|

200

|

200

|

200

|

200

|

200

|

200

|

200

|

200

|

LA MATRICE DES CORRELATIONS

|

APD

|

DEFICIT

|

DEPIB

|

DEPIB2

|

DEXP

|

DEXP2

|

OPEN

|

PNBHAB

|

SERVEXP

|

TEXCH

|

TXCROIS

|

TXINV

|

TXPOP

|

|

APD

|

1.000000

|

-0.196527

|

0.434168

|

0.144966

|

0.305313

|

0.421004

|

-0.103610

|

-0.288980

|

0.081268

|

-0.218194

|

-0.041200

|

-0.242136

|

-0.010125

|

|

DEFICIT

|

-0.196527

|

1.000000

|

-0.424584

|

-0.103089

|

-0.245565

|

-0.387639

|

-0.021618

|

0.166950

|

-0.132152

|

0.347015

|

0.240261

|

-0.091087

|

-0.019489

|

|

DEPIB

|

0.434168

|

-0.424584

|

1.000000

|

0.199662

|

0.410691

|

0.969053

|

0.407233

|

-0.045708

|

0.077639

|

-0.155415

|

-0.222427

|

0.096683

|

0.048765

|

|

DEPIB2

|

0.144966

|

-0.103089

|

0.199662

|

1.000000

|

0.911166

|

0.160424

|

-0.300189

|

-0.206215

|

0.493774

|

0.028556

|

-0.165918

|

-0.238545

|

0.060278

|

|

DEXP

|

0.305313

|

-0.245565

|

0.410691

|

0.911166

|

1.000000

|

0.343043

|

-0.359317

|

-0.325363

|

0.500594

|

-0.032320

|

-0.192474

|

-0.311957

|

0.029297

|

|

DEXP2

|

0.421004

|

-0.387639

|

0.969053

|

0.160424

|

0.343043

|

1.000000

|

0.399498

|

-0.100248

|

0.013353

|

-0.110122

|

-0.193507

|

0.067504

|

0.043147

|

|

OPEN

|

-0.103610

|

-0.021618

|

0.407233

|

-0.300189

|

-0.359317

|

0.399498

|

1.000000

|

0.491426

|

-0.291591

|

0.088122

|

-0.018215

|

0.622178

|

0.074856

|

|

PNBHAB

|

-0.288980

|

0.166950

|

-0.045708

|

-0.206215

|

-0.325363

|

-0.100248

|

0.491426

|

1.000000

|

-0.140557

|

0.054086

|

-0.001504

|

0.608742

|

0.082350

|

|

SERVEXP

|

0.081268

|

-0.132152

|

0.077639

|

0.493774

|

0.500594

|

0.013353

|

-0.291591

|

-0.140557

|

1.000000

|

-0.184582

|

-0.038739

|

-0.104001

|

0.007328

|

|

TEXCH

|

-0.218194

|

0.347015

|

-0.155415

|

0.028556

|

-0.032320

|

-0.110122

|

0.088122

|

0.054086

|

-0.184582

|

1.000000

|

0.139766

|

-0.078412

|

0.164242

|

|

TXCROIS

|

-0.041200

|

0.240261

|

-0.222427

|

-0.165918

|

-0.192474

|

-0.193507

|

-0.018215

|

-0.001504

|

-0.038739

|

0.139766

|

1.000000

|

0.181904

|

0.157631

|

|

TXINV

|

-0.242136

|

-0.091087

|

0.096683

|

-0.238545

|

-0.311957

|

0.067504

|

0.622178

|

0.608742

|

-0.104001

|

-0.078412

|

0.181904

|

1.000000

|

0.106495

|

|

TXPOP

|

-0.010125

|

-0.019489

|

0.048765

|

0.060278

|

0.029297

|

0.043147

|

0.074856

|

0.082350

|

0.007328

|

0.164242

|

0.157631

|

0.106495

|

1.000000

|

|