ANNEXES

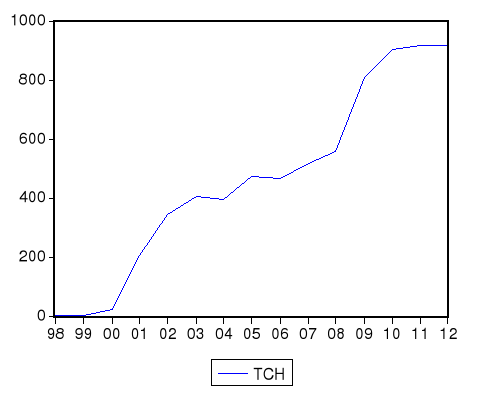

Graphique 1 : évolution du taux

d'inflation de 1998 à 2012.

Source : nous même à partir du

logiciel Eviews5.

|

Null Hypothesis: TINF has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 1 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-4.813138

|

0.0002

|

|

Test critical values:

|

1% level

|

|

-2.754993

|

|

|

5% level

|

|

-1.970978

|

|

|

10% level

|

|

-1.603693

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

Warning: Probabilities and critical values calculated for

20

|

|

observations

and may not be accurate for a sample size of 13

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(TINF)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 07/06/14 Time: 16:59

|

|

|

|

Sample (adjusted): 2000 2012

|

|

|

|

Included observations: 13 afteradjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

TINF(-1)

|

-0.476293

|

0.098957

|

-4.813138

|

0.0005

|

|

D(TINF(-1))

|

0.380509

|

0.134339

|

2.832458

|

0.0163

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.653550

|

Meandependent var

|

-37.00000

|

|

Adjusted R-squared

|

0.622054

|

S.D. dependent var

|

108.8204

|

|

S.E. of regression

|

66.89983

|

Akaike info criterion

|

11.38491

|

|

Sumsquaredresid

|

49231.47

|

Schwarz criterion

|

11.47182

|

|

Log likelihood

|

-72.00190

|

Durbin-Watson stat

|

2.085231

|

|

|

|

|

|

|

|

|

|

|

Graphique 2 : Evolution du taux de change de 1998

à 2012

Source : nous même à partir du

logiciel Eviews5.

|

Null Hypothesis: D(TCH) has a unit root

|

|

|

Exogenous: None

|

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-1.917575

|

0.0555

|

|

Test critical values:

|

1% level

|

|

-2.754993

|

|

|

5% level

|

|

-1.970978

|

|

|

10% level

|

|

-1.603693

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

Warning: Probabilities and critical values calculated for

20

|

|

observations

and may not be accurate for a sample size of 13

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(TCH,2)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 07/06/14 Time: 17:01

|

|

|

|

Sample (adjusted): 2000 2012

|

|

|

|

Included observations: 13 afteradjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(TCH(-1))

|

-0.469083

|

0.244623

|

-1.917575

|

0.0793

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.234550

|

Meandependent var

|

-0.164615

|

|

Adjusted R-squared

|

0.234550

|

S.D. dependent var

|

104.4254

|

|

S.E. of regression

|

91.36174

|

Akaike info criterion

|

11.94133

|

|

Sumsquaredresid

|

100163.6

|

Schwarz criterion

|

11.98479

|

|

Log likelihood

|

-76.61867

|

Durbin-Watson stat

|

2.009034

|

|

|

|

|

|

|

|

|

|

|

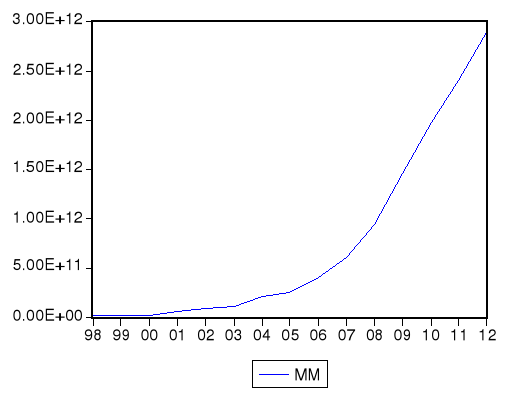

Graphique 3 : Evolution de la masse

monétaire de 1998 à 2012

Source : nous même à partir du

logiciel Eviews5.

|

Null Hypothesis: D(MM) has a unit root

|

|

|

Exogenous: Constant, Linear Trend

|

|

|

Lag Length: 0 (Automatic based on SIC, MAXLAG=1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

t-Statistic

|

Prob.*

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller test statistic

|

-1.915586

|

0.5900

|

|

Test critical values:

|

1% level

|

|

-4.886426

|

|

|

5% level

|

|

-3.828975

|

|

|

10% level

|

|

-3.362984

|

|

|

|

|

|

|

|

|

|

|

|

|

*MacKinnon (1996) one-sided p-values.

|

|

|

Warning: Probabilities and critical values calculated for

20

|

|

observations

and may not be accurate for a sample size of 13

|

|

|

|

|

|

|

|

|

|

|

|

Augmented Dickey-Fuller Test Equation

|

|

|

Dependent Variable: D(MM,2)

|

|

|

|

Method: Least Squares

|

|

|

|

Date: 07/06/14 Time: 17:03

|

|

|

|

Sample (adjusted): 2000 2012

|

|

|

|

Included observations: 13 afteradjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

|

|

|

|

|

|

|

|

|

|

D(MM(-1))

|

-0.457834

|

0.239005

|

-1.915586

|

0.0844

|

|

C

|

-7.28E+10

|

6.36E+10

|

-1.145441

|

0.2787

|

|

@TREND(1998)

|

2.43E+10

|

1.21E+10

|

2.006717

|

0.0726

|

|

|

|

|

|

|

|

|

|

|

|

R-squared

|

0.290042

|

Meandependent var

|

3.80E+10

|

|

Adjusted R-squared

|

0.148050

|

S.D. dependent var

|

7.63E+10

|

|

S.E. of regression

|

7.04E+10

|

Akaike info criterion

|

52.99198

|

|

Sumsquaredresid

|

4.96E+22

|

Schwarz criterion

|

53.12235

|

|

Log likelihood

|

-341.4479

|

F-statistic

|

2.042668

|

|

Durbin-Watson stat

|

1.675334

|

Prob(F-statistic)

|

0.180370

|

|

|

|

|

|

|

|

|

|

|

|