I.2.b. Dual-Listed Companies (DLCs)

A dual-listing (DL), also referred as Siamese twin, is the

result of a merger between companies incorporated in different countries. These

two companies agree to unify their forces (cash flows, operational activities),

but to keep separated their identities (assets, shareholdings). In this case,

there are contractual agreements between the two companies to share the cash

flows from each other's assets. Alternatively, the two companies may transfer

all their assets to a holding company which redistributes the dividends. The

shareholders of the two companies have the same rights in terms of votes and

dividends, "in line with

2

These figures include IPOs and capital increases, but no issues

from mergers and acquisitions

the relative 'weights' of the two companies established at the

time of the creation of the DLC"3.

Under this type of organisation, there is a unique management or

an identical management elected on both board.

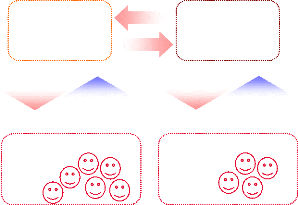

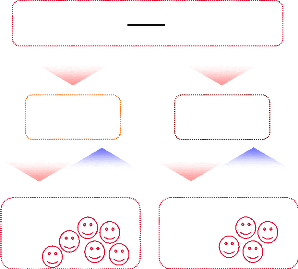

DLC Structure Type 1 (case of Rio Tinto Ltd and Rio Tinto

Plc)

Shareholders of the Dutch Entity

Assets (operations)

Rio Tinto Ltd listed on Sydney

Dividends

Voting rights

Cash

flows

Shareholders of the English Entity

Dividends

Assets (operations)

Rio tinto Plc Listed on the L.S.E

Voting rights

DLC Structure Type 2 (case of Unilever N.V. and Unilever

Plc)

Shareholders of the Dutch Entity

Holding Company

Dividends

Unilever N.V listed on Amsterdam

Dividends Dividends

Voting rights

Cash flows Operations

Assets

Shareholders of the English Entity

Dividends

Unilever Plc Listed on the L.S.E

Voting rights

3 Reserve Bank of Australia Bulletin, 2002,

"Dual-listed Companies"

First of all, it is important to notice that a dual-listing is

different from a cross- listing, since the shares on each stock exchange are

not from the same company. Whereas a dual-listing implies the quasi-merger of

two companies, a cross-listing results into the secondary listing on a foreign

stock exchange. However, the overall philosophy is the same and that is why

during the creation of the sample in part II. The Geography of the Foreign

Cross-Listing, dual-listings will be considered as cross-listings. However, in

the part dealing with the liquidity and the volumes matters (see IV. Is the

Foreign Cross-Listing Efficient ?), DLCs are not taken into consideration since

their shares are different and therefore not tradable on the both stock

exchanges (e.g. impossibility to perform arbitrages, i.e. buy a stocks on the

ASX and sell it on the L.S.E).

At the moment, two of the most relevant cases of dual-listing

are BHP Billiton Plc/BHP Billiton Ltd (U.K., listed on L.S.E/Australia, listed

on ASX) and Unilever Plc/Unilever N.V (U.K., listed on L.S.E/The Netherlands,

listed on Euronext Amsterdam).

All actual dual-listed companies (as of December 2008):

4 ThomsonReuters (Canada/U.K., 2008)

4 Mondi (South Africa/U.K., 2007)

4 Anheuser-Busch InBev (Belgium/Brazil, 2004)

4 Carnival Corporation (U.K./U.S., 2003)

4 Investec Bank (South Africa/U.K., 2002)

4 BHP Billiton (Australia/U.K., 2001)

4 Rio Tinto (Australia/U.K., 1995)

4 Reed Elsevier (U.K./The Netherlands, 1993)

4 Unilever (U.K./The Netherlands, 1930)

Former dual-listed companies (as of December, 2008):

4 Royal Dutch Shell (U.K./The Netherlands, 1907-2005)

4 Brambles Industries (Australia/U.K., 2001-2006)

4 Fortis (Belgium/The Netherlands, 1990-2001)

4 Allied Zurich (now ZFS) (U.K./Switzerland, 1998-2000)

4 Dexia (Belgium/France, 1996-2000)

4 Nordbanken/Merita (now Nordea) (Sweden/Finland, 1997-2000)

4 ABB Group (Sweden/Switzerland, 1988-1999)

4 Smith Kline Beecham (now Glaxo) (U.K./U.S., 1989-1996)

According to the managements of former DLCs, the main reasons

evoked to justify the withdrawal of the DLC structure is the willingness to

eliminate the premium/discount between the two companies, although there is

theoretically no possibility of arbitrage since the two companies offer

equivalent dividend and voting right to their respective shareholders. However,

some examples had shown significant gap between the two stocks values.

Several studies have already been done about this subject (L.

Rosenthal and C. Young4 in 1990, K. Froot and E. Dabora5

in 1999), showing that "significant mispricing in three DLCs (Royal Dutch

Shell, Unilever, and Smithkline Beecham) has existed over a long period of

time. Both studies conclude that fundamental factors (such as currency risk,

governance structures, legal contracts, liquidity, and taxation) are not

sufficient to explain the magnitude of the price deviations". K. Froot and E.

Dabora5 stated that "the relative prices of the twin stocks are

correlated with the stock indices of the markets on which each of the twins has

its main listing. For example, if the FTSE 100 rises relative to the AEX index

(the Dutch stock market index) the stock price of Reed International PLC

generally tends to rise relative to the stock price of Elsevier NV. A potential

explanation is that local market sentiment affects the relative prices of the

shares of the DLC parent companies".

4

L. Rosenthal and C. Young, 1990, "The seemingly anomalous price

behavior of Royal Dutch/Shell and Unilever N.V./PLC"

5 K. Froot and E. Dabora, 1999, "How are stock prices

affected by the location of trade?"

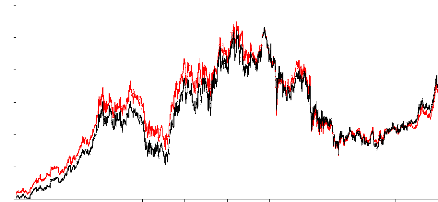

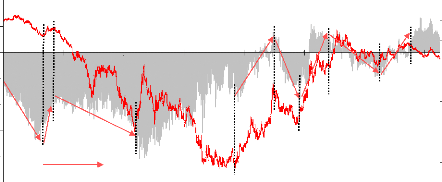

#2: Evolutions of the stocks Rio Tinto Pic (London) and

Rio

Tinto Ltd (Sydney)

Both shares price in £, by using the dai ly currency

conversion rate A$/£

70

60

50

40

30

20

10

0

80

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Sydney London

Source: ThomsonReuters Datastream, from the 07/10/1998 to

the 07/10/2008

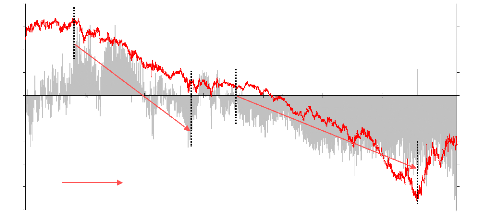

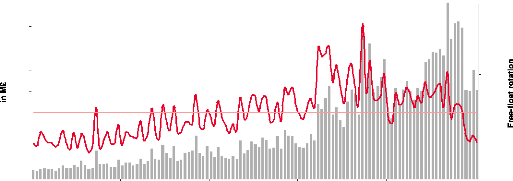

#3: Premium / Discount (Rio Tinto Pic vs. Rio Tinto Ltd)

20%

Premium / Discount

min (29/09/2008) -29.88%

max (31/03/2000) 15.31%

average -3.65%

Gross tendance FTSE vs. ASX

15%

10%

5%

0%

-5%

-10%

-15%

-20%

-25%

30

10

-10

-30

-50

-70

-90

-110

-130

-150

1998 199922000 2001 2002 2003 2004 2005 2006

2007 2008

|

% Premium / % Discount (LHS) Variations FTSE vs. ASX (RHS)

|

|

Source: ThomsonReuters Datastream, from the 07/10/1998 to

the 07/10/2008 Premium / discount calculated by using the daily currency

conversion rate A$/£

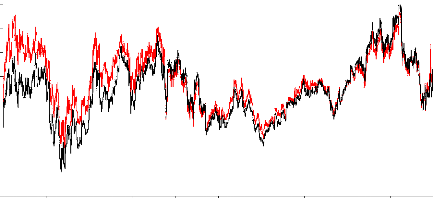

#4: Evolutions of the stocks Royal Dutch N. V (Amsterdam)

and

Shell Plc (London)

40 Both shares price in €, by us ing the daily currency

conversion rate £/€

35

30

25

20

15

10

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

Royal Dutch N.V Shell Plc

Source: ThomsonReuters Datastream, from the 19/07/1995 to

the 19/07/2005, i.e. date of the complete unification of the two companies and

the creation of Royal Dutch Shell

#5: Premium / Discount (Shell Plc vs. Royal Dutch N. V)

-10%

-15%

-20%

-25%

10%

-5%

5%

0%

Gross tendance FTSE vs. AEX

Premium / Discount

min (03/02/1999) -20.48%

max (27/02/2003) 6.74%

average -5.62%

20

0

-20

-40

-60

-80

-100

-120

-140

-160

1995 1996 1998 1999 2001 2002 2003 2005

% Premium / % Discount (LHS) Variations FTSE vs. AEX (RHS)

Source: ThomsonReuters Datastream, from the 19/07/1995 to

the 19/07/2005 Premium / discount calculated by using the daily currency

conversion rate £/€

Both shares price in €, by us ing the daily currency

conversion rate £/€

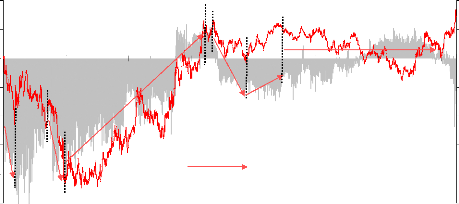

#6: Evolutions of the stocks Unilever N. V (Amsterdam)

and

Unilever Plc (London)

26 24 22 20 18 16 14 12

10

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Unilever N.V Unilever Plc

Source: ThomsonReuters Datastream, from the 07/10/1998 to

the 07/10/2008

#7: Premium / Discount (Unilever Plc vs. Unilever N.V)

- 25%

- 10%

- 15%

- 20%

10%

-5%

5%

0%

Gross tendance FTSE vs. AEX

Premium / Discount

min (03/02/1999) -29.54% max (27/02/2003) 5.85%

average

-4.60%

20

0

- 10

- 20

- 30

- 40

- 50

10

1998 2000 2001 2002 2004 2005 2007 2008

|

% Premium / % Discount (LHS) Variations FTSE vs. AEX (RHS)

|

Source: ThomsonReuters Datastream, from the 07/10/1998 to the

07/10/2008 Premium / discount calculated by using the daily currency conversion

rate £/€

Note: In order to offset the forex variation between two stocks

listed in different currencies, we have used the day-after-day spot conversion

rate.

The analysis of the three exhibits #3, #5, #7 entitled

"Premium / Discount" and representing the cases Royal Dutch Shell, Rio Tinto

and Unilever, confirms the statement made by K. Froot and E. Dabora (see

quotation page 10). During a substantial period of time (several months or

years), the premium/discount evolution of the DLC evolves in the same way as

the difference of variation between the two stock exchanges of quotation. The

more a stock exchange outperforms the second one, the more the premium for the

stock listed on the first one increases (or the discount decreases).

The most striking case concerns Rio Tinto. During an 8-years

period of time (1998-2008), the premium of the stock listed on the L.S.E

reached a maximum of circa 15% and progressively decreased to become a discount

of circa 23% on July 2008. This decrease was quite progressive and regular over

the time. These graphs illustrate the correlation between the premium/discount

and the difference of evolution between the two stock exchanges. Over the

10-years period, the correlation between the two variables is quite strong and

reaches the value of 0.82.

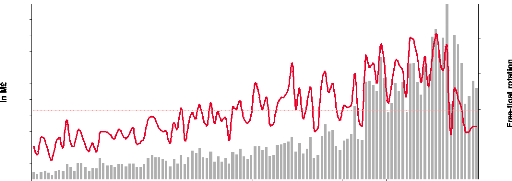

#8: 10-Years Evolution of Rio Tinto Pic Daily Free-Fioat

Rotation (London)

550

2.0%

500

450

1.6%

400

350

200

150

100

0.4%

50

0

0.0%

1.2%

300

250

10Y free-float rotation = 0.79

0.8%

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Monthly average daily volumes (LHS) % of the free-float (RHS)

Source: ThomsonReuters Datastream

#9: 10-Years Evolution of Rio Tinto Ltd Daily Free-Float Rotation

(Sydney)

160

2.0%

0.0%

80

140

1.6%

120

100

1.2%

10Y free-float rotation = 0.76

60

40

0.8%

0.4%

20

0

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

|

Monthly average daily volumes (LHS) % of the free-float (RHS)

|

Source: ThomsonReuters Datastream

As we may notice after the analysis of the two exhibits #8 and

#9, the 10-year daily free-float rotations are almost the same (0.79 vs. 0.76)

and follow the same tendency over the time. Hence, we may reject the hypothesis

that the difference of liquidity between the two stocks could have an influence

on the premium/discount variation.

Since 2002, we may notice the relative narrowing of the gap

between the two stocks, consequence of more efficient financial markets, a

growing deregulation and the fall of barriers between countries.

Through the analysis of former DLCs, we may note that since

the year 2000 a majority of DLCs have disappeared. In each case, the reasons

pleading for the total unification of the DLC were a greater liquidity thanks

to a unique stock traded and the increase of weight in benchmark index.

Moreover, companies' managements have to take into consideration that owning a

control stake in the capital of one of the two companies provides the control

of the whole DLC.

After this simplification of structure, the two listings become a

simple cross-listing.

|