I. Theoretical Approach of the Foreign Cross-Listing

I.1. Preamble

Definition of the foreign cross-listing:

In this research, a company is considered as foreign

cross-listed, if and only if its own shares are officially listed on one

or several foreign stock exchanges, in addition to the stock exchange

of its incorporation country.

By the term officially listed, we consider cross-listing

initiated on the behalf of the company.

Nowadays, foreign cross-listing may complete the hierarchy of

financing sources, the Pecking Order Theory developed by S. Myers and N. Majluf

in 1984.

#1: Successive Process of Global Financingl

Domestic Capital

Market Operations

International

Bond Issue

Foreign Equity

Issue

Foreign Equity

Listing

1

R. Nyvltova, 2006, "The Effects of Cross-Border Listings on the

Development of Emerging Markets: the Case of Czech Republic0

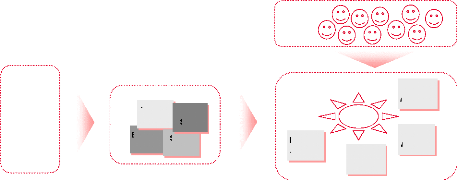

Holders

Stock Exchange

Barcllys ADR 1::

NYSE

AXA

ADR 1:1 11

Tel 'talia

ADR

1:10110

Sanof I ADR 2:1

Depositary Receipts System

Trust

arcla Barclays

tock

Stock

Tel Italie

tock

Stock

Sanof I

tock Stock

AXA

toc Stock

Bank

I.2. Different Methods of Foreign Cross-Listing

In addition to the simple and direct listing through shares,

the financial engineering for corporate finance has developed complementary

ways to perform a foreign cross-listing.

I.2.a. Depositary Receipts (DRs)

Depositary receipts (DRs) are an indirect mean to list foreign

shares. DRs are tradable certificates issued by a "sponsoring bank" (or

"depositary bank"), representing the ownership of stocks in the capital of a

foreign company and compliant with the local financial markets laws. This

product replicates an underlying stock of a company, which is in fact held by a

trust vehicle in a foreign bank. A DR may represent a fraction of a stock, a

single stock, or several stocks. For instance, foreign companies aiming at a

listing in the United States or the United Kingdom may respectively use

"American Depositary Receipts" or "Global Depositary Receipts". In a lesser

extent, there are also "European Depositary Receipts", "International

Depositary Receipts" in Brussels, "Dutch Depositary Receipts" in Amsterdam,

"Swedish Depositary Receipts", "Singapore Depositary Receipts" and so on.

The sponsoring bank provides all the services regarding the

registration, the agency services, the broker trading, the conversion of

dividends into the DR holder's currency, and so on. As a consequence of the

utilisation of a trust vehicle, DR holders are not considered as shareholders

of the company and do not have voting rights; but they may instruct the DR

depositary bank how to vote the stocks underlying their DRs.

There are four types of DR (I, II, III, unsponsored), each one

corresponding to different classes. A sponsored level I DR trades

over-the-counter (OTC) and implies the minimal requirements for companies (e.g.

neither obligation to publish quarterly/annual reports nor to meet the U.S.

GAAP). Level II DR (no capital is issued), is different from level III DR (new

capital is issued), but both have the highest disclosure and fulfilling

requirements. At these two levels, companies with DRs listed in the United

States must annually fill forms (registration statements and financial

statements) for the American S.E.C. and fully meet U.S. GAAP.

Most of time, DRs are issued according to the will of a

company to be listed on a specific market with the aim to become accessible to

new investors and thus to attract additional pool of capital. However, a bank

may also issue unsponsored DRs, that is to say not realized on the behalf of

the company but of an investor. Nowadays, there are no formal requirements to

seek companies' authorisation to issue unsponsored DRs, since such operation is

completely passive, i.e. presents no risks, no future implications, no costs

for the company.

Today DR is the most used method for a listing abroad, in

particular in the United States and in the United Kingdom. According to the

Bank of New York, issues of DRs exceed US$50.0bn in 2007 vs. US$44.5bn in 2006,

which had already set a record high2. Most of DRs issued in 2007 had

been realized on the Nyse, Nasdaq, Nyse Alternext (former Amex) and L.S.E; with

two third of issuers originating from the BRIC countries (Brazil, Russia,

India, China).

|