2.3.1.2. Database Server

The Database Server houses the files and records of bank

products, services and customers. It shares application processing with the PC

Client Workstations. It performs database searches and retrieves customer

information and/or files. Additionally, the Database Server stores the code

that executes the nightly update processing tasks when instructed by the

Nightly Processing module.

2.3.1.3. PC Client Workstations

The PC Client Workstations are used for shared application

execution with the Database Server and also serves as a display to view the

information and is also a data entry and manipulation point. 120 PCs used by

FINABANK's Management Information System, present the following technical

capacities: 1.80GHZ possessing capacity of CPU, 0.98GB of RAM and 150GB of

Local Disc capacity storing.

2.3.2. Video Surveillance Hardware

FINABANK, considered as a big company, takes seriously the

issue of security. Once you observe carefully into corners of FINABANK's

building, one can difficultly notice that there are small and small cameras

deployed any where capturing images and conveying them through appropriate

cables up to the wide video surveillance screen as well as storing that serous

information in database server for the future use. The following is hardware

used by FINABANK Video Surveillance System:

Table3: Video Surveillance Hardware

|

No

|

Description

|

Quantity

|

Brand name

|

Technical

Capacities

|

|

1

|

Camera

|

15

|

SOME

|

90 days

|

|

2

|

Screen Monitor

|

1

|

IRIS

|

16 channels

|

|

3

|

Cables

|

-

|

CAT6

|

-

|

|

4

|

Disc Video Recorder

|

1

|

IRS

|

90 days

|

Source: Primary Data (2008)

A camera records images, either as a still

photograph or as moving images known as videos or movies. The term comes from

the camera obscura (Latin for "dark chamber"), an early mechanism of

projecting images where an entire room functioned as a real-time imaging

system; the modern camera evolved from the camera obscura.

Cameras may work with the light of the visible spectrum or

with other portions of the electromagnetic spectrum. A camera generally

consists of an enclosed hollow with an opening (aperture) at one end for light

to enter, and a recording or viewing surface for capturing the light at the

other end. A majority of cameras have a lens positioned in front

of the camera's opening to gather the incoming light and focus

all or part of the image on the recording surface. The diameter of the aperture

is often controlled by a diaphragm mechanism, but some cameras have a

fixed-size aperture.

Category 6 cable, commonly referred to as

Cat-6, is a cable standard for Gigabit Ethernet and other

network protocols that is backward compatible with the Category 5/5e and

Category 3 cable standards. Compared with Cat-5 and Cat-5e, Cat-6 features more

stringent specifications for crosstalk and system noise. The cable standard

provides performance of up to 250 MHz and is suitable for 10BASE-T, 100BASE-TX

(Fast Ethernet), 1000BASE-T / 1000BASE-TX (Gigabit Ethernet) and 10GBASE-T

(10-Gigabit Ethernet). Category 6 cable has a reduced maximum length when used

for 10GBASE-T; Category 6a cable, or Augmented Category 6, is characterized to

500MHz and has improved alien crosstalk characteristics, allowing 10GBASE-T to

be run for the same distance as previous protocols. Category 6 cable can be

identified by the printing on the side of the cable sheath.

VDR (Video Disk Recorder) is

an open source application for Linux designed to allow any computer to function

as a digital video recorder, in order to record and replay TV programming using

the computer's hard drive. The computer needs to be equipped with a digital TV

tuner card. VDR can also operate as an mp3 player and DVD player using

available plugins

2.3.3. THE Queue Management Hardware

The problem of long lines made up people need to be served by

the bank, was on mind of several managers as well as researchers. Now the queue

Management system is the appropriate response to that particular challenge

faced by FINABANK since long time ago. This equipment is made up following

hardware:

Table 4: Queue Management Hardware

|

No

|

Description

|

Quantity

|

Brand name

|

|

1

|

Queue Management machine

|

5

|

QM

|

|

2

|

Black Screen

|

40

|

QM

|

|

3

|

Cables

|

X

|

CAT6

|

|

4

|

Number caller button

|

40

|

QM

|

|

5

|

Satisfaction test button

|

40

|

QM

|

Source: Primary Data (2008)

The first objective of any queue management system is to

achieve a better quality of service to customers. In its most basic form, a

queue management system will issue a queue ticket to an arriving customer and

later call the ticket when service is available, eliminating the need to stand

in line while waiting. In this way, queue management systems help to provide

comfort as well as fairness to customers, by allowing them to maintain their

position in the queue while they are seated comfortably or engaged in

constructive activity.

The first objective of any queue management system is to

achieve a better quality of service to customers. In its most basic form, a

queue management system will issue a queue ticket to an arriving customer and

later call the ticket when service is available, eliminating the need to stand

in line while waiting. In this way, queue management systems help to provide

comfort as well as fairness to customers, by allowing them to maintain their

position in the queue while they are seated comfortably or engaged in

constructive activity.

2.3.4. Network Communication hardware

FINABANK grows continually and opening branches in different

provinces constitute in this nation. These branches are interconnected dispute

the long distance, through the Network Communication. Helped by Rwanda tell and

MTN Rwanda cell Companies, FINABANK uses following hardware to link various

activities performed by its branches.

Table 5: Communication Hardware

|

No

|

Description

|

Quantity

|

Brand name

|

|

1

|

Routers

|

6

|

SISCO

|

|

2

|

Switchers

|

14

|

SISCO

|

|

3

|

Cables

|

-

|

CAT6

|

Source: Primary Data (2008)

A router is an equipment of a network interconnection enables to

determine the path of data by joining packages within two or more

networks.30

A switch is an electronic equipment help to connect more segments

to one network.

Access Control System in FINABANK is composed mainly by two kinds

of hardware: One Card reader Machine and six accesses scanner machines.

2.3.5. Fire Safety Hardware

Among many serous risks that can affect the bank, we can

highlight fire. The fire safety system is not only the voluptuous choice of

FINABANK by it is also the recommendation from the insurer. To handle this

problem, FINABANK does its best to protect its assets, data and people by

combining following hardware:

30 STEWART, T. «3M Fights Back,»

Fortunes, February5, 2006, p. 99

Table 6: Fire safety equipments

|

No

|

Description

|

Quantity

|

Brand name

|

|

1

|

Fire extinguishes

|

30

|

SAVAL GP9

|

|

2

|

Smoke Detector

|

80

|

MANVIER

|

|

3

|

Fire alarm Controller

|

6

|

MANVIER MF9304

|

|

4

|

Speakers

|

20

|

Sonny

|

Source: Primary Data

The Fire Safety System of FINABANK uses three types of

hardware:

Fire extinguishes: used to attack fire when occurs.

Smoke Detector: helps to notice in advance the fire by

distinguishing smoke. Fire alarm: helps to inform others on the mater.

Speaker: From which alarm worn people upon incident

2.4. THE «SOFTWARE» COMPONENT OF THE FINABANK'S

INFORMATION SYSTEM

To play a useful role in the firm's information technology

infrastructure, computer hardware requires computer software. As it has been

defined by KENETH C. LAUDON in his book named Management Information Systems,

the computer software is a detailed instruction that control the operation of

computer system. 31

31 LAUDON, K. and LAUDON, J.P. «Management

Information Systems: Organization and Technology,» Prentice-Hall of

India: New Delhi, 1999, p.89

Selecting appropriate software for organization is a key

management decision.

As a reference to the first chapter, FINABANK has also two kinds

of software: Application and operating software:

2.4.1. The FINABANK's System Software

Are called System Software (as well explained in the literature

review), ones coordinate other software in a computer, put in relation the

hardware and application software and perform several tasks like DVD playing,

keeping and manage files, etc. Within this context, FINABANK has the following

operating system software.

2.4.1.1. Windows XP Professional

The Windows XP used by FINABANK is Reliable, robust operating

system for powerful PCs with versions for both home and corporate users.

Features support of the internet, multimedia, and the group collaboration,

along with powerful net working, security, and corporate management

capacities.

2.4.1.2. Windows Saver

The Windows Saver supports multitasking, multiprocessing,

intensive networking, and internet services for corporate computing.

2.4.1.3. UNIX

The UNIX Used by FINABANK for powerful PCs, workstation and

servers. Supports multitasking, multiprocessing, intensive networking. It is

portable to different models of computer hardware.

2.4.2. FINABANK's Application Software

Application soft wares are software conceived to perform a given

and specific task. Software of this kind held by FINABANK are the following:

2.4.2.1. Equinox Banking Software

Activities of FINABANK are linked, complete each other and

this happens through the software named «EQUINOX» includes at least

main activities performed by the bank. Here is EQUINOX main interface:

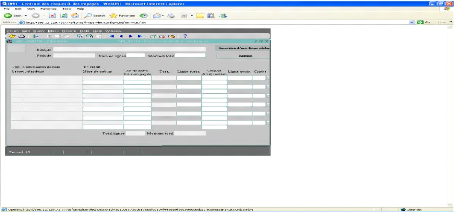

Figure 9: Equinox Banking System's

interface

Source: FINABANK, back office processing, 2009, p.1

Changes in the current business climate around the world place

pressure on industry and commerce. Cyclical boom, bust economic conditions and

the rising global economy place demands on banks and all commercial ventures to

increase productivity, cut costs and be flexible. All of the above are on the

base of shifting from MICROBANKER to EQUINOX Banking System.

FINABANK uses Equinox Banking System to perform and deriver

services to customers. This software has replaced MICROBANKER in 2008 because

it is more advantageous than the last one. EQUINOX is considered as a friendly

user based on its graphical user interface whereas MICROBANKER was a command

line.

2.4.2.2. MICROBANKER

MICROBANKER was the bank system used by FINABANK until 2008,

to handle all business problems in the banking industry, but it has been

replaced by EQUINOX Banking System because it was no longer compatible with the

volume of the bank activities. This application was able to receive a limited

number of users at a once while the number of employees in need was growing as

the business grows. In addition, This system was a command line, what was

somehow complicated to some users, but is very different from EQUINOX Banking

System, currently in use, has a friendly interface, what to say, instead of

commanding the system what to do, it gives to the user various options and

he/she selects the best one.

2.4.2.3. SWIFT System

This software is used by FINABANK to send and receive transfers

between banks either locally or internationally.

2.4.2.4. MEGA System

They use MEGA System to handle problems related to checks, and to

prepare the clearing list to NBR.

2.4.2.5. CRI System

They use CRI System to create, analyze and submits a report,

related to Risk and Arrears Centralization, to NBR.

BNR System Software is a proper version to create and submit

reports, but as these reports are so official and has to be well done; other

software has putted in place as the draft to perform these reports. The

following are interfaces of CRI software related to report to be done:

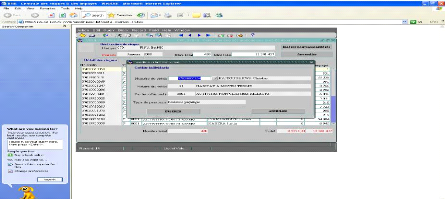

Figure 10: New credit declaration interface from CRI

system:

Source: FINABANK, back office processing, 2009

After daftly processing this declaration of new credit the

statistician transfers the report created from CRI system into BNR system which

has the following interface:

Figure 11: New credit declaration interface from BNR

system software

Source: FINABANK, back office processing,

2009

Figure 12: Risk situation interface from CRI system

Software:

Source: FINABANK, back office processing, 2009

After getting the required information through different ways of

CRI system, it has to be converted into following BNR System's interface:

Figure 13: Risk situation interface from BNR System

software

Source: FINABANK, back office processing, 2009

The interface bellow enables the statistician to perform the

situation of credit arrears in BNR system:

Figure 14: Credit arrears report from BNR System

software

Source: FINABANK, back office processing, 2009

2.4.2.7. LEASEPAC

FINABANK uses LEASEPAC software to establish and manage leasing

facilities.

It is the SME bank with the advertisement sport: «Your

partner in growth and development,» FINABANK makes growing and developed

businesses by providing to them lease loans. To provide loan is one thing and

to manage it is another one, which is some how more complicated. To handle

this, FINABANK has appropriate and qualified software called

«LEASEPAC.» The following is its main interface:

Figure15: Leasepac system software

Source: FINABANK, back office processing manual, 2009

This software (LEASEPAC) contributes on FINABANK's performance

in the way that allows the user to collect any desired information from the

applicant himself and his business as well as to manage the loan. By example

the following is the interface helps the user to collect the information

related to the applicant:

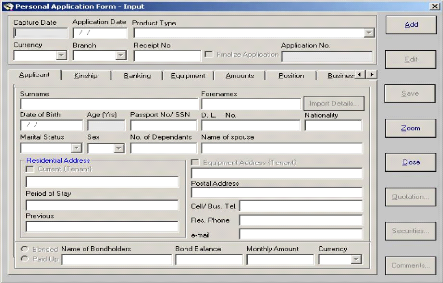

Figure 16: Applicant information interface from LEASEPAC

software

Source: FINABANK, back office processing manual, 2009

2.4.2.8. BNR System

FINABANK uses BNR System to perform, in an appropriate way,

monetary reports to NBR.

NBR has in its responsibilities, to keep stable the Rwandan

currency. So, each and every financial institution, including banks, has to

report, weekly and monthly, to Rwandan Central Bank (NBR). It's in this regard

that National Bank of Rwanda has provided particular software to bank for good

preparing these reports. The following is the main interface of that kind of

software:

Figure 17: Debit interface of BNR System

Software

Source: Primary data

(2008)

2.4.2.9. ASETWARE

They use ASETWARE to manage adequately bank assets.

2.4.2.10. Internet Explorer

They use Internet explorer to find and to display information

and web site in order to communicate, publish, and advertise what they do as

well as to update the knowledge of personnel.

2.4.2.11. Microsoft Office 2003 and 2007

- Microsoft Office Excel

FINABANK performs calculations, analyzes information, and

visualizes data in spreadsheets by using Microsoft Office Excel.

- Microsoft Office Outlook

They send and receive e-mail; manage your schedule, contacts, and

tasks; and record their activities by using Microsoft Office Outlook.

- Office PowerPoint

They create and edit presentations for side shows, meeting, and

web pages by using Microsoft Office PowerPoint.

- Microsoft Office Words

They create and edit professional looking documents such as

letter, papers, reports, and booklets by using Microsoft Office Words.

2.5. THE «DATA» COMPONENT OF THE FINABANK'S

INFORMATION SYSTEM

2.5.1. Introduction

DATA are any raw facts or observations that describe a

particular phenomenon. For example, the cash in hand, the cost of transport of

personnel, and a picture captured all are data.32

In business, for instance, the cost of merchandise may be

information to buyer, but it may represent only data to an accountant who is

responsible for determining the value of current inventory levels. The current

value of inventory for that merchandise is the information the accountant

derives from the two pieces of data and it will be useful to take decision when

selling.

Within FINABANK, data are raw facts or observations that

describe money deposed or withdrawn, given as loan, gotten as loan repayment to

or from customers, disbursed as salary to employees or as the cost of bank's

assets.

32 ROBINS, G., «Data warehousing: Retailers on

the cutting Edge,» STORES, September 1995, pp.19, 24-28

These facts are key resources to FINABANK, because our economy

tends to base on the knowledge and information as it has described by our

general introduction.

2.5.2. The Database and Database Management System (DMS)

in FINABANK

In FINABANK, databases and database management systems provide

the foundation of organizing, managing, and working with the information. In a

database and database management system environment, the database contains the

information, and the database management system is the collection of software

tools that supports management of a database and performance of the bank.

Employees of FINABANK throughout the organization's knowledge workers or IT

specialists, interact with a database by using a database management system

software tools.

2.5.3. FINABANK Data Processing

Data processing can be speeded up by several processors to work

simultaneously on the same task.

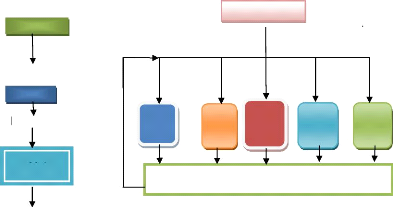

As it is appearing on following figure, FINABANK uses

simultaneously parallel processing (online processing) and serial processing

(batch processing) in data processing. In parallel processing, multiple

processing units (CPUs) break down a problem into smaller part and work on it

simultaneously. Getting a group of processors to attack the same problem at

once requires both rethinking the problems and special software that can divide

problems among different processors in the most efficient way possible,

providing the needed data, and reassembling the many subtasks to reach an

appropriate solution.

Massively parallel computers have huge networks of processor

chips interwoven in

complex and flexible ways to attack large computing

problems. As opposed to parallel

processing, in Sequential or batch

processing, where small numbers of powerful but

expensive specialized chips are linked together, massively

parallel machines link hundreds or oven thousands of inexpensive, commonly used

chips to break problems into many small pieces and solve them.

Figure 18: Sequential and parallel process

CPU

CPU

CPU

CPU

CPU

Task3

Task5

Task4

Task1

Task

RESULT

PROGRAM

CPU

Result

PROGRAM

PROGRAM

Task2

CPU

Result Source: Primary Data (2008)

2.5.4. FINABANK's Data Storing

The capabilities of computer systems depend not only on the

speed and capacity of the CPU but also on the speed, capacity, and design of

storage, input and output technology.33

The following figure gives an image of how FINABANK stores data

at the same time using it in what they call Storage Area Network:

33 NOVACK, J., «The Data Miners,»

Forbes, February 12, 1996, pp.96-97

SERVER

RAID RAID

TAPE

LIBRARY

SAN

SERVER

RAID

Figure 19: A Storage Area Network (SAN).

User1 User2 User3 User4 User5

Source: Primary data (2008)

The SAN of FINABANK consists of a server, storage devices and

is used strictly for storage. The SAN stores data on many different types of

storage devices, proving data to the users in the bank. The SAN supports

communication between any server and the storage unit as well as between

different storage devices in the network.34

34 2nd

HAAG, S. «Management Information Systems for the

Information Age,» Edition, McGraw Hill/Irwin, Boston,

2000, p173

2.6. THE «PROCEDURES» COMPONENT OF FINABANK'S

INFORMATION SYSTEM

In field of MIS, FINABANK undertakes several procedures to

meet its objectives both effectively and efficiently. Among these procedures we

are going to analyze, in this section, four most important of them which are:

account opening procedure, employee recruitment procedure, credit analysis

procedure and the fire safety procedure.

2.6.1. Account opening procedure

To create an account into FINABANK, the following procedures have

first to be undertaken:

For a corporate business wants open an account requirements

are: A notified copy of the startup contract, the trade license or the RDB

permission, on photo and specimen of each of company representatives.

When the client to be served is an individual, he/she is asked

to bring the copy of his/her ID card, one photo and fill the application form.

For these two categories of client, to open their accounts it's made for free

of charge.

2.6.2. Employee recruitment procedure

Prior the right employee arrive in the right place, the following

procedure in FINABANK must be respected:

The department, in need of an employee, makes a requisition to

the Human Resource Management Department, and this one recruits a desired one

through new times, IMVAHO news paper or specialized institutions. The

department prepare and give practically and theoretically an exam to

candidates. The candidate succeeded the both tests (written and interview) is

hired by the department in charge of recruiting and hiring (HR), the new

employee get a concise training in relation with the job he/she is going to

perform. After the training, the new employee sign a temporary

contract (3 to 6 months), if well finished, a definitive contract is signed

between the bank and its employee.

2.6.3. Credit Analysis Procedure

Figure 20: Credit analysis procedure

|

|

Business Banking / SME / Consumer Banking

|

|

Credit Control

|

|

|

Client

|

|

|

|

|

|

|

|

Application letter Recommandation bases on : Credit analysis

bases on

level of risk quantitative issues and

Business Banking SME

Head of Credit Risk Managing Director Board of Directors

Credit

Administration and legal sub

department

: Approval: if x < 10,000,000 Verify the legal conformity

Verification of legal

Approval: if x < 100,000,000 Two parts sign the contract

conformity

Approval: if x >=100,000,000

. tangible facts

Credit Control

Recovery Department

: Establishment of credit Recovery dills with all customer and

reimbursement

monitoring for class 4, 5 and 6 of clients

Source: FINABANK, credit policy and procedure manual, May

10th, 2009

2.6.4. Fire safety procedure

To minimize damages that can be caused by fire in FINABANK,

here's the fire safety procedure to undertake whenever fire occurs in the

bank:

1. Press fire alarm

2. Shout «Fire» «Fire»

3. Call 999 and inform the fire brigade giving precise location

of building, including floor and/or room in which fire has been observed.

4. If possible attack the fire extinguishing appliance avoiding

risk to life.

5. Evacuate the building immediately without stopping to collect

any belongings.

6. Do not use lifts.

7. Use all designated fire exits and stairs to evacuate.

8. Proceed quickly to the nearest designated assembly points.

9. Do not re-inter the building until fire services have

declared the premises safe.

2.6. THE «PEOPLE» COMPONENT OF FINABANK'S

INFORMATION SYSTEM 2.6.1. Introduction

We were discussing hardware, software, data and procedures;

all of this was to give us a broad overview of the nature of MIS components

within FINABANK. Let's now turn our attention to the most important resource in

the business, especially for Management Information Systems-people as the

knowledge worker. 35

Recall that, as a knowledge worker, FINABANK's employees work

with and through

produces information as a product. And it really doesn't

matter if they use a high-powered

35 MARTIN, J. «Are You as Good as You Think

You Are?» Fortune, September 30, 1996, pp.142

workstation or calculator; they are still a knowledge worker,

responsible for processing information that their business (FINABANK) want to

survive.

To succeed, as a knowledge worker in today's information-based

business environment, FINABANK do its best to make its personnel understanding

the true nature of information, what means to be an information-literate

knowledge worker, and to assume the ethical responsibilities of working with

information.

2.6.2. Being an Information-Literate Knowledge

Worker

An information-literature knowledge worker must define what

kind of information is needed, knows how and where to obtain that information,

understands the meaning of the information once received, and can act

appropriately, based on the information, to help the organization achieve the

competitive advantages.36

Knowing the appropriate time, content, and form dimensions of

information needs is a major step toward becoming an information-literate

knowledge worker in FINABANK. But it doesn't stop there-knowing what they need

is only part of the information equation. They also do their best to know such

things as how and where to obtain that information and what the information

means once you receive it.

IT tools are great for helping FINABANK'S employees through

the problem-solving or advantage-realizing process. In fact, many IT-based

systems are designed specifically to help them solve a problem or take

advantage of an opportunity.

36 2nd

HAAG, S. «Management Information Systems for the

Information Age,» Edition, McGraw-Hill, Boston, 2000,

p187

2.6.3. Being a Motivated Employee 2.6.3.1.

Definition

Twyla Dell writes of motivating employees, "The heart of

motivation is to give people what

they really want most from work. The more

you are able to provide what they want, the

more you should expect what you

really want, namely: productivity, quality, and service."

37

2.6.3. 2. How Maslow's Needs Hierarchy helps to motivate

FINABANK's personnel

As MASLOW's theory is true, there are some very important

leadership implications to enhance workplace motivation. The Human Resource

Department profits from these staff motivation opportunities to motivate each

employee through FINABANK style of management as follow:

· Physiological Motivation: FINABANK provides ample breaks

for lunch and recuperation and pay salaries that allow workers to buy life's

essentials.

· Safety Needs: FINABANK provides a working environment

which is safe, relative job security, and freedom from threats.

· Social Needs: FINABANK generates a feeling of acceptance,

belonging, and community by reinforcing team dynamics.

· Esteem Motivators: FINABANK recognizes achievements,

assigns important

projects, and provides status to make employees feel

valued and appreciated.

· Self-Actualization: FINABANK offers challenging and

meaningful work assignments

which enable innovation, creativity, and

progress according to long-term goals.

37 ZEIGER, D. «Smart Card Technology to Get

Boost,» The Denver Post, October, 2006, p.23

2.6.4. FINABANK Employee Situation within five

years

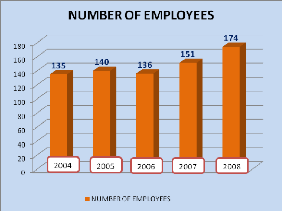

The following figure presents how much FINABANK has increasingly

recruited employees as far as the company itself became bigger compared to the

previous periods:

Figure 21: Employee mouvement situation into

FINABANK

Source: Pimary Data (2004-2008)

From the above figure, FINABANK every and each year increase

its employees for the seek of increasing also its income: in 2004 it had 135

employees, 140 employees in 2005 means an increase of 37% and 136 employees in

2006 means a decrease of 2.9%, this reduction has been justified by the

implementation of the FINABANK police related to cost control from that period.

In 2007 as well as 2008 employees have increased respectively up to 151 and 174

employees. FINABANK chooses increasing continually based on the principal of

economies of scales.

2.7. CHAPTER 2-SUB CONCLUSION

In general, hardware is composed by any physical material that

enables the bank to collect, process, storing and communicating information.

Among this hardware, PCs Work Stations are very crucial for

FINABANK's IT infrastructures to perform banking activities.

To provide a good service to its clients, we sow that

FINABANK has 120 PCs (brand name: HP and DELL) fill the following technical

capacities: The speed of processing (micro-processor): 1.80GHZ, 0.98GB of RAM

and 150GB of Local Disc capacity storing and referring to classical measurement

conditions, as we sow them in previous chapter, one can easier notice that all

these machines meet the normal technical prescription as indicated by

specialists. In addition to these 120 PCs Work Stations, FINABANK uses also 54

laptops with HP AND DELL as brand name, technical capacities: 2.00 GHZ, 5200MB

of RAM and 120GB Disc storing capacity. These laptops perform the same activity

as PCs but there are used by Account Relation Managers (ARM) and other workers

who do not have a fixed work place based on their job.

All of these machines are connected, using CAT6 cables, to

fileserver as well as to database server and all together make a good network

which helps FINABANK to handle quickly and massively a lot of problems so as to

provide a desirable services to its clients.

As this principal hardware, PC Work Stations, used by FINABANK

march three basic technical conditions of the hardware, as FINABANK uses

several applications and operating software in collection, processing as well

as in exploratory of data; as it has curried out a set of procedures to speedup

bank's operations and his sufficient, motivated and qualified employees

enabling FINABANK achieving its objectives. All of these issues help the

researcher proved the first hypothesis. .

CHAPTER 3: BENEFITS OF MANAGEMENT INFORMATION SYSTEMS

(MIS) TO

FINABANK BETTER BANKING SERVICES

3.1. INTRODUCTION

This chapter presents qualitatively and quantitatively how

significantly components of Management Information Systems (MIS) have

contributed directly or indirectly to FINABANK's better banking services within

2004-2008 timeframe.

3.2. BENEFITS OF «HARDWARE» TO FINA BETTER

BANKING SERVICES

The present section analyses and presents different benefits of

«hardware» held by FINABANK, as presented into second chapter, and

gives their contribution to its better banking services.

3.2.1. Benefits of the Equinox Banking

Hardware

Equinox Banking Hardware helps FINABANK:

· control costs and remain competitive in the ever-

changing global economy.

· store data centrally, but share processing between users

so that they can run many applications and process work simultaneously.

· collect, process, store and convey quickly and massively

the information

· The PC Client Workstations are used by FINABANK for

sharing application execution with the Database Server and also serves as a

display to view the information and is also a data entry and manipulation

point

· The Database Server enables the bank to house files and

record of bank products, services and customers

· The File Server helps FINABANK housing the applications

and handles network administration.

3.2.2. Benefits of the Video Surveillance

Hardware

Bank is an institution plays a role of financial

intermediation what means that it mainly manages other's precious properties

(cash), this issue leads FINABANK to sign some contracts with security

companies (KK security and Intersec security Companies) to secure the bank and

its employees at work place in behalf of the bank itself.

Apart from these contracts, FINABANK has what called

«Video Surveillance System» composed by 15 cameras deployed

clandestinely elsewhere, helps the bank to capture many videos from different

strategic points like strong room, tellers' room, IT room and all corners of

the bank, present them on wide frat screen monitor and saved on the Disc Video

Recorder.

This kind of hardware helps FINABANK to control the movement

and acts of employees, clients and others moving in and around the bank, so as

to detect in advance undesirable activities into the bank.

Briefly, this hardware collects, presents and stores facts done

by employees, clients or non authorized people without being away that they are

watch.

3.2.3. Benefits of the Queue Management

Hardware

Prior the installation of this hardware, FINABANK was always

suffering from non finishing files of clients wished either to depose or to

withdraw their cash. By this equipment each client, depending to what need from

bank and time of arriving, gets from machine a voucher number, takes a seat

till others came before, will be served and his number will display on black

screen located at the top of teller's window.

Up to now, this equipment came to handle 90% of the problem

as declared by FINABANK Kigali Branch Manager. In addition to this, the same

system is able to measure clients' satisfaction. How? Each client served

presses a button of «satisfied» or «not satisfied» and

these statistics helps FINABANK to know how good clients appreciate their

services.

3.2.4. Benefits of the Network Communication

hardware

As FINABANK operates in different regions wants to link its

activities, so to provide a good services to its client. That can't realize in

absence of Network Communication hardware. In addition to this, there are some

financial products that could never exist if FINABANK could not have a good

network system, from this we can say: FINA money transfer, FINA direct, etc.

3.2.5. Benefits of the Access Control

Hardware

Before the installation of this hardware, the movement of

people in the organization was somehow disorganized. However could inter

anywhere, what was unfair and could cause the insecurity to the bank. But now

the current situation is quite different: Each employee inters where is

authorized, other place he/she can't because everyone has a coded access card

enabling her/him to inter the place authorized to her/him.

In addition to that, prior this system, employees were

obliged to fill the name, time of arriving and sign in the attendance book and

could happen that the employee sign and after two hours he/she goes wherever he

wants out of the work. But now, the card reader machine helps the human

resources manager, to know that a given employee comes to the job when, he/she

quite the work place when, even these unnecessary movements of employees within

organization are also recorded, so if necessary the causer can explain.

Finally, this kind of hardware was becoming useful to FINABANK

in terms of securing the bank against bandits or other unfair to the

organization.

3.2.6. Benefits of the Fire Safety Hardware

Fire is the most dangerous threats to banks even to all

organizations. In order to protect itself against, FINABANK uses the fire

safety equipment. The last one is able to detect using «smoke

detectors» easily the smoke, regardless what causes, and the «fire

alarms» worn trough «speakers» immediately that there is the

fire. The alarm is installed so during

the night, even workers whenever they inter the bank using

their usual coded access cards not during the work time, means for their own

purposes, it immediately recognize them as robbers and warns. In other words,

it is one of the security facilitators.

In addition, the system is installed as, people from Fire

extinguishers recognize automatically the threat happening in the bank and

intervene at right time.

Briefly, the «hardware» has contributed positively to

the better banking services of FINABANK within the range of 2004 to 2008 as

proved by the upcoming figure.

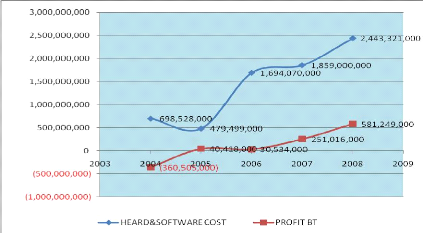

3.2.7. Impact of IT infrastructure to the FINABANK's

performance

Figure 22: Impact of IT infrastructures to FINA

performance

Source: FINABANK, Financial Statement, 2004-2008

From the above figure stated thet FINABANK sa, in one side,

has spent less maney for aquiring the technological infrastructures in 2005

(479,499,000Rwf) compared to ones disboursed in previous year (698,528,000Rwf)

what signifies a decrease of -31.36%.

The year 2006 justifies how good FINABANK sa has recognized

the role of IT whithin the bank's operations because it has spents a huge

amount of money to purchase a modern and qualified IT infrastructures

(1,694,070,000Rwf), an increase of 253.30% compared to the values of the year

2005.

The value of the FINABANK's IT infrastructure did nover stoped

to increase since there because it reached the value of 1,859,000,000Rwf and

2,443,321,000Rwf, an increase of 9.74% and 36.43% respectively for years 2007

and 2008.

Other side, FINABANK has gained positively in 2005

(40,418,000Rwf) compared to year 2004 where it loosed (360,505,000Rwf) but the

following year (2006) its profit has decreased to 30,534,000Rwf and it has

recorded an increase in profit of 251,016,000Rwf, 581,249,000Rwf respectively

for years 2007 and 2008 what determines an increase of 722.09% and 131.56%

respectively.

FINABANK has recorded a high difference in profit between

2006 and 2007, as it comes to be presented, from 30,534,000Rwf to

251,016,000Rwf; because in 2005 and 2006 had to cover first the big losses

registered in previous years.

Statistically, FINABANK sa spends roughly 1,434,883,600Rwf

every year for acquiring MIS infrastructures, the highest amount of money spent

for the same reason is 2,443,321,000Rwf and the lowest cost on the same issue

is 479,499,000Rwf; all of this is located in the interval of year 2004 and

2008. Considering all the above presented, there is a significant and positive

correlation of 0.816472353 between the cost of hardware and software

infrastructures and the profit registered by FINABANK sa.

3.3. BENEFITS OF «SOFTWARE» FOR FINA BETTER

BANKING SERVICES

This section present various benefits of «software»

and their contributions to FINA better banking services. As EQUINOX Banking

System is considered as the pillar of the inter banking system, let's take it,

so to present benefits of «software,» as one of MIS component, to the

better banking services of FINABANK:

3.3.1. Benefits of the EQUINOX Banking

Software

Equinox Banking Software is taken as the backbone of FINABANK's

operations that largely handles the maximum of problems related to banking

activity using its following models:

3.3.1.1. Benefits of the System Administration

Model

The Administrative Model provides integrated controls and

parameters for the Bank, General Ledger, Relationship Management, Security,

Deposit and Loan Products, Safe Deposit Box, Teller, Rates, Charges and a

variety of other administrative functions. This module defines the bank,

branches, products and how they are set up and processed. For example, the

General Ledger Master Chart of Accounts is created and defined in this

module.

3.3.1.2. Benefits of the Account Processing

Model

After the products have been defined and decided how they

will be processed, this module allows the bank to set up and maintain customer

accounts and process monetary and non-monetary transactions. For

example, credits and debits to General Ledger accounts can be

performed online through this module.

3.3.1.3. Benefits of the Nightly Processing

Model

This module runs the program that updates the database each

day. It processes all batch transactions, accrues and pays interest, assesses

service charges, produces reports, notices, checks, transfers funds and updates

customer files and records. This module is where the bank defines and schedules

the custom reports. For example, the bank defines the level

and detail it wants to show on the Statement of Condition and Income and

Expense Report and the General Ledger accounts to be reflected in these

reports.

3.3.1.4. Benefits of the Teller Processing

Model

This module memo posts deposits, withdrawals, payments and

miscellaneous transactions on the system to accurately reflect account activity

through the teller line throughout the day.

3.3.1.5. Benefits of the ATM Processing

Model

This module allows the bank to setup and maintain its card

and transaction processing for ATM and POS. It also allows the bank to setup

and maintain customer ATM accounts, cards and relationship accounts. This

function can also be performed in the Account Processing module.

Globally, the benefits of the software come in the form of

technical improvements in FINABANK's IT Department -- deploying branches

faster, cheaper, and better. However, what is most interesting is that these

technical improvements are large enough to have an impact well beyond the

borders of the IT department and offering strategic competitive benefits to the

way that FINABANK conducts its business.

The following Technical benefits have been gained from

«software,» the component of the FINABANK's Information System:

· reduction in the average time to create and deploy a new

branch

· reduction in the average technical effort to deploy and

maintain a branch, and therefore reduction in the average technical cost per

branch

· increase in the total number of branches that can be

effectively deployed and managed

These technical benefits translated into a very powerful set of

FINABANK strategic business benefits:

· reduced time-to-market and time-to-revenue for new

branch

· improved competitive financial product value

· higher the FINABANK profit margins by helping its

employees work more efficiently

· improved ability to hit market windows

· better product quality and improved FINABANK reputation

for quality

· improved scalability of business model in terms of branch

and markets

· increased agility to expand into new markets

· reduced risk in branch deployments

· cutting costs by automating routine tasks

· improving customer service levels, perhaps by using ATM

that customers can access some financial services- eg allowing customers to

withdraw money without needing to contact any member of staff directly

3.5. BENEFITS OF «DATA» FOR FINA BETTER BANKING

SERVICES

For large commercial organizations, data security is not only

a corporation option, it's the law. Losing sensitive data by way of natural

disasters or physical robbery can have severe consequences on FINABANK,

possibly demolishing entire organization.

FINABANK's Intellectual property such as its employee and client

information,

product descriptions and business outline all qualify as

priceless information. These critical details are somehow secured at all times

to ensure the integrity and confidentiality of FINABANK. This information is

the core of FINABANK and without it, it can't operate. If a criminal is able to

access this data, there is no limit to the damage they can inflict.

FINABANK recognizes that its data is vulnerable and can be

compromised in the following ways:

Virtual attack - This could be an industry

rival that learns to bypass security and gains access to competitive data. It

could also be a malicious attack that purposely corrupts data.

Physical attack - Perhaps a disgruntled employee

is seeking ways to damage the company by stealing files or purposely destroying

data.

For these problems, FINABANK implements multiple forms of

security by using hardware solutions such as routers and firewalls. These

devices protect essential data by keeping external threats out of the network.

Unfortunately, intruders employ numerous attacks, specifically targeted at that

information but FINABANK does all its best, so attackers couldn't find a way to

penetrate its first line of defense.

|