Annexe 1 : Résultats d'estimation du

modèle

Dependent Variable: LOG(PIBT) Method: Least Squares Date:

11/18/13 Time: 09:15 Sample: 1981 2010

Included observations: 30

ii

|

Variable

|

Coefficient

|

Std. Error t-Statistic

|

Prob.

|

|

C

|

2.84E-09

|

1.64E-10 17.31587

|

0.0000

|

|

LOG(PIBT-1)

|

1.000000

|

1.03E-11 9.69E+10

|

0.0000

|

|

LOG(MASMON)

|

-1.42E-12

|

1.37E-12 -1.037137

|

0.3109

|

|

LOG(RESERV)

|

3.63E-13

|

2.28E-12 0.158984

|

0.8751

|

|

LOG(CREDOM)

|

-1.99E-12

|

1.87E-12 -1.065039

|

0.2984

|

|

LOG(EXPORT)

|

7.25E-13

|

3.91E-12 0.185471

|

0.8546

|

|

LOG(TAUDINTER)

|

4.43E-12

|

2.32E-12 1.909173

|

0.0694

|

|

LOG(INVPRIV)

|

-5.50E-12

|

2.96E-12 -1.854203

|

0.0772

|

|

R-squared

|

1.000000

|

Mean dependent var

|

22.77860

|

|

Adjusted R-squared

|

1.000000

|

S.D. dependent var

|

0.322706

|

|

S.E. of regression

|

7.03E-12

|

Akaike info criterion

|

-48.30043

|

|

Sum squared resid

|

1.09E-21

|

Schwarz criterion

|

-47.92677

|

|

Log likelihood

|

732.5064

|

F-statistic

|

8.73E+21

|

|

Durbin-Watson stat

|

0.891198

|

Prob(F-statistic)

|

0.000000

|

10

8

6

4

2

0

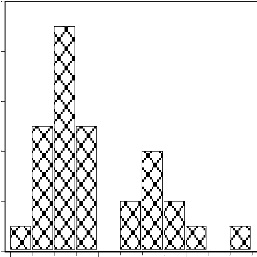

Annexe 2 Test de normalité des erreurs

Series: Residuals

Sample 1981 2010

Observations 30

Mean 1.30E-14

Median -2.50E-12

Maximum 1.68E-11

Minimum -8.21E-12

Std. Dev. 6.12E-12

Skewness 0.919379

Kurtosis 3.057589

Jarque-Bera 4.230436

Probability 0.120607

iii

-10E-11 -81E-28 10E-11

Annexe 3 : Breusch-Godfrey Serial Correlation LM

Test:

F-statistic 1.706831 Probability 0.181977

Obs*R-squared 13.30098 Probability 0.065106

Test Equation:

Dependent Variable: RESID Method: Least Squares

Std. Error t-Statistic Prob.

1.82E-10 0.729937 0.4767

1.10E-11 -0.866757 0.3997

1.33E-12 -0.371644 0.7154

2.16E-12 -0.703121 0.4927

2.07E-12 1.086670 0.2943

4.28E-12 0.303197 0.7659

2.84E-12 -0.232569 0.8192

3.06E-12 0.883622 0.3908

0.264004 2.987751 0.0092

0.330640 -1.211336 0.2445

0.412063 0.436701 0.6685

0.362177 -0.435232 0.6696

0.347351 -0.418201 0.6817

0.327448 -0.485063 0.6346

0.346184 -0.153287 0.8802

Mean dependent var 1.30E-14

S.D. dependent var 6.12E-12

Akaike info criterion -48.41961

Schwarz criterion -47.71901

F-statistic 0.853406

Prob(F-statistic) 0.614077

Date: 02/07/14 Time: 17:31

|

|

Variable

|

Coefficient

|

|

C

|

1.33E-10

|

|

LOG(PIBT-1)

|

-9.54E-12

|

|

LOG(MASMON)

|

-4.95E-13

|

|

LOG(RESERV)

|

-1.52E-12

|

|

LOG(CREDOM)

|

2.25E-12

|

|

LOG(EXPORT)

|

1.30E-12

|

|

LOG(TAUDINTER)

|

-6.61E-13

|

|

LOG(INVPRIV)

|

2.70E-12

|

|

RESID(-1)

|

0.788780

|

|

RESID(-2)

|

-0.400516

|

|

RESID(-3)

|

0.179948

|

|

RESID(-4)

|

-0.157631

|

|

RESID(-5)

|

-0.145263

|

|

RESID(-6)

|

-0.158833

|

|

RESID(-7)

|

-0.053065

|

|

R-squared

|

0.443366

|

|

Adjusted R-squared

|

-0.076159

|

|

S.E. of regression

|

6.35E-12

|

|

Sum squared resid

|

6.05E-22

|

|

Log likelihood

|

741.2942

|

|

Durbin-Watson stat

|

1.590158

|

iv

V

Annexe 4 : Equation à court terme

Dependent Variable: D(LOG(PIBT))

Method: Least Squares

Date: 12/02/15 Time: 09:16

Sample(adjusted): 1982 2010

Included observations: 29 after adjusting endpoints

|

Variable

|

Coefficien

t

|

Std. Error t-Statistic

|

Prob.

|

|

C

|

2.758128

|

2.625610 1.050471

|

0.3054

|

|

D(LOG(MASMON))

|

0.013941

|

0.028807 0.483953

|

0.6334

|

|

D(LOG(RESERV))

|

-0.051714

|

0.052362 -0.987614

|

0.3346

|

|

D(LOG(CREDOM))

|

0.062874

|

0.041733 1.506592

|

0.1468

|

|

D(LOG(EXPORT))

|

0.174837

|

0.129821 1.346758

|

0.1924

|

|

D(LOG(TAUDINTER))

|

-0.047345

|

0.049824 -0.950240

|

0.3528

|

|

D(LOG(INVPRIV))

|

-0.029064

|

0.073272 -0.396655

|

0.6956

|

|

LOG(PIBT(-1))

|

-0.121133

|

0.115450 -1.049224

|

0.0160

|

|

R-squared

|

0.867607

|

Mean dependent var

|

0.001533

|

|

Adjusted R-squared

|

0.856809

|

S.D. dependent var

|

0.182290

|

|

S.E. of regression

|

0.167389

|

Akaike info criterion

|

-0.508045

|

|

Sum squared resid

|

0.588399

|

Schwarz criterion

|

-0.130860

|

|

Log likelihood

|

15.36665

|

F-statistic

|

1.743882

|

|

Durbin-Watson stat

|

1.859080

|

Prob(F-statistic)

|

0.152799

|

|