3.1.2 Moody's Metric and coherent risk measures

We now temporarily put the risk-neutral measure aside and

focus on the historical probability measure. Moody's uses the same methodology

to rate CPDO and CPPI/DPPI products. It estimates the expected present value of

the loss function L(M) through Monte-Carlo simulations under the historical

probability measure.

Definition 2. Moody's expected discounted loss

Let t E I = {0, ät, .., kät, .., T} describe the

discrete time scale with T the maturity of the deal. Let Xt :=

(X(1)

t , .., X(p)

t ) be the p-vector of risk factors observed as of date t. We

introduce the filtration (Ft){t?I} defined as ?t E I, Ft := ó

(Xu,u E I,u = s). We further define the three stopping times (r, r,

r):

r := inf{s = 0, NPV (s) = TRV (s)}

r := inf{s = 0, NPV (s) = BF(s)} A T r := r A r

We then express Moody's risky discount factor DF(M) as

a function of the EURIBOR/LIBOR rate curve and of the senior spread s served to

the investor:

|

?t E I, DF(M)(t) :=

|

t-1Y

i=0

|

1

|

|

1 + ät(EUR(iät, (i + 1)ät) + s)

|

|

>1p i=1 L(M) L(M) = i

p

|

+

|

ót99%

|

|

vp

|

Then, under the historical probability measure, Moody's expected

discounted loss L(M) is given below:

[ ]

L(M) := E 1{ô<ô} [A(1 - sl) - max(NP V

(r), BF (r)) + DI(r)]+ DF (M)(r)

where sl is the detachment point in % of the subordinated

note.

In practise, Moody's uses an unbiased empirical estimator of

L(M), L(M) defined as:

where t99% := Ö-1(99%), p is the number of

Monte-Carlo simulations, L(M)

i is the

loss calculatd on the ith scenario and

ó is the standard error of (L(M)

1 , .., L(M)

p ).

Moody's then maps that value L(M) and the maturity of the deal T

against a positive real scale S = [0, 21] through a function MM called

«Moody's Metric»:

MM : [0, 1] × R+ -? [0, 21]

(x,t) i-? MM(x,t)

We shall now describe how the Moody's Metric mapping function

works. We first define the letter-to-integer mapping function R:

R : {Aaa,Aa1,..,Ca,C} -? {1,..,21}

m -? R(m)

The discrete mapping table is given below:

|

Rating-Figure

|

Rating-Letter

|

|

1

|

Aaa

|

|

2

|

Aa1

|

|

3

|

Aa2

|

|

4

|

Aa3

|

|

5

|

A1

|

|

6

|

A2

|

|

7

|

A3

|

|

8

|

Baa1

|

|

9

|

Baa2

|

|

10

|

Baa3

|

|

11

|

Ba1

|

|

12

|

Ba2

|

|

13

|

Ba3

|

|

14

|

B1

|

|

15

|

B2

|

|

16

|

B3

|

|

17

|

Caa1

|

|

18

|

Caa2

|

|

19

|

Caa3

|

|

20

|

Ca

|

|

21

|

C

|

Figure 3.1: Moody's rating conversion table

We shall now define the discrete function EL that maps the

integer equivalent of a rating category and a maturity with a percentage

expected loss:

EL : {1, .., 21} × {1, .., T} -? [0, 1]

(m, t) '-? EL(m, t)

Moody's calibrates the function EL on historical default data by

using the cohort method.

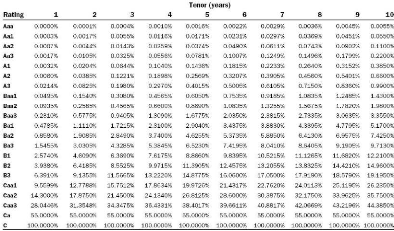

Figure 3.2: Moody's idealized EL values by rating category and

tenor

We shall then define EL, the time-continuous version

of EL function obtained by linearly interpolating EL between two discrete

integer dates:

EL : {1,..,21} x [0,T] -*[0,1]

(m, t) i-* (t + 1 - [t])EL(m, [t]) + (t - [t])EL(m, [t] + 1)

Let us now define the reverse mapping function F -1

that transforms any percentage loss level and tenor into a rating:

F -1 : [0, 1] x [0, T] -* {1, .., 21}

(x,t) -* min{m E {1,..,21}| EL(m,t) = x}

We finally give the expression of the Moody's Metric function MM:

Definition 3. Moody's Metric

?x E [0,1],?t E [0,T],

EL(F -1(x, t), t))

ln x - ln (

MM(x, t) := F -1(x, t) + ln ( EL(F

-1(x, t) + 1, t)) - ln ( EL(F-1(x, t), t))

In other words, the Moody's Metric can be seen as a

standardized continuous scale that allows to compare expected loss levels for

different tenors. We shall now take a closer look at the notion of risk measure

and understand to what extent it makes sense to use the expected loss as a

proxy for measuring risk.

Definition 4. Coherent Risk Measure

Let C denote a set of random variables representing all

possible risky positions and L E C be a random variable whose range of values

represents possible losses from any given risky position. We define the risk

measure function p as a mapping from C to R. The risk measure p is coherent if

it is:

i) monotonous: ?X, Y ? G, X = Y p(X) = p(Y )

ii) positively homogeneous: ?X ? G, ?h > 0, hX ? G and p(hX)

= hp(X)

iii) sub-additive: ?X, Y ? G, X + Y ? G and p(X + Y ) = p(X) +

p(Y )

iv) translation invariant: ?X ? G, ?a ? R s.t. X + a ? G, p(X +

a) = p(X) + a

Proposition 4.

If G+ is a set of non-negative random variables,

interpreted as a loss from a risky position, then expected value is a coherent

risk measure:

?X ? G+, p(X) := E[X]

Proof. Properties (i),(ii), (iii) and (iv) immediately result

from the expectation's linearity.

Unlike E[X], the Moody's Metric MM(X, t), where X is a

positive random variable that takes its values in [0, 1], is not a coherent

risk measure: though it is clearly monotonous and subadditive (because MM(., t)

is increasing and concave), it is neither positively homogeneous, nor

translation invariant.

|