BIBLIOGRAPHIE

· Asif Agha and Muhammad Khan (2006), «An Empirical

Analysis of Fiscal Imbalances and Inflation in Pakistan», SBP Research

Bulletin, Vol. 2, No. 2, pp 343- 362.

· Ball, L. and Mankiw G. (1995), «Relative Price

Changes as Aggregate Supply Shocks,» Quarterly Journal of

Economics, pp: 161-194, February 1995.

· Bruno M. and Fischer S. (1990), «Seignorage,

Operating Rules and the High Inflation Trap,» Quarterly Journal of

Economies, y. 105 (May), pp: 353-74.

· Campillo et al. (1996), «Why Does inflation Differ

Across Countries?», NBER Working Paper, N° 5540, April

1996.

· Chopra A. (1985), «The Speed of Adjustment of the

Inflation Rate in Developing Countries: A Study of Inertia.» IMF Staff

Papers, Vol. 32, No. 4 (December), pp: 693-733.

· Coe, David T. and McDermott J. (1997), «Does the Gap

Model Work in Asia?» IMF Staff Papers, Vol. 44 No. 1, March

1997.

· Gali J. and Gertler M. (1999), «Inflation Dynamics:

A Structural Econometric Analysis,» Journal of Monetary

Economics, y. 44 (October), pp: 195-222.

· Généreux J. (2001), Introduction

à l'économie, Collection Points Économie,

Édition du seuil, 1992, nouvelle édition, 2001, Points E31, pp:

153-157.

· J. Gali et al. (1994), «Sources of Real Exchange

rate Fluctuations: How Important are Nominal Shocks?» NBER Working

Paper, N° 4658, February 1994.

· Kivilcim M. et al. , «Dynamics of Inflation and

Inflation Inertia in Turkey», Bilkent University, Department of

Economics 06533 Ankara.

· Liviatan N. and Piterman S. (1986), «Accelerating

Inflation and Balance of Payments Crises, 1973--1984,» in The Israeli

Economy, ed. By Yoram Ben-Porath (Cambridge: Harvard University Press),

pp. 320-46.

· Loungani P. and Swagel P. (1996), «Supply-Side

Sources of Inflation: Evidence from OECD Countries,» international

Finance Discussion Paper no. 515, Federal Reserve Board, October.

· Lubrano, M. (2006), « Modélisation

Multivariée et cointégration » Université de

Paris Panthéon, Octobre 2006.

· Mialou, A. (2002), « L'inflation sous-jacente en

Afrique du sud et au Gabon : Une modélisation à partir de

l'approche VAR structurelle », Note d'Etude et de Recherche N° 1

, BEAC, octobre 2002.

· Montiel P. 1989, «Empirical Analysis of

High-Inflation Episodes in Argentina, Brazd and Israel,» IMF Staff

Papers, Vol. 36, No. 3 (September), pp: 527- 549.

· Moser, Gary G. (1995), «The Main Determinants of

Inflation in Nigeria,» IMF Staff Papers, Vol. 42, No.2 (June),

pp: 270-289.

· Razin A. and Sadka E. (1987), Economic Policy in

Theory and Practice. New York: St. Martin's Press.

· Tavera, C. (2003), « Modélisation

VAR », Université de Rennes, septembre 2003.

· Watson, T. (1994), vector autoregression and

cointegration , in Handbook of Economics, Ed, by R Engle and D. Mc

FADDEN,vol. IV,Chap 47, Elsevier, new York, PP 2843-2915.

ANNEXES

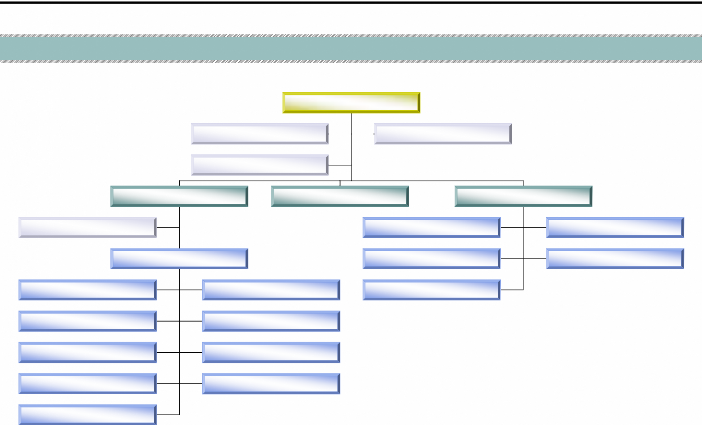

Figure 9 : (Annexe 1) Organigramme de la BEAC Direction

Nationale du Cameroun

DIRECTEUR NATIONAL

Conseil National Du Crédit

Conseil du Directeur National

Secrétaires

Directeurs Adjoints (02)

Responsable Informatique

Agences

Secrétaires

Bafoussam

Douala

Services

Garoua

Limbé

Personnel

Balance des Paiements

Nkongsamba

Gestion

Crédits et Centrale des risques

Émission monétaire

Marché monétaire

Études et Recherche

Comptabilité

Réglementation bancaire

Source : BEAC-DN

Secrétaire

Chef de service

Responsable

Documentation

Assistants Comptables

Comptable

Chef de Division

Chef de section

Principal

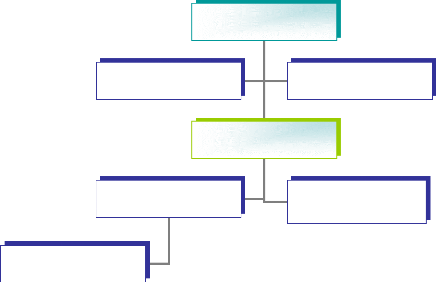

Figure 10 : (Annexe2) Organigramme du service des

Études

- 7.183385

0.0000

Test critical values:

1% level

- 3.577723

- 3.577723

5% level

- 2.925169

5% level

- 2.925169

10% level

- 2.600658

10% level

- 2.600658

2.841923

-3.513146

Augmented Dickey-Fuller test statistic

Augmented Dickey-Fuller Test Equation

*MacKinnon (1996) one-sided p-values.

Adjusted R-squared 0.523815 S.D. dependent var 1.422174

Durbin-Watson stat 1.749160 Prob(F-statistic) 0.000000

Sum squared resid 43.34050 Schwarz criterion 2.920653

S.E. of regression 0.981388

Lag Length: 0 (Automatic based on SIC, MAXLAG=9)

Log likelihood -64.78520 F-statistic 51.60102

Included observations: 47 after adjusting endpoints

R-squared 0.534166 Mean dependent var 0.015621

INFL(-1) -1.024317 0.142595 -7.183385 0.0000

Variable Coefficient Std. Error t-Statistic Prob.

Sample(adjusted): 1995:2 2006:4

Dependent Variable: D(INFL)

Date: 05/20/08 Time: 10:06

C 0.692234 0.171359 4.039666 0.0002

Null Hypothesis: INFL has a unit root

Method: Least Squares

Exogenous: Constant

Akaike info criterion

t-Statistic Prob.*

Adjusted R-squared 0.412718 S.D. dependent var 0.053387

Durbin-Watson stat 1.947784 Prob(F-statistic) 0.000001

Test critical values: 1% level

Sum squared resid 0.075322 Schwarz criterion -3.434416

M2GROWTH(-1) -0.852686 0.147704 -5.772953 0.0000

S.E. of regression 0.040912

Log likelihood 84.55893 F-statistic 33.32698

Lag Length: 0 (Automatic based on SIC, MAXLAG=9)

Augmented Dickey-Fuller Test Equation

*MacKinnon (1996) one-sided p-values.

Dependent Variable: D(M2GROWTH)

Augmented Dickey-Fuller test statistic -5.772953

0.0000

R-squared 0.425485 Mean dependent var 0.000897

Included observations: 47 after adjusting endpoints

Variable Coefficient Std. Error t-Statistic Prob.

Null Hypothesis: M2GROWTH has a unit root

Sample(adjusted): 1995:2 2006:4

C 0.015817 0.006503 2.432186 0.0190

Date: 05/20/08 Time: 10:19

Method: Least Squares

Exogenous: Constant

Akaike info criterion

t-Statistic Prob.*

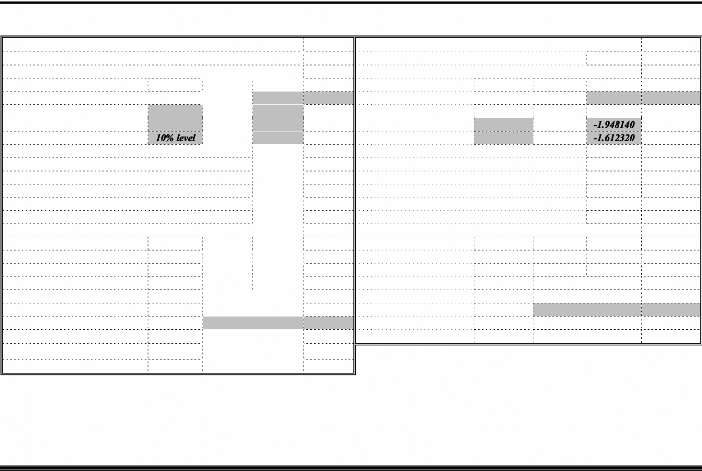

Tableau 3 : (Annexe3) Résultats du test de racine

unitaire des variables du modèle

Null Hypothesis: NONPETROL has a unit root

Null Hypothesis: OUTPUTGAP has a unit root

Exogenous: Constant

Exogenous: None

Lag Length: 1 (Automatic based on SIC, MAXLAG=9)

Lag Length: 1 (Automatic based on SIC, MAXLAG=9)

t-Statistic Prob.*

t-Statistic Prob.*

- 5.741092

0.0000

Augmented Dickey-Fuller test statistic

Augmented Dickey-Fuller test statistic -2.517426

0.0129

- 3.581152

Test critical values: 1% level

Test critical values: 1% level -2.616203

5% level

- 2.926622

5% level

- 2.601424

10% level

*MacKinnon (1996) one-sided p-values.

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller Test Equation

Augmented Dickey-Fuller Test Equation

Dependent Variable: D(NONPETROL)

Dependent Variable: D(OUTPUTGAP)

Method: Least Squares

Method: Least Squares

Date: 05/20/08 Time: 10:25

Date: 05/20/08 Time: 10:30

Sample(adjusted): 1995:3 2006:4

Sample(adjusted): 1995:3 2006:4

Included observations: 46 after adjusting endpoints

Included observations: 46 after adjusting endpoints

Variable Coefficient Std. Error t-Statistic Prob.

Variable Coefficient Std. Error t-Statistic Prob.

NONPETROL(-1) -1.260684 0.219590 -5.741092 0.0000

OUTPUTGAP(-1) -0.133450 0.053010 -2.517426 0.0155

D(NONPETROL(-1)) 0.181513 0.152428 1.190813 0.2403

C 0.006943 0.002133 3.254961 0.0022

D(OUTPUTGAP(-1))

R-squared 0.472800 Mean dependent var -0.000835

0.597968 0.099975 5.981199 0.0000

R-squared 0.549411 Mean dependent var -0.000431

Adjusted R-squared 0.460818 S.D. dependent var 0.005950

Adjusted R-squared 0.528453 S.D. dependent var 0.017079

-7.985967

S.E. of regression 0.004369

Akaike info criterion

Sum squared resid 0.000840 Schwarz criterion -7.906461

S.E. of regression 0.011728

Akaike info criterion -5.990720

Log likelihood 185.6772 Durbin-Watson stat 2.132524

Sum squared resid 0.005914 Schwarz criterion -5.871461

Log likelihood 140.7866 F-statistic 26.21531

Durbin-Watson stat 1.948859 Prob(F-statistic) 0.000000

Augmented Dickey-Fuller test

statistic

Adjusted R-squared 0.525366 S.D. dependent var 0.095545

Test critical values:

Sum squared resid 0.199313 Schwarz criterion -2.543230

S.E. of regression 0.065825

Lag Length: 0 (Automatic based on SIC, MAXLAG=9)

Log likelihood 61.69098 Durbin-Watson stat 2.009927

Augmented Dickey-Fuller Test Equation

*MacKinnon (1996) one-sided p-values.

PETROL(-1) -1.054473 0.147766 -7.136109 0.0000

Included observations: 47 after adjusting endpoints

R-squared 0.525366 Mean dependent var 0.000813

Method: Least Squares

Variable Coefficient Std. Error t-Statistic Prob.

Dependent Variable: D(PETROL)

Sample(adjusted): 1995:2 2006:4

Null Hypothesis: PETROL has a unit root

Date: 05/20/08 Time: 10:35

Exogenous: None

10% level

1% level

5% level

Akaike info criterion

- 7.136109

- 2.615093

- 1.947975

- 1.612408

t-Statistic Prob.*

-2.582595

0.0000

Dependent Variable: D(TXCHANGGROWTH)

TXCHANGGROWTH(-1) -1.045582 0.147326 -7.097070 0.0000

Adjusted R-squared 0.522663 S.D. dependent var 0.071654

Test critical values:

Sample(adjusted): 1995:2 2006:4

Sum squared resid 0.112735 Schwarz criterion -3.113069

S.E. of regression 0.049505

Null Hypothesis: TXCHANGGROWTH has a unit

root

Log likelihood 75.08219 Durbin-Watson stat 1.925654

Date: 05/20/08 Time: 10:38

Lag Length: 0 (Automatic based on SIC, MAXLAG=9)

Augmented Dickey-Fuller Test Equation

*MacKinnon (1996) one-sided p-values.

Augmented Dickey-Fuller test statistic

R-squared 0.522663 Mean dependent var 0.000161

Included observations: 47 after adjusting endpoints

Variable Coefficient Std. Error t-Statistic Prob.

Method: Least Squares

Exogenous: None

10% level

1% level

5% level

Akaike info criterion

- 7.097070

- 2.615093

- 1.947975

- 1.612408

t-Statistic Prob.*

-3.152433

0.0000

Source : Résultats

d'estimations.

Structural VAR Estimates

Date: 05/19/08 Time: 09:04

Sample(adjusted): 1996:1 2006:4

Included observations: 44

after adjusting endpoints

Estimation method: method of scoring (analytic

derivatives)

Convergence achieved after 9 iterations

Structural VAR is

just-identified

Model: Ae = Bu where E[uu']=I Restriction Type: short-run pattern

matrix Log likelihood 498.8528

A=

1,00000 0,00000 0,00000 0,00000 0,00000 0,00000

0,00000 1,00000 0,00000 0,00000 0,00000 0,00000

0,00000 0,00000 1,00000 0,00000 0,00000 0,00000

0,00000 0,00000 0,00000 1,00000 0,00000 0,00000

0,00000 0,00000 0,00000 0,00000 1,00000 0,00000

0,00000 0,00000 0,00000 0,00000 0,00000

1,00000

Estimated B

matrix:

0.048936 0.000000 0.000000 0.000000 0.000000

0.000000

-0.000523 0.010361 0.000000 0.000000 0.000000

0.000000

0.000448 0.003520 0.003656 0.000000 0.000000

0.000000

-0.005018 0.002078 0.001885 0.039843 0.000000

0.000000

0.003045 -0.005381 0.000189 -0.003900 0.040146

0.000000

0.255808 -0.053484 -0.275423 0.012341 -0.046329

0.806619

Tableau 4 : (Annexe4) Résumé de

l'estimation des paramètres structurels du modèle

1996 1998 2000 2002 2004 2006

|

.05

.04

.03

.02

.01

.00

-.01

-.02

|

|

1996 1998 2000 2002 2004 2006

|

.12

.08

.04

.00

-.04

-.08

-.12

|

|

|

1996 1998 2000 2002 2004 2006

|

|

.05

.04

.03 .02 .01 .00

-.01

-.02

|

|

1996 1998 2000 2002 2004 2006

|

.10

.05

.00

-.05 -.10 -.15 -.20

|

|

1996 1998 2000 2002 2004 2006

|

4 3 2 1 0

-1

-2

-3

|

|

|

1996 1998 2000 2002 2004 2006

|

|

INFL

|

OUTPUTGAP

TXCHANGGROWTH

M2GROWTH

Figure 11 : (Annexe5) Graphique des variables du

modèle

PETROL

NONPETROL

Figure 12 : (Annexe6) Graphique des Résidus des

estimations

PETROL Residuals

|

.08 .06 .04 .02 .00 -.02 -.04 -.06 -.08

|

|

1996 1998 2000 2002 2004 2006

OUTPUTGAP Residuals

|

.016 .012 .008 .004 .000 -.004 -.008

|

|

1996 1998 2000 2002 2004 2006

TXCHANGGROWTH Residuals

|

.08 .04 .00 -.04 -.08 -.12

|

|

1996 1998 2000 2002 2004 2006 NON PETROL Residuals

1996 1998 2000 2002 2004 2006

M2GROWTH Residuals

|

.06

.04

.02 .00 -.02 -.04 -.06

|

|

1996 1998 2000 2002 2004 2006

IN FL Residuals

|

1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5

|

|

1996 1998 2000 2002 2004 2006

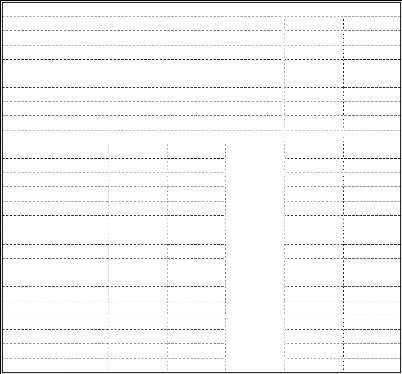

Tableau 5 : (Annexe7) Réponse de l'inflation

à une variation de 1% de chaque variable

|

|

Impulse Response Table

|

|

|

Period PETROL

|

NONPETROL

|

OUTPUTGAP

|

M2GROWTH

|

TXCHANGGROWTH

|

|

1

|

0.255808

|

-0.053484

|

-0.275424

|

0.012341

|

-0.046325

|

|

2

|

0.004686

|

0.118743

|

0.369541

|

-0.140682

|

0.092228

|

|

3

|

0.147507

|

0.253399

|

0.292468

|

-0.146287

|

0.135104

|

|

4

|

-0.223843

|

-0.115752

|

-0.251840

|

0.062269

|

0.259041

|

|

5

|

-0.149545

|

-0.143365

|

-0.262976

|

0.042488

|

-0.011448

|

|

6

|

0.108228

|

0.195199

|

0.101903

|

-0.004511

|

-0.053452

|

|

7

|

0.186234

|

0.267913

|

0.141652

|

-0.291685

|

0.030627

|

|

8

|

0.056304

|

0.113017

|

0.078607

|

-0.165825

|

-0.003740

|

|

9

|

-0.057228

|

0.163590

|

0.243139

|

-0.010004

|

0.037966

|

|

10

|

-0.071406

|

0.073758

|

0.142686

|

0.066036

|

0.163056

|

|

11

|

-0.044113

|

0.036424

|

-0.036474

|

0.055463

|

0.064987

|

|

12

|

-0.020237

|

0.005973

|

-0.078587

|

0.014257

|

-0.034000

|

|

Cholesky Ordering: PETROL NONPETROL OUTPUTGAP M2GROWTH

TXCHANGGROWTH

|

|

INFL

|

Le cas du Cam eroun de 1995 à 2006

Figure 13 : (Annexe8) Graphique des fonctions de

réponse de l'inflation aux divers choc

Response to Structural One S.D. Innovations #177; 2 S.E.

.8

.4

.0

-.4

-.8

.8

.4

.0

-.4

-.8

Response of INFL to PETROL Shock

25 50 75 100

Response of INFL to OUTPUTGAP Shock

25 50 75 100

Response of INFL to NONPETROL Shock

25 50 75 100

Response of INFL to M2GROWTH Shock

25 50 75 100

.8

.4

.0

-.4

-.8

25 50 75 100

Response of INFL to TXCHANGROWTH Shock

|