Annexe 24: Donnees du tourisme à Dubai.

125

126

Annexe 25 : Données tourisme à

Dubaï.

011liddi. Passport

Health and Wellness Tourism in the United Arab

Emirates

Category Briefing 105 Apr 2011

CATEGORY DATA

Table 1 Number of Hotel/Resort Spas: Units

200.5-2010

|

Outlets

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

|

- Hatel{Resart Spas

|

57.0

|

61.0

|

65.0

|

71.0

|

175.0

|

178.0

|

Source: Euromonitor International from official

statistics, trade associations, trade press, company research, trade

interviews, trade

SOU FEE

Table 2 Health & Wellness Tourism Sales by Category:

Value 2005-2010

|

AED million 2065 2006 2067

|

2009

|

2009

|

2010

|

|

Medical Tourism

|

4,121.2

|

4,218.7

|

4,345.0

|

4,542,0

|

4,630.0

|

5,100,0

|

|

Spas

|

814.7

|

854.5

|

897,7

|

943.8

|

1,017.9

|

1,068,0

|

|

- Destination Spas

|

-

|

-

|

-

|

-

|

-

|

-

|

|

- Hotel/Resort Spas

|

789.9

|

827.7

|

868.7

|

913.4

|

986.7

|

1,035.5

|

|

- Other Spas

|

24.8

|

26.8

|

29.0

|

30.4

|

31.2

|

32.5

|

|

Other Health & Wellness

Tourism

|

13.5

|

14.8

|

16.2

|

18.5

|

18.8

|

19.0

|

|

Health & Wellness

Tourism

|

4,949.4

|

5,088.0

|

5,258,9

|

5,504.3

|

5,666,7

|

6,187.0

|

Source: Euromonitor International from official

statistics, trade associations, trade press, company research, trade

interviews, trade sou FEE

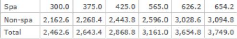

Table 3 Spa Consumer Markets: Domestic Tourism

200.52010

'000 trips 2005 2006 2007 2009 2009 2(

300.0 375.0 425.0

Source: Euromonitor International from official

statistics, trade associations, trade press, company research, trade

interviews, trade Courtes

Table 4 Spa Consumer Markets: Arrivals

2005-2010

|

'000 trips 2665 2006 2007 2006 2009 2010

|

|

Spa

|

850.0

|

950.0

|

1,100.0

|

1,300.0

|

1,514.9

|

1,580.0

|

|

Non-spa

|

6,733.1

|

6,991.9

|

7,374.1

|

7,596.7

|

7,435.4

|

7,606.1

|

|

Total

|

7,583.1

|

7,941.9

|

8,474,1

|

8,896.7

|

8,950.3

|

9,186,1

|

Source: Euromonitor International from official

statistics, trade associations, trade press, company research, trade

interviews, trade

127

128

129

129

Annexe 26: Promotion pour visiter Dubai.

Special Report; Dubai

Travel agencies are reporting mixed success for Dubai hotels'

attempts to stimulate business, as the emirate carried out an exclusive survey

with TTG readers to find how it could better service agents.

Rupert Murray and Martin Ferguson report

Dubai discounts

could backfire

aarhdaivh nlafr,F -. -- 1PFrrnpp~at7'

~r

Searebig fora by` i searciwsfor hotels

in Dubai have risen by 570% slate the state

·hackenJcompany Dubai

World's debts sparked a financial crisis In the emirate,

accarding to Hotelscom.

The wetasite said that in the first half Of

2444, the average price of a five-star hotel room in Dahai was /174

per night but this will have dropped by 17% in January 2410 - equivalent to a

12in saying for a week-long stay.

Alison [Duper. Hotels.rom's director of communications. said.

"Dubai Is great value at the moment:

"There are SOME fantastic prornotioal5 from hoteliers in the city

as they try to attract customers."

ravel agencies have peen bombarded with special

ofiers and discounts For holidays

to Dubai - but fear customers

will hold off until even better

deals materialise.

Fiee

·Stdr hotels, including the recently opened Atlantis

The Palm, have been Contacting ageots ofleriog up to 50% aft rates in

a desperate attempt to sell inventory for 2010. asreported by TTG

last week (Aittuovit,

Luxury operator IF [tribe contacted agents on Monday to tell them

a seven

·night stay al Atlantis. including Emirates flights: wasEI,5o13

cneaper than the prewou5 week.

Agents were unanimous that the price reduc

· tiecis were

good Mel some found that Customers were delaying making bookings, believing

prices would fall Further in the new year.

Janet Whittingham, retail development manager at

Si Andrews Travel in Bolton. said! -One of our regular Dubai clients

admitted he bad seen deals online acid lord us he was going to wait for the

pride to fall further before booking.

"'They recognise What a good product Dubai is aril want lo obtain

the best possible deal"

14 1.1k 1.1.1.2.2009

Jo Gardiner. a Travel Counsellors agent hayed in oxford end

one of the agents who completed tTG's Dubai survey, said she was facing

e raft of cancellations by clients '

on low deposits because

they believed they would gel a better bargain lacer_

llent5 have cancelled with e view to rebooking when prices Fall,'

she said.

"They wilt come down, so it§ probably

rigid for them, tea it's a pain for me."

Gordon Metcalf of Ryedale Travel said he had had to reassure

clients about Dubai s economy.

"We have been reessurfng people. but as a destination Dubai needs

to make Itself more appealing in terms or its prices and packages."

5iobahn McCr y of Anderson Business Travel said hotel rates

were failing but air fares had

yet to fallow snit sa price outs were not yet haying a big

impact_ henM[Hab. managing director of The Travel comparty Edinburgh, said

agents were Ind strong position as suppliers in Dubai would do "whatever it

takes" In retain market share. "They don't look at profit as we do. They'll

slash prices and wait for the economy to re

· cover.

Consumers will go for it if They could nui afford it before:"

Agents spell

out their Dubai

highs and lows

OU AI'S TOURISM authority has turned to TTf, readers to find out

how it can hest reach agents: More than 450 readers took the opportunity to get

their views across to Dubai Tourism and Commerce Marketing UK & Ireland

director lan Scott's office by filling in the online Survey. Here he responds

to the issues they raised!

Ql Which market segments da you sell to? Dubai has invested a

great deal in promoting its variety, so Scott vas pleased to see agents sell-mg

to singles, Couples. honeymooners and families. and pushing sport and wellbeing

breaks:

"I knew couples would come out on lop 191.4%) but it's great to

see familles toile the second spot (g1.7%t," he said. "We have

some work to do to push spa/wellbeing break-S Id8.840 further as the

offering we have is world class, and af50 our extensive range of sporting

· occasions and activities breaks /443%).-

44:796)

130

131

132

Annexe 27 : données sur les différents

événements à Dubaï.

f awrsc snrracuurrs

|

unneV füCV trnrrafes

|

|

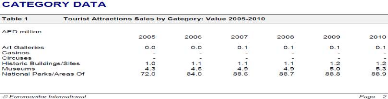

TOURIST ATTRACTIONS IN THE UNITED ARAB

EMIRATES

HEADLINES

· Tourist attractions registers retail value growth of 3%

in 2010 to be worth AED775 million

· Performance of tourist attractions remains positive iu

2010 driven by domestic tourism, popularity of leading attractions and opening

of new attractions such as the Ferrari Theme Park in Abu Dhabi

· Dubai Shopping Festival and Dubai Summer Surprises remain

the largest and most important tourist attractions in the UAE

· The fastest growing category in tourist attractions in

ternis of value in 2010 is zoos/aquariums with retail value growth of 8%,

followed closely by art galleries

· Tourist attractions expected to grow by a constant retail

value CAGR of 6% over the forecast period to be worth AED1 billion by 2015

TRENDS

· The Dubai Shopping Festival in 2010 ran from January 28th

to February 28th during which 6.000 retailers, the majority of which were gold

and jewellery retailers, showcased their products. According to trade sources,

the event generated turnover of US$2.8 billion. Prizes worth AED2 million were

offered during the festival, which is held annually, and in excess of three

million visitors came to the event. Spending recovered somewhat in comparison

to 2009 when consumer confidence decreased. The Dubai Summer Surprises event

also attracted visitors in 2010, with nearly two million visitors over the 10

week event, which started in July. The DCTM makes huge investments every year

in advertising and promotion of the Dubai Shopping Festival and Dubai Summer

Surprises across the Middle East.

· In 2010, the Ferrari Theme Park was a new addition to

tourist attractions in the UAE. The park was opened in October 2010 on Yas

Island, which became a landmark after the Formula One Race in November 2009.

The theme park offers two new roller coaster experiences, the Formula Rossa and

Fiorano GT Challenge, The Formula Rossa is the world's fastest roller coaster

while the Fiorano GT Challenge is a duelling and racing roller coaster with

Ferrari-style cars, which is designed to simulate a Ferrari racing experience.

The park also features the Speed of Magic, an indoor, 4-D movie experience

about Ferraris. Premium tickets are available, which give visitors access to a

lounge with refreshments and priority on riding attractions. Ticket prices vary

between AED165 and AED375, making it one of the most expensive attractions in

the UAE. All tickets provide unlimited rides on all of the attractions.

· The strongest growth in retail value in 2010 goes to zoos

and aquariums which have always recorded a rather fast growth at 5% CAGR for

the review period. This type of attraction in 2010 has been driven by the

opening of the massive Dubai Aquarium at the new Dubai Mall which opened its

doors late in 2009. The aquarium features a 10 million litre Aquarium tank with

33,000 different species, offering shark dives as well.

· The rising number of art galleries across the UAE

contributed to the strong retail value growth of this category in 2010. Over

2008 and 2009, the number of independent galleries in Abu Dhabi alone increased

from three to six. Among these new art galleries were Acento and Salwa Zeidan.

Acento specialises in Mexican art while Salwa Zeidan focuses on abstract art

and the concept of feminine spirituality. Ghaf Gallery is another leading art

gallery which was opened in 2006. It is a contemporary art gallery, the first

of its kind in Abu Dhabi Al Qibab Gallery is also an extremely popular art

gallery because it specialises in Iraqi and Arab art,

· In Dubai, over 60 art galleries participated in Art Dubai

2010. The fair included the unveiling of artwork by the recipients of the

Abraaj Capital Art Prize for 2010. According to a survey carried out for Art

Dubai 2010 the majority of respondents believed that demand for art would

increase compared to 2009. Also, in November 2010, Abu Dhabi Art was held at

the Emirates Palace, with a host of international galleries from

· Euromonitor international Page 1

Tourist Attractions United Arab Emirates

133

the US, Europe, Asia and the Middle East as well as young.

innovative galleries showcasing emerging artists.

· Christie's in Dubai also continued to act as a local

gateway to international art in 2010 and it is responsible for developing and

overseeing the activities of the company in the Middle East and for providing

access to in-house art experts as well as information on buying and selling at

auction.

· Museums also performed well in 2010 registering retail

value growth of 5%, followed by theatres and theme/amusement parks, with growth

of 5% and of 4% respectively. However, theme/amusement parks continued to

account for by far the largest retail share of tourist attractions in 2010,

with sales of AED604 million. Wild Wadi Water Park remained the most popular

attraction in this category in Dubai in 2010 and Ski Dubai continued to attract

more than a million visitors in 2010. Other smaller attractions such as

Adventureland in Sharjah have also contributed to the growth of this

category.

PROSPECTS

· Tourist attractions is expected to grow by a constant

retail value CAGR of 6% over the forecast period, to be worth AED I billion by

2015, driven by growth in the number of visitors, which is expected to grow by

a CAGR of 2% over the forecast period. The fastest growing category, at a

constant retail value CAGR of 8%, is expected to be historic buildings/sites.

The growth of this category is expected to be driven by developments in this

regard. For example, in Abu Dhabi, efforts to promote the emirate's culture and

heritage will create more interest in historical buildings and sites such as

the Al Jahili Fort, Al Mezyad Fort and Al Hilli Watchtowers among others. In

addition, the Qasr el hosn Palace is undergoing an ambitious programme of

conservation that is scheduled for completion in 2011, when the site will

become fully accessible to visitors as the prime memorial in Abu Dhabi. It is

one of the key landmarks in terms of the history of Abu Dhabi.

· Abu Dhabi will also see significant developments in its

arts and culture scene over the forecast period. The opening of the Guggenheim.

the Louvre and the performing arts centre on Yas Island in 2013 will be a major

milestone in art galleries in Abu Dhabi as a result of which the munber of

artists and art lovers that visit Abu Dhabi is expected to increase

significantly over the forecast period. Rather than to promote just local

artists and local artwork, in Abu Dhabi there is expected to be increased focus

on the promotion of international art across the Middle East. making Abu Dhabi

a gateway among artists to the Middle East. This focus on international art is

with the aim of positioning Abu Dhabi as a global arts hub and enhancing the

international image of this emirate Art galleries is expected to grow by a

constant retail value CAGR of 7% over the forecast period and the number of

visitors to art galleries is expected to grow by a CAGR of 7%.

· Theme/amusement parks is expected to be the second most

dynamic category in tourist attractions in tenus of constant retail value

growth over the forecast period. The completion of Ferrari World Abu Dhabi in

2010 with over 20 rides and attractions is expected to boost the performance of

theme/amusement parks in Abu Dhabi and to attract more domestic and

international visitors. Yas Island Water Park and Warner Bros theme park are

also expected to become major attractions when completed and this will also

benefit theme/amusement parks. (c)wing to these developments, Abu Dhabi is

expected to become a major competitor to Dubai over the forecast period.

Tourist Attractions

|

|

|

|

|

United Arab Emirates

|

Natural Beauty

|

|

|

|

|

|

|

Theatres

|

|

-

|

0.3

|

0.3

|

0.4

|

0.4

|

Theme/Amusement Parks

|

468.0

|

523.0

|

560.7

|

571.0

|

579.0

|

603.5

|

Zoos/Aquariums

|

1.6

|

1.7

|

1.8

|

1.8

|

1.9

|

2.1

|

Other Tourist Attractions

|

49.8

|

64.4

|

72.1

|

72.4

|

72.8

|

73.2

|

Tourist Attractions

|

596.8

|

678.9

|

729.6

|

740.4

|

749.1

|

774.5

|

|

Source: Euromonitor International from official statistics,

trade associations, trade press, company research, trade

interviews, trade sources

Table 2 Tourist Attractions Visitors by Category:

2005-2010

'000 visitors

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

Art Galleries

|

1.1

|

1.1

|

2.0

|

2.1

|

2.2

|

2.4

|

Casinos

|

|

|

|

|

|

|

Circuses

|

|

-

|

|

-

|

-

|

|

Historic Buildings/Sites

|

200.5

|

213.6

|

228.5

|

232.1

|

238.0

|

246.0

|

Museums

|

953.2

|

1,014.2

|

1,085.1

|

1,105.0

|

1,128.0

|

1,131.0

|

National Parks/Areas Of

|

3,478.6

|

3,669.9

|

3,879.1

|

3,906.2

|

3,925.0

|

3,943.2

|

Natural Beauty

|

|

|

|

|

|

|

Theatres

|

|

-

|

1.6

|

1.7

|

1.8

|

2.1

|

Theme/Amusement Parks

|

1,125.0

|

1,181.3

|

1,263.9

|

1,284.6

|

1,295.0

|

1,316.5

|

Zoos/Aquariums

|

430.3

|

460.5

|

487.6

|

490.9

|

493.0

|

502.3

|

Other Tourist Attractions

|

5,100.0

|

5,800.0

|

6,802.7

|

8,355.4

|

7,950.0

|

8,955.0

|

Tourist Attractions

|

11,288.7

|

12,340.6

|

13,750.5

|

15,378.0

|

15,033.0

|

16,098.5

|

|

Source: Euromonitor International from official statistics,

trade associations, trade press, company research, trade

interviews, trade sources

|

|

Table 3

|

Tourist Attractions Sales: Internet Transaction Value

2005-2010

|

|

|

AED million

|

|

|

|

|

|

|

2005 2006

|

2007

|

2008

|

2009

|

2010

|

Internet

|

3.4 3.6

|

5.0

|

6.9

|

7.7

|

7.8

|

- Direct Suppliers

|

1.6 1.7

|

2.3

|

3.9

|

4.6

|

4.8

|

- Intermediaries

|

1.8 1.9

|

2.7

|

3.0

|

3.1

|

3.0

|

Others

|

593.4 675.3

|

724.6

|

733.5

|

741.4

|

766.7

|

Total

|

596.8 678.9

|

729.6

|

740.4

|

749.1

|

774.5

|

|

Source: Euromonitor International from official statistics,

trade associations, trade press, company research, trade

interviews, trade sources

Table 4 Leading Tourist Attractions by Visitors

2005-2010

'000 people

134

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

Dubai Shopping Festival

|

3,200.0

|

1,300.0

|

2,000.0

|

2,900.0

|

2,600.0

|

3,350.0

|

Dubai Summer Surprises

|

1,510.0

|

1,600.0

|

1,616.7

|

2,100.0

|

1,870.0

|

1,985.0

|

Dubai Ski

|

600.0

|

1,095.0

|

1,185.6

|

1,200.0

|

1,235.0

|

1,125.5

|

Jumeirah Beach Park

|

850.0

|

940.0

|

1,037.4

|

1,045.0

|

1,056.0

|

1,123.0

|

Creek Side Park

|

760.0

|

900.0

|

970.0

|

988.0

|

1,020.0

|

1,028.0

|

Jumeirah City

|

320.9

|

649.7

|

741.0

|

755.0

|

767.0

|

785.0

|

Wild Wadi

|

640.0

|

660.0

|

727.5

|

735.0

|

752.0

|

755.0

|

Jumeirah Mosque

|

323.6

|

646.9

|

673.6

|

680.0

|

698.0

|

705.0

|

Burj AL Arab

|

282.8

|

575.7

|

606.2

|

620.0

|

624.0

|

625.0

|

Sharjah Natural History

|

214.8

|

444.1

|

485.0

|

490.0

|

508.0

|

556.0

|

Museum

|

|

|

|

|

|

|

Dubai Museum

|

411.0

|

430.0

|

485.0

|

490.0

|

540.0

|

548.0

|

Deira Gold Suks

|

227.1

|

460.5

|

498.5

|

520.0

|

525.0

|

531.0

|

|

135

Tourist Attractions

|

|

|

|

United Arab Emirates

|

Villages

|

|

|

|

|

|

|

Dubai Zoo

|

430.0

|

445.0

|

471.5

|

480.0

|

495.0

|

512.0

|

The courtyard

|

197.1

|

394.7

|

417.6

|

430.0

|

438.0

|

442.0

|

Dhow Warfage

|

165.9

|

339.9

|

377.2

|

408.0

|

410.0

|

423.0

|

Bastakia

|

133.2

|

257.7

|

269.5

|

280.0

|

288.0

|

290.0

|

Al Ahmadiya School

|

89.9

|

164.5

|

202.5

|

208.0

|

222.0

|

238.0

|

Halle Village

|

125.0

|

140.0

|

148.2

|

160.0

|

167.0

|

170.0

|

Sheikh Saeed House

|

43.0

|

48.0

|

52.5

|

53.0

|

56.0

|

58.0

|

Other Visitor Attractions

|

538.7

|

399.3

|

300.0

|

336.0

|

242.0

|

321.0

|

Total

|

11,288.7

|

12,340.6

|

13,750.5

|

15,378.0

|

15,033.0

|

16,098.5

|

|

Source: Euromonitor International from official statistics,

trade associations, trade press, company research, trade

interviews, trade sources

Table 5 Forecast Tourist Attractions Sales by Category:

Value 2010-2015

AED million

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

Art Galleries

|

0.1

|

0.1

|

0.1

|

0.1

|

0.1

|

0.1

|

Casinos

|

|

|

|

-

|

|

|

Circuses

|

|

|

|

|

|

|

Historic Buildings/Sites

|

1.2

|

1.2

|

1.3

|

1.4

|

1.6

|

1.7

|

Museums

|

5.3

|

5.4

|

5.6

|

5.8

|

6.0

|

6.2

|

National Parks/Areas Of

|

88.9

|

89.9

|

91.5

|

93.3

|

95.3

|

97.4

|

Natural Beauty

|

|

|

|

|

|

|

Theatres

|

0.4

|

0.4

|

0.4

|

0.4

|

0.4

|

0.5

|

Theme/Amusement Parks

|

603.5

|

642.7

|

687.1

|

737.2

|

795.5

|

856.7

|

Zoos/Aquariums

|

2.1

|

2.2

|

2.3

|

2.5

|

2.6

|

2.8

|

Other Tourist Attractions

|

73.2

|

74.2

|

75.4

|

76.8

|

78.5

|

80.1

|

Tourist Attractions

|

774.5

|

816.1

|

863.7

|

917.6

|

980.0

|

1,045.5

|

|

Source: Euromonitor International from trade associations,

trade press, company research, trade interviews, trade

sources

Table B Forecast Tourist Attractions Visitors by

Category: 2010-2015

'000 visitors

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

Art Galleries

|

2.4

|

2.5

|

2.6

|

2.8

|

3.0

|

3.2

|

Casinos

|

|

-

|

-

|

-

|

|

-

|

Circuses

|

|

|

|

|

|

|

Historic Buildings/Sites

|

246.0

|

261.7

|

279.8

|

303.3

|

330.9

|

360.7

|

Museums

|

1,131.0

|

1,136.7

|

1,146.9

|

1.161.8

|

1,181.5

|

1,200.4

|

National Parks/Areas Of

|

3,943.2

|

3,982.6

|

4,046.4

|

4.123.2

|

4,205.7

|

4,281.4

|

Natural Beauty

|

|

|

|

|

|

|

Theatres

|

2.1

|

2.2

|

2.4

|

2.6

|

2.8

|

3.0

|

Theme/Amusement Parks

|

1,316.5

|

1,334.9

|

1,357.6

|

1,384.8

|

1,420.8

|

1,450.6

|

Zoos/Aquariums

|

502.3

|

522.4

|

545.9

|

572.1

|

603.6

|

636.2

|

Other Tourist Attractions

|

8,955.0

|

9,071.4

|

9,198.4

|

9,345.6

|

9,532.5

|

9,694.6

|

Tourist Attractions

|

16,098.5

|

16,314.5

|

16,580.0

|

16,896.2

|

17,280.8

|

17,630.1

|

|

Source. Euromonitor International from trade associations,

trade press, company research, trade interviews, trade

sources

136

|

|