4.2 Calculation of the Historical Results Using the

Data from CERFRANCE Isère

The objective of these calculations is to see if the

hypothesis of the traditionalist's approach is verified in agriculture: does

the performance of the firm increases with leverage? Therefore, the results of

firms divided in 5 groups of leverage were analyzed (group 1 high leverages,

group 5 lowest leverages. See section 3.2.4 page 31 for details).

4.2.1 Normality of the Datasets

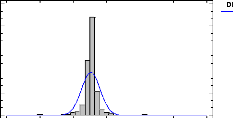

Figure 14 presents the distribution of values for ROE to

compare it with a normal distribution. The distribution does not fit with the

normal distribution line looking at the histogram, because the central values

have an abnormally high frequency. This impression is confirmed by the

KolmogorovSmirnov test, because the P-Value is lower than 0.000. We can reject

with 99% confidence that ROE comes from a normal distribution. The Shapiro-Wilk

test cannot be performed because the sample is bigger than 2000 values.

Figure 14: histogram of frequency for ROE

The distributions of ROE have been tested for each year's

separately, and within each year's for each

production either. Over the 25

tests, ROE could come from a normal distribution only for dairy

Dstrbuon

Normal

producers and cattle producers in 2010. Therefore, only the

Kruskal-Wallis and Mood's Median tests were used to analyze ROE, and the

results of the Anova's were not presented.

Figure 15 presents a histogram of the frequency of the

distribution for ROA to compare it with a normal distribution. From a graphic

perspective, it seems that ROA is closer than ROE to a normal distribution, as

the normal distribution line is closer to the frequency histogram. However, the

Kolmogorov-Smirnov test P-Value was lower than 0.000 as well, therefore we can

also reject at 99% confidence that ROA comes from a normal distribution.

-3 -1 1 3 5 7

Figure 15: Histogram of frequency for ROA

Same as the ROE, the distributions of ROA have been tested for

each year and within each year for each production separately. All the tests

performed reported the same results: ROA does not come from a normal

distribution at 99% confidence. Therefore, only the results of the

Kruskal-Wallis and Mood's Median tests were discussed for ROA.

4.2.2 ROE

4.2.2.1 ROE Tested by Time and Specialization

The dataset have been tested first to see if time had an effect

on ROE. The results of the Mood's

median and Kruskal-Wallis tests were quite

logical: as someone could have predicted, time has a

significant effect on

the ROE, with really low P-Values. The years 2006 and 2009 were two years of

isra A

bad results for farmers in Isère. The price of

agricultural commodities soared in 2007 and 2008,

explaining that these two

years were better. The effect was similar in 2010, when commodity prices

Dstributon

recovered from the severe fall of 2009. .

Mood's Median Test for ROE by YEAR Total n =

2840

Grand median = 0,0583012

|

YEAR

|

Sample Size

|

n<=

|

n>

|

Median

|

90,0% lower CL

|

90,0% upper CL

|

|

2006

|

568

|

326

|

242

|

0,0195117

|

0,00305438

|

0,041546

|

|

2007

|

568

|

245

|

323

5

|

0,0910952

55

|

0,0759334

|

0,110756

|

|

2008

|

568

|

250

|

318

|

0,0837851

|

0,065602

|

0,0957051

|

|

2009

|

568

|

328

|

240

|

0,0176906

|

0,00193535

|

0,0337506

|

|

2010

|

568

|

271

|

297

|

0,0734001

|

0,0512998

|

0,091961

|

Test statistic = 46,0986 P-Value = 2,3492E-9

Kruskal-Wallis Test for ROE by YEAR

|

YEAR

|

Sample Size

|

Average Rank

|

|

2006

|

568

|

1275,31

|

|

2007

|

568

|

1547,93

|

|

2008

|

568

|

1517,84

|

|

2009

|

568

|

1287,11

|

|

2010

|

568

|

1474,32

|

Test statistic = 57,0073 P-Value = 1,2328E-11

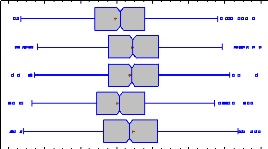

Figure 16: Box and whisker plots with median notch for

ROE by year (means are shown with a red cross)

Figure 16 presents the box and whisker plots with median notch

at 90% confidence intervals, showing that the results of the years 2006 and

2009 were significantly lower than in 2007, 2008 or 2010. Therefore, in order

to isolate the time effect, ROE has to be analyzed year by year.

ROE has been analyzed by specialization:

- Dairy production,

- Cattle ranching,

Bnd

- Grain production,

- Diversified production.

Mood's Median Test for ROE by SPECIALIZATION

Total n = 2840

Grand median = 0,0583012

|

SPECIALIZATION

|

Sample Size

|

n<=

|

n>

|

Median

|

90,0% lower CL

|

90,0% upper CL

|

|

Dairy

|

705

|

326

|

379

|

0,0747834

|

0,0595245

|

0,0896643

|

|

Cattle

|

225

|

154

|

71

|

-0,00274151

|

-0,0266764

|

0,0162487

|

|

Grains

|

630

|

299

|

331

|

0,0769898

|

0,0493805

|

0,103964

|

|

Diversified

|

1280

|

641

|

639

|

0,0580287

|

0,0458927

|

0,0699453

|

Test statistic = 36,2307 P-Value = 6,69281E-8

|

Dairy

Cattle

Grains

Diversified

|

|

Figure 17: Box and whisker plots with median notch for

ROE by specialization (means are shown with a red cross)

The Mood's median test for ROE by specialization illustrates

that the specialization has a significant impact on the ROE, with a really low

P-Value illustrating that we cannot reject the hypothesis that the medians are

different at 99% confidence. The cattle production has a median ROE lower than

the other productions. The P-Value for the Kruskal-Wallis test is 3,96451E-8,

giving the same results. Therefore, ROE was tested separately for each

specialization and each year, in order to isolate the effect of time and

specialization.

|