4.8 DIAGNOSTIC TESTS

In econometrics analysis the diagnostic tests are important to

check whether the assumptions of tradition regression are confirmed.

These tests included Normal distribution test,

Heteroscedasticity test, Autocorrelation test and

Stability test.

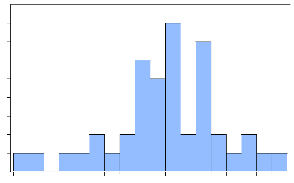

4.8.1 NORMALITY TEST

The hypothesis test is as follow

Ho: The residuals are normal distributed

H1 : The residuals are not normal distributed

The null hypothesis is rejected at 10% level of significant

4

2

9

8

7

6

5

3

1

Series: Residuals

Sample 2007Q1 2017Q4

Observations 44

|

Mean

Median

Maximum

Minimum

Skewness

Kurtosis

Jarque-Bera

Probability

|

|

P a g e 40 | 48

Figure 1: Normality test results

Source: Author's computation (2019) by Eviews

8

Std. Dev.

2.88e-16 0.003337 0.071187

-0.094099 0.036401 -0.499066

3.414288

2.141154

0.342811

Since the p-value 0.3462811 is greater than 10% level of

significance, we fail to reject the null hypothesis that the error term is

normally distributed at 95 % confidence interval and conclusion made that the

error term is normally distributed.

4.8.2 SERIAL CORRELATION LM TEST

Table 12: Serial correlation LM Test

Breusch-Godfrey Serial Correlation LM Test:

F-statistic 1.188804 Prob. F(1,35) 0.2830

Obs*R-squared 1.379702 Prob. Chi-Square(1) 0.2402

Source: Eviews 7,2019

Table 4.10 reports the results of the first diagnostic test of

autocorrelation. The null hypothesis (Ho) claims that there is no

autocorrelation while the alternative hypothesis (H1) claims the opposite. The

decision rule states that the null hypothesis (H0) should be rejected if the

p-value of observed R-squared is less than the 0.05 level of significance.

Hence, there is no presence of serial correlation in the estimated model, since

the p-value of the observed R-squared is 0.2402 which is greater than the 0.05

level of significance.

4.8.3 HETEROSCEDASTICITY TEST

Table 13: Heteroscedasticity Test result

Heteroscedasticity Test: Breusch-Pagan-Godfrey

|

F-statistic

|

0.919697

|

Prob. F(8,33)

|

0.5129

|

|

Obs*R-squared

|

7.657008

|

Prob. Chi-Square(8)

|

0.4677

|

|

Scaled explained SS

|

19.22575

|

Prob. Chi-Square(8)

|

0.0137

|

|

Source: Eviews 7,2019

|

|

|

|

Table 4.13 shows the results of the second diagnostic test of

serial correlation. the null hypothesis (Ho) claims that residuals are

homoscedasticity and the alternative hypothesis claims that the residuals are

heteroscedastic and thus the variance is not constant. The rejection rule

states that the null hypothesis should be rejected if the probability value of

observation R-squared is less than the 0.05 level of significance. Since the

probability of Chi-Square of 0.2402 is greater than 0.05, the test fails to

reject the null hypothesis of constancy of variance among the residuals in the

model, and thus are deemed to be homoscedastic.

4.8.4 STABILITY OF THE MODEL

|

20 15 10 5

0 -5 -10 -15 -20

|

|

|

2009 2010 2011 2012 2013 2014 2015 2016 2017

|

|

|

|

|

CUSUM 5% Significance

|

|

|

|

|

|

|

Figure 4. 2 cumulative sum model stability

Source: Author's computation (2019) by Eviews

8

By analyzing the above graph, it was clear that the model is

stable because the navigating blue line of graph does not cross the borders

(the straight lines represent critical bounds at 5% significance level); this

indicates that the GDP of Rwanda have been moving in a stable way from 2007 to

2017

P a g e 41 | 48

|