|

IMPACT OF TAX REVENUE ON ECONOMIC

P a g e 1 | 48

GROWTH IN RWANDA FROM 2007 -2017.

BY

NZABIRINDA Etienne (MSc, ~CPA, Bed)

E-mail:

etienne.nzabirinda@gmail.com

Linkedin:

https://www.linkedin.com/in/nzabirinda-etienne-963176125/

Kigali November2019

P a g e 2 | 48

ABSTRACT

Rwanda is working tirelessly to achieve economic growth

and development. Taxation effective is the one tool to promote and to

accelerate economic growth and development, several studies analyses the impact

of tax on economic growth and economic development.

The objective of this study is to investigate the impact

of tax revenue on economic growth in Rwanda from 2007-2017. Secondary data were

sourced from Rwanda Revenue Authority (RRA) and National Institute of

statistics of Rwanda (NISR) for the period spanning from 2007Q1-2017Q4.

Descriptive data analysis was used and the variable considered here are: Gross

domestic product (GDP) as proxy for economic growth, direct tax (DT), Tax on

goods and services (TGS) and Tax on international trade and transaction (TITT).

Significant literature review for this study is available.

The results of the unit root and the co-integration tests

revealed that all variables are integrated of order one, I(1) and Johensen

cointegration test indicate existence of a long-run equilibrium relationship

among variables included in the model and we use also Vector Error Correction

Model (VECM) estimation method for data analysis to estimate for short run

result. The empirical findings showed that direct tax(DT)and tax on goods and

services(TGS) variables have positive at 0.1631 to 0.60 31 respectively impact

on economic growth, while Tax on international trade and transactions(TITT)

variable has negative at -0.005913 and it impacts on economic growth.

This study recommends that the policymakers within

government of Rwanda must improve both direct tax and tax on goods and services

(domestic tax) and increase Taxes on international trade transactions (customs

duties), it will harm economic growth of Rwanda therefore custom duties must be

rationally reduced or abolished and free trade zones like

Africa continental free trade area (AfCFTA) must create to foster increased

exchange of goods and services across borders.

Key Words: Tax Revenue, economic

growth, Gross domestic product, direct tax, tax on goods and services, tax on

international trade and transaction, VECM, Rwanda.

P a g e 3 | 48

CHAPTER-1 INTRODUCTION

1.1. BACKGROUND OF STUDY

Rwanda embraced economic growth, the power of any country in

economic growth and development is mainly depends on level of amount of tax

revenue generated to make economy more advanced.

Bruce et al (2006) point out that generating sufficient

revenue to finance government service delivery is the most important function

of a tax system. The government has to provide many goods and services to its

citizens such as health, education, and defense of the country, maintenance of

law and order and management of the economy.

Mustafa (2000) observes that as the economy grows, more people

and companies derive higher income and would therefore be liable to pay higher

taxes. Tax elasticity is an indicator of measuring the efficiency and

responsiveness of tax revenue mobilization in response to growth in the tax

base, GDP or national income. A tax is said to be elastic if tax revenues

increases more than proportionately in response to a rise in the tax base. If

the tax revenue shows less responsiveness to tax base, that type of tax base

fails to generate enough revenue for the government in the long run.

In line with its mandate of assessing, collecting, and

accounting for tax, customs and other specified non tax revenues, assisting

taxpayers in understanding and meeting their tax obligations thus raising their

compliance, Rwanda Revenue Authority also analyses long-term tax elasticity of

tax in relation to changes in GDP in order to highlight tax gaps within a

sector .

It is also in this framework that profitability benchmarking

based on business activities has to be done in order to identify areas of

irregularities in tax compliance hence taking actions for tax collection

optimization.

According to Azubike (2009), tax is a major player in every

society of the world.Taxation is most way to reduce foreign aid by mobilizing

internal government resource which lead to favorable conductive environment

which lead to economic growth promotion.

P a g e 4 | 48

Nzotta (2007) argues that taxes constitute key sources of

revenue to the federation account shared by the federal, state and local

governments.

That is why taxation system in Rwanda is divided into

decentralized tax and fiscal tax and others administrative fees from Rwanda

online known as Irembo.

Oxford Dictionary of Accounting (1995) defined taxation as a

levy on an individual or corporate body by the central or local government to

finance the expenditure of that government and also as a means of implementing

its fiscal policy.

Abomaye-Nimenibo(2017) is of the view that tax is a compulsory

contributions made by animate and inanimate beings to government being a higher

authority either directly or indirectly to fund its various activities and any

refusal is meted with appropriate punishment. He went on to say that Tax is an

involuntary payment made by a resident of a state in obeisance to levy imposed

by a constituted authority of a sovereign state at a particular period of time;

and that Taxation is the process put in place by government (which ever tier)

to exercise authority on and over the imposition and collection of taxes based

on enacted tax laws with which projects are financed. Taxation is therefore

seen as the transfer of resources as income from the private sector to the

public sector for its utilization to achieve some if not all the nation's

economic and social goals such as provision of basic amenities, social

services, educational facilities, public health, transportation, capital

formation etc.

However ,one of main function of government is to

infrastructure service development generation such as roads, schools, hospitals

,defense, pipe-borne water,... as well as ensure the rise of per capita income

and to achieve other macroeconomic factors such low unemployment, inflation,

Balanced of problem balance ,Economic growth, to reduce income inequality,..

For above service and argument to be efficient at optimum

level, government need sufficient resource to finance them. The task of

financing government expenditure and allocating national resource is main

responsibilities and challenges due to limited government resources .therefore

individuals, companies and government body must provide tax based on Rwanda

taxation law. Government always think how to modernized tax revenue by

reforming law . These law aim to ensure to promote tax compliance and to

discourage tax evasion and tax

P a g e 5 | 48

avoidance. The purpose of this study is to show the impact of

aid on economic development of Rwanda

1.1. THE PROBLEM STATEMENT

Rwanda and others countries globally especially in Africa are

nowadays facing series of challenges when it comes to optimizing tax revenue

and tax to GDP ratio for economic growth and development .While aiming to reach

sustainable development objectives. The most obvious difficult challenge is how

to find the optimal balance between a tax regime that is employees, business

and investment friendly while at the same time leveraging enough revenue for

public service delivery which in turn makes the economy more attractive to

financiers.

In addition, tax compliance in Rwanda is doubtable as many

prefer not to pay tax. As a result of the unwillingness to pay tax as well as

evading tax, the economy therefore continues to lose huge amount of revenue. If

this lost tax revenue came back into the economy and well utilized, can change

the wealth of the nation. In developing countries like Rwanda, this problem has

been persistent for so long which requires serious attention and solution.

Therefore, assessing the impact of tax revenue on development

in Rwanda from during 10years from 2007 to 2017 is a research work carried out

at the right time as there is an urgent need to examine more deeply and to look

into the relationship between direct tax , tax on goods and services and tax on

international trade and transaction on economic growth and development of

Rwanda in Rwanda. This study will not only guarantee improved revenue base for

the Rwanda but also take full advantage to African Tax Administration Forum

members and global economies. Therefore, this research work examines the impact

of tax revenue on economic growth in Rwanda by analyzing the tax gap in the

system over the years and so revealing the critical challenges that needs to be

outgrowth. Hence, the need for further study of the tax performance and its

influence on the economic development of Rwanda.

1.2. OBJECTIVE OF STUDY

The general objective of this study is to find out how extend

tax revenue impacts on economic growth in Rwanda from 2007 to 2017. The

specific objectives of the study are to:

i.

P a g e 6 | 48

To analyze the relationship between direct tax and economic

growth in Rwanda;

ii. To examine the relationship between tax on goods and

services and economic growth in Rwanda; and

iii. To find out the relationship between tax on international

trade and transaction and economic growth in Rwanda

1.4. RESEARCH QUESTIONS

The research question of this study is concern about what is

impact of tax revenue on economic growth in Rwanda from 2007 to 2017?

1.5. HYPOTHESIS

This research work is guided to know if tax revenue components

impact positively or negatively by developing null and alternative hypotheses

below: i. H0 : There is no positive

significant relationship between direct tax and economic growth in Rwanda

H1: There is positive

significant relationship between direct tax and economic growth in Rwanda

ii.H0: There is no positive

significant relationship between tax on goods and services and economic growth

in Rwanda

H1:. There is positive significant

relationship between tax on goods and services and economic growth in

Rwanda.

iii..H0: There is no

positive significant relationship between tax on international trade and

transaction and economic growth in Rwanda.

H1: There is positive

significant relationship between relationship between tax on international

trade and transaction and economic growth in Rwanda.

1.6 SCOPE OF THE STUDY:

The scope of this study covers critical examinations on the

impact of taxation on economic development. In order to analyze the

relationship between tax revenues and Gross Domestic

P a g e 7 | 48

Product, Quarterly data for the period of 2007Q1 to 2017Q4

were used for these two variables from RRA and NISR.

1.7 SIGNIFICANCE OF THE STUDY:

One of the most frequently discussed issues in Rwanda is how

to solve the economic hardship in the country and how Tax revenue induces

economic development. Also many elite people around the world wonder reason why

a country which is landlocked as Rwanda it's economy is green and it is not

heavily indebted country.

The study afforded us the opportunity to know the impact of

tax revenue in economic growth of Rwandan economy in 10 years

1.9 DEFINITION OF KEY CONCEPTS

CIT: it is an assessment levied by government on

profit of the company.

Development economics is a branch of

economics which deals with economic aspects of the development process in low

income countries.

Direct tax is set of Pay As You Earn (PAYE),

Taxes on Corporations & Enterprises and Tax on property (Property tax on

Vehicles)

Economic development is the process by which

the well-being of a nation improves because of progress in technology, progress

in science and also because of general economic growth and innovation for

country including Rwanda; it is the process by which a nation improves the

economic, political, and social well-being of its people.

Excise tax is a tax that is measured by the

amount of business done (not on property or income from real estate) excise.

Indirect tax, it is a tax levied on goods or services rather than on persons or

organizations. nuisance tax, sales tax.

Gross domestic Product (GDP) is a monetary

measure of the market value of all the final goods and services produced in a

period (quarterly or yearly) of time

P a g e 8 | 48

Income per capita is a measure of the amount of

money earned per person in a certain area.

Macro environment includes trends in gross

domestic product (GDP), inflation, employment, spending, and monetary and

fiscal policy.

MINECOFIN is Ministry of

finance and economic planning; it was formed in March 1997 from the joining of

the Ministry of Finance and the Ministry of Planning. This was done in order to

improve the co-ordination between the functions of finance and planning. In the

ministerial re-structuring of February 1999, the Ministry took on the function

of development cooperation from the Ministry of Foreign Affair.

Monetary policy is the macroeconomic policy

laid down by the central bank like national bank of Rwanda. It involves

management of money supply and interest rate and is the demand side economic

policy used by the government of a country to achieve macroeconomic objectives

like inflation, consumption, growth and liquidity.

National Bank of Rwanda, established by the

Law of 24th April 1964, came into force from 19th May 1964 with the aim of

fulfilling one of its main missions, namely the issuing of currency on the

Rwandan territory. Vision of national bank of Rwanda is to become a World-Class

Central Bank

Nontax means it is government revenue not

generated from tax such fine, fees, licenses, government rent, concession,

royalties,...

PAYE: A pay-as-you-earn tax or pay-as-you-go

is a withholding tax on income payments to employees.

PIT: It is tax imposed on individuals or

entities (taxpayers) that varies with perspective in come or profit

Profit Tax is composed by corporate income tax

(CIT) and personal income tax(PIT)

RRA is Rwanda Revenue Authority. It is

government body under Ministry of finance and economic planning (MINECOFIN)

which is responsible for Tax revenue matters.

P a g e 9 | 48

Socioeconomic status (SES) is an economic and

sociological combined total measure of a person's work experience and of an

individual's or family's economic and social position in relation to others,

based on income, education, and occupation.

Tax Avoidance: This can be describe as the

arrangement of tax payers' affairs using the tax shelters in the tax law, and

avoiding tax traps in the tax laws, so as to pay less tax than he or she would

otherwise pay. That is, a person pays less tax than he ought to pay by taking

advantage of loopholes in a tax levy (Samuel and Tyokoso, 2014).

Tax Base:Total of taxable assets, income, and

assessed value of property within the tax jurisdiction of a government. To

assess tax base we normally look at GDP, Population and taxpayer.

Tax Evasion: Tax evasion is a deliberate and

willful practice of not disclosing full taxable income so as to pay less tax.

In other words, it is a contravention of tax laws whereby ataxable person

neglects to pay the tax due or reduces tax liability by making fraudulent or

untrue claims on the income tax form, (Samuel and Tyokoso, 2014).

Tax Incidence: It offers to the effect of and

where the burden is finally rested.

Tax Rate The percentage rate at which tax is

charged. It can be Consumption Tax is a tax on the money people spend, not the

money people earn, Progressive Tax is a tax that is higher for taxpayers with

more money, A regressive tax is one that is not progressive, Proportional Tax

is the same as a flat tax.

Tax: A compulsory levy by the government on

its citizen for the provision of public goods and services.

Taxes on goods and services is the set of

Value Added Tax (VAT), Excise Duty, Road Fund, Mining Royalties, Strategic

reserves levy)

Taxes on international trade and transactions

is the set Import Duty, Other Customs Revenues, Infrastructure

development levy and others regular tax

P a g e 10 | 48

Tax-to- GDP ratio is an economic measurement

that compares the amount of taxes collected by a government to the amount of

income that country receives for its products (GDP).

The African Tax Administration Forum (ATAF)

is a platform promoting cooperation, knowledge sharing and capacity building

among African tax administrations. This is achieved, among other approaches,

through conducting and making available applied tax research that can be used

fruitfully by African tax administrations, policy makers, researchers and other

stakeholders.

The Fiscal Policy is the decisions taken by

the government with respect to its revenue collection (through taxation),

expenditure and other financial operations to accomplish certain national

goals.

VAT: Value Added Tax is a multistage tax

levied and collected on transactions at all

stages of sales and distribution.

Withholding Tax: This is tax charged on

investment income namely: rents, interest,

royalties and dividends, presently it is charged as the tax

offset

P a g e 11 | 48

1.10. ORGANIZATION OF THE STUDY

This study was divided into five chapters: Chapter one is

general introduction and it is composed by the background of the study,

Statement of the problem, Research hypothesis, Objectives of the study,

Rationale of the study, and the Scope of the study, crucial definition of

taxation and finally organization of this study.

Chapter two presents the literature in relation to the topic

under study, this chapter deals with the historical background of taxation in

general and Rwanda context, Conceptual framework, Theoretical framework and

studies related to this study.

Chapter three briefly highlights the various research methods,

simply this chapter indicates Data Collection, Sources of Data, Data Collection

Procedure, Data Processing and Data analysis. Chapter four presents data

analysis and interpretation of the results. It shows the index of data analysis

in a scientific way using software and various tools such as tables, graphs,

charts, etc.

Chapter five revealed summary of findings, conclusion and

recommendations. In this study, researcher will combine, both qualitative and

quantitative, so as to gain an insightful analysis of the relevant facts and

figures in explaining impact of tax revenue on economic growth in Rwanda.

P a g e 12 | 48

CHAPTER- 2 LITERATURE REVIEW 2.1 INTRODUCTION

The study observes the ideas or views of various authors who

took keen interest in the subject matter. Basically, the review was done on the

following sub-headings of historical background, conceptual framework,

theoretical framework, related case studies and summary of the literature

reviewed.

2.2 HISTORICAL BACKGROUND OF TAXATION IN GENERAL AND

RWANDA

CONTEXT

Taxation is said to have come into existence «from time

immemorial» without a specific mention of when exactly it evolved.

However, the origin of tax levies can be traced to the ancient cities of Greek

and Rome in modern literature; but from the Bible account, it has been as old

as the world. In these so called cities of Greek and Rome, taxes were levied on

consumption, saving, investment and properties (Abomaye-Nimenibo, 2017). From

the account of St. Mark's gospel (chapter 12:14-16), a disciple of Jesus Christ

precisely St. Peter was reported in the Holy Bible was confronted by the tax

authorities and he met Jesus Christ who commanded him to get money with which

Peter paid for himselve and the Lord Jesus Christ. St. Mathewgospel chapter

17:24-27 of the Holy Bible, stated that our Lord Jesus Christ Himself paid tax.

Furthermore, in Matthew 19:21 we see tax money having its functions to perform

in the society which enables government authorities to use in providing social

services that will be enjoyed by all the citizens of a country. Such social

services include the provision of health and education, maintenance of law and

order, provision of basic amenities and infrastructures etc. Tax payment is

therefore part of the price to be paid by sound members of an organized and

orderly society

In Rwanda, The history of taxation in Rwanda indicates that

the first tax legislation was inherited from colonial regimes. This tax

legislation included the Ordinance of August 1912, which established graduated

tax and tax on real property. There was another Ordinance on 15thNovember 1925

adopting and putting into application the order issued in Belgian Congo on

1stJune 1925, establishing a profits tax. This law was amended by law of 2nd

June 1964 establishing Direct tax on profit. A substantive law governing

customs was ratified on 17th July 1968 accompanying the Ministerial Order of

27th July 1968, putting into application the

P a g e 13 | 48

Customs Law. This law was amended from time to time in order

to comply with the changing economic environment. Such other legislative

instruments include the 1973 law governing property tax, the tax on license to

carry out trade and professional activities, the Law No. 29/91 of 28th June

1991 on sales tax (turnover tax) now repealed and replaced by the Law No.

06//2001 of 20/01/2001 on the Code of Value Added Tax (VAT). In 2005, the

parliament adopted law number No25/2005 of 04/12/2005 on tax procedures,

amending Decree-Law of December 28, 1973 relating to Personal Tax, Law No

06/2001 of January 20, 2001 on the Code of Value Added Tax and Law No 9/97 of

June 26, 1997 on the Code of Fiscal Procedures. Similarly, Law No 16/2005 OF

18/08/2005 2005 on direct taxes on income was adopted replacing Law No 8/97 of

26/6/1997 on Code of Direct Taxes on Different Profits and Professional Income,

and Law No 14/98 of December 18, 1998 establishing the Rwanda Investment

Promotion Agency, especially in its Articles 30, 31 and 34.

The parliament also adopted Law No. 21 of 18/04/2006

establishing the customs law, replacing the Law of July 17th 1968 concerning

the Customs law as amended and completed to date. However, on July 1, 2009,

Rwanda adopted the EAC Customs Management Act 2004, An Act of the Community to

make provisions for the management and administration of Customs and for

related matters

P a g e 14 | 48

2.3. CONCEPTUAL FRAMEWORK

The diagram below represents the independent and dependent

variables. Since there are many variables, the researcher shall concentrate on

three most important variables such as Independent variable, Dependent

variable, and Intervening variables. This conceptual framework interlinks those

three types of variables following their interdependence. It is clear that

direct tax, Tax on goods and services and international trade and transaction

as independent variable impact on the economic growth as a dependent

variable.

|

Independent variables

|

|

Dependent variables

|

|

|

|

|

|

|

|

-Direct tax ( DT)

-Tax on goods and services (TGS)

-Tax on international trade and transactions(TITT)

|

|

|

|

|

Economic growth(GDP)

|

Intervening variables

Fiscal Policy

Diagram1: Conceptual framework

Source: Researcher

P a g e 15 | 48

2.4. Theoretical framework

2.4.1Introduction on theoretical framework

This study review three theories of taxation: the cost of

service theory, the benefit theory and the socio - political theories of

taxation. According to the cost of service theory, the cost incurred by

government in providing certain services to the people must collectively be met

by the people who are the ultimate receivers of the service (Jhingan, 2009).

This theory believes that tax is similar to price. So if a person does not

utilize the service of a state, he should not be charged any tax. Some

criticisms have been leveled against this theory. According to Jhingan (2009),

the cost of service theory imposes some restrictions on government services.

The objective of government is to provide welfare to the poor. If the theory is

applied, the state will not undertake welfare activities like medical care,

education, social amenities, etc. furthermore, it will be very difficult to

compute the cost per head of the various services provided by the state, again,

the theory has violated the correct definition and tenets of tax, finally the

basis of taxation as propounded by the theory is misleading.

The limitations inherent in the cost of service theory led to

the modernization of the theory. This modification gave birth to the benefit

received theory of taxation. According to this theory, citizens should be asked

to pay taxes in proportion to the benefits they receive from the services

rendered by the government. The theory assumes that there is exchange

relationship or quid pro quo between tax payers and

government. The government confers some benefits on tax payers by providing

social goods which the tax payers pay a consideration in the form of taxes for

using such goods. The inability to measure the benefits received by an

individual from the services rendered by the government has rendered this

theory inapplicable (Ahuja, 2012).

The socio-political theory of taxation states that social and

political objectives should be the major factors in selecting taxes. The theory

advocated that a tax system should not be designed to serve individuals, but

should be used to cure the ills of society as a whole (Bhartia, 2009). This

study is therefore anchored on this theory.

P a g e 16 | 48

According to Bhartia (2009), a tax revenue theory may be

derived on the assumption that there need not be any relationship between tax

paid and benefits received from state activities. We shall accordingly

lookatsome of such theories as discussed below.

2.4.2. Socio-Political Theory

This theory of tax revenue states that social and political

objectives should be the major factors in selecting taxes. The theory advocated

that a tax system should not be designed to serve individuals, but should be

used to cure the ills of society as a whole.

2.4.3. Benefit Received Theory

This theory is based on the assumption that there is basically

an exchange relationship between tax-payers and the state because the state

provides certain goods and services to the members of the society, therefore,

members of the society should contribute to the cost of these supplies in

proportion to the benefits received (Bhartia, 2009). Anyanfo (1996),supports

this postulation by saying that taxes should be allocated on the basis of

benefits received from government expenditure.

2.4.4 Faculty Theory

According to Anyanfo (1996), this theory states that one

should be taxed according to the ability to pay. It is simply an attempt to

maximize an explicit value judgment about the

P a g e 17 | 48

distributive effects of taxes. Bhartia (2009), shares this

same view by arguing that a citizen is to pay tax just because he can, and his

relative share in the total tax burden is to be determined by his relative

paying capacity.

2.4.5 Expediency Theory

This theory asserts that every tax proposal must pass the test

of practicality. It must be the only consideration weighted by the authorities

in choosing a tax proposal. Economic and social objectives of the state and the

effects of a tax system should be treated as irrelevant (Bhartia,2009). Anyafo

(1996) and Bhartia (2009) explained that the expediency theory is based on a

link between tax liability and state activities. It assumes that the state

should charge the members of the society for the services provided by it. This

reasoning justifies imposition of taxes for financing state activities by

inferences, which provides a basis, for apportioning the tax burden between

members of the society. This proposition has a reality embedded in it, since it

is useless to have a tax which cannot be levied and collected efficiently.

Pressures from economic, social and political groups abounds

in every economy. Every single group tries to protect and promote its own

interests and by extension, authorities are often forced to reshape tax

structure to accommodate these pressures. In totality, the administrative set

up may not be efficient enough to collect taxes at a reasonable cost of

collection. Tax revenue therefore, provides a powerful set of policy tools to

the authorities and should be effectively used for remedying economic and

social ills of the society such as income inequalities, regional disparities,

unemployment, and cyclical fluctuations and so on.

Adolph Wagner advocated that social and political objectives

should be the deciding factors in choosing taxes. Wagner did not believe in

individualist approach to a problem. He stated that each economic problem be

looked at in its social and political context and an appropriate solution found

thereof. Accordingly, a tax system should not be designed to serve individual

members of the society, but should be used to cure the ills of society as a

whole. This theory relates to a normal development process and represents a

benchmark against which,a country's specific empirical evidence may be

compared.

P a g e 18 | 48

This study therefore focuses on the expediency theory which

enables us to assess the extent to which the Rwanda tax system conforms to this

scenario where the link between tax liability and economic activities are

linked. Where applicable, such a characterization will enhance accurate tax

revenue projection and targeting of specific tax revenue sources given an

ascertained profile of economic development. It will also assist in estimating

a sustainable revenue profile thereby facilitating effective management of a

country`s fiscal policy, among others. This is because the expediency theory

focuses on the fact that taxes are collected to achieve economic objectives

which enhances the growth and development of a society in all its spheres. The

socio-political, benefit and faculty theory are relevant also but they lay more

emphasis on political relationship and ability to be objectives.

2.4.6 Concept of Economic Growth

Beardshaw et al (2001) define economic growth as an increase

in the overall output of an economy over a given period of time; the overall

output of an economy is also called national product. Growth of an economy in a

given year is measured by the change in national output as a percentage of the

national output achieved in the previous year.

The Keynesian four sector expenditure approach model of

determination of national income explains how the equilibrium level of national

income is determined by adding up all expenditures made on goods and services

during a year. Income can be spent either on consumer goods or capital goods.

Again, expenditure can be made by private individuals and households or by

government and business enterprises. Further, people of foreign countries spend

on the goods and services from other countries. These various expenditures are

added up to obtain national income (as shown in Equation 3.1 below).

GDPMP = C + I + G + (X - M) (3.1)

Where

GDPMP = Gross Domestic Product (at Market Prices)

P a g e 19 | 48

C = Final private consumption expenditure (expenditure on

consumer goods and services by individuals and households).

I = Gross domestic capital formation or gross domestic

investment (expenditure by productive enterprises on capital goods and

inventories or stocks). This is divided into two parts: Gross fixed capital

formation and addition to the stocks or inventories of goods.

G = Government final consumption expenditure (government's

expenditure on goods and services to satisfy collective wants).

X = Export expenditure (expenditure made by foreigners on goods

and services of a country)

M = Import expenditure (expenditure by people, enterprises and

government of a country on goods and services produced in other countries)

The simple Keynesian model of income determination treats

government final consumption, gross domestic capital formation (investments)

and exports as autonomous expenditures. Private final consumption expenditure

and import expenditures on the other hand have a constant exogenous component

and that level of expenditure that depends on income (as shown in equations 3.2

and 3.3 below):

C = a +bY .. (3.2)

Where C is private final consumption expenditure;

a is autonomous consumption; and b is marginal propensity to

consume.

M = ??+mY (3.3)

Where ?? is autonomous imports and m is

marginal propensity to import. The equilibrium level of income in a three

sector model is thus given by:

Y =a +b(Y -T)+I

+G (3.4)

Where T is the lump-sum income tax.

Y -bY = a +bT +I

+G

1

Y = 1-b (a +bT +I

+G) (3.5)

Page 20 | 48

Differentiating equation 3.5 with respect to lump-sum tax T will

give us the effect of a change in T on income Y

S'

ST =

A [( 1

(a +bT +I +G ] AT 1-b

Equation 3.7 shows that tax multiplier, is negative meaning an

increase in lump-sum tax by

A

'will reduce equilibrium income by a

multiple.

A??

Incorporating proportional income tax (tax levied as a fixed

percentage or proportion irrespective of the level of income) into the three

sector Keynesian model of income determination, then proportional income tax

would mathematically be expressed as tY where tis the rate of proportion of

income which is payable as a tax. In a real economy, proportional income tax

may be imposed along with any lump-sum tax. Thus, the total tax

A'can be expressed as

A??

T= tY (3.7)

Where t= rate or proportion of income tax and Y = income.

Equilibrium income, Y = a +b(T-Ty) +I

+G (3.8)

Y -by+bYt= a +I +G

1

Y= (a +I +G)

1-b-bt)

Y= 1 (a +I +G)

(3.9)

1-b(1-t)

Equation 3.10 shows that proportional income tax has a negative

multiplier effect on income.

Exports less imports (X - M) estimates net exports of a

country in a four sector model of income determination. The exports and imports

of a country depend to a great extent on the level of economic activity (that

is, the level of output and income of a country) in such a way that, as a

country's industrial output grows, it will generate greater demand for imported

materials and also cause the country's exports to rise provided there is

adequate demand for the output in foreign markets.

Page 21 | 48

The equilibrium level of output in a four sector economy is thus

given as:

Y =a +b(Y

-T)+I +G+[X -(M +mY)] (3.10)

Where T is constant lump-sum tax.

a +bY -Tb+I +G+X

-M -mY (3.11)

Y-by+My= a +bY -Tb+I +G+X

-M (3.12)

Y=

1-b+m

) (3.13)

1 (a +bY

-Tb+I +G+X -M

|

??

where the term

1-b+m

|

is known as the foreign trade multiplier whose value is

determined by

|

marginal propensity to consume (b) and marginal propensity to

import (m). Note that change in any autonomous factor of the model such as a,

I, G, X andM will cause a change in national

income by the amount of the foreign trade multiplier

[1

1-b+M] times the change in the

amount

of the factor. Thus, if exports increase by VY =

1-b ** VY.

+m

Incorporating proportional income tax in the four sector model

of income determination, then only the term of foreign trade multiplier will

change, the other terms of the model remaining the same. Thus, if income tax is

of form where is constant lump-sum tax, is the proportion of income that is

taken as tax. With the incorporation of proportional income tax, the value of

trade multiplier becomes: T= T +Ty where T is

constant lump-sum tax, t is the proportion of income that is

taken as tax. With the incorporation of proportional income tax, the value

of

trade multiplier becomes: ??

1-b(1-t)+m 1=

-b+tb+m (3.14)

1

Where t is the proportional income tax rate. With this

proportional income tax, the equilibrium income equation can be written as

1

Y=

1-b(1-0+m (a +bY

-Tb+I +G+X -M)

(3.15)

6y

67 =

-b

. (3.16)

??-??+????+??

Equations 3.16 and 3.17 shows that proportional income tax and

constant lump-sum tax have a negative multiplier effect on income.

2.4.7. ECONOMIC DEVELOPMENT

Rwanda embrace economic development since our nation is

experienced dramatic improvement in the sector of the economic, political, and

social well-being of its people. Economic development can also be referred to

the quantitative and qualitative changes in the economy

P a g e 22 | 48

Dafionone (2013), noted, «that for the country to lay

claim on growth and development through taxation, there must be an improvement

of the quality of life of the citizens, as measured by the appropriate indices

in economic social, political and environmental term.

2.5 RELATED CASE STUDY

In an attempt to evaluate tax revenue and economic development

of Rwanda, we are prone to utilizing regression analysis for the period of 2007

- 2017. It will therefore be worthwhile to look at the empirical literature.

Engen and Skinner (1996),also carried out a study of taxation

and economic growth of U.S. economy, using large sample of countries and

evidences from micro level studies of labour supply, investment demand, and

productivity growth. Their findings revealed modest effects on the order of 0.2

to 0.3 percentage and pointed differences in growth rates in response to a

major reform. They stated that such small effects can have a large cumulative

impact on living standards.

Brian (2007), analyzed the effects of tax revenue on economic

growth in Uganda`s experience for the period 1987 to 2005. From the study, tax

revenue was found to have had an impact on the economic growth level of the

country, with direct taxes having a positive effect while indirect taxes had a

negative impact. However, he stated that due to time, financial and data

constraints, not all essential issues could be analyzed. The issue arising from

this work is the fact that indirect taxes are not easily evaded when it comes

to payment because they are paid either at the time of consumption of the very

good or service and at source and so one expects that they should have a

positive impact on a country's' economic growth not negative as reported.

Babalola and Aminu (2011), also investigated the impact of

taxation on economic growth in Nigeria over the period 1977- 2009. They

examined the Unit roots of the series using the Augmented Dickey - Fuller

technique after which the co-integration test was conducted using the Engle -

Granger Approach. Error correction models were estimated to take care of

short-run dynamics. The overall results indicated that productive expenditure

did positively impacted on economic growth during the period of coverage and a

long-run relationship exists between them as confirmed by the co-integration

test.

P a g e 23 | 48

Ikem (2011), investigated the interaction between tax

structure and economic growth in Nigeria during the period 1961-2011. He made

his analysis using two different econometric models: the neoclassical growth

framework and Granger causality test in examining the level of impact and

direction of causality respectively. The growth model was decomposed during the

analysis into long run static equation and short run dynamic error correction

model. The results revealed that income and CIT is statistically significant in

promoting economic growth in Nigeria.

The impact of tax revenue on economic growth has been examined

severally by different researchers. The empirical studies of Anyanwu (1997),

Engen and Skinner, (1996), Tosun and Abizadeh, (2005) and Arnold (2011), were

used as the basis for different explanations of taxes on economic.

According to Karran (1985) the tax revenue raised by the

government depends to a large extent on the state of the economy; therefore the

relationship between tax revenue and economic growth is an issue of great

importance. Economic growth entails an increase in gross domestic product

overtime and is mainly linked to tax revenue through its effect on tax base. If

tax revenues are not sufficient to meet expenditure needs, the government must

resort to borrowing, printing money, selling assets, or slowing down the

implementation of development programs. All these actions generally damage the

economy, especially the poorest segment of the society.

Mansfied (1972) observes that high tax elasticity is a

desirable characteristic of a tax system since it allows growth in expenditure

to be financed by raising tax revenue without the need for politically

difficult decisions to raise the taxes.

Karran (1985) identifies three models of tax revenue change:

(i) Macroeconomic determination model, (ii) consumer preference model and (iii)

policy initiative model. Macroeconomic determination model holds that changes

in tax revenues are brought about by economic growth and inflation. Economic

growth may lead to increase in tax revenue by increasing the real value of the

tax base. Economic growth can also change purchasing patterns, thus altering

the revenues raised by particular taxes. Inflation has a direct effect on the

revenue yield of taxes.

If a tax base is measured in money terms and levied on a

percentage basis it is buoyant with respect to inflation; the increase in the

money value of the base increases the revenue yield.

According to Heinemann (2001) tax revenue may be linked to

changes in national income through fiscal drag. Fiscal drag describes the

phenomenon whereby inflation and economic growth push more tax payers into

higher tax brackets. This has the effect of raising tax revenue without

explicitly raising tax rates, or changing tax bases.

2.6 Relationship between Economic Growth and Tax

Revenue evolution from 2007 to 2017

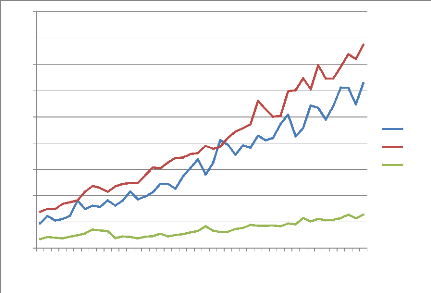

2007Q1 2007Q3 2008Q1 2008Q3 2009Q1 2009Q3 2010Q1 2010Q3 2011Q1

2011Q3 2012Q1 2012Q3 2013Q1 2013Q3 2014Q1 2014Q3 2015Q1 2015Q3 2016Q1 2016Q3

2017Q1 2017Q3

|

2,500 2,000 1,500 1,000

500

-

|

|

|

|

|

Nominal GDP Total tax revenues

|

Source: Authors' computation based on RRA and

NISR data

P a g e 24 | 48

P a g e 25 | 48

During the past decade spanning from 2007Q1 to 2017Q4, Nominal

GDP was 484billion to 1985billion from 2007Q1 to 2017Q4 and Total tax revenues

was 54billion to 306 billion from 2007Q1 to 2017Q4.During the 2007Q1 to 2017,

the tax-to-GDP ratio has increased from 11.5 percent to 15.4 percent

respectively.

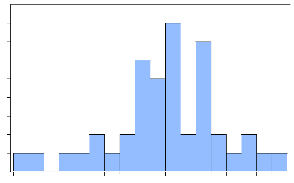

180

160

140

120

100

40

80

60

20

-

2007Q1 2007Q3 2008Q1 2008Q3 2009Q1 2009Q3 2010Q1 2010Q3 2011Q1

2011Q3 2012Q1 2012Q3 2013Q1 2013Q3 2014Q1 2014Q3 2015Q1 2015Q3 2016Q1 2016Q3

2017Q1 2017Q3

DT

TGS

TITT

Source: Authors' computation based on RRA

data

Looking at different components of each tax revenue, the figure 2

above shows that the taxes on goods and services from is the biggest

contributor with 28 billion to 166 billion from 2007Q1 to 2017Q4, direct taxes

is second with 19 billion to 126 billion from 2007Q1 to 2017Q4 and lastly tax

on international trade and transaction with 7 billion to 26 billion from 2007Q1

to 2017Q4

P a g e 26 | 48

CHAPTER 3: RESEARCH METHODOLOGY

3.1. Introduction

This chapter describes the methodology was done on the

following sub-headings of introduction, research design, theoretical framework,

Related case studies and summary, data collection techniques and tools, data

processing, methods of data analysis, limitation, ethical consideration and

model specification

3.2. RESEARCH DESIGN

A research design is a master plan specifying the methods and

procedures for collecting and analyzing the required information. Research

design is the plans and the procedures for research that span the decisions

from broad assumptions to detailed methods of data collection and analysis. The

overall decision involves which design should be used to study a topic.

Informing this decision should be the worldview assumptions the researcher

brings to the study; procedures of inquiry (called strategies); and specific

methods of data collection, analysis, and interpretation.

The selection of a research design is also based on the nature

of the research problem or issue being addressed, the researchers' personal

experiences, and the audiences for the study. ( Creswell,2008,P .3) According

to Grinner and Williams (1990,P.279), research design is the entire process of

the study, the problem formulation through dissemination of findings. It

sometimes used to refer to graphic presentation of the independent variables.

According to Churchill (1992:39), «a study design is simply the frame work

or plan for the study used as a guide in collecting and analyzing data».

The research design related to this study was based on the techniques set at

each objective to have all the objectives achieved.

3.2.2. DATA COLLECTION TECHNIQUES AND TOOLS

Data collection was done through the secondary Data. Rwanda

Revenue Authority(RRA) provides independent variable data as tax revenue and

National institute of statistics of Rwanda(NISR) provides nominal Gross

Domestic product spanning from 2007Q1 to 2017Q4.

P a g e 27 | 48

3.2.3. DATA PROCESSING

This thesis investigates the impact of tax revenue on economic

growth in Rwanda between 2007Q1 and 2017Q4. Many of economic and social changes

have been taken place in Rwanda during this period. It is very important to

analyze and evaluate the factors that affected the economic growth over this

period. The data for the study have been collected from Rwanda Revenue

Authority(RRA) and National institute of statistics of Rwanda( NISR). To find

out the impact of tax revenue on the GDP and to test the study hypotheses,

regression model were used to test the relation between the dependent and

independent variables. Therefore, multiple regression model were developed to

achieve the above objectives. In our model, GDP is the in dependent variable

while direct tax, tax on good and service and tax on international trade and

transaction are the independent variables. In this study we can analyze the

impact of tax revenue on the economic growth in Rwanda. The study covers Rwanda

Revenue Authority(RRA) and National institute of statistics of Rwanda(NISR)

quarterly data spanning from 2007Q1 to 2017Q4.

In this empirical study, data have been processed and

information related to the hypothesis and objectives of the study was taken

into account and transformed into meaningful data for easy interpretation and

understanding. This has been carried out by the use of e-Views package 8.

3.2.4. DATA ANALYSIS

3.4 TECHNIQUES OF DATA ANALYSIS

In analyzing the data gathered regressions model was employed

to establish the relationship between dependent and independent variables. The

study made use of economic approach in estimating the relationship between tax

revenue and economic growth. Vector error correction model (VECM) was employed

in obtaining the numerical estimates of the co-efficient in different equation.

The ordinary least square method was chosen because it possesses some optimal

properties. Its computational procedure is fairly simple

Page 28 | 48

3.8 LIMITATION

Like any other research, this research was encountered by the

difficulties such as; Inadequate funds to carry out the project, Personal

extremely effort to meet deadline.

3.9 ETHICAL CONSIDERATION

For those who interest to read Bible,Matthew 19:21 we see tax

money having its functions to perform in the society which enables government

authorities to use in providing social services that will be enjoyed by all the

citizens of a country. Therefore, we must have attitude and ethics to pay to

tax on time in order to build our nation.

3.10 MODEL SPECIFICATIONS

The method employed in this study, involves discussion of data

collection analysis techniques. We adopted a quasi-experimental research which

is purely analytical. In this study we used quarterly data covering the period

from 2007 to 2017, from the Rwanda Revenue Authority (RRA) statistical bulletin

and annual reports and National institute of statistics of Rwanda(NISR). The

economic growth variable is nominal GDP at current basic prices. The study uses

three independent variables: direct tax including tax on property, taxes on

goods and services, taxes on international trade and transactions including

others tax.

Authors such as Osoro (1993), Kusi (1998), Muriithi &Moyi

(2003) and Bilquess (2004) used the following models to estimate buoyancy and

elasticity:

Tt= aYt f3 e e t

(1)

The logarithm transformation of the equation (1) give

LnTtt = Lna+ f3LnYt + Et

(2)

Or Tax t = u0 + f3yt + et (3)

Where

Tax t = log (Tt) and Yt = log (Yt) e:

Stochastic disturbance term

P a g e 29 | 48

In this this thesis, I am going to use the following models to

estimate long run tax revenue and

economic development in Rwanda: LnGDP = É(LnDT, LnTGS,

lnTITT,) (4)

The estimable econometric model is shown in equation as

LnGDP = á + f31LnLDT + f32LnLTGS +f33LnLTITT + åt ..

(5) Where

LnGDP = Natural logarithm of Gross Domestic Product

LnDT = Natural logarithm of Direct tax

LnTGS = Natural logarithm of Tax on Goods and Services

LnTITT = Natural logarithm of Taxes on International Trade

Transactions

Dummy Variable for Direct taxes (DM_DT)

Dummy Variable for Taxes on goods and services (DM_TGS)

Dummy Variable for Tax on international trade and transactions

DM_TITT) f31, f32, f33 is regression parameters

åt is : stochastic error

Therefore,In order to capture short run dynamics, we estimate

Vector Error Correction Models (VECM)

3.11 DEFINITION OF VARIABLES AND THEIR EXPECTED

SIGNS

Definition of variables used, their estimation coefficients

and expected signs of each

explanatory variable.

Figure 2.definition of variable and expected

sign

|

Variable

|

Definition

|

Estimation coefficient

|

Expected Sign

|

|

GDPt

|

Gross domestic product can be defined as the

total monetary value of all finished goods and services produced within a

country's borders in a specified time period

|

This is the dependent variable

|

|

|

DTt

|

Direct tax is set of Pay As You Earn (PAYE),

Taxes on Corporations & Enterprises and Tax on property (Property tax on

Vehicles)

.

|

f31

|

Positive

|

|

TGSt

|

Taxes on goods and services is the set of

Value Added Tax (VAT), Excise Duty, Road Fund, Mining Royalties, Strategic

reserves levy)

|

B2

|

Positive

|

|

TITTt

|

Taxes on international trade transactions are indirect taxes

and include custom duties and other taxes on

international trade and transactions. These are

imposed by

the government on trade transactions involving exchange of goods and services

between home country and foreign countries.

|

f33

|

Negative

|

Source: Author's computations

P a g e 30 | 48

P a g e 31 | 48

CHAPTER- 4 DATA ANALYSIS AND INTERPRETATION

4.1 Introduction

In this chapter, the researcher used to apply the econometrics

method in order to verify the research hypotheses of the study, the researcher

has developed different points like: summary statistics, correlation matrix,

specification of the model, expected signs, data processing, model estimation

and diagnostic tests by using the data of Rwandan economy on the period from

2007Q1 up to Q42017Q4.

4.2 SUMMARY STATISTICS

The table below summarized quantitative data using mean, median,

maximum, minimum,

standard deviation, skewness and kurtosis. The results are

displayed in Table 1 below. Table 1: Summary Statistics

|

LGDP

|

LDT

|

LTGS

|

LTITT

|

|

Mean

|

6.975523

|

4.043814

|

4.282138

|

2.590486

|

|

Median

|

7.040119

|

4.142989

|

4.303782

|

2.58242

|

|

Maximum

|

7.593374

|

4.835751

|

5.043064

|

3.243469

|

|

Minimum

|

6.182085

|

2.937524

|

3.322205

|

1.933846

|

|

Std. Dev.

|

0.388659

|

0.546176

|

0.499604

|

0.386691

|

|

Skewness

|

-0.30232

|

-0.32776

|

-0.23712

|

0.024329

|

|

Kurtosis

|

2.099475

|

1.923937

|

1.936236

|

1.779536

|

|

Observations

|

44

|

44

|

44

|

44

|

Source: Eviews 8,2019

The statistics from Table 1 is based on 44 Quarterly

observations from Q12007 to Q42017. Over the study period, natural logarithm of

Nominal GDP which is the dependent variable ranged between a maximum value of

7.593374 and a minimum value of 6.182085, with an average of 6.975523. It

recorded a standard deviation of 0.388659, indicating that the data cluster

scatted away the average. The natural logarithm of DT has a mean of 4.043814,

with sample ranging between 4.835751 and 2.937524. LDT had a higher standard

deviation of 0.546176 in the series. natural logarithm of TGS,

recorded the mean of 4.282138 with standard deviation of 0.499604 and a minimum

and maximum value of 3.322205 and 5.043064 respectively. natural logarithm of

TITT obtained the mean value of 2.590486 and the standard

deviation of 0.386691, a minimum value of 1.933846 and a maximum value of

3.243469.

4.3 CORRELATION MATRIX

Correlation matrix showed the Relationship between FDI dependent

and independent variables

Table 2 Relationship between FDI dependent and

independent variables

|

LGDP

|

LDT

|

LTGS

|

LTITT

|

|

LGDP

|

1

|

0.98334

|

0.99452

|

0.89571

|

|

LDT

|

0.98334

|

1

|

0.97934

|

0.88471

|

|

LTGS

|

0.99452

|

0.97934

|

1

|

0.90128

|

|

LTITT

|

0.89571

|

0.88471

|

0.90128

|

1

|

Source: Eviews 8,2019

Table 2 shows the relationship between the

dependent variable GDP with independent variables DT, TGS and TITT.The

correlation between GDP and DT, TGS and TITT is positive and significant. It is

noted that the highest relationship of 99.45% is exhibited by the correlation

between GDP and TGS. This implies that TGS is the most important variable

correlated with GDP for the period under consideration from Q12007 up to

Q42017. TGS in correlation with GDP is followed by DT and TITT respectively.

That is to mean that there is a relationship between independent variables with

GDP in Rwanda during the period of study. However, these preliminary results

are insufficient for reaching a conclusion, and further tests will be carried

out in the following subtopics.

4.4 UNIT ROOT TEST (TEST FOR STATIONARITY)

Unit Root Test is done to ascertain whether the variables used

in the model are normally distributed (stationary) or non-stationary (i.e. have

a unit root). This is done using the Augmented Dicker-Fuller (ADF) Test as

shown in Table 4.

Table 3: Augmented Dicker-Fuller tests for Unit Root at levels

|

Variable

|

AugmentedD

ickey-Fuller

test

statistic

|

MacKinnon(

1996) one

sided

pvalues

|

1% level

Critical

Value

|

5% level

Critical

Value

|

10%level

CriticalV

alue

|

Stationarity

|

|

LNGDP

|

-2.02191

|

-3.60099

|

-2.935

|

-2.60584

|

0.2767

|

Non-stationary

|

|

LDT

|

-2.75693

|

-3.60559

|

-2.93694

|

-2.60686

|

0.0737

|

Non-stationary

|

|

LTGS

|

-1.74149

|

-3.62102

|

-2.94343

|

-2.61026

|

0.4027

|

Non-stationary

|

|

LTITT

|

-1.27281

|

-3.59246

|

-2.9314

|

-2.60394

|

0.6336

|

Non-stationary

|

P a g e 32 | 48

Source: Author's Computation

All variables have unit roots (i.e. non-stationary) at 5% and 10%

levels of significance (as shown in Table 4) and are therefore are subjected to

1st differencing to meet the condition that there should be no unit

roots at 5 % and 10% levels of significance. .

Table 5: Augmented Dicker-Fuller tests for Unit Root after

1st differencing

|

Variable

|

Augmented Dickey-

Fuller test

statistic

|

MacKinnon

(1996) one

sided pvalues

|

1% level

Critical Value

|

5% level

Critical Value

|

10% level

Critical Value

|

Stationarity

|

|

LNGDP

|

-5.42252

|

0.0001***

|

-3.60099

|

-2.935

|

-2.60584

|

Stationary

|

|

LDT

|

-8.88959

|

0.0000***

|

-3.60559

|

-2.93694

|

-2.60686

|

Stationary

|

|

LTGS

|

-5.42252

|

0.0000***

|

-3.60099

|

-2.935

|

-2.60584

|

Stationary

|

|

LTITT

|

-8.0143

|

0.0000***

|

-3.59662

|

-2.93316

|

-2.60487

|

Stationary

|

|

***p<0.01

|

Source: Author's Computation

After subjecting all the non-stationary variables to

1st differencing, they all become stationary at 5% and 10% levels of

significance (as shown in Table 5). They are therefore integrated of order 1

meaning they are stationary at the 1st difference. The null

hypothesis that the variables

have unit roots at first difference is thus rejected and

conclusion made that the variables have no unit roots at 1st

difference.

4.5 COINTEGRATION TESTS

Cointegration tests facilitate to establish if there is a

long-term relationship between the

variables. Subject to proof of cointegration, that will be an

indication that the variables share a certain type of behavior in terms of

their long-term fluctuations. However before testing for cointegration, the lag

length to incorporate in the model will be selected empirically. This will

ensure that the model avoids spurious rejection or acceptance of estimated

results and to have standard normal error terms that do not suffer from

non-stationary, autocorrelation or heteroscedasticity, the results are reported

in Section 4.4.1.

P a g e 33 | 48

P a g e 34 | 48

4.6 LAG LENGTH SELECTION CRITERIA

The selection of optimal lag length is used in the estimation of

vector autoregressive (VAR)

model. This is important to avoid spurious rejection or

acceptance of estimated results. Table 3: Lag length

criteria

VAR Lag Order Selection Criteria

Endogenous variables: LGDP LDT LTGS

LTITT

Exogenous variables: C

Date: 11/02/19 Time: 13:20

Sample: 2007Q1 2017Q4

Included observations: 41

|

Lag

|

LogL

|

LR

|

FPE

|

AIC

|

SC

|

HQ

|

|

0

|

100.9893

|

NA

|

1.04e-07

|

-4.731184

|

-4.564006

|

-4.670307

|

|

1

|

227.5260

|

222.2108*

|

4.74e-10*

|

-10.12322*

|

-9.287330*

|

-9.818834*

|

|

2

|

241.8056

|

22.29014

|

5.28e-10

|

-10.03930

|

-8.534698

|

-9.491405

|

|

3

|

251.0213

|

12.58728

|

7.82e-10

|

-9.708356

|

-7.535045

|

-8.916956

|

* indicates lag order selected by the criterion

LR: sequential modified LR test statistic (each test at 5%

level)

FPE: Final prediction error

AIC: Akaike information criterion

SC: Schwarz information criterion

HQ: Hannan-Quinn information criterion

Table 5 Lag length criteria revealed that researcher should use a

maximum of 1 lag in order to

permit adjustment in the model and accomplish well behaved

residuals. Table 5 confirms the lag lengths selected by different information

criteria such AIC, SIC, Hannan-Quinn Information Criterion (HQI), FPE and the

Likelihood Ratio Test (LR) selected three lags, therefore the information

criteria approach produced agreeing results to adopt three lags. therefore, the

Johansen Cointegration Test is conducted using one lags for the Vector Auto

Regression.

4.7 JOHANSEN COINTEGRATION MODEL SELECTION

Table 6 shows the results of the Johansen Cointegration test

used to investigate whether there exists long-run relationship among the

cointegrating variables

TABLE 6: Cointegration Rank Test (Trace)

|

Unrestricted Cointegration Rank Test (Trace)

|

|

|

|

Hypothesized Trace 0.05

No. of CE(s) Eigenvalue Statistic Critical Value

|

Prob.**

|

|

None * 0.593373 63.0262

|

47.85613

|

0.001

|

|

At most 1 0.254132 25.2321

|

29.79707

|

0.1533

|

|

At most 2 0.198491 12.91741

|

15.49471

|

0.1179

|

|

At most 3 0.08268 3.624537

|

3.841466

|

0.0569

|

|

Trace test indicates 1 cointegrating eqn(s) at the 0.05 level

|

|

|

|

* denotes rejection of the hypothesis at the 0.05 level

|

|

|

|

**MacKinnon-Haug-Michelis (1999) p-values

|

|

|

Source: Eviews 8,2019

Table 6 revealed that Trace test indicates 1 cointegrating

equation at the 0.05 level of significant

Table 7: Cointegration Rank Test (Maximum

Eigenvalue)

|

Unrestricted Cointegration Rank Test (Maximum

Eigenvalue)

|

|

|

Hypothesized Max-Eigen 0.05

No. of CE(s) Eigenvalue Statistic Critical Value

|

Prob.**

|

|

None * 0.593373 37.79411 27.58434

At most 1 0.254132 12.31469 21.13162

At most 2 0.198491 9.292868 14.2646

|

0.0017

0.5169

0.2626

|

|

At most 3 0.08268 3.624537 3.841466

|

0.0569

|

|

Max-eigenvalue test indicates 1 cointegrating eqn(s) at the 0.05

level * denotes rejection of the hypothesis at the 0.05 level

|

|

Source: Eviews 8,2019

Table 7 revealed that Maximum Eigenvalue test indicates 1

cointegrating equation at the 0.05 level of significant.

Since both tests reveal that the variables under study are

cointegrating. therefore, these results reveal the existence of a long-run

equilibrium relationship between the variables.

4.8 ESTIMATED LONG-RUN MODEL

The estimation of the Long-run model helps in discussing some

classical tests like t-Test and

F-test, discussing about Adjusted R-squared (coefficient of

determination), but also in making a deeper analysis.

P a g e 35 | 48

Table 8: Long run relationship between dependent and

independent variables

|

Variable

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

|

C

|

3.748438

|

0.05855

|

64.02121

|

0.0000

|

|

LDT

|

0.163171

|

0.052121

|

3.130639

|

0.0033

|

|

LTGS

|

0.603103

|

0.061307

|

9.837459

|

0.0000

|

|

LTITT

|

-0.005913

|

0.034365

|

-0.172055

|

0.8643

|

|

R-squared

|

0.991228

|

Mean dependent var

|

6.975523

|

|

Adjusted R- squared

|

0.99057

|

S.D. dependent var

|

0.388659

|

|

S.E. of regression

|

0.037741

|

Akaike info criterion

|

-3.629615

|

|

Sum squared resid

|

0.056976

|

Schwarz criterion

|

-3.467416

|

|

Log

likelihood

|

83.85154

|

Hannan-Quinn criter.

|

-3.569464

|

|

F-statistic

|

1506.693

|

Durbin-Watson stat

|

1.333763

|

|

Prob(F- statistic)

|

0.00000

|

|

|

|

Source: Eviews 8,2019

Table 8 Shows the results of long run

relationship between dependent variable and the independent variables and it is

interpreted as follows:

The DT and TGS are two variables which were statistically

significant to influence GDP in Rwanda during the period of study.

The DT has been significant at 5% level of significance and

possesses expected positive sign in long run model, however the positive

cointegrating coefficient of 0.163171 shows a positive relationship between GDP

and the DT in that a 1% increase in DT would increase GDP to 0.163171 %. The

results confirm the expected sign, and this positive sign may mean that in the

long run, the biggest of host's country market is likely to encourage GDP. DT

is statistically significant in explaining changes in GDP, suggesting that DT

is an important factor in influencing Rwandan GDP.

The effects of TGS on GDP: TGS has a positive effect on GDP

and significant relationship with GDP in Rwanda at 5% level of significance.

the results show that increase in TGS by 1% leads to 0.603103% increase to GDP

in Rwanda.

P a g e 36 | 48

P a g e 37 | 48

TITT has a negative effect on GDP and not significant

relationship with GDP in Rwanda. TITT is statistically insignificant in

explaining changes in GDP during the period of Q12007 to Q42017.

The coefficient of determination: the coefficient of

determination (R2) is 0.99057. This means that 99.06% of variations in the

dependent variable GDP are explained by the independent variables considered in

the model.

The P-value of the F-statistic is 0.000000, which means the

overall model is statistically significant at 5% level of significance.

4.9 VECTOR ERROR CORRECTION MODEL

As the variables were non stationary at their levels

integrated of order I(1),stationary at first difference and cointegrated ,we

analyzed the short run relationship among them by formulating an error

correction model. The logic behind that model is to recover the long run

information lost by differencing variables by introducing an error correction

term gives the proportion of shocks accumulated in the previous period that are

corrected in the current period. The results of VECM are presented in the

following table.

Table 9: Vector Error correction model

Results

Dependent Variable: D(LGDP)

Method: Least Squares

Date: 11/02/19 Time: 14:20

Sample (adjusted): 2007Q3 2017Q4

Included observations: 42 after adjustments

D(LGDP) = C(1)*( LGDP(-1) - 0.798843352892*LDT(-1) +

0.060223872029

1*LTGS(-1) + 0.0334606747663*LTITT(-1) - 4.08820567175 ) +

C(2)

*D(LGDP(-1)) + C(3)*D(LDT(-1)) + C(4)*D(LTGS(-1)) +

C(5)*D(LTITT(

|

-1)) + C(6)

|

|

|

|

|

|

Coefficient

|

Std. Error

|

t-Statistic

|

Prob.

|

C(1)

|

-0.142323

|

0.07576

|

-1.878597

|

0.0684

|

C(2)

|

0.205349

|

0.172688

|

1.189129

|

0.2422

|

C(3)

|

-0.043396

|

0.046513

|

-0.932985

|

0.357

|

C(4)

|

0.026459

|

0.073927

|

0.357907

|

0.7225

|

C(5)

|

|

-0.008059

|

0.030651

|

-0.262929

|

0.7941

|

|

P a g e 38 | 48

C(6)

|

0.026192

|

0.006795 3.854348

|

0.0005

|

|

R-squared

|

0.127675

|

Mean dependent var

|

0.03194

|

|

Adjusted R-squared

|

0.006519

|

S.D. dependent var

|

0.027286

|

|

S.E. of regression

|

0.027197

|

Akaike info criterion

|

-4.239863

|

|

Sum squared resid

|

0.026628

|

Schwarz criterion

|

-3.991624

|

|

Log likelihood

|

95.03712

|

Hannan-Quinn criter.

|

-4.148873

|

|

F-statistic

|

1.053803

|

Durbin-Watson stat

|

1.884039

|

|

Prob(F-statistic)

|

0.401802

|

|

|

Source: Eviews 7,2019

Table 6 shows the findings of VECM and the results confirm

that only the speed of adjustment of the model is 14.2% with error correction

of -0.142323 and it is statistically significant at 10%. This implies that

14.2% of errors realized in the previous Quarter are corrected in the current

one. This means that each quarter 14.2% of disequilibrium errors will be

corrected due to any change from the equilibrium.

4.7 GRANGER CAUSALITY TESTS

Granger Causality tests clarified how the variables affect

(drive) each other. The results are

presented in Table 10 below.

Table 10: Granger Causality Tests

|

Null Hypothesis:

|

Obs F-

|

Prob.

|

CONCLUSION

|

|

LDT does not Granger Cause

|

|

|

|

LDT does not Granger Cause

|

|

LGDP

|

43

|

c

2.74474

|

0.1054

|

LGDP

|

|

LGDP does not Granger Cause

|

|

|

1.00E-

|

LGDP does Granger Cause

|

|

LDT

|

|

25.5152

|

05

|

LDT

|

|

LTGS does not Granger Cause

|

|

|

|

LTGS does not Granger Cause

|

|

LGDP

|

43

|

1.81716

|

0.1852

|

LGDP

|

|

LGDP does not Granger Cause

|

|

|

|

LGDP does Granger Cause

|

|

LTGS

|

|

9.12791

|

0.0044

|

LTGS

|

|

LTITT does not Granger Cause

|

|

|

|

LTITT does not Granger Cause

|

|

LGDP

|

43

|

0.00221

|

0.9627

|

LGDP

|

|

LGDP does not Granger Cause

|

|

|

|

LGDP does Granger Cause

|

|

LTITT

|

|

5.68013

|

0.022

|

LGDP

|

Source: Elaborated by research using eviews

8,2019

P a g e 39 | 48

In this section, the study seeks to establish if there is

evidence of a causal relationship between the variables of interest.

? Since P-value=1.00E-05 or 0.001% is less than 5%, we reject

null hypothesis of LGDP does not Granger Cause LDT in order to accept

alternative hypothesis of LGDP does Granger Cause LDT. therefore, the results

reflect that there is evidence of uni-directional causality from LGDP to

LDT.

? Since P-value=0.0044 or 0.4% is less than 10%, we reject

null hypothesis of LGDP does not Granger Cause LTGS in order to accept

alternative hypothesis of LGDP does Granger Cause LTGS. therefore, the results

reflect that there is evidence of uni-directional causality from LGDP to

LTGS.

? Since P-value=0.022or 2.2% is less than 10%, we reject null

hypothesis of LGDP does not Granger Cause LTITT in order to accept alternative

hypothesis of LGDP does Granger Cause LTITT, therefore, the results reflect

that there is evidence of uni-directional causality from LGDP to LTITT.

4.8 DIAGNOSTIC TESTS

In econometrics analysis the diagnostic tests are important to

check whether the assumptions of tradition regression are confirmed.

These tests included Normal distribution test,

Heteroscedasticity test, Autocorrelation test and

Stability test.

4.8.1 NORMALITY TEST

The hypothesis test is as follow