Annexes

1. Données de l'échantillon

? Liste des entreprises de l'échantillon

:

Compartiment

|

Secteur

|

Société

|

Principal A

|

Bâtiments et matériaux de construction

|

Ciments du Maroc

|

|

|

Centrale Danone

|

|

|

Managem

|

|

Afriquia Gaz

|

Principal B

|

Chimie

|

Maghreb Oxygène

|

|

|

Cartier Saada

|

|

|

Southema

|

|

|

|

Néxans Maroc

|

|

IB Maroc

|

|

|

|

Delattre

|

|

Dari Couspate

|

|

Minière Touissit

|

|

|

Realis Mécaniques

|

|

Lydec

|

|

Med paper

|

|

CTM

|

|

2. Données de l'analyse

économétrique ? Données statistiques des

variables

Période 2011-2018

Statistiques descriptives, utilisant les observations 1:1 -

25:8

|

Variable

|

Moyenne

|

Médiane

|

Minimum

|

Maximum

|

|

END_net

|

0,496321

|

0,246321

|

-9,87143

|

38,3000

|

|

RENT

|

0,0686986

|

0,0555307

|

-0,265957

|

0,368154

|

|

LQD

|

0,170271

|

0,0859255

|

-0,131579

|

1,38889

|

|

AUT

|

0,747942

|

0,839734

|

-3,45455

|

1,35664

|

|

SA

|

0,221610

|

0,201637

|

0,00000

|

0,623035

|

|

TAILLE

|

2,83279

|

2,73984

|

1,30103

|

3,91233

|

|

DFRS

|

0,531819

|

0,520328

|

0,00908833

|

1,00000

|

|

INT

|

0,0524504

|

0,0160294

|

0,00000

|

0,818681

|

~ 69 ~

Variable

|

Écart type

|

C.V.

|

Asymétrie

|

Ex. aplatissement

|

|

END_net

|

3,16711

|

6,38116

|

8,50231

|

102,224

|

|

RENT

|

0,0915906

|

1,33322

|

0,391872

|

2,18568

|

|

LQD

|

0,229855

|

1,34993

|

2,33244

|

6,77211

|

|

AUT

|

0,412460

|

0,551461

|

-5,88218

|

52,9948

|

|

SA

|

0,174706

|

0,788351

|

0,402701

|

-0,854989

|

|

TAILLE

|

0,663412

|

0,234190

|

-0,00111975

|

-0,937835

|

|

DFRS

|

0,291785

|

0,548655

|

0,0832479

|

-1,06013

|

|

INT

|

0,132593

|

2,52798

|

4,48469

|

19,8600

|

|

|

Variable

|

5% Perc.

|

95% Perc.

|

IQ range

|

Missing obs.

|

|

END_net

|

-0,629818

|

1,64511

|

0,793738

|

0

|

|

RENT

|

-0,0587125

|

0,265986

|

0,0927589

|

0

|

|

LQD

|

0,00100685

|

0,625546

|

0,224342

|

0

|

|

AUT

|

0,118014

|

1,00000

|

0,303007

|

0

|

|

SA

|

0,00277513

|

0,538661

|

0,298895

|

0

|

|

TAILLE

|

1,72508

|

3,83420

|

1,20166

|

0

|

|

DFRS

|

0,0898214

|

1,00000

|

0,470452

|

0

|

|

INT

|

0,00227735

|

0,129095

|

0,0279456

|

0

|

? Matrice de corrélation

Période 2011-2018

Coefficient de corrélation, utilisant les observations

1:1 - 25:8

5% valeur critique (bilatéral) = 0,1388 pour n = 200

|

Variable

|

END_NET

|

RENT

|

LQD

|

AUT

|

SA

|

TAILL

E

|

DFRS

|

INT

|

|

END_NET

|

1.00000

|

-0.1798

|

0.2545

|

0.0039

|

0.0246

|

-0.0662

|

-0.1734

|

0.0862

|

|

RENT

|

|

1.0000

|

0.2305

|

0.3108

|

0.1928

|

0.2906

|

0.3088

|

-0.1844

|

|

LQD

|

|

|

1.0000

|

-0.0532

|

-0.0701

|

0.2115

|

0.3239

|

-0.1685

|

|

AUT

|

|

|

|

1.0000

|

-0.0763

|

-0.0386

|

0.2415

|

-0.0591

|

|

SA

|

|

|

|

|

1.0000

|

0.3809

|

-0.0088

|

-0.2331

|

|

TAILLE

|

|

|

|

|

|

1.0000

|

0.3307

|

-0.2359

|

|

DFRS

|

|

|

|

|

|

|

1.0000

|

-0.4273

|

|

INT

|

|

|

|

|

|

|

|

1.0000

|

? Estimation du modèle à effets

fixes

Dependent Variable: END_NET

Method: Panel Least Squares

Date: 12/02/20 Time: 17:47

Sample: 2011 2018

Periods included: 8

Cross-sections included: 25

Total panel (balanced) observations: 200

|

Variable

|

Coefficient Std. Error

|

t-Statistic

|

Prob.

|

|

C

|

0.089326 5.671780

|

0.015749

|

0.9875

|

|

RENT

|

-5.008736 3.773490

|

-1.327348

|

0.1862

|

|

LQD

|

8.989841 1.197905

|

7.504636

|

0.0000

|

|

AUT

|

2.464445 0.708971

|

3.476084

|

0.0006

|

|

SA

|

13.32275 4.790238

|

2.781229

|

0.0060

|

|

TAILLE

|

-1.479546 1.957704

|

-0.755756

|

0.4509

|

|

DFRS

|

-2.883841 1.339552

|

-2.152840

|

0.0328

|

|

INT

|

2.852104 5.499950

|

0.518569

|

0.6047

|

|

Effects Specification

|

|

|

|

Cross-section fixed (dummy variables)

|

|

|

|

R-squared

|

0.358401 Mean dependent var

|

|

0.496321

|

|

Adjusted R-squared

|

0.240011 S.D. dependent var

|

|

3.167106

|

|

S.E. of regression

|

2.761000 Akaike info criterion

|

|

5.014709

|

|

Sum squared resid

|

1280.684 Schwarz criterion

|

|

5.542440

|

|

Log likelihood

|

-469.4709 Hannan-Quinn criter.

|

|

5.228274

|

|

F-statistic

|

3.027282 Durbin-Watson stat

|

|

1.580054

|

|

Prob(F-statistic)

|

0.000003

|

|

|

|

? Test de spécification de Fisher

Redundant Fixed Effects Tests Equation: Untitled

Test cross-section fixed effects

|

|

|

|

|

Effects Test

|

Statistic

|

d.f.

|

Prob.

|

|

Cross-section F

Cross-section Chi-square

|

1.619928

41.633305

|

(24,168)

24

|

0.0418

0.0142

|

? Test de spécification de Hausman

Correlated Random Effects - Hausman Test Equation: Untitled

Test cross-section random effects

Test Summary Chi-Sq. Statistic Chi-Sq. d.f. Prob.

Cross-section random 32.561993 7 0.0000 < 5%

~ 70 ~

~ 71 ~

.24

.22

.20

.18

.16

.14

2.86

2.84

2.82

2.80

2.78

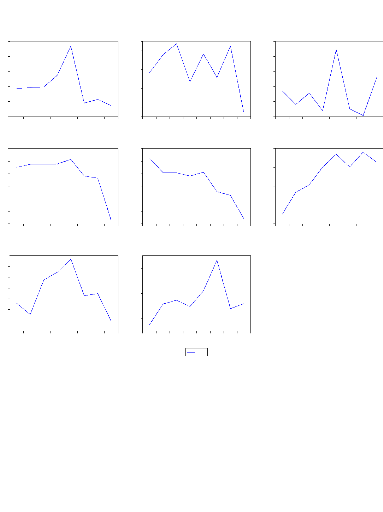

? Présentation graphique

? Tendance moyenne des variables

Mean of END net

2011 2012 2013 2014 2015 2016 2017 2018

Mean of AUT

2011 2012 2013 2014 2015 2016 2017 2018

Mean of DFRS

2011 2012 2013 2014 2015 2016 2017 2018

Mean of RENT

2011 2012 2013 2014 2015 2016 2017 2018

Mean of SA

2011 2012 2013 2014 2015 2016 2017 2018

Mean of INT

2011 2012 2013 2014 2015 2016 2017 2018

2.0

1.5

1.0

0.5

0.0

-0.5

.85

.80

.75

.70

.65

.60

.55

.60

.58

.56

.54

.52

.50

.48

.46

.080

.076

.072

.068

.064

.060

.056

.052

.048

.235

.230

.225

.220

.215

.210

.205

.070

.065

.060

.055

.050

.045

.040

Mean

Mean of LQD

2011 2012 2013 2014 2015 2016 2017 2018

Mean of TAILLE

2011 2012 2013 2014 2015 2016 2017 2018

|

|