III.Methodology and Data

IV.Analysis and Results

V.Limitations and further research needs

VI.Conclusion

12

VII.Recommendations

*** Description of the study ***

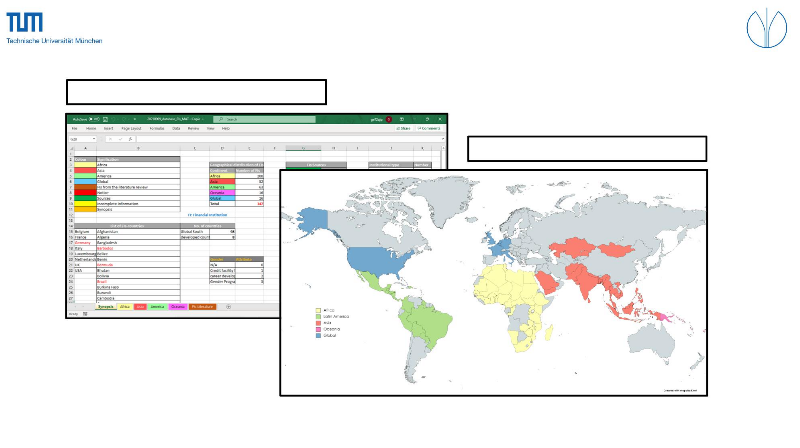

Database of financial institutions

Global Map of financial institutions

13

*** Building the database ***

37

201

109

347

14

*** Statistical Analyses ***

Descriptive statistics

Cluster Analyses

15

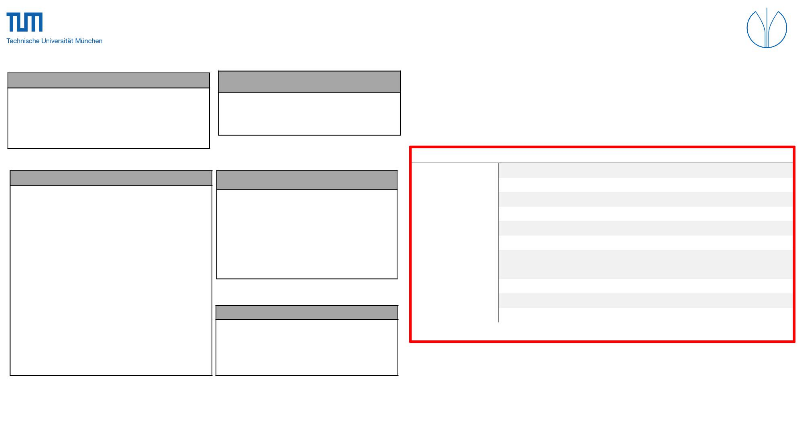

*** Data Types and Variables ***

Continent Attribute

Africa 0

Asia 1

South America 2

Global 3

|

Institutional type

|

Attribute

|

|

Agricultural Bank

|

0

|

|

Commercial Bank

|

1

|

|

cooperative

|

2

|

|

Credit union

|

3

|

|

Development Bank

|

4

|

|

Insurance company

|

5

|

|

International FI

|

6

|

|

International Fund

|

7

|

|

Islamic Bank

|

8

|

|

MFI

|

9

|

|

NGO

|

10

|

|

state development

bank

|

11

|

16

Agricultural loans Attribute

Credit facility for

women

Career development to female staff

Gender Programmes G3

G2

G1

Online Banking DS1

E-Products: DS2

Online Loan Application

DS3

Checking the rubric «Products and Services» AL1,

AL2 0-1

Gender Variables

Digital solution Variables

Farmer credit AL1

Agri-business credit AL2

Continent

Institutional Type

Foundation year

Number of Branches

Agricultural Loans

Gender

Digital solutions

Total assets

Total Equity

Gross Loan Portfolio

Variables Search Method Name/

Scale

checking the institute's website C 0-3

checking the rubric «about us» T 0-11

checking the rubric «our history» F Year

checking the rubric «locate us» B Number

Checking the rubric «our value» and

«events» G1, G2, G3 0-1

Verifying if «online banking» or other

e-products

DS1, DS2,

0-1

investigating the most recent «annual report»

AS $

available

DS3

investigating the most recent «annual report»

EQ $

investigating the most recent «annual report»

LP $

*** financial institutions sample ***

Financial

institutions from

the

literature

review

201

Africa

Sample FIs: 200

Global

Sample FIs: 16

Total of 347 financial institutions

144

17

Plan

I.Introduction

II.Literature Review

III.Methodology and Data

IV.Analysis and Results

V.Limitations and further research needs

VI.Conclusion

18

VII.Recommendations

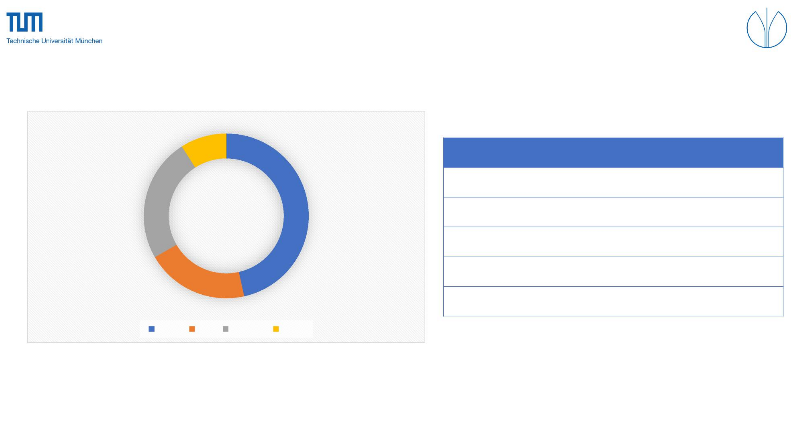

*** Geographic distribution ***

Global

9%

America

24%

Africa

47%

Asia

20%

|

Continent

|

|

No of FIs

|

Share

|

|

Africa

|

|

67

|

47%

|

|

South America

|

|

35

|

24%

|

|

Asia

|

|

29

|

20%

|

|

Global

|

|

13

|

9 %

|

|

Total

|

|

144

|

Africa Asia America Global

19

|

|

|

|

|

|

|

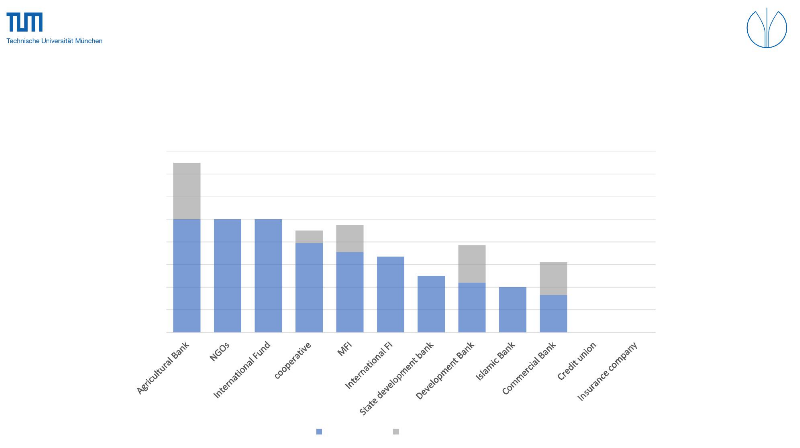

*** Distribution by institutional type ***

|

|

60

50

48 47

5 3 3 2 2 2 1 1

0

40

30

20

10

21

9

Institutional type Commercial Bank

|

Number

48

|

%

33%

|

|

Cooperative

|

47

|

33%

|

|

MFI

|

21

|

15%

|

|

Development Bank

|

9

|

6%

|

|

Islamic Bank

|

5

|

3%

|

|

International FI

|

3

|

2%

|

|

International Fund

|

3

|

2%

|

|

Agricultural Bank

|

2

|

1%

|

|

Credit union

|

1

|

1%

|

|

Insurance company

|

1

|

1%

|

|

NGOs

|

2

|

1%

|

|

State development bank

|

2

|

1%

|

|

Total

|

|

144

|

20

32

33

60

FREQUENCY

19

21

< 1950 1950 -1970 1970 -1990 > 1990

> 1000

100 - 1000

7

1

5

23

12

5

2

< 10

10 - 100

31

14

13

5

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Africa America Asia Global

1

2

4

1

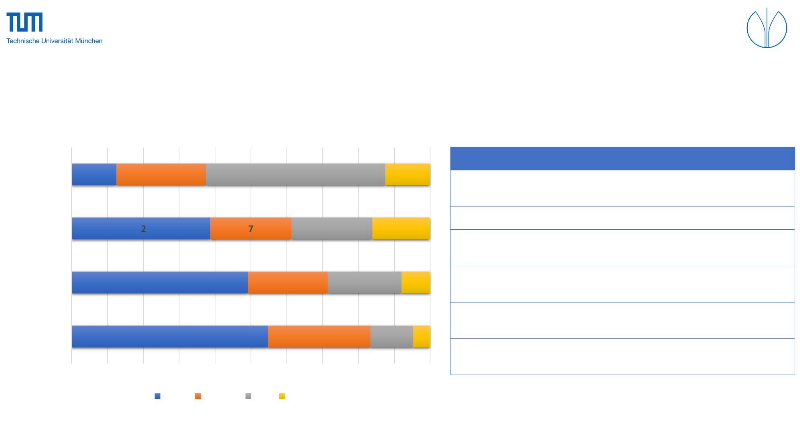

*** Number of Branches per FIs ***

Number of Branches per Region

|

Range

|

Africa

|

Number of Branches per Region

America Asia Global Total

|

%

|

|

< 10

|

23

|

12

|

5

|

2

|

42

|

29%

|

|

10 -

100

|

31

|

14

|

13

|

5

|

63

|

44%

|

|

100 -

1000

|

12

|

7

|

7

|

5

|

31

|

22%

|

|

> 1000

|

1

|

2

|

4

|

1

|

8

|

6%

|

|

Grand Total

|

67

|

35

|

29

|

13

|

144

|

100%

|

22

*** Agricultural loans***

160%

140%

120%

100%

80%

24%

0% 0%

50%

11%

20%

50%

0%

0% 0%

TYPE OF CREDIT OFFERED BY FINANCIAL

INSTITUTIONS

0%

44% 40%

Farmer credit Agribusiness Credit

60%

40%

79%

33%

0%

71%

67%

29%

0%

100%

100%

100%

33%

23

GENDER PROGRAMMES OFFERED BY FIS

|

160%

|

|

|

|

|

|

|

|

|

|

|

|

140%

|

|

|

|

|

|

|

|

|

|

|

|

120%

|

|

50%

|

|

|

|

|

|

|

|

|

|

100%

|

|

|

|

|

|

|

|

|

|

|

|

80%

|

|

|

33%

|

|

|

|

50%

|

|

|

|

|

|

60%

|

|

|

|

67%

|

29%

|

|

|

|

|

|

0%

|

|

33%

|

|

|

|

40%

|

|

|

|

|

19%

|

|

|

|

|

0%

|

|

|

50%

|

50%

|

|

|

|

|

20%

|

|

|

33%

|

33%

|

29%

|

|

0%

|

|

|

|

|

|

|

|

|

|

|

0%

60%

50%

4%

13%

22%

9%

13%

33%

35%

21%

0%

0% 0% 0% 0%

|

|

|

Credits facility for women Career development opportunities to

female staff Gender Programmes

|

24

|

*** Digital Solutions ***

Digital solutions offered by FIs Again

|

40%

20%

80%

|

|

23%

21%

|

|

|

|

|

|

|

77%

|

|

|

|

|

5%

19%

|

|

|

0%

50%

|

|

|

|

6%

9%

|

|

24%

|

|

|

|

21%

|

0% 0% 0% 0% 0% 0% 0%

11%

160%

Online Banking E-Products Online Loan Applications

25

140%

120%

100%

80%

60%

40%

20%

0%

Plz sum it up !

26

Seven key characteristics of financial

institutions

1. Geographic distribution

2. institutional type

3. Foundation Year

4. Branches

5. Agricultural credit

6. Gender Equality

7. Digital solutions

1. Geographic distribution

47%

from Africa

24%

from America

4. Branches

29%

<10 branches

44%

10-100 branches

2. institutional type

33%

commercial bank

33%

cooperative

5. Agricultural credit

58%

Farmer credit

19%

Agribusiness credit

3. Foundation Year

42%

> 1990

6. Gender Equality

15% credit

facility for women

10% Career

development

7. Digital solutions

58% Online

27

banking

Okay descriptive Statistics ...

What about

cluster Analysis ?

28

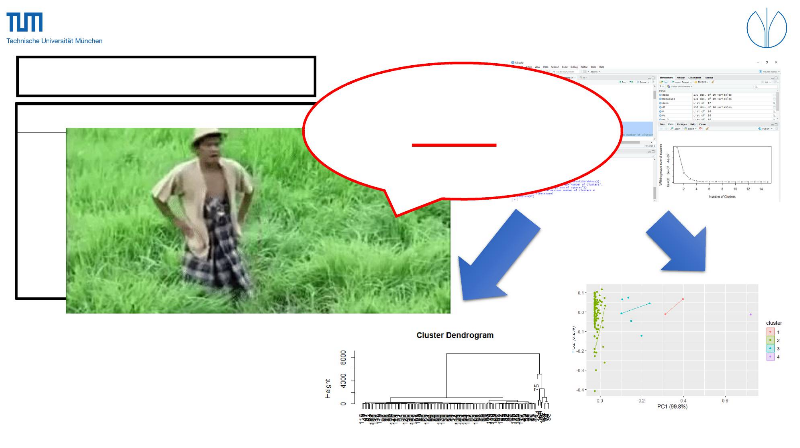

*** Cluster Analysis ***

Descriptive statistics of the dataset

Mean Median Standard

Range Mi

Sample

Variance

Deviation

C 0.96

T 3.44

F 1976

B 215.

AL1 0.58

AL2 0.19

G1 0.15

G2 0.10

G3 0.30

DS1 0.42

DS2 0.13

DS3 0.13

Wrong !

29

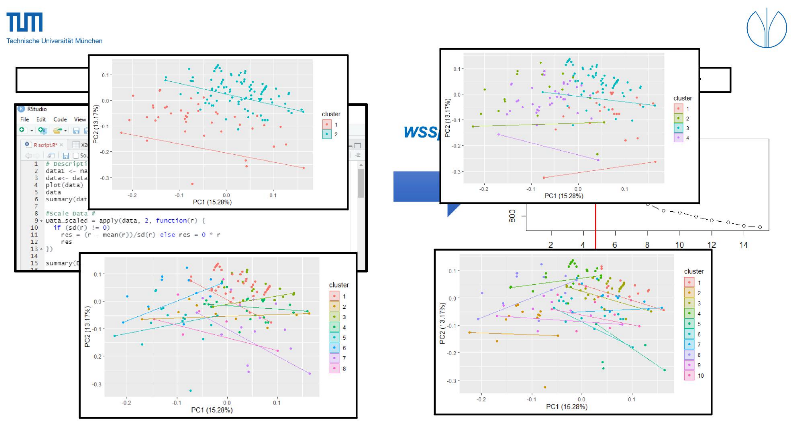

*** k-means Clustering ***

Scale Data

s

30

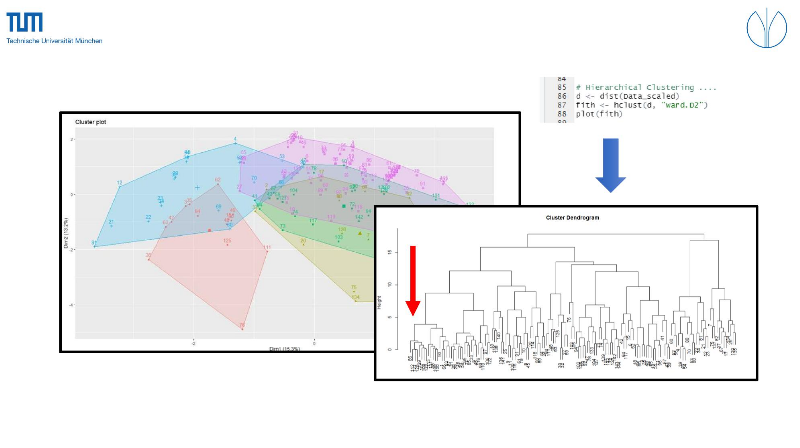

*** k-means VS hierarchical Clustering ***

31

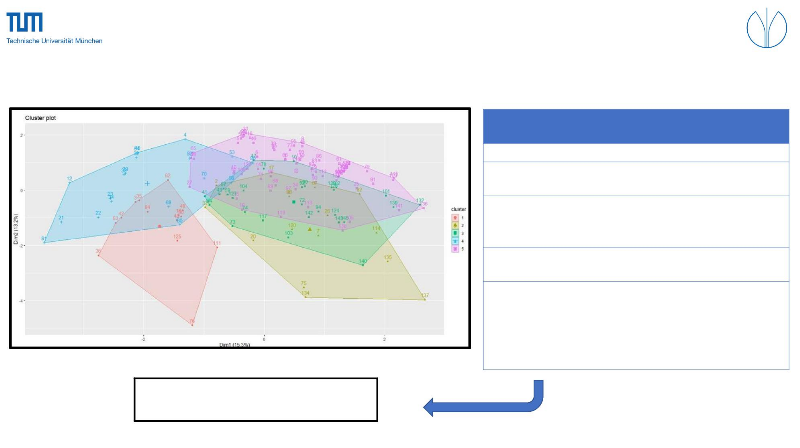

*** k-means Clustering ***

|

Cluster no.

1

|

Observations Number

3 18 35 36 42 48 49 50 62 63 76 84 111 125

|

Total

14

|

|

2

|

2 7 17 20 26 37 67 75 82 88 114 120 134 135

|

15

|

|

137

|

|

|

3

|

10 41 43 47 57 59 64 72 73 74 78 90 92 94 101

|

29

|

|

102 103 104 117 124 126 127 132 133 139 140

|

|

|

142 143 145

|

|

|

4

|

4 12 21 22 23 30 32 34 39 40 52 53 54 56 60 69

|

19

|

|

70 80 81

|

|

|

5

|

1 5 6 8 9 11 13 14 15 16 19 24 25 27 28 29 31

|

67

|

|

33 38 44 45 46 51 55 58 61 65 66 68 71 77 79

|

|

|

83 85 86 87 89 91 93 95 96 97 98 99 100 105

|

|

|

106 107 108 109 110 112 113 115 116 118 119

|

|

|

121 122 123 128 129 130 131 136 138 141

|

|

betweenss_totss (1? 10) Silhouette

plot

32

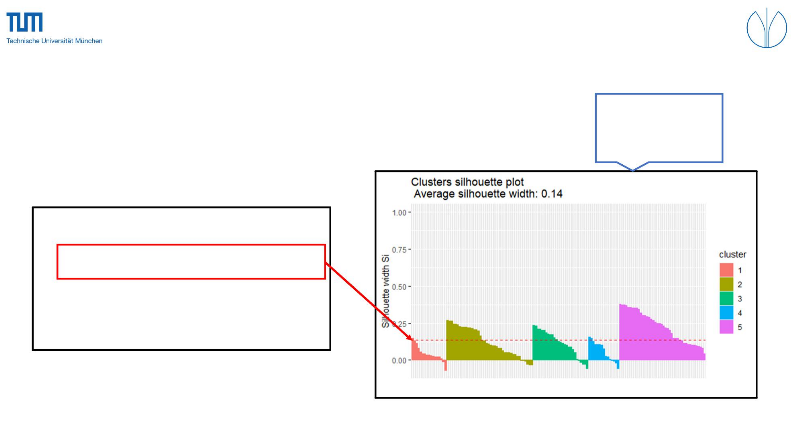

*** k-means Clustering ***

How good is 0.14?

Average silhouette width:

·

Si > 0 indicates that the observations are well

clustered.

· Si < 0 indicates that the observation was placed in

the wrong cluster.

· Si = 0 indicates that the observation is in between

two clusters

33

|

|

|

|

|

|

|

*** Extracting Results ***

|

|

34

Cluster Number

|

Average Cluster Name

Foundation

|

Average number of Branches

|

|

1

|

1948 Value chain oriented FIs

|

517

|

|

2

|

1967 Gender Staff FIs

|

433

|

|

3

|

1975 Farmer credit provider FIs

|

215

|

|

4

|

1990 Innovative digital newcomers

|

95

|

|

5

|

1982 Traditional Banking approaches

|

137

|

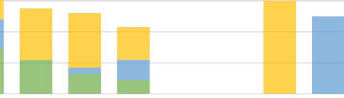

*** Extracting Results ***

Geographic distribution

Value chain oriented FIs Gender Staff FIs

Farmer credit provider FIs Innovative digital newcomers

Traditional Banking approaches

Africa

Institutional type

Value chain oriented FIs Gender Staff FIs

Farmer credit provider FIs Innovative digital newcomers

Traditional Banking approaches

Agricultural Bank

35

South America

International FI

80%

60%

40%

20%

0%

Asia

Global

state development

bank

100%

Commercial Bank

80%

NGO

60%

40%

20%

MFI

0%

Islamic Bank

cooperative

Credit union

Development Bank

International Fund

Insurance company

|

|

|

|

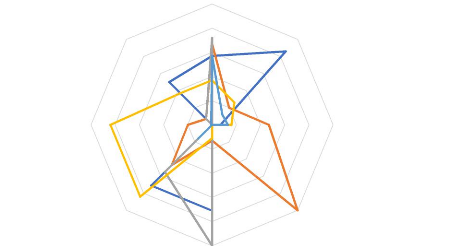

*** Extracting Results ***

|

|

Services

Value chain oriented FIs Gender Staff FIs

Farmer credit provider FIs Innovative digital newcomers

Traditional Banking approaches

Farmer credit

80%

Online Loan Applications

60%

40%

20%

E-Products

Online Banking

0%

agri-business credit

Credits facility for women

opportunities to female

staff

100%

36

Gender Programmes

|

*** Extracting Results***

|

|

|

Technische Universitet München

|

Table 30 Cluster's characteristics

|

Cluster Name

|

Group 1

Value

chain Fls

|

Group 2

Gender

Staff Fls

|

Group 3

Farmer credit

provider Fls

|

Group 4

Innovative digital newcomers

|

Group 5

Traditional Banking approaches

|

|

Region

|

|

|

|

|

|

|

Africa

|

71%

|

47%

|

24%

|

79%

|

42%

|

|

Asia

|

14%

|

13%

|

24%

|

21%

|

19%

|

|

South America

|

14%

|

20%

|

28%

|

|

34%

|

|

Global

|

|

20%

|

24%

|

|

4%

|

|

Institutional Type

|

|

|

|

|

|

|

Agricultural Bank

|

|

|

|

|

3%

|

|

Commercial Bank

|

86%

|

13%

|

21%

|

68%

|

22%

|

|

cooperative

|

7%

|

40%

|

31%

|

16%

|

42%

|

|

Credit union

|

|

|

|

|

1%

|

|

Development Bank

|

7%

|

|

10%

|

|

7%

|

|

Insurance company

|

|

|

|

|

1%

|

|

International Fl

|

|

7%

|

3%

|

|

|

|

International Fund

|

|

|

7%

|

|

1%

|

|

Islamic Bank

|

|

|

10%

|

5%

|

1%

|

|

MFI

|

|

27%

|

14%

|

11%

|

16%

|

|

NGD

|

|

7%

|

3%

|

|

1%

|

|

Average Foundation

|

1940

|

1967

|

1975

|

1990

|

1982

|

|

Average Branches

|

517

|

433

|

215

|

95

|

137

|

|

Agricultural Credit

|

|

|

|

|

|

|

Farmer credit

|

57%

|

67%

|

72%

|

37%

|

57%

|

|

agri-business credit

|

86%

|

20%

|

0%

|

26%

|

12%

|

|

Gender Programmes

|

|

|

|

|

|

|

Credits facility for

women

opportunities to female staff

|

7%

0%

|

47%

100%

|

7%

0%

|

16%

0%

|

13%

0%

|

|

Gender Programmes

|

71%

|

13%

|

100%

|

11%

|

0%

|

|

Digital Solutions

|

|

|

|

|

|

|

Online Banking

|

71%

|

47%

|

55%

|

84%

|

16%

|

|

E-P rod ucts

|

0%

|

20%

|

0%

|

84%

|

0%

|

|

Online Loan

|

50%

|

7%

|

7%

|

37%

|

1%

|

|

Applications

|

|

|

|

|

|

|

Total Fls

|

14

|

15

|

29

|

19

|

67

|

Plan

I.Introduction

II.Literature Review

III.Methodology and Data

IV.Analysis and Results

|