2.2. AVCF definition

There is still no unified definition of AVCF. Different

authors show an understanding with various characteristics on this subject.

However, one of the most widely accepted definitions is the one formulated by

Miller and Jones (2010), who define value chain finance as:» the flows of

funds to and among the various links within a value chain" and distinguish

between internal and external value chain finance. Likewise, authors from FAO

and AFRACA (2020) defined AVCF as two internal flows of financing between chain

actors directly within the VC and for financial service providers who use AVCF

to lend money or to invest in one or more of the chain actors. However, the

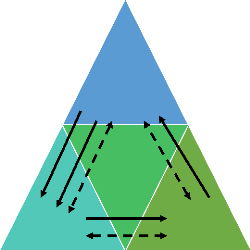

authors of KIT and IIRR (2010) have defined the VCF triangle, in which FI

engages with the actors of the chain. This triangle is among FI, the seller and

the buyer. The figure below illustrates the VCF.

Seller

financial institution

VCF

triangle

Buyer

10

Figure 4: Overview of value chain finance Triangle

Source: KIT and IIRR (2010)

This figure shows the payment, loan, and information and

services flows between the financial institutions and the seller. Additionally,

the payment and information flow between buyer and FI. Eventually, the flows of

information and services and product between the buyer and the seller.

Complementarily, a study by Carroll et al. (2012) provides a

pragmatic definition of AVCF:

...in the case of agriculture, the value chain may include

(but is not limited to) input provision, production, processing, transport,

storage marketing, and export.

Additionally, the Asian Development Bank (ADB) (2012) makes the

definition of AVCF simpler:

...organized linkages between groups of producers, traders,

processors, and service providers (including nongovernment organizations) that

join together to improve productivity and the value-added from their

activities.

Similarly, Zander (2016) presented the following

definition»:

Value chain finance (VCF) denotes all financing arrangements

within a specific value chain or from outside the chain. As the concept of

value chains and their financing is broad and multifaceted, the terms `value

chain' and `VCF' necessarily refer to a broad range of different instruments

and mechanisms.

Finally, a recent study by Villalba, Venus, & Sauer (2021)

explains Agricultural Value Chain Finance (AVCF) as:

A variety of products and approaches that allow stakeholders

from a value chain to leverage social capital and satisfy the funding needs of

the weakest actors. Cooperating within a value chain reduces risk, which can

facilitate the

11

acquisition of financing from financial institutions, and other

lenders at a lower

cost.

While no common definition has been proposed in the

literature, ADB (2012) and Carroll et al. (2012) have the constituting element

«provision», «processing», and «productivity» in

common. They show that the chain starts from the raw material stage to the

final consumer. However, other researchers explain this term as a variety of

different products, mechanisms, and instruments used by different actors in the

chain to initiate financing arrangements (Villalba, Venus, & Sauer, 2021;

Zander R. , 2016).

There is agreement between the literatures when it comes to

the flows of funds. (Miller & Jones, 2010; KIT and IIRR, 2010; AFRACA and

FAO, 2020). In addition, there are definitions of AVCF for which the authors

partially agree such as internal and external value chain (Miller & Jones,

2010; AFRACA and FAO, 2020).

The authors agreed that Internal Value chain finance takes

place within the value chain such as when an input supplier provides credit to

a farmer, or when a lead firm advances funds to a market intermediary. External

value chain finance is that which is made possible by value chain relationships

and mechanisms: for example, a bank issues a loan to farmers based on a

contract with a trusted buyer or a warehouse receipt from a recognized storage

facility.

Other authors defined AVCF as a triangle, in which, an

agreement between the actors (FI, seller and buyer) is made around the product,

the need for financing, the sharing of information, the method of

communication, and finally the way of risk management (AFRACA and FAO, 2020).

This agreement according to KIT and IIRR (2010) allows the development of the

value chain in three different ways:

a) Ensuring liquidity for the actors of the chain

b) Creation of new chains

c) Investments in existing chains

This highlights how general financing of agriculture works,

(new investments, reinvestments, and financing of current assets) and is a

useful typology for value chain development.

|