Conclusion

The Normal SABR model solves the negative density problem

observed with the Hagan approximation. However, it introduces another issue,

the excessive computation time for pricing. Indeed, practitioners prefer closed

form formulas for pricing (such as Black-Scholes) and changing the whole

pricing kernel can quickly become a trip to Pandemonium. Moreover, solving only

the negative density problem leaves untouched the wings control one. In the

next chapter, we will introduce a wings controlling model and show how to

compute arbitrage-free prices.

CHAPTER 2. NORMAL SABR

20 4. PRICING FORMULA WITH NORMAL SABR AS BASE

Chapter 3

The ZABR model

Introduction

Interest rate option desks typically need to maintain very

large amounts of inter-linked volatility data. For each currency, there might

be 20 expiries and 20 tenors, that is, 400 volatility smiles. Furthermore, the

smiles might be linked across different currencies. Interpolation of observed

discrete quotes to a continuous curve is needed for the pricing of general caps

and swaptions. At the same time, extrapolation of options quotes is needed for

constant maturity swap (CMS) pricing. For these purposes, the industry uses to

approximate SABR model using expansions as in [26]. The implied volatility

expansions have the advantages that they are fast and simple to code but as

mentioned in the previous chapter, these expansions are not very accurate,

particularly not for long maturities nor low strikes.

With the low rates we have today, this problem is more acute

than ever. Furthermore, the SABR model only has four parameters to handle the

above-mentioned tasks, which is not enough flexibility to exactly fit all

option quotes. In this chapter, we extend the stochastic volatility process to

include a constant elasticity of variance (CEV) skew on the volatility of

volatility. The CEV volatility process allows us to have more explicit control

of the extrapolated high-strike volatilities, which in turn allows better

control of CMS prices. Further, we will use a non-parametric volatility

function for the spot process, which enables us to have an exact fit to all the

observed quotes and gives us the ability to model negative option strikes.

In this chapter, instead of buying into heat kernel

expansions, we use a short-maturity expansion for the implied volatility of the

option. The short maturity expansion also yields results for the short-maturity

limit of the Dupire forward volatility ( [11]), that is, the short-maturity

limit of the conditional expected local variance

V(F)2 = uim

t?0

|

|

]

dhF it

dt /Ft = F (3.1)

|

|

21

We provide two procedures to directly calibrate the model to

observed CMS prices: an implicit method that works by iteration of the

connection from parameters to price in a non-linear solver (see Section 3.3),

and a direct method that infers the

22 1. SHORT MATURITY EXPANSION

CHAPTER 3. THE ZABR MODEL

parameters of the model from an arbitrage-free continuous

curve of option prices (see Section 5).

1 Short maturity expansion

We consider the slightly more general model:

( dFt =

ót?(Ft)dWt1

with d(W1,

W2)t = ñdt (3.2)

dót =

c(ót)dWt2

The non-parametric form of the volatility function ?(.)

allows us to have a perfect fit to any discrete or continuous set of observed

arbitrage-free options quotes. We can write the price of an European call

option on a fixing FT as:

Ct = E [(FT -

K)+ /Ft] = g (t, Ft, v(t))

where v(t) is the implied normal volatility and g is the

normal (Bachelier) option pricing formula:

g(ô, x, v) = (x - K)JV x - K +

vôfv.Vô)z

Cv~K) , ô = T

- t (3.3)

Applying Itô's lemma to 3.3 yields:

dCt = -gôdt +

gxdFt +1

gxxd(F)t + gvdvt +

2gvvd(v)t +

gxvd(F, v)t (3.4)

where subscripts

denote partial derivatives. In the following, we assume vt > 0

Define Xt = Ft-K. Using Itô's

lemma yields:

vt

1

dXt =

vt

|

dFt -Ft 2Kdvt -

2d(F,v)t + Ft

-3Kd(v)t

vt vt

vt

|

|

(3.5)

(3.6)

1

= (dFt - Xtdvt) +

O(dt)

vt

d(X)t = v2

(d(F)t + Xt d(v)t -

2Xtd(F, v)t)

t

2

gxx

gxx

The normal option pricing function, g, has the following

properties:

gv = vôgxx

Cx - K

gvv = v

x - K

v

gxv =

1

0 = -gô +

2v2gxx

Using the above properties, we can transform equation 3.4

into:

1. SHORT MATURITY EXPANSION

23

CHAPTER 3. THE ZABR MODEL

1 ]

dCt - gxdFt = 2gxx [v2

t (d(X)t - dt) + 2ôvdvt (3.7)

The left

hand side of 3.7 is the change in value of a hedged portfolio. Taking

conditional expectations yields:

1

0 = 2gxxv2

1 t E (d(X)t - dt/Ft) +

gxxôvtE (dvt/Ft) (3.8)

For small

maturities, ô -+ 0, and we have

2gxxv2t E

(d(X)t - dt/Ft) 0 (3.9)

As gxx > 0 for v > 0, and for any diffusion, E

(d(X)t - dt/Ft) = 0 is equivalent to

d(X)t = dt, we obtain the arbitrage condition:

Note that this is a diffusion condition rather than the drift

condition that we normally see in financial mathematics. As the function X

H X(f, ó) must be a function of the state variables

(Ft, ót), the diffusion condition 3.10 leads to the

differential equation:

1 = (XfdFt +

Xódót)2

dt (3.11)

=

ó2t

?(Ft)2X2f

+

E(ót)2X2ó

+

2ñót?(Ft)c(ót)XfXó

Given the function ?(.), we need to solve this non-linear

first order differential equation subject to the boundary condition X(f = K,

ó) = 0. Once we have the solution X(f, ó), we can find the

implied volatility as:

F - K

=

v(3.12) X(F,ó0)

We note that the error of the implied volatility is

O(ô). The result implies that for any choice of ?(F), any function X =

X(f, ó) that satisfies d(X)t = dt leads to an implied

volatility given by v = (F - K)/X.

We could have chosen to derive the short-maturity expansion

in implied Black-Scholes (lognormal) volatility v instead of implied normal

volatility. Instead of X,

we should then have chosen the transformation

. The diffusion condi-

X = ln(F/K)

v

tion would be the same so X = X. This relates

short-maturity implied lognormal and normal volatilities, as in Appendix B

(first order equivalence), by the simple relationship:

v ln(F/K)

= (3.13)

v F - K

The expansion results that we present in the following can

easily be switched between use in implied normal and implied lognormal

volatility form by use of equivalence formulae.

CHAPTER 3. THE ZABR MODEL

2 Application to benchmark models

Before we address the very ZABR model results, we first of all

apply the short-maturity expansions from the previous section to well known

models. Those models can be retrieved while varying the function c(.).

2.1 Local Volatility model : case ~(ót)

= 0

In this case, ót = 1, and the differential equation 3.11

reduces to ordinary differential equation (ODE):

X2f?(F)2 = 1 (3.14)

Using the boundary condition X(F = K) = 0, we find the

solution:

Z F 1

X = ?(u)

K

|

du (3.15)

|

|

v = v =

with corresponding implied normal and Black volatilities given

by:

F - K

f F K ?(u)du

1

(3.16)

ln(F/K)

f F K ?(u)du

1

These results appear in many places, for example in [19]. We

note that 3.15 implies the following relationship between X and the forward

volatility:

Suppose we have X from a stochastic volatility model like

3.2, that is, given as the solution to 3.11 for some volatility functions ?(F),

c(ó) and correlation ñ. Let's define the function V by:

~?X ~-1

V(K) = - (3.18)

?K

and consider the deterministic local volatility model:

dFt = V(Ft)dWt (3.19)

It now follows that:

XLV =

|

Z S K

|

V(u)-1du = X (3.20)

|

|

24 2. APPLICATION TO BENCHMARK MODELS

So the stochastic volatility model 3.2 and the local

volatility model 3.19 will produce the same short-maturity expansion option

prices.

The above is a short-maturity limit version of the general

result by Gyongy and Dupire (see [13] and [6]), that the model:

CHAPTER 3. THE ZABR MODEL

dFt = a(t, Ft)dWt , F0 = F0 (3.21)

produces the same option prices as the model 3.2 if a(., .) is

chosen to be:

~dhF it ~

a(t, k)2 = E dt /Ft = k (3.22)

We conclude that in the short-maturity limit, the conditional

expected variance of the underlying is related to the transformed variable X

by:

-2

V(F)2 t~o E

[dhdtit/Ft =

F~ = (?K\ (3.23)

This constitutes a way of relating the two dimensional

pricing problem 3.2 to the simpler one-dimensional pricing problem 3.19. We

will make use of this relationship to generate arbitrage-free prices later.

2.2 Degeneracy into a SABR model : case €(ó) =

áó

Here, we will solve the diffusion condition for the lognormal

volatility process case. First, we use the transformation:

Y :=

LF

?(u)

1

du (3.24)

and we get:

dY = dWt1 -

áYdWt2 + O(dt)

= [1 + á2Y 2 -

2ñáY ]1/2 dBt + O(dt) (3.25)

= J(Y )dBt +

O(dt)

where (Bt)t is a new Brownian motion. As Y (F = K)

= 0, we can now get X by normalising the volatility of Y , hence:

fY X=J J(u)-1du

= 1ln(J(Y ) - ñ + áY\

o 1--p

v =

|

F - K

|

|

(3.26)

|

|

|

|

ln(F/K) X

|

|

|

For the CEV case ?(F) = ?0Fâ, we have:

1

Y = ó0?0

F1-â - K1-â

(3.27)

1 -â

These formulas are basically the result of Hagan et al

[26]. This is extended to include maturity and various refinements for the

CEV case. The Hagan result does,

2. APPLICATION TO BENCHMARK MODELS 25

CHAPTER. 3. THE ZABR. MODEL

however, produce implied volatility smiles that are prima

facie identical to those produced with formula 3.26.

We can also use 3.26 to retrieve the forward volatility

function of SABR from:

?X ?K =

|

?X

?Y

|

?Y ?K =

|

J(Y ) Ç0?(K))

(3.28)

|

|

26 3. EXPANSION FOR. THE ZABR. MODEL

Hence:

V(K) = J(Y

)ó0?(K) (3.29)

This result could also be deduced from results in [25].

3 Expansion for the ZABR model

We now consider the extended SABR model where the volatility

process is of the CEV type: c(ó) =

áó,y

3.1 Implied volatility computation

Once again, we introduce the intermediate variable:

F

Y = ó,y-2 1

x ?(u)

|

du (3.30)

|

|

For which Itô expansion yields:

dY = ó,y-1 (dW t 1 +

(ã - 2)áYdW 2 +

O(dt) (3.31)

0 t

Let's define X = ó1-,y

0 f(Y ), for some function

f(.), and we get:

dX =ó1-,y

0 f'(Y)dY + (1 -

ã)áf(Y)dWt2

+ O(dt)

[ ] t + O(dt) (3.32)

= f'(Y)dW t 1 +

(ã - 2)áY f'(Y) +

(1 - ã)áf(Y) dW 2

We conclude that the diffusion condition 3.9 is satisfied if f

solves the ODE:

1 = A(Y )f'(Y

)2 + B(Y )f(Y

)f'(Y ) + Cf(Y

)2

A(Y ) = 1 + (ã -

2)2á2Y 2 + 2ñ(ã -

2)áY

B(Y ) = 2ñ(1 -

ã)á + 2(1 - ã)(ã -

2)á2Y

C = (1 -

ã)2á2

f(0) = 0

The above ODE can be rearranged as:

|

(3.33)

|

|

f'(Y ) =

Y -B(Y )f + B(Y

)2

f2 - 4A(Y )(Cf2 - 1))

F(Y, f) (3.34)

2

CHAPTER 3. THE ZABR MODEL

which can be solved by standard techniques for integration of

ODEs. We can evaluate the solution for all strikes one sweep by:

= -ó0

?(K)-1

ã-2

?Y ?K

?K =

ó1-ã

0

=

-ó-1

0 F (Y,

óã-1

0 X)

?(K)-1

(3.35)

?X

?f ?K

X(K =

F) = Y (K

= F) = 0

Again, we can find the forward volatility function as:

/?X\-1=

ó0?(K)f'(Y

)-1 =

ó0?(K)F

(Y, óã-1

0 X)-1 (3.36)

V(K) = -

?K

Equations 3.35 and 3.36 will typically be evaluated at

ó0 = 1. Rather than numerically solving the

two ODEs in 3.35 separately, we favour solving 3.33 as a joint system.

It should here be noted that the ODE representation 3.33 has

previously been obtained by Balland (see [24]) for the lognormal case. Further,

it should be noted that Henry-Labordere has a treatment of the general non-CEV

case (see [27]).

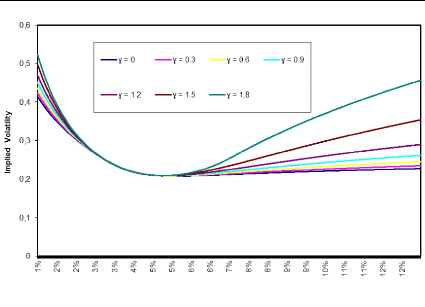

3.2 Graphical results

In order to solve the ODE 3.33, we have the choice between a

classical Euler scheme and an 4th order

Runge Kutta relaxation. The former is faster but deliver unstable solutions,

whereas the latter, even though slower, yields excellent solutions in terms of

stability. We therefore chose a RK4 method to solve the ODE. After solving it,

we find a value for X which leads to the implied volatility. The following

picture plots obtained lognormal implied volatilities for different values of

ã.

3. EXPANSION FOR THE ZABR MODEL 27

28 3. EXPANSION FOR THE ZABR MODEL

CHAPTER 3. THE ZABR MODEL

Figure 3.1: F0 = 0.0325, u0 = 0.087, á

= 0.47, 9 = 0.7, p = -0.48, T = 15Y

Increasing 'y lifts the wings of the implied volatility smile

whereas the smile for strikes close to at-the-money are visibly unaffected.

This can in turn be used to give us better control over the CMS prices.

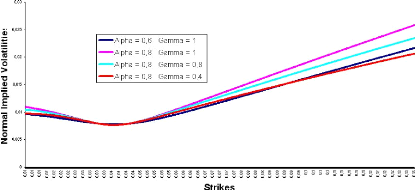

Here is an illustration of how to control CMS prices through

the wings. When we increase á, we lift the wings and therefore raise the

CMS prices. We can then decrease 'y and therefore lower back the wings and the

CMS prices, as we can see it through the following illustration.

Figure 3.2: F0 = 0.0325, u0 = 0.087, 9 =

0.7, p = -0.48, T = 15Y

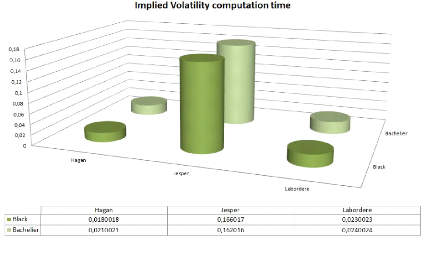

In terms of computation time, we have plotted the time it takes

to compute an implied volatility in a ZABR('y = 1) and compared it with the

time taken by Hagan

CHAPTER. 3. THE ZABR. MODEL

and Labordere approximations.

Figure 3.3: F0 = 0.0325, ó0 = 0.087, á = 0.47,

â = 0.7, ñ = -0.48, ã = 1, T = 15Y

It takes 10 times more time for computing implied volatility

under the ZABR model, in comparison with Hagan and Labordere approximations.

However, this is just the price to pay for gaining control of the wings !

3.3 Fast calibration of the model's parameters

For quick identification of the model parameters, the

following second-order Taylor expansion is convenient:

v(K) = v(F) + v,(F)(K - F) +

12v,,(F)(K - F)2 + O ((K -

F)3) v(F) = ó0?(F)

1 v,(F) =2

hó0-1 ñá + ó0? (F)i

v,,(F) 6ó0?(F)hó02(7-1) ((-5 +

2ã)ñ2 + 2) + óô

(2?(F)?,,(F) - ?,(F)2)i

(3.37)

Let's consider a CEV case where we set ?(K) = ù (K-F

)â

have:

(F -F )â and ó0 = 1. Then we

v(F) = ù

v,(F) = 21 [~

ñá + Fùâ - F

~~(-5 + 2ã)ñ2 + 2 á2 +

ù2â(â - 2) ~

v,,(F) = 1

6ù (F - F)2

3. EXPANSION FOR. THE ZABR. MODEL

|

(3.38)

29

|

|

CHAPTER 3. THE ZABR MODEL

|

\ v(K1), ...,

|

|

For a given set of discrete quotes

|

|

|

be used for regressing the triple v(F), v'(F),

v"(F). One can in turn solve 3.38 to get parameters estimates for â,

ñ, á.

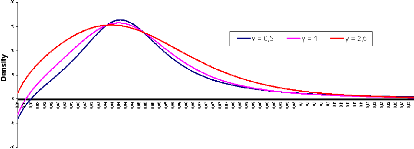

4 Finite difference volatility

Using the implied volatility coming from the short-maturity

expansions 3.16, 3.26 and 3.35, directly for pricing using 3.3 will not give

arbitrage-free options prices. Our short-maturity expansions suffer from the

same problem of potential negative implied densities for low strikes as the

original Hagan expansion. The ZABR model contains an enhanced feature that can

help us avoid negative density problems. Let's plot the implied probability

density function for extreme model parameters and see how it reacts to the

changes in ã values.

Figure 3.4: F0 = 0.0325, ó0 = 0.087,

á = 0.47, â = 0.7, ñ = -0.48, T = 15Y

If we keep increasing ã, the density tends to be more and

more positive... Anyway, this way of skipping negative densities doesn't give

us enough flexibility in the use of the ZABR model.

In order to definitely avoid this problem, we will instead

use the forward volatilities derived in 3.29 and 3.36 as the basis for our

pricing.

The forward volatility V(K) can be used to generate

option prices as the solution of the Dupire forward PDE (see [5]).

?C(T,K)

?T =

?

?

?

2V(K)2 ?2

?(T2,K)

C(0, K) = (F - K)+

(3.39)

30 4. FINITE DIFFERENCE VOLATILITY

The usual way of solving this numerically is to set up a time

discretisation with multiple time steps and then use a finite difference

solver. However, to gain speed, we will instead use the single time step

implicit finite difference approach introduced in [15]. Here we need to solve

the ODE:

C(T, K) - 2T

è(K)2?2C(T, K)

1 ?K2 = (F - K)+ (3.40)

4. FINITE DIFFERENCE VOLATILITY 31

CHAPTER 3. THE ZABR MODEL

Z0

It is shown in [15] that this approach generates a set of

arbitrage-free call prices for any choice of è. It is also shown that

the one-step finite difference price is the Laplace transform of the solution

to 3.39. The Laplace transform of the Gaussian distribution is the Laplace

distribution:

8 t/T 1 F - Kl T

IF K|

vt

vt

dt = e 2v2 (3.41)

v

v

2v2

which is peaked at K = F. Therefore if we choose è =

V, we will also get a peak in the densities.

Instead, we will find an adjustment for the forward

volatility function based on our expansion results. As option prices generated

by 3.39 and 3.40 should be the

same, we can substitute ?2C(T,K) ?C(T,K)

?K2 = 2 ?T from 3.39 into 3.40 and rearrange to

V2

find:

è(K)2 = V(K)2 C(T, K) - (F -

K)+

T ?C(T,K)

?T

V(K)2g(T, F,v) - (Fv)

- K)+

T ?g(T

?T

|

(3.42)

|

|

~ ~

1 - î Ö(-î)

= 2V(K)2 , with î= v X

ö(î) T

= V(K)2P(X)2

where the second (approximated) equality involves the

approximation of the option prices by our expansion result.

The function P(X)2 can conveniently be

approximated with a third or fifth order polynomial. Specially:

Ö(X) X

ö(X) anun, u = 1 (3.43) 1 + pX

n

where the constants p, a1, a2, ... can be found in (26.2.16)

and (26.2.17) of [20]. The finite difference discretisation of 3.40 is:

~ ~

1- 1 2Tè(K)2 ?2 C(T, K) = (F - K)+

(3.44)

?K2

This equation can be represented as a tridiagonal matrix

equation on the grid K0, K1, ..., Kn, which in turn can be solved

for C(T, Ki) in linear CPU time using the tridiag() algorithm in [31].

As an alternative to the finite difference solution 3.44, one

could use the exact solution methodology for ODEs of the type 3.40 described in

[3]. However, for this methodology to be computationally effective, the forward

volatility function è(K) needs to be well approximated by a piecewise

linear function with few knot points over the full domain of the solution. This

is generally not the case here. We have therefore chosen to base our solution

on 3.44.

We can see that the finite difference generated option prices

have corresponding implied densities that are positive, that is, arbitrage is

precluded. We can also

CHAPTER 3. THE ZABR MODEL

see that using our forward volatility result,

V(K), directly in the

single time step finite difference solver produces a density that is peaked

around at-the-money. This, however, is eliminated when using the adjusted

forward volatility

è(K).

5 Calibrating the Volatility function

We first consider the case where we have a continuous curve

of arbitrage-free option prices. This could for example be produced by

Andreasen & Huge interpolation scheme ( [15]) or come from another ZABR

model. We can calculate the forward volatility function by the discrete Dupire

equation:

è(K)2

= 2C(T,

K) - (F -

K)+ (3.45)

T ?2C(T,K)

?K2

Using 3.36, we can calibrate the volatility function:

F (Y, óã-1

0 X)

è(K)

?(K) =

(3.46)

ó0P(X)

?Y

where X and Y are found from 3.35 as the solution to the ODE

system:

ó0 P

(X)

ã-1

?X P(X)

(3.47)

?K =

è(K)

X(K =

F) = Y (K

= F) = 0

The above ODE system can be solved for all strikes in one

sweep. However, typically, we prefer to calibrate directly to the observed

discrete quotes. This is done by solving the ODEs in 3.35 and 3.36 and

including the one-step finite difference adjustment 3.42:

?X ?K =

F (Y, óã-1

0 X)

(3.48)

ó0?(K)

P(X)ó0?(K)

è(K) =

F (Y,

óã-1

0 X)

X(K =

F) = Y (K

= F) = 0

32

5. CALIBRATING THE VOLATILITY FUNCTION

After solving numerically the above system, we can find the

option prices using the one-step finite difference algorithm in 3.44. On top of

this, we can use a nonlinear solver to calibrate the volatility function

ó(K) to observed

discrete option quotes. As we get all option prices in one sweep, we can

include CMS forwards and option quotes in the calibration without additional

computational costs.

CHAPTER 3. THE ZABR MODEL

Even though non-linear iteration is involved, this procedure

is very fast. Typically, we can calibrate a non-parametric volatility function

with 10 knot points to a given smile in roughly 50 iterations, which takes

approximately one millisecond of CPU time.

When it comes to outright pricing speed, the ZABR model is

capable of generating 100'000 smiles, each consisting of 256 strikes in

approximately seven seconds. It should be stressed that this includes both

numerical ODE and finite difference solutions. This is actually faster than

direct use of Hagan's SABR expansion, which takes 10 seconds for the same task.

The reason for this difference is mainly that one time-step finite difference

is faster at producing prices than the Black formula. An alternative to the

ZABR model for producing arbitrage-free options prices is the Fourier-based

models, found in [2] for example. For a displaced Heston model (see [1]),

numerical solution for 100'000 smiles consisting of 256 strikes via the fast

Fourier transform with the Black-Scholes formula used as a control variate

takes around 18 seconds (see [14]). It should be noted that this type of model

is considerably less flexible with respect to fitting discrete quotes and more

difficult to implement.

Though we generally use 3.48 in conjunction with a non-linear

solver for the calibration, the direct calibration methodology 3.47 is relevant

as it admits direct calibration of one ZABR model to another.

The stochastic process (Xt)t

has unit diffusion and thus, in the sense of the short-maturity

limit, is normally distributed. So it is natural to use a uniform spacing in X

and a non-uniform spacing in K. For this, the ODE system 3.48 can conveniently

be transformed to:

?Y

|

óã-1

0

|

?K =

|

F (Y, óã-1

0 X)

|

?K

|

ó0?(K)

|

|

|

|

?X =

(3.49)

F (Y, óã-1

0 X)

P (X)ó0?(K)

è(K) = F (Y,

óã-1

0 X)

Y (X = 0) = 0, K(X = 0) = F

In our implementation, we solve 3.49 on a uniform X grid to

generate and fix a non-uniform strike grid k0, k1, ... , kn

that is used in the numerical solution of 3.48 during

calibration and pricing. As a final remark, we note that ODEs in this section

typically will be solved at ó0 = 1.

|