Introduction

1 Negative density problem

The industry's standard SABR model (SABR stands for

Stochastic-Alpha-Beta-Rho) is a stochastic volatility model defined as

follows:

|

{ dFt =

ótFtâdWt1

dót =

áótdWt2

|

with d(W1, W2)t = ñdt

(1.1)

|

Where

· ñ E] - 1,1[ represents the link between the

forward and its volatility.

· â E [0, 1] is the elasticity of the forward's

backbone and is usually assumed constant, requiring then no calibration.

· á > 0 is the parameter that represents the

volatility of the volatility process.

Such a model presents a huge advantage because it takes into

account the randomness of the volatility parameter of a CEV process. It is then

crucial to be able to make a fair pricing under this model. A key is to rather

compute a lognormal implied volatility and then plug it into the Black-Scholes

formula in order to retrieve the price of the option.

In [26], Hagan et al. used singular perturbation

theory and found the following closed form formula for the implied volatility

in the SABR model

C z ~

óBS(K, F) = -

(FK)(1-â)/2 (1 +

(124)2 log2(F/K) +

(1-92ô4 log4(F/K) +

...) x(z)

ó0

- â)2á2

ñâíá2 - 3ñ2 2

C1 + [ (1

24(F/K)1-â +

4(FK)(1-â)/2 + 24 í ]

tex + ...

(1.2)

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

v1-2ñz+z2+z-ñ

where x(z) = log(

1-ñ ) and z =

í á(F

K)(1-â)/2

log(F/K)

This formula has the advantage to be fast to compute and,

more, is a closed formula. Generally, closed formulas are preferred in the

financial industry because of their rapidness and few need of resources.

The same formula could also be obtained applying infinite

dimensional analysis and Malliavin calculus. In [34], the author considered a

slightly more general model which converges towards the original SABR model and

used a large deviation approach based on the non degeneracy of Malliavin

covariance. The Dynamic SABR model is rather used for FX Option markets.

Malliavin calculus can be used in a more general scope : the

decomposition of a process into consecutive Wiener chaos yields an exact

solution to all stochastic differential equations, provided they really have a

unique one [...].

However, even though this formula apparently suits to our

needs, it produces arbitrage for sufficiently low rates and long maturities.

That arbitrage is also observable when â is set to low values.

In order to highlight the arbitrage, let's compute the

probability density function of the underlying:

Let pF denote the underlying probability density function

(which is then supposed to exist) and PF the corresponding repartition

function.

If we compute the price of a call option under the suitable

forward probability QT, we'd have:

Ct = EQT

((FT - K)+

) t

|

?Ct

|

|

?

|

(FT1{FT

>K} - K1{FT >K})

|

|

?K =

|

?K

|

4

1. NEGATIVE DENSITY PROBLEM

|

?2Ct

?K2

|

= -EQT

(1{FT >K}) t

= -QT

(FT > K) Z +8

= - pF

(y)dy

K

[ ~

?

= PF

(K) -

lim

y?+8 PF

(y)

?K

|

=

pF(K)

Where Ct denotes the price of a European call option of strike

K, written on the underlying

(Ft)t.

Thus, for a set of strikes, we first compute implied

volatilities with Hagan formula, then price a set of calls for each strike, and

finally compute a numerical derivative of the call price twice according to the

strike.

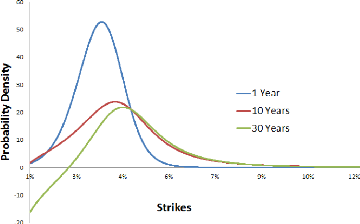

The result is the so-called probability density that we have

plotted in the following picture for several maturities.

1. NEGATIVE DENSITY PROBLEM

5

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR MODEL

Figure 1.1: F0 = 0.0325, ó0 = 0.087,

á = 0.47, â = 0.7, ñ = -0.48

Indeed, as we can see it on the above picture, we may have

some negative densities while increasing the option's maturity.

In order to improve the accuracy of the implied volatility

approximation, Henry Labordere used a heat kernel expansion on a Riemann

manifold endowed with an Abelian connection in [27] and found an approximation

for a more general scope of stochastic volatility models. Applying this

asymptotic development to SABR model yields:

óN(K,T) = S0(K)(1 + TS1(K)) (1.3)

where

1 (x l aauñsinh(d(x))

- 1 S0(x)2xF

S0(x) = S(x) log \Fl , 8 (x) _ 4

(/Eâ-1) d(x) 28(x)2 log

a(x)a(F)xâFâ

q

á(x1-â - F

1-â)

q(x) = 1 - â , a(x) = óô +

q(x)2 + 2ó0ñq(x)

S(x) = 1 log q(x)

u+ o(1 o-0+p +pp) a(x)

d(x) = argch -q(x)ñ -

ó0ñ2 + a(x)

á ó0(1 -

ñ2)

N/

~ = KF

The above implied volatility is a normal one, i.e. retrieved

from an inversion of the pricing formula in the Bachelier Model. For

comparison, we can approximately find back a Black-Scholes implied volatility

through the following equivalence:

|

óN =

|

2 ~S-K ~

3

V'

S - K log KS(log S-log K)

2 2

log S - log K óLN 1 -(log S

- log K)2 óLNT + O (T log(T)

(1.4)

|

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

In particular, uN ~ S-K

log S-log K óLN when T

? 0. We gave a detailed proof of this

equivalence in Appendix B.

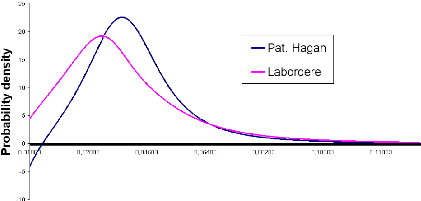

The following picture shows how Labordere's approximation

improves the accuracy of implied volatility asymptotics.

Figure 1.2: F0 = 0.0325, u0 =

0.087, á = 0.47, 9 = 0.7, p = -0.48, T = 15Y

For a 15 years expiry, the negative densities observed with

the Hagan expansion simply vanish. Despite that accuracy, for a sake of rigor,

we make some model parameters "worse" and track the behaviour of the

probability density. We know that a SABR model with parameter 9 = 1 and

constant volatility is identically a Black-Scholes model. We can therefore

reasonably expect the model to spread from the basic Black-Scholes when 9 ? 0.

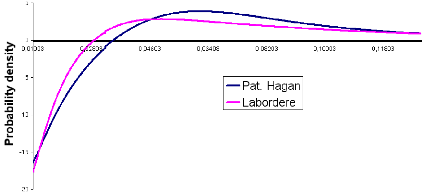

In the following picture, we choosed 9 = 0.4: let's see what happens.

6 1. NEGATIVE DENSITY PROBLEM

Figure 1.3: F0 = 0.0325, u0 =

0.087, á = 0.47, 9 = 0.4, p = -0.48, T = 15Y

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

As we can remark it, both Hagan and Labordere approximations

fail under extreme conditions. This is not really surprising since those

formulas are simply short-maturity expansion results. Hence, we address a more

qualitative question: which one practitioners prefer between fast to compute

approximations and heavy accurate calculus ?

The SABR model can be used to accurately fit the implied

volatility curves observed in the marketplace for any single exercise date.

More importantly, it predicts the correct dynamics of the implied volatility

curves. This makes the SABR model an effective means to manage smile risk in

markets where assets only have a single exercise date; these markets include

swaption ans caplet/floorlet markets.

2 Wings Control

We now address the issue of wings control. The price of

illiquid assets extremely depends on the shape of the implied volatility wings.

This is for example the case of the price of a CMS, specially due to the

computation of convexity adjustments. A high out-of-money implied volatility

yields high prices.

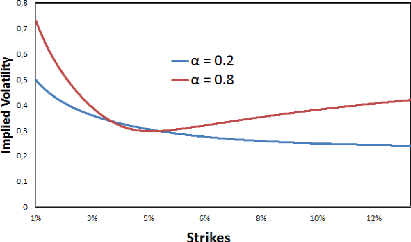

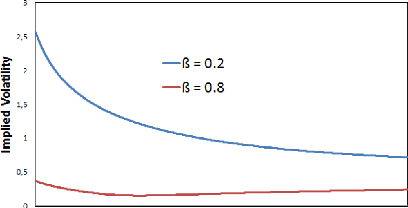

Here is for example how SABR parameters control the smile: The

lower we set á, the more we spread the smile...

Figure 1.4: F0 = 0.0325, u0 = 0.087, â = 0.7, p = -0.48,

T = 15Y

2. WINGS CONTROL 7

The higher we set â, the flatter the smile gets...

8 2. WINGS CONTROL

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

Figure 1.5: F0 = 0.0325, ó0 = 0.087,

á = 0.47, p = -0.48, T = 15Y

This is not surprising since for 9 = 1 and a constant volatility,

we face a Black-Scholes model and the latter produces nothing but a flat smile

!

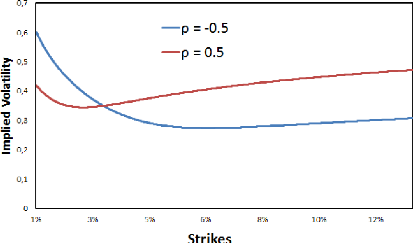

Increasing p rotates the smile in a counter-clockwise

direction.

Figure 1.6: F0 = 0.0325, ó0 = 0.087,

á = 0.47, 9 = 0.7, T = 15Y

We therefore focus on finding other model parameters, or at

least, adapted transformations of SABR model that may provide additional

control features.

2. WINGS CONTROL 9

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

Practitioners usually focus on changing the backbone shape of

SABR model, that is, the curve of ATM implied volatilities for different

strikes. In order to add more control parameters to the model, we can replace

the ?(F) = F'3 in the underlying SDE

by:

· ?(F) = F'3(F) with

â(F) = â0 + (â8 -

â0) (1 - e-F/Fmax)

where Fmax is typically much larger than the forward

rate F0. This gives a control on the upper-wing of

the smile.

· ?(F) = F'3 x

(F/F1)$1+1

(F/F2)$2+1. This

parametrisation allows us to control both lower

and upper wings.

· ?(F ) = F $1

1+F$1-$2 .

The later was suggested to me by the Fixed Income Derivatives

Quants of Crédit Agricole, and has the particularity to converge to

different SABR models. Indeed,

(1.5)

F '31

lim ?(F) = lim = F'32

F?+8

F?+8 1 +

F'31-'32

F '31

lim ?(F ) = lim = F '31

F ?0

?0

F 1 +

F'31-'32

This model tends then to a

SABR(â1) for low values of the forward and a

SABR(â2) for high forwards.

Despite those improving attempts, practitioners still face a

major problem: the above listed backbone transformations lead to a full control

of the smile, both liquid and illiquid regions. As highlighted in the

introduction, models are needed for illiquid assets; however, models should

first behave well for liquid assets for a sake of calibration. If one modifies

SABR's behaviour for the whole smile, one although fits illiquid region's

behaviour but also loses the liquid region's behaviour. This is therefore a

destruction of the cornerstone of our model.

What we need is another model that provides a real parameter

for wings control without changing the model's behaviour for liquid assets. We

will therefore propose a new model which is able to change wings without

(sensibly) touching the liquidity region.

|