RAPPORT DE STAGE

Diplôme escompté : Master

Probabilités et Finance

Entreprise d'accueil: Credit

Agricole CIB

Equipe GMD - Structures Rates

présenté et soutenu

par

Kaiza Amuh

le 19 Septembre 2014

Sujet du stage:

Etude du modèle ZABR et du Normal SABR

Maître de stage: Vincent Porte

Jury

M. Emmanuel Gobet, Examinateur

11

iii

Résumé

Dans ce document, nous exposons et résolvons deux

problèmes rencontrés par les praticiens avec l'utilisation du

modèle SABR : un problème de densité négative et un

problème de contrôle des ailes. Pour le premier problème,

nous proposons un modèle initialement développé par

Philippe Balland, le SABR Normal. Ce dernier permet d'effectuer du pricing sans

arbitrage mais présente deux inconvénients majeurs: un temps de

calcul excessif et le fait même de changer de modèle de base. Le

second problème quant-à lui nous amène à introduite

un nouveau modèle, extension du SABR, appelé modèle ZABR.

Celui-ci permet de contrôler les ailes du smile grâce à un

paramètre particulier mais présente aussi des arbitrages lorsque

l'on tente de faire du pricing directement avec les volatilités

implicites obtenues en les injectant dans les formules de pricing usuelles de

vanilles provenant des modèles de Black-Scholes et de Bachelier.

Néanmoins, nous exposons une technique de migration vers un

modèle à volatilité locale équivalent au ZABR,

essentiellement basée sur de la projection markovienne, qui permet de

faire un pricing plutôt "à la Dupire". Ceci permet effectivement

d'éviter tout arbitrage, de part la construction même des

modèles à volatilité locale. Nous exposons aussi deux

façons de calibrer le modèle ZABR, une première assez

simple mais peu précise, et une seconde plus fastidieuse

découlant du modèle à volatilité locale

équivalent au ZABR. Nous faisons ensuite une comparaison des

différents temps de calcul et montrons enfin comment le contrôle

des ailes de la volatilité implicite peut permettre une couverture plus

efficace contre les risques liés à chacun des paramètres

du modèle.

iv

Abstract

In this document, we highlight and solve two problems that are

encountered by practitioners with the use of the SABR model : a negative

density problem and a wings control problem. For the first one, we propose a

model initially developed by Philippe Balland, the Normal SABR. The latter

allows arbitrage-free pricing but presents two main drawbacks: an excessive

computation time and the change of the basis model. The second problem leads to

the introduction of a new model, an extension of SABR called ZABR. This one

offers a parameter that controls the wings of the smile but also yields

arbitrage while attempting a direct pricing with obtained implied volatility,

using usual vanilla pricing formulae from Black-Scholes and Bachelier model.

However, we expose a trick in order to migrate towards a local volatility model

equivalent to ZABR, mainly based on markovian projection, that allows a

"Dupire-like" pricing. Doing this completely eliminates arbitrage, because of

the very construction of local volatility models. We also present two different

ways to calibrate the ZABR model, a first one simple but inaccurate, and a

second one which is a direct consequence of the equivalent local volatility

modelling and a little bit harder to implement.

v

Acknowledgement

Foremost, I would like to express my sincere gratitude to my

advisor Vincent Porte and his colleague Harry Bensusan for their continuous

support for my internship, their motivation, enthusiasm, and immense knowledge.

Their guidance helped me each time of my research and during the drafting of my

report.

Beside my advisor, I would like to thank the whole Structured

Rates team of Crédit Agricole, specially Eric N., Thomas T. and Nicolas

B. for their availability and their insightful comments.

My sincere thanks also go to all my teachers, specially

Emmanuel Gobet, Nicole El Karoui and Vincent Lemaire for their art of

dispensing courses very clearly.

ACKNOWLEDGEMENT

? ACKNOWLEDGEMENT

vii

Contents

Résumé ..................................... iii

Abstract ..................................... iv

Acknowledgement ............................... v

Contents

..................................... vii

Introduction 1

1 Problems encountered with SABR model 3

1 Negative density problem ......................... 3

2 Wings Control ............................... 7

2 Normal SABR 11

1 Equivalent SABR local volatility ..................... 12

2 Asymptotic expansion with different base models ...........

13

3 Approximation for normal SABR .................... 15

4 Pricing formula with normal SABR as base ............... 16

3 The ZABR model 21

1 Short maturity expansion ........................ 22

2 Application to benchmark models .................... 24

2.1 Local Volatility model : case ~(ót) = 0 .............

24

2.2 Degeneracy into a SABR model : case c(ó) =

áó ....... 25

3 Expansion for the ZABR model ..................... 26

3.1 Implied volatility computation ..................

26

3.2 Graphical results ......................... 27

3.3 Fast calibration of the model's parameters

........... 29

4 Finite difference volatility ........................ 30

5 Calibrating the Volatility function .................... 32

Conclusion 35

Appendices 35

A Numerical pricing under Normal SABR model 37

1 Density for Normal SABR ........................ 37

2 Computation of functions Ö and ê ...................

38

viii CONTENTS

CONTENTS

B Equivalence between Normal and Log-normal Implied

Volatility 41

1 Another pricing formula for call options in the Bachelier model

. . . . 42

2 Asymptotics of the implied normal volatility ..............

45

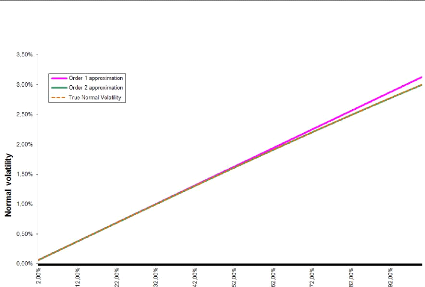

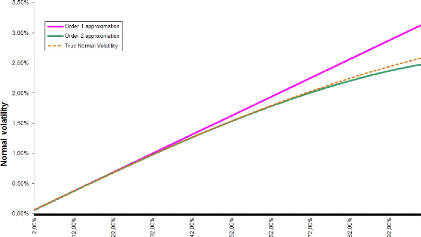

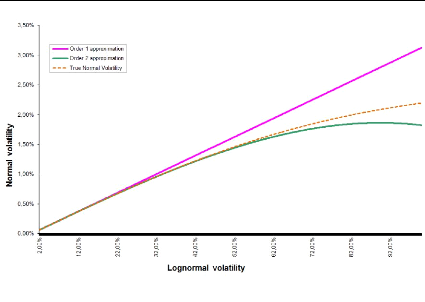

2.1 First and Second order expansion ................ 45

2.2 Accuracy of asymptotic expansions ............... 47

3 Comparing greeks and delta-hedged portfolios .............

49

Bibliography 53

1

Introduction

European options are often priced and hedged using Black's

model, or equivalently, the Black-Scholes model. In Black's model there is a

one-to-one relation between the price of a European option and the volatility

parameter óLN. Consequently, option prices are

often quoted by stating the implied volatility

óLN, the unique value of the volatility which

yields the option's dollar price when used in Black's model. In theory, the

volatility óLN in Black's model is a constant.

In practice, options with different strikes K require different

volatilities óLN to match their market prices.

Handling these market skews and smiles correctly is critical

to fixed income and foreign exchange desks, since these desks usually have

large exposure across a wide range of strikes. Yet the inherent contradiction

of using different volatilities for different options makes it difficult to

successfully manage these risks using Black's model.

The development of local volatility models by Dupire [11] and

Derman-Kani [10] was a major advance in handling smiles and skews. Local

volatility models are self-consistent, arbitrage-free, and can be calibrated to

precisely match observed market smiles ans skews. Currently these models are

the most popular way of managing smile and skew risk. However, the dynamic

behaviour of smiles ans skews predicted by local volatility models is exactly

the opposite of the behaviour observed in the marketplace: when the price of

the underlying asset decreases, local volatility models predict that the smile

shifts to higher prices. In reality, asset prices and market smile move in the

same direction. This contradiction between the model and the marketplace tends

to de-stabilize the delta and vega hedges derived from local volatility models,

and often these hedges perform worse than the naive Black-Scholes' hedges.

To resolve this problem, Hagan, Kumar, Lesniewski and Woodward

derived the SABR model, a stochastic volatility model in which the asset price

and the volatility are correlated. Singular perturbation techniques are used by

the former authors in order to obtain the prices of European options under the

SABR model, and from these prices they obtained a closed-form algebraic formula

for the implied volatility as a function of today's forward price and the

strike. This closed-form formula for the implied volatility allows the market

price and the market risks, including vanna and volga risks, to be obtained

immediately from Black's formula. It also provides good, and sometimes

spectacular, fits to the implied volatility curves observed in the marketplace.

More importantly, the formula shows that the SABR model captures the correct

dynamics of the smile, and thus yields stable hedges.

2 INTRODUCTION

INTRODUCTION

Why models ? Objectively, it is no good pricing a liquid

asset; getting its price directly from the market is largely sufficient. The

purpose of models is the pricing of illiquid or scarce assets, such as vanilla

options with extreme strikes. Thus, a usable model is one which doesn't break

down under extreme conditions. However, SABR model is rather used a reading

tool: market data is usually transformed into model parameters through

calibration to vanilla assets. Then, the obtained market data (stored as a

matrix of SABR parameters) is used for the calibration of more complicated

models designed for the pricing of exotic options.

However, since the financial crisis that began in 2007, the

american Federal Reserve conducts monetary policy to achieve maximum

employment, stable prices, and moderate long-term interest rates. In addition,

the Fed purchased large quantities of longer-term Treasury securities and

longer-term securities issued or guaranteed by government-sponsored agencies

such as Fannie, Mae or Freddie Mac. With such low rates, the SABR model,

endowed with Hagan approximation for implied volatility, yields arbitrage. This

arbitrage is observable through the negative density of the underlying

process.

Furthermore, Interest rate option desks typically need to

maintain very large amounts of interlinked volatility data. For each currency,

there might be 20 expiries and 20 tenors, that is, 400 volatility smiles.

Furthermore, the smiles might be linked across different currencies.

Interpolation of observed discrete quotes to a continuous curve is needed for

the pricing of general caps and swaptions. At the same time, extrapolation of

options quotes are needed for constant maturity swap (CMS) pricing. The SABR

model only has four parameters to handle the mentioned tasks, which is not

enough flexibility to exactly fit all option quotes.

In this document, we shall outline some problems encountered

with SABR model nowadays. We will first solve each problem, then highlight a

new model that solves both of our problems.

3

Chapter 1

Problems encountered with SABR

model

Introduction

1 Negative density problem

The industry's standard SABR model (SABR stands for

Stochastic-Alpha-Beta-Rho) is a stochastic volatility model defined as

follows:

|

{ dFt =

ótFtâdWt1

dót =

áótdWt2

|

with d(W1, W2)t = ñdt

(1.1)

|

Where

· ñ E] - 1,1[ represents the link between the

forward and its volatility.

· â E [0, 1] is the elasticity of the forward's

backbone and is usually assumed constant, requiring then no calibration.

· á > 0 is the parameter that represents the

volatility of the volatility process.

Such a model presents a huge advantage because it takes into

account the randomness of the volatility parameter of a CEV process. It is then

crucial to be able to make a fair pricing under this model. A key is to rather

compute a lognormal implied volatility and then plug it into the Black-Scholes

formula in order to retrieve the price of the option.

In [26], Hagan et al. used singular perturbation

theory and found the following closed form formula for the implied volatility

in the SABR model

C z ~

óBS(K, F) = -

(FK)(1-â)/2 (1 +

(124)2 log2(F/K) +

(1-92ô4 log4(F/K) +

...) x(z)

ó0

- â)2á2

ñâíá2 - 3ñ2 2

C1 + [ (1

24(F/K)1-â +

4(FK)(1-â)/2 + 24 í ]

tex + ...

(1.2)

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

v1-2ñz+z2+z-ñ

where x(z) = log(

1-ñ ) and z =

í á(F

K)(1-â)/2

log(F/K)

This formula has the advantage to be fast to compute and,

more, is a closed formula. Generally, closed formulas are preferred in the

financial industry because of their rapidness and few need of resources.

The same formula could also be obtained applying infinite

dimensional analysis and Malliavin calculus. In [34], the author considered a

slightly more general model which converges towards the original SABR model and

used a large deviation approach based on the non degeneracy of Malliavin

covariance. The Dynamic SABR model is rather used for FX Option markets.

Malliavin calculus can be used in a more general scope : the

decomposition of a process into consecutive Wiener chaos yields an exact

solution to all stochastic differential equations, provided they really have a

unique one [...].

However, even though this formula apparently suits to our

needs, it produces arbitrage for sufficiently low rates and long maturities.

That arbitrage is also observable when â is set to low values.

In order to highlight the arbitrage, let's compute the

probability density function of the underlying:

Let pF denote the underlying probability density function

(which is then supposed to exist) and PF the corresponding repartition

function.

If we compute the price of a call option under the suitable

forward probability QT, we'd have:

Ct = EQT

((FT - K)+

) t

|

?Ct

|

|

?

|

(FT1{FT

>K} - K1{FT >K})

|

|

?K =

|

?K

|

4

1. NEGATIVE DENSITY PROBLEM

|

?2Ct

?K2

|

= -EQT

(1{FT >K}) t

= -QT

(FT > K) Z +8

= - pF

(y)dy

K

[ ~

?

= PF

(K) -

lim

y?+8 PF

(y)

?K

|

=

pF(K)

Where Ct denotes the price of a European call option of strike

K, written on the underlying

(Ft)t.

Thus, for a set of strikes, we first compute implied

volatilities with Hagan formula, then price a set of calls for each strike, and

finally compute a numerical derivative of the call price twice according to the

strike.

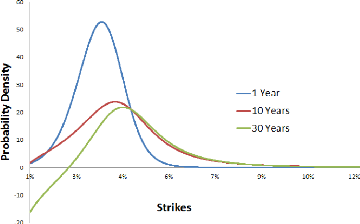

The result is the so-called probability density that we have

plotted in the following picture for several maturities.

1. NEGATIVE DENSITY PROBLEM

5

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR MODEL

Figure 1.1: F0 = 0.0325, ó0 = 0.087,

á = 0.47, â = 0.7, ñ = -0.48

Indeed, as we can see it on the above picture, we may have

some negative densities while increasing the option's maturity.

In order to improve the accuracy of the implied volatility

approximation, Henry Labordere used a heat kernel expansion on a Riemann

manifold endowed with an Abelian connection in [27] and found an approximation

for a more general scope of stochastic volatility models. Applying this

asymptotic development to SABR model yields:

óN(K,T) = S0(K)(1 + TS1(K)) (1.3)

where

1 (x l aauñsinh(d(x))

- 1 S0(x)2xF

S0(x) = S(x) log \Fl , 8 (x) _ 4

(/Eâ-1) d(x) 28(x)2 log

a(x)a(F)xâFâ

q

á(x1-â - F

1-â)

q(x) = 1 - â , a(x) = óô +

q(x)2 + 2ó0ñq(x)

S(x) = 1 log q(x)

u+ o(1 o-0+p +pp) a(x)

d(x) = argch -q(x)ñ -

ó0ñ2 + a(x)

á ó0(1 -

ñ2)

N/

~ = KF

The above implied volatility is a normal one, i.e. retrieved

from an inversion of the pricing formula in the Bachelier Model. For

comparison, we can approximately find back a Black-Scholes implied volatility

through the following equivalence:

|

óN =

|

2 ~S-K ~

3

V'

S - K log KS(log S-log K)

2 2

log S - log K óLN 1 -(log S

- log K)2 óLNT + O (T log(T)

(1.4)

|

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

In particular, uN ~ S-K

log S-log K óLN when T

? 0. We gave a detailed proof of this

equivalence in Appendix B.

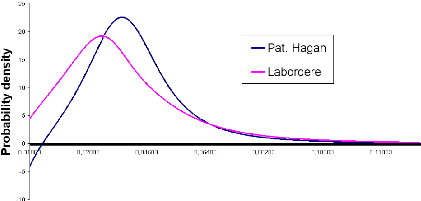

The following picture shows how Labordere's approximation

improves the accuracy of implied volatility asymptotics.

Figure 1.2: F0 = 0.0325, u0 =

0.087, á = 0.47, 9 = 0.7, p = -0.48, T = 15Y

For a 15 years expiry, the negative densities observed with

the Hagan expansion simply vanish. Despite that accuracy, for a sake of rigor,

we make some model parameters "worse" and track the behaviour of the

probability density. We know that a SABR model with parameter 9 = 1 and

constant volatility is identically a Black-Scholes model. We can therefore

reasonably expect the model to spread from the basic Black-Scholes when 9 ? 0.

In the following picture, we choosed 9 = 0.4: let's see what happens.

6 1. NEGATIVE DENSITY PROBLEM

Figure 1.3: F0 = 0.0325, u0 =

0.087, á = 0.47, 9 = 0.4, p = -0.48, T = 15Y

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

As we can remark it, both Hagan and Labordere approximations

fail under extreme conditions. This is not really surprising since those

formulas are simply short-maturity expansion results. Hence, we address a more

qualitative question: which one practitioners prefer between fast to compute

approximations and heavy accurate calculus ?

The SABR model can be used to accurately fit the implied

volatility curves observed in the marketplace for any single exercise date.

More importantly, it predicts the correct dynamics of the implied volatility

curves. This makes the SABR model an effective means to manage smile risk in

markets where assets only have a single exercise date; these markets include

swaption ans caplet/floorlet markets.

2 Wings Control

We now address the issue of wings control. The price of

illiquid assets extremely depends on the shape of the implied volatility wings.

This is for example the case of the price of a CMS, specially due to the

computation of convexity adjustments. A high out-of-money implied volatility

yields high prices.

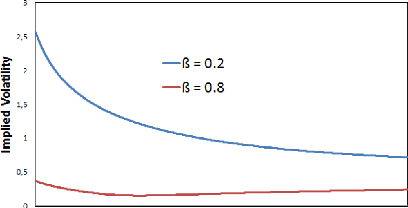

Here is for example how SABR parameters control the smile: The

lower we set á, the more we spread the smile...

Figure 1.4: F0 = 0.0325, u0 = 0.087, â = 0.7, p = -0.48,

T = 15Y

2. WINGS CONTROL 7

The higher we set â, the flatter the smile gets...

8 2. WINGS CONTROL

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

Figure 1.5: F0 = 0.0325, ó0 = 0.087,

á = 0.47, p = -0.48, T = 15Y

This is not surprising since for 9 = 1 and a constant volatility,

we face a Black-Scholes model and the latter produces nothing but a flat smile

!

Increasing p rotates the smile in a counter-clockwise

direction.

Figure 1.6: F0 = 0.0325, ó0 = 0.087,

á = 0.47, 9 = 0.7, T = 15Y

We therefore focus on finding other model parameters, or at

least, adapted transformations of SABR model that may provide additional

control features.

2. WINGS CONTROL 9

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR

MODEL

Practitioners usually focus on changing the backbone shape of

SABR model, that is, the curve of ATM implied volatilities for different

strikes. In order to add more control parameters to the model, we can replace

the ?(F) = F'3 in the underlying SDE

by:

· ?(F) = F'3(F) with

â(F) = â0 + (â8 -

â0) (1 - e-F/Fmax)

where Fmax is typically much larger than the forward

rate F0. This gives a control on the upper-wing of

the smile.

· ?(F) = F'3 x

(F/F1)$1+1

(F/F2)$2+1. This

parametrisation allows us to control both lower

and upper wings.

· ?(F ) = F $1

1+F$1-$2 .

The later was suggested to me by the Fixed Income Derivatives

Quants of Crédit Agricole, and has the particularity to converge to

different SABR models. Indeed,

(1.5)

F '31

lim ?(F) = lim = F'32

F?+8

F?+8 1 +

F'31-'32

F '31

lim ?(F ) = lim = F '31

F ?0

?0

F 1 +

F'31-'32

This model tends then to a

SABR(â1) for low values of the forward and a

SABR(â2) for high forwards.

Despite those improving attempts, practitioners still face a

major problem: the above listed backbone transformations lead to a full control

of the smile, both liquid and illiquid regions. As highlighted in the

introduction, models are needed for illiquid assets; however, models should

first behave well for liquid assets for a sake of calibration. If one modifies

SABR's behaviour for the whole smile, one although fits illiquid region's

behaviour but also loses the liquid region's behaviour. This is therefore a

destruction of the cornerstone of our model.

What we need is another model that provides a real parameter

for wings control without changing the model's behaviour for liquid assets. We

will therefore propose a new model which is able to change wings without

(sensibly) touching the liquidity region.

Conclusion

In addition to the negative density problem for very

in-the-money vanilla options, the SABR model lacks an additional control

parameter for very out-of-money options.

In the next chapter we will expose solutions for both of

these problems. We shall develop a Normal SABR model which solves the negative

density problem, and then study the ZABR model that controls the wings.

CHAPTER 1. PROBLEMS ENCOUNTERED WITH SABR MODEL

10 2. WINGS CONTROL

11

Chapter 2

Normal SABR

Introduction

As mentioned in the previous chapter, problems with the SABR

implementation through the Hagan expansion, such as the breakdown of the

expansion for high volatility and the possibility of negative probabilities for

very low strikes, did not matter at the time but now constitute a pressing

problem for the swap and rates options markets. In this chapter, we present a

solution to these problems based on Philippe Balland and Quan Tran

expansion (see [7])

The SABR backbone function ?(.) satisfies the usual

linear growth and Hölder continuity conditions to ensure that the SABR

stochastic differential equation admits a unique solution when appropriate

boundary conditions are specified.

In the original dynamics, ?(F) = Fâ

and the forward rate is assumed to be absorbed at zero. The

constant elasticity of variance (CEV) â is typically greater

than zero and smaller than one in interest rate applications. Negative rates

can be accommodated by assuming that (Ft +

Ä)t follows SABR dynamics. The model is very popular

among practitioners because it provides an intuitive parametrisation of

volatility smiles.

Unfortunately, the asymptotic formula derived by Hagan et

al. (2002) loses accuracy for long-dated expiries, especially when the CEV

exponent is close to zero or when the volatility-of-volatility is large. This

loss of accuracy is problematic from a practical point of view because the

density can become negative near the forward. New techniques have recently been

proposed to improve the accuracy in the original expansion of the implied

volatility. When the correlation is zero, Antonov & Spector [35] derived an

exact expression for the price of a vanilla option based on a double integral.

When the correlation is non-zero, the authors proposed using an approximately

equivalent SABR model with zero correlation.

Small CEV exponents are typically used to represent swaption

and caplet smiles at the long end of the curve, where the asymptotic formula

also breaks down. Based on this observation, we perform an asymptotic expansion

of the implied volatility corresponding to Normal SABR with absorption at zero,

instead of Black-Scholes. We find that the resulting approximation is more

accurate than the original SABR

and the measure d Q

dQ

Q except for the drift of ót:

ñt. We note that Jt has the same dynamics under Q and

12 1. EQUIVALENT SABR. LOCAL VOLATILITY

CHAPTER. 2. NOR.MAL SABR.

expansion and results in significant calculation time saving

when compared with solving the one-factor equivalent local volatility PDE.

1 Equivalent SABR local volatility

As explained in [15] and [25], we can obtain an accurate

approximation of the local volatility equivalent to SABR. The local volatility

g(t, K) for SABR is given by the following expression:

g(t, K)2 = ?(K)2E [ó2

t ä (Ft - K)] (2.1)

E [ä (Ft

- K)]

We denote the numerator of this expression (the so-called

local time) by Lt, and the denominator (the process's probability density) by

Dt. In this section, we derive an approximation for g(t, K) by simple

applications of Itô's lemma and Girsanov's theorem. We have included this

derivation as it will serve as the basis for our normal SABR expansion.

The SABR local time Lt is approximated by introducing the

process:

1 du

J(Ft,ót) =ót jFt

(u) (2.2)

and observing that:

Lt = ó0?(K)E [eáWt2-2tä(Jt)]

(2.3)

By applying Itô's lemma and performing the change of measure

dbQ

dQ =

eáWt2-21á2t,

we derive:

Lt = ó0?(K)

bE [ä(Jt)]

1 (2.4)

dJt = \/q(Jt)dcWt - 2

ÿ?(Ft)ótdt

where q(J) = 1 - 2ñáJ +

á2J2 and (Wt)t is a brownian motion

under bQ.

The SABR density Dt is similarly approximated by performing the

change of

-áWt2-21á2t :

E [ä(Jt)/ót]

D=

?(K)

=

measure dQ

dQ = e

E [ä(Jt)]eá2t

ó0?(K) (2.5)

p

dJt = q(Jt)d Wt + ÿq(Jt)dt - 21

ÿ?(Ft)ótdt We define the martingale:

dñt ÿq(Jt)

= d W (2.6)

ñt Nq(Jt)

CHAPTER 2. NORMAL SABR

1 !

Z t ÿd(Ju)

Xt = ñt exp ÿ?(Fu)óuq(Ju)du (2.7)

2 0

It follows that the SABR density satisfies:

i

E hq(J0)

eá2t

q(Jt)ä(Jt)

q(J0)ó0?(K)

Dt =

=

E hexp C2 R0

ÿ?(Fu)óuÿqqt du) /Jt =

0i

×

q(J0)ó0?(K)

(2.8)

E [ä(Jt)]

Since the volatility ót only appears in the drift

expression of Jt, we conclude that

bE[ä(Jt)]

E[ä(Jt)]

= 1 + O(t2). We consequently have:

g(t, K)2 = q(J0)ó20?(K)2e 2

(ñáÿ?(K)-21ÿ?(F0)Z0))t

+ O(t2) (2.9)

We finally derive the following first-order approximation in

time of the SABR local volatility:

p

g(K) = ó0?(K) 1 + 2ñáf(K) +

á2f(K)2,

Z K

1 du (2.10)

f(K) = ó0 ?(u)

F0

Using this equivalent local volatility, we obtain Hagan's first

order approximation for the implied volatility under SABR using standard

results for local volatility:

ln (K/F0) =(2.11)

R f(K;?) dí

0 v1+2ñáí+á2í2

ln (K/F0)

IV (K; ?, á, ñ) =

RK du

0 g(u)

The SABR local volatility behaves like a CEV dynamic near

zero. The absorption at zero is ignored in the above approximation because we

are using Black-Scholes as the base model for our implied volatility

calculation. Hence, we can expect to improve accuracy by choosing a base model

with a dynamic absorbed at zero.

2 Asymptotic expansion with different base models

Suppose that we can accurately integrate the following

instance of the SABR dynamics:

?

????

????

|

dFt = ót?base(Ft)dWt1

dót = áótdWt2

ót=0 = b0

|

(2.12)

|

|

where á and ñ are as in SABR. By matching the

first-order implied volatility approximations, that is, IV (K; ?base, á,

ñ) = IV (K; ?, á, ñ), we derive the base

2. ASYMPTOTIC EXPANSION WITH DIFFERENT BASE MODELS 13

CHAPTER 2. NORMAL SABR

implied volatility b0 so that the base model and

SABR share the same implied volatility to first order in time:

u

ó0(1 - r

JFK0

(Pbasde(u)

b0 = (2.13)

K1-â - F1-â

0

We consider two base candidates. Our first one is SABR with

shifted lognormal backbone:

?

base 1 (F) = pF + (1 - p)F0 (2.14)

This base

dynamics can be integrated by inverting a Laplace transform. Al-

though tractable, this requires a double integration.

Our second candidate is normal SABR with absorption at zero:

?base 2 (F) = lim â?0

|

Fâ = 1{F>0} (2.15)

|

|

We will see in the next section that SABR with a normal

backbone can be accurately approximated with limited calculation cost. We

observe that the initial normal volatility to use when approximating SABR with

this base model is as follows:

ó0(1 - â)(K

- F0)

b0 = (2.16)

K1-â - F

1-â

0

In the case where we attempt to approximate SABR with an

extended backbone ?(.) instead of a CEV backbone, then our formula for

b0 is generalised as follows:

ó0(K - F0)

(2.17)

b0 = rK du

JF0 ?(u)

As observed in [4], the SABR dynamics calibrated to swaption

smiles do not imply Constant Maturity Swap (CMS) levels consistent with the

market. Various methods have been proposed to address this issue. These

attempts to steepen the upper-strike wing while not affecting the liquid region

and the lower wing too much. They are based on modifying either the density,

conditionally to being in the upper-wing or directly the SABR dynamics.

We can gain control on the upper-wing steepness by assuming

the following backbone:

?(F) = Fâ(F)

F~F~, a~ (2.18)

â(F) = â0 +

(â8- â0)(1 - e- )

where Fmax is typically much larger than the forward

rate F0 in order to localise the effect of double beta to the

high-strike wing.

An alternative is to use the following double-beta backbone

to control both lower and upper wings:

?(F) = Fâ x

(F/F1)â1 + 1 (2.19)

(F/F2)â2 + 1

14 2. ASYMPTOTIC EXPANSION WITH DIFFERENT BASE MODELS

CHAPTER 2. NORMAL SABR

This parametrisation allows us to account for the extra risk

premium for high-strike volatilities and for the fact that traders typically

increase â when interest rates become very low.

3 Approximation for normal SABR

We obtain the following formula for a call option under the

normal SABR model by applying the Tanaka-Meyer formula to a call payout (see

[8]):

T

E[(FT - K)+] = (F0 -

K)+ + 2 J b20E

[u2tä(Ft - K)]

dt (2.20)

0

where ut = ót/b0 with

ó0 = b0. We observe that:

E [u2t

ä(Ft - K) = E

[utä(Xt)]

Xt = Ft - K (2.21)

ut

Finally, we denote by Pu the probability measure associated

with the Radon derivative ut = ót/b0 and

obtain the following formula for a call option under normal SABR:

T

E[(FT - K)+] = (F0 -

K)+ + 2 Z bEu

[ä(Xt)] dt (2.22)

The process (Xt)t satisfies:

p

dXt = b0 q(Xt)dW u

(2.23)

t?ô

where q(X) = 1 -

2ñáX +

á2X2,

á = á/b0 and r is the first

time F hits zero.

The stopping of the diffusion is a consequence of using SABR

with vanishing CEV coefficient. As explained in [25], accounting for this

stopping is important because the support of SABR is the positive half line and

our base model must share with SABR the same behaviour at zero otherwise our

lower-strike wing will be too steep. The importance of using interest rate

models with absorbing and reflecting boundaries is discussed in [12].

Ignoring the volatility-of-volatility, we approximate r

as the first time X hits its expected barrier level under Pu, at

which point Xô = Eu [-K/ut] = -K.

This approximation does not compromise the accuracy of our call price because

it only affects option prices with very low strikes. We can gain additional

control on the lower-wing steepness by assuming that X is absorbed at

the level Fmin - K where Fmin = (p -

1)/pF0 is negative, that is, 0 < p < 1.

We define the following process:

!

xt

It = I(Xt) = / du = 1

ln q(Xt) - ñ + áXt

(2.24)

o q(u) á 1 -

ñ

We can derive an approximation for the density of

(Xt)t at zero using the reflection principle for Brownian

motion (see Appendix A):

3. APPROXIMATION FOR NORMAL SABR 15

CHAPTER 2. NORMAL SABR

Eu [ä(Xt)] = q(X0)14

b0 v2ðt

~ ~

e- B2

b2 0t - e-

b2

× Ë(t) × 0t

16 4. PRICING FORMULA WITH NORMAL SABR AS BASE

I(F0 - K) 2I(Fmin - K) - I(F0 - K)

B = v2 , C = v2

~ ~

Ë(t) e- 8 á2t × Ö

1 t, I0

b0

~ 3 Z t ~ ~

du

Ö(t, z) = E exp 8á2(1 -

ñ2) /Wt = z

f(Wu)

0

1 ~(1 + ñ)2e-2áW + (1 -

ñ)2e2áW + 2(1 - ñ2)~ f(W)

= 4

|

(2.25)

|

|

Hence, we obtain the following approximation for call prices

under SABR:

2 C2

E[(FT - K)+] = (F0 - K)+ + q(F0 -

K)1/4b0 T1ef0 ,L e° (e b20t - e b20t) dt

2v2ð o t

ó0(K - F0) b0 = R K du

F0 ?(u)

ê(t, z) = -8á2 +

?tlnÖ(t, z) 1

(2.26)

The function ê(t, z) is independent of K and only

depends on the SABR parameters á and ñ.

~ 1 ~

1 3 1

2 2 2

(2.27)

We have the following first-order approximation:

Ö(t, z) = exp

[-18á2t

+ 16á2(1 - ñ2) C f(0) +

f(z)/

t]

+ O(t2)

We can estimate ê(t, z), Ö(t, z) more accurately

without any major increase in calculation time. First, we pre-compute by

forward induction Ö (Ti,îjvTi) on a fixed-time grid {Ti}i<N and

an N(0, 1)-mesh {îj}j<M as explained in Appendix A.

~ ~

Finally, we approximate ê s, I0 by a constant

êi over each interval (Ti-1, Ti): b0

êi 1 2

= -8á +

|

h ~ i h ~ i

ln Ö Ti, I0 - ln Ö Ti-1, I0

b0 b0

|

(2.28)

|

|

|

where Ö(Tk, z) is obtained by cubic spline interpolation of

{Ö (Tk, îjvTk) : j = 0,..., M - 1}.

4 Pricing formula with normal SABR as base

From our previous calculations, we derive the following

approximation for the price of an option on a SABR underlying (Ft)t

using normal SABR as a base for our asymptotic expansion:

CHAPTER 2. NORMAL SABR

N

E[(FT-K + = (F0 - K)#177; + q(F0 - K)1/4b

é (âa2+~z)Ti 1~ (T Io × J

) ) 2v2ð o ( Z-1 bo / i

i=1 \

Ji =

|

1 Z Ti 1 vt

2 Ti-1

|

~ ~

e- B2

eêit b2 0t - e- C2

b2 0t dt

|

|

(2.29)

The above integrals Ji are calculated using formula (7.4.33) in

[20]:

I

~ ~v ~ ~~

+ e-2|ë|v-ê -êT - |ë|

erf v + 1

T

T r2

~teêu-û2 du

=Le2|ë|v-ê (erf (-êT + - T(2.30)

where

Z x ~ v ~

2

erf(x) = ?ð e-t2dt = 2N x 2 - 1

(2.31)

0

and v-ê is either imaginary or real. The error function

with complex argument can be estimated using the infinite series approximation

of Abramowitz & Stegun (see formula 7.1.29 in [20]) as suggested in [8]:

+8

e

x2 2

-

n2

-

n2 + 4x2 (fn(x, y) + ign(x, y))

e

4

X

e-x2

erf(x + iy) = erf(x) + 2ðx (1 - cos 2xy +

isin2xy) + ð

n=1

fn(x, y) = 2x - 2x cosh(ny) cos(2xy) + n sinh(ny)

sin(2xy) gn(x, y) = 2x cosh(ny) sin(2xy) + n sinh(ny) cos(2xy)

(2.32)

In practical application, it is sufficient to include the first

10 terms to ensure a very good accuracy. From the above expression, we can

calculate analytical expressions for the cumulative and density functions.

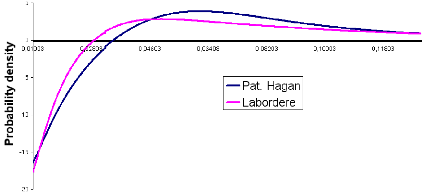

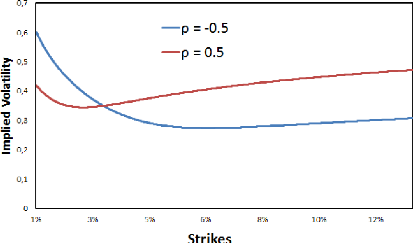

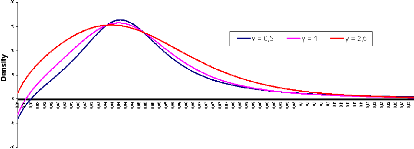

In the following picture, we have plotted the implied density

obtained when pricing under Normal SABR. For a sake of comparison, we have also

plotted densities obtained from Hagan and Labordere approximations.

4. PRICING FORMULA WITH NORMAL SABR AS BASE 17

18 4. PRICING FORMULA WITH NORMAL SABR AS

BASE

CHAPTER 2. NORMAL SABR

Figure 2.1: F0 = 0.0325, u0 = 0.087, á

= 0.47, 9 = 0.4, p = -0.48, 'y = 1, T = 15Y

Indeed, the negative density problem is solved, even for

extreme model parameters.

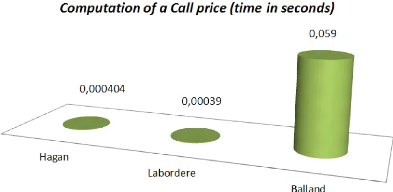

The main drawback is a high computation time, mainly due to

the computation of transition probabilities. The latter is however performed

once for all strikes.

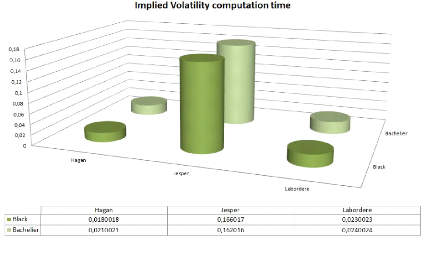

Figure 2.2: F0 = 0.0325, u0 = 0.087, á

= 0.47, 9 = 0.4, p = -0.48, 'y = 1, T = 15Y

The above picture shows how much time it actually takes to

price under Normal SABR. This pricing takes 200 times more time than the Hagan

and Labordere approximations but that is the price we pay in order to eliminate

arbitrage.

4. PRICING FORMULA WITH NORMAL SABR AS BASE 19

CHAPTER 2. NORMAL SABR

Conclusion

The Normal SABR model solves the negative density problem

observed with the Hagan approximation. However, it introduces another issue,

the excessive computation time for pricing. Indeed, practitioners prefer closed

form formulas for pricing (such as Black-Scholes) and changing the whole

pricing kernel can quickly become a trip to Pandemonium. Moreover, solving only

the negative density problem leaves untouched the wings control one. In the

next chapter, we will introduce a wings controlling model and show how to

compute arbitrage-free prices.

CHAPTER 2. NORMAL SABR

20 4. PRICING FORMULA WITH NORMAL SABR AS BASE

Chapter 3

The ZABR model

Introduction

Interest rate option desks typically need to maintain very

large amounts of inter-linked volatility data. For each currency, there might

be 20 expiries and 20 tenors, that is, 400 volatility smiles. Furthermore, the

smiles might be linked across different currencies. Interpolation of observed

discrete quotes to a continuous curve is needed for the pricing of general caps

and swaptions. At the same time, extrapolation of options quotes is needed for

constant maturity swap (CMS) pricing. For these purposes, the industry uses to

approximate SABR model using expansions as in [26]. The implied volatility

expansions have the advantages that they are fast and simple to code but as

mentioned in the previous chapter, these expansions are not very accurate,

particularly not for long maturities nor low strikes.

With the low rates we have today, this problem is more acute

than ever. Furthermore, the SABR model only has four parameters to handle the

above-mentioned tasks, which is not enough flexibility to exactly fit all

option quotes. In this chapter, we extend the stochastic volatility process to

include a constant elasticity of variance (CEV) skew on the volatility of

volatility. The CEV volatility process allows us to have more explicit control

of the extrapolated high-strike volatilities, which in turn allows better

control of CMS prices. Further, we will use a non-parametric volatility

function for the spot process, which enables us to have an exact fit to all the

observed quotes and gives us the ability to model negative option strikes.

In this chapter, instead of buying into heat kernel

expansions, we use a short-maturity expansion for the implied volatility of the

option. The short maturity expansion also yields results for the short-maturity

limit of the Dupire forward volatility ( [11]), that is, the short-maturity

limit of the conditional expected local variance

V(F)2 = uim

t?0

|

|

]

dhF it

dt /Ft = F (3.1)

|

|

21

We provide two procedures to directly calibrate the model to

observed CMS prices: an implicit method that works by iteration of the

connection from parameters to price in a non-linear solver (see Section 3.3),

and a direct method that infers the

22 1. SHORT MATURITY EXPANSION

CHAPTER 3. THE ZABR MODEL

parameters of the model from an arbitrage-free continuous

curve of option prices (see Section 5).

1 Short maturity expansion

We consider the slightly more general model:

( dFt =

ót?(Ft)dWt1

with d(W1,

W2)t = ñdt (3.2)

dót =

c(ót)dWt2

The non-parametric form of the volatility function ?(.)

allows us to have a perfect fit to any discrete or continuous set of observed

arbitrage-free options quotes. We can write the price of an European call

option on a fixing FT as:

Ct = E [(FT -

K)+ /Ft] = g (t, Ft, v(t))

where v(t) is the implied normal volatility and g is the

normal (Bachelier) option pricing formula:

g(ô, x, v) = (x - K)JV x - K +

vôfv.Vô)z

Cv~K) , ô = T

- t (3.3)

Applying Itô's lemma to 3.3 yields:

dCt = -gôdt +

gxdFt +1

gxxd(F)t + gvdvt +

2gvvd(v)t +

gxvd(F, v)t (3.4)

where subscripts

denote partial derivatives. In the following, we assume vt > 0

Define Xt = Ft-K. Using Itô's

lemma yields:

vt

1

dXt =

vt

|

dFt -Ft 2Kdvt -

2d(F,v)t + Ft

-3Kd(v)t

vt vt

vt

|

|

(3.5)

(3.6)

1

= (dFt - Xtdvt) +

O(dt)

vt

d(X)t = v2

(d(F)t + Xt d(v)t -

2Xtd(F, v)t)

t

2

gxx

gxx

The normal option pricing function, g, has the following

properties:

gv = vôgxx

Cx - K

gvv = v

x - K

v

gxv =

1

0 = -gô +

2v2gxx

Using the above properties, we can transform equation 3.4

into:

1. SHORT MATURITY EXPANSION

23

CHAPTER 3. THE ZABR MODEL

1 ]

dCt - gxdFt = 2gxx [v2

t (d(X)t - dt) + 2ôvdvt (3.7)

The left

hand side of 3.7 is the change in value of a hedged portfolio. Taking

conditional expectations yields:

1

0 = 2gxxv2

1 t E (d(X)t - dt/Ft) +

gxxôvtE (dvt/Ft) (3.8)

For small

maturities, ô -+ 0, and we have

2gxxv2t E

(d(X)t - dt/Ft) 0 (3.9)

As gxx > 0 for v > 0, and for any diffusion, E

(d(X)t - dt/Ft) = 0 is equivalent to

d(X)t = dt, we obtain the arbitrage condition:

Note that this is a diffusion condition rather than the drift

condition that we normally see in financial mathematics. As the function X

H X(f, ó) must be a function of the state variables

(Ft, ót), the diffusion condition 3.10 leads to the

differential equation:

1 = (XfdFt +

Xódót)2

dt (3.11)

=

ó2t

?(Ft)2X2f

+

E(ót)2X2ó

+

2ñót?(Ft)c(ót)XfXó

Given the function ?(.), we need to solve this non-linear

first order differential equation subject to the boundary condition X(f = K,

ó) = 0. Once we have the solution X(f, ó), we can find the

implied volatility as:

F - K

=

v(3.12) X(F,ó0)

We note that the error of the implied volatility is

O(ô). The result implies that for any choice of ?(F), any function X =

X(f, ó) that satisfies d(X)t = dt leads to an implied

volatility given by v = (F - K)/X.

We could have chosen to derive the short-maturity expansion

in implied Black-Scholes (lognormal) volatility v instead of implied normal

volatility. Instead of X,

we should then have chosen the transformation

. The diffusion condi-

X = ln(F/K)

v

tion would be the same so X = X. This relates

short-maturity implied lognormal and normal volatilities, as in Appendix B

(first order equivalence), by the simple relationship:

v ln(F/K)

= (3.13)

v F - K

The expansion results that we present in the following can

easily be switched between use in implied normal and implied lognormal

volatility form by use of equivalence formulae.

CHAPTER 3. THE ZABR MODEL

2 Application to benchmark models

Before we address the very ZABR model results, we first of all

apply the short-maturity expansions from the previous section to well known

models. Those models can be retrieved while varying the function c(.).

2.1 Local Volatility model : case ~(ót)

= 0

In this case, ót = 1, and the differential equation 3.11

reduces to ordinary differential equation (ODE):

X2f?(F)2 = 1 (3.14)

Using the boundary condition X(F = K) = 0, we find the

solution:

Z F 1

X = ?(u)

K

|

du (3.15)

|

|

v = v =

with corresponding implied normal and Black volatilities given

by:

F - K

f F K ?(u)du

1

(3.16)

ln(F/K)

f F K ?(u)du

1

These results appear in many places, for example in [19]. We

note that 3.15 implies the following relationship between X and the forward

volatility:

Suppose we have X from a stochastic volatility model like

3.2, that is, given as the solution to 3.11 for some volatility functions ?(F),

c(ó) and correlation ñ. Let's define the function V by:

~?X ~-1

V(K) = - (3.18)

?K

and consider the deterministic local volatility model:

dFt = V(Ft)dWt (3.19)

It now follows that:

XLV =

|

Z S K

|

V(u)-1du = X (3.20)

|

|

24 2. APPLICATION TO BENCHMARK MODELS

So the stochastic volatility model 3.2 and the local

volatility model 3.19 will produce the same short-maturity expansion option

prices.

The above is a short-maturity limit version of the general

result by Gyongy and Dupire (see [13] and [6]), that the model:

CHAPTER 3. THE ZABR MODEL

dFt = a(t, Ft)dWt , F0 = F0 (3.21)

produces the same option prices as the model 3.2 if a(., .) is

chosen to be:

~dhF it ~

a(t, k)2 = E dt /Ft = k (3.22)

We conclude that in the short-maturity limit, the conditional

expected variance of the underlying is related to the transformed variable X

by:

-2

V(F)2 t~o E

[dhdtit/Ft =

F~ = (?K\ (3.23)

This constitutes a way of relating the two dimensional

pricing problem 3.2 to the simpler one-dimensional pricing problem 3.19. We

will make use of this relationship to generate arbitrage-free prices later.

2.2 Degeneracy into a SABR model : case €(ó) =

áó

Here, we will solve the diffusion condition for the lognormal

volatility process case. First, we use the transformation:

Y :=

LF

?(u)

1

du (3.24)

and we get:

dY = dWt1 -

áYdWt2 + O(dt)

= [1 + á2Y 2 -

2ñáY ]1/2 dBt + O(dt) (3.25)

= J(Y )dBt +

O(dt)

where (Bt)t is a new Brownian motion. As Y (F = K)

= 0, we can now get X by normalising the volatility of Y , hence:

fY X=J J(u)-1du

= 1ln(J(Y ) - ñ + áY\

o 1--p

v =

|

F - K

|

|

(3.26)

|

|

|

|

ln(F/K) X

|

|

|

For the CEV case ?(F) = ?0Fâ, we have:

1

Y = ó0?0

F1-â - K1-â

(3.27)

1 -â

These formulas are basically the result of Hagan et al

[26]. This is extended to include maturity and various refinements for the

CEV case. The Hagan result does,

2. APPLICATION TO BENCHMARK MODELS 25

CHAPTER. 3. THE ZABR. MODEL

however, produce implied volatility smiles that are prima

facie identical to those produced with formula 3.26.

We can also use 3.26 to retrieve the forward volatility

function of SABR from:

?X ?K =

|

?X

?Y

|

?Y ?K =

|

J(Y ) Ç0?(K))

(3.28)

|

|

26 3. EXPANSION FOR. THE ZABR. MODEL

Hence:

V(K) = J(Y

)ó0?(K) (3.29)

This result could also be deduced from results in [25].

3 Expansion for the ZABR model

We now consider the extended SABR model where the volatility

process is of the CEV type: c(ó) =

áó,y

3.1 Implied volatility computation

Once again, we introduce the intermediate variable:

F

Y = ó,y-2 1

x ?(u)

|

du (3.30)

|

|

For which Itô expansion yields:

dY = ó,y-1 (dW t 1 +

(ã - 2)áYdW 2 +

O(dt) (3.31)

0 t

Let's define X = ó1-,y

0 f(Y ), for some function

f(.), and we get:

dX =ó1-,y

0 f'(Y)dY + (1 -

ã)áf(Y)dWt2

+ O(dt)

[ ] t + O(dt) (3.32)

= f'(Y)dW t 1 +

(ã - 2)áY f'(Y) +

(1 - ã)áf(Y) dW 2

We conclude that the diffusion condition 3.9 is satisfied if f

solves the ODE:

1 = A(Y )f'(Y

)2 + B(Y )f(Y

)f'(Y ) + Cf(Y

)2

A(Y ) = 1 + (ã -

2)2á2Y 2 + 2ñ(ã -

2)áY

B(Y ) = 2ñ(1 -

ã)á + 2(1 - ã)(ã -

2)á2Y

C = (1 -

ã)2á2

f(0) = 0

The above ODE can be rearranged as:

|

(3.33)

|

|

f'(Y ) =

Y -B(Y )f + B(Y

)2

f2 - 4A(Y )(Cf2 - 1))

F(Y, f) (3.34)

2

CHAPTER 3. THE ZABR MODEL

which can be solved by standard techniques for integration of

ODEs. We can evaluate the solution for all strikes one sweep by:

= -ó0

?(K)-1

ã-2

?Y ?K

?K =

ó1-ã

0

=

-ó-1

0 F (Y,

óã-1

0 X)

?(K)-1

(3.35)

?X

?f ?K

X(K =

F) = Y (K

= F) = 0

Again, we can find the forward volatility function as:

/?X\-1=

ó0?(K)f'(Y

)-1 =

ó0?(K)F

(Y, óã-1

0 X)-1 (3.36)

V(K) = -

?K

Equations 3.35 and 3.36 will typically be evaluated at

ó0 = 1. Rather than numerically solving the

two ODEs in 3.35 separately, we favour solving 3.33 as a joint system.

It should here be noted that the ODE representation 3.33 has

previously been obtained by Balland (see [24]) for the lognormal case. Further,

it should be noted that Henry-Labordere has a treatment of the general non-CEV

case (see [27]).

3.2 Graphical results

In order to solve the ODE 3.33, we have the choice between a

classical Euler scheme and an 4th order

Runge Kutta relaxation. The former is faster but deliver unstable solutions,

whereas the latter, even though slower, yields excellent solutions in terms of

stability. We therefore chose a RK4 method to solve the ODE. After solving it,

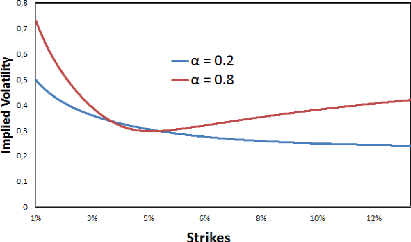

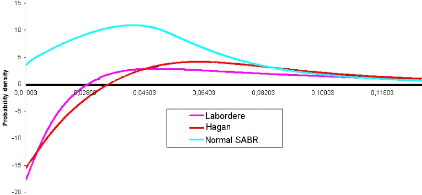

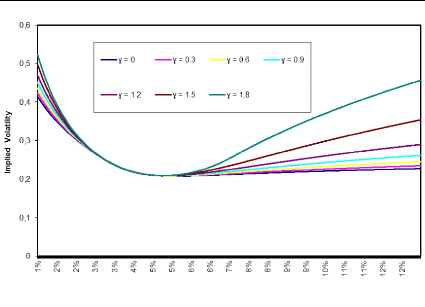

we find a value for X which leads to the implied volatility. The following

picture plots obtained lognormal implied volatilities for different values of

ã.

3. EXPANSION FOR THE ZABR MODEL 27

28 3. EXPANSION FOR THE ZABR MODEL

CHAPTER 3. THE ZABR MODEL

Figure 3.1: F0 = 0.0325, u0 = 0.087, á

= 0.47, 9 = 0.7, p = -0.48, T = 15Y

Increasing 'y lifts the wings of the implied volatility smile

whereas the smile for strikes close to at-the-money are visibly unaffected.

This can in turn be used to give us better control over the CMS prices.

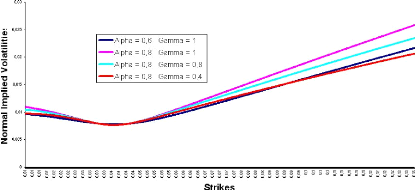

Here is an illustration of how to control CMS prices through

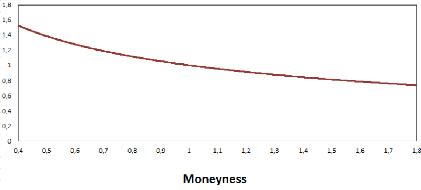

the wings. When we increase á, we lift the wings and therefore raise the

CMS prices. We can then decrease 'y and therefore lower back the wings and the

CMS prices, as we can see it through the following illustration.

Figure 3.2: F0 = 0.0325, u0 = 0.087, 9 =

0.7, p = -0.48, T = 15Y

In terms of computation time, we have plotted the time it takes

to compute an implied volatility in a ZABR('y = 1) and compared it with the

time taken by Hagan

CHAPTER. 3. THE ZABR. MODEL

and Labordere approximations.

Figure 3.3: F0 = 0.0325, ó0 = 0.087, á = 0.47,

â = 0.7, ñ = -0.48, ã = 1, T = 15Y

It takes 10 times more time for computing implied volatility

under the ZABR model, in comparison with Hagan and Labordere approximations.

However, this is just the price to pay for gaining control of the wings !

3.3 Fast calibration of the model's parameters

For quick identification of the model parameters, the

following second-order Taylor expansion is convenient:

v(K) = v(F) + v,(F)(K - F) +

12v,,(F)(K - F)2 + O ((K -

F)3) v(F) = ó0?(F)

1 v,(F) =2

hó0-1 ñá + ó0? (F)i

v,,(F) 6ó0?(F)hó02(7-1) ((-5 +

2ã)ñ2 + 2) + óô

(2?(F)?,,(F) - ?,(F)2)i

(3.37)

Let's consider a CEV case where we set ?(K) = ù (K-F

)â

have:

(F -F )â and ó0 = 1. Then we

v(F) = ù

v,(F) = 21 [~

ñá + Fùâ - F

~~(-5 + 2ã)ñ2 + 2 á2 +

ù2â(â - 2) ~

v,,(F) = 1

6ù (F - F)2

3. EXPANSION FOR. THE ZABR. MODEL

|

(3.38)

29

|

|

CHAPTER 3. THE ZABR MODEL

|

\ v(K1), ...,

|

|

For a given set of discrete quotes

|

|

|

be used for regressing the triple v(F), v'(F),

v"(F). One can in turn solve 3.38 to get parameters estimates for â,

ñ, á.

4 Finite difference volatility

Using the implied volatility coming from the short-maturity

expansions 3.16, 3.26 and 3.35, directly for pricing using 3.3 will not give

arbitrage-free options prices. Our short-maturity expansions suffer from the

same problem of potential negative implied densities for low strikes as the

original Hagan expansion. The ZABR model contains an enhanced feature that can

help us avoid negative density problems. Let's plot the implied probability

density function for extreme model parameters and see how it reacts to the

changes in ã values.

Figure 3.4: F0 = 0.0325, ó0 = 0.087,

á = 0.47, â = 0.7, ñ = -0.48, T = 15Y

If we keep increasing ã, the density tends to be more and

more positive... Anyway, this way of skipping negative densities doesn't give

us enough flexibility in the use of the ZABR model.

In order to definitely avoid this problem, we will instead

use the forward volatilities derived in 3.29 and 3.36 as the basis for our

pricing.

The forward volatility V(K) can be used to generate

option prices as the solution of the Dupire forward PDE (see [5]).

?C(T,K)

?T =

?

?

?

2V(K)2 ?2

?(T2,K)

C(0, K) = (F - K)+

(3.39)

30 4. FINITE DIFFERENCE VOLATILITY

The usual way of solving this numerically is to set up a time

discretisation with multiple time steps and then use a finite difference

solver. However, to gain speed, we will instead use the single time step

implicit finite difference approach introduced in [15]. Here we need to solve

the ODE:

C(T, K) - 2T

è(K)2?2C(T, K)

1 ?K2 = (F - K)+ (3.40)

4. FINITE DIFFERENCE VOLATILITY 31

CHAPTER 3. THE ZABR MODEL

Z0

It is shown in [15] that this approach generates a set of

arbitrage-free call prices for any choice of è. It is also shown that

the one-step finite difference price is the Laplace transform of the solution

to 3.39. The Laplace transform of the Gaussian distribution is the Laplace

distribution:

8 t/T 1 F - Kl T

IF K|

vt

vt

dt = e 2v2 (3.41)

v

v

2v2

which is peaked at K = F. Therefore if we choose è =

V, we will also get a peak in the densities.

Instead, we will find an adjustment for the forward

volatility function based on our expansion results. As option prices generated

by 3.39 and 3.40 should be the

same, we can substitute ?2C(T,K) ?C(T,K)

?K2 = 2 ?T from 3.39 into 3.40 and rearrange to

V2

find:

è(K)2 = V(K)2 C(T, K) - (F -

K)+

T ?C(T,K)

?T

V(K)2g(T, F,v) - (Fv)

- K)+

T ?g(T

?T

|

(3.42)

|

|

~ ~

1 - î Ö(-î)

= 2V(K)2 , with î= v X

ö(î) T

= V(K)2P(X)2

where the second (approximated) equality involves the

approximation of the option prices by our expansion result.

The function P(X)2 can conveniently be

approximated with a third or fifth order polynomial. Specially:

Ö(X) X

ö(X) anun, u = 1 (3.43) 1 + pX

n

where the constants p, a1, a2, ... can be found in (26.2.16)

and (26.2.17) of [20]. The finite difference discretisation of 3.40 is:

~ ~

1- 1 2Tè(K)2 ?2 C(T, K) = (F - K)+

(3.44)

?K2

This equation can be represented as a tridiagonal matrix

equation on the grid K0, K1, ..., Kn, which in turn can be solved

for C(T, Ki) in linear CPU time using the tridiag() algorithm in [31].

As an alternative to the finite difference solution 3.44, one

could use the exact solution methodology for ODEs of the type 3.40 described in

[3]. However, for this methodology to be computationally effective, the forward

volatility function è(K) needs to be well approximated by a piecewise

linear function with few knot points over the full domain of the solution. This

is generally not the case here. We have therefore chosen to base our solution

on 3.44.

We can see that the finite difference generated option prices

have corresponding implied densities that are positive, that is, arbitrage is

precluded. We can also

CHAPTER 3. THE ZABR MODEL

see that using our forward volatility result,

V(K), directly in the

single time step finite difference solver produces a density that is peaked

around at-the-money. This, however, is eliminated when using the adjusted

forward volatility

è(K).

5 Calibrating the Volatility function

We first consider the case where we have a continuous curve

of arbitrage-free option prices. This could for example be produced by

Andreasen & Huge interpolation scheme ( [15]) or come from another ZABR

model. We can calculate the forward volatility function by the discrete Dupire

equation:

è(K)2

= 2C(T,

K) - (F -

K)+ (3.45)

T ?2C(T,K)

?K2

Using 3.36, we can calibrate the volatility function:

F (Y, óã-1

0 X)

è(K)

?(K) =

(3.46)

ó0P(X)

?Y

where X and Y are found from 3.35 as the solution to the ODE

system:

ó0 P

(X)

ã-1

?X P(X)

(3.47)

?K =

è(K)

X(K =

F) = Y (K

= F) = 0

The above ODE system can be solved for all strikes in one

sweep. However, typically, we prefer to calibrate directly to the observed

discrete quotes. This is done by solving the ODEs in 3.35 and 3.36 and

including the one-step finite difference adjustment 3.42:

?X ?K =

F (Y, óã-1

0 X)

(3.48)

ó0?(K)

P(X)ó0?(K)

è(K) =

F (Y,

óã-1

0 X)

X(K =

F) = Y (K

= F) = 0

32

5. CALIBRATING THE VOLATILITY FUNCTION

After solving numerically the above system, we can find the

option prices using the one-step finite difference algorithm in 3.44. On top of

this, we can use a nonlinear solver to calibrate the volatility function

ó(K) to observed

discrete option quotes. As we get all option prices in one sweep, we can

include CMS forwards and option quotes in the calibration without additional

computational costs.

CHAPTER 3. THE ZABR MODEL

Even though non-linear iteration is involved, this procedure

is very fast. Typically, we can calibrate a non-parametric volatility function

with 10 knot points to a given smile in roughly 50 iterations, which takes

approximately one millisecond of CPU time.

When it comes to outright pricing speed, the ZABR model is

capable of generating 100'000 smiles, each consisting of 256 strikes in

approximately seven seconds. It should be stressed that this includes both

numerical ODE and finite difference solutions. This is actually faster than

direct use of Hagan's SABR expansion, which takes 10 seconds for the same task.

The reason for this difference is mainly that one time-step finite difference

is faster at producing prices than the Black formula. An alternative to the

ZABR model for producing arbitrage-free options prices is the Fourier-based

models, found in [2] for example. For a displaced Heston model (see [1]),

numerical solution for 100'000 smiles consisting of 256 strikes via the fast

Fourier transform with the Black-Scholes formula used as a control variate

takes around 18 seconds (see [14]). It should be noted that this type of model

is considerably less flexible with respect to fitting discrete quotes and more

difficult to implement.

Though we generally use 3.48 in conjunction with a non-linear

solver for the calibration, the direct calibration methodology 3.47 is relevant

as it admits direct calibration of one ZABR model to another.

The stochastic process (Xt)t

has unit diffusion and thus, in the sense of the short-maturity

limit, is normally distributed. So it is natural to use a uniform spacing in X

and a non-uniform spacing in K. For this, the ODE system 3.48 can conveniently

be transformed to:

?Y

|

óã-1

0

|

?K =

|

F (Y, óã-1

0 X)

|

?K

|

ó0?(K)

|

|

|

|

?X =

(3.49)

F (Y, óã-1

0 X)

P (X)ó0?(K)

è(K) = F (Y,

óã-1

0 X)

Y (X = 0) = 0, K(X = 0) = F

In our implementation, we solve 3.49 on a uniform X grid to

generate and fix a non-uniform strike grid k0, k1, ... , kn

that is used in the numerical solution of 3.48 during

calibration and pricing. As a final remark, we note that ODEs in this section

typically will be solved at ó0 = 1.

Conclusion for the ZABR model

We have used a simple method to derive short-maturity

expansion for forward volatilities from stochastic volatility models. The

solution is an ODE that can be solved numerically for all strikes in one sweep.

Finally, we used a one-step finite difference scheme to generate option prices.

That approach is very fast and it generates arbitrage-free option prices. We

have added flexibility to the original SABR model to get an exact fit of all

quoted option prices and better control of the

5. CALIBRATING THE VOLATILITY FUNCTION 33

34 5. CALIBRATING THE VOLATILITY FUNCTION

CHAPTER 3. THE ZABR MODEL

wings of the smile for improved CMS pricing. Also, we can add

CMS prices to the calibration without additional computational costs.

35

Conclusion

This research internship focused on solving two main problems

encountered with the SABR model in the financial industry:

· an arbitrage problem observed through the negative

density of the underlying,

· a lack of flexibility in wings control

We first developed the Normal SABR model and solved the

negative density problem (Chapter 2). We then solved the wings control problem

by another model, the ZABR model, which is just an extension of the SABR model

where one replaces the (usually) lognormal volatility process by a CEV

volatility process, gaining then a control on the smile's wings through the CEV

exponent 'y (Chapter 3). We remarked that a direct use of computed implied

volatilities for pricing doesn't yield arbitrage-free prices and we finally

used a Markovian Projection and found an equivalent local volatility model that

is rather used for pricing.

For each solved problem, we gain accuracy but we pay back a

computation time, specially for the Normal SABR model. Anyway, the time lost

with the ZABR model is worth the wings control and the arbitrage-free prices

obtained. The ZABR model is therefore usable in pricing libraries without

additional excessive costs.

Beyond the subjects studied in my internship, as suggested

through picture 3.2, one can efficiently hedge against model parameters' risk

by using the 'y parameter to thwart the movements of the other model

parameters. Here, we did it manually but it can be very interesting to look for

particular relationships between 'y and (á, 9, p) in terms of a

parametric function that will be calibrated while readjusting the level of 'y

according to how the other parameters move. We should therefore look for a

stability in the smile shape despite the changes in other parameters of the

model. This can be done by matching the slope and the convexity of the obtained

smiles around the strike. Numerical resolution yields optimization

algorithms.

We can therefore look forward to finding closed form formulas

in the ZABR model scope. My idea is to rely on the Labordere's heat kernel

expansion on a Riemann manifold; and the research continues...

CONCLUSION

36 CONCLUSION

Appendix A

Numerical pricing under Normal

SABR model

1 Density for Normal SABR

We approximate the density of (Xt)t

at zero, that is, EQu

[ä(Xt)]. As previously explained, the process

(Xt)t satisfies:

V

dWt = b0 q(Xt)dW u t?ô

= X0 = F0 - K

where q(X) =

1-2ñáX

+á2X2,

á-á/b0,

(Wtu)t is a zero-drift Brownian motion

under Qu, and ô is the first time X hits -K.

This is achieved by defining the following process:

Xt

(I(X)) du = 1ln

(V(Xt) - ñ + áX\

t -- 10Vq(u)

á 1 - ñ

1 (1 +

ñ)2e2áI + (1 -

ñ)2e2áI + 2(1 -

ñ2)) q(X) = g(I)

- 4

The process It - I(Xt) admits the

following dynamic:

V b2 01{t<ô}dt

1 + á2X2 t -

2ñáXt

1

dIt = b0dWt?ô - 2

áXt -

ñá

37

We define the process At =

q(Xt)1/4q(X0)1/4

and observe that:

~ ~

2

dlnAt = dlnñt + -1 + 31 -

ñ á2bo1{t<ô}dt

8 8 q(Xt)

dñt 1

=

ñt 2

áXt -

ñá

V1 +

á2X2t -

2ñáXt

b0dWt?ô

The martingale (ñt)t defines

a new measure Qñ and we have:

dIt = b0dW Qñ

t?ô

APPENDIX A. NUMERICAL PRICING UNDER NORMAL SABR MODEL

where (W Qñ

t )t is a Brownian motion under Qñ.

We observe that:

EQu [ä(Xt)] = q(X0)1/4EQu

[Atä(Xt)] = q(X0)1/4Ë(t)EQñ

[ä(Xt)]

[exp (-8 á2b20(t t?ô 11= EQñ ?

ô) + 3á2b20(1 -82)

o du g(Iu)du)) /It = 0J

Ignoring the stopping time in above expression for Ë(t)

and using áb0 = á, we derive:

Ë(t) e- a á2t × Ö(t, I0

b0

(:á2(1

1z) = EQñ [exp - ñ2) t

f(W?)) /WQñ = zJ

1 f(W) = 4 ((1 + ñ)2e-2áW +

(1 - ñ)2e2áX + 2(1 -

ñ2))

where (W Qñ

t )t is a Qñ-Brownian motion with initial value zero.

Since Ö(t, z) depends exclusively on ñ and

á, this function can be pre-calculated or alternatively approximated as

follows:

Ö(t, z) = exp [á2(1 - ñ2) (f(0) +

f(z) / t] + O(t2)

We define ê(t, z) = -18á2

+ 136á2(1 - ñ2)

(f(0) + f(z)) + O(t)

Since EQñ [ä(It)] = EQñ

[ä(Xt)], we finally derive using the reflection principle for

Brownian motions:

EQu [ä(Xt)] = q(X0)1/4

b0 v2ðt

I(F0 - K)

B=

2I(Fmin - K) - I(F0 - K)

v2 , C = v2

B2 - C2

× ef0 ê(s,b00)ds × [eTht - e bit

38 2. COMPUTATION OF FUNCTIONS Ö AND ê

2 Computation of functions Ö and ê

We propose a simple algorithm to calculate the functions Ö

and ê. Let's choose a time grid {Ti : i = 0, ... , N} such that T0 = 0,

TN = T and we simplify the computation of Ö(Ti, B) with the following

approximation:

IE [exp

3 Tz dul l(z)

(8á2(1 - ñ2) Jo ?(Wu)/ I WT% =

zJ

Then, we calculate Øi : î 7? Öi (îvTi) on

a set of symmetric Hermite nodes that appear in the Gauss-Hermite integration.

One chooses M = 2m for a symmetric set and {îk : k = 1, ..., M} such

that:

APPENDIX A. NUMERICAL PRICING UNDER NORMAL SABR MODEL

E [f(î)] = XM pkf(îk).

k=1

We can calculate Øi by forward induction:

Øi(îk) E [Øi-1(æTi-1) exp

(ëÄTi 1 J /æTi = îkJ exp (1ÄTi 1

40(si-1æTi-1)/ \ ~(siîk)

si =pTi ë =

16á2(1 - ñ2), æt

=NAWt.

The conditional expectation can be analytically computed since

æTi-1 and æTi are unit normal variables with correlation

ñi =q Ti .

Let's consider the following function:

Fi-1(z) = Øi-1(z) exp ~

ëÄTi 1

?(si-1z)

Then we have:

~ Øi(îk) = E Fi-1(ñiîk + q1 - 401

exp(ëÄTi(1))

Using the decomposition of Fi-1(z) in its basis cubic spline

functions, we can write:

Fi-1(z) = XM Fi-1(îj)èj(z). j=1

By integrating the above, we can simplify the former equation as

follows:

|

Øi(îk) =

|

XM j=1

|

~ tt ëÄT ëÄTi

pkj x Øi-1(S9) x exp itt +

?(si-1sj) ?(siîk))

|

ci(z) = A1i (z - îi)3 + B1i (z -îi) - A0i

(z - îi+1)3 - B0i (z - îi+1) Lil0 = îi, L0 = -50,

Ui6=M = îi+1, UM = 50.

2. COMPUTATION OF FUNCTIONS Ö AND ê 39

~ ~ q ~~

pkj = pkj(ñi) = E

(i) èj ñiîk + 1 - ñ2 i

æ

where p(i)

kj satisfies Pj p(i)

kj = 1 but can be negative.

A crucial observation for time saving is the fact that the

pseudo-transition proba-

bilities pkj only depends on the mesh îk and the grid Ti.

Consequently, the respective

expectations only need to be computed once.

We can analytically calculate the pseudo-transition

probabilities. The function

èj is a cubic spline with value zero at every node except

at z = îj where it takes

value 1.

èj(z) = XM 1{Li<z<Ui}ci(z),

i=1

APPENDIX A. NUMERICAL PRICING UNDER NORMAL SABR MODEL

where A0i, B0i, A1i, B1i are calculated using the standard cubic

spline algorithm. We finally compute the pseudo-transition probabilities:

pkj(ñ) = XM

ñ3? [A1iI3(li, ui, vi) -

A0iI3(li, ui, vi+1)] + ñ?

[B1iI1(li, ui, vi) - B0iI1(li,

ui, vi+1)] , i=0

|

Li - ñîk

li = (1 - ñ2)1/2, ui =

|

Ui - ñîk

(1 - ñ2)1/2, vi =

|

ñîk - îi

p

(1 - ñ2)1/2, ñ? = 1 -

ñ2

|

Where In(a, b, c) = E

[1{a<î<b}(î + c)n]. By

integration, we obtain:

I1(a, b, c) = c [N (b) -

N(a)] + fz(a) -

fz(b)

I3(a, b, c) = (c2 +

3c)[N(b) - N(a)] + [3c(c

+ a) + a2 + 2]

fz(a) - [3c(c + b)

+ b2 + 2] fz(b)

where fZ(.) is the Gaussian density.

40 2. COMPUTATION OF FUNCTIONS Ö AND ê

41

Appendix B

Equivalence between Normal and

Log-normal Implied Volatility

Asymptotics of implied volatility are important for different

reasons. On the one hand, they give information on the behaviour of the

underlying through the moment formula [29] or the tail-wing formula [30]. On

the other hand, they allow a full correspondence between vanilla prices and

implied volatilities. With such a correspondence, asymptotics in call prices

can be easily transformed into asymptotics in implied volatilities. When

applied to a specific model, asymptotics are widely used as smile generators

[26]. In practice, other models are then used for pricing options using tools

like Monte-Carlo simulations.

So far, all the asymptotics studied by authors concern

asymptotics for implied lognormal volatility. In this chapter, we consider

implied normal volatility which refers to the Bachelier model. Why is it

interesting to consider normal implied volatility? One the one hand, for short

maturities, the Bachelier process makes more sense than the Black-Scholes

model. Indeed, the behaviour of the underlying from one day to another is

generally well approximated by a Gaussian random variable [32]. That's the

reason why the Bachelier model is very popular in high frequency trading [21].

On the second hand, the "breakeven move" of a delta-hedged option is easily

interpreted as normal volatility. Generally, the P&L of a book of

delta-hedged option is positive if the (historical) volatility of the

underlying is greater than a breakeven volatility which has to be expressed in

normal volatility. Moreover, it makes more sense to compare implied normal

volatilities with historical moves of the underlying as can be done by a market

risk department. Likewise, some markets such as fixed-income markets with

products like spread-options are quoted in terms of implied normal volatility

[16]. Finally, the skewness of swaption prices is much reduced if priced in

terms of normal volatility instead of lognormal volatility. Therefore, it is

important to have a robust and quick way to compute implied normal volatilities

from market prices and also to be able to switch between lognormal volatilities

and normal volatilities.

What kind of asymptotics should we consider? Most of the

approximations in option pricing theory are made under the assumption that the

maturity is either small (see the Hagan et al. formula [26]) or large

[17]; it is actually assumed that

42 1. ANOTHER PRICING FORMULA FOR CALL OPTIONS IN THE

BACHELIER MODEL

APPENDIX B. EQUIVALENCE BETWEEN NORMAL AND LOG-NORMAL

IMPLIED VOLATILITY

a certain time-variance U2T is either

small or large. A possible way to derive such approximations is to replace the

factor of volatility U by EU and then set E = 1.

This can be done at the partial differential equation level (see all the

techniques coming from physics [26]) as well as directly at the stochastic

differential equation level with the help of the Wiener chaos theory for

instance [33]. Other types of asymptotics are obtained by considering large

strikes. In our approach, we unify all those types of asymptotics (see [18] and

[9] for the lognormal case). Indeed, we obtain an approximation of the implied

normal volatility as an asymptotic expansion in a parameter À

for À « 1 and it turns out that

À -+ 0 when T -+ 0

or K -+ +00.

This study is organized as follows. We first give another

expression for the pricing of a European call option which involves an

incomplete Gamma function (Proposition 1.1). Then, we inverse this function

asymptotically and obtain an expansion of normal implied volatility. This is

particularly important if we want to quickly obtain the implied normal

volatilities from call prices as is the case in high frequency trading [21].

The formula is also potentially useful theoretically if, given an approximation

for the price of a European call option or a spread option (for instance in the

framework of the Heston or the SABR model), we want to obtain an approximation

of the normal implied volatility. Finally, we restrict our formula to the order

0 and we compare it to a similar formula for the lognormal case. Then, we

obtain an equivalence between normal volatility and lognormal volatility. We

use it also to compare the Black-Scholes greeks to the Bachelier greeks.

Finally, we consider a delta-hedged portfolio and we compute the breakeven move

in the normal case as well as in the lognormal case.

1 Another pricing formula for call options in the

Bachelier model

In the Bachelier model, the dynamic of a stock

(St)t?R+ is given by:

( dSt = UNdWt,

(B.1) S0 = S

The so-called normal volatility UN is related to the

price of a call C(T, K) struck at K with maturity

T by the following formula:

(S - K ) (S - K

)

\/

C(T, K) = (S - K)

\/ + UN T fz

\/ ,

UN T UN T

(B.2)

( ) Z x

1 -x2