Nowadays, the growing globalisation and accessibility to

financial markets all around the world make the geography less and less

relevant: restrictions for international capital movements disappear, trading

costs decrease, stocks exchanges merge or enter into alliances, and so on. The

purpose of a foreign cross-listing may be the presence in a wider, more

efficient and more innovative financial market than its incorporation country

one. We may give the example of Russian and Indian companies which are listed

in their domestic financial place, but also often in London or in New York.

Influences on the shares

First of all, a foreign cross-listing increases the trading

volumes and therefore improves the overall liquidity. In efficient markets,

greater liquidity should be translated into lower cost of capital, since

liquidity is valued by investors. Y. Amihud and H. Mendelson12

stated that "the theory of corporate finance has been based on the idea that a

company's market value is determined mainly by just two variables: the

company's expected after-tax operating cash flows or earnings, and the risk

associated with producing them." The two authors also argued that "there is

another important factor affecting a company's value: the liquidity of its own

securities, debt as well as equity". For instance, since 2008 more and more

companies initially listed on the Londoner fast growing market AIM (Alternative

Investment Market) have initiated cross-listings on Euronext Alternext in order

to offset the lack of liquidity on their primary stock exchange and to benefit

from a second European market in the Eurozone, the world's second main

currency. This was the goal of IPOs of British companies Proventec and Accsys:

"European investors are not comfortable dealing in the AIM market. There aren't

many market makers handling our shares, there aren't many market makers

handling most AIM shares 11.3 we do not want to knock AIM but want to provide

better liquidity for our European investors", Proventec's CEO

said13.

12

Y. Amihud and H. Mendelson, 2008, "Liquidity, the Value of the

Firm, and Corporate Finance", Journal Applied Corporate Finance

13 See Appendix 2: Article by Jon Mainwaring, The

Independent published on Sunday, 10 February 2008, "AIM companies bid for dual

listings on Euronext to boost liquidity"

Then, the reduction of transaction costs should also improve

the volumes and the liquidity, by encouraging investors to perform more

buy/sell operations. However, in his study14 published in 2001, J.

Hamet highlighted that cross-listings may affect the equilibrium of the

markets. Indeed, Hamet's rationale suggests that trades in each listing place

may risk to become more limited, not facilitating the pricing discovery

process.

Moreover, in part I.3.b. Corporate Governance Motivations, we

have already dealt with the influence of the shareholding diversification for

the corporate governance. However, according to R. Merton, it is also possible

to establish the positive impact of the shareholder basis widening on the stock

price. R. Merton15 stated "when the shareholder base broadens,

risks' sharing improves, bringing about a positive impact on stock prices. [..]

Smaller shareholder base is associated with lower firm value".

Finally, we may imagine that a foreign cross-listing in

markets having different time zones may reduce the volatility of the stock. In

this perspective, P. Lowengrub and M. Melvin16 arrived at the

conclusion that pricing errors are reduced because "it facilitates the process

of assessing a stock's value at the beginning of the trading session. At the

opening of the trading, prices are less volatile for shares that traded

overnight on another exchange than for those that did not".

Influences on the cost of capital

Through a foreign cross-listing, there are different ways to

influence a company's financing.

Firstly, we may consider a positive influence on the cost of

capital thanks to a better access to capital markets. Indeed, empirical

studies17 showed that the cost of equity generally declines after a

foreign cross-listing. This decline may be explained by the access to easier

and more competitive financing conditions

14 J. Hamet, 2001, "La cotation des titres d'une

entreprise française sur un marché étranger et ses

conséquences pour l'actionnaire", PUF

15 R. Merton, 1987, "A simple Model of Capital Market

Equilibrium with Incomplete Information", Journal of Finance 72, No.3

16 P. Lowengrub and M. Melvin, 2006, "Before and

After International Cross-Listings: An Intraday Examination of Volume and

Volatility"

17

A. Karolyi, 1998; R. Stulz, 1999; V. Errunza and D. Miller,

2000

(loans, issuance of shares, equity-linked or bonds

instruments), but also by the elements previously given in part I.3.b Corporate

Governance Motivations, i.e. a decrease of transaction costs for investors, a

higher reliability and quality of information provided to investors, as well as

a better investor protection. For instance, a higher reliability and quality of

information may reduce the investor's cost for researching information and the

risk related to a company, therefore allowing the company to obtain lower cost

of funding, R. Stulz18.

Secondly, the increase of the company's geographical customer

basis helps to lower the company's beta R (see Appendix 1) which

impacts downwards the cost of capital, R. Stulz18, P. Martin and H.

Rey19, D. Lombardo and M. Pagano20.

Influences on the valuation

As a matter of fact, it is well established that the cost of

funding has an influence on the company's valuation.

In its study, L. Zingales21 measured the

difference between market value and book value, with the conclusion that

"shares of foreign companies listed both in the company's home market and on a

U.S. stock market traditionally trade at a higher valuation as a percentage of

book value than domestic peers that aren't cross-listed. A cross-listed company

traded at 150% of book value and a similar company from the same country listed

only on their home market traded at 120% of book value, the valuation premium

would be 30 percentage points. [..] The premium for listing on both U.S. and

foreign markets averaged 51 percentage points from 1997 to 2001. It dropped to

31 percentage points between 2002 and 2005". As a consequence, we may deduct

that investors would pay more for a company listed in the United States, mainly

for the reasons given previously in this research.

The influence of the corporate governance on company's

valuation had already been highlighted by the work of P. Hostak, E. Karaoglu,

T. Lys and Y. Yang22, who noticed that "compared to foreign firms

that maintained their ADRs, foreign firms which voluntarily delisted have

weaker corporate governance, had a less negative

18 R. Stulz, 1999, "Globalization of Equity Markets

and the Cost of Capital"

19 P. Martin and H. Rey, 1999, "Financial Integration

and Asset Returns"

20 D. Lombardo and M. Pagano, 1999, "Law and Equity

Markets: A Simple Model"

21 L. Zingales, 2006, "Is the U.S. capital market

losing its competitive edge?"

22

P. Hostak,, E. Karaoglu, T. Lys and Y. Yang, 2007, "An

Examination of the Impact of the SarbanesOxley Act on the Attractiveness of US

Capital Markets for Foreign Firms"

stock market reaction when SOX was passed, and suffered a

significant price decline in their home-markets when they announced their

intention to delist."

Over the years, some financial places have managed to become

the center of gravity for some sectors: Nasdaq has become a natural stock

exchange for investors and funds specialized in technology-IT-biotech, whereas

the places of London, Toronto and Sydney own a real expertise in Mining and Oil

& Gas sectors. Such evidence has already been showed by A. Blass and Y.

Yafeh23 with the demonstration that Dutch and Israeli companies

performing a listing in the United States are "young, fast growing,

overwhelmingly high-tech oriented and highquality innovative".

Furthermore, not being listed in a place specialized in its

sector, may contribute to a lower the liquidity, and therefore the company's

stock underperformance in comparison to its sector.

Being foreign cross-listed may also help the company to gain

in price-to-earnings ratio (P/E). Indeed, it is well established that the

difference of the average P/E between stock exchanges (see exhibit #10) may

offer substantial gap, and therefore lead to important difference in market

capitalisation for companies evolving in the same sector.

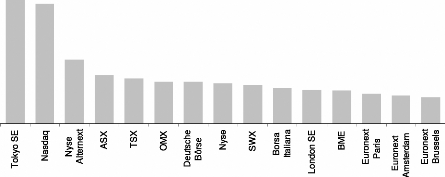

#10: Historical Average P/E of the World Main Stock

Exchanges

(Period 2000-2007)24

61.8 59.8

31.9

24.1 22.6 21.1 20.9 20.2 19.2 17.9 16.7 16.4 14.9 14.1 13.2

23 A. Blass and Y. Yafeh, 1999, "Vagabond Shoes

Longing to Stray: Why Foreign Firms List in the United States"

24

Sources: World Federation of Exchanges, Bloomberg,

ThomsonReuters Datastream

As we can see in the exhibit #10, there are major differences

of valuation between stock exchanges. For instance, the Nasdaq offers a 7-years

average P/E of 59.8 whereas the Nyse and Euronext Paris offer respectively 20.2

and 14.9. By taking advantage of this mispricing (low domestic P/E in

comparison to foreign P/E), a company may initiate a foreign cross-listing on a

stock exchange where its peers benefit from relative higher P/E.

#11: 2007 P/E Comparison of Foreign Companies Foreign

Cross-Listed

on American Stock Exchanges