IV. Is the Foreign Cross-Listing Efficient ?

IV.1. Empirical Determination of the Efficiency

The current globalisation of financial markets implies a

greater mobility of capital, an easier access to the main financing markets,

the emergence of new trading facilities and a standardisation of the corporate

governances.

After the analysis over the last years of the reasons given

by companies announcing a foreign cross-delisting, it emerges that the notion

of "efficiency" is most of time associated with "significant trading

volumes".

|

#27: Recent Foreign Cross-Delistings

|

Rationales behind the delisting (sources

company)

|

Company

|

Country

|

Dates

|

Delisting from

|

Low trading

volumes

|

Costs

|

Administrative

complexity

|

Deregulation of

capital markets

|

|

|

|

|

|

|

|

|

Volvo

|

Sweden

|

2001

|

Tokyo SE

|

|

|

|

|

|

|

2003

|

Euronext Brussels

|

|

|

|

|

|

|

2003

|

Frankfurt

|

|

|

|

|

|

|

2004

|

L.S.E

|

|

|

|

|

|

|

2007

|

Nasdaq

|

|

|

|

|

LVM H

|

France

|

2002

|

Nasdaq

|

|

|

|

|

|

|

2003

|

Euronext Brussels

|

|

|

|

|

Nokia

|

Finland

|

2003

|

L.S.E

|

|

|

|

|

|

|

2004

|

Euronext Paris

|

|

|

|

|

|

|

2007

|

OMX Stockholm

|

|

|

|

|

Lafarge

|

France

|

2004

|

L.S.E

|

|

|

|

|

|

|

2004

|

Frankfurt

|

|

|

|

|

|

|

2007

|

Nyse

|

|

|

|

|

Bombardier

|

Canada

|

2004

|

Euronext Brussels

|

|

|

|

|

|

|

2005

|

Frankfurt

|

|

|

|

|

ABB

|

Switzerland

|

2005

|

L.S.E

|

|

|

|

|

|

|

2005

|

Frankfurt

|

|

|

|

|

Euro Disney

|

France

|

2005

|

L.S.E

|

|

|

|

|

|

|

2005

|

Euronext Brussels

|

|

|

|

|

K Line

|

Japan

|

2005

|

Euronext Brussels

|

|

|

|

|

|

|

2005

|

Frankfurt

|

|

|

|

|

Vivendi

|

France

|

2006

|

Nyse

|

|

|

|

|

RSA Insurance

|

U.K

|

2006

|

Nyse

|

-

|

-

|

-

|

-

|

Pioneer

|

Japan

|

2006

|

Nyse

|

|

|

|

|

|

|

2006

|

Euronext Amsterdam

|

|

|

|

|

|

|

2006

|

Osaka SE

|

|

|

|

|

Ahold

|

Netherlands

|

2007

|

Nyse

|

|

|

|

|

BASF

|

Germany

|

2007

|

Nyse

|

|

|

|

|

Fiat

|

Italy

|

2007

|

Nyse

|

|

|

|

|

E.ON

|

Germany

|

2007

|

Nyse

|

|

|

|

|

Technip

|

France

|

2007

|

Nyse

|

|

|

|

|

Danone

|

France

|

2007

|

Nyse

|

|

|

|

|

British Airways

|

U.K

|

2007

|

Nyse

|

|

|

|

|

Suez

|

France

|

2007

|

Nyse

|

|

|

|

|

Akzo Nobel

|

Netherlands

|

2007

|

Nasdaq

|

|

|

|

|

Telenor

|

Norway

|

2007

|

Nasdaq

|

|

|

|

|

Arcadis N.V.

|

Netherlands

|

2007

|

Nasdaq

|

|

|

|

|

Scor

|

France

|

2007

|

Nyse

|

|

|

|

|

Swisscom

|

Switzerland

|

2007

|

Nyse

|

|

|

|

|

Adecco

|

Switzerland

|

2007

|

Nyse

|

|

|

|

|

BG Group PLC

|

U.K

|

2007

|

Nyse

|

|

|

|

|

|

(following, on the next page)

(following of the previous page)

|

|

Rationales behind the delisting (sources

company)

|

Company

|

Country

|

Dates

|

Delisting from

|

Low trading

volumes

|

Costs

|

Administrative

complexity

|

Deregulation of

capital markets

|

|

|

|

|

|

|

|

|

Bayer

|

Germany

|

2007

|

Nyse

|

|

|

|

|

|

|

2008

|

Tokyo SE

|

|

|

|

|

Boeing

|

U.S

|

2008

|

Tokyo SE

|

|

|

|

|

Ducati Motor

|

Italy

|

2008

|

Nyse

|

|

|

|

|

Societe Generale

|

France

|

2008

|

Tokyo SE

|

|

|

|

|

Dassault Syst.

|

France

|

2008

|

Nasdaq

|

-

|

-

|

-

|

-

|

Altria Group

|

U.S

|

2008

|

Euronext Paris

|

|

|

|

|

Telefonica

|

Spain

|

2008

|

Euronext Paris

|

|

|

|

|

|

|

2008

|

Frankfurt

|

|

|

|

|

BP Plc

|

U.K

|

2008

|

Nyse Arca & Chicago

|

-

|

-

|

-

|

-

|

|

|

2008

|

Toronto SX

|

|

|

|

|

|

|

2008

|

Tokyo SE

|

|

|

|

|

|

|

2009

|

Swiss SX

|

-

|

-

|

-

|

-

|

Boeing

|

U.S

|

2008

|

Tokyo SE

|

|

|

|

|

Bosch

|

Germany

|

2008

|

Tokyo SE

|

-

|

-

|

-

|

-

|

Barclays Plc

|

U.K

|

2008

|

Tokyo SE

|

|

|

|

|

KPN

|

Netherlands

|

2008

|

Nyse

|

|

|

|

|

|

|

2008

|

L.S.E

|

|

|

|

|

|

|

2008

|

Frankfurt

|

|

|

|

|

Ericsson

|

Sweden

|

2008

|

L.S.E

|

|

|

|

|

AnheuserBush*

|

U.S

|

2008

|

L.S.E

|

|

|

|

|

Alcatel-Lucent

|

France

|

2008

|

Tokyo SE

|

|

|

|

|

ING Groep

|

Netherlands

|

2009

|

Euronext Paris

|

|

|

|

|

|

|

2009

|

Frankfurt

|

|

|

|

|

|

|

2009

|

Zurich

|

|

|

|

|

BNP Paribas

|

France

|

2009

|

Tokyo SE

|

|

|

|

|

|

85.5% 51.6% 12.9% 24.2%

* delisting announcement was made on March 2008, whereas the

takeover by InBev was announced in June 2008 Sources: Companies

The previous exhibit #27 underpins that in the very great

majority of foreign cross-delisting cases, companies' management are used to

pointing out the low trading volumes (85.5%). As regards the second most evoked

rationale, the costs (51.6%) stem from the low trading volumes since the

management highlight the weak relevance to pay such costs for insignificant

trading volumes. Managers estimate that volumes on foreign stock exchanges no

longer justify a broad range of foreign cross-listings. The findings deriving

from the previous analysis allow us to determine the operational definition of

the efficiency.

Operational definition of an efficient foreign cross-listing

In this research, we consider a foreign cross-listing as

efficient, from the moment that the volumes and the liquidity on the foreign

listing place are "significant" in comparison to those on the primary listing

place.

In this research, "significant" implies a free-float rotation

higher than 0.1% and volumes accounting for more than 5% of the total

volumes.

However a question remains without answer. Do the notions of

volume and liquidity overshadow all the advantages provided by foreign

cross-listings and enounced in part 1.3. Reasons Pleading for Foreign

Cross-Listing ? According to the companies' managements, the answer is in the

very great majority 'yes". Undeniably, nowadays it appears that some

advantages, true in the past, have become operationally negligible or no more

relevant.

As regards the reduction of volatility and transaction costs

that may provide a foreign cross-listing, the on-going evolution initiated by

new trading platforms (see part 111.3. A New Deal in the World of Stock

Exchanges 1ndustry) helps to improve all two points. Indeed, the increasing

competition between traditional and alternative trading platforms improves the

trading effectiveness, reduces the volatility by making shares accessible for a

largest panel of investors, and lowers the transaction costs. Foreign

cross-listings are not anymore the only one solution to improve these

points.

Furthermore, the idea that a foreign cross-listing allows to

access to new investors and to broaden shareholders basis remains true, but the

contrary is not necessarily true. As we have already noticed, nothing is more

mobile than the capital, which may easily and rapidly move from one financial

place to another one. Hence, by taking into consideration this fact, not being

cross-listed does not prevent companies from accessing foreign investors

because investors are more and more mobile. Nowadays, roles have been reversed,

i.e. it is not anymore the company that reaches investors, but investors that

reach the company. To some extent, this situation is more convenient.

Concerning the business motivations (visibility, notoriety,

relations with clients/suppliers) and the corporate governance motivations

(gain in media and analyst coverage, facilitate M&A operations with foreign

companies), it is quite difficult to materialize and to quantify their

advantages. But we may consider that from the companies' management point of

view, these elements are secondary considerations in the decision of the

foreign cross-listing.

Differences Between Stock Exchanges

Since we have noted that the notions of liquidity and volumes

are the most important elements in the management's decision for a foreign

cross-delisting, it may be relevant to compare the liquidity by main stock

exchanges.

#28: Rationales Behind the Delisting

Low trading Costs Administrative Deregulation

of

volumes complexity capital markets

Cases in which the

rationale is evoked

|

84.2% 42.1%

|

12.3% 21.1%

|

Sources: Companies

|

|

|

|

As stated B. Kadlec and J. McConnell48, some

financial markets like New York and London provide a better liquidity thanks to

a greater competition between actors which implies a fall of transaction costs

and an increase of the trading activity.

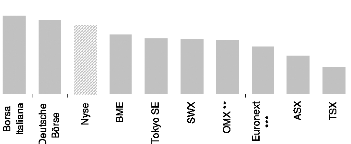

#29: 2007 Liquidity49 on each Stock Exchange

0.86% 0.82% 0.76%

0.65% 0.61% 0.60% 0.59%

0.52%

0.42%

0.30%

1.52%

1.06% 1.04%

0.92%

Sources: World Federation of Exchanges, ThomsonReuters

Datastream

* includes the Nyse, the Nasdaq and the Nyse

Alternext

** includes the Copenhagen, Helsinki, Iceland, Stockholm,

Tallinn, Riga and Vilnius Stock Exchanges *** includes Euronext Paris, Euronext

Amsterdam, Euronext Brussels, Euronext Lisbon

According to the exhibit #29, the Nasdaq appears to be by far

the most efficient stock exchange in terms of liquidity, followed by the L.S.E

and the Nyse Alternext. Regarding Borsa Italiana, it is important to mitigate

its figures and its honorable 0.86% by regarding the relatively "weak" total

market capitalisation of the Italian place in comparison to the Italian GDP.

48 B. Kadlec and J. McConnell, 1994, "The Effect of

Market Segmentation and Illiquidity on Asset Prices Evidence from Exchange

Listings"

49 Average Daily Turnover in US$ / Total Market

Capitalisation in US$

|