|

SPECIALIZED MASTER

In Corporate Finance

Professional thesis subject:

Analysis of the Efficiency and the Future of the Foreign

Cross-Listing

Societe Generale Corporate & Investment

Banking

(Contact : vincent-chertier.mas(c)

em-lyon.com)

Promotion 2008

Date: 17th December 2008

Professor supervisor: Associate Professor in Finance Mr Loïc

Belze

Copyright E.M.LYON

Par accord du CFC

Cession et reproduction interdite

Summarv

Introduction...............................................................................................

3

I. Theoretical Approach of the Foreign Cross-Listing

......................................... 5

Preamble

..........................................................................................

5

Different Methods of Foreign Cross-Listing ............... 6

I.2.a. Depositary Receipts (DRs) ...............................

6

I.2.b. Dual-Listed Companies (DLCs) 7

I.2.c. Other Means

..............................................................................

16

Reasons Pleading for Foreign Cross-Listing

.......................................... 16 I.3.a. Business Motivations

................................................................... 16 I.3.b.

Corporate Governance Motivations

................................................ 17 I.3.c. Financial

Motivations ...................................................................

20 I.3.d. Main Impacts of the Foreign Cross-Listing

...................................... 25

Different Geographical Origins Imply Different Purposes

........................ 27

II. Geography of the Foreign Cross-Listing

................................................... 28

Methodology for the Creation of the Sample

....................................... 28 II.1.a. Sources

....................................................................................

28 II.1.b. Statements and Assumptions Regarding the Analysis

...................... 30

Presentation of the Results

............................................................... 31

Empirical Interpretation of the Results

............................................... 33 II.3.a. Geographic

Distribution .............................................................. 33

II.3.b. Sector

......................................................................................

36 II.3.c. Size and Growth

........................................................................ 38

II.3.d. Cultural Similarities

................................................................... 41

Going Further in the Empirical Interpretation ......... 42

III. Environment and Current Evolutions

...................................................... 43

III.1. Decreasing Advantages and Increasing Concerns ? 43

III.2. A Major Tendency Has Emerged ..........................

45

III.3. A New Deal in the Stock Exchanges Industry 49

III.3.a. Mergers between Stock Exchanges 49

III.3.b. Strategic Partnerships between Stock Exchanges 50

III.3.c. New Actors Are Arriving... 50

IV. Is the Foreign Cross-Listing Efficient

?.................................................... 52

Empirical Determination of the Efficiency 52

Liquidity Analysis 56

Volumes Analysis 60

IV.3.a. Analysis of the Efficiency 60

IV.3.b. Current Tendency: the "Fading Listing" 64

Future of the Foreign Cross-Listing 69

ArcelorMittal Case Study 71

V. Conclusion

...........................................................................................

75

Bibliography............................................................................................

78

OtherSources 79

Appendix1 80

Appendix2: Articles 81

Introduction

In 2001, the Kenyan based company East African Breweries Ltd,

initially listed on the Nairobi Stock Exchange, performed a foreign

cross-listing on the Uganda Securities Exchange and, the year after,

re-performed this operation on the Tanzanian Dar-es-Salaam Stock Exchange in

Tanzania. This atypical example materializes how the company's decision to be

cross-listed on a foreign stock exchange depends on a set of motivations or

events inherent to each company. Over the decades, the phenomenon related to

foreign cross-listing has known various tendencies, illustrated by a set of

highs and lows. This phenomenon started in the 70s and reached its highs during

the 1980s-1990s. However, since the beginning of the new millennium new

cross-listings have become scarcer, but above all the number has been steadily

diminishing. This growing loss of interest in foreign cross-listing mainly

results from regulatory framework evolutions, materialized by the

Sarbanes-Oxley Act (2002) and the amendment of the Markets in Financial

Instruments Directive (2007) which paved the way to the harmonisation of

regulatory regime for investment services.

Up to now, many researches have already dealt with the

phenomenon of foreignlisting and foreign cross-listing, but few have developed

the notion of efficiency of such operations. In this perspective, this research

bases its findings on a sample of 1,347 foreign cross-listing cases and tries

to answer to the following problematic:

Within the current context of financial markets, is the foreign

cross-listing an efficient tool for companies ?

Nevertheless, on account of the existence of intangible

benefits like the visibility, the prestige and the recognition, there is no

Manichean answer. However, through the analysis of a set of elements, it is

possible to outline the current tendencies and therefore to predict the likely

future of foreign cross-listing.

In the first place, this research focuses on the theoretical

analysis of the foreign cross-listing, describing the advantages and drawbacks

for a company. The goal is to understand the motivations and the patterns

leading to perform such operations.

Then, the second part develops a statistical analysis of the

foreign cross-listing

phenomenon and its geographical distribution, with a

focus on Western European,

North American, Japanese and Australian stock

exchanges. Through the analysis

of the collected data, the purpose is the identification of

the main characteristics of cross-listed companies. This step is essential

because it serves of foundation of the part dealing with the efficiency

analysis.

In the third place, this research tackles the theme related to

the on-going revolution in the stock exchanges industry. This research tries to

outline the impacts and the implications on foreign cross-listing.

Finally, this research combines the statements made in the

previous parts and the outputs given by the efficiency test. Hence, the

interpretation of the results helps to draw the conclusion and the future of

foreign cross-listing.

I. Theoretical Approach of the Foreign Cross-Listing

I.1. Preamble

Definition of the foreign cross-listing:

In this research, a company is considered as foreign

cross-listed, if and only if its own shares are officially listed on one

or several foreign stock exchanges, in addition to the stock exchange

of its incorporation country.

By the term officially listed, we consider cross-listing

initiated on the behalf of the company.

Nowadays, foreign cross-listing may complete the hierarchy of

financing sources, the Pecking Order Theory developed by S. Myers and N. Majluf

in 1984.

#1: Successive Process of Global Financingl

Domestic Capital

Market Operations

International

Bond Issue

Foreign Equity

Issue

Foreign Equity

Listing

1

R. Nyvltova, 2006, "The Effects of Cross-Border Listings on the

Development of Emerging Markets: the Case of Czech Republic0

Holders

Stock Exchange

Barcllys ADR 1::

NYSE

AXA

ADR 1:1 11

Tel 'talia

ADR

1:10110

Sanof I ADR 2:1

Depositary Receipts System

Trust

arcla Barclays

tock

Stock

Tel Italie

tock

Stock

Sanof I

tock Stock

AXA

toc Stock

Bank

I.2. Different Methods of Foreign Cross-Listing

In addition to the simple and direct listing through shares,

the financial engineering for corporate finance has developed complementary

ways to perform a foreign cross-listing.

I.2.a. Depositary Receipts (DRs)

Depositary receipts (DRs) are an indirect mean to list foreign

shares. DRs are tradable certificates issued by a "sponsoring bank" (or

"depositary bank"), representing the ownership of stocks in the capital of a

foreign company and compliant with the local financial markets laws. This

product replicates an underlying stock of a company, which is in fact held by a

trust vehicle in a foreign bank. A DR may represent a fraction of a stock, a

single stock, or several stocks. For instance, foreign companies aiming at a

listing in the United States or the United Kingdom may respectively use

"American Depositary Receipts" or "Global Depositary Receipts". In a lesser

extent, there are also "European Depositary Receipts", "International

Depositary Receipts" in Brussels, "Dutch Depositary Receipts" in Amsterdam,

"Swedish Depositary Receipts", "Singapore Depositary Receipts" and so on.

The sponsoring bank provides all the services regarding the

registration, the agency services, the broker trading, the conversion of

dividends into the DR holder's currency, and so on. As a consequence of the

utilisation of a trust vehicle, DR holders are not considered as shareholders

of the company and do not have voting rights; but they may instruct the DR

depositary bank how to vote the stocks underlying their DRs.

There are four types of DR (I, II, III, unsponsored), each one

corresponding to different classes. A sponsored level I DR trades

over-the-counter (OTC) and implies the minimal requirements for companies (e.g.

neither obligation to publish quarterly/annual reports nor to meet the U.S.

GAAP). Level II DR (no capital is issued), is different from level III DR (new

capital is issued), but both have the highest disclosure and fulfilling

requirements. At these two levels, companies with DRs listed in the United

States must annually fill forms (registration statements and financial

statements) for the American S.E.C. and fully meet U.S. GAAP.

Most of time, DRs are issued according to the will of a

company to be listed on a specific market with the aim to become accessible to

new investors and thus to attract additional pool of capital. However, a bank

may also issue unsponsored DRs, that is to say not realized on the behalf of

the company but of an investor. Nowadays, there are no formal requirements to

seek companies' authorisation to issue unsponsored DRs, since such operation is

completely passive, i.e. presents no risks, no future implications, no costs

for the company.

Today DR is the most used method for a listing abroad, in

particular in the United States and in the United Kingdom. According to the

Bank of New York, issues of DRs exceed US$50.0bn in 2007 vs. US$44.5bn in 2006,

which had already set a record high2. Most of DRs issued in 2007 had

been realized on the Nyse, Nasdaq, Nyse Alternext (former Amex) and L.S.E; with

two third of issuers originating from the BRIC countries (Brazil, Russia,

India, China).

I.2.b. Dual-Listed Companies (DLCs)

A dual-listing (DL), also referred as Siamese twin, is the

result of a merger between companies incorporated in different countries. These

two companies agree to unify their forces (cash flows, operational activities),

but to keep separated their identities (assets, shareholdings). In this case,

there are contractual agreements between the two companies to share the cash

flows from each other's assets. Alternatively, the two companies may transfer

all their assets to a holding company which redistributes the dividends. The

shareholders of the two companies have the same rights in terms of votes and

dividends, "in line with

2

These figures include IPOs and capital increases, but no issues

from mergers and acquisitions

the relative 'weights' of the two companies established at the

time of the creation of the DLC"3.

Under this type of organisation, there is a unique management or

an identical management elected on both board.

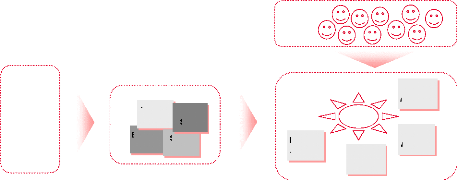

DLC Structure Type 1 (case of Rio Tinto Ltd and Rio Tinto

Plc)

Shareholders of the Dutch Entity

Assets (operations)

Rio Tinto Ltd listed on Sydney

Dividends

Voting rights

Cash

flows

Shareholders of the English Entity

Dividends

Assets (operations)

Rio tinto Plc Listed on the L.S.E

Voting rights

DLC Structure Type 2 (case of Unilever N.V. and Unilever

Plc)

Shareholders of the Dutch Entity

Holding Company

Dividends

Unilever N.V listed on Amsterdam

Dividends Dividends

Voting rights

Cash flows Operations

Assets

Shareholders of the English Entity

Dividends

Unilever Plc Listed on the L.S.E

Voting rights

3 Reserve Bank of Australia Bulletin, 2002,

"Dual-listed Companies"

First of all, it is important to notice that a dual-listing is

different from a cross- listing, since the shares on each stock exchange are

not from the same company. Whereas a dual-listing implies the quasi-merger of

two companies, a cross-listing results into the secondary listing on a foreign

stock exchange. However, the overall philosophy is the same and that is why

during the creation of the sample in part II. The Geography of the Foreign

Cross-Listing, dual-listings will be considered as cross-listings. However, in

the part dealing with the liquidity and the volumes matters (see IV. Is the

Foreign Cross-Listing Efficient ?), DLCs are not taken into consideration since

their shares are different and therefore not tradable on the both stock

exchanges (e.g. impossibility to perform arbitrages, i.e. buy a stocks on the

ASX and sell it on the L.S.E).

At the moment, two of the most relevant cases of dual-listing

are BHP Billiton Plc/BHP Billiton Ltd (U.K., listed on L.S.E/Australia, listed

on ASX) and Unilever Plc/Unilever N.V (U.K., listed on L.S.E/The Netherlands,

listed on Euronext Amsterdam).

All actual dual-listed companies (as of December 2008):

4 ThomsonReuters (Canada/U.K., 2008)

4 Mondi (South Africa/U.K., 2007)

4 Anheuser-Busch InBev (Belgium/Brazil, 2004)

4 Carnival Corporation (U.K./U.S., 2003)

4 Investec Bank (South Africa/U.K., 2002)

4 BHP Billiton (Australia/U.K., 2001)

4 Rio Tinto (Australia/U.K., 1995)

4 Reed Elsevier (U.K./The Netherlands, 1993)

4 Unilever (U.K./The Netherlands, 1930)

Former dual-listed companies (as of December, 2008):

4 Royal Dutch Shell (U.K./The Netherlands, 1907-2005)

4 Brambles Industries (Australia/U.K., 2001-2006)

4 Fortis (Belgium/The Netherlands, 1990-2001)

4 Allied Zurich (now ZFS) (U.K./Switzerland, 1998-2000)

4 Dexia (Belgium/France, 1996-2000)

4 Nordbanken/Merita (now Nordea) (Sweden/Finland, 1997-2000)

4 ABB Group (Sweden/Switzerland, 1988-1999)

4 Smith Kline Beecham (now Glaxo) (U.K./U.S., 1989-1996)

According to the managements of former DLCs, the main reasons

evoked to justify the withdrawal of the DLC structure is the willingness to

eliminate the premium/discount between the two companies, although there is

theoretically no possibility of arbitrage since the two companies offer

equivalent dividend and voting right to their respective shareholders. However,

some examples had shown significant gap between the two stocks values.

Several studies have already been done about this subject (L.

Rosenthal and C. Young4 in 1990, K. Froot and E. Dabora5

in 1999), showing that "significant mispricing in three DLCs (Royal Dutch

Shell, Unilever, and Smithkline Beecham) has existed over a long period of

time. Both studies conclude that fundamental factors (such as currency risk,

governance structures, legal contracts, liquidity, and taxation) are not

sufficient to explain the magnitude of the price deviations". K. Froot and E.

Dabora5 stated that "the relative prices of the twin stocks are

correlated with the stock indices of the markets on which each of the twins has

its main listing. For example, if the FTSE 100 rises relative to the AEX index

(the Dutch stock market index) the stock price of Reed International PLC

generally tends to rise relative to the stock price of Elsevier NV. A potential

explanation is that local market sentiment affects the relative prices of the

shares of the DLC parent companies".

4

L. Rosenthal and C. Young, 1990, "The seemingly anomalous price

behavior of Royal Dutch/Shell and Unilever N.V./PLC"

5 K. Froot and E. Dabora, 1999, "How are stock prices

affected by the location of trade?"

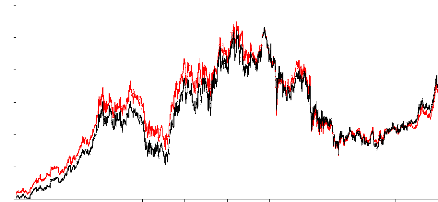

#2: Evolutions of the stocks Rio Tinto Pic (London) and

Rio

Tinto Ltd (Sydney)

Both shares price in £, by using the dai ly currency

conversion rate A$/£

70

60

50

40

30

20

10

0

80

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Sydney London

Source: ThomsonReuters Datastream, from the 07/10/1998 to

the 07/10/2008

#3: Premium / Discount (Rio Tinto Pic vs. Rio Tinto Ltd)

20%

Premium / Discount

min (29/09/2008) -29.88%

max (31/03/2000) 15.31%

average -3.65%

Gross tendance FTSE vs. ASX

15%

10%

5%

0%

-5%

-10%

-15%

-20%

-25%

30

10

-10

-30

-50

-70

-90

-110

-130

-150

1998 199922000 2001 2002 2003 2004 2005 2006

2007 2008

|

% Premium / % Discount (LHS) Variations FTSE vs. ASX (RHS)

|

|

Source: ThomsonReuters Datastream, from the 07/10/1998 to

the 07/10/2008 Premium / discount calculated by using the daily currency

conversion rate A$/£

#4: Evolutions of the stocks Royal Dutch N. V (Amsterdam)

and

Shell Plc (London)

40 Both shares price in €, by us ing the daily currency

conversion rate £/€

35

30

25

20

15

10

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

Royal Dutch N.V Shell Plc

Source: ThomsonReuters Datastream, from the 19/07/1995 to

the 19/07/2005, i.e. date of the complete unification of the two companies and

the creation of Royal Dutch Shell

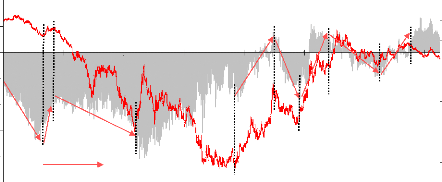

#5: Premium / Discount (Shell Plc vs. Royal Dutch N. V)

-10%

-15%

-20%

-25%

10%

-5%

5%

0%

Gross tendance FTSE vs. AEX

Premium / Discount

min (03/02/1999) -20.48%

max (27/02/2003) 6.74%

average -5.62%

20

0

-20

-40

-60

-80

-100

-120

-140

-160

1995 1996 1998 1999 2001 2002 2003 2005

% Premium / % Discount (LHS) Variations FTSE vs. AEX (RHS)

Source: ThomsonReuters Datastream, from the 19/07/1995 to

the 19/07/2005 Premium / discount calculated by using the daily currency

conversion rate £/€

Both shares price in €, by us ing the daily currency

conversion rate £/€

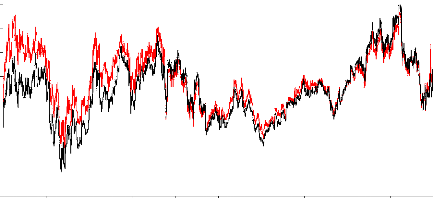

#6: Evolutions of the stocks Unilever N. V (Amsterdam)

and

Unilever Plc (London)

26 24 22 20 18 16 14 12

10

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Unilever N.V Unilever Plc

Source: ThomsonReuters Datastream, from the 07/10/1998 to

the 07/10/2008

#7: Premium / Discount (Unilever Plc vs. Unilever N.V)

- 25%

- 10%

- 15%

- 20%

10%

-5%

5%

0%

Gross tendance FTSE vs. AEX

Premium / Discount

min (03/02/1999) -29.54% max (27/02/2003) 5.85%

average

-4.60%

20

0

- 10

- 20

- 30

- 40

- 50

10

1998 2000 2001 2002 2004 2005 2007 2008

|

% Premium / % Discount (LHS) Variations FTSE vs. AEX (RHS)

|

Source: ThomsonReuters Datastream, from the 07/10/1998 to the

07/10/2008 Premium / discount calculated by using the daily currency conversion

rate £/€

Note: In order to offset the forex variation between two stocks

listed in different currencies, we have used the day-after-day spot conversion

rate.

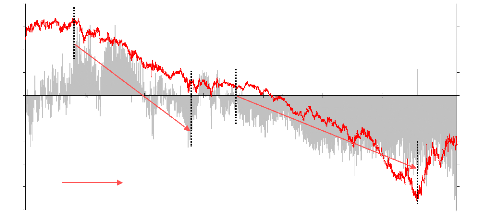

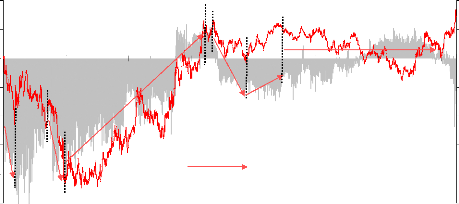

The analysis of the three exhibits #3, #5, #7 entitled

"Premium / Discount" and representing the cases Royal Dutch Shell, Rio Tinto

and Unilever, confirms the statement made by K. Froot and E. Dabora (see

quotation page 10). During a substantial period of time (several months or

years), the premium/discount evolution of the DLC evolves in the same way as

the difference of variation between the two stock exchanges of quotation. The

more a stock exchange outperforms the second one, the more the premium for the

stock listed on the first one increases (or the discount decreases).

The most striking case concerns Rio Tinto. During an 8-years

period of time (1998-2008), the premium of the stock listed on the L.S.E

reached a maximum of circa 15% and progressively decreased to become a discount

of circa 23% on July 2008. This decrease was quite progressive and regular over

the time. These graphs illustrate the correlation between the premium/discount

and the difference of evolution between the two stock exchanges. Over the

10-years period, the correlation between the two variables is quite strong and

reaches the value of 0.82.

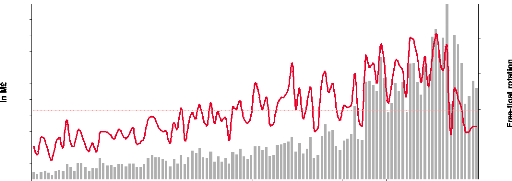

#8: 10-Years Evolution of Rio Tinto Pic Daily Free-Fioat

Rotation (London)

550

2.0%

500

450

1.6%

400

350

200

150

100

0.4%

50

0

0.0%

1.2%

300

250

10Y free-float rotation = 0.79

0.8%

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Monthly average daily volumes (LHS) % of the free-float (RHS)

Source: ThomsonReuters Datastream

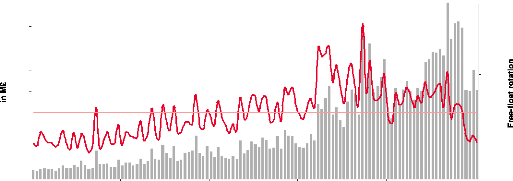

#9: 10-Years Evolution of Rio Tinto Ltd Daily Free-Float Rotation

(Sydney)

160

2.0%

0.0%

80

140

1.6%

120

100

1.2%

10Y free-float rotation = 0.76

60

40

0.8%

0.4%

20

0

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

|

Monthly average daily volumes (LHS) % of the free-float (RHS)

|

Source: ThomsonReuters Datastream

As we may notice after the analysis of the two exhibits #8 and

#9, the 10-year daily free-float rotations are almost the same (0.79 vs. 0.76)

and follow the same tendency over the time. Hence, we may reject the hypothesis

that the difference of liquidity between the two stocks could have an influence

on the premium/discount variation.

Since 2002, we may notice the relative narrowing of the gap

between the two stocks, consequence of more efficient financial markets, a

growing deregulation and the fall of barriers between countries.

Through the analysis of former DLCs, we may note that since

the year 2000 a majority of DLCs have disappeared. In each case, the reasons

pleading for the total unification of the DLC were a greater liquidity thanks

to a unique stock traded and the increase of weight in benchmark index.

Moreover, companies' managements have to take into consideration that owning a

control stake in the capital of one of the two companies provides the control

of the whole DLC.

After this simplification of structure, the two listings become a

simple cross-listing.

I.2.c. Other Means

Instead of performing foreign cross-listings, companies may

decide to list locally one of their foreign subsidiaries. In 1997, Yahoo! made

such decision by listing Yahoo! Japan Corp on the Japanese market JASDAQ.

Another example was the Royal Dutch Shell and its subsidiary Shell Canada

(founded by Shell in 1911 and listed on the Toronto Stock Exchange until

2007).

However, this kind of operation is not considered as

cross-listings and will not be analyzed in this research.

I.3. Reasons Pleading for Foreign Cross-Listing

"[Dual listing] is an innovative concept that ratchet's up the

debate regarding the quality of the trading environment for securities - and

what is best for shareholders."

Jeffrey Sonnenfeld, Associate Dean, Yale School of Management

Cross-listing's rationales may be depicted into three main

motivations: business, corporate governance and financial. Generally, the

decision to initiate a foreign cross-listing results from a combination of

these three types of motivation.

I.3.a. Business Motivations

In a study surveying European managers about the benefits of

foreign listing6, managers were used to pointing out the visibility

and the notoriety as the main gains. While the visibility facilitates relations

with clients and suppliers, the notoriety helps the recognition of a brand in

foreign market.

Moreover, in some cases the question of prestige regarding the

listing place may be taken into consideration. Indeed for some companies, being

listed in financial centers like New York or London has become a mean to

distinguish themselves from their competitors. Such notion had also been

confirmed by the study of F. Bancel and C. Mittoo6.

6 F. Bancel and C. Mittoo, 2001, "European Managerial

Perceptions of the Net Benefits of Foreign Stock Listings"

I.3.b. Corporate Governance Motivations

Regarding corporate governance matters, there are several reasons

pleading in favor of foreign cross-listing.

Firstly, one of the most evoked elements by managers is the

gain in recognition, since both media and financial analyst coverage increase

after a foreign cross- listing. The more a stock is covered by analysts, the

more it draws the attention from the market and investors.

Secondly, a foreign cross-listing may be useful for companies

based in countries providing low domestic regulatory standards. By being listed

in a major financial place and by adopting higher accounting/governance

standards, the company sends positive signals to the market by providing more

reliable and more qualitative information to investors.

Thirdly, the management may be attracted to broaden, to

diversify and to internationalize the company shareholder basis. A foreign

cross-listing allows the company to access to a greater range of institutional

and individual investors. Nowadays, international markets remain in a certain

way relatively segmented, domestic investors keeping a strong motivation

(legal, fiscal and cultural) to invest in domestic stocks. This is notably the

case in the United States where some pension funds, one of the most important

types of investors, have limitations for their foreign investments (e.g. can

only hold dollar denominated instruments or have a threshold for foreign stocks

corresponding to a percentage of their total assets) and thus have a limited

access to international markets. By being directly listed on the local American

stock exchanges, foreign companies may get round this problem.

Moreover, in 1987 R. Merton7 explained that investors

are usually inclined to invest in companies they know, that is to say in

domestic shares.

Fourthly, there is a matter of quality investor's right.

Indeed, for investors one of

the most fundamental determinants is the

protection of their rights, evidence

7 R. Merton, 1987, "A Simple Model of Capital Market

Equilibrium with Incomplete Information"

showed by W. Reese and M. Weinbach8. Furthermore,

R. La Porta, F. Lopez de Silanes, A. Shleifer and R. Vishny(9 and

10) arrived at the conclusion that "the legal system is the primary

determinant for external financing in a country" and "the common-law system

provides better quality protection for investors than civil-law systems".

Nowadays, the common law system is widespread in countries with British

heritage like the United Kingdom, the United States, South Africa, Canada,

Australia and so on.

Fifthly, foreign cross-listing may also be a mean to

facilitate merger and acquisition operations (M&A) with foreign companies,

notably by providing the possibility to pay the target by the mean of share

exchange. Such evidence had been pointed out by P. Tolmunen and S.

Torstila11, through the study of "196 European firms cross-listed in

the U.S. showing that cross-listed firms are significantly more active than

matching pair firms in U.S. acquisitions. Cross-listed firms are also somewhat

more likely to use equity payment, particularly in the year of cross-listing.

The act of cross-listing, however, does not in itself increase the likelihood

of U.S. acquisitions for any given company: rather, cross-listed firms are

likely acquirers both after and before the cross-listing. After cross- listing,

however, the proportion of aggregate M&A volume financed with equity

increases, as cross-listed shares are used to finance large acquisitions".

After an important M&A operation with shares exchange, the

buyer often asks for the admission of its shares on the target's main listing

places. The goal is to remain close to the target's main clients, suppliers,

investors, banks and authorities. This point is more public relationships than

pure financial preoccupations.

Furthermore, foreign cross-listings consecutive to M&A

operations allow to comply with an element thereby called in this research

"national sensibility" or simply "economic patriotism". Sometimes, it appears

to be unthinkable and politically inconceivable that a national champion

completely disappears after being acquired by a foreign company. For the buyer,

becoming cross-listed on the stock exchange of the target's incorporation

country allows to maintain a part of the target's identity and may facilitate

the transaction with local investors and authorities.

8 W. Reese and M. Weinbach, 1999, "Protection of

Minority Shareholder Interests, Cross-listing in the United States, and

Subsequent Equity Offerings"

9 R. La Porta, F. Lopez-de-Silanes, A. Shleifer and R.

Vishny, 1998, "Law and Finance, Journal of Political Economy"

10 R. La Porta, F. Lopez-de-Silanes, A. Shleifer and

R. Vishny, 1997, "Legal Determinants of External Finance"

11

P. Tolmunen and S. Torstila, 2002, "Cross-Listings and M&A

Activity: Transatlantic Evidence"

There are different cases of M&A operations:

4 Hostile takeover: e.g. in 2006 Mittal Steel and its

successful takeover bid on Arcelor. The new group ArcelorMittal had been

admitted for listing on Euronext Paris, Euronext Brussels, BME Madrid and

Bourse de Luxembourg, in addition to Mittal's listing places Euronext Amsterdam

and the Nyse (further details are given in part IV.5. ArcelorMittal's Case

Study).

4 Merger: e.g. in 2007 Unibail-Rodamco which had been created

by the merger between the French Unibail and the Dutch Rodamco. Since, the new

created company Unibail-Rodamco is cross-listed in both countries and is a

constituent of the two national reference indexes (CAC 40 and AEX).

4 Merger through a dual-listing: InBev, one of the world

leading brewers resulting from the combination (2004) of the Belgian InterBrew

and the Brazilian Ambev. As a result, InBev is now listed on Euronext Brussels,

whereas Ambev remains listed on the Brazilian Bovespa. In 2008, InBev launched

a successful bid on the biggest American brewer Anheuser-Busch, and will

consider a new listing in Anheuser-Busch's home country, i.e. the Nyse.

4 Spin-off: in 2008, Suez Environnement has been cross-listed

on Euronext Paris and on Euronext Brussels, i.e. the two main listing places of

its mother company, GDF-Suez.

Finally, we may consider that two different types of foreign

cross-listings may occur:

4 Active cross-listing, where the foreign cross-listing

operation results from the management's decision.

4 Passive cross-listing, where the foreign cross-listing

operation results from a M&A operation.

I.3.c. Financial Motivations

Nowadays, the growing globalisation and accessibility to

financial markets all around the world make the geography less and less

relevant: restrictions for international capital movements disappear, trading

costs decrease, stocks exchanges merge or enter into alliances, and so on. The

purpose of a foreign cross-listing may be the presence in a wider, more

efficient and more innovative financial market than its incorporation country

one. We may give the example of Russian and Indian companies which are listed

in their domestic financial place, but also often in London or in New York.

Influences on the shares

First of all, a foreign cross-listing increases the trading

volumes and therefore improves the overall liquidity. In efficient markets,

greater liquidity should be translated into lower cost of capital, since

liquidity is valued by investors. Y. Amihud and H. Mendelson12

stated that "the theory of corporate finance has been based on the idea that a

company's market value is determined mainly by just two variables: the

company's expected after-tax operating cash flows or earnings, and the risk

associated with producing them." The two authors also argued that "there is

another important factor affecting a company's value: the liquidity of its own

securities, debt as well as equity". For instance, since 2008 more and more

companies initially listed on the Londoner fast growing market AIM (Alternative

Investment Market) have initiated cross-listings on Euronext Alternext in order

to offset the lack of liquidity on their primary stock exchange and to benefit

from a second European market in the Eurozone, the world's second main

currency. This was the goal of IPOs of British companies Proventec and Accsys:

"European investors are not comfortable dealing in the AIM market. There aren't

many market makers handling our shares, there aren't many market makers

handling most AIM shares 11.3 we do not want to knock AIM but want to provide

better liquidity for our European investors", Proventec's CEO

said13.

12

Y. Amihud and H. Mendelson, 2008, "Liquidity, the Value of the

Firm, and Corporate Finance", Journal Applied Corporate Finance

13 See Appendix 2: Article by Jon Mainwaring, The

Independent published on Sunday, 10 February 2008, "AIM companies bid for dual

listings on Euronext to boost liquidity"

Then, the reduction of transaction costs should also improve

the volumes and the liquidity, by encouraging investors to perform more

buy/sell operations. However, in his study14 published in 2001, J.

Hamet highlighted that cross-listings may affect the equilibrium of the

markets. Indeed, Hamet's rationale suggests that trades in each listing place

may risk to become more limited, not facilitating the pricing discovery

process.

Moreover, in part I.3.b. Corporate Governance Motivations, we

have already dealt with the influence of the shareholding diversification for

the corporate governance. However, according to R. Merton, it is also possible

to establish the positive impact of the shareholder basis widening on the stock

price. R. Merton15 stated "when the shareholder base broadens,

risks' sharing improves, bringing about a positive impact on stock prices. [..]

Smaller shareholder base is associated with lower firm value".

Finally, we may imagine that a foreign cross-listing in

markets having different time zones may reduce the volatility of the stock. In

this perspective, P. Lowengrub and M. Melvin16 arrived at the

conclusion that pricing errors are reduced because "it facilitates the process

of assessing a stock's value at the beginning of the trading session. At the

opening of the trading, prices are less volatile for shares that traded

overnight on another exchange than for those that did not".

Influences on the cost of capital

Through a foreign cross-listing, there are different ways to

influence a company's financing.

Firstly, we may consider a positive influence on the cost of

capital thanks to a better access to capital markets. Indeed, empirical

studies17 showed that the cost of equity generally declines after a

foreign cross-listing. This decline may be explained by the access to easier

and more competitive financing conditions

14 J. Hamet, 2001, "La cotation des titres d'une

entreprise française sur un marché étranger et ses

conséquences pour l'actionnaire", PUF

15 R. Merton, 1987, "A simple Model of Capital Market

Equilibrium with Incomplete Information", Journal of Finance 72, No.3

16 P. Lowengrub and M. Melvin, 2006, "Before and

After International Cross-Listings: An Intraday Examination of Volume and

Volatility"

17

A. Karolyi, 1998; R. Stulz, 1999; V. Errunza and D. Miller,

2000

(loans, issuance of shares, equity-linked or bonds

instruments), but also by the elements previously given in part I.3.b Corporate

Governance Motivations, i.e. a decrease of transaction costs for investors, a

higher reliability and quality of information provided to investors, as well as

a better investor protection. For instance, a higher reliability and quality of

information may reduce the investor's cost for researching information and the

risk related to a company, therefore allowing the company to obtain lower cost

of funding, R. Stulz18.

Secondly, the increase of the company's geographical customer

basis helps to lower the company's beta R (see Appendix 1) which

impacts downwards the cost of capital, R. Stulz18, P. Martin and H.

Rey19, D. Lombardo and M. Pagano20.

Influences on the valuation

As a matter of fact, it is well established that the cost of

funding has an influence on the company's valuation.

In its study, L. Zingales21 measured the

difference between market value and book value, with the conclusion that

"shares of foreign companies listed both in the company's home market and on a

U.S. stock market traditionally trade at a higher valuation as a percentage of

book value than domestic peers that aren't cross-listed. A cross-listed company

traded at 150% of book value and a similar company from the same country listed

only on their home market traded at 120% of book value, the valuation premium

would be 30 percentage points. [..] The premium for listing on both U.S. and

foreign markets averaged 51 percentage points from 1997 to 2001. It dropped to

31 percentage points between 2002 and 2005". As a consequence, we may deduct

that investors would pay more for a company listed in the United States, mainly

for the reasons given previously in this research.

The influence of the corporate governance on company's

valuation had already been highlighted by the work of P. Hostak, E. Karaoglu,

T. Lys and Y. Yang22, who noticed that "compared to foreign firms

that maintained their ADRs, foreign firms which voluntarily delisted have

weaker corporate governance, had a less negative

18 R. Stulz, 1999, "Globalization of Equity Markets

and the Cost of Capital"

19 P. Martin and H. Rey, 1999, "Financial Integration

and Asset Returns"

20 D. Lombardo and M. Pagano, 1999, "Law and Equity

Markets: A Simple Model"

21 L. Zingales, 2006, "Is the U.S. capital market

losing its competitive edge?"

22

P. Hostak,, E. Karaoglu, T. Lys and Y. Yang, 2007, "An

Examination of the Impact of the SarbanesOxley Act on the Attractiveness of US

Capital Markets for Foreign Firms"

stock market reaction when SOX was passed, and suffered a

significant price decline in their home-markets when they announced their

intention to delist."

Over the years, some financial places have managed to become

the center of gravity for some sectors: Nasdaq has become a natural stock

exchange for investors and funds specialized in technology-IT-biotech, whereas

the places of London, Toronto and Sydney own a real expertise in Mining and Oil

& Gas sectors. Such evidence has already been showed by A. Blass and Y.

Yafeh23 with the demonstration that Dutch and Israeli companies

performing a listing in the United States are "young, fast growing,

overwhelmingly high-tech oriented and highquality innovative".

Furthermore, not being listed in a place specialized in its

sector, may contribute to a lower the liquidity, and therefore the company's

stock underperformance in comparison to its sector.

Being foreign cross-listed may also help the company to gain

in price-to-earnings ratio (P/E). Indeed, it is well established that the

difference of the average P/E between stock exchanges (see exhibit #10) may

offer substantial gap, and therefore lead to important difference in market

capitalisation for companies evolving in the same sector.

#10: Historical Average P/E of the World Main Stock

Exchanges

(Period 2000-2007)24

61.8 59.8

31.9

24.1 22.6 21.1 20.9 20.2 19.2 17.9 16.7 16.4 14.9 14.1 13.2

23 A. Blass and Y. Yafeh, 1999, "Vagabond Shoes

Longing to Stray: Why Foreign Firms List in the United States"

24

Sources: World Federation of Exchanges, Bloomberg,

ThomsonReuters Datastream

As we can see in the exhibit #10, there are major differences

of valuation between stock exchanges. For instance, the Nasdaq offers a 7-years

average P/E of 59.8 whereas the Nyse and Euronext Paris offer respectively 20.2

and 14.9. By taking advantage of this mispricing (low domestic P/E in

comparison to foreign P/E), a company may initiate a foreign cross-listing on a

stock exchange where its peers benefit from relative higher P/E.

#11: 2007 P/E Comparison of Foreign Companies Foreign

Cross-Listed

on American Stock Exchanges

Origin Country

|

Average P/E of Foreign

|

Average P/E on the Primary Premium/

|

|

Companies on the Nyse

|

Stock Exchange Discount

|

Latin America

|

13.1x

|

9.9x

|

|

|

|

India

|

11.7x

|

9.7x

|

20%

|

|

China Hong Kong

|

11.9x

|

8.4x

|

41%

|

|

Shanghai

|

19.2x

|

13.3x

|

44%

|

|

Canada

|

15.5x

|

11.2x

|

39%

|

|

U.K

|

10.4x

|

7.7x

|

34%

|

|

Western Europe

|

12.1x

|

10.6x

|

14%

|

|

Japan

|

11.7x

|

12.5x

|

(7%)

|

South Korea

|

7.4x

|

8.4x (12%)

|

|

Average P/E of Foreign

Companies on the

Nasdaq

|

|

Average NewTech's P/E on

the Tel Aviv

SE

|

|

Premium/

Discount

|

|

|

|

|

|

|

Israel* 15.1x 13.8x 9%

P/Es are calculated with 2007 net incomes and market

capitalisations as of the 06/11/2008

* Regarding Israeli companies, we compared those

cross-listed on the Nasdaq, due to their large presence on this stock

exchange

Sources: ThomsonReuters Datastream, Bloomberg

The exhibit #11 corroborates the statement previously enounced

concerning the

companies originating from MEDC25 but also from

emerging countries. However,

two notable exceptions exist with the cases of

Japanese and South Korean

25 More Economically Developed Countries (Western and

Northern Europe, Canada, the United States, Japan, South Korea, Australia and

New Zealand)

companies, consequence of the 1990s stagflation impact and

overvalued companies in comparison to their results.

By analyzing the premium/discount, it emerges that a foreign

cross-listing on the Nyse allows companies to gain on average 23% in P/E;

figure which is quite significant because it concerns companies with market

capitalisation in billion U.S. Dollars.

Other influences

Through a foreign cross-listing and the exercise of

stock-options, a company may dispose of a new mean to pay its employees in

foreign subsidiaries. This solution is more convenient, may be done at a lower

cost and enables the association of foreign employees in the capital.

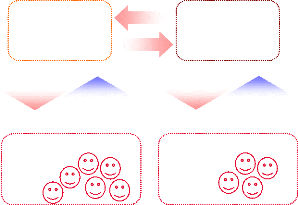

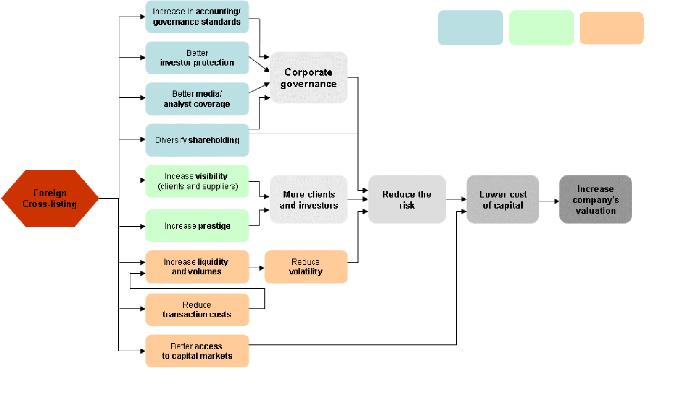

I.3.d. Main Impacts of the Foreign Cross-Listing

As we noticed, foreign cross-listing may theoretically have

many impacts, all resumed by the following diagram #12. In fine, the goal of a

foreign cross-listing is to influence the company's valuation for the benefit

of shareholders.

All connections and impacts (see next page, exhibit #12)

Corporate

Governance

Other minor rationales:

n M&A purposes

n National sensibility / economic patriotism

n Different trading time zones

Business

Financial

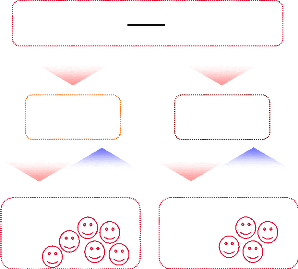

I.4. Different Geographical Origins Imply Different

Purposes

After the analysis of the reasons pleading for foreign

cross-listing, companies may be depicted into two main classes, each one

differentiated by its purposes.

The first class is mostly made up of companies originating

from the MEDC countries. These companies generally decide to perform one or

several foreign cross-listings in another MEDC country for business and/or

financial motivations, but also sometimes to comply with reasons of "national

sensibility" (further details in part I.3.b. Corporate Governance Motivations,

sub part M&A operations).

As regards the second class of cross-listed companies, we may

consider companies originating from the emerging countries, mostly from the

BRIC (Brazil, Russia, India and China), but also to a lesser extent from

Mexico, Turkey, South Korea, Taiwan, Indonesia and South America. The main

purposes are more oriented towards corporate governance matters (accounting

standards, investor's rights protection, better media/analyst coverage,

visibility to clients and suppliers), but also towards the access to easier and

more competitive financing conditions.

Conversely to the tendency in the MEDC countries, foreign

cross-listings still have an interest for companies from emerging countries. Up

to now, there is still a large number of foreign cross-listings with issuers

from emerging countries, consequence of not sufficiently developed local

financial markets and low domestic regulatory standards.

II. Geography of the Foreign Cross-Listing

II. 1. Methodology for the Creation of the Sample

II.1.a. Sources

Different sources had been used and cross-checked for the

creation of the sample, therefore allowing us to develop our foreign

cross-listing analysis.

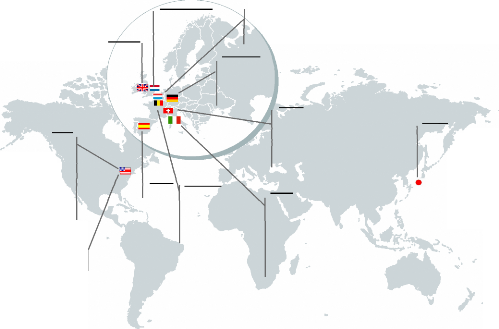

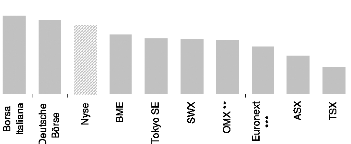

This analysis focus on 15 stock exchanges (4 North American,

11 Western European, 1 Japanese, 1 Australian) located in 15 developed

countries, and representing 85.31% of the world total trading value as of July

2008 YTD26, i.e. US$49,856,092 million27.

#13: Map of the Stock Exchanges Selected for the Analysis

26 YTD means Year-to-date, as of July 2008

27

Calculated with data from the World Federation of Exchanges

#14: Stock Exchanges Share of Worldwide Volumes July 2008 YTD

|

Share inTotal

|

Western

|

Share inTotal

|

|

Share inTotal

|

|

Americas

|

Trading Value

|

Europe

|

Trading Value

|

Asia-Oceania

|

Trading Value

|

|

|

|

|

|

|

|

Nyse

|

35.16%

|

L.S.E

|

7.81%

|

Tokyo SE

|

6.04%

|

|

Nasdaq

|

14.69%

|

Deutsche Bôrse

|

4.36%

|

ASX

|

1.49%

|

|

Nyse Alternext

|

0.66%

|

Euronext

|

5.10%

|

|

|

|

TSX

|

1.90%

|

Paris

|

|

|

|

|

|

Amsterdam

|

|

|

|

|

|

Brussels

|

|

|

|

|

|

SWX

|

1.76%

|

|

|

|

|

OMX

|

1.56%

|

|

|

|

|

Borsa Italiana

|

1.88%

|

|

|

|

|

BME

|

2.89%

|

|

|

Source: World Federation of Exchanges

In a first step, we used stock exchanges' websites in order to

get the complete lists of all foreign companies listed on each places.

4 Nyse (New York Stock Exchange)

4 Nasdaq

4 Nyse Alternext, former Amex (American Stock Exchange)

4 TSX and TSX Venture (Toronto Stock Exchange)

4 Euronext-Alternext Paris, Amsterdam, Brussels

4 L.S.E-AIM

4 Deutsche Biirse

4 SWX/VTX (Swiss Stock Exchange)

4 OMX Nordic Exchange (Stockholm, Copenhagen and Helsinki)

4 Borsa Italiana

4 BME (Bolsas y Mercados Espafioles)

4 ASX (Australian Stock Exchange)

4 TSE (Tokyo Stock Exchange)

After a precise analysis and cross-check with several tools

like Bloomberg and ThomsonReuters Datastream, we had arrived to a final sample

composed of 1,347 foreign cross-listing cases.

However it is important to notice that the figure 1,347

includes cases where a company owns multiple foreign cross-listings. The

company ArcelorMittal is one of these cases with listings on Euronext Paris,

Euronext Brussels, Euronext Amsterdam, Bourse du Luxembourg, BME Madrid and on

the Nyse.

Afterwards, as regards of the analysis of data such as the

performances, the volumes, the sales or the net incomes, the sample had been

reduced to companies providing daily trading information with tools like

Bloomberg and ThomsonReuters Datastream.

II.1.b. Statements and Assumptions Regarding the

Analysis

In this analysis,

4 If a company is listed on different stock exchanges belonging

to the same country, e.g. Nyse/Nasdaq or Frankfurt/Xetra, we had only

considered it once.

4 If a company owns on the same stock exchange different

kinds of financial instruments (e.g. class A and class B shares, different

kinds of ADR, shares and ADR), we had only considered it once. For instance,

this was the case of the Japanese companies Torray Industries and Fujitsu

listed on the L.S.E.

4 In the sample, we consider DLCs (Dual-Listed Companies).

4 As regards listings in Germany (Frankfurt and XETRA), the

quasi totality of listed companies in the world are proposed to the trading by

the operator Deutsche Biirse, i.e. a total of 11,355 German and foreign

companies. However, in this research we had only considered companies having

initiated by themselves foreign cross-listings in Germany.

The following cases had been excluded from the sample,

4 ETF (Exchange-Traded Funds) or index trackers, e.g. Lyxor

ETFs, iShares, PowerShares, and so on

4 Companies which are not listed in their (or at least one of

their) incorporation country(ies)

4 OTC (Over-the-Counter) traded shares

4 Non-sponsored Depositary Receipts (DRs)

Stock Exchange

TSX 34 2173 12 1 2

SWX 60 4 16 2 12 20 6 251 7 1 7 135 6

141 392 36,0%

OMX 3 3 1 676 7 0 7 682

1,0%

BME 1 1 1 1 151 1 5 29 34 192

17,7%

Borsa Italiana 1 6 17 12 1 1 3 286 41 1

42 328 12,8%

Tokyo SE 8 1 1 3 2 1 1 1 2271 18 2

20 2295 0,9%

ASX 8 10 2024 18 15 33 2056

1,6%

Nyse 2869

Nasdaq 2895

Nyse Alternext Amex) 759

Euronext Amsterdam 2 2 142 4 7 2 9 1 2 29

6 35 196 17,9%

Euronext Brussels 4 187 6 1 11 8

19 237 8,0%

Euronext Paris 15 8

Deutsche Börse 3 1 2 1 5 1307 3 2 1 2 2 1

23 7 30 1336 2,2%

L.S.E 31

Origin

Sc

U.S Canada NL Belgium France Germany U.K Swiss Spain

Italy Japan Australia

andinavia

36

42

76

62

4 3 3 5 1 3 7 10 72 61 133 3200 4,2%

6 1 9 9 26 5 4 5 5 19 5 170 148 318 3620

8,8%

7 3 9 1810 5 4 17

9

673 3 11 1 0 2 1 50 15 65 756 8,6%

2 1 65 2 67 862 7,8%

36

26

Total from

MEDC

Countries

154 156 310 2333 13,3%

75 18 93 2369 3,9%

Total from

Emerging

Countries

Total

Cross-

Listings

# of local

companie

s listed

% of foreign cross- listings

3,5%

2,4% 3,9%

10 55 79 873 474 1347

1,1% 6,3% 9,0% 100%

11.2. Presentation of the Results

Total Listings

|

166

|

224

|

55

|

17

|

66

|

61

|

89

|

11

|

25

|

15

|

Degree of cross-listing

|

2,6%

|

10,3%

|

38,7%

|

9,1%

|

9,8%

|

4,7%

|

4,9%

|

4,4%

|

3,7%

|

9,9%

|

Weight / total

|

19,0%

|

25,7%

|

6,3%

|

1,9%

|

7,6%

|

7,0%

|

10,2%

|

1,3%

|

2,9%

|

1,7%

|

|

#15: Geographic Distribution of Foreign Cross-Listings from the

MEDC Countries28

#16: Geographic Distribution of Foreign Cross-Listings from

non-MEDC Countries

Origin

Stock Exchange

Nyse Nasdaq

Nyse Alternext (Amex)

TSX

Euronext Amsterdam Euronext Brussels

Euronext Paris

Deutsche Börse

L.S.E SWX OMX BME Borsa Italiana

Tokyo SE

ASX

Total Listings

Lux.

Greece

|

Ireland

|

Austria

|

Lichtens

Portugal

tein

|

Russia

|

Turkey

|

Eastern

Europe

|

China

|

India

|

South

Korea

|

Taiwan

|

Pakistan

|

Indonesi

a

|

Singap.

|

New

Zealand

|

Africa /

Middle

East

|

Israel

|

South

Am.

|

1

|

3

|

4

|

|

1

|

|

5

|

1

|

1

|

20

|

10

|

8

|

5

|

|

2

|

|

1

|

6

|

3

|

77

|

1

|

|

3

|

|

|

|

|

|

|

|

1

|

1

|

1

|

|

|

1

|

|

5

|

42

|

6

|

|

|

|

|

|

|

|

|

|

1

|

|

|

|

|

|

|

|

|

1

|

|

|

|

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

2

|

9

|

|

3

|

4

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

3

|

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9

|

|

1

|

|

|

4

|

|

|

|

3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

5

|

1

|

|

1

|

|

24

|

9

|

12

|

7

|

22

|

13

|

9

|

3

|

1

|

1

|

|

42

|

4

|

|

1

|

|

|

1

|

|

2

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

12

|

2

|

|

|

19

|

8

|

12

|

1

|

2

|

2

|

32

|

10

|

13

|

32

|

35

|

23

|

15

|

3

|

4

|

3

|

15

|

76

|

53

|

116

|

|

II.3. Empirical Interpretation of the Results

II.3.a. Geographic Distribution

This study focuses on companies which are foreign

cross-listed on the main world financial places located in 15 countries: the

United States, Canada, Australia, Japan, The United Kingdom, France, Germany,

the Netherlands, Belgium, Switzerland, Northern Europe (Sweden, Finland and

Denmark), Italy and Spain.

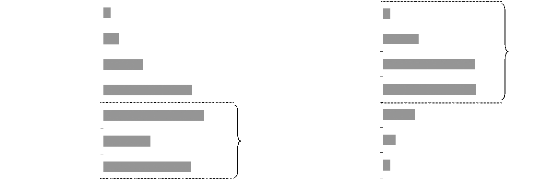

This analysis records a total of 1,347 foreign cross-listing

cases. Among these 1,347 foreign cross-listings, 873 (64.8%) come from the main

MEDC28 countries, whereas the rest comes from Eastern Europe,

Russia, Turkey, China, India, Taiwan, South Korea, Pakistan, Indonesia,

Singapore, New Zealand, Israel, South America and Africa.

As we could anticipate, the most attractive places are the

American stock exchanges (Nyse, Nyse Alternext and Nasdaq), the L.S.E and to a

lesser extent the Swiss Stock Exchange, with respectively 518, 310 and 141

cross-listings of foreign companies. This supremacy is probably linked to the

strong degree of internationalisation of these stock exchanges (see following

exhibit #17), the predominant influence of three of the strongest currency in

the world (US Dollar, British Pound and Swiss Franc), but also the weight in

the world financial system of Wall Street, the City and the Swiss banking

industry.

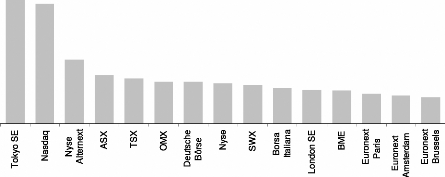

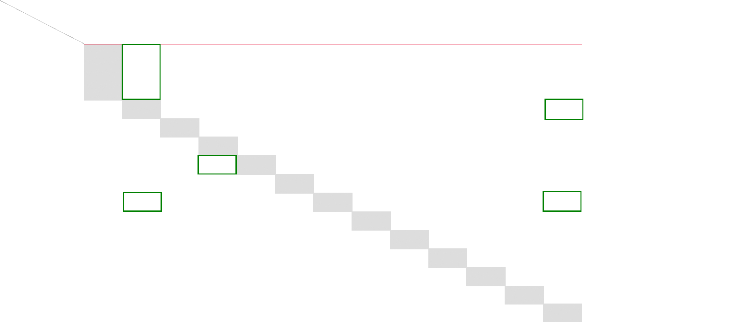

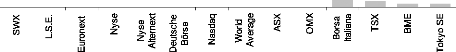

#17: Weight of Foreign Companies on Each Main Stock

Exchange29

21.7%

19.6% 18.2% 17.6%

12.1% 11.5%

7.0%

4.1% 3.1% 2.0% 1.8% 1.1% 1.0%

24.4%

Source: World Federation of Exchanges

28 More Economically Developed Countries (Germany,

France, U.K, Switzerland, Italy, Spain, Netherlands, Belgium, Scandinavia,

Canada, the United States, Japan and Australia)

29 Excluding investment funds and Calculated in terms

of number of companies

The exhibit #18 provides a global overview of the interest in

foreign cross-listin by local companies.

#18: Number of National Companies Cross-Listed Abroad

Total Cross-

Listings Abroad

Degree of

cross-listing 43

Total Cross-

Listings Abroad

Degree of

cross-listing 43

|

U.S

|

Canada

|

France

|

Japan

|

Australia

|

|

Worldwide

|

Spain

|

Italy

|

|

224

|

|

79

3.9%

Belgium

|

Swiss

|

873

4.7%

Scandinavia

|

|

10.3%

|

|

U.K

|

|

89

4.9%

|

66

|

55

|

17

|

11

4.4%

|

25

|

15

|

10

3.5%

|

|

38.7%

|

9.1%

|

|

9.9%

|

|

The Canada and the United States present both the greater

number of cross- listings abroad, with respectively 224 and 166 cases, that is

to say 25.7% and 19.0% of the total sample. However, after a more precise

analysis of the degree of cross-listings31, it appears that Canadian

companies are much more favorable for foreign cross-listings, since 10.3% of

companies listed on the TSX and TSX Venture have another listing abroad vs.

only 2.6% for American ones. In the past, Canadian companies have been

historically cross-listed in the United States, whereas the reverse is not

completely true: 77.7% of Canadian foreign cross- listings are performed in the

United States vs. only 20.5% for American companies in Canada. Worldwide, the

degree of cross-listing represents 4.7% of all national listings.

According to the results, it emerges that companies from the

Euro Zone32 are the most eager to perform foreign cross-listings

(Euro Zone average at 8.2%), even if result are relatively disparate (from 3.5%

up to 38.7%). The other countries reach a maximum of 4.9% (one notable

exception, Canada which is at the same level as France and Spain, i.e. circa

10%). Moreover, the Euro Zone companies appear more likely to perform a second

listing inside the Euro Zone (77.2% of cases),

30 Number of cross-listings performed by national

companies / Number of national companies listed

31 # of cross-listings abroad performed by national companies /

Total # of national companies listed on the national stock exchange

32 The Netherlands, France, Spain, Belgium, Germany

and Italy

whereas at the European Union scale the figure decreases to

64.2%. This result is not surprising since we may point up the beginning of a

unified European market materialized by a unique currency, a common top

authority (the European Commission) and the total abolition of borders.

#19: Distribution of French Cross-listed Companies

Peugeot Saint Gobain

Frankfurt

Eurotunnel

EADS Lagardère Sanofi

Saint Gobain Total

Tokyo

Alcatel-Lucent

Nyse

BNP Paribas

*****

Societe Generale *

***

Swiss

Alcatel-Lucent GDF Suez

Axa Sanofi

BNP Paribas Scor

Danone Saint Gobain

France Telecom Total

LVMH Vivendi

Spain

Brussels

~ ~~ ~ ~ ~

Milan

EADS

Alcatel-Lucent

Axa

CGG Veritas

France

Telecom

Sanofi (ADR)

STMicroelectronics

Total

Thomson

Veolia

(ADR)

Alcatel-Lucent

GDF Suez Peugeot

Saint Gobain

Total Vranken-Pommery

Nasdaq

* Dassault Systemes

** Ilog

*** Wavecom

Alcatel-Lucent LVMH

AXA PPR

BNP Paribas Renault

Carrefour Sanofi

Crédit Agricole Societe Generale Danone

STMicroelectronics

France Telecom Vivendi

GDF suez Total

L'Oréal

Amsterdam

Alcatel-Lucent Saint Gobain

Air France-KLM STMicroelectronics EADS

Unibail-Rodamco

Gemalto

Luxembourg GDF Suez

London

Sources: Companies

* The delisting of Dassault Systemes from the Nasdaq in 2008

is in progress

** In 2008,the American IBM launched a takeover on

Ilog

*** In December 2008, the Canadian Sierra Wireless launched

a takeover on Wavecom

**** Societe Generale has announced its delisting from Tokyo

for the end of 2008 ***** BNP Paribas has announced its delisting from Tokyo

during the year 2009

II.3.b. Sector

A closer look at the exhibits #15 and #16 highlights the

correlation between the foreign cross-listings and the dynamism of cross-border

mergers/acquisitions at the European scale (e.g. connections between

France/Italia, France/Netherlands, U.K./Netherlands and

Germany/Switzerland).

As noticed in part I.3.c Financial Motivations, the findings

also verify the attractiveness of specialized financial places for some

sectors. The case of the Toronto Stock Exchange (TSX) is particularly eloquent

(see exhibit #20); among all the foreign cross-listings on the TSX, 87% are

performed by companies operating in the Mining or Oil & Gas sectors. The

analysis of the typical Canadian company listed on the TSX shows that more

Mining and Oil & Gas companies are listed on the TSX than on any other

financial place in the world (Mining and Oil & Gas represent 402 of the 612

Canadian companies listed on the TSX). This result is the consequence of the

major influences of these sectors within the Canadian economy.

#20: Weight of Companies Operating in

he Mining and Oit

& Gas sectors in the TSX

|

Canadian

Companies

on the TSX

|

Foreign

Cross-Listings

on the TSX

|

Mining

|

267

|

87

|

Oil & Gas

|

135

|

12

|

Sum

|

402

|

99

|

% of all Canadian companies on the TSX

|

66%

|

|

|

% of cross-listed companies on the TSX

|

|

87%

|

|

|

This tendency may also be verified with the

technology-IT-biotech companies foreign cross-listed on the Nasdaq, with 77% of

Australian cross-listed companies operating in the Pharmaceutical or

Biotechnology sector.

Another example: among the 41 Israeli cross-listed companies

on the Nasdaq, 40 are operating in the Pharmaceutical, Biotech or IT sectors.

In comparison, there are only 3 Israeli foreign cross-listings on the Nyse and

4 on the L.S.E.

Moreover, we may notice that a major player within a sector

has an influence on the foreign cross-listings of its peers by attracting them

in its primary listing place. The rationale for such operation is the

following: when a financial place and its local investors are familiar with a

sector thanks to the presence of a local important player, it may be natural

for competitors to approach these same investors and therefore to raise

capital.

For instance, the analysis of British companies foreign

cross-listed on Euronext Paris shows that these companies own an important

subsidiary operating in the French market or have a French important

competitor. Among the 11 British companies cross-listed on Euronext Paris

4 HSBC owns the former French bank CCF since 2005

4 Kesa owns Darty, the second largest business unit of the group

(after Comet)

4 Kingfisher owns Castorama, the second largest French retailer

of home improvement tools and supply

4 Diageo is the main competitor of Pernod-Ricard, the world's

second largest player in the beverage sector

4 BP is one of the main competitors of the French major Total

4 Hammerson and Segro are competitors of world biggest real

estate company, the French-Dutch Unibail-Rodamco

As regards the 42 foreign companies cross-listed in Italy

4 AXA, Allianz, Aegon, Fortis, ING are competitors of the

3rd European insurer, Generali

4 Total is one of the main European competitors of the major

Eni

4 BNP Paribas and Credit Agricole are foreign cross-listed in

Italy since their important acquisition of Italian banks, respectively BNL

and

Ca riparma/FruilAdria

4 LVMH and PPR made important Italian acquisitions such as

Fendi, Gucci, Bottega Veneta

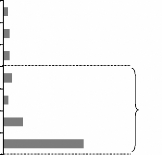

II.3.c. Size and Growth

As anticipated in part 111.1. Decreasing Advantages and

Increasing Concerns ?, a focus on companies' size shows that foreign

cross-listings are in the very great majority performed by large companies,

with 76.4% of the sample presenting a market capitalisation greater than US$1bn

(as of October 2008). The main reason behind this tendency is the cost related

to a foreign listing which is a financial border between small and large

companies.

According to the results, foreign cross-listed companies present

on average sales of US$31.2bn and a market capitalisation of US$26.8bn.

#21: Average Sales and Market Capitalisation of

Companies

Composing the Sample

Total Sales

(mUS$)

|

|

Market Cap.

(mUS$)

|

|

|

|

|

Average 31238 26793

Median 9640 8274

Source: ThomsonReuters Datastream

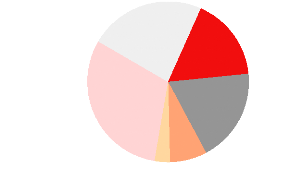

#22: Breakdown of the Sample by Market Capitalisation

5.3%

9.9%

8.5%

6.6%

3.9%

9.1%

13.5%

14.4%

28.8%

76.4%

More than $100bn

Between $75bn - $100bn

Between $50bn -

$75bn

Between $20bn - $50bn

Between $10bn - $20bn

Between $1bn -

$10bn

Between $500m - $1 bn

Between $100m - $500m

below $100m

Source: ThomsonReuters Datastream

#23: Average Sales and Market Capitalisations by Stock

Exchange (in mUS$)

Sales Mkt Cap Sales Mkt Cap Sales Mkt Cap

28522 27819 6516 3263 194 420

Milan

|

Swiss

|

Frankfurt

|

Paris

|

|

Sales Mkt Cap Sales Mkt Cap Sales Mkt Cap Sales Mkt Cap

63801 54269 57650 45209 44832 52508 42048

39410

Sales Mkt Cap Sales Mkt Cap Sales Mkt Cap

25928 18203 22425 19514 16992 22125

Sales Mkt Cap Sales Mkt Cap

58493 63088 3618 4157

Source:

ThomsonReuters Datastream

After a more detailed look at the data, it emerges major

differences of company profile between stock exchanges.

First of all, the analysis of the average size brings to

light that places like Paris, Frankfurt, Milan, Zurich or Tokyo mainly attract

very large multinationals (i.e. most of these companies belong to their

national reference index), whereas London and New York have a broader scope by

attracting more medium-sized companies as well as emerging countries companies.

This point is reinforced by the analysis of the dot distribution in the four

point clouds in exhibits #24.

Furthermore, it is worth to notice the major difference of

size and sales between the two main American stock exchanges, since foreign

cross-listed companies on the Nasdaq are on average far away smaller than those

on the Nyse. This may be explained by the different roles played by each stock

exchange: the Nyse is mainly targeted by multinational companies, well

established and operating in traditional activities, whereas the Nasdaq

welcomes more fast growing companies (see exhibit #25).

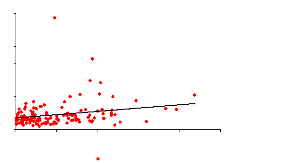

#24: Correlation between Net Incomes 2007 and Market

Capitalisations (mUS$)

Net Incomes 07 Net Incomes 07

R2 = 0.7612

Market Cap.

0 50000 100000 150000 200000 250000 300000

Nyse

Net Incomes 07

0 50000 100000 150000 200000 250000 300000

Europe*

Net Incomes 07

0 50000 100000 150000 200000 250000 300000

L.S.E

0 50000 100000 150000 200000 250000 300000

Nasdaq

30000

25000

30000

R2 = 0.7475

Market Cap.

25000

20000

15000

10000

5000

0

R2 = 0.9052

Market Cap.

30000

25000

20000

15000

10000

5000

0

30000

25000

20000

15000

10000

R2 = 0.464

Market Cap.

5000

0

20000

15000

10000

5000

0

Source: ThomsonReuters Datastream R2 is the

correlation in linear regression

Most striking, is the strong correlation between the net

incomes 2007 and market capitalisations for companies foreign cross-listed on

the L.S.E, on the Nyse and in Europe, with respectively R2 of 0.91,

0.76 and 0.75. A contrario, foreign crosslisted companies on the Nasdaq

generally offer a weak correlation with R2 dropping to 0.46. This

confirms the presence on the latter of smaller and fast-growing companies.

However, there is no proven correlation between the Price

Earnings Ratio (P/E) and the sales growth CAGR (Compound Annual Growth Rate)

for the period 2004- 2007 (see appendix 1).

* Europe includes main European markets for Foreign

cross-listing, i.e. France, Germany, Switzerland and Italy

#25: Sales Growth CAGR during the period 2004-2007

Euro Zone U.K Canada U.S

Origin Place

Foreign Listing Place

Japan Emerging

Countries

|

|

|

Average

|

|

|

Nyse

|

+9.3%

|

+6.3%

|

+24.4%

|

-

|

+10.5%

|

+30.8%

|

Nasdaq

|

+19.7%

|

+10.8%

|

+33.9%

|

|

-+1.9%

|

+14.6%

|

L.S.E

|

+10.9%

|

-

|

+38.7%

|

+7.1%

|

+7.1%

|

+17.7%

|

Euronext Paris

|

+4.6%

|

+9.1%

|

n.a

|

+8.3%

|

n.a

|

+33.0%

|

|

n.a: no enough data available Source: ThomsonReuters

Datastream

Note:

As regards Canadian foreign cross-listed companies, the

figures mostly concerns companies operating in the sector of Mining and Oil

& Gas; that explains the impressive double digit sales growth over the last

few years.

II.3.d. Cultural Similarities

The overall results bring to light the strong influence of

cultural similarities in the choice of the cross-listing place. Indeed,

companies performing foreign cross- listings are particularly inclined to list

in countries culturally similar to their origin country. We may note the

influence of elements such as a common language, a common culture, a common

history, and so on. Such statement has already been evoked by the work of M.

Pagano, A. Rbell and J. Zechner34, and a precise look at the results

of the exhibits #15 and #16 in part 11.2. Presentation of the Results

corroborates such idea.

First of all, a striking figure is the weight of foreign

cross-listings performed between Anglo-Saxons35, which represents

35.6% of all 1,347 foreign cross- listings. Another example is the

attractiveness of Euronext Paris for Belgian companies; Euronext Paris

gathering 53% of all the 17 Belgian foreign cross- listings. On the other side,

French and Luxembourgian companies represent 62%

34 M. Pagano, A. Rdell, and J. Zechner, 1999, "The

Geography of Equity Listing: Why Do European Companies List Abroad?"