Chapter 5

INTERNET TRAVEL

THE GLOBAL NET

The Internet continues to grow at a phenomenal pace. Internet

users have soared from 171 million in 1999 to 354 millions as of today (NUA

Internet Survey, 2001). North America remains ahead with 135 million of the

world total. Europe and Asia Pacific follow with 113 million and 105 million

Internet users respectively. Current predictions indicate that Internet users

could exceed the 1 billion mark by 2005, with the explosion of Internet access

wireless devices. According to the International Technology and Trade Associate

(ITTA, 2000), adoption of Internet and IT sector is at the heart of the decade

long economic expansion. The adoption of IT and Internet tools has driven

growth in almost every sector including travel and tourism by practically

doubling productivity. The Web contains 2.1 billion indexable pages (7 million

pages added daily) distributed over 17.7 million sites. «Dot-Com»

domain names dominate the Internet with 9.4 million sites.

|

|

Number of Worldwide Online Households

(in

millions)

200

|

|

150 100 50

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0

YEARS

|

|

Figure 4. Number of Worldwide Online Households (Bear, Stearns

& CO, 2000).

INTERNET BUSINESS TRAVEL

United States

Approximately 90 million online travelers or about 44 percent of

the U.S. adult population are online travelers (past-year travelers who

currently use the Internet). Two-thirds (66%) of online travelers or 59.4

million U.S. adults have used the Internet to make travel plans in the last

year (PhoCusWright, 2001). Travel planning consists of activities such as

getting information on destinations or checking prices and schedules. This is

up 23 percent from 48.1 million adults in 1999. Among them 21.9 millions adults

or 36 percent of current Internet users have used the Internet to make travel

reservations in the past year. Travel reservations include actual booking or

paying an airline ticket,

hotel room, rental car, and package tour. The number of online

travel buyers is projected to reach 72 million in 2003. (Forrester Research,

2000)

Search engine websites are the most popular for online travel

planning (62%). Company-run websites and destination sites are also popular at

51 and 48 percent each. Online travel agency sites are used by over half (36%)

of online travel planners (Travel Industry Association of America, 2000).

Figure 5. Types of Internet sites used for Travel Planning.

(Travel Industry Association of America, 2000)

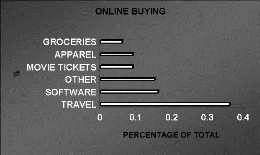

Travel is the most important business on the web in term of the

volume of e-commerce (eMarketer, 1999). By 2003, US$29 billion in travel will

be sold online, almost four times 1 999's level (Forrester Research, 2000).

Despite this immense growth most Internet travel research companies' estimates,

only put

online travel booking at 10% of total travel booking in 2003.

Today airline booking represents 60% of total Internet travel buying.

Figure 6. Online Buying in United States (With reference to Bear,

Stearns & CO, 2000)

Europe

The European online travel market is gaining prominence as the

economic signs for this e-commerce segment continue to grow stronger. The

European online travel market will soar from US$2.9 billion in 2000 to US$10.9

billion in 2002 - nearly a 300% two-year gain (PhoCusWright, 2001).

Factors contributing to this growth were continuing rapid

expansion in Internet and wireless usage; the breakdown of e-commerce barriers

such as bill payment, security and privacy concerns; improved

telecommunications; and the

influx of new and improved online travel services. Increasingly,

Europeans are able to access the Internet using flat-rate payment plans instead

of having to pay for Internet access by the minute, which had been a major

constraint. At the same time, several online players have begun to build

significant market share - and are raising public awareness of travel

e-commerce in the process. Airline Web sites and tour operators control 28% and

27%, respectively, of the European online travel market in 2000. Online travel

agencies have a 26% market share; railways, 9%; hotels, 7%; and car rental

companies, 3%. Unlike in the U.S., supplier Web sites dominate the online

travel market in Europe. Airlines, tour operators, hotels, railways and car

rental companies represent

74% of the European online travel market in 2000, while online

agencies' share is 26%.

Airline Web site sales will total $810 million in 2000, while

$382 million of airline tickets will be sold through online travel agencies.

The two airlines with the largest online bookings, Easy Jet and Ryan air book

100% of their Internet sales on their own Web sites.

|