|

DESTINATION MANAGEMENT SYSTEM FOR MOROCCO

TOURISM

By

Inan Elmerini

An Executive Project submitted in partial fulfillment of the

requirements for the

degree of

Master in Business Administration for Aviation and

Aerospace

Professionals

Embry-Riddle Aeronautical University

Daytona Beach, Florida

April 2001

Copyright (c) Inan Elmerini 2001

DESTINATION MANAGEMENT SYSTEM FOR MOROCCO TOURISM

By

Inan

Elmerini

This graduate research project was prepared under the direction

of the candidate research advisor, Dr Easwar Nyshadham, Department of Business

Administration and has been approved by the Project Review Committee. It was

submitted to the Department of Business Administration and was accepted in

partial fulfillment of the requirements for the degree of Executive Master in

Business Administration For Aviation and Aerospace Professionals.

PROJECT REVIEW COMMITTEE

Approved by:

Dr. Easwar Nyshadham Earaar /1(tekadkaff Date: April 2001

Project Advisor

Dr Blaise Waguespack 8laise lagueepael

Graduate Program Coordinator Date: April 2001

Dr Dan Petree Pax Pet ee

Department Chair Date: April 2001

ABSTRACT

TITLE: DESTINATION MANAGEMENT SYSTEM FOR MOROCCO TOURISM AUTHOR:

Inan Elmerini

INSTITUTION: Embry-Riddle Aeronautical University.

DEPARTEMENT: Business Administration

DEGREE: Master in Business Administration for Aviation and

Aerospace Professionals YEAR: 2001

The rapid development of Information and Communication technology

(ICT) in the distribution and intermediation of tourism products has set new

competitive environment for destination's tourism industry. A comprehensive

research on ICT implications on the tourism and travel industry was conducted

to demonstrate the critical competitive factors of comprehensive database of a

Webbased Destination Management System and the seamless marketing chain it

creates: Awareness-Information-Booking-CRM. This project proposes a Destination

Management System for Morocco's Tourism Destination and carefully evaluates

strategic implications of its realization. Marketing, financial and

organizational strategic requirements are analyzed for a successful

implementation. This executive project demonstrates how a DMS will enable the

Moroccan National Tourism Office, as an organization, to establish a critical

competitive advantage for Morocco's entire tourism industry.

TABLE OF CONTENTS

ABSTRACT .. iii

LIST OF TABLES v

LIST OF FIGURES ..vi

Chapter

1. INTRODUCTION ..1

2. WORLD TOURISM: AN OVERVIEW ..4

Historical Trend 4

International Tourism in 2000 ... .4

Regional Highlights ....6

International Tourism Expenditures 10

Morocco Destination Overview ...11

Destination Positioning . 11

Market Share .. ..11

Competition and Potential Development . 12

3. TOURISM INDUSTRY 14

Global Characteristics ..14

Core Characteristics .15

Market Characteristics .16

Competitive Constraints for Destinations 20

Industry's Driving forces 20

Marketing Constraints for Tourism Boards .21

4. TOURISM AND INFORMATION TECHNOLOGY .23

Demand Trends and Information Technology .23

ICT Strategic Implications for Tourism ....27

5. INTERNET TRAVEL ...34

The Global Net ...34

Internet Business Travel ..35

United States ...35

Europe 37

6. DESTINATION MANAGEMENT SYSTEM ..39

The Nature of a National Tourism Office ....39

Comprehensive Study of a DMS ..40

Definition 40

Historic Background ....41

DMS Fundamental Objectives .42

Destination Stakeholders' Objectives ...43

DMS's Success Criteria 44

Existing DMSs 47

TIScover, Austria .47

Gulliver, Ireland ...48

7. DMS FAISABILITY FOR MOROCCO DESTINATION ...50

MNTO Marketing Challenge ...50

Major Issues 50

Strategic Environment .50

Marketing Objectives ...52

Overall Objectives ...52

Tourism Businesses 52

The Consumer .53

Building the Web Based DMS .54

Database Characteristics .. 54

Business Model and Financial Feasibility ..62

Constraints ..62

Financial Analysis 64

MNTO's Organizational Challenge ...70

Operational Environment 70

Managements Objectives 72

SWOT Analysis ..74

Vision and Mission ..75

Changing MNTO's Organization .76

8. CONCLUSION .79

INDEX OF TABLES

Number Page

Table 1. Top Destination in Africa and Middle East . 6

Table 2. Top Destinations in the Americas .. 7

Table 3. Top Destinations in East Asia . 8

Table 4. Top Destinations in Europe 9

Table 5. Pre Internet Tourism 19

Table 6. Tourism Competitive Drivers in ITs Environment ..28

Table 7. Internet Enabled Tourism . 33

Table 8. Destination Marketing System Characteristics 56

Table 9. Interactive Marketing Framework 59

Table 10. Financial Inputs ... 66

Table 11. Projected Revenues . 67

Table 12. Loan Amortization . 68

Table 13. Financial Outputs 69

Table 14. Financial Scenario Summary . 70

LIST OF FIGURES

Number Page

Figure 1. Stylized View of the Tourism and Travel Market 17

Figure 2. The Deployment of IT in Tourism 27

Figure 3. Current and Future Position of Online Services . 30

Figure 4. Number of Worldwide Online Households 35

Figure 5. Types of Internet Sites used for Travel Planning 36

Figure 6. Online Buying in the United States 37

Figure 7. Success Criteria for DMS .. 46

Figure 8. Morocco Destination Marketing SWOT Analysis... 51

Figure 9. Outline of a Web Based Destination Marketing System

57

Figure 10. A Framework for Web Design 61

Figure 11. MNTO's Operational Strategic Environment 72

ACKNOWLEDGMENTS

The author wishes to express special thanks to the project

advisor, Dr. Easwar Nyshadham, whose constant encouragement, helpful counsel

and practical suggestions were crucial to the successful outcome of this

Graduate Research Project. Appreciation is also due to Drs. Petree and

Waguespack, Project Review Committee Members, for their assistance in preparing

this manuscript.

This statement of acknowledgement would be incomplete without a

formal expression of sincere appreciation and gratitude to both Dr. Saad

Laraqui and the author's family for providing the assistance and encouragement

needed to complete the task.

Chapter 1

INTRODUCTION

Tourism clearly counts as one of the social and economic

phenomena of the last century. According to WTO, the number of international

tourists traveling in the world reached 698 millions in 2000. International

tourism receipts for the same year have been estimated at US$ 476 billion.

Today, Tourism is perceived as an eminently global industry with a worldwide

network of producers, suppliers and intermediaries. This industry is also

characterized by its fragmentation and heterogeneity, thus a complex product

with different components. Moreover, Tourism is information intensive industry,

with worldwide heterogeneous consumers communities with constant changing

needs.

Recognizing the benefits of tourism, many countries have created

coordinating agencies at national level, to address tourism related services.

Often, these agencies, such as Tourist Boards tend to be state organizations in

charge of marketing their country as a «brand». Historically, Tourist

Boards have marketed their destinations by communicating their countries'

tourism offer to the international markets through various media, including

direct contact with the consumers through physical offices in the world's major

cities. They also

promote their destinations by distributing printed and video

materials and taking part in tourism trade shows or «similar live

activities». However, in recent years, tremendous changes that have

occurred in the travel industry have driven Tourist Boards all over the world

to adapt their missions, and sharpen their marketing strategies. Probably, the

single most significant change driving this redefinition of corporate mission

is the revolutions in information technology. Information and Communication

Technologies (ICT) available today make it possible to radically reengineer

activities between an organization, its customers, suppliers and

stakeholders.

The role of such national institutions in creating a general

enabling environment for the tourism industry is crucial especially for

developing countries. Morocco is one of those developing countries that are

relying on Tourism to jumpstart a tourism driven economy. The State owned

Tourism Board for Morocco, called the Moroccan National Tourism Office (MNTO),

is naturally also confronted with those changes and that is a strong

reinforcing factor to its obligation to become the leveraging instrument of

Morocco Destination's global image and tourism product positioning in

international consumers' mind. Therefore, MNTO should reevaluate its approach

towards marketing Morocco as a destination to tourists worldwide.

The purpose of this project is to evaluate the technical,

managerial and organizational feasibility of a destination marketing system for

the Moroccan

National Tourism Office. The project is organized as follows:

Section 1 contains an overview of the world tourism travel; Section 2 reviews

the tourism industry characteristics and business constraints; Section 3

introduce the strategic implications of Information Technology on the tourism

industry; Section 4 describe today's Internet travel; Section 5 introduce to

Destination Management System and highlights its success criteria; Section 6

propose the Destination Management System conception and implementation for the

MNTO.

Chapter 2

WORLD TOURISM: AN OVERVIEW

HISTORICAL TREND

International Tourism in past half-century has been marked

foremost by its tremendous expansion. Between 1950 and 2000 the number of

arrivals has shown an evolution from a mere 25 million international arrivals

to 698 million in 2000, corresponding to an average growth rate of 7 %. This

strong overall expansion is also characterized by its geographical spread among

Asian, North African, South American and Caribbean destinations. Numerous

countries in those regions has turned tourism as a primarily source of wealth.

More than 70 countries receive over one million international visitors a

year.

INTERNATIONAL TOURISM IN 2000

World Tourism statistics has traditionally used measurement such

Tourist Arrivals and International Tourist Receipts. According to the World

Tourism Organization (WTO), world tourism grew by an estimated 7.4% in 2000

spurred on by a strong global economy and special events held to commemorate

the new millennium. Nearly 50 million more international trips were made in

2000, the

same number of new tourists as major destinations such Spain or

the United States receive in one year. The number of international arrivals in

2000 totaled 698 million, according to preliminary results released in January

2001 by the WTO. Receipts from international tourism also climbed to US$476

Billion, an increase of 4.5% over the previous year, translating into receipts

per arrival of US$681. All regions of the world hosted more tourists in 2000,

although the fastest developing areas continued to be East Asia and the

Pacific. Countries in Western Mediterranean performed well in 2000 as tourists

shunned away from destinations in East Mediterranean Sea, perceived as to close

to the conflict in Kosovo. Turkey made a great come back with 39.6 %increase in

visitor despite political problems and the 1998 earthquake disaster.

International arrivals to Morocco, for example rose by 7. 4 % in 2000, totaling

4.1 million tourist arrivals, following an excellent 21.6 % increase in 1999

over the previous year.

REGIONAL HIGHLIGHTS

Africa and Middle East: Africa is still left out

of tourism boom despite an enormous potential. While Kenya, Egypt and Morocco

enjoyed strong growth, two of Africa's biggest destinations, (South Africa and

Zimbabwe) suffered setbacks.

Table 1

Top Destination in Africa and the Middle East

|

Top Destinations

|

Arrivals in 2000

|

% Of change

|

1. South Africa

|

6,108,000

|

+ 1.4%

|

2. Egypt

|

5,150,000

|

+14.7%

|

3. Tunisia

|

5,057,000

|

+4.7%

|

4. Morocco

|

|

4,100,000

|

+7.4%

|

|

|

5.Israel

|

2,400,000

|

+3.8%

|

|

6.Jordan

|

1,256,000

|

-7.5%

|

|

7.Kenya

|

1,226,000

|

+ 30.0%

|

|

8.Zimbabwe

|

840,000

|

-60.0%

|

Source: With reference to WTO

Americas: Central America continued to record

the biggest growth in the American continent (+8.8%), while the United States

showed a solid 8.7% increase despite the strength of the US dollar.

Table 2

Top Destinations in the Americas

|

Top Destinations

|

Arrivals in 2000

|

% Of change

|

1. United States

|

52,690,000

|

+8.7%

|

2. Canada

|

20,423,000

|

+4.9%

|

3. Mexico

|

20,000,000

|

+5.0%

|

4. Brazil

|

5,190,000

|

+1.6%

|

5. Puerto Rico

|

3,094,000

|

+2.3%

|

6. Argentina

|

2,988,000

|

+3.1%

|

7. Dominican Republic

|

2,977,000

|

+ 12.4%

|

8. Uruguay

|

1,968,000

|

-5.1%

|

9. Chile

|

|

1,71 9,000

|

+6.0%

|

|

|

10.Cuba

|

1,700,000

|

+8.9%

|

Source: With reference to WTO

East Asia and Pacific: This part of the world

saw important growth driven by China and Honk-Kong. South East Asia especially

Thailand, Cambodia and Vietnam is becoming one of the world's favorite

destination in the world.

Table 3

Top Destinations in East Asia

|

Top Destinations

|

Arrivals in 2000

|

% Of change

|

1. China

|

31,236,000

|

+15.5%

|

2. Hong Kong

|

13,059,000

|

+ 15.3%

|

3. Malaysia

|

10,000,000

|

+26.1%

|

4. Thailand

|

9,574,000

|

+ 10.5%

|

5. Singapore

|

7,000,000

|

+11.9%

|

6. Macao

|

6,682,000

|

+32.3%

|

7. South Korea

|

5,336,000

|

+ 14.5%

|

8. Indonesia

|

5,012,000

|

+6.0%

|

9. Australia

|

4,882,000

|

+ 9.5%

|

10. Japan

|

|

4,758,000

|

+7.2%

|

|

Source: With reference to WTO

Europe: The star performer remains Europe with

some 300 million international visitors fueled by Expo 2000 in Germany and the

Vatican Jubilee in Italy. However East Europe is making a come back after the

Kosovo war and Turkey made a strong come back after the natural disaster in

1998.

Table 4

Top Destinations in Europe

|

Top Destinations

|

Arrivals in 2000

|

% Of change

|

1. France

|

74,000,000

|

+2%

|

2. Spain

|

53,600,000

|

+3.7%

|

3. Italy

|

41,182,000

|

+12.8%

|

4. United Kingdom

|

24,900,000

|

-1.9%

|

5. Russian Federation

|

22,783,000

|

+23.2%

|

6. Germany

|

18,916,000

|

+10.5%

|

7. Poland

|

18,183,000

|

+1.3%

|

8. Austria

|

17,81 8,000

|

+2.0%

|

9. Hungary

|

15,571,000

|

+8.1%

|

10. Greece

|

12,500,000

|

+2.8%

|

11. Portugal

|

|

12,000,000

|

+3.2%

|

|

|

14. Turkey

|

9,623,000

|

+39.6%

|

Source: With reference to WTO

All those figures shows that South East Asia is undoubtedly the

fastest growing tourism region in the world and it is likely to keep this trend

for years to come. As West European destinations are becoming more saturated,

and with

WTO's projections of 1 billion International Tourism Arrivals in

2010, regional competition is likely to accentuate, particularly between

Mediterranean and South East Asia tourist destinations.

INTERNATIONAL TOURISM EXPENDITURES

In 1999, 45 countries recorded each more than US$ 1 billion in

international tourism expenditure (WTO, 2000) with the big industrial powers

clearly in the lead. The United States, Germany, the United Kingdom and Japan

toping the list with spending ranging from US$ 29 billion to US$ 56 billion per

year. Those countries represent over one-third of total international tourism

expenditure.

According to a study by the World Travel and Tourism Council

(WTTC), travel and tourism is the world's largest industry directly or

indirectly driving more than 10% of global jobs, GDP, and investment.

In an increasingly global society, the economic and social

contribution of this industry to the world is highly significant and continues

to grow.

International aviation is the prime engine of travel and

tourism, which presently contributes more than USD 3,500 billion to the world

economy, or nearly 12 percent of the total. More than 192 million jobs are

generated, 8% of the world total. Capital investment for travel and tourism is

at present US$ 733

billion a year. This represents more than 11 percent of the world

total (IATA, 2000).

MOROCCO DESTINATION OVERVIEW

Destination Positioning

Morocco is roughly comparable in size, geography and climate to

California, with a population of 35 millions. Morocco is a unique country. The

destination holds an unquestionable differentiating advantage with a product

that has a strong cultural content and incomparable geographical diversity,

which brings big potential to seaside Atlantic coast beaches, mountains and

inland Sahara desert adventure tourism that is enjoyable all year long. Given

the product attributes of Morocco as a destination and the characteristics and

trends of International Tourism that is leaning toward cultural discovery and

adventure, the destination holds a potentially promising future.

Market Share

Morocco repre sent a very small portion of this huge business

with less than 0.6% of the International tourism flow or 4.1 millions

international visitors annually generating $2.8 billions total revenue (Source:

WTO 2001). European Union members (France, Spain, Germany, Italy, Benelux and

Great Britain generate nearly 70% of inbound travel to Morocco. North America

outbound

tourism to Morocco reaches a mere 5%. The Middle East and North

East Asia also generate almost 5% of total arrivals. Total airborne

International arrivals represent 66%. According to the Ministry of Tourism,

tourism sector contributed in 1999, to 8% of the Gross Domestic Product (GDP),

generating 600,000 (direct and indirect) jobs.

Competition and Potential Development

Direct competitive destinations to Morocco are those with similar

tourism products content with strong cultural and adventures attributes in the

perimeter of the Mediterranean Sea. Such Destinations are Turkey, Egypt,

Israel, Tunisia, Portugal, Spain and South Africa that is part of the African

continent. However new entrants from South East Asia region are more and more

direct competitors despite their distances from the European world biggest

outbound market. Those countries are represented by Thailand, Malaysia and most

recently aggressive destinations such as Vietnam and Cambodia.

Traditional competitors such as Egypt and Turkey have

accomplished tremendous progress by developing a strong tourism industry in the

last decade. Morocco despite being an earlier entrant in new developing

countries destinations lagged behind because of lack of strategic vision and

planning. The country slipped from a 25th position in International

Arrivals in 1990 to 37th

rank in 1999. The tourism industry suffered a structural crisis

leading to insufficient lodging capacity and deteriorating infrastructure and

quality product. In 1999 effective lodging capacity was reaching a mere 70,000

beds in total. At the same time Egypt and Tunisia lodging capacity were set to

140,000 and 180,000 respectively. However Morocco destination is recovering

from the structural crisis and a jointly public-private sector initiative

identified major red tapes that have to be eliminated as well as fiscal

incentives to apply for a successful tourism development policy. Actions have

already been taken to attract foreign investment, while numerous major

infrastructure projects are being launched. Morocco destination should be able

to attract 10 million international tourists by 2010, thus becoming one of the

major Mediterranean tourism destinations.

Chapter 3

TOURISM INDUSTRY

The Tourism industry is by definition a global industry with a

worldwide network of producers, suppliers, and intermediaries. There are a few

large multinational airlines, tour operators, hotel chain and theme parks. The

tourism enterprise-overwhelming majority is small or medium size business. This

is particularly true in the case of Morocco destination.

GLOBAL CHARACTERISTICS

> Global industry (Tourists= 698 millions, Expenditures = $476

billions) > Air Transport liberalization =New entrants

> Highly competitive

> Capital-intensive industry

> Information based industry

> 9 dominants players: Developed countries (USA, France,

Italy, Spain, United Kingdom, Germany, etc.) with 51% of worldwide total

receipts.

> Less Developed Countries with 12.3 % of total receipts

with China

leading with 23 millions arrivals and 2.3 % of total world

receipts.

CORE CHARACTERISTICS

The industry is by essence an information intensive service

industry that has historically struggled under the weight of fragmented supply

chains, which results in complex and often-inefficient business processing.

Firstly it is heterogeneous and hence relies most exclusively upon

representations and descriptions (information in printed and audiovisual

format) by the travel trade and other intermediaries for its ability to attract

consumers. Unlike durable goods, intangible tourism services cannot be

physically displayed or inspected at the point of sale before purchasing.

Hence, they are normally bought before the time of use and away from the place

of their consumption (Buhalis, 1996). Tourism products are particularly

difficult to describe due to their multi-national and cultural character.

Different cultures, cuisine, customs, constitute the context, whereas the

content is represented by geographical locality, lodging amenities and

attractions/activities. So the information provided through images portrayed by

media, promotional materials and word of mouth is highly critical for provision

and distribution of tourism products. Tourism products require a great degree

of commitment and cannot be replaced, should consumers being not satisfied with

their attributes. Therefore timely and accurate information is the key success

to successful satisfaction of the demand (Buhalis, 1994). Furthermore success

will depend on the quick identification of the consumer needs and the

interaction with prospective clients, by using comprehensive, personalized and

up to date

media to convey this information and to design that specific

product that will satisfy today's more experienced consumer.

MARKET CHARACTERISTICS

Until today's new ITs' driven competitive environment, few

players in the various sectors of the tourist industry understood the

importance of cooperation and networking because of the fragmented nature of

the travel market. In particular DMOs and the travel trade still do not

collaborate adequately to represent their destination globally to foreign

markets. The public sector and private sector are in fact addressing tourists'

needs separately without a system that can enable the creation of a value chain

that strengthens the performance of the destination in a synergic manner. On

the contrary conflicts are created by the dissimilar objectives and interest of

various stakeholders, thus hurting the destination in general.

DMOs Intermediaries

Suppliers

GOV. BODIES

NTO

RTO

Primary Supplier

T.O CRS/

GDS

Travel Agent

Hotel

Chain

Airlines

Figure 1. Stylized View of the Tourism and Travel Market

(Werthner 1993)

Figure 1 represents a functional and structural view of the

tourism and travel market. It differentiates between the supply and the demand

side and the different intermediaries. Links mark the relationship as well as

the flow of information. On the supply side, primary suppliers are hotels,

restaurants, cultural or sport event organizers, etc, which are mostly Small

and Medium Tourism Enterprises (SMTEs). Tour Operators (TOs) can be seen as

product aggregators whereas Travel Agents, act as information brokers,

providing the consumer with relevant information and booking facilities.

Computerized Reservation Systems (CRSs) and Global Distribution Systems (GDSs)

cover airlines offering as well as other products such as packages holidays.

They provide the main links to TOs and to travel agents. Whereas the

intermediaries on the right side are the commercial link between supplier and

consumer, the left side is relevant for destination management and planning

entities such as DMOs (National Tourist Offices (NTOs) and Regional Tourist

Offices (RTO)) that are not involved in the booking process.

Table 5

Pre Internet Tourism

|

Countries

|

Producers

|

Intermediaries

|

Consumers

|

|

D

E

S

T

I

N

A

T

I

O

N

|

Hotels

Restaurants

Airlines

Provisions

Entertainment Recreations

|

Hotel Chain

Tour Operator

Travel Agent

GDS/CRS

Tourism associations

|

Tourists

|

|

DMO

|

|

Source: UNCTAD, 2000

COMPETITIVE CONSTRAINTS FOR DESTINATIONS

Developing countries have often used their natural and

geographical endowments to achieve remarkable growth in their tourism sector.

However, a number of circumstances common, but not exclusive, to developing

countries such as Morocco militate against their efforts to develop a strong

tourism export sector (UNCTAD, 2000):

> A generally weaker bargaining position towards international

tour operators;

> Long distances and less than acute or no competition result

in high air fares;

> Global distribution systems (GDSs) and computer reservation

systems (CRSs) owned by large international airlines;

> An increasingly competitive global tourism sector, where

natural competitive advantages are becoming less significant;

INDUSTRY'S DRIVING FORCES

> The tourism sector is profiting from the processes of

globalization and liberalization.

> Tourism producers and intermediaries are increasingly

competing on the confidence inspired in the customer directly through the

quality of the information they provide.

> The tourism industry is learning fast that the Internet can

satisfy this need far better than any other existing technology.

> The use of the Internet in developed countries for

purchasing tourism products is increasing dramatically.

> National tourism boards and tourism business associations

will exercise the leadership in embracing the digital age.

MARKETING CONSTRAINTS FOR TOURISM BOARDS

The marketing of a destination is a very difficult task because

the Tourism and Travel product is complex, consisting of a set of very

different products that are perishable in a highly information based

industry

environment. As keepers of the destination «brand»,

Tourists Boards are responsible for positioning the destination in the mind of

the consumer. This usually involves expensive print or broadcast media

campaigns, often with no call to action or sometimes with a number to call for

brochures fulfillment. The main objective is to raise awareness and create the

destination positioning in the tourist's mind. Today the effectiveness of

Destination Marketing Organization's traditional promotional actions are to be

questioned giving the new overall economic, social and technical back round,

which has to be considered, that shows the following trends according to the

International Federation of Information Tourism and Technology (IFITT,

Innsbruck, Austria).

> A further increase in tourism can be expected; the future

development of the industry will result in further differentiation and mass

customization as well as consolidation and globalisation. (Regional

competition).

> A common infrastructure, including software and hardware

tools and enabling e-commerce is emerging.

> Technology is becoming transparent and invisible to the

consumer. (DMO's that are not embracing technology will disappear).

> Information is already available at home, the work place and

during travel enabled by mobile computing and WAP technology.

> Destination branding will become more important, leading

probably to virtual organization branding with different products integrated

into e- commerce architectures.

These changes in the worldwide travel industry are having

tremendous impact on DMO s' traditional marketing models. Nowhere are the

changes mentioned above more evident than in the use of information to

position, market and sell destinations. Therefore major issues are to be

addressed, in this new strategic environment. DMOs are condemned to adapt their

mission, marketing and organizations to new models in order to create a

platform of development of the tourist demand at the level of the nation as a

destination in our modern information society.

Chapter 4

TOURISM AND INFORMATION TECHNOLOGY

DEMAND TRENDS AND INFORMATION TECHNOLOGY

ITs are not new to tourism industry. Computerized networks, and

particularly airline Computer Reservation Systems (CRSs) have been leading

dramatic changes since the early 1 970's. Airlines realized that their presence

through interfaces on travel agencies desktop was critical to attract booking

and manage their inventory and capacity distribution. The evolution of CRSs to

Global Distribution Systems (GDSs) in the early 1980's developed the first

electronic marketplace by integrating other airlines' reservation systems as

well as providing booking access to a range of tourism products from hotel to

car rentals. However the traditional CRS/GDS had only improved the information

communications between tourism businesses such as airlines and travel agents,

as they do not interact directly with the consumer. The systems are also

expensive to both the tourism producer and the retailer. Moreover these systems

are flawed with incompatibilities between each other, especially in the lodging

sector where «switch» companies such as THISCO (The Hotel Industry

Switching Company) was needed to connect hotels with majors GDSs, to facilitate

room reservations

for travel agents worldwide (Liu, 2000). But one should keep in

mind that GDSs are the backbone of the electronic distribution system of the

travel industry.

Information Technologies' (ITs) rapid developments in the 1990s

are now having profound impacts and implications for the whole tourism

industry. Beside the macroeconomic level where ITs are regarded as instrumental

in regional development, long term pro sperity, new information society and

knowledge-based economic powers (Buhalis, 1996), tourism is inevitably

influenced by the business re-engineering experience that this revolution had

provide (WTO, 1998). As information is the life-blood of the travel industry

(Sheldon, 1997), effective use of technology is fundamental to the tourism

sector. The most pro found impact of ITs on tourism management is efficiency in

cooperation among the industry's actors and the availability of tools for a

real globalization of the industry. It changes the best operation practices and

provides opportunities for business expansion in the geographical, marketing

and operational sense (Buhalis, 2000). As a result ITs facilitate the

integration of the industry in both geographical and operational terms.

(expansion to new productdestinations and vertical integration). Consequently,

tourism destinations must compete in a fiercely competitive marketplace; thus,

ITs have become a critical factor in determining future success or failure, as

well as tourism impacts at destinations. In fact ITs can empower promotion's

management and distributions of product-destination through the development of

Destination Marketing Systems (Buhalis, 1997).

Destinations increasingly attract international tourism from

distant and long haul markets, making information dissemination more imperative

than ever. Outbound markets are characterized by short gateways breaks with

trip decisions made on impulse from previous trips shortly before departures.

Therefore, the international tourist put emphasis on speed and information's

availability and accuracy as well as efficient reservation facilities. He is

increasingly more sophisticated and «wired». Consequently the rapid

development of both tourism supply and demand makes ITs an imperative partners

of the industry and thus ITs ever more play an important role in tourism

marketing, distribution, promotion and co-ordination (Buhalis and Spada, 2000).

Efficiency, speed and flexibility in responding to consumer requirements and

needs are now becoming a core competency in tourism marketing. ITs tools now

facilitate mass customization of tourism products. Complex and flexible bundles

of tourism offering can be configured. Furthermore ITs' based knowledge

management tools enable individualized marketing to customers (Werthner and

Klein, 1999).

Hence tourism organizations should develop partnerships aimed to

improve business processes using ITs, which will enhance the quality of their

interactions with their stakeholders from the producer to the supplier to the

consumer. The challenge for the industry is to provide a seamless integration

of information and physical service, with flexible configurations of the

physical and the information parts. Destinations that provide timely,

appropriate and accurate information, using ITs tools, to consumers and the

travel trade, have a better

chance of being selected and of strengthening their

competitiveness (Buhalis, Spada, 2000).

Today the development of the Internet revolutionized the usage of

ITs by providing the infrastructure of intra and inter-organization networking

between all computer users. The problem of GDSs incompatibility can now be

addressed effectively and cheaply. In addition a web base GDS has improved the

quality of information delivery (window based computer screen) and is

accessible instantly worldwide at a cheaper cost. The Internet tool enabled

instant distribution of rich media colorful content, booking capabilities and

e-commerce platforms to conduct online business. It offers substantial

advantages in communications, market research, market targeting, costumer

services, product development, cost savings and product delivering. Today, the

Internet is widely recognized as an extremely valuable marketing tool.

Inside organization

Between organizations

Between organization and clients

LAN Org.

MIS

C RS/GDS

Web page

W

W

W

System

I T

Coop. System

Figure 2. The deployment of IT in Tourism (With ref. to Shertler

W., 1990).

ICT STRATEGIC IMPLICATIONS FOR TOURISM

The most significant strategic implication of ITs is the

development of competitive advantages by product differentiation, seamless

product packaging for niche markets, cost reduction in the business processing

and travel distribution as well as increased speed of information retrieval and

exchange.

Table 6

Tourism Competitive Drivers in ITs Environment

Globalisation of Tourism Supply

Fierce Global Competition

Efficiency in Communication and Operation

Development of Yield Management systems

New Distribution Channels and Cost Control

Competitive advantages through Differentiation

Flexible and Customized Tourism Products

Product Innovation

Creating Seamless Tourist Experience

Close Interaction with Consumers

Building relationship and one-to-one Marketing

Source: WTO, 1998

The emerging globalization and tremendous competition between

tourism destinations require great degree of efficiency in communications and

operations. Adoption of ITs provides new ways of collecting, analyzing,

transmitting and delivering information and new ways to facilitate the creation

and transmission of knowledge throughout the tourism industry. The tourism

product being a «confidence good» (Werthner, Klein, 1999), an

assessment on the product quality before a buying action is practically

impossible. Information of high content and knowledge is therefore needed.

Organizations that offer that

degree of efficiency in information delivery, both externally and

internally will be able to succeed in the marketplace. The use of ITs' tools to

achieve that goal by providing instantaneous, flexible and customized products

to customers constitute a certain competitive advantage in a technological

driven competitive environment.

The dramatic grow of Internet has begun to fundamentally change

the relationship between consumers and suppliers. The way that buyers and

sellers share information and transactions has dramatically improved. Many if

not most, commerce relationships are very inefficient in the travel space.

(Bear, Stearns & CO, 2000). Because buyers and sellers are dispersed over

wide geographic areas and the transactions execution in the travel business is

by essence very complex, it almost appear as if the Internet were specifically

designed to correct the inefficiencies in research and transactions that are

inherent to the travel industry.

DMO

Consumer

Destin.

System

Tourist

Routing Server

T.O

Hotel

T.A

GDS

|

|

|

|

Airlines

|

|

Supplier

|

|

Primarily Supplier

|

|

|

|

|

|

Figure 3. Current and Future Position of Online Services

(Werthner and Klein, 1999)

The new marketplace is now a set of players (GDS, TOs, hotel

chain,

airlines, travel agents) that pursue an online strategy. The

above figure shows that technology, not only, enables direct access to the

consumer, but also improves

the internal information flow and cooperation processes

(Intranet, Extranet). The Internet serves as a centralized source for

information on many related travel

topics (i.e., air, hotel, car, attractions, activities). Internet

applications are now the electronic interface to the world's suppliers and

consumers. In electronic

marketplace, marketing push is replaced by marketing pull

(Fingar, Kumar & Sharma, 1999).

The Internet since its inception created a world of communities

of interest where peoples share ideas, information and opinions. Services are

defined now from a supplier and a consumer perspective (Werthner, Klein, 1999).

The consumer pool is now a very powerful agent in the suppliers marketing

strategy. Existing channels of distribution are giving way to global

communities-of-interest that eliminate channel components that they do not

perceive as adding value. For example, American Airlines' Travelocity was

originally designed so that travel agents would still add value by being the

means of delivering the ticket. Consumers who represent the travel community

saw little value in this arrangement and the travel agent was disintermediated

from the process (Fingar, Kumar & Sharma, 1999).

Those new intermediaries or online booking servers such as

Travelocity, Expedia, Preview Travel that are potentially dangerous for travel

agents act as virtual travel agents or travel supermarkets providing booking

facilities for air, hotel, car rentals as well as many information retrieval

services. They are new players often called «Infomediaries». They had

come with innovative business models that combine consumer advocacy (being well

aware of communities-ofinterest power) and flexible pricing. The infomediaries

have strategically positioned their applications in order to generate benefits

for customers and

suppliers such as reducing transaction's costs and generating

volume for suppliers witch are not feasible in direct sales mode.

Although it is recognized that the Internet medium is chaotic,

mainly because a lack of standardization and immaturity, it is evident that the

World Wide Web provide inexpensive delivery of information concerning every

single enterprise and destination. Thus the Internet empowers the marketing and

communication functions of remote, peripheral and insular destinations as well

as Small and Medium sized Tourism Enterprises (SMTEs). They are now able to

communicate directly to their prospective customers and differentiate their

product offering. Competitiveness and prosperity of both tourism enterprises

and destination in the new millennium will depend on the degree of innovation

by using the new strategic tools provided by the revolutionary information

technology.

In any case failure to take advantages of Information Technology

will undoubtedly lead to competitive disadvantage for organizations that fail

to adapt to those sweeping changes. Hence the pervasive ITs tools especially

Internet require re-engineering of business processes, as well as the

development of a strategic vision and commitment. Tourism destinations and

enterprises will therefore be able to embrace change and develop their

competitiveness in this new digital age.

Table 7

Internet Enabled Tourism

|

Countries

|

Producers

|

Intermediaries

|

Infomediaries

|

Consumers

|

|

D

|

|

|

Web based

|

|

|

E

|

Hotels

|

Hotel Chain

|

travel and

|

|

|

|

|

Tourism

|

|

|

S

|

|

|

|

|

|

Restaurants

|

Tour Operator

|

Hotel

|

|

|

T

|

|

|

|

|

|

|

|

Chain.com

|

Tourists

|

|

I

|

Airlines

|

Travel Agent

|

Tour

|

|

|

N

|

Provisions

|

GDS/CRS

|

Operator.com

|

|

|

A

|

Entertainment

|

Tourism

|

Travel

|

|

|

T

|

Recreations

|

associations

|

Agent.com

|

|

|

I

|

|

DMO

|

Tourism

associations.com

|

|

|

O

|

|

|

|

|

|

|

|

DMO.com

|

|

|

N

|

|

|

|

|

Source: With reference to UNCTAD, 2000

Chapter 5

INTERNET TRAVEL

THE GLOBAL NET

The Internet continues to grow at a phenomenal pace. Internet

users have soared from 171 million in 1999 to 354 millions as of today (NUA

Internet Survey, 2001). North America remains ahead with 135 million of the

world total. Europe and Asia Pacific follow with 113 million and 105 million

Internet users respectively. Current predictions indicate that Internet users

could exceed the 1 billion mark by 2005, with the explosion of Internet access

wireless devices. According to the International Technology and Trade Associate

(ITTA, 2000), adoption of Internet and IT sector is at the heart of the decade

long economic expansion. The adoption of IT and Internet tools has driven

growth in almost every sector including travel and tourism by practically

doubling productivity. The Web contains 2.1 billion indexable pages (7 million

pages added daily) distributed over 17.7 million sites. «Dot-Com»

domain names dominate the Internet with 9.4 million sites.

|

|

Number of Worldwide Online Households

(in

millions)

200

|

|

150 100 50

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0

YEARS

|

|

Figure 4. Number of Worldwide Online Households (Bear, Stearns

& CO, 2000).

INTERNET BUSINESS TRAVEL

United States

Approximately 90 million online travelers or about 44 percent of

the U.S. adult population are online travelers (past-year travelers who

currently use the Internet). Two-thirds (66%) of online travelers or 59.4

million U.S. adults have used the Internet to make travel plans in the last

year (PhoCusWright, 2001). Travel planning consists of activities such as

getting information on destinations or checking prices and schedules. This is

up 23 percent from 48.1 million adults in 1999. Among them 21.9 millions adults

or 36 percent of current Internet users have used the Internet to make travel

reservations in the past year. Travel reservations include actual booking or

paying an airline ticket,

hotel room, rental car, and package tour. The number of online

travel buyers is projected to reach 72 million in 2003. (Forrester Research,

2000)

Search engine websites are the most popular for online travel

planning (62%). Company-run websites and destination sites are also popular at

51 and 48 percent each. Online travel agency sites are used by over half (36%)

of online travel planners (Travel Industry Association of America, 2000).

Figure 5. Types of Internet sites used for Travel Planning.

(Travel Industry Association of America, 2000)

Travel is the most important business on the web in term of the

volume of e-commerce (eMarketer, 1999). By 2003, US$29 billion in travel will

be sold online, almost four times 1 999's level (Forrester Research, 2000).

Despite this immense growth most Internet travel research companies' estimates,

only put

online travel booking at 10% of total travel booking in 2003.

Today airline booking represents 60% of total Internet travel buying.

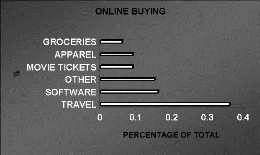

Figure 6. Online Buying in United States (With reference to Bear,

Stearns & CO, 2000)

Europe

The European online travel market is gaining prominence as the

economic signs for this e-commerce segment continue to grow stronger. The

European online travel market will soar from US$2.9 billion in 2000 to US$10.9

billion in 2002 - nearly a 300% two-year gain (PhoCusWright, 2001).

Factors contributing to this growth were continuing rapid

expansion in Internet and wireless usage; the breakdown of e-commerce barriers

such as bill payment, security and privacy concerns; improved

telecommunications; and the

influx of new and improved online travel services. Increasingly,

Europeans are able to access the Internet using flat-rate payment plans instead

of having to pay for Internet access by the minute, which had been a major

constraint. At the same time, several online players have begun to build

significant market share - and are raising public awareness of travel

e-commerce in the process. Airline Web sites and tour operators control 28% and

27%, respectively, of the European online travel market in 2000. Online travel

agencies have a 26% market share; railways, 9%; hotels, 7%; and car rental

companies, 3%. Unlike in the U.S., supplier Web sites dominate the online

travel market in Europe. Airlines, tour operators, hotels, railways and car

rental companies represent

74% of the European online travel market in 2000, while online

agencies' share is 26%.

Airline Web site sales will total $810 million in 2000, while

$382 million of airline tickets will be sold through online travel agencies.

The two airlines with the largest online bookings, Easy Jet and Ryan air book

100% of their Internet sales on their own Web sites.

Chapter 6

DESTINATION MANAGEMENT SYSTEM

NATURE OF A NATIONAL TOURISM OFFICE

One of the main tasks of National Tourist Offices (NTOs) that are

called often Destination Marketing Organizations (DMOs) is to create a platform

for the development of tourism demand at the level of the nation as a

destination, while promoting vertical cooperation with Tour Operators in the

outbound markets and domestic regional tourism Associations, in the area of

marketing. Until recently and still for the vast majority of DMOs, the main

concern is market communication for the purpose of positioning the destination

in relation to worldwide competitors, making use of conventional media.

Generally the DMOs do not attempt or take very little advantage of other

marketing mix tools such as product development, pricing policy or

distribution. With some exceptions, they are among the less developed players

in the online tourism industry.

Tourism Destinations emerge as umbrella brands and they need

to be promoted in the global marketplace as one entity for each target market

they want to attract (Paulo Rita, 1999). Tourism is a networked and

information- intensive industry. The success of DMOs depends therefore on the

quality of the

infrastructure (e.g. road, highway system) of the destination

they represent (Gartrell, 1988). The Internet is part of the infrastructure.

Thus, the mission of National Tourism Offices in contributing to the domestic

economy by maintaining destination attractiveness and by increasing the

awareness of prospective visitors is challenged by a whole new environment. It

is difficult for most of NTOs to keep pace with the emergence of innovative

marketing strategies based on ITs. In these new conditions set by the ITs'

revolution, DMOs need to determine to what extent they wish to make use of the

possibilities offered by information technology, and with what systems. The

question of how to move from the current way of doing business to one that is

responsive to these changes becomes a vital concern (Gretzel, et. al.,

2000).

COMPREHENSIVE STUDY OF A DMS

Definition

A Destination Management System is a web based integrated

information, destination marketing and reservation systems. They

may be referred elsewhere as Destination Databases or Destination Marketing

Systems. It is a combination of technological enablers and demand drivers that

has propelled the realization of destination management systems (Buhalis &

Spada, 2000). Buhalis and Pringle described it as:» a collection of

computerized information, interactively accessible, about a

destination».

DMSs are usually managed by destination management organizations

witch may be public such as state tourism offices or private organizations or a

combination of both (Pollock, 1998). They must provide timely, appropriate and

accurate information for tourism stakeholders:

u On the demand side they cater for multiple forms of access by

potential visitors, directly or through travel agents and tour operators,

through call

centers, visitor information centers, airlines' GDS, Internet and

interactive Web television. Potential visitors can be logged into a client

database and tracked through their purchase life cycle.

u On the supply side DMSs provide a comprehensive database of

products and services that the destination has to offer. Destinations

Management Systems are attractive to the consumer as well as the travel trade

as they provide a one-stop marketplace.

Historic background

More than 200 DMSs have been conceptualized and developed around

the world the last decade. However few systems have reached the major goal as

global distributors of all products of tourism destinations. The grand majority

of these systems have been implemented in local level and operate on a limited

basis, thus many of them had collapsed few years after their initial

development. (Buhalis, Spada, 2000).

DMSs are often limited in their scope and ambition by a

non-supportive organizational structure or by their technology. As a result

many commercial structures emerged with the consequence of inaccurate

information range since they favor big suppliers that can afford membership

fees in detriment of SMTEs with weaker financial resources (Buhalis, Spada,

2000). Therefore, destinations with an economic tissue mostly constituted by

low tech and marginalized regional SMTEs will suffer setbacks that are likely

to disadvantage their regional tourism industry development.

DMS Fundamental Objectives

The overall objectives of a DMO are to increase the productivity

of public and private tourism professionals, and to improve the satisfaction of

the international tourists through the use of advanced information and

communication technology, in order to create economic wealth and jobs. In

particular, DMSs look after the followings:

· The availability of an Internet server offering

information and primarily dissemination of tourism marketing information and

execution of electronic bookings and payments

· A critical mass of users/beneficiaries sufficient for the

self-support of the system and its organization

· The promotion of STMEs in the global market with low

costs

· The exploration of new and niche markets.

· Forecasts and a better understanding of the

evolution of the market.

· Increase of knowledge and capacity of the DMOs and

SMTEs to answer to the market trends.

The DMS aims to provide with all the information that a

potential visitor might need to make the decision to become an actual visitor,

and to choose that destination out of all other alternatives. The DMS is

therefore a marketing tool for the whole destination in a virtual context.

Consequently a virtual destination must not be a repository of information from

a single source but rather from an entire community that is competing in the

international tourism market. It is an extremely interactive communication tool

that encourages communication between its visitors and the members of the

community it represents. It promotes communication beyond the realm of business

but favors and encourages ultimately online transactions.

Destination Stakeholders' objectives

From a product supplier perspective a DMS can

assist its enterprise to know more on what the existing and potential costumers

want, to reach them, satisfy their needs in order to operate its business

profitably. Moreover the global e-marketplace accessibility is provided to the

full range of tourism enterprises, from the five star resorts to the craft

shops. At the same time they are able to

benefit from NTOs promotional activities and trade under a

widely known umbrella brand of the national destination.

The National Tourism Offices' objectives are

more complicated, in view of their mission and responsibilities. They do not

market accommodations or transportation but provide physical data and data

mining. In fact they are in the business of shifting the market information

back and forward. Their main objective is to foster an environment in witch the

tourism sector can prosper through well-directed marketing operations,

information integration, training and regulations.

For the consumer, simplicity, quick access to

accurate information and booking facilities to speed up travel decision while

saving money are the most important objectives. Visitors traditionally are

interested in both natural beauty and cultural heritage; but in addition to

such attractions they like to be able to choose their own products and get an

emotional experience.

DMS s' Success Criteria

As «info-structures», DMSs must enable destinations

to disseminate comprehensive information about resources and services of a

destination and local tourism products as well as to facilitate the planning,

management and marketing of countries as tourism entities or brands. However

previous failures

have prompted for the need of a close examination on success

criteria that have to be taken into consideration before conceptualizing and

developing a DMS.

Recently, an exploratory research combining qualitative and

quantitative methodologies conducted by Dimitrios Buhalis, Senior Lecturer,

School of Management Studies, University of Surrey (U.K), demonstrated the

important necessity of public - private sector cooperation, as being the most

powerful enabler of a DMS development and implementation. However, lack of

commercial background and bureaucracy often diminish public agencies capability

to foster greater cooperation between industry's stakeholders and to exercise

influence over the direction of DMSs' success criteria.

Buhalis and Spada synthesized the research results by proposing

a «5'Cs»framework namely: Choice, Convenience, Consistency and

Competitive Pricing, that groups identified DMS's success criteria for six key

tourism stakeholders. The following figure present most important selected

criteria among stakeholders:

Tourism Supplier

Use of DMS as promotional tool Provisions of guaranteed

bookings

DMS's ability to distribute info globally

Reduction of IT cost

User-Friendly

Public sector

Use of DMS as promotional tool

|

Public sector

Marketing tool

Support of SMTEs Economic benefits Quality and accuracy Use

DMS as management tool

|

|

Consumer

Comprehensive info before, during, and after trip

Speedy transactions

Secure online payments

User-friendly system

Multi-channel access

Virtual tour

Wild range of choices

Help function

|

|

TOs

Reduction of distribution & communication costs

Market info

Inventory management

Minimum membership fees

|

Travel Agents

Info reliability & accuracy

Real time info

Use of DMS to compete with TOs Online bookings capability

|

|

Investors

Profit center ability

Private -Public partnership

System's operating efficiency

System's Ability of strategic alliances

System's ability to interface with other systems Profitability

of membership fees

|

|

Figure 8. Success Criteria for a DMS (With reference to Buhalis

& Spada, 2000)

The five values (5Cs), which synthesize the above success

criteria, are the guiding requirements of a successful conceptualization and

development of a DMS. Therefore, various stakeholders' cooperation is critical

to achieve this cooperative network, so all actors can enable the creation of

this value chain of: Awareness- Information-Booking-Consumer Relationship. On

one hand the public sector boasts considerable degree of influence through

planning and legislation. It represents a major tool for fostering cooperation

among different stakeholders. On the other hand the private sector involvement

is significant in contributing essential capital, know how and commercial drive

that determine the profitability and viability of a DMS.

EXISTING DMSs

TIScover, Austria

Tyrolean Information System (TIScover) has been operating for

five years. It is the most worthy of comparison. In 1997, which was its first

complete year of operation, over 23 000 transactions were made through the

Austrian DMS (TIScover), generating about $8million in revenue. In 1998

TIScover generated accommodation revenue of about $20 million, which was set to

increase to about $55 million in 1999. It was hoped that break-even for the

TIScover Internet investment will be reached in 1999. TIScover adopted a

clientserver intranet/internet model. From 1998 until the middle of 1999, in

Austria,

England, Scotland, Ireland, TIScover was the only or at least

the most comprehensive destination-based booking system, which offers online

bookings via the Internet, and certainly the one that generates most revenue.

TIScover has since been privatized in order to provide more freedom to attract

more private sector capital.

Gulliver, Ireland

In Ireland there is a system called Gulliver, which is Ireland's

most advanced and comprehensive tourism database. Gulliver is build on a

distributed client-server system based around Windows NT 4.0/SQL server with

static data being accessed locally on PCs. Originally it was an

information-only system without booking facilities, like one of its

forerunners, the Danish Dan data. It is now possible to make bookings via the

Internet through the Bord Failte (Irish Tourist Board) website, with instant

confirmation. In 1998 the amount of reservations and booking enquiries has been

estimated to almost 87 000, 75% of which are assumed to lead to actual stays,

each generating $307 in revenue. For 1999 about 200 000 reservations and

booking enquiries were expected, 75% of which are assumed to lead to actual

stays, each generating $364 in revenue. Gulliver has been sold to a private

operator in 1997. FEXCO a foreign exchange company secured a majority (74%)

stake in this new joint venture and took Gulliver forward as this acquisition

shows an obvious synergy with the company's core strength: the expertise in

provision telesales and technology-based retail

solutions (Frew & O'Connor, 1999). Today well over 1.5

million people worldwide have used Gulliver's site to access detailed

information on Ireland (Irish Tourist Board, 2001).

Chapter7

DMS FAISABILITY FOR MOROCCO DESTINATION

MNTO MARKETING CHALLENGE

Major issues

· Attract, retain high spending independent traveler

· Create a seamless marketing system with GDS/CRS

leverage

· Improve destination marketing

· Organizational barriers

Strategic Environment

(See next page)

Competitive environment

IT DRIVERS ECONOMIC CONSTRAINTS

· Competition based on quality of information

· Internet use increasing

dramatically

· National tourism boards

embracing the digital age

|

· Globalization and liberalization

· A generally weaker bargaining position towards TOs

· GDSs and CRSs owned by large airlines

· Natural competitive advantages less significant

· Open skies results in lower airfares

|

|

Destination Marketing SWOT Analysis

|

Strengths

|

Weaknesses

|

Opportunities

|

Treats

|

|

-Product brand

name

-Product attributes -Mild seasonality

|

-Capacity

-Air transportation -Inefficient MNTO -Lack of IT in tourism

|

-National awareness -Saturated North Mediterranean

destinations

|

-Competition - IT tools in competitive destination

|

Figure 8. Morocco Destination Marketing SWOT Analysis

MARKETING OBJECTIVES

Overall Objectives

Information constitute undoubtedly MNTO's raw material necessary

to accomplish and perform its core competency witch is Destination Marketing.

However, the industry's small and medium players have little know-how

concerning the use of information and communication technologies, lack of

digitized promotion material and absence of any kind of database. The MNTO

should therefore play a proactive role in the future development of national

tourism through the implementation of appropriate information, communication

and marketing tools. Information management should constitute MNTO's new

competitive advantage. MNTO should therefore seek the implementation of a

successful Destination Marketing System that will enable the Tourism Board to

store online information, market it to the private sector and use it to

streamline

its promotional strategy. It supposes the acquisition of the

necessary technology in order to be able to manage, structure, and integrate

the information. Implementation of a synergic platform, therefore, becomes a

prerequisite to a destination marketing system.

Tourism Businesses

The main strategic target for a DMS is undoubtedly the

independent traveler. However the tourist businesses (all range of domestic

suppliers and

foreign markets intermediaries) are the backbone of the system.

So the MNTO should define DMS objectives accordingly:

> Altering existing tourism distribution channels to increase

the autonomy of regional destinations and Small and Medium Tourism Enterprises

(SMTEs)

> Bridging the Distance between the SMTE of peripheral and

remote locations and travel agencies worldwide

> Reducing the SMTEs dependence upon intermediaries and big

tour operators.

> DMS is the answer to large commercial tourism

distribution and reservation systems and to the ongoing concentration and

mergers in Europe distribution system.

> Targeting smaller groups of holiday's makers (customization

and special packaging especially in the US).

> Building intra and inter regional cooperation with an

operational, and commercially viable information, communication and marketing

system at the disposal of regional tourism organizations and foreign based

bureaus (Intranet).

The Consumer

Tourism destination marketing is based on intangibility and

perishability. Clearly the international tourist and mostly the independent

traveler is the main target for a DMS. The Moroccan National Tourism Office's

marketing objectives should focus on maintaining and improving the contact with

the tourist (at home or at the destination) through multimedia up to date

information and instant booking (Internet). Travel and Tourism

fit especially well with interactive media because of the industry's

information intensive characteristic. Interactive media

provided by a DMS call for interactive marketing. « The

essence of interactive marketing is the use of information from the customer

rather than about the customer» (Day, 1998). The MNTO markets intangible

experience. A DMS must then be able to deliver this intangibility by providing

pictures and chat rooms through its Web site. So information readiness and

availability, easy booking and expert advice are the most adding value factors

to the destination products and services.

BUILDING THE WEB BASED DMS

Database Characteristics

Accessible via Internet, Product information database will covers

a full range of accommodation from small «Riyadh» (traditional

houses) to five

star hotels and self-catering such as apartments and villas. It

should also covers Car Rental, Flights, Ferries, Rail. The product database

has, naturally, to be tailored according to the needs of the Morocco Tourism

Office. Its web

support should be professionally designed, reflecting Morocco

cultural richness with friendly user interface, bring technologically reliable

online booking system and secured End-to-End transactions. This database will

store information for the use of potential and actual visitors, suppliers, and

planners. It can contain information about both private and public sector

services. This includes accommodation and restaurants, attractions, weather

conditions, events, public transport and timetables museums, art

galleries, festivals and the like. Enquiries, by independent travelers, for

specific information can also be stored in the Marketing Database thus building

the client profile.

The real opportunity in databases is to build relationship with

customers, suppliers and other businesses. Building virtual communities with

«collaborative marketing» has a considerable economic potential as

well. Consumer virtual communities are focus groups that last 24 hours a day, 7

days a week and offer enormous learning opportunities for tourism organizations

(Gretzel et. al., 2000). This dynamic and valuable information will be

commercialized to Tourism Businesses within and outside Morocco, thus creating

a profit center to finance future DMS system maintenance and enhancement. This

is how the MNTO can create the complete marketing value chain

(Awareness-Information-Booking-CRM), and acquire a competitive advantage for

the Morocco destination in general with an efficient DMS.

Table 8

Destination Marketing System Characteristics

|

Efficient DMS Characteristics

|

Failing DMS Characteristics

|

|

Complete and detailed Data Base

|

Incomplete database

|

|

Information Quality and Reliability

|

Information obsolete and imprecise

|

|

Information targeted toward independent traveler

|

In competition with the travel trade

|

|

Operational and efficient booking /call center

|

Difficult online booking

|

|

Supported and promoted by MNTO

|

No support or promotion

|

|

Complementary to existents distribution channels

|

In competition with distribution channels

|

|

Managed by a Marketing oriented organization

|

Managed by a bureaucratic organization

|

|

Marketing Orientation supported by technology

|

Technology oriented

|

|

Products tailored to consumers' needs

|

List of products without packaging

|

|

Provide easy buying process

|

|

|

Enhance product quality

|

|

Source: With reference to (Tunnard, Haines, 1999)

Figure 8. Outline of a Web Based Destination Marketing System

57

Web Design

The web offers a powerful tool set that combine interactivity

between suppliers, consumers and intermediaries, seamless transactions,

adressability, availability and mass customization (Gretzel, et. al., 2000).

According to Parsons, Zeisser, and Waitman, the success factors for marketing

on the web are: Attract, Engage, Retain, Learn, Relate. The following table

explicit marketing interactivity success factors and different tactical ways to

fulfill them.

Table 9

Interactive Marketing Framework (Parsons, et. al., 1998)

|

Activity

|

What

|

How

|

|

Attract

|

Attract consumers to the application

|

Audience creation

Mnemonic Branding Piggy-back advertising

|

|

Engage

|

General interest and participation

|

Intuitive interface or navigation Interface content

User-generated content

|

|

Retain

|

Make sure customers come back

|

Dynamic content

Transaction capabilities Online communities

|

|

Learn

|

Learn about customers' preferences

|

Information capture Continuous preference learning

|

|

Relate

|

Customize interaction and value delivery

|

Personalized/customized communications and products/ services

Real time interactions

Linkage to core business

|

The DMS's Web site should reflect the characteristics of a

unifying platform, and a one-stop marketplace. It must be user friendly and

enjoyable, must hold good content (information and education), be creative,

interactive and support secure transactions. When looking at a Web site the

users go successive steps: 1) exposure, 2) attention, 3) comprehension and

perception, 4) acceptance, 5) retention (Gretzel et. al., 2000). Therefore the

design, (images, page copy, structure) must take account of these stages to

impact consumer behavior. The content is also extremely important for a DMO

since it is the image and perception of the destination that are portrayed.

Interactivity and vividness are important characteristics of the content too.

Thus community building features are extremely important, since they provide a

discussion forum that are likely to raise awareness, and give the destination a

valuable focus group evaluation on a 24/24 hour basis. The Web is a pull

medium, because consumers actively seek information, therefore simplicity must

provide in content, in order to avoid mental fatigue and «site

jumping». The Web design should reflect the characteristics of the medium,

the consumers and the competitive environment (Gretzel et. al., 2000).

All these factors are very important and should guide Web design.

Thus it is crucial that content is accurate, attractive and easily searchable.

Well-designed Web site ultimately succeed in transforming «lookers»

into «bookers».

Medium

Competition

Content

Design Technology

Features

Design parameters

Organization

Positioning Aligning

Strategy

Application domain

Consumer segment

Figure 10. A Framework for Web Design (Werthner and Klein,

1999)

BUSINESS MODEL AND FINANCIAL FAISABILITY

Constraints

Apart of the reliability and efficiency, funding and

profitability are decisive factors of success in the development and

implementation of a DMS. Commercial attributes and ability to generate profits

must therefore be taken into consideration, as future private investors will

mainly be looking at a successful revenue model that will ensure their return