4.2 Comparative analysis

The idea of applying multiple performance criteria at the farm

level is not to evaluate performance in terms of profitability alone but to

find a balance and examine the farm system in relation to the 5 criteria.

4.2.1 Productivity

In the present case productivity is measured in Kilograms per

Unit pivot or hectare (Kg/unit pivot) or (Kg/ha) as shown in the following

table:

Table 1 Productivity of main and secondary product

|

Crop

|

Main Product

|

Secondary Product

|

|

Potato

|

Onion

|

Peanut

|

|

Scenario

|

current

|

improved

|

current

|

improved

|

current

|

improved

|

|

Production (Kg/unit pivot or ha)

|

30,000

|

40,000

|

50,000

|

70,000

|

1,000

|

3,000

|

|

Amelioration

|

+33.33%

|

+40%

|

+200%

|

Source: GIZ/ FBS Potato. 2020. Module 5

Table 1 shows the significant improvements in production.

These improvements are the results of the application of GAP, better management

and adjustment of farm system components and efficiency in the use of resources

to increase yield. The remarkable increase in yield 33.33% for the potato, 40%

for the onion and 200% for the peanut can be explained at this level by using

certified and recommended seeds, fertilizers, which are better adapted to the

medium and give extreme high yield in comparison with the local variety.

4.2.2 Profitability

The profitability of a farm enterprise defined in the part 3.5

Methodological Approach is measured in monetary terms as total gross revenue

minus total costs over the course of a campaign. To measure the economic

profitability; gross margin is one of the performance criteria in the current

case.

21|

The purpose of these parameters is to evaluate the system, the

process and the performance of an activity of a small agricultural enterprise.

This type of evaluation is widely used to structure agricultural development

projects.

The following table consists of a budget which is applied to

the potato production in the current and improved to evaluate the impact of the

improved production on the profitability. To make the comparison, all the

parameters which change by adopting the improved production should be taken

into consideration. These changes also include additional yield, labor use and

reduced transport cost. The result of these changes is an increase in the gross

margin.

The next table for the main product contains a gross margin,

return on investment and unit cost calculation which are performance factors of

a farm, and a quick tool to make a comparison between several scenarios.

The gross margin is hence obtained by subtracting the total

income from the variable costs. Fixed costs are excluded here because it can

enter the production of another activity or for several years of production.

Unit cost is determined by dividing the cost of production by the number of

units produced. The Return on Investment (ROI) is the benefit (or return) of an

investment is divided by the cost of the investment. The result is expressed as

a percentage or a ratio.

22|

Table 2 Potato production Comparative Analysis

|

Input

|

Unity

|

Current Scenario

|

Improved Scenario

|

Change

|

|

Quantity

(kg)

|

Price

(DZD)

|

Total

(DZD)

|

Quantity

|

Price

(DZD)

|

Total

(DZD)

|

%

|

|

Input

|

|

Seeds

|

Kg

|

2,000

|

150

|

300,000

|

3,000

|

150

|

450,000

|

Quantity: +50%

|

|

organic manure

|

Kg

|

20,000

|

4.5

|

90,000

|

30,000

|

4.5

|

135,000

|

Quantity: +50%

|

|

Fertilizer NPK

|

Kg

|

1,200

|

105

|

126,000

|

800

|

105

|

84,000

|

Quantity: -33.33%

|

|

Tractor Service

|

Fixed Price

|

-

|

40,000

|

40,000

|

-

|

40,000

|

40,000

|

No change

|

|

Ammonite 33%

|

Kg

|

-

|

-

|

-

|

150

|

6

|

900

|

+100%

|

|

Potash (K)

|

Kg

|

-

|

-

|

-

|

200

|

195

|

39,000

|

+100%

|

|

Chemical fertilizer

|

Kg

|

3

|

4,000

|

12,000

|

1

|

4,000

|

4,000

|

Quantity: -66.66%

|

|

Treatment ser-

vices

|

l

|

-

|

-

|

-

|

8

|

7,500

|

60,000

|

+100%

|

|

Irrigation water

|

m3

|

5,000

|

4

|

20,000

|

8,000

|

4

|

32,000

|

Quantity: +60%

|

|

Packaging bag

|

bag

|

300

|

260

|

78,000

|

400

|

260

|

104,000

|

Quantity: +33%

|

|

Transport Service

|

Fixed price

|

3

|

25,000

|

75,000

|

1

|

28,000

|

28,000

|

Quantity: -66.66% Total: -62.66% Price: +12%

|

|

Electricity

|

Invoice

|

1

|

50,000

|

50,000

|

1

|

10,000

|

10,000

|

Price: -80%

|

|

Labor

|

Man-day

|

105

|

1,500

|

157,500

|

114

|

1,500

|

171,000

|

+9 Man-day

|

|

Total Variable

Cost

|

|

948,500

|

1,157,900

|

+22%

|

|

Output

|

|

Gross Revenue

|

DZD

|

30,000

|

33

|

990,000

|

40,000

|

34

|

1,360,000

|

Yield: +33.33% Price: +3% Revenue: +37%

|

|

Gross Margin

|

DZD

|

41,500

|

202,100

|

+387%

|

|

ROI

|

(%)

|

4%

|

17%

|

+13%

|

|

Unit Cost

|

DZD

|

31.62

|

28.95

|

-8.4%

|

Source: GIZ/ FBS Potato. 2020. Module 5

Table 2 shows a comparison of the costs for the two scenarios.

In fact, an increase in seeds costs by +50% for seeds are noticed. This is due

to the increase in the quantity of planting. These varieties of seed are of

better quality than the one used in the current scenario and shows better

yields. Also, for irrigation water, 60% additional quantity

23|

was added in the improved scenario for more efficiency and

therefore 60% additional cost at a fixed price per cubic meter. Some treatment

services and fertilizer additives such as ammonite 33% and potash (K) are also

added for the improved scenario marked by + 100% in order to ensure better

growth of tubers. Less than 66% of NPK fertilizer and chemical fertilizer are

used for the production and therefore less cost during the tuber growth face.

The objective is to reduce residues and ensure good potato quality. Regarding

the transport service, at a slightly increased price + 12% and a better

service, there was a need for at least operation -66% and therefore a reduction

in costs of 62%. Following the adoption of the improved scenario, a further

significant reduction in the price of electricity by 80% and consequently 80%

in costs reduced is noticed. For labor, a slight increase in man-day needed + 9

and hence additional employment.

As a result of these changes in the potato production activity

as announced in part 4.3.1 productivity an excess production of 10,000 Kg is

noticed, Furthermore, a remarkable and logical increase in the Gross Revenue

more than 37% following this better productivity and a 3% higher price. What is

very interesting, we notice that only the excess of the gross margin in the

improved scenario is equal to 160,600 DZD almost 4 times the gross margin in

the current scenario. Concerning ROI, for each DZD invested in the current

scenario, it gives 0.04 DZD. On the other hand, regarding the improved

scenario, it gives 0.17 DZD, more than 4 times. Again, there is a reduction in

the unit cost, which shows that the changes are profitable. The next Figure 8

provides an overview of all changes in production costs and the farmer's

margin.

comparison of potato production costs and profit margin

(DZD)

|

Improved Potato

Current Potato

|

|

|

|

|

0 200000 400000 600000 800000 1000000 1200000 1400000 1600000

Seeds Fertilizer other costs Post Harvest cost Labor cost

Margin

Figure 8 Overview of production costs and profit

margin

Source: GIZ/ FBS Potato. 2020. Module 5

This analysis was for the primary product, the following is

the same analysis for the secondary products in a shortened form. The following

table shows the performance analysis of onion production in the current

scenario and the improved one.

Table 3 Onion Comparative production Analysis

|

Input

|

Unity

|

Current Scenario

|

Improved Scenario

|

Change

|

|

Quan-

tity

(kg)

|

Price

(DZD)

|

Total (DZD)

|

Quan-

tity

|

Price

(DZD)

|

Total

(DZD)

|

%

|

|

Input

|

|

Input Cost

|

DZD

|

520,000

|

611,100

|

+17.5%

|

|

Labor

|

Man- day

|

95

|

1,500

|

142,500

|

101

|

1,500

|

151,500

|

+6 Man-day

|

|

Total Varia- ble Cost

|

|

663,100

|

762,600

|

+15%

|

|

Output

|

|

Gross Revenue

|

DZD

|

50,000

|

20

|

1,000,000

|

70,000

|

21

|

1,470,000

|

Yield: +40% Price: +5% Rev-

enue: +47%

|

|

Gross Mar- gin

|

DZD

|

336,900

|

707,400

|

+110%

|

|

ROI

|

(%)

|

50%

|

92%

|

+42%

|

|

Unit Cost

|

DZD

|

13.26

|

10.89

|

-18%

|

Source: GIZ/ FBS Potato. 2020. Module 5

For onion production, table 3 shows a 17.5% increase in input

costs and a 6.3% increase in labor costs. Following these changes in

production, a remarkable increase in gross margin of 47% in the improved

scenario is observed. Thus, an increase in labor (6 man-day). Moreover, one DZD

invested in this production gives 0.5 DZD in the current scenario and 0.92 DZD

in the improved scenario. Likewise, the unit cost evolution shows a notable

reduction from 13.26 DZD in the current scenario to 10.89 DZD in the improved

scenario. The next Figure 9 provides an overview of all changes in production

costs and the farmer's margin.

24|

comparison of Onion production costs and profit margin (DZD)

|

Improved Onion

Current Onion

|

|

|

0 200000 400000 600000 800000 1000000 1200000 1400000 1600000

Input costs and service Labor Cost Margin

25|

Figure 9 comparison of onion production costs and profit

margin

Source: GIZ/ FBS Potato. 2020. Module 5

Table 4 Peanut production Comparative Analysis

|

Input

|

Unity

|

Current Scenario

|

Improved Scenario

|

Change

|

|

Quantity

(kg)

|

Price

(DZD)

|

Total

(DZD)

|

Quantity

|

Price

(DZD)

|

Total

(DZD)

|

%

|

|

Input

|

|

Input Cost

|

DZD

|

168,200

|

257,600

|

+53%

|

|

Labor

|

Man-day

|

47

|

1,500

|

70,500

|

47

|

1,500

|

70,500

|

No change

|

|

Total Variable Cost

|

|

238,700

|

328,100

|

+37%

|

|

Output

|

|

Gross Revenue

|

DZD

|

1,000

|

260

|

260,000

|

3,000

|

260

|

780,000

|

+200%

|

|

Gross Margin

|

DZD

|

21,300

|

451,900

|

+2022%

|

|

ROI

|

(%)

|

8.9%

|

137%

|

+128.1%

|

|

Unit Cost

|

DZD

|

238.7

|

109.37

|

-54%

|

Source: GIZ/ FBS Potato. 2020. Module 5

For Peanut production, table 4 shows a 37% increase in input

costs and 200% increase in peanut production. Following these changes, a

remarkable increase in gross margin +430.600 DZD in the improved scenario is

observed. Besides, one DZD invested in this production gives 0.089 DZD in the

current scenario and 1,37 DZD in the improved scenario. Likewise, the unit cost

evolution shows a notable reduction from 238,7 DZD in the current scenario to

109,37 DZD in the improved scenario. The next Figure 10 provides an overview of

all changes in production costs and the farmer's margin.

comparison of peanut production costs and profit margin (DZD)

Improved Peanut

0 200000 400000 600000 800000 1000000 1200000

Input costs and service Labor Cost Margin

26|

Figure 10 comparison of peanut production costs and profit

margin

Source: GIZ/ FBS Potato. 2020. Module 5

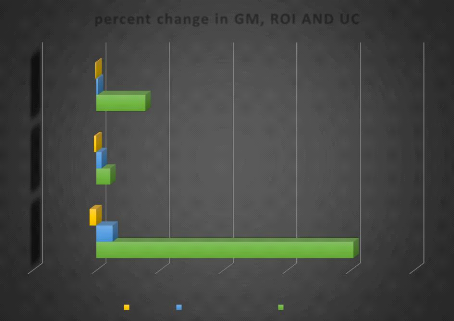

Finally, to get a global overview and based on the different

performance criteria, the following figure 11 summarizes the evolution of the

parameters GM, ROI and UC of the 3 agricultural activities (Potato, onion,

peanut).

-500% 0% 500% 1000% 1500% 2000% 2500%

Peanut

Potato

Onion

-54%

-18%

-8%

percent change in GM, ROI AND UC

13%

42%

110%

128%

Unit cost Return on Investment Gross Margin

387%

2022%

Figure 11 Summary percent change of the 3 activities

Source: GIZ/ FBS Potato. 2020. Module 5

27|

Figure 11 shows that the evolution of the GM, UC and the ROI

in the improved scenario are mostly very important for the secondary products

than for the main product, This may look contradictory, but this is explained

by the advantage of potato production, for example, having 3 harvests

throughout the year, the importance of this product in the eating habits of

Algerians and the remarkable increase in its consumption in recent years, in

addition to the orientation of industrial operators to engage in transformation

and the start of exporting this product to Russia. As a consequence, and due to

the state policy aimed at the development of the agricultural land, the

cultivated potato land has increased from 300 ha in 1993 to 33,000 ha in 2000

and the number of potato producers has increased from 800 to 5,000 between 2000

and 2014. This can largely confirm the choice of potatoes as the main product.

(Chambre d'agriculture Algeria, 2014).

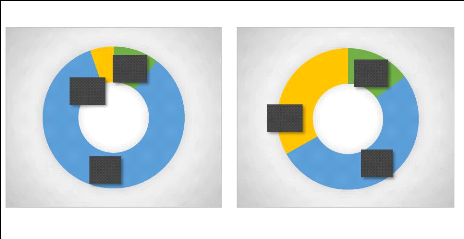

To get an idea on the distribution of the gains concluded from

the three activities and the improvement of the incomes. The chart in Figure 11

shows the composition of the smallholder farmer's income in the two scenarios

and shows how many times the income has increased.

Total Revenue: 399,700 DZD Total Revenue: 1,361,400

DZD

Current Scenario Improved Scenario

Peanut

5%

Onion

84%

Potato

11%

Peanut

33%

Potato

15%

Onion

52%

Figure 12 share of total output Value

Source: GIZ/ FBS Potato. 2020. Module 5.

Figure 12 highlights the profit composition of the 3 crops in

both scenarios. The total income from agricultural production increased more

than three times. As far as income distribution is concerned, a great disparity

of income between the 3 products in the

28|

current scenario is noticed, but in the improved scenario, the

distribution is more equitable. This is of great importance to practice this

crop rotation system with a stable income with potato and Peanut in the first

year and onion in the following year.

This last budgeting analysis is valid only at a certain time

interval, any change in price and cost of production can directly influence the

market and the introduction of a new technology such as the irrigation pivot by

the farmer which can also cause changes in costs and prices.

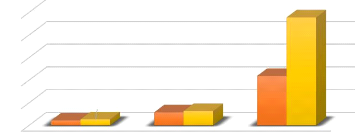

It would be better to anticipate future changes and make a

risk analysis and determine the influence of a price change on the gross margin

in both scenarios. In this study more importance is given to the main product,

the potato, and one of the most significant parameters, which has a great

effect on the budget which is the price of potatoes. Already there is a large

fluctuation of potato wholesale prices in Algeria, which alternates between 33

and 45 DZD per Kg. As a result, a simple equation of this parameter (potato

price) can be established.

Gross Margin/plot = Gross revenue/plot - Variable cost/plot,

GM= TR - CV = (Yield/plot) x (Price/kg) - VC = Y pp - VC

For the current scenario, the equation is: GM= 30,000 pp -

948,500

For the Improved Scenario, the equation is: GM= 40,000 pp -

1,157,900

Potato Gross Margin

700000

|

GM (DZD)

|

600000 500000 400000 300000 200000 100000

0

|

642100

402100

221500

162100

41500

401500

33 DZD 39 DZD 45 DZD

Potato Price

Current Scenario Improved Scenario

Figure 13 Potato Gross Margin evolution for both

scenario

Source: GIZ/ FBS Potato. 2020. Module 5

29|

Figure 13 highlights the effect of changing potato prices on

GM. In fact, the increase in potato prices has a very important impact, which

highlights the importance of investing in potato storage, or else, smallholders

should get updates on the prices each week. Then, they could decide how many

batches they produce, the quantity of each batch and the time of planting,

harvest and selling.

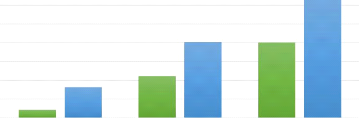

Concerning the unit cost and after moving to the improved

scenario, an important reduction of the cost of production for the 3 crops is

noticed as shown in the following histogram (Figure 14). This allows farmers to

increase their competitiveness.

Unit Cost (DZD) per Kg

250

200

150

100

50

0

10.89

13.26 28.95 31.62

109.37

238.7

Onion Potato Penaut

Improved Scenario Current Scenario

Figure 14 Unit cost evolution for both scenario

Source: GIZ/ FBS Potato. 2020. Module 5

Through the results found above, the productivity of capital

and labor productivity can be deduced as shown in the following table 5.

Table 5 comparison of Labor productivity & Capital

productivity

|

Crop

|

Potato

|

Onion

|

Peanut

|

|

Labor productivity = (Revenue - Input Cost) /

Labor

|

+1,377

|

+3,457

|

+ 9,161

|

|

number used

|

(+72%)

|

(+68%)

|

(+470%)

|

|

Additional Labor for one mini-pivot (man-day)

|

9

|

6

|

0

|

|

Capital productivity= Gross Margin /Variable

cost

|

+0,13

|

+0,42

|

+1,29

|

Source: GIZ/ Potato Spreadsheet. 2020

The comparison of capital and labor productivity shows a large

increase in the improved scenario as a result of a good allocation of

production resources. This large

30|

gap between the two values as shown in Table 5 shows how

absolute effective the improved scenario is. This productivity is increased

thanks to the introduction of high-performance innovations, efficient work,

training of the labor in new techniques and almost importantly by improving the

production process and adopting GAP.

At this level, this type of last analysis, budgeting and the

variable costs considered indicate to retain the necessary adjustments in

production costs to increase profitability and also to highlight the direct

impact of the GAP application, the improvement of technical, managerial and

thus economic skills. It is all a complex process and with the adjustment of

these parameters together, the profitability of the farm can be greatly

increased. Moreover, additional employment has been realized after adopting

GAP.

With regard to job creation, Ould Rebai et al. (2017, p.7) has

enumerated from a sample of farmers surveyed, which distinguishes three types

of investors, who specialize in potato production using the new mini-pivot

technology. These are large investors, small investors and cultivators). The

table 6 shows the number of pivots used for each category during a potato and

Onion production campaign and then deduced the number of additional jobs

created. (Production lasts two years)

Table 6 Additionall job created using GAP

|

Type of Farm- ers

|

Number of mini

Pivot

|

Additional jobs created (man-days)

|

Total addi-

tional jobs

|

|

Potato

|

Onion

|

|

large investors

|

12

|

9

|

6

|

180 man-days

|

|

small investors

|

6

|

9

|

6

|

90 man-days

|

|

cultivator

|

2

|

9

|

6

|

30 man-days

|

Source: ould Rebai. 2017. An incremental innovation: design

and diffusion of an artisanal center pivot for irrigationin the Souf (Algerian

Sahara).

The number of jobs created varies between 30 and 180 man-days

depending on the type of investor. This shows only the direct employment after

the adoption GAP. Other indirect employment could be proclaimed, such as

maintenance services, all the trainer from the training centers, who work in

the mini-pivot production chain, the supply companies and importers of parts

necessary to produce mini-pivot. This technology (mini-pivot Irrigation) has

created a dynamic in the region starting with the return of investors,

providing income to the local population, employing young people (majority of

small investors, Table 6) and opening agro-supply businesses.

31|

|