In

order to arrive at good conclusions and propose important policies, data to be

used must be stationary or made stationary .Non-stationary variables can lead

to misleading inferences. So, the following is the analysis of stationarity by

using the PP and ADF tests.

Table 5: Summary of Unity

root Test using PP and ADF tests

|

Variables

|

PP test

|

ADF test

|

Conclusion

|

|

Level

|

Intercept & Trend

|

Intercept

|

None

|

Intercept & Trend

|

Intercept

|

None

|

I(1)

|

|

LCPI

|

Level

|

-1.509203

|

-0.037775

|

1.304367

|

-1.593095

|

-0.166940

|

1.201365

|

|

?level

|

-5.671982*

|

-5.278210*

|

-5.107284*

|

-5.541824*

|

-5.277734*

|

-5.107284*

|

|

LM2

|

Level

|

-1.808800

|

-0.840839

|

-0.919552

|

-1.808800

|

-0.840839

|

-0.912034

|

I(1)

|

|

?level

|

-5.215006*

|

-5.172020*

|

-5.156853*

|

-5.206502*

|

-5.171833*

|

-5.156853*

|

|

LEXCH

|

Level

|

-1.465468

|

-0.700263

|

2.044835

|

-1.295550

|

-0.700263

|

2.189489

|

I(1)

|

|

? level

|

-4.560735*

|

-4.493495*

|

-3.732926*

|

-3.798612**

|

-4.506769*

|

-3.755935*

|

|

LLIR

|

Level

|

-2.598714

|

-2.192332

|

0.665482

|

-2.238489

|

-2.087310

|

0.279109

|

I(1)

|

|

? level

|

-6.873350*

|

-6.320553*

|

-6.143093*

|

-4.021954**

|

-2.074770

|

-1.859478***

|

Source: Eviews7

* Indicates statistical significant at the 1 percent level,

** Indicates statistical significant at the

5 percent level

*** Indicates statistical significant at the

10 percent level.

From the table above, it can be deduced that variables are not

stationary at level. We did not found statistical evidence of rejecting the

Null hypothesis of unit root because the asymptotic critical values are less

than the calculated value for ADF and the p values are more than 5%. However,

when all the variables are transformed to their first difference, the

null hypothesis is rejected and variables became stationary. Finally, we

concluded that all variables are integrated of order one.

4.2.2.2 Co-integration test

If two or more time series are not stationary, it is important

to test whether there is a linear combination of them which is stationary. This

phenomenon is referred to as the test for co-integration. The evidence of

co-integration implies that there is a long run relationship among the

variables. Hence, the short-run dynamics can be represented by an error

correction mechanism (Engle and Granger, 1987).

There are two most popular approaches for testing for

cointegration, the Engle- Granger two steps procedure and the Johansen

procedure. In this research, we applied the Johansen Maximum Likelihood

Methodology for the cointegration test. The obtained results are in the

following table:

Table 6: Results of Johansen

Cointegration Test

|

Unrestricted Cointegration Rank Test (Trace)

|

|

|

|

|

|

|

|

|

|

|

|

|

Hypothesized

|

|

Trace

|

0.05

|

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Prob.**

|

|

|

|

|

|

|

|

|

|

|

|

None

|

0.650795

|

45.29174

|

54.07904

|

0.2391

|

|

At most 1

|

0.340354

|

20.04146

|

35.19275

|

0.7242

|

|

At most 2

|

0.221537

|

10.05623

|

20.26184

|

0.6343

|

|

At most 3

|

0.155133

|

4.045828

|

9.164546

|

0.4053

|

|

|

|

|

|

|

|

|

|

|

|

Trace test indicates no cointegration at the 0.05 level

|

|

* denotes rejection of the hypothesis at the 0.05 level

|

|

**MacKinnon-Haug-Michelis (1999) p-values

|

|

|

Unrestricted Cointegration Rank Test (Maximum Eigenvalue)

|

|

|

|

|

|

|

|

|

|

|

|

Hypothesized

|

|

Max-Eigen

|

0.05

|

|

|

No. of CE(s)

|

Eigenvalue

|

Statistic

|

Critical Value

|

Prob.**

|

|

|

|

|

|

|

|

|

|

|

|

None

|

0.650795

|

25.25028

|

28.58808

|

0.1260

|

|

At most 1

|

0.340354

|

9.985229

|

22.29962

|

0.8363

|

|

At most 2

|

0.221537

|

6.010404

|

15.89210

|

0.7868

|

|

At most 3

|

0.155133

|

4.045828

|

9.164546

|

0.4053

|

|

|

|

|

|

|

|

|

|

|

|

Source: Eviews7

Max-eigenvalue test indicates no cointegration at the 0.05

level

|

|

* denotes rejection of the hypothesis at the 0.05 level

|

|

**MacKinnon-Haug-Michelis (1999) p-values

|

|

The Trace test as well as the Maximum Eigenvalue test reveals

that variables are not co-integrated. Then, these variables are not co

integrated to run a regression line by using OLS. Such a regression can lead to

misleading inferences. So, we have to use other methods such as unrestricted

VAR.

4.2.2.2.1

Estimation of an impact of monetary policy on CPI of Rwanda

The coefficients of our model are numerous and not readily

subject to interpretation. Hence, the interpretation follows from the path of

the impulse response functions generated from the recursively-orthogonalized

VAR estimated residuals. The impulse responses show the path of CPI when there

is an increase in the monetary policy variables.

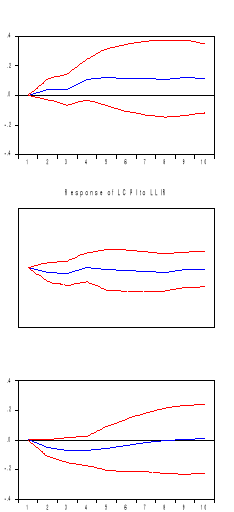

Figure 8: Response of CPI

to Monetary Policy Variables

The figure 8 shows three panels of impulse response graphs

indicating how increase in respective monetary policy variables affects the CPI

of Rwanda in a period of five years. Each panel illustrates the response of CPI

to a one standard deviation innovation (corresponding to an increase) in the

monetary policy variable.

A value of zero means that the increase in monetary policy

variable has no effect on CPI of Rwanda and the CPI continues to behave as if

there was no increase in monetary policy variable. A positive or negative value

indicates that the increase in the monetary policy variable would cause the CPI

of Rwanda to be above or below its natural path as the case may be. The blue

lines depict the estimated effects, while the dashed red lines show the

boundaries of a 95% confidence interval.

In Panel 1, we observe that an increase in nominal exchange

rate has an effect of increasing quickly inflation in the first year, and in

the second year it becomes stationary while it increases again in the third

year and becomes stationary in the following years. In general, the increase in

nominal exchange rate has an effect of increasing the inflation in Rwanda as

the blue line is above the natural path. This increase of inflation resulting

from the depreciation of Rwandan currency is as expected by theories and given

the structure of Rwandan economy. Normally, when there is a depreciation of a

country's currency, the theory predicts that the country's exports become cheap

while its imports become expensive.

Panel 2 shows how the CPI of Rwanda responds to an increase of

nominal interest rate. Increase of nominal interest rate in Rwanda has an

effect of decreasing inflation in the first two years. However, in the third

year, inflation increases again and reaches its level of beginning in the

fourth and fifth year. In the following years, inflation is found to decrease.

This is logical because increase in nominal interest rate discourages people to

ask for loans and consequently reduces money into circulation.

Panel 3 shows the response of CPI to a positive shock in money

supply measured by M2. When there is an increase in money supply in Rwanda,

inflation decreases considerably in the first year. However, in the second

year, inflation start increasing again and it reaches its original level in the

seventh but it increases again in the tenth year. It means that, when monetary

authorities realize a need of stimulating production, they increase money into

circulation. That increased money is invested into productive activities which

increase production in Rwanda.

That increase in production results in reduction of prices in

the first year. However, it has been seen that the continual increase of money

supply push again prices up in the following years and prices reaches its

original level in the seventh year.

|