|

The Impact of Monetary Policy on Consumer Price Index

(CPI): (1985-2010)

Sylvie NIBEZA

Department of economics, ULK-University

Corresponding Author E-mail:

sylvienibeza@gmail.com

Phone: +250 788 256 898

Declaration

I, NIBEZA Sylvie, hereby declare that the work presented in

this dissertation titled «The Impact of Monetary Policy on Consumer Price

Index (CPI): (1985-2010)» is my original work and it has

never been submitted to any institution of learning for any award.

Signed .....................

Date: 15/11/2014

Approval

This work was done under my close supervision at Kigali

Independent University supervisor.

I therefore acknowledge its authenticity and approve it as

worth for the award of the Master's Degree of Science in Economics.

Signed............................................... Date

15/11/2014

Dr Moses Matundura

Dedication

To

My beloved Husband, HABAMENSHI Védaste

My Son, MUGISHA IHIRWE Willy Consolateur

My Mother, NYIRABAHIZI Agnès

My family,

All creative thinkers and Researchers.

Acknowledgements

First and foremost I thank Almighty GOD who gave me a life

worth living and I thank Him for giving me the strength to accomplish this

project.

My thanks go to Prof. Dr RWIGAMBA Balinda, President and

Founder of Kigali Independent University (ULK) for his contribution to the

development of Rwandan Higher Education and to the national development in

general and good initiative deserves appreciation.

My profound gratitude is addressed to Dr. Moses Matundura, my

supervisor for his immeasurable commitment, effort, positive criticisms and

willingness to spare and given up his scarce time to help me acquire new

skills.

I would not forget to address a word of thanks to all my

lecturers in Kigali Independent University (ULK) who followed me along my

academic course without their effort; I could not reach this level.

My academic education would not be possible without the

support from my lovely husband Védaste HABAMENSHI. His financial and

moral support was valuable in the accomplishment of my studies.

My thanks to my son Willy Consolateur MUGISHA IHIRWE, who

despite their tender age endured my absence during the studies.

I also acknowledge the moral support from my mother

NYIRABAHIZI Agnès, my Family and my friends.

I would like to thank all those who have, in various ways,

supported me during this work, and whose their names are not written here, that

they find here the expression of my deep recognition.

God bless you all.

Sylvie NIBEZA

Table of Contents

Declaration

i

Approval

ii

Dedication

iii

Acknowledgements

iv

Table of Contents

v

List of Tables

viii

List of Figures

ix

Abbreviations and Acronyms

x

Abstract

xi

CHAPTER 1: INTRODUCTION TO THE STUDY

1

1.1 Background to the study

1

1.2 Problem statement

4

1.3 Purpose of the study

5

1.4 Research objectives

5

1.4.1 General objective

5

1.4.2 Specific objectives

6

1.5 Research Questions

6

1.6 Hypothesis

6

1.7 Scope of the study

6

1.8 Significance of the study

7

1.8.1 Choice of the study

7

1.8.2 Interest of study

7

1.8.2.1 Personal interest

7

1.8.2.2 Interest of the community

7

1.8.2.3 Scientific interest

8

1.9 Definitions of key terms

8

1.9.1 Money

8

1.9.2 Interest Rates

8

1.9.3 Money Supply

9

1.9.4 Exchange rate

10

1.9.5 Monetary policy

10

1.10 Organization of the dissertation

11

CHAPTER 2: LITERATURE REVIEW

12

2.1 Introduction

12

2.2 Theory of Monetary Policy

15

2.2.1 Transmission of monetary policy

17

2.2.2 Objectives of Monetary Policy

19

2.2.3 Instruments of monetary policy

23

2.2.4 Strategies of monetary policy

25

2.2.5 Taylor rule

26

2.2.6 Economic situation

28

2.2.6.1 Consumer Price Index

31

2.2.6.2 Economic effects of monetary policy

33

2.3 Monetary policy in Rwanda

35

2.3.1 Overview of monetary policy in Rwanda

35

2.3.2 Evolution of monetary policy in Rwanda

36

2.3.3 Monetary policy management

37

2.3.4 Money supply

40

2.3.5 Exchange rate

40

2.3.6 Interest rate

41

CHAPTER 3: RESEARCH METHODOLOGY

42

3.1 Introduction

42

3.2 Model Specification

42

3.3 Research Design

44

3.3.1 Quantitative and Statistics methods

44

3.4 Estimation techniques

44

3.4.1 Unit Root Test

44

3.4.2 Co-integration Test

45

3.5 Data Collection Methods and Tool

45

3.6 Sample Size

45

3.7 Statistical Test

45

3.8 Characteristics of variables

46

3.8.1 Dependent variable

46

3.8.2 Independent variables

47

3.9 Data processing

48

3.10 Limitations & Delimitations

49

CHAPTER 4: RESEARCH FINDINGS

50

4.1 Introduction

50

4.2 Strategies of monetary policy in stabilizing economy

50

4.2.1 Open market operations

50

4.2.2 Reserve requirement

51

4.2.3 Discount rate

52

4.2.4 Exchange Rate

52

4.2.5 Direct Credit Control

52

4.2.6 Moral Suasion

52

4.3 Impact of monetary policy on Consumer Price Index (CPI)

53

4.3.1 Evolution of CPI, money supply, Nominal interest rate and

nominal exchange rate in

Rwanda

53

4.3.2 Econometric analysis of the impact of monetary policy on

Consumer Price Index

60

4.3.2.1 Analysis of stationarity for different variables

60

4.3.2.2 Co-integration test

61

4.3.2.2.1 Estimation of an impact of monetary policy on CPI of

Rwanda

62

CHAPTER FIVE: SUMMARY, CONCLUSION AND RECOMMENDATIONS

65

5.1 Introduction

65

5.2 Summary

65

5.3 General conclusion

67

5.4 Recommendations

69

References

70

List of

Tables

Table 1: Consumer price index (CPI) in Rwanda

3

Table 2: Money Supply in Rwanda

55

Table 3: Nominal Interest Rate in Rwanda

56

Table 4: Nominal Exchange Rate in Rwanda

58

Table 5: Summary of Unity root Test using PP and

ADF tests

60

Table 6: Results of Johansen Cointegration Test

62

List of Figures

Figure 1: Monetary targeting Framework

3

Figure 2: Consumer Price Index

33

Figure 3: Development of money supply (in billions

of RWF)

40

Figure 4: Consumer Price Index (CPI) in Rwanda

54

Figure 5: Money Supply in Rwanda

56

Figure 6: Nominal Interest Rate in Rwanda

57

Figure 7: Nominal Exchange Rate in Rwanda

59

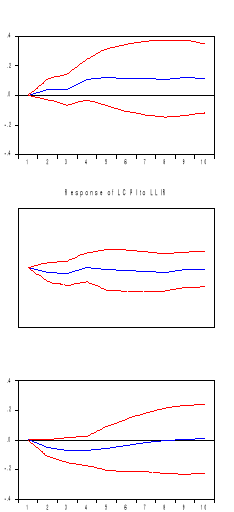

Figure 8: Response of CPI to Monetary Policy

Variables

63

Abbreviations and Acronyms

|

|

ADF :

|

Augmented Dickey- Fuller

|

|

AFDB :

|

African Development Bank

|

|

BNR :

|

Banque Nationale du Rwanda

|

|

BOP :

|

Balance of Payment

|

|

CIP :

|

Crop Intensification Program

|

|

CPI :

|

Consumer Price Index

|

|

CUSUM :

|

Cumulative Sum

|

|

ECM :

|

Error Correction Model

|

|

EDPRS :

|

Economic Development and Poverty Reduction Strategy

|

|

ESAF :

|

Enhanced Structural Adjustment Facilities

|

|

EXCH :

|

Exchange Rate

|

|

GDP :

|

Gross Domestic Product

|

|

GOR :

|

Government of Rwanda

|

|

IMF :

|

International Monetary Fund

|

|

NIR :

|

Nominal Interest Rate

|

|

KRR :

|

Key Repo Rate

|

|

MINALOC :

|

Ministère de l' Administration Locale

|

|

MINECOFIN :

|

Ministry of Finance and Economic Planning

|

|

M2 :

|

Money Supply

|

|

NBR :

|

National Bank of Rwanda

|

|

PP :

|

Phillips-Perron

|

|

RWF :

|

Rwandan Franc (s)

|

|

ULK :

|

Université Lible de Kigali

|

Abstract

The research study on the impact of monetary policy on

Consumer price index (CPI) was conducted by taking NBR as a case study. The

researcher main purpose was to evaluate the use of monetary policy on economy.

The specific objectives were to find out the impact of monetary policy on CPI

and to describe strategies of monetary policy in stabilizing economy.

To achieve the desired objectives, the researcher consulted

different documents on monetary policy and collect Secondary data on different

time series where they obtained data were tested for stationarity in order to

avoid regression involving non-stationary variables which can lead to

misleading inferences. ADF and PP tests were used to check for stationarity.

Engle- Granger two steps procedure and the Johansen Maximum Likelihood

Methodology were used to see whether variables are co integrated or not. All

those two tests revealed that there is no cointegration among our variables.

And this has leaded us to the use of impulse response in order to estimate the

impacts of monetary policy on Consumer price index.

The research found that the National Bank of Rwanda uses

different tools of monetary policy in order to stabilize economy. It uses them

in attempting to achieve the objectives of the monetary policy. With those

tools, money supply, credit, interest rates and other monetary variables can be

manipulated by the central bank of Rwanda in order to stabilize economy.

The research found that the National Bank of Rwanda uses

different tools of monetary policy in order to stabilize economy.

Keywords: Money supply, Exchange rate,

Nominal interest rate, monetary policy, Consumer Price Index (CPI)

CHAPTER 1: INTRODUCTION TO THE STUDY

1.1 Background to the study

Monetary policy can be defined as the process

by which the government, central bank, or monetary authority of a

country controls (i) the supply of money, (ii) availability of money, and (iii)

cost of money or rate of interest, in order to attain a set of objectives

oriented towards the growth and stability of the economy. The Central Bank is

the highest authority employed by the government for formulation of monetary

policy to guide the economy in a certain country. Monetary policy is defined as

the regulation of the money supply and interest rates by a central bank.

Monetary policy also refers to how the central bank uses interest rates and

the money supply to guide economic growth by controlling inflation and

stabilizing currency.

Monetary policy rests on the relationship between the rates

of interest in an economy, that is the price at which money can be borrowed,

and the total supply of money. Monetary policy uses a variety of tools to

control one or both of these, to influence outcomes like economic

growth, inflation, exchange rates with other currencies.

The economic theory states that monetary policy is important

policy to affect the level of output which is one of the targets of economic

policy (Teigen 1978). The monetarists believe that monetary policy exerts

greater impact on economic activity. The Keynesians believe that the monetary

policy exerts greater influence on economic activity.

Adam Smith first delved into the subject monetary policy rules

in the Wealth of Nations arguing that «a well-regulated paper-money»

could have significant advantages in improving economic growth and stability

compared to a pure commodity standard. By the start of the 19th century Henry

Thornton and then David Ricardo were stressing the importance of rule-guided

monetary policy after they saw the monetary-induced financial crises related to

the Napoleonic Wars.

The choice between a monetary standard where the money supply

jumped around randomly versus a simple policy rule with a smoothly growing

money and credit seemed like a no brainer.

The choice was both broader and simpler than «rules

versus discretion.» It was «rules versus chaotic monetary

policy» whether the chaos was caused by discretion or simply exogenous

shocks like gold discoveries or shortages.

A significant change in economists' search for simple

monetary policy rules occurred in the 1970s, however, as a new type of

macroeconomic model appeared on the scene. The new

models were dynamic, stochastic, and empirically estimated. And because they

incorporated both rational expectations and sticky prices, they were

sophisticated enough to serve as a laboratory to examine how monetary policy

rules would work in practice. These were the models that were used to find new

policy rules, such as the Taylor Rule, to compare the new rules with earlier

constant growth rate rules or with actual policy, and to check the rules for

robustness.

Examples include the simple three equation model in Taylor

(1979), the multi-equation international models in the comparative studies by

Bryant, Hooper, and Mann (1993), and the econometric models in robustness

analyses of Levin, Wieland, and Williams (1999).

More or less simultaneously practical experience was

confirming the model simulation results as the instability of the Great

Inflation of the 1970s gave way to the Great Moderation around the same time

that actual monetary policy began to resemble the simple policy rules that were

proposed.

From the experience of developed economies in the world which

exhibit strong economic management, various countries in developing economies

have undertaken economic reforms consisting essentially of a set of

market-oriented economic policies intended to readjust the economy to the

liberalization as well as bringing about an institutional reorganization.

Monetary policy is only one element of overall macroeconomic

policy, and can only affect the production process through its impact

on interest rates. Contractionary monetary policy raises

longer-term real interest rates. The nominal interest rate

equals the real interest rate plus the expected inflation rate. If

contractionary monetary policy lowers expected inflation or leaves it

unchanged, then evidence that it increases the nominal interest

rate implies that it must be increasing the real interest rate also

(Thorbecke and Zhang, 2008).

Hardouvelis and Barnhardt (1989), Frankel (2008) and others

have shown that if monetary policy actions are expected to increase real

interest rates they will lower commodity prices and if they are expected to

lower inflation they will also lower commodity prices. The main cause of high

interest rates is high inflation, through the expected inflation Premium.

Conversely, the best prospect for low interest rates is a stable environment of

low inflation.

In this context, the relatively high interest rates

that may be necessary to achieve a desired disinflation represent

«short-term pain for long term gain.» Central Bank, therefore, has a

current focus on anti-inflation policy which will ensure steady growth in the

long run (Shamshad, 2007).

In the sub-Sahara African context, reforms increased

significantly in the 1990s. The broad strategy has been the emphasis placed on

the policy programs supported by the International Monetary Fund (IMF) and the

World Bank, including among others fiscal reforms, liberation of exchange

restriction and the adoption of indirect instrument of monetary policy,

market-based interest policies, and so on. (IMF, December 2000).

In such program, the monetary policy played a central role in

producing macroeconomic stability. It stated that monetary and credit policies

would aim at further reducing the rate of inflation, and the authorities would

continue to monitor development in both reserve money and broad money closely

(IMF and Rwanda 1995/2002).

The control of money supply is an important policy tool in

conducting monetary policy. The success of monetary policy depends on the

degree of predictability, measurability and controllability that the monetary

authority has over Money supply.

Rwanda is no exception to this situation. Rwanda's economy is

very small and open, heavily reliant on the export of few major products,

especially coffee and tea. In addition it is also very reliant on imports for

most of its consumables. The government of Rwanda's commitment to create a

favorable production is deeply enshrined in its Vision 2020, where it has one

of its strong pillars «Development of entrepreneurship and private sector

(MINALOC.Rwanda Vision 2020 Umurenge, 2000, p4.), EDPRS in order to

achieve sustainable economic development.

Monetary policy in Rwanda has had several reforms over time,

from the use of direct instruments to indirect instruments to achieve

macroeconomic targets within a liberalized system.

Currently, the National Bank of Rwanda (BNR) conducts monetary

policy based on a monetary targeting framework with the monetary base as

operating target and interest rate (the Key Repo Rate) as the policy

instrument (BNR 2013, 13).

A monetary program is prepared considering the

economic outlook of the country and projections based on the desired rate of

monetary expansion to achieve a target rate of inflation,

consistent with the projected rate of economic growth, balance of

payments forecast and expected fiscal operations of the government (BNR 2013,

13).

The outcome of this study will help improve monetary policy

implementation and thus strengthen macroeconomic stability in Rwanda.

1.2 Problem statement

Grinnell and Williams (1990:60) state that a problem is only a

problem when something can be done to solve it. This looks appropriate to

explain how different variables of the Monetary Policy work and manipulated to

affect the dependent variables (CPI). This will also study the relationship

among these variables by measuring the elasticity and time lag.

Monetary policy influences the aggregate demand and aggregate supply

affecting economy accordingly. Hyperinflation undermines saving on the one

hand and prompts speculation, dollarization, capital flight

through uncertainty adversely affecting the poor.

Thus, this study examines whether changes in monetary policy

can account for the changes in experienced on the economy in Rwanda. This is

done by adopting a model that allows simultaneous determination of the long run

and short run relationship between dependent variable and independent variables

in a model.

1.3 Purpose of the study

According to Lee et al., (2008) and Hacker and Hatemj, (2005)

monetary policy only has a role to play in macroeconomic stabilization if the

money demand function is stable. Indeed, to emphasize the stability of the

demand function for money as highlighted by others (Mehra, 1993). Rwanda

adopted price stability as the goal for economic stabilization (IMF, 1998: 7).

The National Bank of Rwanda utilizes the M2 monetary aggregate (NBR, 2003:

30-31) as a guide variable for price stability and the monetary base (currency

plus reserves) is considered the operating target (NBR, 2003: 33). From 2004 to

2008, net external reserves had increased (Kanimba, 2008:4). Therefore, the

exchange rate of the Rwandan franc against major international currencies

maintained a trend of a slight but continuous appreciation of the Rwandan franc

against the US dollar. In 2006, Rwanda benefited from a reduction of debt

due to activities of the IMF, the World Bank and the

African Development Bank (AFDB, 2007). In January 2008, the National Bank

of Rwanda recommended that the commercial banks increase their registered

capital (Kanimba, 2008).

1.4 Research objectives

Objectives are defined as dealing with outward things or

exhibiting facts uncolored by feeling or opinion. The objectives of the study

are divided into two forms: main objective and specific objectives.

1.4.1 General objective

The General objective of this research is to evaluate the use

of monetary policy on CPI.

1.4.2 Specific objectives

Specific objectives of this study were including:

· To analyze the impact of monetary policy on Consumer

Price index.

· To find out and describe the strategies of monetary

policy in stabilizing Rwandan economy.

1.5 Research Questions

By attempting to evaluate the impact of monetary policy, the

questions raised are the following:

· Is there any impact of monetary policy on Consumer

price index?

· What are the strategies of monetary policy in

stabilizing economy in Rwanda?

1.6 Hypothesis

According to MUCHIELLI (1979:26) hypothesis are relative

answers which lead work an analysis of data and they have to be tested

consequently, correctly, and deeply by the Work.

From the research questions that were set the following

hypothesis are formulated to guide the researcher throughout study as stated

below:

Ho: monetary policy has no significant impact on CPI.

H1: monetary policy has a significant impact on

CPI.

H0: monetary policy has no significant contribution to

stabilize Rwandan economy.

H1: monetary policy has significant contribution to stabilize

Rwandan economy.

1.7 Scope of the study

This research is limited in area (space), in time (period) and

in domain.

This research is focused in NBR (Bank National du

Rwanda) area in order to manage the time limits and financial

constraints.

It is limited in period 1985-2010 the reason for this period

is the period where some data are available and it is limited in domain of

monetary policy and economy.

This study is defined in a macroeconomic

framework in the sense that it deals with national income and

inflation which are among major macroeconomic aggregates and the way of

stabilizing them. This study concerns mainly the case of NBR.

1.8 Significance of the study

1.8.1 Choice of the study

The researcher has chosen to deal with the impact of monetary

policy on consumer price index (CPI) because of the researcher want to increase

her knowledge and skills in monetary policy on economy.

1.8.2 Interest of study

The interest of study is divided in personal interest,

interest of the community and scientific interest

1.8.2.1 Personal

interest

The interest of this research is to analyze deeply the impact

of monetary policy on consumer price index (CPI).

1.8.2.2 Interest of

the community

The result of this study was facilitating the implementation

of suggestions and recommendations in order to improve the contributions of

monetary policy on CPI.

1.8.2.3 Scientific interest

The interest of this research was facilitating to the students

of Kigali Independent University (ULK) and other researchers to do the research

study to fulfill their academic requirement of being awarded.

1.9 Definitions of key terms

This chapter refers to defining the key words used in the work

in order to facilitate the interested reader to have the same understanding

with the authors about such important concepts.

1.9.1 Money

Money is any asset that is acceptable as a medium of exchange

in payment for goods and services. The functions of money are as follows:

· A medium of exchange used in payment

for goods and services

· A unit of account used to relative

measure prices and draw up accounts

· A standard of deferred payment : for

example when using credit to purchase goods and services now but pay for them

later

· A store of value: money holds its

value unless there is a situation of accelerating inflation. As the general

price level raises the internal value of a unit of currency decreases.

1.9.2 Interest Rates

An interest rate is the rate at which

interest is paid by a

borrower (debtor) for the use of money that they borrow from a

lender (creditor).

Specifically, the interest rate (I/m) is a

percentage of

principal (P)

paid a certain number of times (m) per period (usually quoted per year). For

example, a small company borrows capital from a bank to buy new assets for its

business, and in return the lender receives interest at a predetermined

interest rate for deferring the use of funds and instead lending it to the

borrower.

Interest rates are normally expressed as a percentage of the

principal for a period of one year. Interest-rate targets are a vital tool

of

monetary

policy and are taken into account when dealing with variables

like

investment,

inflation, and

unemployment. The

Central banks of

countries generally tend to reduce interest rates when they wish to increase

investment and consumption in the country's economy.

The interest rates are calculated using the

simple

interest formula:

Simple Interest = P (

principal) x I

(annual interest rate) x N (years) (

http://www.investopedia.com/terms/i/interestrate.asp

visited on 28 August, 2014).

1.9.3 Money Supply

The

quantity

of

liquid

assets (usually

cash) in

economy

can be exchanged for

goods

and services.

Increase in

money supply

(relative to the

output of

goods and services)

leads to

inflation,

higher

employment,

and

high

utilization of

the

manufacturing

capacity.

Its decrease leads to

deflation,

unemployment,

and idle manufacturing capacity. It can have different meanings depending on

the

degree of

liquidity chosen

to

define an

asset as

money.

Measures

of money supply (

called

monetary

aggregates) have different

criteria in

different

countries,

and are categorized from the narrowest to the broadest.

(

http://www.businessdictionary.com/definition/money-supply

visited on 30 August, 2014).

There are different measures of money:

1. The narrowest measure of money (M1) in Rwanda includes the

currency in circulation out the banking sector (CC) and checking account

deposit (CD) in other words, narrow money measures cover highly liquid forms of

money (Money as means of exchange).

2. The broad monetary aggregate (M2) in Rwanda adds to M1

savings deposits in Rwf and in foreign currency. It includes the less liquid

forms (Money as a store of value).

1.9.4 Exchange rate

The

exchange

rate is used when simply converting one currency to another (such as

for the purposes of travel to another country), or for engaging in

speculation or

trading in

the

foreign

exchange market. There are a wide variety of

factors which

influence the exchange rate, such as

interest

rates,

inflation, and

the state of politics and the

economy in

each country.

Exchange rate is also called rate of exchange or foreign

exchange rate or currency exchange rate.

1.9.5 Monetary policy

Johnson defines monetary policy as «policy employing

Central bank's control of the supply of money as an instrument for achieving

the objectives of general economic activity». It consists of those actions

undertaken by a Central bank in pursuit of macroeconomic stability.

According to A. G. Hart, a policy which influences the public

stock of money substitute of public demand for such assets of both that is

policy which influences public liquidity position is known as a monetary

policy.

From both these definitions, it is clear that a monetary

policy is related to the availability and cost of money supply in the economy

in order to attain certain broad objectives.

The Central bank of a nation keeps control on the supply of

money to attain the objectives of its monetary policy. Monetary policy is

regulation of the money supply by the Fed in order to influence aggregate

economic activity; the Fed's role in supplying money to the economy.

Economic regulation is a Government's measure aimed to

controlled price, output, market entry and exit, and product quality in

situations where monopoly is inevitable or desirable.

1.10 Organization of the

dissertation

The study is divided into five chapters: It begins with an

introduction presenting the back ground of the study, significance of the

study, the scope of the study, problem statement as well as the hypothesis and

the objectives and then the organization of the study is constructed as

follow:

The first chapter is related to the study includes the problem

statement, the objectives of the study, the research motivation and

the structure of the study is outlined in this chapter.

The second chapter is related to the literature review which

is attempted to define and explain some key concepts, Books and journal

articles have been consulted to find out how different authors explain theories

and/or provide evidences related to the topic the impact of monetary policy on

consumer price index (CPI).

The third chapter discusses the method to analyze the data and

information collected estimation used in chapters 4.

The fourth chapter was analyzed the findings on data collected

on monetary policy and see how this chapter is verified.

The fifth chapters are related to the summary, conclusion and

policy recommendations of the study.

CHAPTER 2: LITERATURE REVIEW

Introduction

This chapter refers to defining the key words used in the work

in order to facilitate the interested reader to have the same understanding

with the authors about such important concepts.

It is also aimed at analyzing and putting in place all

theories made by different authors, scholars and researchers and it facilitate

to understand the different relationship between terms or concepts of the topic

in order to understand deeply this topic which is the monetary policy on

CPI.

According to Monetary Theory, Monetary Policy

manipulates the money supply and rate of interest in such a way to

achieve the goals of the manifestation of the ruling party (Shoaib k, 2010).

Monetary Policy provides a logical relationship

between its variables stipulated to affects the outcomes

regarding the Central Bank applies these tools to regulate the money creation,

targeting the rate of interest to manage the pace of monetary circulation. The

objective is to stabilize internal and external value of the currency

(Wikipedia, Monetary policy September, 2014).

In present times wide range monetary decisions are required

such as short term and long term interest rates; velocity of money; exchange

rates; bonds and equities. They will also have to look into the government

and private expenditure; savings; inflows of capital and other

financial derivatives (Wikipedia, Monetary policy September, 2014).

Many scholars who have investigated on the effect of monetary

policy have come up with varieties of remedial steps.

Tailor (1963) studied the interest rate effect of monetary

transmission mechanism and

Observed that contractionary monetary policy leads to a rise

in domestic real interest rates, raises cost of capital, thereby causing a fall

in investment spending and a decline in output.

Ozme (1998) adopted a simplified Ordinary Least Square

techniques in his analysis on monetary policy and macroeconomic stabilization

in Nigeria and found out that interest rate has an insignificant influence on

price stability.

Killick and Mwega (1990:3) recapitulated traditional

monetary policy goals to include price stability, promoting

growth, achieving full employment, smoothing the business cycle,

preventing financial crises, and stabilizing long-term interest rates and

the real exchange rate.

Genev (2002) studied the effects of monetary shocks in 10

Central and Eastern European (CEE) countries and found some indication that

changes in the Exchange rate affects output but no evidence that suggests that

changes in interest rate affect output.

Balogun (2007) used simultaneous equation model in testing the

hypothesis of effectiveness of monetary policy in Nigeria, and found out that

rather than promote growth, domestic monetary policy was a source of stagnation

and persistent inflation.

Okwo and Nwoha (2010) examined the effect of monetary policy

outcomes on macroeconomic stability in Nigeria using a simplified Ordinary

least square technique stated in multiple forms. They found out that there

exists an insignificant relationship between monetary policy, gross domestic

product, credit to private sector and inflation in Nigeria.

Omoke and Ugwuanyi (2010) in their long - run study of money,

prices and output in

Nigeria found out that there exists no co-integrating vector

but however proved that money supply granger causes both output and inflation.

Thus, suggest that monetary stability can contribute towards price stability

since inflation in Nigeria is a monetary phenomenon.

Nwosa (2011) in his appraisal of monetary policy development

in Nigeria, examined the effect of monetary policy on macroeconomic variables

using an Ordinary Least Square technique after conducting the unit root, co

-integration tests revealed that monetary policy has a significant effect on

exchange rate and an insignificant influence on price stability.

Government policies, including monetary policy,

affect the growth of domestic output to the extent that they

affect the quantity and productivity of capital and labor. Monetary policy is

only one element of overall macroeconomic policy, and can

only affect the production process through its impact on

interest rates.

There are two main channels of monetary policy.

One is through the effect that interest rate changes have on

the exchange rate of a currency, and the other is through the

effect that interest rate changes have on demand. Therefore monetary policy has

an impact on economic activity and growth through the workings of foreign and

domestic markets for goods and services (Boweni, 2000)

The instrument of monetary policy ought to be the short term

interest rate, that policy should be focused on the control of inflation, and

that inflation can be reduced by increasing short term interest rates (Alvarez,

2001).

Kuttner and Mosser (2002) indicated that monetary policy

affects the economy through several

Transmission mechanisms such as the interest rate channel, the

exchange rate channel, Tobin's q theory, the wealth effect, the

monetarist channel, and the credit channels including the bank

lending channel and the balance-sheet channel. But mainly

monetary policy plays its role in controlling inflation through money

supply and interest rate. Money Supply (M2) would affect real GDP positively

because an increase in real quantity of money causes the nominal interest rate

to decline and real output to rise (Hsing, 2005).

Friedman (1963) emphasizes money supply as the key factor

affecting the wellbeing of the economy. Thus, in order to promote steady growth

rate, the money supply should grow at a fixed rate, instead of being regulated

and altered by the monetary authority.

After the Great Depression, JM Keynes who advocates for demand

management policies, for the first time recognized the direct effect of money

supply on the economic health of a nation.

He also argues for intervention of the Central Bank to

operate monetary policy to stabilize the economy (Shoaibk, 2010).

The concepts defined in this study are: Consumer Price Index,

Nominal Interest Rate, Money Supply and Exchange rate.

2.1 Theory of Monetary Policy

Monetary policy is the process by which the government,

Central bank or monetary authority of a country controls: (i) the supply of

money, (ii) availability of money, and (iii) cost of money or rate of interest

to attain a set of objectives oriented towards the growth and stability of the

economy.

Monetary theory provides insight into how to craft optimal

monetary policy.

Monetary policy rests on the relationship between the rates of

interest in an economy, that is the price at which money can be borrowed, and

the total supply of money. Monetary policy uses a variety of tools to control

one or both of these, to influence outcomes like economic growth, inflation,

exchange rates with other currencies.

Where currency is under a monopoly of issuance, or where there

is a regulated system of issuing currency through banks which are tied to a

Central bank, the monetary authority has the ability to alter the money supply

and thus influence the interest rate (to achieve policy goals). If policymakers

believe that private agents anticipate low inflation, they have an incentive to

adopt an expansionist monetary policy (where the

marginal

benefit of increasing economic output outweighs the

marginal cost of

inflation); however, assuming private agents have

rational

expectations, they know that policymakers have this incentive.

Hence, private agents know that if they anticipate low

inflation, an expansionist policy will be adopted that causes a rise in

inflation.

Consequently, (unless policymakers can make their announcement

of low inflation credible), private agents expect high inflation.

This anticipation is fulfilled through adaptive expectation

(wage-setting behavior); so, there is higher inflation (without the benefit of

increased output). Hence, unless credible announcements can be made,

expansionary monetary policy will fail.

While a Central bank might have a favorable reputation due to

good performance in conducting monetary policy, the same Central bank might not

have chosen any particular form of commitment (such as targeting a certain

range for inflation).

Reputation plays a crucial role in determining how much

markets would believe the announcement of a particular commitment to a policy

goal but both concepts should not be assimilated. Also, note that under

rational expectations, it is not necessary for the policymaker to have

established its reputation through past policy actions; as an example, the

reputation of the head of the Central bank might be derived entirely from his

or her ideology, professional background, public statements.

In fact it has been argued that to prevent some pathology

related to the

time

inconsistency of monetary policy implementation (in particular

excessive inflation), the head of a Central bank should have a larger distaste

for inflation than the rest of the economy on average. Hence the reputation of

a particular Central bank is not necessary tied to past performance, but rather

to particular institutional arrangements that the markets can use to form

inflation expectations.

Despite the frequent discussion of credibility as it relates

to monetary policy, the exact meaning of credibility is rarely defined. Such

lack of clarity can serve to lead policy away from what is believed to be the

most beneficial. For example, capability to serve the public interest is one

definition of credibility often associated with Central banks.

The reliability which a Central bank keeps its promises is

also a common definition. While everyone most likely agrees a Central bank

should not lie to the public, wide disagreement exists on how a Central bank

can best serve the public interest.

Therefore, lack of definition can lead people to believe their

supporting one particular policy of credibility when they are really supporting

another (

B.M. Friedman,

2001).

Before proceeding to review what other researchers

have found about relationship of CPI and Money supply, interest

rate, and Inflation, we first attempt to explain the importance of monetary

policy in light of available literature.

Government policies, including monetary policy,

affect the growth of domestic output to the extent that they

affect the quantity and productivity of capital and labor. Monetary policy is

only one element of overall macroeconomic policy, and can

only affect the production process through its impact on

interest rates.

There are two main channels of monetary policy.

One is through the effect that interest rate changes have on

the exchange rate of a currency, and the other is through the

effect that interest rate changes have on demand. Therefore monetary policy has

an impact on economic activity and growth through the workings of foreign and

domestic markets for goods and services (Boweni, 2000)

Kuttner and Mosser (2002) indicated that monetary policy

affects the economy through several transmission mechanisms such as the

interest rate channel, the exchange rate channel but mainly monetary

policy plays its role in controlling inflation through money supply and

interest rate. Money Supply (M2) would affect real GDP positively because an

increase in real quantity of money causes the nominal interest rate to decline

and real output to rise (Hsing, 2005).

The National Bank of Rwanda establishes and enforces banking

rules that affect monetary policy and the overall level of the competition

between different banks. It determines which non-banking activities, such as

brokerage services, leasing and insurance, are appropriate for banks and which

should be prohibited.

The National Bank of Rwanda is also responsible for

supervising the central insurance funds that protects the deposits of member

institution (O.C. Ferrell et al, 2006).

2.1.1 Transmission of monetary

policy

The monetary policy transmission mechanism describes

the channels through which changes in monetary policy affect

the objective target. It describes how private sector agents

respond to the policy actions of the monetary authorities. The

channels through which monetary policy are transmitted are varied and complex

depending on the financial structure, expectations, openness of the economy and

production functions. In the long run the price level is determined

solely by the actions of the monetary authorities.

This stems from the fact that the central bank

alone creates the ultimate means of payments, base money, on which a

monetary economy depends.

By altering the terms at which this means of payment is

provided, the authorities are able to determine the nominal value of

transactions in the economy and hence the price level in the long run.

To a large extent the debate on the mechanism

is centered on the precise temporal impact of monetary shocks

on the economy and the means by which such shocks are

propagated. The intellectual divide on this issue involves the classical

/monetarist school (Friedman, Cagan, Meltzer, MaCallum, Lucas et al) and

the Keynesians/Neo-Keynesians such as Grossman, Mankiw and Romer among

others.

For the case of Rwanda, the transmission of monetary policy

can be schematized as follow:

Figure 1: Monetary targeting Framework

Source: BNR, Economic Review no3

Based on this figure, the NBR sets base money as an operating

target with the intention of changing the intermediate target of any monetary

aggregate (money stock in the economy). Indeed monetary aggregate targeting is

part of the strategy by which the National Bank of Rwanda chooses the money

stock as the nominal anchor for achieving price stability as a final

objective. To attain this final objective, the following two

requirements are necessary:

(i) A stable demand functions for money;

(ii) A long-run relationship between the money stock and the

price level (Hansen and Kim, 1995:286).

2.1.2 Objectives of Monetary Policy

Broadly speaking, the objective of monetary policy is to

influence the performance of the economy as reflected in factors such as

inflation, economic output and employment. It works by affecting demand across

the economy in terms of people and firms willingness to spend on goods and

services (Federal Reserve Bank of San Francisco, 2004). The objectives of a

monetary policy are similar, planning aims at growth, stability and social

justice.

After the Keynesian revolution in economics, many people

accepted significance of monetary policy in attaining following objectives (

http://www.yourarticlelibrary.com/policies/monetary-policy-meaning-objectives-and-instruments-of-monetary-policy/11134/

visited on 17 September 2014):

· Rapid economic growth

· Price stability

· Exchange rate stability

· Balance of Payment Equilibrium (BOP)

· Full employment

· Equal income Distribution

These are the general objectives which every Central bank of a

nation tries to attain by employing certain tools (instruments) of a monetary

policy.

In Rwanda the Central bank has always aimed to control the

expansion of bank credit and money supply, with special attention to the season

needs of a credit.

The objectives of monetary policy in detail

(

http://www.yourarticlelibrary.com/policies/monetary-policy-meaning-objectives-and-instruments-of-monetary-policy/11134/

visited on 17 September 2014):

1. Rapid economic growth

It's the most important objective of a monetary policy. The

monetary policy can influence economic growth by controlling real interest rate

and its resultant impact on investment.

If the Central bank opts for a cheap or easy credit policy by

reducing interest rates, the investment level in the economy can be encouraged.

This increased investment can speed up economic growth is possible if the

monetary policy succeeds in maintaining income and price stability.

2. Price stability

All the economics suffer from inflation and deflation. It can

be also called as price instability. Both inflation and deflation are harmful

to the economy. Thus, the monetary policy having an objective of price

stability tries to keep the value of money stable. It helps in reducing the

income and wealth inequalities. When the economy suffers from recession the

monetary policy should be an easy money policy but when there is inflationary

situation there should be a dear money policy.

3. Exchange rate stability

Exchange rate is the price of a home currency expressed in

terms of any foreign currency. If this exchange rate is very volatile leading

to frequent ups and downs in the exchange rate, the international community

might lose confidence in our economy. The monetary policy aims at maintaining

the relative stability in the exchange rate. The Central bank by altering the

foreign exchange is tries to maintain the exchange rate stability.

4. Balance of Payment Equilibrium (BOP)

Many developing countries like Rwanda suffer from the

disequilibrium in the BOP. The Central bank through its monetary policy tries

to maintain equilibrium in the balance of payments. The BOP has two aspects:

the BOP Surplus and the BOP Deficit. The former reflects an excess money supply

in the domestic economy, while the later stands for stringency of money. If the

monetary policy succeeds in maintaining monetary equilibrium, then the BOP

equilibrium can be achieved.

5. Full employment

The concept of full employment was much discussed after

Keynes's publication of the «General Theory» in 1936. It refers to

absence of involuntary unemployment. In simple words «full

employment» stands for a situation in which everybody who wants jobs gets

jobs. However it does not mean that there is zero unemployment. In that senses

the full employment is never full. Monetary policy can be used for achieving

full employment. If the monetary policy is expansionary the credit supply can

be encouraged. It could help in creating more jobs in different sector of the

economy.

6. Neutrality of money

Economists such as Wicksted, Robertson and others have always

considered money as passive factor. According to them, money should play only a

role of medium of exchange and not more than that. Therefore, the monetary

policy should regulate the supply of money. The change in money supply creates

monetary disequilibrium. Thus monetary policy has to regulate the supply of

money and neutralize the effect of money expansion. However this objective of a

monetary policy is always criticized on the ground that if money supply is kept

constant then it would be difficult to attain price stability.

7. Equal income distribution

Many economists used equal income distribution to justify the

role of fiscal policy in order to maintain economic equality. However in recent

years, economists have given the opinion that the monetary policy can help and

play a supplementary role in attainting economic equality. Monetary policy can

make special provisions for the neglect supply such as agriculture, small-

scale industries, village industries, etc. and provide them with cheaper credit

for long term.

This can prove fruitful for these sectors to come up. Thus in

recent period, monetary policy can help in reducing economic inequalities among

different sections of society.

The goal of monetary policy is set out in the National Bank of

Rwanda (BNR) Law which requires the BNR to conduct monetary policy in a

way to deliver price stability and in low inflation environment. Law no

55/2007 of 30/11/2007 governing the Central bank of Rwanda assigns to the

BNR responsibility of formulating and implementing monetary policy.

According to article 5 of the same law, the main missions

of the National Bank of Rwanda shall be:

· To ensure and maintain price stability

· To enhance and maintain a stable and competitive

financial system without any exclusion

· To support Government's general economic policies,

without prejudice to the two missions referred to in Paragraphs 1°

and 2° above.

These objectives allow the National Bank of Rwanda to focus on

price stability while taking into account of the implications of monetary

policy for the whole economic activity and, therefore, price stability is

a crucial precondition for sustained economic growth. The National Bank

of Rwanda agrees on the importance of low inflation and low inflation

expectations. NBR mission's assists businesses in making sound investment

decisions, underpin the creation of jobs, protect the savings of Rwandans

and preserve the value of the national currency.

In pursuing the goal of medium-term to long term price

stability, the National Bank of Rwanda agrees with the Government on the

objective of keeping consumer price inflation low and stable. This

formulation allows short-run variation in inflation while preserving a clearly

identifiable performance benchmark over time.

To achieve the price stability objective, the BNR currently

operates in a flexible monetary targeting framework with the monetary base

as operating target, broad money aggregate as an intermediate target and

inflation as the ultimate goal. The BNR monitors movements in monetary base on

daily basis in line with the targets as set in the annual monetary

program.

In that exercise, the BNR uses several policy instruments

mainly open market operations, discount rate and reserve requirement.

The key repo rate (policy rate) set by the monetary policy

committee is used to signal the stance of monetary policy.

2.1.3 Instruments of monetary policy

The instruments or tools of monetary policy are of two types

Qualitative and Quantitative in nature.

Qualitative control includes change in margin requirements,

regulation of consumer credit, moral persuasion, publicity, direct action.

Quantitative control includes open market operations, the

reserve ratio, the discount rate, Foreign Exchange Interventions.

Monetary policy guides the Central bank's supply of money in

order to achieve the objectives of price stability (or low inflation rate),

full employment, and growth in aggregate income.

The instruments of monetary policy used by the Central bank

depend on the level of development of the economy, especially its financial

sector (Federal Reserve System and Monetary Policy, 1979).

The commonly used instruments are:

1. Reserve Requirement

The monetary authority exerts regulatory control over banks.

Monetary policy can be implemented by changing the proportion of total assets

that banks must hold in reserve with the central bank. Banks only

maintain a small portion of their assets as cash available for

immediate withdrawal; the rest is invested in illiquid assets like mortgages

and loans.

By changing the proportion of total assets to

be held as liquid cash, the Federal Reserve changes the availability

of loan able funds. This acts as a change in the money supply. Central

banks typically do not change the reserve requirements often

because it creates very volatile changes in the money supply

due to the lending multiplier.

2. Open Market Operations

The Central bank buys or sells ((on behalf of the Fiscal

Authorities (the Treasury)) securities to the banking and non-banking public

(that is in the open market).

One such security is Treasury Bills. When the Central bank

sells securities, it reduces the supply of reserves and when it buys (back)

securities-by redeeming them-it increases the supply of reserves to the Deposit

Money Banks, thus affecting the supply of money.

3. Lending by the Central bank

The Central bank sometimes provide credit to Deposit Money

Banks, thus affecting the level of reserves and hence the monetary base.

4. Interest Rate

The Central bank lends to financially sound Deposit Money

Banks at a most favorable rate of interest, called the minimum rediscount rate

(MRR). The MRR sets the floor for the interest rate regime in the money market

(the nominal anchor rate) and thereby affects the supply of credit, the supply

of savings (which affects the supply of reserves and monetary aggregate) and

the supply of investment (which affects full employment and GDP).

5. Direct Credit Control

The Central bank can direct Deposit Money Banks on the maximum

percentage or amount of loans (credit ceilings) to different economic sectors

or activities, interest rate caps, liquid asset ratio and issue credit

guarantee to preferred loans. In this way the available savings is allocated

and investment directed in particular directions.

6. Moral Suasion

The Central bank issues licenses or operating permit to

Deposit Money Banks and also regulates the operation of the banking system. It

can, from this advantage, persuade banks to follow certain paths such as credit

restraint or expansion, increased savings mobilization and promotion of exports

through financial support, which otherwise they may not do, on the basis of

their risk/return assessment.

7. Prudential Guidelines

The Central bank may in writing require the Deposit

Money Banks to exercise particular care in their operations in order that

specified outcomes are realized.

Key elements of prudential guidelines remove some discretion

from bank management and replace it with rules in decision making.

8. Exchange Rate

The balance of payments can be in deficit or in surplus and

each of these affect the monetary base, and hence the money supply in one

direction or the other. By selling or buying foreign exchange, the Central bank

ensures that the exchange rate is at levels that do not affect domestic money

supply in undesired direction, through the balance of payments and the real.

2.1.4 Strategies of monetary policy

Having identified the instruments available for active

monetary policy implementation, it is important to understand the current

conduct of monetary policy needs to be operated within a well-defined to

independent Central bank. This means simply to provide the authorities of

Central banks with the power to determine quantities and interest rates on its

own transactions without interference from government institutions (Lybeck,

1998 quoted in Worrel, 2000).

Similarly, Blinder (1998) shows that Central bank independence

means two things: Firstly, that the Central bank has the freedom to decide how

to pursue its goals, and secondly, that its decisions are very difficult for

other branches of government to reverse.

This implies that an independent Central bank needs to be free

of the political pressures that influence other government institutions. This

is particularly important when a Central bank needs to target inflation,

exchange rates or the monetary base for example.

On this basis, an important point to analyze could be the way

Central banks process before following a given strategy.

Monetary policy will aim at keeping the annual inflation rate

below 5 percent. The monetary authorities will pursue a reserve money

target, while closely monitoring developments in bank liquidity and broad

money.

The BNR will control monetary aggregates and influence

interest rates through indirect instruments: the Treasury bill auctions

(commenced in late 1998) and money market operations on its own account.

The Government intends to progressively replace the

outstanding stock of consolidated debt held by commercial banks by negotiable

treasury bills in the course of 1999-2000, so as to contribute to the

development of a secondary market for government paper. Coordination between

the Ministry of Finance and the BNR will be strengthened to ensure the

consistency of the program's fiscal and monetary objectives.

2.1.5 Taylor rule

The Taylor rule is also known as a simple interest rate rule.

That is, simply speaking, it is the current practice where Central bankers

could formulate policy in terms of interest rates. This rule was originally

proposed by the economist John Taylor following to the need of American Central

bank to set the interest rates to achieve stable price while avoiding large

fluctuations in output and employment (Mankiw, 2000).

Considering the monetary transmission mechanism as the process

through which monetary policy decisions are transmitted into changes in real

GDP and inflation, Taylor (1995) argued that most Central banks today are

taking actions in the monetary market to guide the short-term interest rate in

a particular way. In other words, rather than changing the money supply by a

given amount and then letting the short-term interest rate take a course

implied by money demand, the Central banks adjust the supply of high-powered

money in order to give certain desired movements to the fund rate. The aim

knows how much the Central bank should adjust the short-term interest rate in

response to various factors in the economy including real GDP and inflation.

Taylor proposed a simple interest rule in which the funds rate

reacts to two variables: the deviation of inflation from a target rate of

inflation, and the percentage deviation for real GDP from potential GDP.

Specifically, the Taylor rule can be written as follows:

In this equation,

Is the target short-term

nominal interest

rate Is the target short-term

nominal interest

rate

· is the rate of

inflation as measured

by the

GDP deflator

·  is the desired rate of inflation, is the desired rate of inflation,

·  is the assumed equilibrium real interest rate, is the assumed equilibrium real interest rate,

·  is the logarithm of real

GDP is the logarithm of real

GDP

·  is the logarithm of

potential output,

as determined by a linear trend. is the logarithm of

potential output,

as determined by a linear trend.

In this equation,

Both  and and  should be positive (as a rough rule of thumb, Taylor's 1993 paper

proposed setting should be positive (as a rough rule of thumb, Taylor's 1993 paper

proposed setting

That is, the rule "recommends" a relatively high interest rate

(a "tight" monetary policy) when inflation is above its target or when output

is above its

full-employment level,

in order to reduce inflationary pressure.

It recommends a relatively low interest rate ("easy" monetary

policy) in the opposite situation, to stimulate output. Sometimes monetary

policy goals may conflict, as in the case of stagflation, when inflation is

above its target while output is below full employment. In such a situation, a

Taylor rule specifies the relative weights given to reducing inflation versus

increasing output

The Taylor principle states that the Central bank's policy

interest rate should be increased more than one for one with increases in the

inflation rate.

(

http://en.wikipedia.org/wiki/Taylor_rule

visited on 2 September, 2014)

The Taylor principle ensures that an increase in the inflation

rate produces a policy reaction that increases the real rate of interest. The

rise in the real interest reduces private spending, slows the economy down and

brings inflation back to the Central bank's inflation target.

Conversely, if inflation falls below the Central bank's

target, the Taylor principle calls for a more than one for one cut in the

Central bank's policy interest rate. This reduces the real rate of interest,

stimulates private spending, and pushes inflation back to its target level

(Walsh, 2001).

Over several years there has been an emerging consensus among

economist authors that the Taylor rule appears to be a good description of the

interest rate policies of many Central banks. Thus, Taylor's rule is the most

popular approach to the empirical analysis of reaction functions (Sanchez-Fung,

2000).

Mankiw (2000) shows that Taylor's rule for monetary policy is

not only simple and reasonable, but also resembles the American Central bank

behavior in recent years fairly accurately.

In the light of the different policy rules mentioned above, it

is worth noting that studies on monetary policy rules show that it is possible

to use very simple rules to achieve better economic performance. However,

generally speaking, the question of determining the best rule needs first of

all a better understanding of the transmission mechanism of monetary policy

through the economic system.

The exchange rate will continue to be market determined,

with the BNR's intervention in the exchange market confined to meeting the net

foreign assets target and smoothing short-term exchange rate fluctuations,

while not resisting underlying trends.

To improve the functioning of the exchange market, the BNR

will continue to communicate to economic agents the cost advantages of bank

settlements instead of cash transactions (currently causing a premium for

dollar bills), and develop a forward market, for which the regulatory framework

was established in May 1999.

2.1.6 Economic situation

Rwanda's economy is agrarian. Agriculture

employs almost 80 percent of the population, accounting for

more than 40 percent of gross domestic product (GDP)

and more than 70 percent of exports. Subsistence food production is the

dominant activity in the agriculture sector. Production of coffee and

tea for export is still modest.

The service sector contributes approximately 39 percent of GDP

and employs roughly 6.5 percent of the working population. The percentage

of Rwandans living in poverty has decreased from 60.4 percent in

2000-2001 to 56.9 percent in 2005-2006.

(National Institute of Statistics Rwanda, `Preliminary

Poverty Update Report, Integrated Living Conditions Survey

2005/06' December 2006.)

Rwanda's economic growth was rapid in the years following the

genocide, largely due to determined economic policy, the `catch-up' effect (due

to starting from a very low baseline in 1994) and relatively high aid flows.

Economic growth has been more modest in recent years. For 2007,

the GoR forecast for GDP growth is 6.0 percent

Rwanda embarked on a continuous, aggressive, ambitious agenda

of political, financial and economic reforms to establish an attractive

environment for both domestic and foreign investments. Rwanda has continuously

improved its policy and institutional reforms towards poverty reduction.

It is evident that Rwanda is an example of success stories in

post-conflict reconstruction (Bigsten and Isaksson, 2008). Rwanda has made

progress in fighting corruption and promoting gender equality, as well as

creating a soft business environment. It is one of the most improved countries

in the world in the annual Doing Business Index, thus attracting both private

and foreign direct investments.

Rwanda's economy has demonstrated a strong recovery from the

global recession. Real GDP growth edged up to 7.5% in 2010 from 4.1% in 2009

due to expansion in government spending, robust growth in services

(primarily telecom and financial services) and recovery in tourism. The

large fiscal stimulus and expansionary monetary policy implemented in 2010

bolstered the recovery. Key growth drivers in the short and medium term

include expansion in services sector, increased productivity in the agriculture

sector, and increased public and private investment (AfDB, Research Department

using data from WEF, 2010).

The services sector accounts for the largest share of GDP at

47% and its share has continued to grow during the period 1995-2010 while

shares for industry and agriculture have been declining. Growth in services

has been fuelled by expansion in trade, transport, telecommunications, finance

and insurance (Human Development Report, 1999).

GoR's responses include a Crop

Intensification Program (CIP) implemented since 2008 and focusing on several

priorities including land use consolidation; Fertilizer and seed

distribution; and post-harvest activities and marketing and a Strategic

Plan for the Transformation of Agriculture, Phase II (2009-12).

As a result, food production has increased and this has

shielded Rwanda from the on-going food crisis in the Horn of Africa.

According to Macroeconomic framework and strategy for the

period 1999-2002, the main elements of the medium-term macroeconomic

program are:

(i) To achieve annual average real GDP growth rate of

5-6 percent a year;

(ii) To keep inflation at below 5 percent a year;

(iii) To maintain the external current account deficit

(excluding official transfers) at about 17 percent of GDP and the level of

gross official reserves at a level of at least four months of imports,

whereas the high growth rate in real GDP in 1995-98 was achieved by bringing

existing capacity back into use, hence forth, sustained growth at the targeted

rate would require a significant increase in investment, from

15½ percent of GDP in 1998-99 to 19½ percent in 2001-2002

(African Economic Outlook,2010).

With government investment projected at about 9 percent

of GDP, an increase in private investment from 8½ percent of GDP in

1998-99 to more than 10 percent in 2001-2002 would be needed, as well as

similar increase in private savings. Increases in investment and savings levels

will depend on continued progress in restoring confidence in the economy,

which, in turn, depends on the progress in national reconciliation, domestic

and regional security, and structural reforms. Significant foreign aid,

including assistance to reduce the external debt burden, will remain essential

to enable Rwanda to achieve high and sustainable growth.

2.1.6.1 Consumer Price Index

International Labour Office (ILO) defined consumer prices

index (CPI) as index numbers that measure changes in the prices of goods and

services purchased or otherwise acquired by households, which households use

directly, or indirectly, to satisfy their own needs and wants.

According to the National Institute of Statistic of Rwanda,

The CPI is a measure of the average change over time in the prices of consumer

items goods and services that people buy for day-to-day living. The CPI is a

complex construct that combines economic theory with sampling and other

statistical techniques and uses data collected each month to produce a timely

measure of average price change for the consumption sector of the Rwandan

economy (NISR: March 2010)

The CPI can be intended to measure either the rate of price

inflation as perceived by households, or changes in their cost of living (that

is, change in the amounts that the households need to spend in order to

maintain their standard of living).

In practice, most CPI are calculated as weighted averages of

the percentage price changes for specified set, or «basket», of

consumer products, the weights reflecting their relative importance in

household consumption in some period. Much depend on how appropriate and timely

the weights are. (ILO 2004:4).

However there is some criticism in calculation of this CPI

whereby the prices collected were not a fair sample of the prices that actually

existed for goods of equal quality.

According to the Morgan (1947:29) CPI neglect to consider the

following:

1. Underreporting of prices by stores and large rise in prices

of important goods not included in the index.

2. Disappearance of low grades of goods and deterioration in

the quality of goods priced.

3. Large retail-price increase in smaller cities not covered

by the index

According to the National Institute of Statistics of Rwanda

(CPI October 2009), The CPI is a Modified Laspeyres index that covers household

consumption as it is used by national accounts. The reference population for

the CPI consists of all households living in urban areas in Rwanda.

The household basket includes 1,136 products observed in many

places spread all over the administrative centers of all provinces in Rwanda.

All kinds of places of observation are selected: shops, markets, services, etc.

More than 29,200 prices are collected every month by enumerators of the

National Institute of Statistics of Rwanda and of the National Bank of

Rwanda.

The weights used for the new index (CPI of the Base year of

February 2009) are the result of the Household Living Conditions Survey (EICV

II) conducted in 2005-2006 with a sample of 6,900 households.

The basket used in measuring CPI by NISR is composed by the

following division of commodities:

1. Food and non-alcoholic beverages (Bread and Cereals, Meat,

Fish, Vegetables, Non-alcoholic beverages)

2. Alcoholic beverages and tobacco

3. Clothing and footwear

4. Housing, water, electricity, gas and other fuels

5. Furnishing, household equipment and routine household

maintenance

6. Health

7. Transport

8. Communication

9. Recreation and culture

10. Education

11. Restaurants and hotels

12. Miscellaneous goods and services.

Rwanda has implemented an expansionary monetary policy

stance aimed at reversing the domestic liquidity crisis that

started in 2008 and to accelerate the rebound in

growth. However, structural rigidities and low financial

sector depth impeded the fiscal stimulus effects. Successful

implementation of CIP contributed to a reduction in inflation

from 2011 10.3% in 2009 to 2.3% in 2010 However, since Rwanda remains a

net food importer and given the large import share of energy products (19.5% in

2010), inflation is projected to edge upwards to 3.9% in 2011 due to the rising

global food and fuel prices.

CPI from 2003 up to 2010 can be schematized by the following

figure:

Figure 2: Consumer Price

Index

Source: AfDB Statistics Department, African Economic Outlook

April 2010

2.1.6.2 Economic effects of monetary policy

The Central bank tries to maintain price stability through

controlling the level of money supply. Thus, monetary policy plays a

stabilizing role in influencing economic growth through a number of channels.

However, the scope of such a role may be limited by the concurrent pursuit of

other primary objectives of monetary policy, the nature

of monetary policy transmission mechanism, and by

other factors, including the uncertainty facing policy makers and the

stance of economic policies.

In addition, the concurrent target of intermediate goals may

have implications on the attainment of the ultimate objective of achieving

sustainable growth. The contribution of monetary policy maker to sustainable

growth is the maintenance of price stability.

Since sustained increase in price levels is adjudged

substantially to be a monetary phenomenon, monetary policy uses its

tools to effectively check money supply with a view to maintaining

price stability in the medium to long term.

Theory and empirical evidence in the literature

suggest that sustainable long term growth is associated with

lower price levels. In other words, high inflation is damaging to long-run

economic performance and welfare.

Monetary policy has far reaching impact on

financing conditions in the economy, not just the costs, but also the

availability of credit, banks' willingness to assume specific risks, etc.

It also influences expectations about the future direction of

economic activity and inflation, thus affecting the prices of goods, asset

prices, exchange rates as well as consumption and investment.

A monetary policy decision that cuts interest

rate, for example, lowers the cost of borrowing, resulting

in higher investment activity and the purchase of consumer

durables.

The expectation that economic activity will strengthen may

also prompt banks to ease lending policy, which in turn enables

business and households to boost spending.

In a low interest-rate regime, stocks become more attractive

to buy, raising households' financial assets. This may also contribute to