4.1.3. System of National

Accounts of Rwanda

Due to technical reasons that include huge informal and

non-monetary sectors (about 65% of the economy in 2006) and data availability

among others, in Rwanda National Accounts are only compiled using the Out

Put/Production approach. On the other hand as far as the expenditure

approach is concerned, it is only the final household expenditure that cannot

be measured on a yearly basis. Hence in this case it can then be calculated by

subtracting as a balancing item from the output approach (Republic of Rwanda,

NISR, 2010, GDP Annual Estimates for 2009 based on 2006 benchmark).

.

Therefore finally GDP estimates of both the production and

expenditure approaches are computed annually in Rwanda. National Accounts are

estimated by economic activities which are classified according the

International Standard Industrial Classification of all economic activities

(ISIC). This is used alongside the United Nations Central Product

Classification (CPC) that is linked to the Harmonized System (HS) used for

classifying international trade (Republic of Rwanda, NISR, 2010, GDP Annual

Estimates for 2009 based on 2006 benchmark).

All these, are adapted to Rwanda's development level keeping

their framework as much as possible. The Industries include:

A.Agriculturea.- Food cropb.- Export cropc.- Livestockd.- Forestrye.-

FisheriesB.- Industrya.- Mining and quarryingb.- Manufacturingc.- Electricity,

gas and waterd.- ConstructionC.- Servicesa.- Whole sale and retail tradeb.-

Hotels and restaurants. Transport, storage and communicationd.- Finance,

insurancee.- Real estate, business servicesf.- Public

administrationg. Educationh.- Healthi.- Other

personal services (trade unions, religious activities, sporting, hair dressing,

domestic services, visiting national parks etc) (Republic of Rwanda, NISR,

2010, GDP Annual Estimates for 2009 based on 2006 benchmark).

.

In Rwanda, national accounts are estimated on an annual basis

by the National Institute of Statistics of Rwanda and from time to time the

estimation methodology is revised due to reasons that include: improvement in

data sources and systems and changes in the national economic structure.

In this regard the first benchmark of 2001 was done in 2003 and now the

National Institute of Statistics of Rwanda is in the process of rebasing the

benchmark to 2006. The rebasing exercise is practically possible two

years after the intended base year which in this case is 2006. This allows for

the use of final approved data for 2006 base year and 2007 current year.

4.1.4. Rwanda's Economic

Emergency

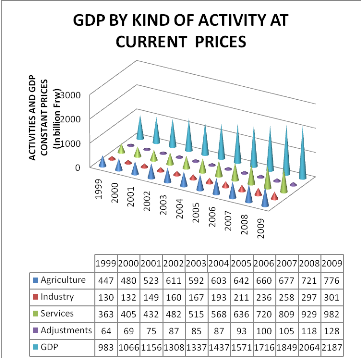

In 2009 Rwanda's gross domestic product (GDP) grew by 4.5% and

is projected to recover moderately in 2010 to 5.1%. The impressive growth that

the country has experienced over the last six years has largely been driven by

the good performance of the agricultural sector. However, the government is

making efforts to diversify the economy as a long-term strategy for sustaining

long-term growth.

In particular, Rwanda is the second most densely populated

country in sub-Saharan Africa after Mauritius with a population density of 384

inhabitants per square kilometer in 2008. While practical steps have been

taken to address environmental challenges stemming from population pressures,

which threatened agricultural productivity, further productivity growth in

agriculture is likely to require higher investment levels than has been the

case before. In addition, 28% of Rwandans are food-insecure in spite of

improvements in this field. The country also remains highly dependent on

foreign aid, which accounted for more than 45% of the government budget in

2009.

In view of the country's land-locked location and its limited

natural resources, the services sector is considered a strategic one, with a

potential to spur long-term growth and transform the economy. This process

should be driven by technology and knowledge-based activities, yet currently

the country has a shortage of skilled labor.

Rwanda is taking steps to address the developmental

challenges. In this context, its medium-term development strategy, the Economic

Development and Poverty Reduction Strategy (EDPRS) and the long-term strategy

Vision 2020 Umurenge provide the policy framework and government priorities for

economic and social development. Vision 2020 prioritizes expansion of non-farm

activities that increase efficiency in service delivery and better targeting of

social safety nets.

Building on its previous policies, Rwanda has scored major

successes. The country has been identified as the top reforming economy in

Africa. The business environment and governance indicators have also improved

and Rwanda has a lean and efficient public administration structure. Policy

reforms are expected to continue following the success of the coalition under

the ruling Rwandan Patriotic Front (FPR) in the parliamentary elections in

2008.

Furthermore, the current government has pursued macroeconomic

stability as one of its major objectives. The spike in year-on-year inflation

above 22% at the end of 2008, caused by fuel and food price increases, had

fallen to below 6% by the end of 2009. This sharp drop in inflation in 2009 was

a result of many factors, including, among others, falling international fuel

and food prices, the domestic credit crunch and prudent monetary policy.

The policy reforms, however, have not yet brought about the

structural changes that are necessary to achieve significant poverty reduction

and lower levels of unemployment, with agriculture still dominating the overall

growth outcomes. In addition, the slow pace in job creation in the formal

sector has resulted in a large informal sector estimated to have contributed

48% to GDP in 2008. This large informal sector has posed serious challenges to

tax revenue mobilization in spite of the increase in tax collection and tax

efficiency over the past three years. As a result, Rwanda still faces a

challenge in widening its tax base.

Continuing efforts to improve the business environment and

intensification of tax education should help increase tax compliance and a

widening of the tax base. More importantly, economic diversification supported

by a vibrant private sector, attracting formal business investors in

labor-intensive activities, should be part of the strategy aimed at reducing

poverty and unemployment.

|