2.2. Other specific political risks and

impacts

2.2.1 Inflation rate and political

crisis

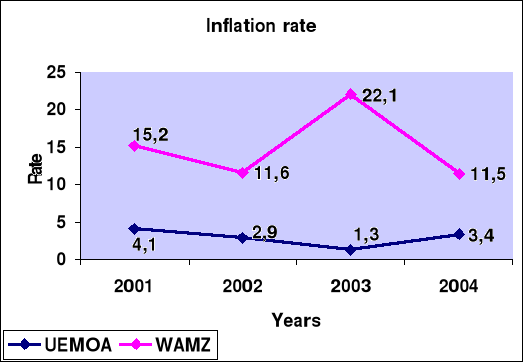

The following figure compares the inflation rate between UEMOA

(Union Monetaire West Africaine), and WAMZ (West Africa Monetary Zone). All

eight member states of UEMOA share the same currency, CFA, while each member of

WAMZ (Ghana, Guinea, Nigeria, Liberia, Sierra Leone) has it own currency.

The finding is that the inflation rate of WAMZ is far above that

of UEMOA from 2001 to 2003.

During this period, each group was facing tough political

situation. Sierra Leone and Cote d'Ivoire have been at wars. Though civil war

has been prevailing in each group, UEMOA kept a low inflation rate. We assume

that, this low rate is due to the relative stable currency, CFA. Regional

monetary grouping is a factor that favor better exchange rate in transactions.

European Union is another good example. Therefore, in international marketing

operations, a marketer should look for currency stability, and choose to work

with such monetary grouping countries, even though some political risks may

exist. West Africa nations, through ECOWAS are now planning to make one major

currency by putting UEMOA and WAMZ together.

2.2.2 Import and Export in UEMOA zone

during political conflicts

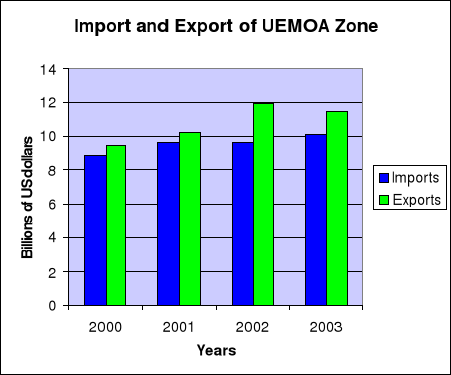

The following figure shows that from 2000 to 2003, EUMOA total

exports exceeded imports. During that period, Cote d'Ivoire the largest economy

of the group, 40% of total share, has been at civil war. Though in conflicting

situation, UEMOA did not face any trade deficit. Production might be disrupted

but products can cross borders and be sold in neighboring countries. This

resulted in increase trade in other UEMOA countries and contributes to keep the

overall exports higher. An international marketer that really knows the terrain

where is making business, could always find opportunities when political risks

erupt.

2.2.3 Employment distribution in UEMOA zone during political

conflicts

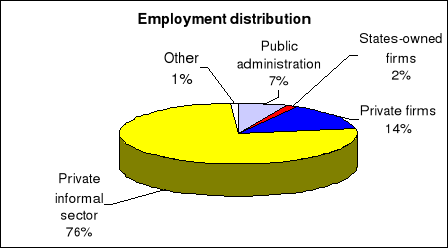

We have selected employment status in UEMOA countries capital

cities, in 2001-2002. Figure 4 is an illustration.

Private informal sector owns 76% of the employments, private

firms supply jobs up to 14%, public administration is responsible of 7% of jobs

rate against 2% for states-owned firms and 1% for other, mainly association

sector.

Informal private sector is a specific work area in developing.

It comprises of individual not officially register as corporate, but who work

as such. Some work like, carpentry, shoes repairing fabric, hair cut

shops...etc, are concerned. As shown in the figure, it represents a huge

segment of market, which any international marketer should take into account if

his firm activities should encompass those sectors. Because he will have to

share customers with those individuals, plan should be carefully tailored.

People working in the informal private sector are easy to delocalize to work

for a national or multinationals, since their working conditions are too hard

and gains too small.

The formal private sector covers only 14% of employment. This

means that opportunities still exist, and one should foster private

investments, mainly in other non agricultural industries like communication,

mining, electricity, electronic, and so forth. Increasing investment is a way

to reduce the redundancy high rate (11.4%) in UEMOA Zone.

States-owned firms represent only 2%, this is an indicator of

privatization that is going on in every country in Africa.

|