|

MBA THESIS

UNIVERSITY OF NORTHERN WASHINGTON,

U.S.A.

Impact of political risks in international marketing: The

case of West Africa

Student: Samuel Y. Andoh

Supervisor: Dr. Joseph Paul.

CONTENTS

Introduction................................................................................................................2

PART ONE: THE CONTEXT OF INTERNATIONAL MARKETING AND

POLITICAL RISK.

CHAPTER I: INTERNATIONAL MARKETING CONCEPT

......................................................5

1.1

Definitions.......................................................................................................5

1.1.1 Marketing

1.1.2 Marketing Mix

1.1.3 International marketing

1.2. Differences between domestic and international

marketing.......................................5

1.3. International marketing environment

.....................................................................7

1. 3.1 Cultural environment

1.3.2 Economic environment

1.3.3 Financial environment

CHAPTER II : POLITICAL ENVIRONMENT AND POLITICAL

RISKS....................................10

2.1 General context

.............................................................................................10

2.2 Classification and description of political risks

......................................................10

2.2.1 Classification based on the

characteristics of the political risks

2.2.1.1 Ownership risk

2.2.1.2 Operating risk

2.2.1.3 Transfer risk

2.2.2 Classification based on host country

actions

2.2.2.1 Political risk out of government

control

2.2.2.2 Political risk induced by the

government

2.2.3 Impact of some political risks

PART TWO: CASE STUDY: WEST AFRICAN COUNTRIES

CHAPTER I: METHODOLOGY FOR ASSESSING POLITICL

RISKS......................................15

1.1 Study area

.....................................................................................................15

1.2 Data sources, selection and analysis

..................................................................15

CHAPTER II: RESULTS AND COMMENTS

.......................................................................17

2.1 Countries' political, demographic and economic

profile.............................................8

2.2 Other specific political risks and impact .........18

2.2.1 Inflation rate and political crisis

......

2.2.1 Import and export in UEMOA zone during

political conflicts ......

2.2.1 Employment distribution in UEMOA zone

during political conflicts ......

2.3 Interactions between political risks

.....................................................................22

2.4 Towards new types of political risks

...................................................................23

CHAPTER III: RECOMMENDATIONS

.............................................................................................24

CONCLUSION

.................................................................................................................................

27

REFERENCES

.................................................................................................................................28

INTRODUCTION

World economic order is increasingly changing. Emergence of

new economic power, democratization, falling of barriers between countries, are

all accelerating free trade. Domestic firms have been engaged into worldwide

business, increasing their profits, but at the same time, competing with other

firms. Marketing tools formerly tailored for domestic purpose are going

profound changes with adjustment to new environments.

This international marketing must take into account the laws

of the home country, as well as that of the host countries in which the firms

operate. This is not obstacles free. According to Ricky Griffin et all, beside

supply factor and demand factor, political factor is the third factor

influencing foreign direct investments [1]. International relations are

influencing international marketing and vice versa. Thus, political risks may

emerge as serious barriers to Multinational companies (MNCs). However, those

effects are not out control of a well-trained international marketer.

As world is assimilated to a global village, increasingly,

many MNCs are willing to invest in Africa in general and West Africa in

particular. So, it might be helpful to look for what kind of political risks

firms may face in West Africa? Our hypothesis is that political risks in West

Africa are both specific to that continent and also common to that of other

places.

West African problem is that, African countries are not

investors' nations; they rarely invest in other countries. However, all of them

are host countries. So deal with only what investors countries should do will

yield bias to the debate. And so, to depict the actual situation and fit well

what is going on, there is necessity to focus on what investors should do to

avoid African government-induced political risks, and how those countries can

behave to preserve a safe business environment.

Under some ongoing structural reforms of ECOWAS and

UEMOA1(*), what are business

opportunities in West Africa.? Also how the international marketer beside

political risks, can reach the market. In particular the present thesis aims to

review political risks in West Africa and to explore the link between country

political disturbances and the some international trade indicators like

production, import, exports, and so forth. Also some interactions between, and

possible causes of, political risks will be assess in the context of Africa.

After discussing those issues, some recommendations will be made accordingly.

PART ONE

The context of international marketing and political

risks

Chapter 1: International marketing concept

1. 1 Definitions

1.1.1 Marketing: is the

process of planning and executing the conception, pricing, promotion, and

distribution of ideas, goods, and services to create exchanges that satisfy

individual and organizations objectives2(*).

1.1.2 Marketing Mix:

consists of the way a firm chooses to address product development, pricing,

promotion and distribution. Generally, it is admitted that marketing Mix

encompasses the 4P: Product, Pricing, Promotion and Place (distribution).

Often, two or more firms express share marketing services and expertise. This

is marketing alliance

1.1.3 International marketing:

is the extension of marketing activities across national boundaries.

It involves firms trading in two or more countries. We may oppose domestic

marketing and international one.

1. 2. Differences between international and domestic

marketing

International marketing retains basis markets tenets of

«satisfaction» and «exchange». The fact that in

international marketing, the transactions take places across national borders

highlights the difference between domestic and international marketing.

The basic principles of marketing still apply, but their

applications, complexity, and intensity may vary substantially. Some

adjustments are necessary in international marketing context. For example, the

following figure shows the elements of marketing mix for international firms

Figure 1: The elements of the Marketing

Mix for international firms

BUSINESS

STRATEGIES

Differentiation Cost leadership

Focus

MARKETING

MIX

PRODUCT

Develop tangible and intangible features that meet

customer needs in divers markets

PLACE

Get products and services into customers' hands via

transportation and merchandising

PROMOTION

Devise ways to enhance desirability of the product or

service to potential buyers

PRICING

Develop policies that bring in revenue and strategically

shape the competitive environment

KEY DECISION-MAKING FACTORS

· Target customers: industrial or consumer

· Cultural influences

· Competition

· Standardization vs. customization

· Legal forces

· Economic factors/income levels

· Changing exchange rates

Source, Ricky W. Griffin, International business, 2005,

page 459

A company looking for improvement in its present position by

exploring market abroad, could do it only through international marketing

analysis and perspectives. International marketing have form ranging from

import-export trade to licensing, joint ventures, wholly owned subsidiaries,

turnkey operations and managements contracts. With international marketing

rather than domestic one, some specific approaches have been developed. The

approaches supply the answers of standardization and customization concerns.

We distinguish the ethnocentric approach that

is a managerial approach in which a firm operates internationally the same way

it does domestically. This approach avoids the expense of development of new

marketing product. It is generally used by some firms experiencing first

internationalization. Firm adopting this approach may fail because it does not

take into account the idiosyncratic needs of its foreign customers. Should

there be an attempt to adjust the firm's marketing mix to satisfy customers,

then we talk about polycentric approach. In this approach, the

corporate customizes its operations for each market it serves. Polycentric

approach is more costly. However, it may yield revenues, since it exactly meet

customers needs. Multidomestic international firms use to adopt this approach.

Finally, firm may choose the geocentric approach, in which a

firm analyses the needs of its customers worldwide and then adopts standardized

operating practices for all markets. There is a nuance between ethnocentric and

geocentric approaches. Both argue for standardization. However, the

ethnocentrism stagnate on the basis of what the firm does in its home country,

whereas geocentric starts with not such home country bias. Instead, the

geocentric approach considers the needs of all the firm's customers around the

world and then standardizes on that basis.

How may the local ideas, goods, and services fit into the

international markets? May supplies be domestically-based or from abroad? What

are necessary adjustments the firm might do to overcoming global competition?

These are some issues the international marketing ought to deal with. In

addition, international marketing is subject to a new set of macro

environmental factors, to different constraint, to different laws, cultures and

societies.

1. 3. International marketing environment

International marketer operating around the world encountered

various environment-related norms. The most critical environmental elements

able to shape international marketing activities are cultural, economic,

financial and political. [2] The last one, matter of the present thesis, will

be fully described in the next chapter.

1.3.1. Cultural environment

The ways people appreciate manufactured items, express their

specific needs, and purchase, are deeply rooted in their culture. Culture

itself is a collection of values, beliefs, behaviors, customs, and attitudes

that distinguish and define a society. It is often said that culture is

learned, shared and transmitted from one generation to the next. Nevertheless,

in the context of international marketing, it seems not appropriate to learn a

culture, we have to live it. That is why Stephen Kobin [3] classified business

travel and assignment overseas as the top two factors considered critical and

important for culture knowledge. However, at least the factual knowledge of

culture can be learned and the interpretive one be acquired through

experience.

International marketer needs both knowledges to master

language, religion, values and attitudes, manners and customs, aesthetics,

technology, education and social institutions, which all determine a given

culture.

In business context, two schools of thought exist. One assumes

that business should prevail upon culture factors in marketing approach. The

other proposes that companies must tailor business approach to individual

culture. Also, for efficient managerial purpose, any international marketer

should consider any cultural aspects of a given society if this is the only way

to succeed there.

In the case of Sub-Saharan Africa in general, and West Africa

in particular, cultural similarities (religion, language, tradition patterns,

high illiteracy...) are greater between countries. This psychological distance

factor could guide the manager willing to trade within West African countries.

1.3.2. Economic environment

International marketing activities are favored by

appropriate economic environment. The secure economic environment could be

judged by the international marketer through some market's characteristics such

as population, income, consumption pattern, infrastructures, geography and

attitudes towards foreign investments.

The population growth rate serves for estimation and active

population is the main source of labor a company may need. Markets require not

only people but also purchasing power, which is a function of income, prices,

savings, and credit availability. The share of income spent on products will

provide an indication of the market development level as well as an

approximation about how much money left for other purchases. So, information on

the percentage of households in a market that own a particulars product, allow

a further evaluation of market potential. The successful economic environment

involves the presence of basic economic infrastructures. They consist of

transportation (roads, railways, highways, and airports) the so-called linear

development, energy (water supply, electricity, oil, gas), and communications

systems (television, media, telephone, internet...).

Regional economic groupings are powerful factors an

international marketer should never neglect. In fact, economic integration in

world markets transactions poses unique opportunities and challenges for

corporate international marketing systems. Removing barriers between member

markets and erecting new ones for non members will call for adjustments in past

strategies to fully exploit the new situations.

In West Africa, there are also several economic grouping, but

the most important are ECOWAS (Economic Community of West African States), and

UEMOA (Union economique et Monetaire Ouest Africaine) we will further describe

in the second part of the thesis.

1.3.3. Financial environment

The international marketer should make a careful analysis of

the financial environment, since this area faces several risks. Even political

risks are part of the financial risks, among many other such commercial risks,

foreign exchange risks, inflation and so forth. In international business, the

two major concerns for the manager are how to get paid and how to avoid the

above mentioned risks. As money should flow between countries, credible

financial infrastructures like facilitating agencies, commercial banks,

research firms, are necessary. In some part of the world, the international

firm may have to be an integral partner in developing the various

infrastructures before it can operate, whereas in others, it may greatly

benefit from their high level of sophistication.

In West Africa, every single country has its won national

commercial banks. However transactions towards neighboring countries are

sometimes restricted to some amount of money and take time to be done. There

are some commercial banks like Citibank, and Ecobank that faster service, since

they are established in several countries. Also, Western Union and Money Gram

are specialized money transfer agencies, which enable fluidity in

transactions.

Chapter 2: The Political environment and political

risks

2.1. General context

Assessing the political environment is an important part in

any business decision. Laws and regulations passed by either local, regional

and central government bodies can affect foreign firms' operations. Also, firms

are comfortable assessing the political climates in their home countries.

However, assessing the political climates in other countries is still

problematic.

2.2. Classification and description of political

risks

When doing international business, the manager may face

several types of financial risks. The major types of financial risks are

commercial risks, political risks, exchange rate risks, and other such as

inflation-related risks. Thus, political risks are non commercial risks.

Political risks are any changes in the political environment that may adversely

affect the value of a firm's business activities. Political risks may occur in

any nation, but the risks vary considerably between countries. We may

distinguish two types of classification of political risks. A classification

based on the characteristic of political risks and a classification or

categorization based on the local government actions or control.

2.2.1 Classification based on the characteristics of

political risks

Characteristics refer to as the facts that are inherent to

each political risk. In other terms, their uniqueness or what make them

different from one another. There are three types of such characteristics:

ownership risks, operating risks, and transfer risks.

2.2.1.1. Ownership risk

In which the property of the

firm is threatened through expropriation,

confiscation or domestication.

Ownership risk exposes property and life.

The triad will be explained in

the second classification.

2.2.1.2 Operating risk

In which

there is interference with the firm operations. The ongoing operations of the

and/or the safety of its employees are threatened through changes in laws,

environmental standards, tax codes, terrorism, armed insurrection or wars, and

so forth.

2.2.1.3 Transfer risk

In which

the government interferes with a firm's ability to shift funds into and out of

the country.

2.2.2 Classification based host country

actions

We can distinguish two types: political risks out of the

government control and political risk induced by the government.

2.2.2.1 Political risks out of

government control.

There are risks or events arise from nongovernmental actions,

factors that are outside the government responsibility. There are wars,

revolution, coup d'etat, terrorism, strikes, extortion, and

kidnappings. They all derived from some unstable social situation,

with population frustration and intolerance. All these risks can generate

violence, directed towards firms' property and employees. We may also have the

case of externally induced financial constraints and externally imposed

limits on imports or exports, especially in case of embargoes or any

economic sanctions against the host country.

2.2.2.2 Political risks induced by

the government

These risks constitute some laws directed against foreign

firms. Some government-induced risks are very drastic. There are expropriation,

confiscation and domestication.

Expropriation is the seizure of

foreign assets by a government with payment of compensation to the owners. In

other terms, it is involuntary transfer of property, with compensation, from a

privately owned firm to a host country government. Expropriation may generate

some funds for the owners. However, procedures to get paid from the government

are sometimes protracted and the final amount remains low. Furthermore, if no

compensation is paid, conflicts may erupt between the host country and the

country of the expropriated firm. For instance, the relations between U.S. and

Cuba acknowledge such situation, since Cuba does not offer compensation to U.S.

firms that have their assets sized.3(*) Also, expropriation can refrain other companies from

investing in the concerned country.

Confiscation is another type of

ownership risk similar to expropriation, except compensation. It is involuntary

transfer of property, no compensation, from a privately owned firm to a host

country government. In confiscation, firms do not receive any funds from

government. Thereby, it represents a more risky situation for foreign firms.

Some industries are more vulnerable to confiscation than others because of

their importance to the host countries and their lack of ability to shift

operations. Sectors such as mining, energy, public utilities, and banking have

been targets of such government actions.

Domestication offers to governments a

subtle control over the foreign investments. There is a partial ownership

transfer and companies are urged to prioritize local production and to retain a

large share of the profit within the country. Domestication can negatively

impact the international marketer activities, as well as that of the entire

firm. For example, if foreign companies are forced to hire nationals as

managers, poor cooperation and communication can result. If domestication was

imposed within a short time span, poorly trained and inexperienced local

managers would head the firm operations with possible lost of profits.

Other government actions-related risks

are less dangerous but more common such as boycott, sabotage.

When facing shortage of foreign currency, government, sometimes, attempts to

control the movement of capital in and out of the country.

Often, exchange controls are levied selectively against

certain products or companies. Exchange controls limit importation of goods so

that firms might be confronted with difficulties in their regular transactions.

Severe restrictions on import can be a motive for foreign

corporate to shut down. Governments may also raise the tax rate applied to

foreign investors in order to control them and their capital. Government may

implement a price control system. Such control uses to derive

from a sensitive political situation. For example, social pressure may result

in a kind of price standardization for particular sectors like food,

transportation, fuel, and healthcare.

Political risks like arms conflicts, insurrection may affect

all firms in the country equally. For that reason they are called macro

political risks. Unlike, nationalization, strikes, expropriation may

affect only a handful and specific firm, they are named micro political

risks.

2.2.3. Impact of some political risks

Some negative effects of political risks on firm are summarized

in the following table.

Table 1. Holistic table summarizing the major political

risks and their effects on firms

|

TYPES

|

IMPACT ON FIRMS

|

|

Expropriation

|

Loss of future profits

|

|

|

|

Confiscation

|

Loss of assets

|

|

Loss of future profits

|

|

|

|

Campaigns against foreign goods

|

Loss of sales

|

|

Increased costs of public relations efforts to improve public

image

|

|

|

|

Mandatory labor benefits legislation

|

Increased operating costs

|

|

|

|

Kidnappings, terrorists threats, and other forms of violence

|

Disrupted production

|

|

Increased security costs

|

|

Increased managerial costs

|

|

Lower productivity

|

|

|

|

Civil wars

|

Destruction of property

|

|

Lost sales

|

|

Disruption of production

|

|

Increased security costs

|

|

Lower productivity

|

|

|

|

Inflation

|

Higher operating costs

|

|

|

|

Repatriation

|

Inability to transfer funds freely

|

|

|

|

Currency devaluations

|

Reduced value of repatriated earnings

|

|

|

|

Increased taxation

|

Lower after-tax profits

|

Source, Ricky W. Griffin, International business, 2005, page

73

In long run, and depending on the severity of the risks,

action taken by government may decrease income and be detrimental to the host

country economy. Strong political risks that are deeply rooted in the country

governance habit might be barriers to foreign investment and country

prosperity. What is going on in West Africa?

PART

TWO

Case study: West African countries

Chapter 1: Methodology for assessing political

risks

1.1. Study area

The study area is Western Africa. It encompasses sixteen

countries. They are Benin, Burkina Faso, Capo Verde, Cote d'Ivoire (Ivory

Coast), Gambia, Ghana, Guinea, Guinea Bissau, Liberia, Mali, Mauritania, Niger,

Nigeria, Senegal, Sierra Leone, and Togo. All of them are member countries of

ECOWAS4(*) except

Mauritania. However, at the creation of the organization in 1975, Mauritania

was member. It left ECOWAS later to join the Arabic community of the northern

of Africa. ECOWAS covers all West African area, with a population of about 260

millions. ECOWAS encouraged free trade between member states but the

cooperation is still more political than economic. To mitigate conflicts of the

region, ECOWAS has established a West African force.

Union Economique et Monetaire Ouest Africaine (UEMOA)5(*) is the French speaking countries

economic integration group. It comprises of eight countries (Benin, Burkina

Faso, Cote d'Ivoire (Ivory Coast), Guinea Bissau, Mali, Niger, Senegal, and

Togo. Unlike ECOWAS, UEMOA is a full economic integration organization. There

are no political activities. It constitutes a real free trade area.

Transactions have being facilitated because countries members share the same

currency, CFA ($ 1 = 500 CFA), and the same official language, French. They all

have the same colonial background because they have been colonized by France,

except Guinea Bissau that is a former Portuguese colony. Other countries,

which own their currencies are Gambia, Ghana, Guinea, Nigeria, Sierra Leone,

they form the West Africa Monetary zone (WAMZ), or simply called the second

monetary zone [4].

1.2. Data sources, selection and

analysis.

To assess political risks and markets patterns in West Africa,

we rely on different data sources. Most data about political risks are

difficult to be obtained, since governments are reluctant to publish and make

official any political disturbances they may face. To this regards man relies

on the author throughout knowledge of the region. Some historical archives were

assessed though web site [4-6]. Also, we compiled data from the publications of

ECOWAS, and UEMOA that is an economic grouping of French speaking countries

libelled (Union Economique et Monetaire Ouest Africaine). We also, carried out

some online researches by visiting main internet directories such Yahoo.com,

Google.com. Key words like, «political risks, expropriation,

domestication, confiscation, west African wars, Africa import and export, Gross

domestic products Africa, », have been used. In addition, we

interviewed some key workers of ECOWAS's economic branches. We assessed the

official websites of the heads of states of West African countries, and some

international political risks management -related organizations such as times

publications, global assessment risk6(*) [7-12]. For additional economic information and

countries ranking indicators we refer to the journal, Le Monde [13]. Upon

compilation of data, analysis has been performed by Excel to calculate,

percentage, ratio, average, and sum, and make appropriate figures.

Chapter 2: Results and comments

2.1. Countries' political, demographic

and economic profile

The following table summarize political risks and some key

socio economic indicators of West African countries (15 Ecowas member states).

Political risks are mainly the type outside government control risks.

Table 2: Countries' political, demographic and

economic profile

|

Countries

|

Political risks *

|

Level of political risk

|

Population (2006)

|

GDP per capita

|

Growth rate (%)

|

HDI

|

|

Benin

|

· Revolution (1980)

· Coup d'etat (1980)

|

Highest

|

8 700 000

|

510

|

4

|

0.428

|

|

Burkina Faso

|

· Revolution (1983)

· Coup d'etat (1986)

· Nationalization

|

Highest

|

13 600 000

|

400

|

5

|

0.342

|

|

Capo Verde

|

· Revolution

|

Highest

|

500 000

|

1 870

|

5

|

0.722

|

|

Cote d'Ivoire

|

· Coup d'etat (1999)

· Civil war (2002)

· Public violence

|

Highest

|

20 000 000

|

840

|

0

|

0.421

|

|

Gambia

|

· Human right issues

|

Highest

|

1 500 000

|

290

|

5

|

0.479

|

|

Ghana

|

· Coup d'etat (1980s)

· Revolution

|

High

|

22 600 000

|

450

|

6

|

0.532

|

|

Guinea

|

· Revolution (1960)

· Strikes (2007)

|

Highest

|

9 800 000

|

370

|

3

|

0.445

|

|

Guinea Bissau

|

· Coup d'etat (2000)

· Wars

|

Highest

|

1 400 000

|

180

|

4

|

0.349

|

|

Liberia

|

· Coup d'etat (1985)

· Wars (1995)

· Terrorism

|

Highest

|

3 400 000

|

130

|

5

|

n.a

|

|

Mali

|

· Secessionism

· Coup d'etat (1992)

|

Highest

|

13 900 000

|

380

|

5

|

0.338

|

|

Niger

|

· Coup d'etat (2000)

|

Highest

|

14 400 000

|

240

|

5

|

0.311

|

|

Nigeria

|

· Coup d'etat (1980s)

· Wars (Biafra)

· Religious faction

|

Highest

|

134 500 000

|

560

|

7

|

0.448

|

|

Senegal

|

· Secessionism

|

High

|

11 900 000

|

710

|

6

|

0.460

|

|

Sierra Leone

|

· Coup d'etat (1999)

· Terrorism (2000)

· Wars ( prior 2002)

|

Highest

|

5 700 000

|

220

|

8

|

0.335

|

|

Togo

|

· Political crisis

· One year long strikes (1992)

|

Highest

|

6 300 000

|

350

|

3

|

0.495

|

|

AVERAGE

|

|

|

17 880 000

|

503.75

|

5

|

0.439

|

|

TOTAL

|

|

|

268 200 000

|

8 060

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

Lowest

|

300 000 000

|

43 740

|

4

|

0.948

|

HDI = Human development Index (United Nations, UNDP),

* year of occurrence of the risks, other are 2006-2007 data.

Any West African nation has experienced at least one «out

of government control political risks». A part from Senegal which has

been never confronted with coup d'etat, all other countries suffered from

coups. 5 in 15 countries (33%) have been at wars in their history. The most

recent civil wars in the region are that of Sierra Leone ended in 2002, and

Cote d'Ivoire started the same year, which is currently under post war

recovery. Liberia has drastically been destroyed by more ten years war

(1985-1995), followed by political instability. We know that civil wars per se,

are responsible of destruction of property, lost sales, disruption of

production, increased security costs, and lower productivity, to name a few.

Political upheavals are generally protracted. They may occur decades ago and

still have harmful impact on the socioeconomic situation and on foreign firms

willingness to invest.

It is true that the table did not take into account other

political risks such as ownership, and transfer risks. However, the results

point out the country's political riskiness based on the Euromoney's survey

[14]. This evaluation considered all types of political risks. Our analysis

demonstrated that 100% of West African countries are classified «high

risk», and among them 80% are classified «highest risk». There

are no countries with medium, low or lowest risks like the United States. In

that condition it is truly difficult to find an international marketer pushing

his firm to invest in West Africa, because it is a risky area.

With the population data, we show that these 15 countries

represent a market of 260 millions potential customers. But all of them cannot

even assess to new products because of the lack of foreign investments due to

the fearful situation surrounding the market. Though some countries enjoy

economic growth (average = 5%) at U.S level, the GDP per capita remains low

(average = 503.75), and the Human Development Index (HDI, encompasses

education, life expectancy and income), is one of the lowest (average = 0.439)

far behind U.S.'s figures.

Speculation about population growth is a critical issue for

future international marketing. The number of people in a particular market

provides one of the most basic indicators of market size. In the coming year,

the world population will change with Africa having the highest growth rate

(above 3%), whereas U.S. and Western Europe will remains less than 1%. Of the

World 8.47 billions people, by 2025, more than 1.2 billions will be African

[15-16]. On market size basis, market opportunities will grow in Africa. Yet,

peace is needed.

2.2. Other specific political risks and

impacts

2.2.1 Inflation rate and political

crisis

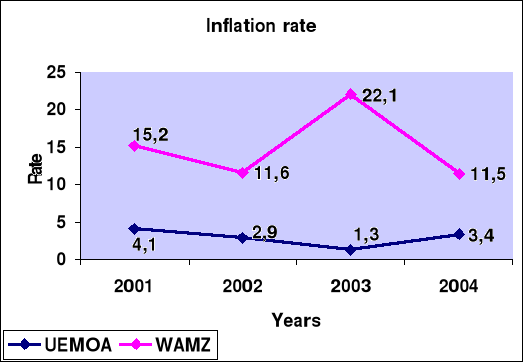

The following figure compares the inflation rate between UEMOA

(Union Monetaire West Africaine), and WAMZ (West Africa Monetary Zone). All

eight member states of UEMOA share the same currency, CFA, while each member of

WAMZ (Ghana, Guinea, Nigeria, Liberia, Sierra Leone) has it own currency.

The finding is that the inflation rate of WAMZ is far above that

of UEMOA from 2001 to 2003.

During this period, each group was facing tough political

situation. Sierra Leone and Cote d'Ivoire have been at wars. Though civil war

has been prevailing in each group, UEMOA kept a low inflation rate. We assume

that, this low rate is due to the relative stable currency, CFA. Regional

monetary grouping is a factor that favor better exchange rate in transactions.

European Union is another good example. Therefore, in international marketing

operations, a marketer should look for currency stability, and choose to work

with such monetary grouping countries, even though some political risks may

exist. West Africa nations, through ECOWAS are now planning to make one major

currency by putting UEMOA and WAMZ together.

2.2.2 Import and Export in UEMOA zone

during political conflicts

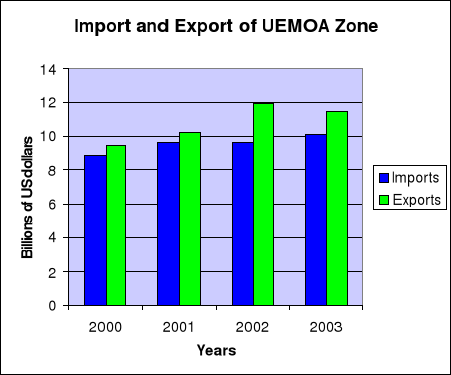

The following figure shows that from 2000 to 2003, EUMOA total

exports exceeded imports. During that period, Cote d'Ivoire the largest economy

of the group, 40% of total share, has been at civil war. Though in conflicting

situation, UEMOA did not face any trade deficit. Production might be disrupted

but products can cross borders and be sold in neighboring countries. This

resulted in increase trade in other UEMOA countries and contributes to keep the

overall exports higher. An international marketer that really knows the terrain

where is making business, could always find opportunities when political risks

erupt.

2.2.3 Employment distribution in UEMOA zone during political

conflicts

We have selected employment status in UEMOA countries capital

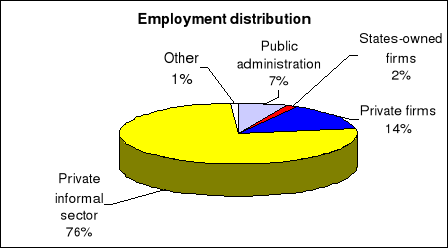

cities, in 2001-2002. Figure 4 is an illustration.

Private informal sector owns 76% of the employments, private

firms supply jobs up to 14%, public administration is responsible of 7% of jobs

rate against 2% for states-owned firms and 1% for other, mainly association

sector.

Informal private sector is a specific work area in developing.

It comprises of individual not officially register as corporate, but who work

as such. Some work like, carpentry, shoes repairing fabric, hair cut

shops...etc, are concerned. As shown in the figure, it represents a huge

segment of market, which any international marketer should take into account if

his firm activities should encompass those sectors. Because he will have to

share customers with those individuals, plan should be carefully tailored.

People working in the informal private sector are easy to delocalize to work

for a national or multinationals, since their working conditions are too hard

and gains too small.

The formal private sector covers only 14% of employment. This

means that opportunities still exist, and one should foster private

investments, mainly in other non agricultural industries like communication,

mining, electricity, electronic, and so forth. Increasing investment is a way

to reduce the redundancy high rate (11.4%) in UEMOA Zone.

States-owned firms represent only 2%, this is an indicator of

privatization that is going on in every country in Africa.

2.3 Interactions between political

risks

There are some interactions between political risks man should

not ignore. A revolution or strikes are very often symptomatic of coup d'etat,

which in turn paves the way for wars. As shown in table 2, almost all countries

that have been into coup d'etat, face wars later on. In the same way, a

government conducting expropriation is neither far from confiscation nor

domestication. One risk entails this other. In some case, people can combine

many risks as means to operate. For instance, the methods used by terrorists

against business facilities include bombing, arson, hijacking, and sabotage. To

obtain funs, the terrorists resort to kidnappings, armed robbery, and

extortion7(*).

Obviously, impacts on economic indicators are also

interrelated. Even, environmental factors such cultural, economic, financial

and political and legal are also interconnected. Some cultural components of

the society may generate ethnocentrism, or lead directly to religious factions

and nationalism. So, the problem is not to run away from political risks;

rather the international marketer should keep in mind such connections to

carefully investigate the causes of political risks.

The international marketing manager should bear in mind that

Multinational Companies (MNCs) can either improve or hurt the economy of the

host country. MNCs may make direct investments in new plants and factories and

thereby creating jobs. Also, jobs can be provided for local constructors,

builders, and suppliers. Technology could be transfered to host country. MNCs

may pay tax that benefic for national and local authorities like

municipalities.

However, there is a subtle or opened competition between MNCs

and local firms, which may results in lost of profits and jobs for the latter.

MNCs can also increase the competition for workers or introduce products or

practices incompatible with the local culture. As local economy is becoming

dependant from MNCs, once an unfortunate event like shut down occurs, the

entire local economy is at high risk.

In area where corruption rate is high like West Africa, MNCs

can go for some illegal procedure of tax payment, as well as natural resources

exploitation. By corrupting government officers, MNCs will enrich some

individuals and the state itself will stay poor.

Also, unfair incentives would allow foreign firms to keep

exploiting their employees with low income and no other suitable advantages.

Such practices can result in strike, extortion, sabotage and aggression of MNCs

property and employers.

2.4 Towards new type of political

risks.

In analyzing political risks occurrence factors, and as we

have mentioned in the classification, one focuses on risks out of government

control and political risks caused by the host country. This is true. However,

foreign firms also can create some political risks. Simply, how could we

understand the crucial lack of infrastructures in a Africa continent full of

natural resources, which move from there to other places? Any international

marketer, who would operate by developing the local environment, is going to

avoid additional political risks and therefore will succeed. Doing business in

Africa, require honesty and fairness and respect vis-à-vis the local

people. African people did not forget yet, the heavy burden of four centuries

of slavery and colonization, which are nothing but «exploitation».

Thus, when international firms overlook the local people right and compromise

their survival, there is a kind of «historical reflex» that shows up

and pushes the entire population, and mainly the youth standing against the

threat.

An international marketer willing to succeed in a long run

business in Africa should remember that historical context. Very often,

investors and other Western political leaders fail to realize that time has

passed and mind has being changing. With globalization, increased level of

education, awareness raising programmes around the world, African people do

know what is able to help emerge from the current situation they are into.

Therefore, should they feel being neglected; they will fight back by erecting

criticism and violence. So, firms that neglect or put aside the host country

economic interests, are generating «foreign firms- induced

political risks».

Let consider the privatization we have mentioned above. As

former Soviet Union nations, African countries are shifting firm ownership from

public to private. Sometimes, governments are under financial pressure and have

to do so to save some key corporate like oil, water supply, electricity and

post industries. In Africa, there is a second type of political risk we may

call «exterior pressure-induced firms». In fact,

some governments are reluctant to sell states-owned firms. However, given the

worse economic condition, and the burden of exterior and even interior

indebtedness, Western governments (mainly former colonizers), make pressure to

acquire some states-owned firms operating in promising sectors like energy,

water, and agriculture. We may call it privatization, but actually it is not

real privatization.

Chapter 3: Recommendations

Before making recommendations, it is important to review some

limitations of this study. The main limitation is the shortage of data about

political risks. Though, we have focused on some political risks, others were

not properly coped with. For instance, it would have been much better to

analyze in deep the extent of expropriation, confiscation, domestication, and

nationalization. What are governments that perform such political risks? What

are their purposes? How many firms have been under such risks and what are they

countries of origin? Also, the scarcity of organs of trade regulations in

Africa, did not allow us to make some case study so elucidate how do firms use

to address political risks, and whether is the system similar in the 15

countries of ECOWAS? However, the above limitations did not hamper our

objectives. Subsequently, based on the findings, the following recommendations

have been made.

i. Any African country should have a corporate of experts in

international marketing, to form association like American Marketing

Association (AMA). This network of African experts will work in partnership

with association of other developed and developing countries. Such groups of

professionals will raise the importance of international marketing to domestic

firms, trade related-decision makers, government bodies or organization like

ECOWAS, WAMZ, and UEMOA...etc. Furthermore, the association could advocate and

do some social mobilization about political risks in the context of Africa.

Such home-based marketing experts could help foreign investors understand the

African context, by leading them to generate local wealth and support local

economy.

ii. To protect themselves from changes in international

environment, firm should continually monitor the political situations in the

countries in which they operate by consulting with local staff, embassy

officials, and, where appropriate, firms specializing in political risks

management. The monitoring system should be built up on some political risks

indicators and determinants. Each international marketing department of any

firms should elaborate it own criteria of political stability propitious to

foreign investments. For instance, gathering indicators and their determinants

can be done by providing clear and precise answers to the following questions

proposed by some authors8(*). Firms can score this set of questions and obtain a

score that could serve as guideline.

1. Is the country a democracy or dictatorship?

2. Is power concentrated in the hands of one person or one

political party?

3. Does the country normally rely on the free market or on

government controls to allocate resources?

4. How much of a contribution is the private sector expected

to make in helping the government achieve its overall economic objectives?

5. Does the government view foreign firms as a means of

promoting or hindering its economic goals?

6. Are the firm's customers in the public or private

sector?

7. If firm's customers are in public, does the government

favor domestic suppliers?

8. Are the firm's competitors are in the public or private

sector?

9. If competitors are in public sector, will the government

allow foreigners to compete with the public firms on even terms?

10. When making changes in its policies, does the government

act arbitrarily, does it rely on the rules of law?

11. How stable is the existing government?

12. If the government leaves office, will there be drastic

changes in the economic policies of the new government?

iii. Before starting any activities, at the implementation

face, the foreign firms should have an international business contracts with

the host country, which clearly define the right and obligations of each side.

The contracts between West African countries and foreign firms should provide

answers to each political risk. Resolution should not only focus on the effects

of the risks, but deal with the deep causes of the risks. Since we believe that

any political risk has it root somewhere, investigations should lead to the

causes. Then, foreign firms and host government responsibilities should be

clearly established in an outstanding fair process. To make the process

corruption free or intimidation free, it is better in delicate conflicts to

adopt arbitration9(*).

Because of the speed, privacy, and informality of such proceedings, disputes

can often be resolved cheaply than through the court system. It is time to urge

African governments and decision-makers to create association like the American

Arbitration Association to softly mitigate trade conflicts through arbitration.

It is known that 16 francophone African nations have established a regional

commercial arbitration court in Abidjan, Cote d'Ivoire. [17]. Duplication of

such initiative is welcomed in Africa, because it builds trust and confidence,

and increases foreign investments.

iv. Another alternative for African nations is to follow the

United States example. U.S. uses to negotiate bilateral treaties to protect its

firm from arbitrary actions by host country governments. This is a government-

to- government negotiation. These treaties require the host country to agree to

arbitrate investment disputes involving host country and citizens of other

country. Inversely, the treaties can ask the country of the foreign firms to

keep host country rules and be responsible for any damages they may cause to

the host country.

v. In all cases, cautious contracts should find room for the

following issues: Which country's law applies, the host country or the foreign

firm home country, and in which country should the issue be resolved? Which

technique should be use to resolve the conflicts that may occur, litigation,

arbitration, mediation or negotiation? And how will the settlement be enforced?

Individual country courts should be involved in the contract process, so that

in case of disputes they can react accordingly.

vi. International communities like the WTO, must appropriately

react if one side did not observe the terms of the contracts. There is need for

the WTO to fairly start guiding and protecting the world business partners with

possibility to sue the guilty party in courts. This would bring in relief in

Africa.

vii. The United States created the Overseas Private Investment

Corporation (OPIC) that insures US overseas investments against

nationalization, insurrections or revolutions, and foreign-exchange

inconvertibility. Such institutions can be adapted to serve and protect African

countries' interest.

viii. Also, the World Bank's Multilateral Investment Guarantee

Agency (MIGA), which provides insurance against political risks, should be

known from African countries. And if not done yet, MIGA must include some

actions in it guidelines that can protect African host countries.

CONCLUSION

Some degree of political risk exists in every country,

although the nature and importance of these risks vary. In political risks

assessment, as in most business decisions, it is a matter of balancing risks

rewards.

If a firm is considering an investment in a political risky

environment, it should be sure that it can obtain rates of return that are high

enough to offset the risks of entering that market.

A firm might build a domestic political support in the host

country by being a good corporate citizen; for example, the firm might purchase

inputs from local suppliers where possible, employ African countries citizen in

key management and administrative positions, and support local charities.

West African is confronted with many political upheavals, but

the market potential is still high. International marketing is a one of the

pillar of world peace, as international relations are. So invest in a risky

country could yield peace that will increase profits. What and how much

information a firm needs to assess political risk will depend on the type of

business it is and how it is likely to be in the host country. Given that the

more they stay and the more they may get into political trouble. Also, the more

they stay, and the more they need to legally support the host country.

ECOWAS is currently carrying out political, economical and

monetary reforms that could establish a strong democratic order and facilitate

the free move of goods and services. The promising future of the region with

plethoric natural resources requires special attention from international

marketers.

REFERENCES

1. R.W Griffin et W. Michael. Pustay, International Business,

4th edition. Pearson Prentice hall, 2005, USA

2. Michael R. Czinkota et al, International Marketing,

6th edition, Harcourt College Publishers, 2001, USA.

3. Stephen. J. Kobrin, International Expertise in American

Business, New York Institute of International Education, 1984, 38.

4. P. J. Obaseki, «The future of West African Monetary

Zone (WAMZ) programme» West African Journal of Monetary and economic

integration, Volume 5, 2005, 2-5

5. M.O. Ojo. Towards a common currency in West Africa:

progress, lessons and prospects, West African Journal of Monetary and

economic integration, Volume 5, 2005, 6-10

6. F.Egwaikhike, et al. Foreign direct investments in the West

African monetary zone: Assessment of flows, volatility and growth. West

African Journal of Monetary and economic integration, Volume 5, 2005,

20-28.

7. ECOWAS,

www.ecowas.int /

www.cedeao.int

8. UEMOA,

www.izf.net

9. AON,

www.aon.com;

10. Global Risk Assessment,

www.grai.com ;

11. Willis,

www.willis.com ;

12. Times publication,

www.times-publications.com

13. Le Monde, Numéro spécial, Bilan annuel 2006

de tous les pays du monde, Atlas, 2007.

14. Euromoney's survey of country risk, Euromoney, September

2002, p.211 fff

15. Thomas M. McDevitt, World population profile: 1998,

Washington, DC: Government printing office. p.1-2.

16. www.census.gov,

17. «Commercial law Plan in Francophone Africa,»

Financial Times, May 13, 1999, p.9

* 1 ECOWAS and UEMOA are West

African regional economic organizations. They will be fully described later.

* 2 International Business,

Ricky Griffin et al, 4th edition, 2005, page 630.

* 3 International business,

page 65

* 4 ECOWAS,

www.ecowas.int /

www.cedeao.int

* 5 UEMOA,

www.izf.net

* 6

www.aon.com;

www.grai.com ;

www.willis.com ;

www.times-publications.com

* 7 Michael R. Czinkota et al,

International Marketing, 6th edition, page 175

* 8 International business,

page 73

* 9 Arbitration is a process by

which both parties to a conflict agree to submit their cases to a private

individual or body whose decision they will honor.

|