|

qwertyuio pas dfghj klzxcvbnmqwertyui

opazxcvbnmqwertyuiopasdfghj

klzxwertyuiopasdfghjklzxcvbn

mqwpasFdfghjklzxcvbnmqwert

yuiopasd fghj kl zxcvbn m qwertyui opasdf

|

ghjk

bnm

|

Stock Market Success For Beginners

bnmqwertyuiopasdfgzxcv

wer

g

Maksim Pecherskiy

|

|

tyui

|

ocbpasd

Stéphan Laouadi

|

|

fghjk

|

wertyu

Bachelor Thesis

Spring semester 2008

Atlantis Program

|

zxcv

|

Linköping University: Business Administration

bnm pasdfghjklqwer

ISRN: LIU-IEI-FIL-G--08/00246--SE

Tutor: Dr. Emeric

Solymossy

tyuiopasdfghjklzxcvbnmqwerty uiopasd

fghj klzxcvbnmqwertyuiopasdfghj klzxcv

bnmqwertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghj klzxcvbnmrtyuiopasdfghj

klzxcvbnmqwertyuiopasdfghj klzxcvbn

mqwertyuiopasdfghjklzxcvbnmqwerty

Abstract

Bachelor thesis in Business Administration, Linköping

University

Spring sem ester 2008

Authors: Maksim Pecherskiy and Stéphan Laouadi Tutor: Dr.

Emeric Solymossy

|

Title

|

Stock Market Success For Beginners

|

|

Key words

|

Investing; Stocks; Stock Exchanges; Funda mental analysis.

|

|

Background and Problem discussion

|

The finance world is complicated and can be very intimidating

to someone who knows nothing about it. This paper provides knowledge in a

simple way for anyone who wants to enter this world by purchasing shares of

stock. It provides general market knowledge and after looking at successful

strategies of the greatest investors it proposes a strategy for investing in

the stock market.

|

|

Purpose

|

The purpose of this paper is to see what worked for the best,

and what worked historically, combine the data and come up with a strategy that

may not work 100% of the time, but overall provides a positive return.

|

|

Methodology

|

This paper is based on internal and external secondary

sources. We have used the inductive approach and most our data is

qualitative.

|

|

Theories

|

Our theories are based on security analysis and mostly on

Fundamental analysis.

|

|

Empirical Data

|

Our empirical data consists of strategies used by successful

investors: Benjamin Graham, Philip Fisher and Warren Buffett. As well as

internal reports from S&P and Reuters.

|

|

Conclusion

|

Our proposed strategy advocates investing in undervalued growth

stocks with strong fundamentals for the long run.

|

Acknowledgements

We would like to thank Dr. Emeric Solymossy for his great

ideas and helping us structure our ideas, Stefan's mom for the French wine and

cheese to help us relax during our work, Charlotte Parkinson for providing us

with some ideas using her knowledge of economics, Cecile Lauroa for letting us

borrow the Methodology Book, Benji Greenberg for looking over our paper and

providing his input based on his knowledge, and to Max's DePaul Professor Eric

Greenberg for getting him interested in the topic and teaching him

accounting.

Table of content

Abstract ii

A cknowledgements iii

Table of content a

Introduction 1

Background 1

Purpose 1

Problem Statement 2

Research Methodology 3

Nature of the Problem 3

Exploratory Research 3

Frame Of Reference 4

Data Collection 4

Analysis of Data 4

About the market 5

What is a stock? 5

Why, How and Where does A Company Sell Stock? 8

Investing 13

Market Philosophies 15

Evaluating Potential Investments 18

Growth Vs Value 18

Fundamental Vs Technical Analysis 21

Finding Information 55

Companies Themselves 55

Financial Publications 56

Internet 59

Other Medias 62

Personal experience 63

Successful strategies 64

Benjamin Graham 64

Philip Fisher 67

Warren Buffett 71

Proposed strategy 80

Introduction 80

Finding Stocks 82

Evaluating companies behind stocks 84

Other advices 91

Example 93

Bibliography 100

Appendix 104

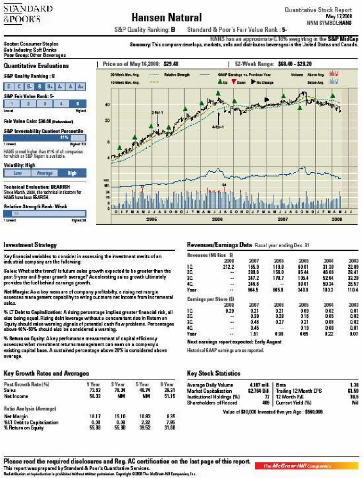

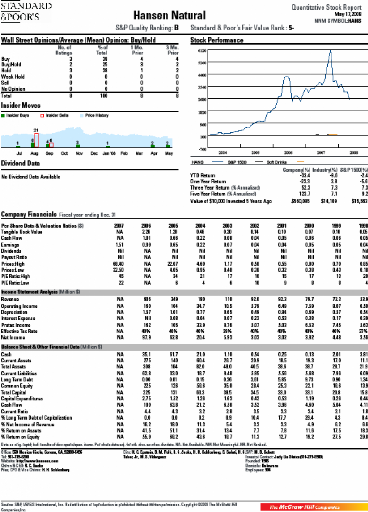

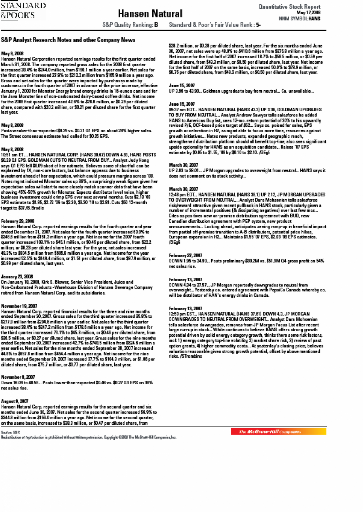

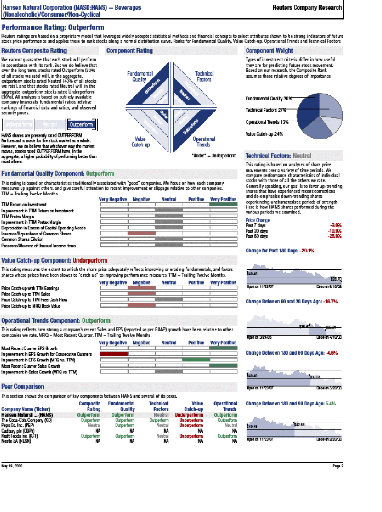

S&P reports on Hansen Natural 104

Reuters report on Hansen Natural 110

Introduction

Background

Tony is currently a student at De Paul University. He is a

third year student who is working toward his major in Information Assurance and

Security Engineering, an information technology bachelor degree. He has been

saving up his money for the past several years from working for several

security companies because he has a lot of security knowledge and it's in

demand. He has about $10,000 saved up and feels that he can do better things

with it than keeping it in his Etrade account and getting only 5.05% annual

return. He was thinking about investing in bonds, but he realized that he would

barely be beating inflation using that approach. So he was wondering how to get

started investing in stocks. He does not really have any knowledge of the stock

market other than what he watches on the news about the S&P 500 and the

Dow. He knows that S&P 500 tracks the 500 companies that represent the

stock market, while the Dow tracks the top companies in the market. When he

tried researching about how to invest, he was bombarded with a myriad of

information that was dispersed all over the place and that he could not

understand. This paper is for him.

Purpose

This paper is written with the beginning investor in mind. The

current economic downturn has numerous banks and financial institutions in

trouble and they are unable to provide decent rates of return on money that

people put in the savings accounts of these institutions. The Fed has decreased

the rate of return on Federal Savings Bonds and they barely beat the rate of

inflation. But does the person that has no knowledge of finance or the stock

market really stand no chance of profiting and getting returns that are better

than the average 3% annually offered in an average savings account? Is the only

way to profit in the stock market through sheer luck like gambling in a Las

Vegas casino? Or is there a way to make informed buying and selling decisions

that can provide a great return for the risk the investor chooses to take? Is

it possible to take publicly available information and analyze it to make

informed and confident stock valuations and purchases? And is it possible to

follow in the strategies of investing of the great gurus like Buffet and make a

profit? If so, is the only way to do it by reading hundreds of boring 1000 page

books that an accountant would not understand, much less Tony, the average

no-knowledge investor?

This paper provides a way for Tony to understand the stock

market but only to the point of getting him off on the right track in

investing. We try to suggest what works and what doesn't and try to take the

best from some of the greatest investing gurus. We try to set him on a path to

a strategy that will keep him out of trouble in the stock market while

providing a decent return. Of course, we can't guarantee that, because the only

thing sure about the market is that it will fluctuate. However, we can see what

worked for the best, and what worked historically, combine the data and come up

with a strategy that may not work 100% of the time, but overall provides a

positive return. That is the purpose of this paper.

Problem Statement

By writing this paper we try to answer the two main questions

that have driven us to pick this topic. We know that there is more than one way

to make money in stocks and in the market in general. However, what we focus on

in this thesis is how to make money by finding, buying, and holding stocks of

good, solid companies, and how to obtain the most return for the risk taken.

Therefore, or main problems are:

· How does the beginning investor make money through

capital appreciation of stocks of companies on major stock exchanges?

· How does the beginning investor obtain the most return

for the risk that he or she undertakes while investing?

Research Methodology

Nature of the Pro blem

Originally, we were interested in doing something with the

stock market and the finance sector in general. Since we had a level of

knowledge in economics and finance, and because of the general economic

condition of the United States, we first decided to look at the relationship

between stock market fluctuations and the economy. However, we quickly found

that issue to be outside our scope of knowledge, and decided to look into the

causes of market fluctuation. This led us to contemplate the reasons behind the

fluctuation of stocks in general, posing a question of what makes price go up

or down every single day. Naturally, we became interested on how people make

money in the stock market. We began to research, and got bombarded with an

overwhelming supply of information, very few of it providing us with a clear

picture of the world of investing. We needed to narrow down our audience to see

at what level we would be writing this paper. Eventually, we decided to write

this paper to Tony, mentioned in the background, who is a beginning investor

and knows nothing about the market or stocks. We decided to keep one question

in mind above everything else. How does one make money in stocks? We started

looking at some of the world's greatest investors such as Buffett and Graham.

Eventually, after further refinement and research, we came up with our problem

statement. Based on the insights from some of the most successful investors,

how does one understand the market, and find and research successful stocks

which provide a decent rate of return compared to the amount of risk the

investor can afford?

Exploratory Research

After contemplating our problem, we came to understanding

that the nature of it is unstructured. The reason we came to this conclusion is

because the problem seemed to be not well understood. It's obvious that the

stock market and all the stocks on it fluctuate on a daily, even a minute

basis. However, what causes them to fluctuate, and more specifically what

causes some investments to double or triple in value while others fail

miserably, seemed to be a mystery. Furthermore, we wanted to look at how people

that have successfully beaten the market over the years were able to know which

stocks would succeed and which would fail. Knowing that the solution would not

be simple, and the answers could be numerous, we knew we had to look at several

sources and several ways of investing to come to our conclusions. We also knew

that the direction of our research could change based on our findings.

Therefore, we chose to utilize the Exploratory Research methodology. By

examining and analyzing strategies of successful investors as well

understanding how to find a great company that stands behind the stock symbol

by using ratios and fundamental valuations, we hope to arrive at our proposed

strategy.

Frame Of Reference

We know nothing of stock valuation or market fluctuations. We

do understand however that the people who have successfully beaten the market

over a long period of time have had a system for doing so that worked. We hope

to provide a theoretical strategy based on our observations and the

recommendations of the world's greatest investors as well as valuation books

that will try to beat the market. We do understand and assert that this

strategy would be theoretical and only a conclusion of our research and

deductions. In addition, we do understand that the market can be irrational and

unpredictable and that this strategy will not guarantee a positive return

percentage all the time. However, we do believe that by picking companies with

solid fundamentals and holding them for long periods of time will provide a

great way to earn a good amount of return in the stock market.

Data Collection

Since we are using the exploratory model, most of our data

comes from secondary sources. We have used several internal and external

sources. External sources used for this paper include books and articles, while

internal sources consist of stock research reports from the Standard and Poor

Corporation as well as Reuters Research Reports.

At first we were building from our existing knowledge of

finance, however that turned out to be insufficient. In order to find more

information, we turned to libraries, such as the LIU library and the DePaul

University library. We have been able to obtain several books that described

the investing style of some great investors as well as several books on

analysis of different securities. We used these to build our knowledge of

valuation formulas, as well as to provide information about the strategies of

the great investors. We have also turned to the internet for sources. There are

several investing websites which were especially helpful for explaining

different ratios and what they mean and how they should be looked at.

For explaining core earnings, we looked at primary sources

from Standard and Poor's in a document describing the reason for creating these

measurements. In order to collect our primary data, we have also used S&P

reports to collect different ratios and key fundamentals. We have used the

inductive way of collecting data. We have first observed and researched,

looking at some major ways of investing that exist, then took general

conclusions from our research and created our theory.

Analysis of Data

In analyzing data, we have tried to concentrate on what are

the similarities between the investing styles of the great investors that we

have researched. We have also looked at internal documents from the S&P for

an explanation of core earnings in order to understand their importance and

implementation. For evaluation by formulas, we have tried to pick the most

important formulas and to try to organize them first by the financial

statement, and then, in our strategy by importance so that the investor who has

less time on their hands will be able to skip the highly detailed and in depth

valuations that our strategy proposes. From the information we have gathered,

we have taken the main points and provided them in this paper. We have tried to

limit the formulas that we use to only the most important ones and ones

essential for analyzing companies' performance. For the investors, we took out

their main philosophy and investing strategy and summarized them here. We have

departed from data, and using the qualitative information we have gathered and

analyzed, we have created a theory.

About the market

What is a stock?

A company's operations are financed in one of two ways. The

first way is by loans from major lending institutions such as banks and credit

agencies or though sales of bonds. The other way for a company to raise money

to fund its operations is through sales shares of stock or equity. Shareholders

are essentially owners of small pieces of the company, because that's what a

share of stock is. Therefore, the management of the company is responsible to

the shareholders, because they are essentially owners of the company that they

are managing.

Why Invest in Stocks?

So why invest in stocks? They are volatile, risky, and the

investor could lose if the market crashes. The answer is actually quite simple.

Stocks allow the investor to own successful companies, and stocks tend to be

the best investments over time. And, if the investor is not a speculator and

does his or her due diligence and research, stocks can really pay off.

Table 1 below shows the average total return of stocks measured

by the S&P 500 Index and AAA Corporate Bonds shown by Moody's Seasoned AAA

Corporate Bond Yield Index over five decades.

Table 1- Percentage Return

PERCENTAGE RETURNS

|

|

STOCKS

|

BONDS

|

|

Per Year*

|

Total

|

The 1950s

|

486.5%

|

19.4%

|

11.3%

|

The 1960s

|

112.1%

|

7.8%

|

19.2%

|

The 1970s

|

76.8%

|

5.9%

|

81.7%

|

The 1980s

|

398.1%

|

17.4%

|

238.3%

|

The 1990s

|

432.3%

|

18.2%

|

131.9%

|

* Compounded

|

|

Compiled Using Data from FRED and Yahoo Finance

It's easy to see that every 10 year period, stocks have

outperformed bonds, and by quite a lot. Even during the 1980s when one of the

great recessions happened and the 1990s when the dot com bubble burst, stocks

on average seemed to provide a way better return than bonds.

Types of Shares

However, not all shares of stock are created equal. There are

two types of stock offered by the company in order to finance its operations.

Even though most beginners will deal with common stock, it is necessary to

understand both types:

Preferred Stock

The first type of stock is preferred stock. If the company

goes bankrupt and after all the creditors get paid off, the holders of

preferred shares get first claim on whatever is left over, followed by the

holders of common stock. Preferred stockholders usually get paid dividends, and

if there's still money left over after paying dividends to the preferred

stockholders, the corporation will issue a dividend to pay the common

stockholders. Furthermore, preferred stock shares usually do not have voting

rights.

The exact definition and rights of preferred stock vary from

company to company, but the best way to think of this of preferred stock is a

financial instrument that is similar to a bond (fixed dividends) and equity

(stock price appreciation).

Common Stock

The stock that is most often traded on the markets is common

stock. Corporations usually issue a lot more shares of common stock than they

do preferred. Holders of these shares maintain control of the company through a

board of directors, and have voting rights on corporate policy. However, they

are on the bottom of the list if the company goes bankrupt and gets liquidated,

right after the creditors, bondholders and preferred stockholders. However,

common shares most often outperform preferred shares in the long run.

Making money in stocks

So how can stocks return gains on the money Tony invests in

them? There are several ways:

Capital Appreciation

The first is capital appreciation, or when the price of the

stock goes up. Therefore, the capital that Tony has invested into the security

has increased in value, because the value of his shares has increased. The

capital appreciations part of the investment includes all of the market value

exceeding the original investment or cost basis.

Dividend

The other way to make money is by holding stocks that pay

dividends. Dividends are a distribution of a portion of a company's earnings to

a class of its shareholders. The distribution of dividends and how much is

decided by the company's board of directors. It's most often quoted in the

terms of the dollar amount per share such as $.50 per share. For example, if

Tony is the owner of 10 shares of Disney, and they decide to issue a dividend

of $.50 a share, he will receive a total dividend of $5 for the shares that he

is holding. Not all companies pay dividends, but generally the well

established, slow growth companies. High growth companies usually reinvest

their dividends in order to maintain high levels of growth and don't pay out

their investors.

Declaration Date

This is the date on which the next dividend payment is announced

by the board of directors. This announcement will include the dividend size,

ex-dividend date and payment date. Once this announcement has been made, the

dividend becomes a declared dividend and it is now the company's legal

liability to pay it. Ex-Dividend Date

This is the date on which the security becomes traded without

a previously declared dividend. After this date, the seller, and not the buyer

of the stock will be entitled to the announced dividend. It is usually two

business days before the record date.

Record Date

This is the date on which the shareholder must be holding the

security in order to receive the declared dividend. On this date, the company

records who the holders on record are and makes sure that they receive the

dividend. Even if the shareholder sells the stock after this date, he or she

will still receive the dividend. Payment Date

This is the date on which the dividend payment is finally

made. Only the shareholder who bought the stock before the ex-dividend date and

were still holding it during the record date will receive the dividend

distribution.

Extra dividends

These are a non-recurring distribution of the assets of a

company, determined by the board of directors to shareholders. These are

unusually large in size and are not on the usual payout date. These dividends

are often declared following strong earnings results as a way for a company to

distribute the really good profits of the fiscal cycle to the shareholders.

Stock Splits

A stock split is a corporate action where existing shares are

divided into two or more shares. Even though the number of shares increases,

the value of each share decreases proportionally. This is in order to keep the

company's market capitalization (explained further) the same, since no real

value has been added because of the split. For example if Google is currently

trading at $580 a share, and has 33.74 Million shares outstanding. The company

decides to do a 2:1 split. The stock price becomes $290 a share and they now

have 67.48 Million shares outstanding. In each case, 290 * 67.48Million and

580*33.74 million provides the same number for market capitalization. In

addition, if an investor is the owner of 100 shares before the stock split, he

or she is the owner of 200 shares after. Companies may do this in order to

decrease their per share price so that different kinds of investors would

invest in it. For example, since Tony only has $10000 to invest, he can only

buy 16 shares of Google, and if the stock goes up by $100, he will only make

$1600. However, if he buys after a 2:1 split for Google, he can buy 32 shares,

and if those shares increase by $100 a share, he or she will make $3200.

Therefore, in order to attract smaller investors, companies may want to perform

a stock split.

Stock splits also go the other way. A company can also reduce

the number of shares trading on the market by doing a reverse stock split. This

can be done to increase the company's Earnings per share, even though nothing

has really changed. It's usually a bad sign if the company has to reverse stock

split as they may do so to make their shares look more valuable or even to

avoid being delisted.

Why, How and Where does A Company Sell Stock?

Selling stock to rais e money

In order to raise money to fund its operations, a company has

two main choices. The first choice is debt. This involves going to a bank or

lending institution and borrowing money at a certain percentage and pay it back

over a certain period of time. Another choice is to go into debt by issuing

bonds where the company pays the bondholders back at a certain percentage for a

certain amount of time. The other option is to finance its operations by

selling shares to investors. A share is essentially a part of the company, and

therefore entitles the shareholders to a certain percentage of the company's

profits.

In order to go public, a company has to go through an

investment bank and make an IPO or an initial public offering to the primary

stock market. Afterwards, these shares go to a secondary market such as NYSE or

Nasdaq. This allows the company to sell shares to millions of investors

therefore using their capital to fund its operations.

Primary market

The primary market is where new issues of stock are first

offered. Companies, governments, and other entities obtain money by either debt

or equity securities. The primary markets are facilitated by underwriting

groups which usually consist of investment banks. They will set a beginning

price range for a given security and then oversee the sale directly to

investors. The issuing company receives cash proceeds from the sale which are

used to fund operations and fuel growth. Once the initial sale is complete the

security begins to trade on the secondary market.

Secondary market

The market that is on the news every day is the secondary

market where shares are traded between different investors and institutions.

Before, the secondary market used to be a large trading floor with different

investors yelling out orders to buy and sell. However today, thanks to

computers, all the trades are done almost real time by computerized systems and

the floor now only exists in virtual reality. The main markets that show up on

the news every day are NYSE which the New York Stock Exchange, AMEX and NASDAQ.

One of the largest difference between primary and secondary markets is that in

the primary market, the prices are set beforehand, while in the secondary

market, the prices are only determined by market forces such as supply and

demand.

All those symbols streaming during CNN Financial news are

called ticker symbols, and each corporation's stock has one. It's an

arrangement of characters which are usually letters to represent a security

that's being publicly traded on an exchange. When a company becomes publicly

traded, it gets to pick a ticker symbol for its stock. It's useful to know that

stocks trading on the NYSE usually have three symbols, and Nasdaq stocks have

four letter symbols.

Types of secondary markets

Centralized markets

A centralized market consists of a market structure where all

orders are routed to a central exchange such as a trading floor. The quoted

prices of different securities trading on the market show the only price that's

available for the security available to investors. NYSE is considered to be a

centralized market.

Over the counter markets

An over the counter market or OTC market is a network of

brokers and dealers with no centralized exchange. Usually stocks will trade on

such an exchange because they do not meet the listing requirements of other

exchanges. Even though Nasdaq operates as a network of dealers communicating by

computer systems, it is a very large stock exchange with listing requirements

and is therefore not referred to as an OTC Market.

Exchanges

Exchanges are marketplaces where securities and other

financial instruments are traded. The main function of an exchange is to

coordinate fair and orderly trading as well as to provide information about the

price of those securities to investors in an efficient manner. An exchange can

be considered a platform where investors trade securities with one another and

where economic concepts such as supply and demand are clearly exemplified.

Exchanges do not have to be a public trading floor, but could exist in a

virtual world where all the trading is coordinated by computers. Many famous

exchanges are located around the globe such as NYSE in New York, Tokyo Stock

Exchange in Tokyo, and NASDAQ which is an exchange fully run on computer

systems.

In order to be listed on a specific exchange, a company must

meet certain requirements such as regular financial reports and a certain

amount of market capitalization.

NYSE

The New York Stock Exchange or the «Big Board» is

considered to be the largest exchange of equities in the world judging by the

total market capitalization of the securities that are listed on it. Even

though it used to be a private organization, it became a public entity in 2005.

Its parent company is called NYSE Euronext after it acquired the European

Exchange in 2007.

At first, NYSE relied only on the floor trading system,

having all the trades yelled by investors and then executed. Today however,

more than half of all the transactions that happen on this exchange are

conducted by electronic means, and floor trading is used for only high volume

institutional trading.

The beginnings of the NYSE go back to 1792. Because of its

long history and high reputation, some of the most prominent and well known

companies of the world are listed on it. Foreign corporations can list on it as

well as long as they adhere to specific SEC rules known as listing

standards.

NYSE opens for trading Monday through Friday 9:30 AM to 4:00 PM

Eastern Time. It also shuts down for nine holidays out of the

year.1

1

Investopedia.com

Nasdaq

NASDAQ or National Association of Securities Dealers

Automated Quotation is a computerized exchange that provides the ability to

trade for more than 5000 actively traded over the counter stocks. This exchange

is only a few decades old, dating back to 1971 when it became the world's fist

electronic stock market. While stocks listed on the NYSE are comprised of three

letters generally, the stocks on NASDAQ tend to be listed in four or five

letter symbols. However, if the stock is a transfer from the NYSE, then it

could have a three letter symbol while trading on NASDAQ.2 Usually,

stocks on Nasdaq tend to be high tech and carry a little bit more risk than

those on NYSE. It's home to tech giants such as Microsoft, Intel, and Cisco.

AMEX

AMEX is the third largest exchange in the United States and

has now merged with Nasdaq. It is located in New York City and now handles

roughly 10% of all securities traded in the US3. Before Nasdaq, it

used to be a strong competitor to NYSE, but now it carries a lot of small cap

stocks, and ETFs.

2

Investopedia.com

3 IBID

The Market

What is commonly referred to as the market is where shares

are traded and is more specifically the equity market. It is one of the most

vital areas of the market economy since it provides companies with access to

capital to finance their operations and it lets investors own a piece of the

companies and therefore realize potential gains based on the company's future

performance.

Indexes

An index is best understood as a statistical measure of

change in economy or a securities market. In the case of the financial markets,

an index acts like a portfolio with securities that represent a particular

portion of the market. The index is usually expressed as a change from a base

value in percentages.

Since investors cannot directly invest in a whole index, and

the only way to do that is by individually selecting stocks in the index and

adjusting them accordingly, index mutual funds and index-based ETFs (See Below)

allow investors to buy securities that represent the broad market segments. It

is important to remember that the index does not reflect the individual stocks,

but rather acts as a barometer for market sentiment. Stocks change in price due

to many different factors, and stocks will not necessarily stop going up in a

bear market.

Main Indexes

Dow Jones

The Dow Jones Industrial Average, also known as the DOW, is a

price-weighted selection and average of 30 significant stocks traded on Nasdaq

and NYSE that are thought to represent the market as a whole. Also known as the

DJIA, this is what is used to gauge whether the market has gone up or down and

where it is headed. It is the oldest and most watched index in the world. A

concept that is important to understand is the Dow Theory that states that

prices tend to move with positive correlation to each other. This is a very

detailed theory and is well out of scope of this paper; however, it is worth

summarizing. Under this theory, if the Dow Jones Industrial Average moves in a

certain direction, it's not an indication of a trend. However, if the DJIA and

the Dow Jones Transportation Average move in the same direction, it could

indicate an emerging trend. It is what technicians use to gauge market

sentiment and movement.

Nasdaq 100

The Nasdaq 100 is composed of 100 largest and most actively

traded companies on Nasdaq. While it includes many different industries, it

generally does not include financial institutions since those usually trade on

NYSE.

S&P 500

The Standard and Poor's 500 index is comprised of 500 stocks

chosen for their market size, liquidity and industry grouping as well as

several other factors. It is designed to be an indicator of US equities. It is

one of the most commonly used benchmarks to gauge the US market. Since it

contains so many companies and in so many broad ranges, many people consider it

to be the definition of the market.

Exchange Traded Funds

ETFs or Exchange Traded Funds are securities traded on the

stock exchange with a specific symbol just like any other company. However,

ETFs track an index or a commodity, or several assets like an index fund. By

owning an ETF, an investor can use the diversification of an index fund, as

well as the ability to sell short, or leverage a specific index fund. For

example, one of the best known ETFs is SPDR (Spider) which tracks the S&P

500 and trades under the sym bol SPY.

Market Sentiment

It's in the news all the time. «This bear market

this» or «This bull market that.» These metaphors came from the

different way the animals use to attack their opponents. The bull swipes his

horns up when attacking, while the bear swipes his paws down. They describe

current market sentiment and how investors feel about putting money in the

market in general. The two main descriptions are «Bear Market» and

«Bull Market.»

Bear Market

A bear market is a market condition in which the prices of

the securities on average are falling or are expected to fall. Usually, a

downturn of 15 - 20% in different indexes is considered the beginning of a bear

market. Usually, investors are pessimistic or scared, and are pulling their

money out of the market causing stock prices to fall.

Bull Market

It's the exact opposite of the bear market. Whereas in the

bear market the prices of securities are falling, the prices of securities in a

bull market are on the rise. Also generally defined as a climb of 15-20% in

different indexes is the beginning of a bull market.4 Usually

investors in such a market are optimistic, investor confidence is up, and so

are stock prices.

4

Investopedia.com

Investing

In order to invest in the market, an individual needs to go

through a broker who will charge a fee or commission for execution of trades

ordered by its clients. Whereas before, only the wealthy could afford a broker

and therefore access the stock market, the birth of the internet allowed for

the subsequent birth of discount brokers on the internet. These brokers allow

investors to trade at a lower cost, but they don't provide investors with

personalized advice. Many brokers will charge under $10 per trade and some will

go even lower. Thanks to discount brokers, almost anyone can trade in the stock

market.

Brokers

Brokers come in two different flavors. The first kind is the

full service brokerage firm. These are the largest and most known brokers in

the country and they spend millions of dollars a year on advertising to make

sure of that. The problem with these brokerages is that they are expensive and

they are biased. Such large firms usually have an investment banking division

that helps companies make IPOs. It's not hard to see that it may pose a

conflict of interest when the other part of the company is dedicated to

advising people on what to invest in. Therefore, they may guide the investor to

buy shares of a company that they put to market just to keep a good banking

relationship with that company. Furthermore, they are very expensive with fees

upwards of a $100 per trade. A trade may cost a lot of money and their advice

is usually misleading.

The second kind of brokerage firm, and the most appealing one

to use, is the discount brokerage firm. They do not have investment banking

divisions, but even if they did it would not matter anyways because they don't

give their investors any advice. They provide a trading platform to stay

competitive and may help the investor by giving them reports from third

parties, but the only reason they really exist (in the mind of the investor) is

to execute his or her orders to buy or sell. Here, a trade may cost around $7

to $10, so it's more affordable. In addition, they make commission the same no

matter what stock gets traded, so they are not interested in giving the

investor any recommendations.

Types of orders

In order to invest intelligently and successfully, the

investor needs to put all the tools available to him or her to use. Different

orders that the brokerage performs are some of those tools and are instrumental

in executing trades under specific conditions.

Market Orders

When a market order is placed, it is an order to purchase

shares of stock immediately at the next available current price. It guarantees

execution, and also carries with it a lower commission, because all the broker

has to do is buy or sell. However, placing a market order with a stock that has

low average daily volume can be dangerous. In such a situation, the ask price

can be a lot higher than the bid, causing a larger spread, and therefore making

the shares cost a lot more than originally quoted.

Above the market Orders

An order to buy or sell at a price that's higher than price

the security is currently trading. An example of such an order can be a limit

order to sell, a stop order to buy, or a stop-limit-order to buy. Momentum

traders will often place such traders above the resistance level in the hopes

that once a price breaks through the resistance level, it will continue in an

upward trend.

Below the market Orders

An order to buy or sell the security at a price that's lower

than the current price. An example would be a limit order to buy, a stop order

to sell, or a stop-limit order to sell. This can be used to limit losses by

some investors who will want to sell a security after it has hit a certain low

price point.

Trade execution

Limit Order

An order that instructs the broker to buy or sell a number of

shares at specific price or better. The investor can also limit the length of

time the order can be outstanding before it's no good. These can often cost

more than market orders, but are sometimes worth the higher price if used to

limit losses, or purchase shares at a low price the stock hits for only a few

minutes.

Example: Tony has decided he wants to buy 100 shares of

Coca-Cola but he is willing to pay no more than $30 per share. He sets a Buy

Limit order at $30 for 100 shares. If the price of the stock drops to $30 or

below, the order will become a market order and execute but only a price of $30

or below. If the price never reaches that point, the order will not execute.

Stop Order

An order to buy or sell a security when its price passes a

certain point. This gives the investor a larger probability of hitting an entry

or exit price that he or she wants. Once the price passes that point, the order

becomes a market order. Investors usually use this when they know they will be

unable to monitor their portfolio for a certain period. However, they are not a

guaranteed the transaction will happen at the price the trader wants. If the

stock drops down really quickly or jumps, the investor's stock will be sold or

bought at a very different price than what the investor expected.

Example: Tony has bought a stock for $20 that is now trading

for $70. He wants to sell it at $60, therefore locking in a 200% gain. He

places a stop order to sell at $60. The order will execute at the best price it

can after the price hits $60 or lower.

Stop Limit Order

This order combines the features of a stop order with those

of a limit order. This order will be executed at a specified price or better

after a given stop price has been reached. In other words, once the stop price

has been reached, the order becomes a limit order instead of a market order,

therefore giving greater assurance that the order will be filled at the price

desired by the investor.

However, the downside is that the trade may not be executed

if the stock reaches the stop but does not hit the limit.

Example: Going back to Tony and his stock that he wants to

lock in a 200% gain on. If he places a stop limit order to sell at $60, and the

price hits $60, the order will only execute at a price that is $60 or higher,

unlike the stop order which will execute at any price after the price point has

been hit.

Market Philosophies

Before talking about investing and different strategies that

exist, it is necessary to undertake a certain philosophy about how the market

functions, therefore bringing about some basic assumptions.

The Efficient Market Hypothesis

The efficient market theory was published in the 1970s by

Eugene Fama. It is a theory that states that all share prices at any given time

are the result of all available information. It makes the assumption that

people analyze information in the same way, that they are rational, that all

information is available to everyone at the same time, they react to it

instantaneously, and that there is an infinite number of investors who want to

sell or buy a given stock at any given time.

There are three levels of this academic theory. The first

version is called «Weak Form Efficiency» and asserts that all

information from the past is already included in the current price. This goes

against the tenets of technical analysis, because this says that future price

movements cannot be predicted based on past price fluctuation patterns.

The second version is called «Semi-Strong Form

Efficiency,» and it states information that can only be obtained from

insider trading can benefit investors with an edge in the market.

Finally, the third version is called «Strong Form

Efficiency» and states that all information about a stock is already

reflected in its price, and its impossible to gain an edge through fundamental

or technical analysis. Therefore, it is impossible to «beat» or

outperform the market over the long term.5

This paper's philosophy of the market

This paper will be written on the assumed rejection of this

hypothesis because due to the information that we have read, we do not believe

it to be true. Investors like Warren Buffett and Benjamin Graham have

consistently beaten the market over the long term as well as many others. This

brings to assume that the market is inefficient which leads us to three main

investment methodologies.

· Behavioral Finance

· Investing Based on Technical Analysis

· Investing Based on Fundamental Analysis

Details of Behavioral Finance are out of the scope of this

paper because it deals with psychological aspects and we have no background

with psychology. We do accept that numerous studies have been made that explain

market anomalies based on the lack of investor rationality, and we will use

that fact further in our paper.

5

Investopedia.com

We also believe that investing based on technical factors

carries greater risk than what an average beginning investor may want to

undertake, therefore the details of investing based on technical analysis will

be excluded from the scope of this paper. In addition, the average investor

will not likely have an extensive knowledge of the mathematics and charting

needed to perform technical analysis with a certain range of confidence.

However, we do recognize that certain technical phenomena and combinations of

technical and fundamental factors may help to make rational decisions for

investors and we will discuss those in some details in our valuation and

strategy sections.

We will propose a strategy for investing based on fundamental

factors of companies behind the stock. From our research we have concluded that

people that have managed to successfully beat the market have been able to do

so in this manner. From our research, we firmly believe that by picking

companies with strong fundamentals, it is possible to outperform the market.

This leads us to a further breakdown of the Fundamental Analysis I nvestment

Methodology as follows.

· Income Investing

· Speculation

· Value Investing

· Growth Investing

Income Investing is based on finding companies with good

fundamentals that will pay a good amount of dividends. However, the most an

investor can obtain from dividends on average is about 5-6%, and dividends are

not guaranteed, so if a company is not doing well, they may cancel several

dividend payments. A missed dividend in one quarter can decrease the gains to

around 4%. In addition, the price of the company's stock could fluctuate which

would also affect the income of the investor. Therefore, we believe that the

risk of being invested in the stock market is too great for the small amount of

gains that the investor would receive compared to a savings bond. We recognize

that some investors would prefer this method because of its decreased

volatility compared to other investing methodologies, but we would like to

point out that income investing is out of the scope of this paper.

Speculation is a much more risky strategy than income

investing, as well as any of the other strategies mentioned above. "An

investment operation is one which, upon thorough analysis, promises safety of

principal and a satisfactory return. Operations not meeting these requirements

are speculative."6 We believe that speculation carries more risk

than a beginning investor would like to take on in addition to not having

enough experience to speculate. Therefore, speculation is out of scope of this

paper.

6 Benjamin Graham, Security Analysis(18)

Value investing, described further in this paper involves

finding undervalued companies with good fundamentals and holding onto them for

a long time. Benjamin Graham, considered to be the father of value investing

was successful in the market over the long term as well as several others who

followed this methodology. We will further focus on this methodology in order

to develop our strategy.

Growth Investing, also described further in this paper

focuses on finding companies with reasonable potential for growth in the long

term. Investors such as Philip Fisher used this methodology to become

successful in the market over the long term. We will apply this methodology as

well to the development of our strategy.

To summarize, our strategies and our theories will assume

that:

· The market is inefficient

· All information is not available to everyone at the same

time

· That investors do not react to information

instantaneously,

· That a large percentage of investors are irrational and

emotional because a large percentage of them are human7

· Investors Make Mistakes

· It is possible to outperform the market over the long

term.

· Stocks of companies with strong fundamental factors will

perform well in the long run

7 A certain percentage of investments are performed by computers

who process market information and react to it instantaneously based on pre-set

guidelines.

Evaluating Potential Investments

Evaluating a potential investment can be a daunting task for

a beginning investor. There are different styles of investing such as growth

and value investing. Furthermore, analyzing investments themselves can be done

through technical or fundamental analysis. In addition, there are many ratios

that can be looked at and compared in order to make educated decisions about

whether the company the investor is buying will go up in price and is a

profitable investment over time. This chapter will provide a sort of

«investor's toolkit» for evaluating investments.

Growth Vs Value

In order to fully explain stock classification to the

beginning investor, it is necessary to clarify the main strategies that traders

use to succeed in the market. These strategies are not set in stone, but are

rather guidelines and philosophies used by different investors. Even though

this section will not go into full detail on stock picking strategies, it is

necessary to introduce them in order for the reader to understand different

valuation principles.

Value Investing

Value investing is perhaps one of the most widely known

methods to pick stocks. When a person who is new to investing thinks about

trading stocks, value investing undoubtedly comes to mind. The strategy was

formalized by Benjamin Graham in the 1930s in his books Security

Analysis and The Intelligent Investor. Some of the better known

value investors include Warren Buffet and Benjamin Graham.

The main premise of value investing is the rejection of the

Efficient Market Hypothesis. 8 After all, if the market always

assigns the correct value to stocks, it is impossible to ever buy stocks that

are undervalued. Rather, value investors follow the mindset of Benjamin Graham

who believes that the market is irrational and will not always price a

company's stock correctly, but will often undervalue it or overvalue it. In

fact, one of his most popular followers, Warren Buffet said, «In the short

run the market is a popularity contest. In the long run, it is a weighing

machine.»9

Based on this philosophy, value investors look for good,

solid companies, that for one reason or another are selling really cheap

compared to their intrinsic value and not historical prices. Value investing is

a strategy of buying stocks whose intrinsic value is higher than the price that

the market has assigned to it. It's important to note that this does not refer

to the actual stock price. Some may confuse value investing with just buying

stocks because they are cheap ($5 a share rather than $300). This is not the

case. Value investing is based on the understanding of the fact that when you

purchase a stock, you are purchasing a part of a living, breathing and

operating company. The value investor sees stock ownership as a means to owning

a part of a company, rather than just gambling on a stock hoping it will go up.

The performance of the stock, and the price of the stock in the market will

undoubtedly eventually be based on the performance of the company. One of

Buffet's most known phrases is that «time helps great companies and

destroys mediocre ones.»10 Therefore, it is necessary for the

value investor to assess how good of a company it is that he or she is buying.

When

8

Investopedia.com

9 Robert Hagstrom, The Warren Buffet Way( 103)

10 Robert Hagstrom, The Warren Buffet Way( 147)

buying a computer, the customer has to look at its processor,

how much memory it has, how big it's hard drives are and many other factors in

order to assess its future performance. In comparison, the value investor must

look at numerous key measurements of the company's performance in the past in

order to assess whether this is a good company to own a part of. These

measurements will often be found on the Balance Sheet, Income Statement and

Statement of Cash Flows which every publicly traded company must provide

quarterly, as well as many other places such as the Shareholder's Report,

company website, or the company's Investor Relations department as well as the

internet. This paper goes into detail on how to locate them in a further

section. These values include everything from how the management runs the

company, to how much debt the company has, to how much money it earns annually,

and many other different factors. A value investor's job is to look at all

these values, known as fundamental measurements, and make a decision as to how

much the company is worth, or its intrinsic value. It's worth noting, however,

that different investors will judge intrinsic value differently. If two

investors were given the same information, they may come up with two completely

different estimates of intrinsic value. Once the intrinsic value is known, the

investor will compare it to the current market price, and if the stock is

trading lower than what the investor believes its worth, he or she will

purchase shares. Therefore, he or she is usually not interested in the day to

day price fluctuations of the stock because he or she knows that he or she has

picked a solid company that is posed to perform well.

For example, Tony is thinking about which companies are good

to add to his portfolio. He decides to look at SBUX, a Starbucks stock that has

been trading for around $40 a share until recently when it fell to $15. He is

wondering if SBUX's price fell because the market has undervalued it, or

because there is something wrong with the company. He spends a few days

researching the company, looking at P/E ratios, statements of Cash Flows, and

many other different quantitative factors. He also looks at the recent news

about the company, recent changes in management and other qualitative

factors.

He then makes a decision that to him, Starbucks is worth $45

a share, because it's a good solid company and has a bright future and bright

expansion plans. He sees now, that he can get a bargain because the price fell

to $15 a share, so he buys. He doesn't really care to look at day to day market

fluctuations and he is not biting his or her nails off because he is afraid he

will lose his or her investment. He knows he has bought a solid company. In two

weeks, he checks to see that the stock has risen back up to $40 dollars.

He then decides to take a look at some of the other stocks in

his portfolio and sees that a company with a stock symbol of WINS, which he

bought for $7 a share has fallen to $4 a share. He is wondering if he should

buy more. He re-evaluates his or her stocks, taking his time to do research,

only to find out that the management changed in the company for the worse. He

decides to sell his stock so that he won't lose any more money. The company

eventually bankrupts. In this case, the price fell, but it was the market's

reaction to a change in management for the worse. The market has evaluated the

price of the stock correctly.

Growth Investing

Growth Investing, on the other hand is a little bit different

cup of tea. The best way to explain growth investing is to put it into direct

contrast with value investing. Value investors are focused on the current price

of the company and its current intrinsic value, always shopping for a bargain.

Growth investors, on the other hand are interested in the future potential of

the company they are looking at, while not really putting much emphasis on the

current price. They don't mind paying more for a company than its intrinsic

value, because they believe that the company will grow way beyond their

valuations anyway.

For example, growth investing could be compared to a team

manager trying to recruit Michael Jordan. The manager would have to pay Jordan

a lot of money, but as long as he or she keeps winning games and putting people

in the seats, it's worth it. In addition, if he or she trains more, he or she

can get better. However, value investing on the other hand looks for players

that are good but don't have Jordan's hype. Therefore they would have to pay

them less, and get a great player at a bargain price. However, there is always

the possibility that they get what they paid for and the player really is

bad.

Growth investors are interested in growth stocks and those

tend to be companies that grow a lot faster than others. It makes sense then

for growth investors to be primarily concerned with younger companies that have

a lot of potential for growth. They base their philosophies on the theory that

growth in earnings and revenues will make the stock price go up. Growth

investors realize all of their profits through the increase of the stock price

rather than dividends paid out to them, because the companies they invest in

usually do not pay dividends.

For example, Tony's wife, Tanya is a growth investor. He or

she decides to look at shares of Google. They are currently trading for around

$530 a share, up from about $430 last quarter before the company's earnings

report came out. She wants to buy several shares of the stocks because after

evaluating the company, she strongly believes that the company can go up in

price even more, or perhaps the stock will split. She ignores Tony's advice to

wait until the share price drops a little bit, and makes the purchase. Google

continues to go up in price and Tanya makes money, making sure to tell Tony

that she was right.

Other types

There are two other major types of investing that are worth

mentioning but merit no further discussion in this paper due to its scope. The

first is income investing where the investor picks companies based on their

dividend yield and the income from the shares comes not from capital gains, but

only from dividends. The other type is called speculation and is where

investors look at chart patterns and have very little interest in the company

they are buying. This is a very risky way to trade and requires looking at

stock price changes on minute to minute levels.

Fundamental Vs Technical Analysis

There are two generally accepted ways to look at stocks and

determine whether they are worth purchasing or not. This chapter will

concentrate mostly on Fundamental analysis, as this is the main underlying

factor behind most of the successful strategies that were researched. However,

technical analysis is also very useful to know and should not be neglected.

Both ways of analyzing stocks should be included in a successful investor's

strategy because both provide information about the stock and its price

movements that should not be missed.

Fundamental Analysis is a term for a technique for looking at

a security such as a stock or a bond and analyzing its value by looking at

certain underlying factors behind that specific security. As discussed before,

a purchase of a stock is a purchase of a certain part of a living breathing

corporation. Successful investors have always performed fundamental analysis in

order to determine how much a security that they are looking at is worth.

Investopedia calls it the cornerstone of investing. It does however merit to

say that a growth investor and a value investor will look at different aspects

of the company's fundamentals differently, each will undoubtedly perform

fundamental analysis in order to know what he or she is putting his money into.

By looking at certain fundamentals of a company, industry or a whole economy,

the investor can make educated guesses as to the well-being of the company he

or she is looking at. Some questions answered by fundamental analysis

include

· Is the revenue growing?

· Is it making a profit?

· How does the company stack up against competition?

· How is the industry the company is in is doing?

· How deep is the company in debt?

· How free is the cash flow through the company?

· Is there evidence of «creative accounting»?

· And many more.

However, all these questions really boil down to one specific

question. Should I put money into this stock and is this a good investment

which will make my money work for me?

The real purpose of doing any kind of fundamental analysis

for any security is essentially finding out the security's intrinsic value.

Essentially, this is based on the rejection of the Efficient Market Hypothesis

because after all, if the market were always correct in its pricing, there

would be no reason to look for undervalued stocks. This essentially brings

another assumption: In the long run, the market will reflect the fundamentals

of the company and price the stock accordingly. According to Warren Buffet,

«In the short term the market is a popularity contest; in the long term it

is a weighing machine."11 The trouble is however, that the long run

may be just a few weeks or a few years and knowing the exact time frame is

impossible. The other problem is that one doesn't know if his valuation of the

intrinsic value is correct. As previously mentioned, there is no correct way to

determine intrinsic value, and different investors will come up with different

valuations.

Technical analysis, on the other hand is at a completely

different range of the spectrum. While fundamental analysis is concerned mainly

with the value of the company behind the stock, technical analysis looks more

at the price and volatility patterns of the stock rather than the company

behind it. Technical

11 Robert Hagstrom, The Warren Buffet Way( 103)

analysts are generally interested in the price movements of

the stock on the market. Essentially it studies supply and demand and by the

direction of the charts, technical analysis attempts to determine where the

stock will head. Technical analysis assumes that the price of the stock will

always reflect all the information about the company and the market that the

price moves in trends, and that price movements repeat.

Another main way that technical analysis differs from

fundamental analysis is the time horizon. Technical analysts will look at data

in months, weeks, days, hours and minutes in order predict future price

movements. They are often called swing traders because they do not hold on to a

stock for a very long time. Fundamental analysis however focuses on a time

frame of years, looking at num bers from financial statements of the past five

years in order to determine the value of the company. In addition, things like

management, brand recognition, and other qualitative factors that fundamental

investors look at can only be analyzed by looking at historical data from years

ago. The fundamental investor will hold on to a stock for a number of years,

because he or she believes that in the long run, the market will reflect the

intrinsic value of the stock.

Fundamental Analysis

Here, this paper will focus on fundamental analysis, or

analyzing the company behind the stock. When performing fundamental analysis,

there are two types of factors that comprise the fundamentals of any given

company. The first and the most obvious type that one might expect to look at

are the quantitative factors. These are capable of being measured and expressed

in numerical terms. Examples of these can be Assets, Liabilities, Revenues,

Expenses and many other factors found on the financial statements of a company

as well as on the internet. Qualitative factors, on the other hand, include

everything else. Things that cannot be measured such as the efficiency of

management, brand value, future outlook, patents, proprietary technology,

competition, and everything else about a company that cannot have a specific

number assigned to it. Qualitative factors are the largest reason why when two

different investors are given the same figures, they can come up with two

drastically different valuations of the company. These factors cannot be

measured, but comprise a large portion of the intrinsic value of the

company.

Qualitative Fundamental Factors

10k and 10q

Before discussing qualitative fundamental factors, it is

important to mention these annual reports of a company's performance that have

to be submitted either yearly (10k) or quarterly (10q) by publicly traded

companies to the SEC. The 10k usually contains company history, organizational

structure, and much other information not contained on the annual earnings

report. The 10q discusses the company's financial position and performance.

These can both be pulled up from the EDGAR database at

secinfo.org along with the annual

report and other SEC filings by companies12.

Company Level

Business Model

When Warren Buffet invests in a stock, he makes sure to treat

the investment as though he were buying the whole company.13 And

anyone buying a whole company would like to know its business model, and

understand it. The business model gives the answer to the most important

question - how does the company make money. It's possible to get a good

overview of the business model by looking at the company's website or checking

out the company's 10k filing (described below). In addition to looking over the

business model, it's necessary to understand it. Buffet talks about a circle of

competence, by which he means knowledge of a particular sector. He does not

invest in tech stocks not because he is afraid that they are too volatile, but

rather because they are out of his circle of competence - he does not

understand them. If an investor cannot understand a company's business plan, he

does not know what the drivers are for future growth, and investing in it could

be extremely risky.

12 Can be found at

secinfo.com

13 Robert Hagstrom, The Warren Buffet Way

Competitive Advantages

The competitive advantage of a company is also extremely

important. If the company does not differentiate itself from its competitors,

what is there to keep it in business? It can't get more market share, and

therefore is stifled in growth. Michael Porter, a Harvard Business School

Professor says that very few companies can compete successfully if they are

only doing the same things as their competitors. He argues that sustainable

competitive advantages can be obtained in several ways:

· Unique position in the market place

· Clear tradeoffs and choices vs. competitors

· Activities that are tailored to the company's strategy

A high level of integration across activities (The activity

system)

· A high degree of operational

effectiveness14

Signals of these factors can be seen in news reports, and also

the investor can get clues to these by looking at the financial statements

(discussed below).

Management

What good is a great business plan when the management is a

bunch of crooks, or they are stupid enough not to implement it correctly? Every

investor needs to know a lot about the management of the company. While

individual investors can't really get a face to face meeting with managers like

analysts that work for multi-million dollar funds can, it is possible for the

average investor to get a good feel for management in several different

ways.

Conference calls are hosted quarterly by the CEO and CFO of

the company. The first portion of the call is dedicated to reading off

financial results, but the really juicy part is the question and answer part.

This is where the line is open and different analysts can ask questions from

management. The answers here can be revealing, because analysts know what to

ask. But the more important part is how the management answers. Are they

answering like politicians or are they straightforward about their answers.

In addition, the Management and Discussion portion of the

annual report is where the management gets to be honest about the company's

outlook and is fully at management's discretion. A good thing is to look at

some annual reports from several years ago and compare them and see if the

management has followed up on what they have said and if the changes they

wanted to make have been implemented.

If the people who run the company have a material interest in

its success, they are more likely to work harder to make it succeed. The

investor should look for a large stake in the company to be owned by insiders.

It is especially crucial for small cap companies as management is crucial in

the success of the company, and the investor should look for management to be

invested in the company. In addition, it is worth noting that while insider

buys are worth looking, insider sells are worthless information, unless several

key executives are selling at the same time. The reason for this is that people

sell stock all the time to finance their child's education, make a down payment

on a house, or many other different reasons.

14 Michael E. Porter, Cynthia A. Montgomery, Strategy:

Seeking and Securing Competitive Advantage. (182)

Industry Level

Assessing the company in relation to its industry can help the

investor to obtain an understanding of different external factors affecting the

company and how in control the company is of those factors. Customers

Some companies only cater to a few customers, while others

serve millions. A big red flag comes up when a business relies on only a few

customers for a large portion of its sales simply because of the question, what

if they go away? For example, if a company has the government as its sole

customer, what will happen to the company when there is a policy change and the

government no longer requires the company's product?

Market Share

The market share of the company can tell the investor a lot

about the company itself. If the company possesses most of the market share,

the investor can judge the stability of the company in the industry. In

addition, companies that hold a large amount of market share have an economic

safety guard against competitors and because of economies of scale they are

capable of absorbing costs a lot better and still maintaining the lead.

Industry Growth

If the industry where the company operates has a bleak outlook,

how can the company grow? This factor needs to be carefully considered before

investing in any company.

Competition

Some companies have one or two competitors while others can have

hundreds. Companies with hundreds of competitors can have a harder playing

field compared to those with only one or two.

Regulation

Is the company's product regulated? For example in the

pharmaceutical industry, the FDA has to approve any drug before it reaches the

market. This can take years and billions of dollars. This needs to be

considered in the attractiveness of the investment.

Several Guidelines for Performing Fundamental Analysis / Looking

At Ratios

When performing fundamental analysis, it's important to keep

several things in mind regarding ratios and other numbers. The first and one of

the more important things is that ratios are best looked at as a long term

trend. Even though it's useful to compare a ratio to a universally accepted

standard, or the industry, a ratio compared over five or ten years can tell a

lot more about a company. In addition, as previously mentioned the validity of

some numbers found on the financial statements often needs to be questioned and

adjusted in order to get a clearer picture. It is the investor's job as a

detective to provide him or herself with a clear picture of the company he or

she is buying. Furthermore, it is important to look at a number of different

factors and ratios that reveal important facts about the company's risk and its

potential because there is no indicator that will tell everything. Fundamental

analysis becomes a valuable tool when the investor begins to review trends,

each developed from tests of different ratios. It is also important to

understand that goals need to be set by the investor for him or herself in

terms of ratios. For example with the P/E ratios the investor may want to make

a goal to sell when the ratio hits a certain point because at that point the

company is not worth holding or could go down.

Quantitative Fundamental Factors

In order to understand quantitative fundamental factors, it

is necessary to understand where they can be found. Most of these factors can

be found in a company's financial statements. However, at the first look, these

can be extremely intimidating due to the extremely large amount of different

numbers and definitions on each. The three most important financial statements

of a company are the income statement, balance sheet, and statement of cash

flows. These can be found in either the investors packet along with the annual

report and can be obtained by calling investors relations, or by simply looking

up the company in a financial website such as Google Finance and looking at

these electronically. Following is a brief description of each statement and

some of its most important sections.

Balance Sheet

The balance sheet is a representation of assets, liabilities

and equity of a company at any given point in time. All balance sheets, at the

beginning say «As Of DATE.» This is important to understand because a

balance sheet is a snapshot of the company's financial situation at that given

point in time. It does not track changes over periods of time, but is rather a

clear picture of one point in time in the day of the company's life. The

premise of the balance sheet is that well, it balances. The businesses

financial structure balances in the following manner:

Assets = Liabilities + Stockholders Equity

Figure 1 - Balance Sheet

Source: Stock Market Investor's Pocket Calculator (113)

Assets

The resources that business owns or controls at the time

specified on the balance sheet. These can range anywhere from the stapler on

the secretary's desks, to the trucks that transport machinery, to the computers

that the IT department manages, and the building where it's based to the liquid

cash that's available in a company's bank account. They are further broken down

into categories called current assets, long term assets, and other assets.

Current assets

They are either cash, or can be easily converted to cash

within the nearest 12 months. This section of the balance sheet contains three

very important items crucial to company analysis. These include cash,

inventories, and accounts receivable.

Cash

Generally, investors are attracted to companies with a large

amount of cash on their balance sheets, believing that cash offers protection

from hard times and the ability for a company to quickly take advantage of

emerging business opportunities. And a growing cash account over several