|

KIGALI INDEPENDENT UNIVERSITY

(ULK)

FACULTY OF ECONOMIC SCIENCES AND

MANAGEMENT

DEPARTMENT OF MANAGEMENT

P.O.BOX. 2280 KIGALI -

RWANDA

«MANAGING INFORMATION SYSTEMS

FOR A BETTER BANKING SERVICES»

The case study of FINABANK SA

Kigali main branch (2004-2008)

A dissertation submitted to the faculty of Economic

Sciences and Management in partial fulfillment of the academic requirements for

the award of a «Bachelor's» degree in Management.

By HABARUREMA Jean Damascene

Supervisor: Okoko OSAMBO

Kigali, November 2009

DEDICATION

To the Lord Almighty God;

To our beloved parents: Our Mother Leoncia MUGOYIKAZI and our

grand-Mother Pricilla

NYIRABEZA

To FARG: The Genocide Survivors Assistance Fund of Rwanda

To

our family;

To FINABANK Top Management;

To all of our friends and

Colleagues,

We dedicate the result of our scientific research.

ACKNOWLEDGEMENTS

This work would never come to the end without the assist of many

people. We are grateful to all who have contributed to the realization of this

scientific research.

May, our deepest appreciations goes to the Government of

Rwanda for their positive contemplation by creating fund as FARG is concerned;

if it couldn't be their efforts we could never enter ULK's gates. Also our

deepest thanks goes to our lovely Campus and his Excellency ULK president and

founder, Prof, Dr. RWIGAMBA Balinda for the advices he gave us for each and

every beginning of the academic year.

Our special thanks go to Mr. Okoko OSAMBO who supervised our

entire research work and gave our good academic advices, as well as allowed our

distressing his busy schedule to contact him anytime we needed his assistance

to complete this work.

Finally, our thanks goes to «group number one of year four,

Management, day session,» which we belonged, for provided us with moral

support.

May Almighty God bless all of you, in the name of Jesus

Christ!

DECLARATION

I, HABARUREMA Jean Damascene, declare that, except where

otherwise indicated, this document is entirely my own work and has never been

submitted in whole or in part to any other university.

Signature: Date:

ABSTRACT

The research study was on «Managing Information Systems

for better banking services». It looks a case study of FINABANK SA Kigali

main branch. The objectives were; to investigate upon the Management of

Information System within FINABANK SA and to know whether the Management

Information Systems contributes significantly to the better banking services of

FINABANK for the 2004-2008 time frames. The hypothesis stated as «FINABANK

SA manages effectively its Information Systems, means, in relation to the

scientific theoretical presented framework and that the Management Information

Systems contribute to the better banking services of FINABANK SA for the

2004-2008 time frame. The researcher used both the primary data by use of

structured interviews, and observation techniques and secondary data gotten

mainly from documentaries. Research findings revealed that FINABANK implements,

as it should, the Management Information Systems and its components

significantly contribute to the better banking services of FINABANK SA.

LIST OF ACRONYMS AND ABBREVIATIONS

ALCO : Assets & Liabilities Committee

ALU : Arithmetic and Logical Unit

ATM : Automatic Teller Machine

BACAR : Banque Continentale Africaine au Rwanda

CD : Compact Disk

CEO : Chief Executive Officer

CEO : Chief Executive Officer

CPU : Central Processing Unit

CRI : Crédits, Risques et Impayés

CRT : Cathode-Ray Tube

CSR : Corporate Social Responsibility

DVD : Digital Versatile Disc

EXCO : Executive Committee

FARG : Genocide Survivors Assistance Fund of Rwanda

FINA : Financial Institution for Africa

GUI : Graphical User Interface

HP : Hewlett Packard

HRD : Human Resource Department

IT : Information Technology

LAN : Local Area Network

LCD : Liquid Crystal Display

MIS : Management Information Systems

NBR : National Bank of Rwanda

NIC : Network Interface Card

PC : Personnel Computer

P.O. Box : Post Office Box

RAM : Random access memory

RDB : Rwanda Development Board

RDB : Rwanda Development Board

ROM : Read Only Memory

SAN : Storage Area Network

SME : Small and Medium Enterprise

LIST OF FIGURES

(Page N°-)

Figure-1: MIS Terminology 11

Figure-2: Dimension of Information 13

Figure 3: Management Information Systems (MIS) Components 16

Figure -4: Hardware components of a computer system. 17

Figure-5: Input devices 18

Figure-6: Output devices 20

Figure-7: Classification of the computer 22

Figure-8: Equinox Banking System 33

Figure-9: Equinox Banking System's interface 42

Figure-10: New credit declaration interface from CRI system:

44

Figure-11: New credit declaration interface from BNR system

software 45

Figure-12: Risk situation interface from CRI system Software:

45

Figure 13: Risk situation interface from BNR System software

46

Figure-14: Credit arrears report from BNR System software 46

Figure-15: Leasepac system software 47

Figure-16: Applicant information interface from LEASEPAC software

48

Figure-17: Debit interface of BNR System Software 49

Figure 18: Sequential and parallel process 52

Figure-19: A Storage Area Network (SAN). 53

Figure-20: Credit analysis procedure 55

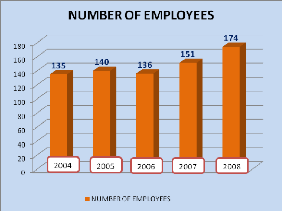

Figure-21: Employee mouvement situation into FINABANK 59

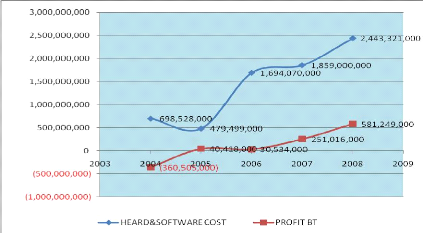

Figure-22: Impact of IT infrastructures to FINA performance 64

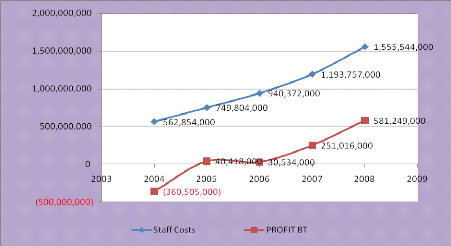

Figure-23: Impact of people to FINA performance 73

LIST OF TABLES

(Page N°-)

Table-1: Maslow's hierarchy of needs 27

Table-2: Equinox System hardware 32

Table-3: Video Surveillance Hardware 35

Table-4: Queue Management Hardware 37

Table 5: Communication Hardware 38

Table-6: Fire safety equipments 39

Table-7: General conclusion 76

TABLE OF CONTENTS Page N°

DEDICATION II

ACKNOWLEDGEMENTS III

DECLARATION IV

ABSTRACT V

LIST OF ACRONYMS AND ABBREVIATIONS VI

LIST OF FIGURES VIII

LIST OF TABLES IX

TABLE OF CONTENTS X

GENERAL INTRODUCTION 1

1. SCOPE OF THE STUDY 2

2. PROBLEM STATEMENT 3

3. HYPOTHESES 4

4. SIGNIFICANCE OF THE STUDY 1

5. OBJECTIVES OF THE STUDY 5

6. Research methodology 5

6.1. Techniques USED 5

6.2. METHODS USED 7

7. CHAPTERIZATION OF THE STUDY 9

CHAPTER 1 : THE LITERATURE REVIEW 10

1.1. INTRODUCTION 10

1.2. MEANING AND ROLE OF MIS IN THE ORGANIZATION 11

1.2.1. Management 11

1.2.2. Information .. 12

1.2.3. Systems 15

1.3. COMPONENTS OF MIS 15

1.3.1. HARDWARE 16

1.3.2. SOFTWARE 23

1.3.3. DATA 24

1.3.4. PROCEDURES 25

1.3.5. PEOPLE 25

CHAPTER 2: MANAGEMENT INFORMATION SYSTEMS IN FINABANK

28

2.1. PRESENTATION OF FINABANK 28

2.1.1. FINABANK-Rwanda Background 28

2.1.2. FINABANK Corporate Governance 29

2.1.3. FINABANK's Mission 30

2.1.4. FINABANK Social Responsibilities 30

2.3. THE «HARDWARE» COMPONENT OF THE FINABANK

INFORMATION SYSTEM 31

2.3.1. Equinox Banking Hardware 31

2.3.2. Video Surveillance Hardware 35

2.3.3. THE Queue Management Hardware 36

2.3.4. Network Communication hardware 37

2.3.5. Fire Safety Hardware 38

2.4. THE «SOFTWARE» COMPONENT OF THE FINABANK'S

INFORMATION SYSTEM 39

2.4.1. The FINABANK's System Software 40

2.4.2. FINABANK's Application Software 41

2.5. THE «DATA» COMPONENT OF THE FINABANK'S INFORMATION

SYSTEM 50

2.5.1. Introduction 50

2.5.2. The Database and Database Management System (DMS) in

FINABANK 51

2.5.3. FINABANK Data Processing 51

2.5.4. FINABANK's Data Storing 52

2.6. THE «PROCEDURES» COMPONENT OF FINABANK'S

INFORMATION SYSTEM 54

2.6.1. Account opening procedure 54

2.6.2. Employee recruitment procedure 54

2.6.3. Credit Analysis Procedure 55

2.6.4. Fire safety procedure 56

2.6. THE «PEOPLE» COMPONENT OF FINABANK'S INFORMATION

SYSTEM 56

2.6.1. Introduction 56

2.6.2. Being an Information-Literate Knowledge Worker 57

2.6.3. Being a Motivated Employee 58

2.7. CHAPTER 2: SUB CONCLUSION 60

CHAPTER 3: BENEFITS OF MANAGEMENT INFORMATION SYSTEMS

(MIS) TO FINABANK BETTER BANKING SERVICES 61

3.1. INTRODUCTION 61

3.2. BENEFITS OF «HARDWARE» TO FINA BETTER BANKING

SERVICES 61

3.2.1. Benefits of the Equinox Banking Hardware 61

3.2.2. Benefits of the Video Surveillance Hardware 62

3.2.3. Benefits of the Queue Management Hardware 62

3.2.4. Benefits of the Network Communication hardware 63

3.2.5. Benefits of the Access Control Hardware 63

3.2.6. Benefits of the Fire Safety Hardware 63

3.3. BENEFITS OF «SOFTWARE» FOR FINA BETTER BANKING

SERVICES 66

3.3.1. Benefits of the EQUINOX Banking Software 66

3.5. BENEFITS OF «DATA» FOR FINA BETTER BANKING

SERVICES 69

3.4. BENEFITS OF «PROCEDURES» FOR FINA BETTER BANKING

SERVICES 70

3.4.1. Benefits of the Account opening procedure 70

3.4.2. Benefits of Credit analysis procedure 71

3.4.3. Benefits of Employee recruitment procedure 71

3.4.4. Benefits of Fire safety procedure 71

3.5. BENEFITS OF «PEOPLE» FOR FINA BETTER BANKING

SERVICES 72

3.6. THE CHAPTER 3: SUB CONCLUSION 74

GENERAL CONCLUSION 75

OBSERVATIONS: 80

SUGGESTIONS: 81

BUBLIOGRAPHY 83

ANNEXURE

GENERAL INTRODUCTION

1. SIGNIFICANCE OF THE STUDY

According to LAUDON, K and LAUDON, JP, economies of different

countries are facing the third economic revolution. During the first

revolution, their economies have transformed themselves from an artisan one to

an agrarian powerhouse, capable of feeding large segments of the world

population. In the second revolution, they transformed themselves from an

agrarian society to an industrial power based society.

Now, in the third revolution, in progress, these countries are

transforming themselves into the knowledge and information based service

economy, called «the knowledge and information based service

economy»; an economy into which information, technology and systems take a

great importance.1

Today most people no longer work in farms or factories but

instead they are located in sales, deliveries, education, healthcare, banks,

insurance firms, law firms, etc.

The rhythm of these changes accelerates and continues, today

does not look like yesterday and tomorrow will be completely different. The

jobs will primarily involve working with information, managed by information

systems.2

This study has been chosen so as to investigate upon the

usefulness of Information Systems to the growth of FINABANK SA.

Richards M. stated that Management theory and practice have

undergone radical

changes in the past two decades; these changes will

inevitably continue and even

accelerate. It is no longer enough that

managers be skilled in a functional specialty such

1 LAUDON, K. and LAUDON, J.P. «Management

Information Systems: Organization and Technology,» Prentice-Hall of

India: New Delhi, 1999, p.6

2HAAG, 2nd

S., CUMMING, M. and DAWKINS, J. »Management Information

Systems for the Information Age,»: Edition, McGraw Hill/Irwin, Boston,

2000, p.14

as engineering or marketing and that they understand the

traditional functions of planning, organizing, and controlling.3

Something more is needed, the systems approach to management,

coupled with the ability to participate to the design and the utilization of

computer-based information systems. Indeed, the systems approach is the new

philosophy of managerial life. We are now in the «age of systems.

We are sure that this kind of research comes at right time and on

right place because it leads to following results:

-Provide a more up-to-date and integrated treatment of

organization and management, as well as emphasize the utilization of management

information systems to improve the art of managing banking institution.

-To get practicing managers and students of management to

«think systems».

This kind of research is not only interesting for those initiate

to computer system management but also for the computer specialist by improving

the utility of the systems.

2. SCOPE OF THE STUDY

The study is restricted to the usage of Management Information

Systems into banking institutions. It focuses on FINABANK SA as a case study,

within a period of 5 years (2004-2008), year 2004 because it is from that

period that owners of FINABANK SA have acquired BACAR (Banque Continentale

Africaine au Rwanda) and that bank became FINABANK SA of Rwanda and years 2008

with the reason that any kind of decision to be taken should be based upon

accurate information.

3 RICHARDS, B. «Inside Story: Intranets Foundation for

Early Electronic Commerce,» The Wall Street Journal: Technology, June

17, 1996, p. 23

3. PROBLEM STATEMENT

Increasing Interest upon Management Information Systems is not a

present issue.

In 1983, over 80% of colleges of business accredited by the

American Association of Collegiate Schools of Business offered a degree program

with major emphasis in information systems or planned to implement such program

within the next three years.

More than half of all employed Americans now earn their

livings as «knowledge workers,» exchanging various kinds of

information.

In 1982 alone, more than 100 companies sold almost 3 millions

of personal computers. Some 16,000 software programs are available for the

Apple Personal Computer.

These headlines are interesting and fairly descriptive of the

explosion in computer use during the recent past. But what does it means for

today's student of management and the practitioners?

It probably means that managers who do not have the ability to

use computers will become organizationally dysfunctional or worse, useless as

decision makers.4

Several years ago the consulting firm of BOOZ, ALLEN, and

HAMILTON conducted a comprehensive study surrounding computer usage and

concluded that the modern-generation equipment was being used for first

generation systems design.

At about the same time another respected consulting

organization, McKinsey & Company, concluded that «in terms of

technical achievement, the computer revolution in U.S. has been outrunning all

expectations. In terms of economic payroll on new applications, it has rapidly

lost momentum.»

4 LAUDON, K. and LAUDON, J.P. «Management

Information Systems: Organization and Technology,» Prentice-Hall of

India: New Delhi, 1999, p.6

These conclusions reflect the fact that for decades the focus

on computer use has been on the machine itself rather than on the vastly more

important dimension of application and software-the systems design

capability-the «brainware» if you like.

This trend towards the use of computer is backed by one

important tool, which is: an Information System, managing information output by

the computer, briefly, managing largely the computer input and output.

It is exactly the same into this nation; the issue of

information system is on the mind of several managers, even if some of them do

ignore its contribution on the performance of their companies.

Two questions do therefore arise out of the above:

1. How does FINABANK SA manage its Information Systems?

2. Does FINABANK's Information Systems contribute to its better

banking services?

3. HYPOTHESES

As it has been defined by GRAWITZ, hypothesis is a proposal

response to an asked question related to the research object. Base on this we

suggest the following:5

1) FINABANK SA manages effectively its Information Systems,

means, in relation to the scientific theoretical presented framework.

2) FINABANK SA's Information System contributes to its better

banking services.

5 3rd

GRAWITZ, M. « Introduction to research

methodology,» Edition, Wadsworth, Belmont, CA, 1994, p.12

4. OBJECTIVES OF THE STUDY

This study is targeting mainly two following objectives:

1. To investigate the Management of Information Systems within

FINABANK SA, for the 2004-2008 time frame.

2. To analyze upon the contribution of Information Systems upon

FINABANK's better banking services for the 2004-2008 time frame.

6. RESEARCH METHODOLOGY 6.1. Techniques used

According to HEFFERMAN LINCOLN says that book and other

sources used in research may be classified as primary or secondary. In this

study, the researcher used both primary and secondary sources of data in

relation with this topic.6

6.1.1. Primary source of data

According to HEFFERMAN and LINCOLN, primary source is any

first hand account of an experience or discovery. They go on stating that

writings of this kind generally give firsthand information about a topic.

BAIRLEY asserts that the primary data are eyewitness accounts written by people

who experienced a particular event or behavior. He also says that primary

documents include any origin document, which is not based or delivery from

other documents.7

6 HEFFERNAN, L. «Research

methodology,» Addison-Wesley, Cambridge, MA, 1982, p.428

7 2nd

BAIRLEY, M. « Research methodology, the basics,»

Edition, HarperCollins, New York, 1987, p.28

Three techniques were used to get primary data used in this

study: These are interview, observation techniques and questionnaire.

6.1.1.1. Structured Interview Technique

The structures interview is an oriented and face to face

conversation between an interviewer and a respondent which is conducted for the

purpose of obtaining information on an issue. This technique is helpful only

when if is flexible to use. It is appropriate to studying respondent's

attitudes, values, beliefs and motives.8

In this research the interview was conducted face to face

between me and respondents, mainly heads of some departments (Information

Technology, Finance and Human Resources and Management Information Systems) of

FINABANK SA.

6.1.1.2. Observation Technique

Observation involves data collection and other senses of human

being based on nonverbal behaviors in a research.

The Observation technique used to help the researcher to make a

follower-up upon the customer care in FINABANK SA within the period of

internship.

6.1.2. Secondary source of data

BRENDA SPATT explains that the secondary source can be any

commentary written

both after and about the primary source. In the present

study, to get data of the style

8 HELMUST, S. «Techniques de

recherché, » HOTELS, Octobre, 1990, p.35

from books, internet web site, annual reports, financial

statements and other official documents, different techniques have been

used:9

6.1.2.1. Documentary technique

This technique have been used to search written documents related

the Management Information System.

6.2. METHODS USED

For a better analysis and synthesis of several data collected,

the researcher has used the following methods: Quantitative, Historical,

Analytical, Comparative and Synthesis.

6.2.1. Quantitative methods

Quantitative methods are used in analysis and presentation of

data. In the present study, data analysis and presentation were conducted using

tables and figures. The statistical regression analysis enables the researcher

to determine the relationship between MIS components and the performance of

FINABANK SA using the coefficient of correlation analysis.

9 BRENDA, S., «Introduction on Scientific

Research,» New Delhi, 1991, p.307

6.2.2. Historical Method

According to GRAWITZ M, «historical method fills the gap of

facts and events, referring on time, can be artificially reconstructed, but

ensuring continuity, trams of procedures.»

In this dissertation study, the present method has enabled the

researcher to execute a back-analysis for the performance of the service into

FINABANK SA.10

6.2.3. Analytical method

The analytical method has been used to analyze systematically all

data collected during this research.

6.2.4. Comparative method

According to GRAWITZ M, «comparative helps a good analysis

of data by providing differences and cooperation, of constant elements of the

same type».

This method was useful to assess changes in management of

information system in one side and change into quality of service provided by

FINABANK during the range of 2004 up to 2008, in other way of thinking.

6.2.5. Synthetically method

The synthetically method has been used to summarize entire work

into interesting conclusion and to make a short summary at the end of each

chapter.

10 3rd

GRAWITZ, M. « Introduction to research

methodology,» Edition, Wadsworth, Belmont, CA, 1994, p.157

7. CHAPTERIZATION OF THE STUDY

Apart from general introduction and general conclusion, the

dissertation is made up three chapters as follows:

Chapter one is concerned by the literature review and shows

exactly the Meaning and Role of Management Information Systems in

organization.

The second chapter is related to implementation of

«Management Information Systems» into FINABANK SA.

And the third chapter is concerned about the contribution of

Management Information Systems to the better banking service of FINABANK SA.

CHAPTER 1: THE LITERATURE REVIEW

1.1. INTRODUCTION

Despite the fact that the computer is nothing more than a tool

for processing data, many managers view it as the central element in

information system. This attitude tends to overrate and distort the role of the

computer. Its real role is to provide information for decision and for planning

and controlling operations.

Judging from the business press, the brave new world of

management information systems (MIS) is upon the book written by Stephen Haag

in his book with title «MIS for Information Age».11

There is hardly a business magazine today that does not

contain articles on Information systems, data banks, and related subjects.

Despite this proliferation of books, articles, seminars, and courses

surrounding this area, few efforts have managed to synthesize the separate

subject of management, information, and systems and to show how these are

related to computers. Among these few efforts we can highlight the book written

by ROBERT G. MURDICK, Joel E. ROSS and JAMES R. with the title: Information

Systems for Modern Management.12

It's in the same context that we are going, within this

chapter, to define essential concepts in relation with our topic and clarify

what «Management Information Systems» (MIS) is; mainly based on its

five components which are: hardware, software, information, people and

procedures.

This chapter made the part of this study to show the exact

meaning and role of MIS as well as to define key concepts related to this

topic.

11HAAG, 2nd

S., CUMMING, M. and DAWKINS, J. «Management Information

Systems for the Information Age,» Edition, McGraw Hill/Irwin, Boston,

2000, p.4

12MURDICK 2nd

G, JOEL E. «Ross and James R: Information Systems for

Modern Management,» Edition, McGraw Hill

2006, p.14

1.2. MEANING AND ROLE OF MIS IN THE ORGANIZATION

«Management Information Systems,» as the stamina of

our study, could be number one to be clarified but before one can explain it,

the terms systems, information, and management must briefly be defined.

Thus,13

Figure 1: MIS Terminology

M-I-S

Source: MURDICK, G, (2006-26)

Management

Information

Systems

1.2.1. Management

Management has been defined in a variety of ways, but for our

purposes it comprises the process or activities that describe what managers do

in the operation of their organization: plan, organize, initiate, and control

operations. One plans by setting strategies and goals and selecting the best

course of action to achieve the plan. He/she organizes the tasks necessary for

the operational plan, set these tasks up into homogeneous groups, and assigns

authority delegation.

Management is usually defined as planning, organizing,

directing, and controlling the

business operation. This definition, which

evolved from the work of HENRI FAYOL in the

early 1900s, defines what a

manager does, but it is probably more appropriate to define

13 2nd

MURDICK G., JOEL E. ROSS and JAMES R. «Information

Systems for Modern Management,» Edition, McGraw

Hill 2006,p.26

what management is rather than what management does.

Management is the process of allocating an organization's inputs, including

human and economic resources, by planning, organizing, directing, and

controlling for the purpose of producing goods or services desired by customers

so that organizational objectives are accomplished. If management has knowledge

of the planning, organizing, directing, and controlling of the business, its

decisions can be made on the basis of facts, and decisions are more accurate

and timely as a result.

They control the performance of the work by setting

performance standards and avoiding deviation from standards.

Because decision making is such a fundamental prerequisite to

each of the foregoing process, the job of Management Information Systems

becomes that of facilitating decisions necessary for planning, organizing, and

controlling the work and functions of the business.

1.2.2. Information

Information consists of data that have been retrieved,

processed or other ways used for informative or inference purposes, argument,

or as a basis for forecasting or decision making. An example here would also be

any one of the supporting documents already mentioned, but in this case data

could be used by internal auditor, or internal management service department of

an external auditor, or internal management for profit planning and control or

for other decision-making purposes.14

14 BAXTER, ANDREW, «Smart Response to a

Changing Market», Financial Times, March 1, 1995, p. 13.

1.2.2.1. Dimensions of Information

As a knowledge worker this issue of information value is an

important one. Because he/she works with and produces information as a product,

information is one of his/her most valuable resources. So, how to determine the

value of information? What makes certain information highly valuable and other

information completely worthless? Unfortunately, it's impossible to put an

exact dollar figure on the value of information. But what one can do, is

defining his needs according to three dimensions of information-time, content,

and form presented as follows15:

Figure 2: Dimension of Information

Source: LAUDON, K. (1999, pp.67)

Timeliness

(When)

Time (When)

(free errors)

Accuracy

(up-to-date)

Currency

Content (What)

Relevance

Dimensions of

Information

(Useful)

(more details)

Detail

(Detailed relatively)

Completeness

Form (How)

(appropriate form)

Presentation

15 LAUDON, K. and LAUDON, J.P. «Management

Information Systems,» Prentice-Hall of India: New Delhi, 1999,

pp.67

- The Time Dimension of Information

Whether you're providing your customers with information about

products and services or using information to make a decision, the time

dimension of information is critical. The time dimension of information deals

with the «when» of information aspect. Time characteristics of

information include:

Timeliness: Information when you need it

Currency: Information that is up to date

Timeliness means having Information when you need it. If you

don't have the right information at the right time, it's almost impossible to

make the right decision.

Currency means having the most recent or up-to-date

information. In today's fast-paced business environment, yesterday's

information is often obsolete and of no use to a knowledge worker.

- The Content Dimension of Information

«Content» is often considered as the most critical

dimension of information. It deals with the «what» aspect of

information, and its characteristics include

Accuracy: Information free of errors

Relevance: Information useful to what you're

trying to do

Completeness: Information that completely

details what you want to know. - The Form Dimension of

Information

The last dimension of information is the «form», which

deals with the «how» aspect of information. Form of information

include

Detail: Information detailed to the appropriate

level

Presentation: The information that is provided

in the most appropriate form-narrative, graphics, color, print, video, sound,

and so on.

1.2.3. Systems

A system can be defined as a set of elements joined together,

interrelated, for a common objective. A subsystem is a part of a large system

with which we are concerned. All systems are part of large systems. For our

purposes the organization is the system, and the parts (divisions, departments,

functions, units, etc.) are the sub systems.

The systems concept of MIS is therefore one of optimizing the

output of organization by connecting the operating subsystems through the

medium of information exchanges.16

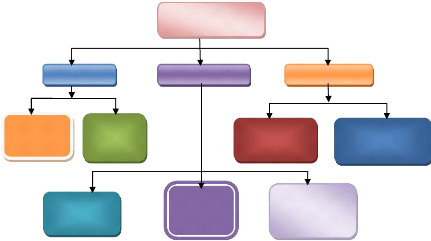

1.3. COMPONENTS OF MIS

As it has been defined by LOOIJEN, M, Management Information

Systems (MIS) is all hardware with the relevant basic software and application

software, dataset and people involved into producing information for the

purpose of right decision making.» 17

16 SPROUT, A., «The Internet inside Your

Company,» Fortune, November 27, 1995, pp.161-162

17 2nd

MURDICK G, JOEL E. «Ross and James R: Information Systems

for Modern Management,» Edition, McGraw

Hill 2006, p.14

In other words, MIS is a set of five following components:

Hardware, Software, Data, Procedures and People necessary to produce

information, useful for decision making. This can be presented into the follow

drawing:

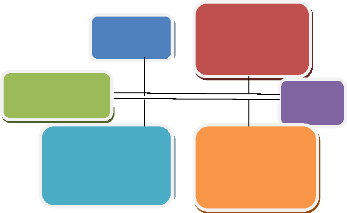

Figure 3: Management Information Systems (MIS)

Components

INFORMATION

DECISION

MAKING

Source: MURDICK, G. (2006, 16)

1.3.1. HARDWARE

1.3.1.1. Definition of the hardware

Hardware is the mechanical and electronic parts that

constitute a computer system, as distinguished from the computer programs

(Software) that drive the system. The main hardware elements are the Central

Processing Unit, Disk or magnetic tape data storage devices, Cathode-Ray Tube

display terminals, keyboards, and Printers.18

18 STEWART, THOMAS, «What Information

Costs,» Fortune, July 10, 1995, pp.86

1.3.1.2. Computer Hardware

A computer is a machine that can be programmed to accept data

(input), process it into useful information (output), and store it away (in

secondary storage devise) for safekeeping or later reuse. Equipment associated

to that computer is called hardware and consist of the central processing unit,

primary storage, secondary storage, input devices, output devices, and

communications devices.

Figure 4: Hardware components of a computer

system.19

Source: HAAG, S. (2000, p121)

Central

Processing Unit (CPU)

Input devices:

· Keyboard

· Computer mouse

· Touch screen

· Source data

Communications

Devices

Secondary storage:

Output devices:

· Magnetic disk

· Optical disk

· Magnetical tape

· Printers

· Video display

terminals

· Plotters

Storage

Primary

- Central Processing Unit (CPU)

The CPU is at the heart of all computers. All data passes through

it.

The CPU is the computing part of the computer. Also called the

processor, it is made up of the control unit and ALU. Today, the CPUs of almost

all computers are contained on a single chip. The CPU, clock and main memory

make up a computer.

19 HAAG, S. « Information Technology:

Tomorrow's Advantage Today,» McGraw-Hill, New York, 1996, p37

Micro, or personal, computers use microprocessors that run at

approximately 500 megahertz per second. Mainframe computers measure their speed

in millions of instructions per second.

- Random Access Memory

Random access memory (RAM) consists of microchips that allow

for the temporary storage of data. RAM functions as the workspace for the CPU.

The "workspace" temporarily holds the program and the active calculation before

deriving an outcome. One example would be using a word processor's spelling

check tool on a document. The words being checked and the program would be

temporarily stored in RAM.

- Input Devices

Computers receive information from a variety of sources. The

most common input device is a keyboard, but the pointing device (mouse or

trackball) is equally important with today's GUI interface. Other input devices

include video cameras, scanners, microphones, digital cameras, CD-ROMs, and

voice commands that operate the computer.

Figure 5: Input devices

Sources: STEWART, T. (1995, pp.125)

- Output Devices

The computer monitor is an output device that is changing

rapidly. For several decades computer screens only displayed letters or numbers

onto a green or amber screen. As computers began using GUIs, the display device

took on greater significance. The success of Apple's Macintosh computer with

the graphical user interface caused Microsoft to come out with their GUI,

called the Windows Operating System. Thus, all current operating systems use

GUI and color for both print and images.

The standard monitor for many years has been a cathode-ray

tube (CRT). CRT monitors are still very common, and they are capable of

high-quality pictures. However, they are inherently bulky and relatively heavy.

Portable computers became possible only when smaller and lighter-weight and

display units became available. Current portable or laptop computers use LCD

(liquid crystal display) panels, which are flat. LCD panels are now also being

used for desktop monitors. LCD units cost about three times what comparable CRT

units do, but they occupy far less space and have a very bright picture.

Computer projectors are commonly used to display data or

information onto a large screen. This setup can be used to demonstrate

programs, provide visuals for training, or show Web sites to large groups of

people. Many businesspeople travel with both a portable computer and a computer

projector to visually display information for training or to aid in sales.

The GUI and the general popularity of computers have caused

significant changes in the hardware available for printing. The earliest

printers were essentially automatic typewriters and had little flexibility.

Today, there are wide variety of printers currently available that are capable

of nearly professional-quality output.

Laser printers, which first became available in the early

1980s, had an inherent

advantage over earlier computer printers; that is,

the laser beam could place tiny ink dots

anywhere on the page. In practice,

this means that laser printers can print fonts of any

size or typeface. Further, they can print text in any

direction and also print pictures. Current laser printers print at a very crisp

1200 dots per square inch and are considered to be very reliable. Color laser

printers are also available, though they are much slower and also more

expensive than black-and-white printers.

Ink-jet printers essentially spray ink onto the paper. They

are normally very quiet, are relatively inexpensive, and have high-quality

output. Further, all the newest ink-jet printers offer reasonably high-quality

color printing. Both the in creased use of the Internet to download color

pictures and the prevalence of digital cameras have significantly increased the

popularity of color ink-jet printers.

Figure 6: Output devices

Source: STEWART, T. (1995, pp.129)

- Connection Devices

Partially because of the popularity of the Internet, more and

more computers of all kinds have some means of connecting to other computers.

For desktop computers in schools and businesses, a network interface card (NIC)

is frequently used. Portable computers and home desktop units typically use a

modem as a connection device. Modems connect a personal or portable computer to

dial-up networks through a regular telephone line. This connectivity has served

as a boon to telecommuting and changed the way work is

performed in organizations. Modems and NICs can serve as both

input and output devices, depending on whether the computer is receiving or

sending information.

- Sound Cards and Speakers

Today, any multi-media computer contains a device to reproduce

sound. Typically this means that computers have a sound card that contains a

mini-amplifier and connects to speakers. Sounds can also come from programs,

from the Internet, and from participants in desktop teleconferences. A sound

card can also function as an input device when it utilizes a microphone.

- Storage Devices

The number and size of storage devices are increasing. Floppy

disks are portable, but they can store only a relatively small amount of

information compared to the newest storage units, Zip disks, which are also

portable and small. A Zip disk has about a hundred times the storage capacity

of a floppy disk. Hard drives are internal storage devices that hold the

computer's operating system, the application software, and other

files.20

1.3.1.3. Classifications and Definitions of

Computers

There are three main classifications of computers: mainframe,

minicomputer, and microcomputer. The major categories can only be used as

general guidelines because of the huge variety in product lines. Computer

"servers" have also been included in this discussion because of their important

role in networking and Internet applications.

A mainframe computer is any large computer system, such as that

used by the Internal

Revenue Service. Another typical use of a mainframe

computer would be for an airline

20 STEWART, T. «What Information

Costs,» Fortune, July 10, 1995, pp.119-121

ticketing system, which can have thousands of users connected

to one computer. The next smaller-sized computer is termed a minicomputer. It

is of medium scale and can serve up to several hundred users. The microcomputer

is the smallest in size and power, and the term is "generally synonymous with

personal computer, such as a Windows PC or Macintosh, but it can refer to any

kind of small computer". Very small computers include hand-held units and pen

computers that store information the user enters with a stylus rather than a

key board.

A "server" computer is one that is used to connect a cluster

of personal computers through using a local area network (LAN). World Wide Web

pages are also stored on a "Webserver," which is typically a dedicated personal

computer.

Figure 7: Classification of the computer

(1) (2) (3) (3)

Mainframe (1) Mini computer (2) (3) Desktop & Laptop PCs

Source: HAAG, S. (2000, p57)

1.3.1.4. PC technical measurement capacities

Scientists give us the following technical characteristics of a

Personnel Computer according MIS discipline's norms:

- The speed of data processing: more or equal to 1GHZ - The

local disc storing capacity: more or equal to 10GB - The temporally Memory

(essentially RAM): more or equal to 100MB

1.3.2. SOFTWARE

The software is the set of instructions that cause a computer

to perform one or more tasks. The set of instructions is often called a program

or, if the set is particularly large and complex, a system. Computers cannot do

any useful work without instructions from software; thus a combination of

software and hardware (the computer) is necessary to do any computerized work.

A program must tell the computer each of a set of minuscule tasks to perform,

in a framework of logic, such that the computer knows exactly what to do and

when to do it.

There are two major types of software: system software and

application software. Each kind performs a different function.

1.3.2.1. The System Software

System software is a set of generalized programs that manage the

computer's resources, such as the central processor, communications links, and

peripheral devices.

1.3.2.2. The Application Software

Application software describes programs that are written for

or by users to apply the computer to a specific task. Software for processing

an order or generating a mailing list is application software.21

21 LAUDON, K. and LAUDON, J.P. : Management

Information Systems, Prentice-Hall of India: New Delhi, 1999, pp.127

1.3.3. DATA 1.3.3.1. Definition

Data must be distinguished from information (as defined

before), and this distinction is clear and important for our purposes. Data are

facts and figures that are not currently being used in a decision process and

usually take the form of historical records that are recorded and filed without

immediate intent to retrieve for decision making. An example would be any one

of the supporting documents, ledgers, and so on that comprises the source

material of profit and loss statements. Such material would only be of

historical interest to an external auditor.

1.3.3.2. Database

The term «database» is perhaps one of the most

overused and misunderstood terms in today's business environment. Many of

people will tell you that they have a database, in fact, have only files.

Others simply refer to a gathering of information as a file. In reality, many

of these files are probably databases. Consider these definitions of a

database:

Collection of data organized to serve many applications

Collection of related files

Integrated collection of computer data

Collection of files

Superset of related files

This is why it's easy to misunderstand the database concept.

Each definition refers to a database as a «collection,» but describes

the collection differently. Let's adopt the following definition of a

database:

A database is a collection of information that you organize and

access according to logical structure of that information.

1.3.4. PROCEDURES

A procedure is a specified series of actions or operations

which have to be executed in the same manner in order to always obtain the same

result under the same circumstances. Less precisely speaking, this word can

indicate a sequence of activities, tasks, steps, decisions, calculations and

processes, that when undertaken in the sequence laid down produces the

described result, product or outcome. A procedure usually induces a change. It

is in the scientific method.»22 Procedures can differ from one

organization to other; it depends on the industry in which the firm

operates.

1.3.5. PEOPLE

1.3.5.1. Meaning of people in the

organization

It's true that any individual who works in Human Resources

must be a "people person." Since anyone in this department deals with a number

of employees, as well as outside individuals, on any given day, a pleasant

demeanor is a must.

None can talk about employee in organization and forgets to

talk upon motivation because in today's turbulent, often chaotic, environment,

commercial success depends on employees using their full talents. Yet in spite

of the countless of available theories and practices, managers often view

motivation as something of a mystery. In part this is because individuals are

motivated by different things and in different ways.23

In addition, these are times when delivering and flattening of

hierarchies can create insecurity and lower staff morale. Moreover, more staff

than ever before are working part time or on limited-term contracts, and these

employees is often especially hard to motivate.

22 KEOHAN, M. «The Virtual Office: Impact and

Implementation,» Business week, September 11, 1995, pp.95-98

23 BARLEY, D., «Groupware and Your

Health,» Health Management Technology, Forbes, September 1995,

pp.20-22

1.3.5.2. Advantages of Employee Motivation

A positive motivation philosophy and practice should improve

productivity, quality, and service. Motivation helps people:

· achieve goals;

· gain a positive perspective;

· create the power to change;

· build self-esteem and capability,

· manage their own development and help others with

theirs.

Among various behavioral theories long generally believed and

embraced by businesses are that of Abraham MASLOW.

MASLOW, a behavioral scientist and contemporary of HERZBERG's,

developed a theory about the rank and satisfaction of various human needs and

how people pursue these needs.

1.3.5.3. MASLOW's hierarchy of needs as the employee

motivation tool

In 1954, MASLOW first published Motivation and Personality,

which introduced his theory about how people satisfy various personal needs in

the context of their work. He postulated, based on his observations as a

humanistic psychologist, that there is a general pattern of needs recognition

and satisfaction that people follow in generally the same sequence. He also

theorized that a person could not recognize or pursue the next higher need in

the hierarchy until her or his currently recognized need was substantially or

completely satisfied, a concept called prepotency. MASLOW's hierarchy of needs

is shown in table-1. It is often illustrated as a pyramid with the survival

need at the broad-based bottom and the self-actualization need at the narrow

top. 24

24 STODGILY, R. «One Company, Two

Cultures,» Business Week, January 22, 2004, p.68

Table 1: Maslow's hierarchy of needs

|

Level

|

Type of Need

|

Examples

|

|

1

|

Physiological

|

Thirst, sex, hunger

|

|

2

|

Safety

|

Security, stability, protection

|

|

3

|

Love and

Belongingness

|

To escape loneliness, love and be loved,

and gain a sense of

belonging

|

|

4

|

Esteem

|

Self-respect, the respect others

|

|

5

|

Self-actualization

|

To fulfill one's potentialities

|

Source: STODGILY (2004, 24)

On basis of various literatures about motivation, individuals

often have problems consistently articulating what they want from a job.

Therefore, employers have ignored what individual say that they want, instead

telling employees what they want, based on what managers believe most people

want under the circumstances. Frequently, these decisions have been based on

MASLOW's needs hierarchy. As a person advances through an organization, his

employer supplies or provides opportunities to satisfy needs higher on MASLOW's

pyramid.

CHAPTER 2 MANAGEMENT INFORMATION SYSTEMS IN

FINABANK

The present chapter has the objective of investigating upon

the Management of Information Systems within FINABANK SA, for the 2004-2008

time frames. Referring to the simplest definition of Management Information

Systems brought out by LOOIJEN (located in the first chapter), this analysis is

based on five MIS components (Hardware, Software, Data, Procedures and People).

Prior we do that, let's first present briefly the organization on which the

study has been curried out:

2.1. PRESENTATION OF FINABANK 2.1.1. FINABANK-Rwanda

Background

In 2004, FINABANK acquired a formerly insolvent

privately-owned commercial bank known as BACAR, transforming it into a major

commercial bank. The bank which had obtained a full banking license in 1983 and

was one of the first privately owned banks formed in the country had been under

central bank supervision due to managerial issues. Following extensive

renovations, the bank was formally launched in 2008 with the redesign and

renovation of the new Head Office along with the formation of the new SME

department.

The bank's principal activities comprise corporate banking,

international trade financing and retail banking financial services and

products to corporate and established medium and small businesses as well as

salaried workers.

The bank has revamped all its operations and seeks to become a

leader in small and medium business banking. FINABANK was the first Kenyan bank

to venture into the Rwandan market and its entry into the market is part of an

ambitious expansion plan that seeks to see it becomes the regional SME bank of

choice through its excellent customer service, cross-border products and modern

look branches countrywide. Since its entry

into the Rwandan market, FINABANK has come to be regarded as a

leader among its peers. 25

2.1.2. FINABANK Corporate Governance

The Bank pursues policies and strategies aimed at entrenching

sound corporate governance practices. In doing this, the Bank benchmarks itself

with best practice as per statute, prudential requirements and world class

practice.

The Board of Directors is responsible for the governance of

the Bank. To discharge its mandate effectively, the bank delegates its

authority to Board Committees which meet quarterly or on ad hoc basis whenever

need arises. The authority for the day to day running of the Bank is delegated

to the Managing Director.

Currently, the Bank has four Board Committees, namely Board

Risk Management, Board Audit, Board Credit and Board Assets and Liabilities

(ALCO). All these committees operate as per the provisions of the country's

Prudential Guidelines. In line with the Corporate Governance requirements under

the Prudential Guidelines the Bank has ensured compliance in the following

ways:

1. The Bank has an effective independent Risk and Compliance

function that monitors risk and assesses compliance.

2. The Board holds quarterly Board meetings during the financial

year.

3. Board Committees are also held quarterly.

4. In addition senior management Committees, which include

EXCO, meet on a monthly basis to evaluate business and operational performances

in line with the banks strategy focus.

25 FINABANK, «Annual Report,» Kigali,

2006, p.2

5. With the Board and Directors Charters in place, the Board

conducts an annual Board Evaluation and Directors Peer Evaluation.

The Board also ensures that effective communication with the

stakeholders is upheld. This is done through holding of AGM with full

compliance of the requirements of the Companies Act and provision of annual

Report and financial statements. Considering, ones financial services are

provided to; FINABANK produces financial products into four

categories.26

2.1.3. FINABANK's Mission

«To be recognized as the leading SME bank that encourages

entrepreneurship, with a reputation for providing a proactive and personalized

service while practicing the highest standards of integrity in all that we

do.»27

2.1.4. FINABANK Social Responsibilities

Corporate Social Responsibility (CSR) has over the years been

embraced by organizations that seek to make a difference in the community they

serve. CSR is important as it enhances a good relationship between the

organization, its clients and the community. Through CSR, the organization

continues to communicate that it is interested in the needs of its clients and

the community they serve. FINABANK is committed to growing the face of its CSR

programs through its continued focus on partnering with others to meet the real

needs of the society rather than the perceived needs. In addition to supporting

children and health programs, we also seek to give back directly to our clients

through free business workshops for our Small and Medium Enterprises (SME)

clients in addition to sponsorship of various activities that influence the

community.

26 FINABANK, «Annual Report,» Kigali,

2006, p. 2

27 Idem, p.3

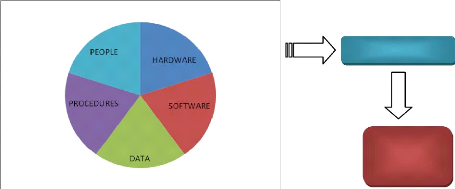

2.3. THE «HARDWARE» COMPONENT OF THE FINABANK

INFORMATION SYSTEM

Within FINABANK, hardware is composed by all tangible

machinery allows the bank: capturing, conveying, creating, treating, cradling,

storing and communicating information to internal as well as external users.

As particularity of FINABANK, this one has many subsystems

under Management information systems and all putted together enable this bank

to provide services of quality to its clients at right time. Among these

subsystems we can say: EQUINOX Banking System, Video Surveillance System, Queue

Management System, Network Communication System, Hard Communication System,

Wireless Access System and Fire Safety System and each system requires its own

and specific hardware.

2.3.1. Equinox Banking Hardware

EQUINOX is the Banking System currently used by FINABANK to

handle all problems related to the daily banking activity. Computer provides

the underlying physical foundation for the FINABANK's IT infrastructure means

that it is the principal hardware tool used by this system.

The following table indicates the situation of current hardware

used by EQUINOX Banking System within FINABANK:

Table2: Equinox System hardware

|

No

|

Description

|

Quantity

|

Brand name

|

|

1

|

File Servers

|

6

|

HP

|

|

2

|

Database Servers

|

3

|

DELL

|

|

3

|

PCs Client Workstations

|

120

|

HP & DELL

Optimplex 320

|

|

4

|

Laptops

|

54

|

HP & DELL Presario

|

|

4

|

Printers

|

42

|

Ecosys FS1030D

|

|

5

|

Copy Machine

|

30

|

KYOCERA KM1650

|

|

6

|

ATM

|

2

|

DIEBOLD

|

|

7

|

Counter Machine

|

40

|

CASIO

|

|

8

|

Check verifier

|

5

|

-

|

|

9

|

Bar Code Leader

|

1

|

SIMBOL

|

|

10

|

Scanners

|

20

|

HP Scan jet G2710

|

|

11

|

Check certifier

|

5

|

NSI

|

|

12

|

Generator

|

1

|

SDMO

|

Source: Primary Data (2008)

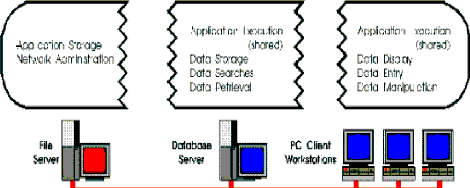

Client/Server

Client/Server computing systems is the architecture of choice for

helping organizations control costs and remain competitive in the ever-

changing global economy.

Client/Server allows an organization to store data centrally,

but share processing between the server and PC client workstations so that they

can run many applications and process work simultaneously.28

28 FINABANK, «Equinox Banking System: The back

Office Processing,» Kigali, 2008, pp.2

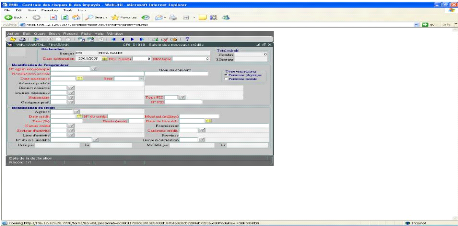

Figure 8: Equinox Banking System

Source:

FINABANK: Equinox Banking System manual, 2008

As seen from the illustration above, there are three basic

hardware components that work together in the Client/Server environment in

FINABANK:29

· Six File Servers

· One with other two Database Servers backups.

· One hundred and twenty PCs Client Workstations.

2.3.1.1. File Server

A file server is a computer attached to a network that has the

primary purpose of providing a location for the shared storage of computer

files (such as documents, sound files, photographs, movies, images, databases,

etc.) that can be accessed by the workstations that are attached to the

computer network. The term server highlights the role of the

29 Idem 2008, pp3

machine in the client-server scheme, where the clients are the

workstations using the storage. A file server is usually not performing any

calculations, and does not run any programs on behalf of the clients. It is

designed primarily to enable the rapid storage and retrieval of data where the

heavy computation is provided by the workstations.

The File Server houses the applications and handles network

administration. The Equinox Banking System application software is stored on

the file server. Additionally, the file server directs the paths on which

message requests travel. For example, if a teller requests an

account balance, the message requesting the balance goes from the PC Client

Workstation, through the File Server, then to the Database Server. In response,

the Database Server finds the balance, sends it back through the File Server to

the PC Client Workstation.

2.3.1.2. Database Server

The Database Server houses the files and records of bank

products, services and customers. It shares application processing with the PC

Client Workstations. It performs database searches and retrieves customer

information and/or files. Additionally, the Database Server stores the code

that executes the nightly update processing tasks when instructed by the

Nightly Processing module.

2.3.1.3. PC Client Workstations

The PC Client Workstations are used for shared application

execution with the Database Server and also serves as a display to view the

information and is also a data entry and manipulation point. 120 PCs used by

FINABANK's Management Information System, present the following technical

capacities: 1.80GHZ possessing capacity of CPU, 0.98GB of RAM and 150GB of

Local Disc capacity storing.

2.3.2. Video Surveillance Hardware

FINABANK, considered as a big company, takes seriously the

issue of security. Once you observe carefully into corners of FINABANK's

building, one can difficultly notice that there are small and small cameras

deployed any where capturing images and conveying them through appropriate

cables up to the wide video surveillance screen as well as storing that serous

information in database server for the future use. The following is hardware

used by FINABANK Video Surveillance System:

Table3: Video Surveillance Hardware

|

No

|

Description

|

Quantity

|

Brand name

|

Technical

Capacities

|

|

1

|

Camera

|

15

|

SOME

|

90 days

|

|

2

|

Screen Monitor

|

1

|

IRIS

|

16 channels

|

|

3

|

Cables

|

-

|

CAT6

|

-

|

|

4

|

Disc Video Recorder

|

1

|

IRS

|

90 days

|

Source: Primary Data (2008)

A camera records images, either as a still

photograph or as moving images known as videos or movies. The term comes from

the camera obscura (Latin for "dark chamber"), an early mechanism of

projecting images where an entire room functioned as a real-time imaging

system; the modern camera evolved from the camera obscura.

Cameras may work with the light of the visible spectrum or

with other portions of the electromagnetic spectrum. A camera generally

consists of an enclosed hollow with an opening (aperture) at one end for light

to enter, and a recording or viewing surface for capturing the light at the

other end. A majority of cameras have a lens positioned in front

of the camera's opening to gather the incoming light and focus

all or part of the image on the recording surface. The diameter of the aperture

is often controlled by a diaphragm mechanism, but some cameras have a

fixed-size aperture.

Category 6 cable, commonly referred to as

Cat-6, is a cable standard for Gigabit Ethernet and other

network protocols that is backward compatible with the Category 5/5e and

Category 3 cable standards. Compared with Cat-5 and Cat-5e, Cat-6 features more

stringent specifications for crosstalk and system noise. The cable standard

provides performance of up to 250 MHz and is suitable for 10BASE-T, 100BASE-TX

(Fast Ethernet), 1000BASE-T / 1000BASE-TX (Gigabit Ethernet) and 10GBASE-T

(10-Gigabit Ethernet). Category 6 cable has a reduced maximum length when used

for 10GBASE-T; Category 6a cable, or Augmented Category 6, is characterized to

500MHz and has improved alien crosstalk characteristics, allowing 10GBASE-T to

be run for the same distance as previous protocols. Category 6 cable can be

identified by the printing on the side of the cable sheath.

VDR (Video Disk Recorder) is

an open source application for Linux designed to allow any computer to function

as a digital video recorder, in order to record and replay TV programming using

the computer's hard drive. The computer needs to be equipped with a digital TV

tuner card. VDR can also operate as an mp3 player and DVD player using

available plugins

2.3.3. THE Queue Management Hardware

The problem of long lines made up people need to be served by

the bank, was on mind of several managers as well as researchers. Now the queue

Management system is the appropriate response to that particular challenge

faced by FINABANK since long time ago. This equipment is made up following

hardware:

Table 4: Queue Management Hardware

|

No

|

Description

|

Quantity

|

Brand name

|

|

1

|

Queue Management machine

|

5

|

QM

|

|

2

|

Black Screen

|

40

|

QM

|

|

3

|

Cables

|

X

|

CAT6

|

|

4

|

Number caller button

|

40

|

QM

|

|

5

|

Satisfaction test button

|

40

|

QM

|

Source: Primary Data (2008)

The first objective of any queue management system is to

achieve a better quality of service to customers. In its most basic form, a

queue management system will issue a queue ticket to an arriving customer and

later call the ticket when service is available, eliminating the need to stand

in line while waiting. In this way, queue management systems help to provide

comfort as well as fairness to customers, by allowing them to maintain their

position in the queue while they are seated comfortably or engaged in

constructive activity.

The first objective of any queue management system is to

achieve a better quality of service to customers. In its most basic form, a

queue management system will issue a queue ticket to an arriving customer and

later call the ticket when service is available, eliminating the need to stand

in line while waiting. In this way, queue management systems help to provide

comfort as well as fairness to customers, by allowing them to maintain their

position in the queue while they are seated comfortably or engaged in

constructive activity.

2.3.4. Network Communication hardware

FINABANK grows continually and opening branches in different

provinces constitute in this nation. These branches are interconnected dispute

the long distance, through the Network Communication. Helped by Rwanda tell and

MTN Rwanda cell Companies, FINABANK uses following hardware to link various

activities performed by its branches.

Table 5: Communication Hardware

|

No

|

Description

|

Quantity

|

Brand name

|

|

1

|

Routers

|

6

|

SISCO

|

|

2

|

Switchers

|

14

|

SISCO

|

|

3

|

Cables

|

-

|

CAT6

|

Source: Primary Data (2008)

A router is an equipment of a network interconnection enables to

determine the path of data by joining packages within two or more

networks.30

A switch is an electronic equipment help to connect more segments

to one network.

Access Control System in FINABANK is composed mainly by two kinds

of hardware: One Card reader Machine and six accesses scanner machines.

2.3.5. Fire Safety Hardware

Among many serous risks that can affect the bank, we can

highlight fire. The fire safety system is not only the voluptuous choice of

FINABANK by it is also the recommendation from the insurer. To handle this

problem, FINABANK does its best to protect its assets, data and people by

combining following hardware:

30 STEWART, T. «3M Fights Back,»

Fortunes, February5, 2006, p. 99

Table 6: Fire safety equipments

|

No

|

Description

|

Quantity

|

Brand name

|

|

1

|

Fire extinguishes

|

30

|

SAVAL GP9

|

|

2

|

Smoke Detector

|

80

|

MANVIER

|

|

3

|

Fire alarm Controller

|

6

|

MANVIER MF9304

|

|

4

|

Speakers

|

20

|

Sonny

|

Source: Primary Data

The Fire Safety System of FINABANK uses three types of

hardware:

Fire extinguishes: used to attack fire when occurs.

Smoke Detector: helps to notice in advance the fire by

distinguishing smoke. Fire alarm: helps to inform others on the mater.

Speaker: From which alarm worn people upon incident

2.4. THE «SOFTWARE» COMPONENT OF THE FINABANK'S

INFORMATION SYSTEM

To play a useful role in the firm's information technology

infrastructure, computer hardware requires computer software. As it has been

defined by KENETH C. LAUDON in his book named Management Information Systems,

the computer software is a detailed instruction that control the operation of

computer system. 31

31 LAUDON, K. and LAUDON, J.P. «Management

Information Systems: Organization and Technology,» Prentice-Hall of

India: New Delhi, 1999, p.89

Selecting appropriate software for organization is a key

management decision.

As a reference to the first chapter, FINABANK has also two kinds

of software: Application and operating software:

2.4.1. The FINABANK's System Software

Are called System Software (as well explained in the literature

review), ones coordinate other software in a computer, put in relation the

hardware and application software and perform several tasks like DVD playing,

keeping and manage files, etc. Within this context, FINABANK has the following

operating system software.

2.4.1.1. Windows XP Professional

The Windows XP used by FINABANK is Reliable, robust operating

system for powerful PCs with versions for both home and corporate users.

Features support of the internet, multimedia, and the group collaboration,

along with powerful net working, security, and corporate management

capacities.

2.4.1.2. Windows Saver

The Windows Saver supports multitasking, multiprocessing,

intensive networking, and internet services for corporate computing.

2.4.1.3. UNIX

The UNIX Used by FINABANK for powerful PCs, workstation and

servers. Supports multitasking, multiprocessing, intensive networking. It is

portable to different models of computer hardware.

2.4.2. FINABANK's Application Software

Application soft wares are software conceived to perform a given

and specific task. Software of this kind held by FINABANK are the following:

2.4.2.1. Equinox Banking Software

Activities of FINABANK are linked, complete each other and

this happens through the software named «EQUINOX» includes at least

main activities performed by the bank. Here is EQUINOX main interface:

Figure 9: Equinox Banking System's

interface

Source: FINABANK, back office processing, 2009, p.1

Changes in the current business climate around the world place

pressure on industry and commerce. Cyclical boom, bust economic conditions and

the rising global economy place demands on banks and all commercial ventures to

increase productivity, cut costs and be flexible. All of the above are on the

base of shifting from MICROBANKER to EQUINOX Banking System.

FINABANK uses Equinox Banking System to perform and deriver

services to customers. This software has replaced MICROBANKER in 2008 because

it is more advantageous than the last one. EQUINOX is considered as a friendly

user based on its graphical user interface whereas MICROBANKER was a command

line.

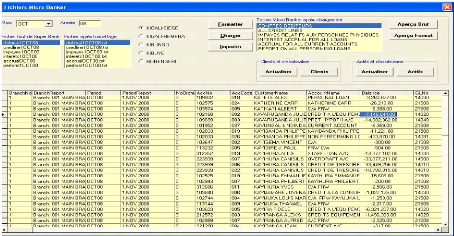

2.4.2.2. MICROBANKER

MICROBANKER was the bank system used by FINABANK until 2008,

to handle all business problems in the banking industry, but it has been

replaced by EQUINOX Banking System because it was no longer compatible with the

volume of the bank activities. This application was able to receive a limited

number of users at a once while the number of employees in need was growing as

the business grows. In addition, This system was a command line, what was

somehow complicated to some users, but is very different from EQUINOX Banking

System, currently in use, has a friendly interface, what to say, instead of

commanding the system what to do, it gives to the user various options and

he/she selects the best one.

2.4.2.3. SWIFT System

This software is used by FINABANK to send and receive transfers

between banks either locally or internationally.

2.4.2.4. MEGA System

They use MEGA System to handle problems related to checks, and to

prepare the clearing list to NBR.

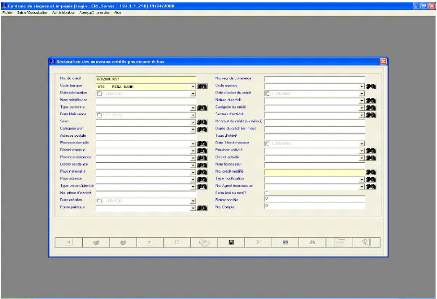

2.4.2.5. CRI System

They use CRI System to create, analyze and submits a report,

related to Risk and Arrears Centralization, to NBR.

BNR System Software is a proper version to create and submit

reports, but as these reports are so official and has to be well done; other

software has putted in place as the draft to perform these reports. The

following are interfaces of CRI software related to report to be done:

Figure 10: New credit declaration interface from CRI

system:

Source: FINABANK, back office processing, 2009

After daftly processing this declaration of new credit the

statistician transfers the report created from CRI system into BNR system which

has the following interface:

Figure 11: New credit declaration interface from BNR

system software

Source: FINABANK, back office processing,

2009

Figure 12: Risk situation interface from CRI system

Software:

Source: FINABANK, back office processing, 2009

After getting the required information through different ways of

CRI system, it has to be converted into following BNR System's interface:

Figure 13: Risk situation interface from BNR System

software

Source: FINABANK, back office processing, 2009

The interface bellow enables the statistician to perform the

situation of credit arrears in BNR system:

Figure 14: Credit arrears report from BNR System

software

Source: FINABANK, back office processing, 2009

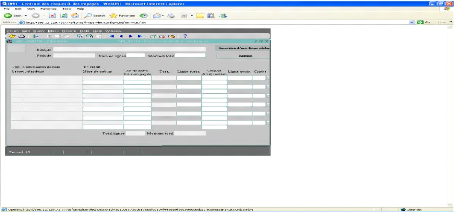

2.4.2.7. LEASEPAC

FINABANK uses LEASEPAC software to establish and manage leasing

facilities.

It is the SME bank with the advertisement sport: «Your

partner in growth and development,» FINABANK makes growing and developed

businesses by providing to them lease loans. To provide loan is one thing and

to manage it is another one, which is some how more complicated. To handle

this, FINABANK has appropriate and qualified software called

«LEASEPAC.» The following is its main interface:

Figure15: Leasepac system software

Source: FINABANK, back office processing manual, 2009

This software (LEASEPAC) contributes on FINABANK's performance

in the way that allows the user to collect any desired information from the

applicant himself and his business as well as to manage the loan. By example

the following is the interface helps the user to collect the information

related to the applicant:

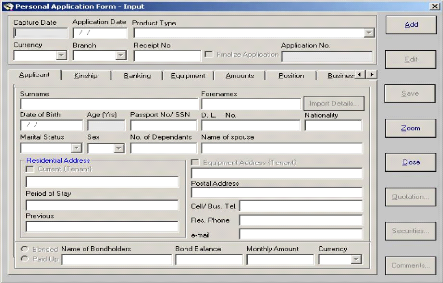

Figure 16: Applicant information interface from LEASEPAC

software

Source: FINABANK, back office processing manual, 2009

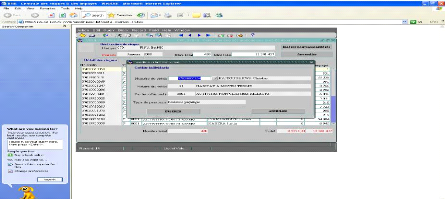

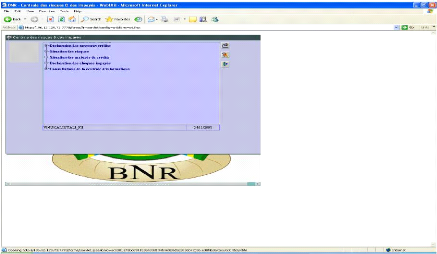

2.4.2.8. BNR System

FINABANK uses BNR System to perform, in an appropriate way,

monetary reports to NBR.

NBR has in its responsibilities, to keep stable the Rwandan

currency. So, each and every financial institution, including banks, has to

report, weekly and monthly, to Rwandan Central Bank (NBR). It's in this regard

that National Bank of Rwanda has provided particular software to bank for good

preparing these reports. The following is the main interface of that kind of

software:

Figure 17: Debit interface of BNR System

Software

Source: Primary data

(2008)

2.4.2.9. ASETWARE

They use ASETWARE to manage adequately bank assets.

2.4.2.10. Internet Explorer

They use Internet explorer to find and to display information

and web site in order to communicate, publish, and advertise what they do as

well as to update the knowledge of personnel.

2.4.2.11. Microsoft Office 2003 and 2007

- Microsoft Office Excel

FINABANK performs calculations, analyzes information, and

visualizes data in spreadsheets by using Microsoft Office Excel.

- Microsoft Office Outlook

They send and receive e-mail; manage your schedule, contacts, and

tasks; and record their activities by using Microsoft Office Outlook.

- Office PowerPoint

They create and edit presentations for side shows, meeting, and

web pages by using Microsoft Office PowerPoint.

- Microsoft Office Words

They create and edit professional looking documents such as

letter, papers, reports, and booklets by using Microsoft Office Words.

2.5. THE «DATA» COMPONENT OF THE FINABANK'S

INFORMATION SYSTEM

2.5.1. Introduction

DATA are any raw facts or observations that describe a

particular phenomenon. For example, the cash in hand, the cost of transport of

personnel, and a picture captured all are data.32

In business, for instance, the cost of merchandise may be

information to buyer, but it may represent only data to an accountant who is

responsible for determining the value of current inventory levels. The current

value of inventory for that merchandise is the information the accountant

derives from the two pieces of data and it will be useful to take decision when

selling.