3.2 Monetary and Exchange Rate Policy Management

3.2.1 Monetary Policy

Since the Central Bank of Rwanda assumed its primary

responsibility of formulation and implementation of monetary policy following

the Central bank law that gave the National Bank of Rwanda independence in

monetary policy, several instruments of monetary policy have been actively

applied to regulate liquidity in the economy. The monetary programming has

helped to guide the National Bank of Rwanda's conduct of its monetary policy to

ensure that liquidity expansion is consistent with target inflation and GDP

growth levels.

Monetary programming as a tool of the Central Bank of Rwanda

is characterized especially by the way it describes the monetary by an indirect

character. The objectives that have been set to conduct monetary policy are the

following:

- Final objective: control of inflation,

- Intermediate objective: monetary stock aggregate (M2)

because of the strong correlation between inflation and monetary stock,

- Operational objective: monetary base.

The frame of Central Bank's interventions in the indirect

character of monetary policy consists of:

- Projection of annual monetary balance,

- Forecast to be done on a monthly, quarterly and annual

basis,

- Weekly appreciation of the total level of the banking

liquidity by reference at the desired level of the monetary base.

The monetary instruments that have been used to conduct

monetary are among others:

- Monetary market, which was created in August 1997 as a

single framework for the allowance of the Central Bank currency and the

formation of interest rates through the levels of demand and supply. This

implies the interbank market interventions of Central Bank etc.

- Treasury bills market for monetary policy purposes or for

the needs of the government,

- Obligatory reserves as an instrument of banking liquidity

adjustment.

When the objectives and instruments to be used by the National

Bank of Rwanda are determined the next step to be specified in monetary

programming was focusing on the sources of the creation of currency or

counterparts of the money supply. The latter, as taken by the National Bank of

Rwanda, consists of Net External Assets (NEA) and Net Interior Assets (NIA)

(among others net credit to the private sector). Thus M2 can be expressed

as:

M2 = NEA + NIA

According to the above relation, the change of M2 will consist

of the change of the counterparts (predominance of NEA or NIA). On the other

hand, the regulation of the monetary base follows the counterparts of the

monetary base, which are mainly Central Bank Net External Assets and Central

Bank Net Interior Assets.

The policy of stabilization and economic reforms after the war

period aimed at the re-establishment of fundamental balances. In 1997, as in

previous years, the Central Bank of Rwanda with the Ministry of Economy and

Finance defined an annual inflation target of 7% by the end of 1997. During

1998 and 2000 the inflation was set at below 5%. However, after the

modifications made to the economic program under PRGF (from 1999 to the

present) inflation has been set at 3%. In addition, the GDP growth rate has

been set at 12.7% in 1997; 7% in 1998 and at 6% in 1999 to 2003 in the context

of PRGF.

The macroeconomic objectives undertaken during those years

were oriented towards restoring fundamental economic balances in order to allow

sustainable development. During that period, inflation came down from 11.7% in

1997 to -2.42% in 1999. Nevertheless, as shown in figure3-1, due to the great

inflationary uncertainty associated with the fact that the prices of food

products in Rwanda are often unstable due to the change of climatic conditions

(the drought in some areas) the annual targets for 1997 and 1998 were not

reached. However in 1999 and 2002 inflation was below the proposed target.

TABLE 3-1: INFLATION OBJECTIVE AND INFLATION OBSERVED IN

PERCENTAGE

|

Years

|

Inflation Objective (%)

|

Observed Inflation (%)

|

|

1997

1998

1999

2000

2001

2002

|

7

5

3

3

3

3

|

12.1

6.22

-2.42

3.91

3.36

1.98

|

(Source: IMF and Rwanda, 1995-2002)

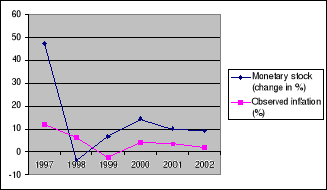

The monetary programme in Rwanda follows the change in

monetary stock (M2) as an indicator of inflation. The relationship between the

growth of the aggregate M2 and inflation in 1997-2003 periods can be shown in

the figure 3.1 below:

FIGURE 3-1: ANNUAL GROWTH OF AGGREGATE M2 AND INFLATION:

1997-2002

Table 3-2 shows the change in inflation and monetary stock. It

can be seen that the change in M2 depends on how is the predominance in the

change for NEA or NIA.

TABLE 3-2: MONETARY STOCK (M2), NET EXTERNAL ASSET (NEA) AND

NET INTERIOR ASSET (NIA) IN PERCENTAGE

|

Years

|

Monetary stock (M2)

|

Net External Asset

|

Net Interior Asset

|

|

1997

1998

1999

2000

2001

|

47.5

-3.9

6.6

14.4

10.1

|

22.6

4.55

-7.05

49.33

21.076

|

77.14

-10.93

20.32

12.207

12.207

|

(Source: Banque Nationale du Rwanda, 2002)

|