2.1. Evolution of gross consumption expenditure in Rwanda

1995-2015

James Duesenberry (1946) in his relative income hypothesis

rejected the fundamental assumption of consumption theory of Keynes. He

challenged the assumption of the independence of individual's consumption and

postulated interdependence in consumption behavior. He posited that consumption

behavior is not independent but interdependent on the behavior of every other

individual. He explained that people do not only derive satisfaction from

consumption but also from how the consumption compares with that of others.

(Ahuja: 2013).

As such, the relative size of a household income to that of

other households determines consumption level. The hypothesis is based on three

relative aspects:

? A household's income position is relative

to its associates or group to which it belongs.

? A household's present income is relative to

its previous incomes.

? The wellbeing of society depends on

Government intervention through economic measures.

By this, he posited that households strive constantly toward a

higher consumption level and emulate the consumption pattern of a neighbor.

(Ohale: 2002).If income of all individuals/household increases by the same

percentage, and then relative income would remain the same despite the increase

in absolute income. Since the relative income remains the same, the same

proportion of income would still be spent on consumption, Average Propensity to

Consume (APC) will thus, remain the same. To capture the determinant of

aggregate consumption expenditure in Rwanda, the following model has been

specified by the researcher: GCE= f(Y, INT, INF, and EXR).Where GCE = Gross

Consumption Expenditure Y= Income (GDP), INT= Interest Rate, INF= Inflation

Rate, EXR= Foreign Exchange Rate.

28

Thus, GCE= â0

+â1GDP+â2INT+â3INF+â4EXR+u

Where: â0>0, â1>0,

â2><0, â3<0, â4<0

? Gross Consumption Expenditure proxied by GCE

is the consumption without tax or other contributions having been

deducted. In other words, it is the consumption at current prices used by

household in the community.

? Income: The researcher used GDP

as a proxy for income. A positive sign is expected as there is a

direct relationship between consumption and income. Consumption expenditure is

expected to increase with an increase in income.

? Interest Rate: (Proxied by

INT) an increase in lending interest rate may lead to a

decrease or increase in consumption. As such, the expected sign was determined

by researcher findings.

? Inflation Rate: we use INF

as a prosy of inflation rate. This tries to capture the effect of

increase in price level of consumption. When there is inflation (general price

level increase), the real value of the consumer's cash balance is falls. As

such their purchasing power is hampered, leading to a fall in consumption

expenditure. Thus an inverse relationship is expected to occur between

inflation and consumption; therefore, the researcher interpreted this

hypothesis regression.

? Exchange Rate: The researcher used

EXCHR as a proxy of exchange rate. The researcher attempted to

capture how households react to changes in price of foreign goods by including

exchange rate of Rwandan currency to dollar in the used model. This stems from

the fact that about 1837.3 b Frw of consumer goods is imported

from foreign countries which include food items, services, automobiles, etc.

While Exported goods are 846.15 b Frw. Thus the expected sign

of the relationship between exchange rate and consumption expenditure shown by

the researcher after regression. To estimate the results, the researcher

employed the ordinary least square (OLS) method of estimation to check for

variables that determine consumption.

29

WORLD BANK DATA USED BY RESEARCHER

|

Year

|

GDP

|

EXCH

|

CPI

|

GCE

|

|

1995

|

338.21

|

262.18

|

37.5

|

327.73

|

|

1996

|

423.41

|

306.82

|

40.07

|

398.87

|

|

1997

|

557.83

|

301.53

|

44.88

|

527.68

|

|

1998

|

621.49

|

312.31

|

47.67

|

577.77

|

|

1999

|

607.77

|

333.94

|

46.52

|

554.34

|

|

2000

|

674.18

|

389.7

|

48.34

|

631.31

|

|

2001

|

739.79

|

442.99

|

49.95

|

637.91

|

|

2002

|

798.62

|

475.37

|

50.95

|

713.06

|

|

2003

|

994.65

|

537.65

|

54.74

|

876.37

|

|

2004

|

1206.87

|

577.45

|

61.45

|

1056.7

|

|

2005

|

1439.176

|

557.82

|

66.99

|

1149.1

|

|

2006

|

1715.81

|

551.71

|

72.94

|

1340.7

|

|

2007

|

2067.5

|

546.96

|

79.56

|

1520.6

|

|

2008

|

2624.88

|

546.85

|

91.85

|

2017.9

|

|

2009

|

3017.56

|

568.28

|

97.74

|

2318.6

|

|

2010

|

3323.84

|

583.13

|

100

|

2583.3

|

|

2011

|

3847.98

|

600.31

|

105.67

|

3001.6

|

|

2012

|

4435.24

|

614.3

|

112.3

|

3440.1

|

|

2013

|

4862.73

|

600.31

|

121.32

|

3614.7

|

|

2014

|

5379.87

|

614.3

|

122.87

|

3988.9

|

|

2015

|

5741

|

701.03

|

123.91

|

3862.7

|

Source: World Bank indicators1995-2015

Table 1: Status and trends of gross

consumption expenditure, Gross domestic product, Interest rate, Consumer price

indices (Inflation) and exchange rate in Rwanda from 1995 up to 2015

30

Source: World Bank indicators1995-2015 and author's

computation

Figure 2: Status and trends of gross consumption

expenditure, Gross domestic product, Interest rate, Consumer price indices and

exchange rate in Rwanda from 1995 up to 2015

Gross Consumption Expenditure: According to

the above figure, the post 1994 Genocide (from 1995), household consumption in

Rwanda was very low where percentages show that 94.31 % of Rwandans consumed

327.73 Frw. Because of post war period, the economic system were destructed,

infrastructures were ruined by the war so that every economic sector were

shocked. But from 1995, statistics show that there is an increase of the level

of gross consumption expenditure from 1995-2015 where it started from 327.73

Frw from 1995 and grew slowly until 2004 where consumption reached 1056.73.

Within 3 years (from 2005 to 2007), the level of consumption grew quickly where

it reached 1520.55 Frw. Because different initiatives put in economic sector by

the Government of Rwanda, the level of consumption were increased at high rate

where from 2008 to 2011, an increase of 983.67Frw whereby 78% of Rwandans

consumed 3001.55Frw. From that period, the level of consumption grew slowly by

422.6 Frw because of different economic challenges.

31

Gross Domestic Product: According to the

above figure, using the documentary technique, the researcher has obtained data

from the World Bank. The data have been analyzed and

interpreted using the statistical, analytical and synthetic methods. The

statistical method helped the researcher to plot the evolution of GDP of Rwanda

from 1995 to2015. The figure 2 above shows that the gross domestic product has

the upward trends. They are increasing over time because from 1995 up to 2003,

the level of GDP has grown by 656.44 b Frw, but because of economic

reconstruction as well as the whole country, this level grew slowly in a period

of 8years thereafter that period, the level of GDP grew rapidly because after

presidential elections, many policies put in action such as increase of foreign

direct investment, increase of domestic agro processing industries, financing

the small and medium entrepreneurs, etc. Normally, this is shown by the above

given figures where from 2004 up to 2009, there is a high increase compared to

the starting period with 1810.69 b Frw which means that is are positive trend.

From 2010 up to 2015, there is a continuous increase in GDP because the level

of increase is 2417.16 b Frw.

Exchange rate: The exchange rate in Rwanda

has been fluctuated in four main categories under relative period from

1995-2015. From 1995, the Government of Rwanda introduced the regime of

floating exchange rate where this exchange rate is allowed to fluctuate in

response to the economic condition. We normally know that in a fixed exchange

rate regime, the Central Bank trades domestic for foreign currency at a

predetermined level of price. The post Genocide period of 1995-2015 was a

period of reconstruction in whole Country particularly in the economic system.

Therefore, from 1995 up to 1999, the; level of exchange rate has been

fluctuated (increased one hand and decreased on the other hand). The lower

level of net export which is the exports minus imports is the main determinants

of exchange rate. This lower level of net export was low from many years ago

because Rwanda is a landlocked country and it does not have natural resources

that can induce the level of domestic production as well as the level of

export. With policy of monetary targeting used by the central bank of Rwanda,

from 2000 up to 2005, the money market which is introduced in the period of

1999-2005 to increase the level of transactions among domestic commercial

institutions. This has changed many things in Rwandan economic system. The

system faced an increase in money supply where this increase in money causes a

decrease of interest rate of bonds. Because we are in open economy, the

domestic rate of interest would be equal to the world one. So the system faced

many investors who converted Rwandan currency into foreign currency to invest

outside of the Country (Capital outflows). There is therefore a depreciation of

the domestic currency. This depreciation of the domestic currency causes the

exchange rate to flow down, induce the level of net export without forgetting

the level of income. Even if it is so, the national

32

export, at lower level than import, have a lower price outside

the country. The introduction of capital market in Rwanda in 2005 did change

nothing on depreciation of Rwanda currency. From 2005 up to 2011, the exchange

rate continued to decrease where it shifted from 557.82 to 600.31 by one

dollar. Because of the trade balance deficit faced by Rwanda economic system a

longtime ago, there is a continuous decrease of exchange rate which depreciate

our domestic currency whereby from 2012 to 2015, domestic currency depreciated

by 2.81%. Without going far from the facts, an increase in Government spending

(Expansionary fiscal policy) is the only solution because it can increase

income and interest rate on bonds which can make capital inflows and appreciate

the domestic currency. The level of exchange rate will increase which will

lower net export and income. Thus offset occurs between incomes.

Inflation: The annual percentage change in a

Consumer Price Index (Inflation) is used to measure inflation. The Consumer

Price Index (CPI) can be used to index the real value of wages, salaries,

pensions, and price regulation. It is one of the most closely watched national

economic statistics. The consumer price index (CPI) is a statistical estimate

of the level of prices of goods and services bought for consumption by

households. It measures changes in the price level of a market basket of goods

and services used by households. The CPI is calculated by collecting prices of

a sample of representative items over a specific period of time. Goods and

services are divided into categories, sub categories, and sub-indexes. All

information is combined to produce the overall index of consumer expenditures.

Such that the annual percentage change in a CPI is used to measure inflation,

in Rwanda, the level of inflation measured by CPI, from 1996-2002, the levels

of price were decreasing because many people were outside the country due to

the 1994 Genocide while domestic production were high. With many programs of

sensitizing refugees to comeback because of security, the level of population

increased and the level of price started to rise due to lower level of

production.

However, in 1999, a shock happened where the level of price

decreased gradually and it riches a negative value. This was caused by high

level of production (Supply) against lower level of demand. It is like a short

run deflation. From 2003 up to 2008, a continuous rise of price occurred

because of the continuous rise of the population. (DHS: 2005). But again from

2008 to 2015, because many policies put into action by the Government of Rwanda

like, Girinka, Umurenge SACCOs, Agriculture policies of irrigation as well as

new investments in different economic sectors like industrialization, financial

institutions, and so on, all those policies increased the level of consumer

goods therefore the level of price reduced by 12.9% which shows a high impact

in the economy.

33

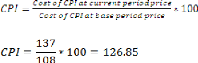

CPI calculation:

For example, imagine you buy five sandwiches, two magazines,

and two pairs of jeans. In the first period, those goods are market basket at

base period prices = 5(6.00) + 2(4.00) + 2(35.00) = 108.00. Market basket at

current period prices = 5(7.00) + 2(6.00) + 2(45.00) = 137.00. The CPI

represents the cost of a basket of goods and services across the country on a

monthly basis. Those goods and services are broken into eight major groups:

Food and beverages Housing, Apparel, Transportation, Medical care, Recreation,

Education and communication and other goods and services. From the above

example:

From the above figure, the rate of lending interest rate in

Rwanda is at high level. Normally, Rwanda institutions seek for high return

compared to the level of income as well as the rate of people that take credits

in good collaboration with financial institutions to induce the level of

investment in the community. From 1995 to 1999, the rate of lending interest

was 17 and 16%. This is the post Genocide period where financial institutions

started to reconstruct without enough capital as well as qualified employees.

The monetary authorities and commercial banks have had faced the problem of

dealing with the lower level of money. Measures were put in place to call upon

people to use credits as a financial support in order to induce the level of

investment in Rwanda as well as domestic production. Fluctuations continued

where from 2003 to 2009, the level of interest rate changed from 16 to 17%. The

introduction of money market and capital market (1999-2005) has had affected

the increase of that rate. However a continuous depreciation of the domestic

currency affects the level of interest rate because the economic system cannot

attract foreign investors. From 2010 to 2015, the level of interest rate

changed from 18 to 19%. Local people as small and medium entrepreneurs are not

attracted by financial institutions to take loans because of that high level of

interest rate. If is so, the level of investment cannot increase to affect the

level of income. By lower level of income, household consumption is also

decreased.

34

Partial conclusion

With the above findings, the explained variable GCE has upward

trend as it is shown by numbers. By 1995 to 2003, the level of consumption

increased from 327.73 Frw up to 876.37 Frw per household (96.95% to 88.1%) i.e

96.95 % of household in Rwanda consumed 327.73 Frw in 1995, this is the post

1994 Genocide in the country where all sectors including economic ones were

destructed by conflicts. However, after presidential elections, the level of

consumption in Rwanda has gradually increased again because of many policies

put into action by the Government of Rwanda. From 2004 up to 2007, the levelof

consumption faced a high increase because 87.55% up to 73.51% of Rwandan

consumed between 1056.73 Frw to 1520.55 Frw. Thereafter, from 2008 up to 2015,

the level of consumption has been increased by about 2.55% where a decrease

vary between73.51% to 69.4%. Generally, from 1995 up to 2015, the level of

income has affected positively the gross consumption expenditure. The

continuous level of interest rate is a challenge to the household market

basket. The level of inflation is also a challenge to the consumption because

the income from investments is affected by inflation. A continuous depreciation

of the domestic currency to the dollar causes the imported goods to be very

expensive. Therefore, the next chapters give the econometric facts to know the

exact relationship between variables used in the model. Therefore, the

researcher affirms, based on the first hypothesis that the trends of the used

model are upward sloping and the used variables are significantly related.

35

CHAPTER 3: ECONOMETRIC ANALYSIS OF THE RELATIONSHIP

BETWEEN GROSS CONSUMPTION EXPENDITURE AND ITS DETERMINANTS IN

RWANDA

|