INTRODUCTION

On one hand, whisky is trending and is becoming more and more

popular. For instance, France is currently the biggest whisky drinker

worldwide. On the other hand, wine, despite its important awareness and

domination notably in terms of consumption is going through a change in

behaviour in Europe (but not only). Indeed, a noticeable decrease in wine

consumption is observed in many European countries. The purpose of this article

aims to see what are the evolutions in wine and whisky consumption: Are there

more whisky drinkers to the detriment of wine drinkers? What are the trends in

the different countries? What are the drivers of the consumption changes? What

could we forecast for a near future?

Thus, the first part of this research is aimed to get a global

overview on the European Wine and Whisky market with the overall consumption of

both alcohol beverages and the different trends. The second part is designed to

have a whisky focus with the different producing countries as well as new

incomers in order to see their influence on the consumption. The third stage is

an exploratory research with a snowball sampling (quantitative survey) which

aims to put in evidence different consumption behaviours for both wine and

spirits. The survey will help us estimating the price people are ready to pay

for a good bottle of wine and/or whisky, in which circumstances do they like

drinking, when and the frequency. The last and final part is a discussion. It

will be based on the quantitative survey results analysis and supported by

other documents study to figure out what are the consumer behaviours and

expectations. The conclusion will try to forecast where both European wine and

whisky markets are going.

6

LITERATURE REVIEW

France can boast about a great heritage as regards to wine as

well as spirits (Cognac, Armagnac, Anise drinks), but it should be noted that

French are quite fond of another distilled alcohol but rather confidentially in

the country: whisky (La consummation de whisky: une étude

exploratoire du comportement du consommateur dans le contexte français,

M-F. GAUTHIER, C. LABORDE, B. MAZIERES, p.3).

Where does this dynamism and enthusiasm come from? The

«flexibility» in terms of means of consumption (in cocktails, neat

etc.) gives whisky more opportunities and it is reinforced by brands activity

and distributors with regards to advertisements and promotion (Le whisky,

superstar des spiritueux toujours en croissance, M. BAILLY).

According to Guillaume Deglis head of Vinexpo, the consumption

tendencies for the next five years will be supported by whiskies as well as

bourbons since they managed to bring innovation

to their offer. Brown alcoholic drinks (including whiskies)

are surfing on this cocktail, parties in bars trend more and more praised by

women and millennials. The whisky market should thus increase from 9% from now

to 2018, Bourbon from 19% (Whisky et bourbon, nouveaux chouchous du

marché des spiritueux, P. DENIS).

As of today, the spirits universe has never been as much

diverse and multi-coloured. Ranges of spirits in supermarkets shelves and in

specialised shops are so varied and internationalised and

the demand for luxury drinks has never been so important.

Bars, cafes, restaurants, clubs have now a cocktail menu that is getting bigger

and bigger (Encyclopédie des Alcools et Spiritueux, A. DOMINE, 2009,

1st ed. H.f. Ullman, p.15). Whisky's good health is notably due

to Europe's consumption.

What about wine? The wine market is not going well everywhere

in the world, in Europe as well. By 2018, worldwide wine market should rise by

3.7% which is not a lot compared to

whisky to reach 2.732 billion of 9 litres boxes, which

represents 32.78 billion bottles. China

where consumption progression levels were reaching explosive

rates (+70% between 2009 and 2013), consumption has suddenly slowed down since

2013 because of Beijing's anti-corruption

measures (Whisky et bourbon, nouveaux chouchous du

marché des spiritueux, P. DENIS). Generally speaking, Europe also

has a decreasing wine consumption but is this drop due to a better consumption?

Is it benefiting whisky consumption?

7

I. European Wine & Whisky markets

1. Old & New world wine & whisky consumption

Many evidences have revealed that winemaking is known for

millennia. With current level of knowledge, the scientific consensus is that

winemaking has been first performed in Caucasus region, probably in Armenia.

Wine is an alcoholic beverage, produced by the fermentation of the grapes.

Worldwide, the International Organisation of Vine and Wine (OIV) has drafted in

1928 a resolution which states the legal definition of wine: «no other

product that those obtained by the alcoholic fermentation of fresh grapes juice

can get the wine appellation».

Since 1973, OIV has decided that wine can be obtained only by

the complete or partial alcoholic fermentation of fresh grapes, whether or not

crushed, or of grape must.

The wide variety of wines existing in the world can be

explained thanks to the variety of vineyards, wine varieties, winemaking

methods, or ageing. That is why we have red, rosé and white wines, dry

or sweet ones, or even still or sparkling. Viticulture has spread all over the

world and many countries are wine producers.

All over the world, wine names in the different languages have

in common the V letter (or its variant W) and the N: vera (Albanian),

Wein (German), wine (English), vino (Spanish,

Italian, Croatian, Czech), vin (Danish, French, Islandic, Romanian and

Swedish), vein (Estonian), viini (Finish), ... with 2

exceptions: ardo (Basque), and bor (Hungarian) (Indifferent

Languages).

There are more than one million winemakers in the world who

produce approximately three billion cases of wine each year. The production is

projected to have approximately grown by 2.2% in 2015 (274 million

hectolitres), due to solid harvests thanks to great climatic conditions in many

countries which allowed the vineyards to get matured grapes and perfect

conditions for harvesting.

According to the Organisation of Vine and Wine (OIV, 2015),

the world wine consumption represented 240 million hectolitres in 2015, which

equals 32 billion 75cl bottles, and it has increased by 0.9 billion hectolitres

last year.

It is important to notice that the consumption/production ratio

is not really balanced.

The overall demand is increasing but is it the case everywhere in

the world?

About two thirds of the world wine consumption relies on only ten

countries.

Furthermore, the wine business is changing shape: The Old

World (which basically represents Europe) leads the wine consumption for now

but it is gradually losing its pole position.

8

Yet, these outcomes confirm a change in this consumption from

the traditional producers such as France or Italy to other wine producers,

although more recent, but also wine enthusiasts, the United States and China.

There are indeed new actors from the New World (outside the traditional area of

wine-growing).

As you can see on this graph, and looking at the variation

2015 vs 2014:

- The first consuming country are now the United States, which

overtook on France since 2012 and it keeps increasing.

- At the second and third place, we found the traditional

consuming countries (France and Italy) with a decreasing trend in France and a

stable consumption in Italy.

- Germany, China, UK and Argentina wine consumption show a

slight increase, while Russia's and Australia's consumption are declining.

There is a noticeable rise of consumption in countries outside

Europe even though wine is undeniably one of the most popular alcoholic drink

there.

Spirits are also popular alcoholic beverages in the world and

whisky belongs on the top alcoholic beverages and is one of the most popular

spirits.

The word whisky is English and came from the Celtic word

uisge in Scottish Gaelic (or uisce in Irish Gaelic).

«Uisgue» or «uisce» means simply

«water»; by adding »beatha», you get the Celtic

word «water of life» («uisge beatha» in

Scottish Gaelic and «uisce beatha» in Irish). When English

people has discovered this spirit, they have only kept the first part of the

word and wrote it their way: «whisky».

Whisky finds its origin in Ireland. The legend says that Saint

Patrick, the patron saint of the Irish, has brought himself the secret of the

distillation in Ireland at the 5th century. This secret has then

crossed the sea to join Scotland. Irish and Scottish are still claiming the

fathering of this famous beverage!

Whisky has a slight advantage compared to some beverages, for

instance Cognac or Champagne (governed by an appellation system): it can pretty

much be produced anywhere.

Source: Wikipedia

9

And so, whisky is everywhere. Scotland, Japan, the United

States, Ireland, India, Sweden, Australia, New Zealand, South Africa ...

Furthermore, there is another way to spell the word

«whisky» which is «whiskey». Should we say

whisky or whiskey then? Well, it differs geographically: the American and Irish

write «whiskey» and the Scottish, Canadians and the rest of the world

write «whisky». Where does this come from?

It started during the 19th century. Scotch whiskies

were of poor quality and were inadequately distilled in Coffey stills (see

photo on the right). For exportation in the US, the Irish distillers wanted to

discern their production from the Scottish competitors, therefore they added an

«e» to point out their difference. Nowadays, Scotch is one of the

greatest spirits in the world but the spelling still varies. Americans still

spell their whisky with an «e» but some distillers prefer the

Scottish spelling (Maker's Mark for instance for their Scots ancestors).

But what is whisky?

Whisky is a term that designates spirits obtained by the

distillation of malted and/or non-malted cereals, then aged in wooden barrels

and containing at least 40% alcohol.

There are different types of whiskies depending on the raw

materials entering in their recipe, or on their production process:

- A Single Malt whisky is made of malted barley from a single

distillery.

- A Pure Malt whisky is also elaborated with malted barley but

from several distilleries. - A Blend is a mix of malt and grain whiskies from

different distilleries. It can also be a mixture of two or more whiskies that

will be bottled and sold as one whisky.

These three `whisky types' can be produced anywhere.

However, there is on top a national appellation system. Thus

Scotch, the most popular whisky but also the best-selling whisky can only be

produced in Scotland.

It is the same with the Irish whiskey in Ireland, or Bourbon in

the United States.

To be considered as a Bourbon, the whisky has to be produced

in the US, the grain mash must be at least 51% corn and the mixture also has to

be stored and aged a minimum of 2 years in charred oak containers.

Rye whiskey can refer to Canadian whisky or American whiskey

and must be distilled from at least 51% rye.

10

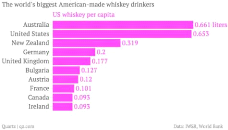

Regarding the consumption, here is a graph showing the biggest

whisky (and/or whiskey) drinkers in the world.

According to this Euromonitor analysis:

- France, Uruguay and the United States ascend to the top 3

- The original producing countries (Ireland and UK) arrive

respectively in 7th and 8th position - India (in

9th position with 1,24L/capita, is by far the world's biggest

drinker due to its population: approximately half of the world's whisky is

drunk there). Some interesting remarks on to the Indian market: They are not

only the biggest whisky consumers, their whiskies are also part of the world's

top 10 whiskies (in volume). United Breweries, an Indian conglomerate is also

the world's largest whisky company by volume. It owns several important

subsidiaries, notably United Spirits Limited (which manufactures McDowell's),

the world's best-selling whisky according to The Millionaires' Club (Officer's

Choice and McDowell's No. 1 are respectively the top 2 whiskies sold in the

world).

Why are these whiskies so powerful on the international market

and yet not very well-known, even from whisky amateurs?

First off, they benefit from their own national market. With

1, 2 billion habitants and a middle class boom, India is the world's first

whisky market. So when Scotch producers sell 90 million whisky cases in the

world, meanwhile approximately 120 million of local whisky cases are being

consumed in India!

Problem is, according to regulations, the Indian whisky

(except Amrut, actually sold in the European market and others) is simply not

whisky. Distilled from molasses (the liquid obtained

11

after the cane sugar extraction), it is sometimes mixed with a

little bit of malt or grain whisky. Outside of the subcontinent, it would be

labelled as Rum, thus it cannot be sold on the European market or anywhere else

as `whisky'.

Outside the United States, Australians, New-Zealanders,

Germans and British are big consumers of American whiskey.

Concerning the US, Beam is responsible for more than 40% of

the US Bourbon sales which accounts for almost half of the American whiskey

market. According to the International Wine and Spirit Research, the United

States consumes roughly 70% of the whiskey it makes.

2. Focus on the European market

Let us now have a look on the consumption trends for wine and

Whisky in the 5 main European countries:

France:

Whiskies: With more than two hundred million bottles

sold every year, whisky (Scotch, Bourbon, Rye or Japanese) is the most consumed

spirit in France to the detriment of Cognac. In the wine country, whisky is the

king of spirits.

As we saw previously, with 2.15 litres per capita, it

represents nearly 40% of the total spirit consumption (Fédération

Française des Spiritueux, FFS).

Overall, 120.9 million litres of whiskies have been consumed

in France in 2015 (FFS). With a market share close to 40%, whisky surpassed

pastis (73.84 million litres, 24% market share), rums (30.31 million litres,

9.9% market share) or white alcohols (tequila, gins, vodka, 29.56 million

litres and 9.6% market share).

Spirits market share

Source: Nielsen

Eaux-de-vie

0,50%

White alcohols

9,62%

Armagnac

0,20%

Calvados

0,20%

Rums

9,92%

Cognac

0,20%

Liquors

9,12%

Aniseed drinks

24,15%

Bitters

4,41%

Whiskies

39,48%

Others

2,20%

12

Nearly 80% of spirits (77.2%) are bought in

supermarkets/hypermarkets. The rest is divided in away-from-home catering,

specialised retail shops... According to the FFS, the spirits turnover is 4.6

billion euros in 2015. In 2014, about half of the total turnover (46.9%) was

generated by whisky sales (2.09 billion euros). In volume, there is a slight

decrease of -0.5% of spirits sales (279 million).

Wine: France's wine consumption is regularly declining

since the early eighties.

Since 1980, France AgriMer performs every 5 years a survey on

wine consumption in France. 4000 people, representative of the French

population, are interviewed, in order to understand the real behaviors of

people in wine consumption: motivations, frequency, quantity, and also opinions

and attitude that people can have vs wine. Last survey was made in 2015

(8th edition). According to this survey, 51% of people drinking wine

were drinking every day or nearly every day in 1980 while in 2010, only 17% of

the population drinking wine were drinking every day. The percentage of people

drinking wine occasionally in 1980 was 30% and 45% in 2010, an important

increase compared to the freefall with more «regular drinkers».

The proportion of French who never drink wine keeps growing

and all changes in drinking habits are observable through generations'

attitudes.

According to the results of the 2015 survey, wine perception

is improving. A renewed interest is observed between 2010 and 2015, with a more

important part of the population declaring liking wine taste. This trend

correlates well with the growing interest of French people for cooking, the

come-back of home-made food, cookery programs, and wine and food pairing.

13

Wine is more consumed at the aperitif moment, especially white

and rose wines (red wines are more associated to the lunch moment).

Wine seems to move from one of the components of a lunch to a

more cultural drink.

The UK:

Whisky:

It is interesting to analyse the information provided by IWSR

(International Wine and Spirit Record). This agency claims to be the leading

source of data and analysis on the alcoholic beverage market. It covers 155

markets in total.

According to the IWSR, the whisky market represents 1.2

billion bottles in 2015. The spirit market is indeed quite significant in the

UK: with 139 million bottles of gin, 58.5 million bottles of vodka, 1.1 billion

litres exported to foreign markets (2013) which 28.2 billion pounds in economic

activity.

Vodka is the N°1 consumed spirit, representing nearly 30%

of the UK spirit consumption, and Whisky arrives 2nd with 25.56%.

Spirits market share

Source: The IWSR (2013)

National Spirits

0,05%

Brandy

6,30%

Tequila

Cane

0,60%

0,10%

Gin / Genever

8,90%

9,00%

Rum

29,89%

Vodka

Flavoured Spirits

19,59%

Whisky

25,59%

:

18,49% 6%

1,1%

Wine: According to the IWSR, the UK wine market is the

6th largest wine market in the world. UK wine production represents

only 0.01% of the local consumption and so UK must import nearly the totality

of its consumption. Indeed, the industry generates 17.3 billion pounds in

economic activity to the British economy and 10 billion pounds in sales.

14

More than 80% of wine sales take places retail outlets, the

remaining sales are through bars, restaurants and hotels (in other words

away-from-home catering).

UK is an important wine consumer. According to the OIV, the UK

reached 12.9 millions of hectolitres in 2015. It is a small growth compared

with 2014 and it also counterbalance the drop between 2013 and 2014.

Wine is the most popular alcoholic drink in the UK according

to the Wine and Spirit Trade Association (WSTA) and is not just limited to

connoisseurs. It is actually the preferred choice for millennials (in that case

people between 25 and 34 years old) when it comes to drinking with over half

(57%) picking wine over other alcoholic drinks. Also, women tend to drink more

wine than men.

White wine is favoured over red consumption (47% of all sales

in 2015 versus 42%). Rosé wines also share a small percentage (11%).

Sparkling wines shows the most important growth thanks to Prosecco and Cava and

are perceived to have a better value for money than Champagne. Fruit flavoured

wine as well as low-alcohol wine also show potential for the future and can be

a threat to still Rosé wine (United States Department of Agriculture

(USDA)).

Ireland:

Whiskey: Ireland ranks in the top 10 for biggest

whiskey consumers. With 1.24 litres per capita, the country is head to head

with India and is almost overtaking the United Kingdom. Overall, spirits

consumption has increased from 1.9% from 2014 to 2015.

Worldwide sales of Irish whiskey keep rising: a 10.1% growth

with 62 million litres in 2013 (55.8 million litres the year before (source

IWSR)).

Ireland knew an intricate story with whiskey. It was not so

long ago the world whiskey leader but it went through tough times and the most

affected city was actually Dublin, the spiritual mother of Irish whiskey, where

it all began. It was abandoned in 1976 after Jameson's pot still fire stopped.

At that time, Irish whiskey hit rock bottom: while Scotch whisky conquers the

world, it was just considered as a bizarre, an odd beverage barely used to

rinse out someone's glass.

What was in the past a proud industry at a global scope was

reduced to two companies producing bad quality whiskies (a pure euphemism),

which totally accepted their ignorance of the Irish pot still tradition. Dark

times for Irish whiskey, almost vanished due to war, trade restrictions,

Prohibition, economic difficulties etc.

It was only in 1987 when the Irish entrepreneur John Teeling

founded the Cooley distillery. His sons, Jack and Stephen worked for the

company until 2012 when it was bought out by Jim

15

Beam. They simply figured that they wouldn't be satisfied

working for an important group. Anyway, the demand for whiskey was rising,

consumption too, awareness as well notably thanks to the group Irish

distillers' Jameson (Pernod Ricard) and their important marketing. From the

eighties until 2012, there was only three companies which distilled whiskey. In

May 2015, five companies distilled whiskey. With more than twenty distilleries

under construction or planned, new actors, a growing (and reborn) reputation,

American consumers as a support, Irish whiskey is getting better.

Wine: Wine is not the most popular alcoholic drink in

Ireland, beer is. With almost half of alcohol consumption (47%), beer won't be

dethroned anytime soon. Wine is actually the second most consumed alcoholic

drink with a 27,7% market share, followed by spirits (18,7%) and cider (6,6%)

(Source: Irish Revenue Commissioners Clearance Data).

Women are more likely to drink wine than men (61% versus 39%

(TGI Data 2015). Also, wines from Chile are the best-selling wines with a 25.3%

market share (more than 2 million cases), followed by Aussie wines (18.1%, 1.5

million cases) and France (14%, 1.2 million cases). Wine sales are mainly

through off-trade (grocery, independent retail etc.) with 80.9% market share,

the rest is on-trade (away-from-home network: bars, restaurants etc.) with

19.1% (Source: IWA Country of Origin Survey, AC Nielsen and other trade

reports).

Italy:

Whisky: Overall, Italians drink less alcohol now.

In last international ranking, Italy is at the 32nd

place (Source Euromonitor survey).

In less than 10 years, we observed a 23% decrease in rate of

alcohol consumption which makes an average of 4.4 drinks per week in 2014

(versus 5;6 drinks per week in 2006). This fall is actually due to a drop in

wine consumption over this period (31%). However, the consumption of beer and

spirits remained the same.

Wine: Regarding the consumption, the country

experienced a modest growth and is behind France and the United States.

As we said previously, the country's falling drinking rates is

due to many things.

Eating habits which changed with lunch losing its position as

a «family meal», wine is now mainly consumed during dinner (before it

was usually drunk during both). Also, the proliferation of non and

low-alcoholic drinks played a central role in wine consumption habits with a

growing «health awareness».

16

On the production side, Italy dethroned France and became the

world's biggest wine producer with 48.9 million hectolitres (versus 47.4

million hectolitres). It represents a 10% increase compared to 2014 (source

OIV).

Germany:

The following graph shows Germany's alcohol consumption. As you

can see there are two sets of line: The first set on the left show data from

West Germany since data from the East was difficult to gather. The second set

shows data when Germany was finally reunited.

Whisky: On average, spirits consumption remained stable

throughout the years.

22nd in the ranking of the whisky consuming countries,

with 0.45 litre/capita;

Wine: Germany saw a small growth in wine consumption with

20.5 million hectolitres.

Even if Italy dominates wine production, it has been surpassed

by Germany for the consumption. It is actually the first time Italians have

been overtaken by Germans according to the Organisation of Vine and Wine

(OIV).

|