|

Academic Year

|

2016/2017

|

|

Program

|

Msc Wine Management

|

|

Submission date

|

January 10th

|

1

PROFESSIONAL THESIS

Student's Name & First name: BOUCHARD

Antoine

|

Thesis subject and Tutor's comment:

Is there a move away from wine to whisky in the European

market?

|

Professor Tutor's Name, First name: CROUCH

Roberta

Mark .../20

2

ACKNOWLEDGMENT

I would first like to thank my tutor Professor Roberta Crouch

of the School of Wine and Spirits Business. The door to Roberta Crouch office

was always open whenever I ran into a trouble spot or had a question about my

research or writing. She consistently allowed this paper to be my own work, but

steered me in the right direction whenever she thought I needed it.

I would also like to thank one expert who was involved in my

research project and whose help has been very valuable: Professor Michael Moss

of Northumbria University. Without his incredible knowledge about history and

whisky, his passionate participation and input, my research would have not been

complete.

My sincere thanks also goes to Professor Pierre Joulié,

Head of the Msc Wine Management Program at the School of Wine and Spirits

Business, whose passion and endless dedication for the Msc WM is astonishing

and enable students like myself to spend a memorable year. I am gratefully

indebted for his commitment and support throughout my studies.

To my girlfriend, thank you for reading, offering me advice

and supporting me through this adventure.

Finally, I must express my very profound gratitude to my

family and especially my parents for providing me with unfailing support and

continuous encouragement throughout my years of study and through the process

of researching and writing this thesis. This journey would have not been

possible without them, they have always been here to support me emotionally and

financially as well. They never stopped believing in me and always wanted the

best for me. They gave so much of their time, energy, always showed what it

meant to be dedicated and I am forever in their debt.

Thank you,

Antoine Bouchard

3

ABSTRACT

The purpose of this thesis is to answer the following question:

Is there a move away from wine to whisky in the European market?

This research fits into a perspective of studying the consumption

of wine and whisky in this market.

The first stage if this article is giving an overview of wine and

whisky consumption in the Old and New world with trends of the past 5 years,

taking into account the production evolution. The second stage is focusing on

the worldwide whisky market: production methods, labelling and market

trends.

The third stage is presenting the analysis of around 150

responses to a specific questionnaire, allowing us to get a more in depth view

of the wine and whisky market.

The final stage aims to discuss about the overall results and

future tendencies.

Key words: wine and whisky consumption, European market,

quantitative research, Old world, New world, wine and whisky trends.

4

TABLE OF CONTENTS

Acknowledgments 2

Abstract 3

Table of Contents 4

Introduction 5

Literature review 6

I- European Wine & Whisky markets 7

1) Old & New World Wine & Whisky consumption 7

2) Focus on the European market 11

3) Trends and changes during the last 5 years 16

II- Worldwide whisky market 23

1) Overall picture, main producing countries 23

2) «The Judgment of London» - Scotch vs Japan 26

3) New incomers 28

III- Questionnaire 33

IV- Discussion 48

1) Market trends conclusion 48

2) Consumer trends and expectations 53

3) Where are the Wine & Whisky markets going? 57

Conclusion 62

Bibliography 63

Appendices 78

5

INTRODUCTION

On one hand, whisky is trending and is becoming more and more

popular. For instance, France is currently the biggest whisky drinker

worldwide. On the other hand, wine, despite its important awareness and

domination notably in terms of consumption is going through a change in

behaviour in Europe (but not only). Indeed, a noticeable decrease in wine

consumption is observed in many European countries. The purpose of this article

aims to see what are the evolutions in wine and whisky consumption: Are there

more whisky drinkers to the detriment of wine drinkers? What are the trends in

the different countries? What are the drivers of the consumption changes? What

could we forecast for a near future?

Thus, the first part of this research is aimed to get a global

overview on the European Wine and Whisky market with the overall consumption of

both alcohol beverages and the different trends. The second part is designed to

have a whisky focus with the different producing countries as well as new

incomers in order to see their influence on the consumption. The third stage is

an exploratory research with a snowball sampling (quantitative survey) which

aims to put in evidence different consumption behaviours for both wine and

spirits. The survey will help us estimating the price people are ready to pay

for a good bottle of wine and/or whisky, in which circumstances do they like

drinking, when and the frequency. The last and final part is a discussion. It

will be based on the quantitative survey results analysis and supported by

other documents study to figure out what are the consumer behaviours and

expectations. The conclusion will try to forecast where both European wine and

whisky markets are going.

6

LITERATURE REVIEW

France can boast about a great heritage as regards to wine as

well as spirits (Cognac, Armagnac, Anise drinks), but it should be noted that

French are quite fond of another distilled alcohol but rather confidentially in

the country: whisky (La consummation de whisky: une étude

exploratoire du comportement du consommateur dans le contexte français,

M-F. GAUTHIER, C. LABORDE, B. MAZIERES, p.3).

Where does this dynamism and enthusiasm come from? The

«flexibility» in terms of means of consumption (in cocktails, neat

etc.) gives whisky more opportunities and it is reinforced by brands activity

and distributors with regards to advertisements and promotion (Le whisky,

superstar des spiritueux toujours en croissance, M. BAILLY).

According to Guillaume Deglis head of Vinexpo, the consumption

tendencies for the next five years will be supported by whiskies as well as

bourbons since they managed to bring innovation

to their offer. Brown alcoholic drinks (including whiskies)

are surfing on this cocktail, parties in bars trend more and more praised by

women and millennials. The whisky market should thus increase from 9% from now

to 2018, Bourbon from 19% (Whisky et bourbon, nouveaux chouchous du

marché des spiritueux, P. DENIS).

As of today, the spirits universe has never been as much

diverse and multi-coloured. Ranges of spirits in supermarkets shelves and in

specialised shops are so varied and internationalised and

the demand for luxury drinks has never been so important.

Bars, cafes, restaurants, clubs have now a cocktail menu that is getting bigger

and bigger (Encyclopédie des Alcools et Spiritueux, A. DOMINE, 2009,

1st ed. H.f. Ullman, p.15). Whisky's good health is notably due

to Europe's consumption.

What about wine? The wine market is not going well everywhere

in the world, in Europe as well. By 2018, worldwide wine market should rise by

3.7% which is not a lot compared to

whisky to reach 2.732 billion of 9 litres boxes, which

represents 32.78 billion bottles. China

where consumption progression levels were reaching explosive

rates (+70% between 2009 and 2013), consumption has suddenly slowed down since

2013 because of Beijing's anti-corruption

measures (Whisky et bourbon, nouveaux chouchous du

marché des spiritueux, P. DENIS). Generally speaking, Europe also

has a decreasing wine consumption but is this drop due to a better consumption?

Is it benefiting whisky consumption?

7

I. European Wine & Whisky markets

1. Old & New world wine & whisky consumption

Many evidences have revealed that winemaking is known for

millennia. With current level of knowledge, the scientific consensus is that

winemaking has been first performed in Caucasus region, probably in Armenia.

Wine is an alcoholic beverage, produced by the fermentation of the grapes.

Worldwide, the International Organisation of Vine and Wine (OIV) has drafted in

1928 a resolution which states the legal definition of wine: «no other

product that those obtained by the alcoholic fermentation of fresh grapes juice

can get the wine appellation».

Since 1973, OIV has decided that wine can be obtained only by

the complete or partial alcoholic fermentation of fresh grapes, whether or not

crushed, or of grape must.

The wide variety of wines existing in the world can be

explained thanks to the variety of vineyards, wine varieties, winemaking

methods, or ageing. That is why we have red, rosé and white wines, dry

or sweet ones, or even still or sparkling. Viticulture has spread all over the

world and many countries are wine producers.

All over the world, wine names in the different languages have

in common the V letter (or its variant W) and the N: vera (Albanian),

Wein (German), wine (English), vino (Spanish,

Italian, Croatian, Czech), vin (Danish, French, Islandic, Romanian and

Swedish), vein (Estonian), viini (Finish), ... with 2

exceptions: ardo (Basque), and bor (Hungarian) (Indifferent

Languages).

There are more than one million winemakers in the world who

produce approximately three billion cases of wine each year. The production is

projected to have approximately grown by 2.2% in 2015 (274 million

hectolitres), due to solid harvests thanks to great climatic conditions in many

countries which allowed the vineyards to get matured grapes and perfect

conditions for harvesting.

According to the Organisation of Vine and Wine (OIV, 2015),

the world wine consumption represented 240 million hectolitres in 2015, which

equals 32 billion 75cl bottles, and it has increased by 0.9 billion hectolitres

last year.

It is important to notice that the consumption/production ratio

is not really balanced.

The overall demand is increasing but is it the case everywhere in

the world?

About two thirds of the world wine consumption relies on only ten

countries.

Furthermore, the wine business is changing shape: The Old

World (which basically represents Europe) leads the wine consumption for now

but it is gradually losing its pole position.

8

Yet, these outcomes confirm a change in this consumption from

the traditional producers such as France or Italy to other wine producers,

although more recent, but also wine enthusiasts, the United States and China.

There are indeed new actors from the New World (outside the traditional area of

wine-growing).

As you can see on this graph, and looking at the variation

2015 vs 2014:

- The first consuming country are now the United States, which

overtook on France since 2012 and it keeps increasing.

- At the second and third place, we found the traditional

consuming countries (France and Italy) with a decreasing trend in France and a

stable consumption in Italy.

- Germany, China, UK and Argentina wine consumption show a

slight increase, while Russia's and Australia's consumption are declining.

There is a noticeable rise of consumption in countries outside

Europe even though wine is undeniably one of the most popular alcoholic drink

there.

Spirits are also popular alcoholic beverages in the world and

whisky belongs on the top alcoholic beverages and is one of the most popular

spirits.

The word whisky is English and came from the Celtic word

uisge in Scottish Gaelic (or uisce in Irish Gaelic).

«Uisgue» or «uisce» means simply

«water»; by adding »beatha», you get the Celtic

word «water of life» («uisge beatha» in

Scottish Gaelic and «uisce beatha» in Irish). When English

people has discovered this spirit, they have only kept the first part of the

word and wrote it their way: «whisky».

Whisky finds its origin in Ireland. The legend says that Saint

Patrick, the patron saint of the Irish, has brought himself the secret of the

distillation in Ireland at the 5th century. This secret has then

crossed the sea to join Scotland. Irish and Scottish are still claiming the

fathering of this famous beverage!

Whisky has a slight advantage compared to some beverages, for

instance Cognac or Champagne (governed by an appellation system): it can pretty

much be produced anywhere.

Source: Wikipedia

9

And so, whisky is everywhere. Scotland, Japan, the United

States, Ireland, India, Sweden, Australia, New Zealand, South Africa ...

Furthermore, there is another way to spell the word

«whisky» which is «whiskey». Should we say

whisky or whiskey then? Well, it differs geographically: the American and Irish

write «whiskey» and the Scottish, Canadians and the rest of the world

write «whisky». Where does this come from?

It started during the 19th century. Scotch whiskies

were of poor quality and were inadequately distilled in Coffey stills (see

photo on the right). For exportation in the US, the Irish distillers wanted to

discern their production from the Scottish competitors, therefore they added an

«e» to point out their difference. Nowadays, Scotch is one of the

greatest spirits in the world but the spelling still varies. Americans still

spell their whisky with an «e» but some distillers prefer the

Scottish spelling (Maker's Mark for instance for their Scots ancestors).

But what is whisky?

Whisky is a term that designates spirits obtained by the

distillation of malted and/or non-malted cereals, then aged in wooden barrels

and containing at least 40% alcohol.

There are different types of whiskies depending on the raw

materials entering in their recipe, or on their production process:

- A Single Malt whisky is made of malted barley from a single

distillery.

- A Pure Malt whisky is also elaborated with malted barley but

from several distilleries. - A Blend is a mix of malt and grain whiskies from

different distilleries. It can also be a mixture of two or more whiskies that

will be bottled and sold as one whisky.

These three `whisky types' can be produced anywhere.

However, there is on top a national appellation system. Thus

Scotch, the most popular whisky but also the best-selling whisky can only be

produced in Scotland.

It is the same with the Irish whiskey in Ireland, or Bourbon in

the United States.

To be considered as a Bourbon, the whisky has to be produced

in the US, the grain mash must be at least 51% corn and the mixture also has to

be stored and aged a minimum of 2 years in charred oak containers.

Rye whiskey can refer to Canadian whisky or American whiskey

and must be distilled from at least 51% rye.

10

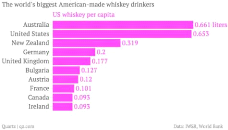

Regarding the consumption, here is a graph showing the biggest

whisky (and/or whiskey) drinkers in the world.

According to this Euromonitor analysis:

- France, Uruguay and the United States ascend to the top 3

- The original producing countries (Ireland and UK) arrive

respectively in 7th and 8th position - India (in

9th position with 1,24L/capita, is by far the world's biggest

drinker due to its population: approximately half of the world's whisky is

drunk there). Some interesting remarks on to the Indian market: They are not

only the biggest whisky consumers, their whiskies are also part of the world's

top 10 whiskies (in volume). United Breweries, an Indian conglomerate is also

the world's largest whisky company by volume. It owns several important

subsidiaries, notably United Spirits Limited (which manufactures McDowell's),

the world's best-selling whisky according to The Millionaires' Club (Officer's

Choice and McDowell's No. 1 are respectively the top 2 whiskies sold in the

world).

Why are these whiskies so powerful on the international market

and yet not very well-known, even from whisky amateurs?

First off, they benefit from their own national market. With

1, 2 billion habitants and a middle class boom, India is the world's first

whisky market. So when Scotch producers sell 90 million whisky cases in the

world, meanwhile approximately 120 million of local whisky cases are being

consumed in India!

Problem is, according to regulations, the Indian whisky

(except Amrut, actually sold in the European market and others) is simply not

whisky. Distilled from molasses (the liquid obtained

11

after the cane sugar extraction), it is sometimes mixed with a

little bit of malt or grain whisky. Outside of the subcontinent, it would be

labelled as Rum, thus it cannot be sold on the European market or anywhere else

as `whisky'.

Outside the United States, Australians, New-Zealanders,

Germans and British are big consumers of American whiskey.

Concerning the US, Beam is responsible for more than 40% of

the US Bourbon sales which accounts for almost half of the American whiskey

market. According to the International Wine and Spirit Research, the United

States consumes roughly 70% of the whiskey it makes.

2. Focus on the European market

Let us now have a look on the consumption trends for wine and

Whisky in the 5 main European countries:

France:

Whiskies: With more than two hundred million bottles

sold every year, whisky (Scotch, Bourbon, Rye or Japanese) is the most consumed

spirit in France to the detriment of Cognac. In the wine country, whisky is the

king of spirits.

As we saw previously, with 2.15 litres per capita, it

represents nearly 40% of the total spirit consumption (Fédération

Française des Spiritueux, FFS).

Overall, 120.9 million litres of whiskies have been consumed

in France in 2015 (FFS). With a market share close to 40%, whisky surpassed

pastis (73.84 million litres, 24% market share), rums (30.31 million litres,

9.9% market share) or white alcohols (tequila, gins, vodka, 29.56 million

litres and 9.6% market share).

Spirits market share

Source: Nielsen

Eaux-de-vie

0,50%

White alcohols

9,62%

Armagnac

0,20%

Calvados

0,20%

Rums

9,92%

Cognac

0,20%

Liquors

9,12%

Aniseed drinks

24,15%

Bitters

4,41%

Whiskies

39,48%

Others

2,20%

12

Nearly 80% of spirits (77.2%) are bought in

supermarkets/hypermarkets. The rest is divided in away-from-home catering,

specialised retail shops... According to the FFS, the spirits turnover is 4.6

billion euros in 2015. In 2014, about half of the total turnover (46.9%) was

generated by whisky sales (2.09 billion euros). In volume, there is a slight

decrease of -0.5% of spirits sales (279 million).

Wine: France's wine consumption is regularly declining

since the early eighties.

Since 1980, France AgriMer performs every 5 years a survey on

wine consumption in France. 4000 people, representative of the French

population, are interviewed, in order to understand the real behaviors of

people in wine consumption: motivations, frequency, quantity, and also opinions

and attitude that people can have vs wine. Last survey was made in 2015

(8th edition). According to this survey, 51% of people drinking wine

were drinking every day or nearly every day in 1980 while in 2010, only 17% of

the population drinking wine were drinking every day. The percentage of people

drinking wine occasionally in 1980 was 30% and 45% in 2010, an important

increase compared to the freefall with more «regular drinkers».

The proportion of French who never drink wine keeps growing

and all changes in drinking habits are observable through generations'

attitudes.

According to the results of the 2015 survey, wine perception

is improving. A renewed interest is observed between 2010 and 2015, with a more

important part of the population declaring liking wine taste. This trend

correlates well with the growing interest of French people for cooking, the

come-back of home-made food, cookery programs, and wine and food pairing.

13

Wine is more consumed at the aperitif moment, especially white

and rose wines (red wines are more associated to the lunch moment).

Wine seems to move from one of the components of a lunch to a

more cultural drink.

The UK:

Whisky:

It is interesting to analyse the information provided by IWSR

(International Wine and Spirit Record). This agency claims to be the leading

source of data and analysis on the alcoholic beverage market. It covers 155

markets in total.

According to the IWSR, the whisky market represents 1.2

billion bottles in 2015. The spirit market is indeed quite significant in the

UK: with 139 million bottles of gin, 58.5 million bottles of vodka, 1.1 billion

litres exported to foreign markets (2013) which 28.2 billion pounds in economic

activity.

Vodka is the N°1 consumed spirit, representing nearly 30%

of the UK spirit consumption, and Whisky arrives 2nd with 25.56%.

Spirits market share

Source: The IWSR (2013)

National Spirits

0,05%

Brandy

6,30%

Tequila

Cane

0,60%

0,10%

Gin / Genever

8,90%

9,00%

Rum

29,89%

Vodka

Flavoured Spirits

19,59%

Whisky

25,59%

:

18,49% 6%

1,1%

Wine: According to the IWSR, the UK wine market is the

6th largest wine market in the world. UK wine production represents

only 0.01% of the local consumption and so UK must import nearly the totality

of its consumption. Indeed, the industry generates 17.3 billion pounds in

economic activity to the British economy and 10 billion pounds in sales.

14

More than 80% of wine sales take places retail outlets, the

remaining sales are through bars, restaurants and hotels (in other words

away-from-home catering).

UK is an important wine consumer. According to the OIV, the UK

reached 12.9 millions of hectolitres in 2015. It is a small growth compared

with 2014 and it also counterbalance the drop between 2013 and 2014.

Wine is the most popular alcoholic drink in the UK according

to the Wine and Spirit Trade Association (WSTA) and is not just limited to

connoisseurs. It is actually the preferred choice for millennials (in that case

people between 25 and 34 years old) when it comes to drinking with over half

(57%) picking wine over other alcoholic drinks. Also, women tend to drink more

wine than men.

White wine is favoured over red consumption (47% of all sales

in 2015 versus 42%). Rosé wines also share a small percentage (11%).

Sparkling wines shows the most important growth thanks to Prosecco and Cava and

are perceived to have a better value for money than Champagne. Fruit flavoured

wine as well as low-alcohol wine also show potential for the future and can be

a threat to still Rosé wine (United States Department of Agriculture

(USDA)).

Ireland:

Whiskey: Ireland ranks in the top 10 for biggest

whiskey consumers. With 1.24 litres per capita, the country is head to head

with India and is almost overtaking the United Kingdom. Overall, spirits

consumption has increased from 1.9% from 2014 to 2015.

Worldwide sales of Irish whiskey keep rising: a 10.1% growth

with 62 million litres in 2013 (55.8 million litres the year before (source

IWSR)).

Ireland knew an intricate story with whiskey. It was not so

long ago the world whiskey leader but it went through tough times and the most

affected city was actually Dublin, the spiritual mother of Irish whiskey, where

it all began. It was abandoned in 1976 after Jameson's pot still fire stopped.

At that time, Irish whiskey hit rock bottom: while Scotch whisky conquers the

world, it was just considered as a bizarre, an odd beverage barely used to

rinse out someone's glass.

What was in the past a proud industry at a global scope was

reduced to two companies producing bad quality whiskies (a pure euphemism),

which totally accepted their ignorance of the Irish pot still tradition. Dark

times for Irish whiskey, almost vanished due to war, trade restrictions,

Prohibition, economic difficulties etc.

It was only in 1987 when the Irish entrepreneur John Teeling

founded the Cooley distillery. His sons, Jack and Stephen worked for the

company until 2012 when it was bought out by Jim

15

Beam. They simply figured that they wouldn't be satisfied

working for an important group. Anyway, the demand for whiskey was rising,

consumption too, awareness as well notably thanks to the group Irish

distillers' Jameson (Pernod Ricard) and their important marketing. From the

eighties until 2012, there was only three companies which distilled whiskey. In

May 2015, five companies distilled whiskey. With more than twenty distilleries

under construction or planned, new actors, a growing (and reborn) reputation,

American consumers as a support, Irish whiskey is getting better.

Wine: Wine is not the most popular alcoholic drink in

Ireland, beer is. With almost half of alcohol consumption (47%), beer won't be

dethroned anytime soon. Wine is actually the second most consumed alcoholic

drink with a 27,7% market share, followed by spirits (18,7%) and cider (6,6%)

(Source: Irish Revenue Commissioners Clearance Data).

Women are more likely to drink wine than men (61% versus 39%

(TGI Data 2015). Also, wines from Chile are the best-selling wines with a 25.3%

market share (more than 2 million cases), followed by Aussie wines (18.1%, 1.5

million cases) and France (14%, 1.2 million cases). Wine sales are mainly

through off-trade (grocery, independent retail etc.) with 80.9% market share,

the rest is on-trade (away-from-home network: bars, restaurants etc.) with

19.1% (Source: IWA Country of Origin Survey, AC Nielsen and other trade

reports).

Italy:

Whisky: Overall, Italians drink less alcohol now.

In last international ranking, Italy is at the 32nd

place (Source Euromonitor survey).

In less than 10 years, we observed a 23% decrease in rate of

alcohol consumption which makes an average of 4.4 drinks per week in 2014

(versus 5;6 drinks per week in 2006). This fall is actually due to a drop in

wine consumption over this period (31%). However, the consumption of beer and

spirits remained the same.

Wine: Regarding the consumption, the country

experienced a modest growth and is behind France and the United States.

As we said previously, the country's falling drinking rates is

due to many things.

Eating habits which changed with lunch losing its position as

a «family meal», wine is now mainly consumed during dinner (before it

was usually drunk during both). Also, the proliferation of non and

low-alcoholic drinks played a central role in wine consumption habits with a

growing «health awareness».

16

On the production side, Italy dethroned France and became the

world's biggest wine producer with 48.9 million hectolitres (versus 47.4

million hectolitres). It represents a 10% increase compared to 2014 (source

OIV).

Germany:

The following graph shows Germany's alcohol consumption. As you

can see there are two sets of line: The first set on the left show data from

West Germany since data from the East was difficult to gather. The second set

shows data when Germany was finally reunited.

Whisky: On average, spirits consumption remained stable

throughout the years.

22nd in the ranking of the whisky consuming countries,

with 0.45 litre/capita;

Wine: Germany saw a small growth in wine consumption with

20.5 million hectolitres.

Even if Italy dominates wine production, it has been surpassed

by Germany for the consumption. It is actually the first time Italians have

been overtaken by Germans according to the Organisation of Vine and Wine

(OIV).

3. Trends and changes during the last 5 years

It is interesting to have a look at worldwide alcohol

consumption on the health side. The World Health Organisation (WHO) publishes

regular reports on this topic. According to the WHO, 48% of the world adult

population has never consumed any alcohol. But what about the rest?

The drinker's geography commonly claims a wide prevalence of

alcohol consumption in Western countries and Russia, while temperance is

demonstrated by African countries, Arabian region and South East Asia.

17

The more a country is developed, the more its alcohol

consumption is high. On the contrary, developing countries show lower

consumptions.

Let's have a look at this map representing the alcohol

consumption per capita (considering only 15+ people) in each country, the

repartition is slightly different: if a wide part of the population of the

developing countries, like India and Africa, is indeed abstinent from alcohol,

the part of their population who drinks alcohol grow up the consumption volume

of these countries.

If 48% of the world adult population has never consumed any

alcohol, the consumption per capita is underestimated.

Regarding the type of alcohol consumed, more than a half of

the alcohol consumed in the world is part of the spirit family, followed by

beer (34.8%) and wine (8%).

The American continent (AMR) consumes more beer vs spirits,

while this proportion is reversed in Pacific countries (WPR). The same trend,

even majored, is assessed in South East Asia (SEAR). Middle East countries

(EMR), the spirits consumption is similar to the wine one. According to WHO

reports, Canadian people drink more than American or Australian people. Alcohol

consumption is low in Maghreb, but more important in Sub-Saharian Africa, South

Africa and Namibia.

But what happens in the «old world»?

18

The WHO is working to prevent potential health issues linked

to an excessive alcohol consumption (see advertising hereunder):

The WHO has also published the ranking of the alcohol

consumption in European countries (2005 data, Cf. appendix n°1).

The alcohol consumption is really variable depending on the

countries: Russian and their neighbors drink more than all the other countries.

Portugal is also clustered in the heavy drinkers with more than 14.5 liters per

capita, followed by Ireland and France and UK. Italy differentiate itself with

a significantly lower consumption (10.7 liters per capita). Let's have a look

at what is happening on the wine production side. We can indeed make a parallel

with the European consumption tendency. As we said previously, the Old World

continues to lose ground against the New World.

When we take a look to the following chart, it perfectly

illustrates this growing trend.

19

Europe is still leading this ranking, with Italy, France and

Spain but something is happening with New World countries. United States,

Argentina, Chile, etc. are progressively rising. When we actually compare their

wine production with their wine consumption, it is interesting to notice that

it is increasing as well:

- The US became the largest domestic market and the biggest

wine consumer,

- China, South America as well as South Africa's wine

consumption is slowly (sometimes

quite rapidly) but surely increasing, even though China's

production remained quite stable. Contrary to clichés, Russians are not

the biggest alcoholic beverage drinkers. The country that will know the

strongest consumption is China, with more than 1.5 litre of pure alcohol per

year and per capita till 2025. Even if Europe will remain the thirstiest region

of the globe.

Furthermore, China is not only becoming one of the top

winemakers in terms of production but also one of the top consuming countries.

Indeed, it is in the top 10 of the main wine producing countries

(9th position), right behind South Africa but in front of

Germany.

Who is behind this trend in New World countries?

Well, mainly Millennials (it generally applies to people who

reached adulthood around the 21st century). The «Y

Generation» that grew up in a growing electronics-filled, online and

social-networked environment has a strong interest in wine but not just

wine...

Millennials are playing a fundamental role in wine as well as

spirits consumption. While previous generation young people were mainly

consuming beer, millennials are abandoning

most commercial and popular beers (from macro-brews like

Anheuser-Busch with Budweiser, Leffe, Stella Artois, Hoegaarden and so on) and

are switching towards craft beers, wine and spirits.

A survey in 2015 found that more than 24% of interrogated

people wanted to decrease their beer consumption versus 8% for those who are

planning on increasing it. This trend is particularly noticeable amongst the

young. According to MorganStanley, millennials are losing interest in

macro-brews, are less interested than their elders and tend to prefer wine and

spirits. This interest for beer is fading: In 2013, 33% of millennials surveyed

said that beer was their favourite alcoholic beverage and in 2015, only 27,4%

cited so.

On the other hand, in France for example (which is part of the

Old Continent), young people do not have that much interest in wine, it is

actually the opposite. According to FranceAgriMer, wine consumption depends on

the age and the generation: The more a person gets older, the more he/she

consumes wine. In the eighties, more than 70% of French people over 15 years

old were wine consumers from the 20-24 years old age bracket. In 2015, people

who reach this rate are from 45-49 years old.

Individuals who are sixty to seventy grew up with wine at

pretty much all meals, it is part of their cultural heritage. The «Middle

Generation», which basically represents people in their forties of

fifties, perceives wine as an infrequent treat. They counterbalance this

weakened consumption by spending more money on wine (more qualitative, drink

less but better).

The «Y Generation», millennials, do not take

interest in wine before their late twenties.

Men (on the left) and Women's (on the right) wine

consumption in France

1980 1990 2000 2010 2015

22%

69%

9%

34%

22%

44%

24%

40%

36%

46%

28%

26%

25%

52%

23%

1980 1990 2000 2010 2015

37%

37%

27%

43%

40%

17%

47%

41%

13%

42%

47%

11%

50%

39%

11%

20

|

Non-consumers

|

|

Occasional consumers

|

|

Regular consumers

|

Source: FranceAgriMer. Enquête sur la consommation

du vin en France 2015

The number of regular drinkers is getting lower and lower

while the occasional drinkers are growing and the non-consumers remain pretty

stable for both genres when we hit the nineties. Numbers of non-consumers

doubled between 1980 and 1990. We observe this change for all three categories

during these ten years except for regular consumers who are lessening. This

drop in consumption is mirrored in other countries of the Old World.

In Ireland, women have more interest in drinking wine compared

to men (61% volume share versus 39%). Also, 35 to 44 years old people tend to

drink more wine than millennials (25% for women, 21% for men versus 5% for male

and 10% for female - TGI Data).

Wine market share (in volume) rose from 2005 to 2015 (19,9%

versus 27,7%), spirits market share increased as well in 2015, not by much

however (18,7% in 2015, 18,5% in 2005).

Generally speaking, wine consumption is in decline in Europe

except for minor rises in certain countries like United Kingdom and Ireland.

The French, Italian as well as German markets are projected for waning over the

next four years. Still, there is a «less but better consumption»

mantra growing in many countries. Wine is more and more seen as an elitist

drink rather than a standard alcoholic beverage.

As regards to whisky, we can observe some trends in terms of

consumption in many countries. For instance, here is a graph showing France's

alcohol consumption over the years:

21

As we can see, there is a noticeable decrease in wine

consumption whereas whisky consumption has remained stable (along with

beer).

What are the different tendencies? What happened during the last

five years (or more)?

22

During the last five years, Irish whiskey has been taking off,

rocketing especially in the US in terms of sales: Although it represents quite

a long time (between 2002 and 2014), whiskey sales have been gigantically

rising from 538%!

The demand for top of the range, limited-edition, exclusive,

innovative and rare whiskies is also soaring both in the Old and the New World

and it involves Bourbon, Scotch as well as Japanese whiskies. «A more

sophisticated and demanding consumer is emerging» (The Future of Irish

Whiskey p.7) because he/she is more and more knowledgeable, even sometimes

passionate and complex about their whisky choices. People want something

unique, something not available in every supermarket.

We have seen Japanese whisky exploding for the last ten years,

and it is really defying Scotch's domination. Indeed, Nippon's whisky started

to draw interest quite late mainly due to Suntory's marketing but is now part

of the greatest whiskies in the world by notably winning several awards.

Whiskies are also very popular for their nice cocktails. The Whisky Sour, the

Manhattan, the Godfather, the Rob Roy, so many names that make us want to try

them all (with moderation). It exists new formats for making cocktails, and not

just made with Bourbon or Rye, but with Irish whiskey, Canadian whiskies,

Japanese whiskies too (to drink during a meal with a refreshing highball) and

even Scotch!

In other words, people are looking for innovation (new types

of oak, casks, ageing processes...), they want to try new and more types of

whisky, from other places. It is a very intricate market. This complex market

is also draining the stock of old vintage whiskies (usually single malt Scotch)

which makes distilleries release more and more No Age Statement whiskies (NAS).

It gives them the opportunity to have whisky at disposal without having to wait

several years. Additionally, according to the IWSR, by 2020, whisky will push

the global spirits consumption to 3,2 billion cases. Whisk(e)y should also

overtake on vodka and «become the second-largest spirits category»,

right behind national spirits. Global consumption should grow to 467,5 million

cases. Where will the growth come from? Mainly from Asia with China and India

surpassing any other markets. Furthermore, there will be a rise not only in

North-American markets, Africa and Middle-East but also in duty-free

markets.

We will now discuss the whisky market in more details.

23

II. Worldwide whisky market

1. Overall picture, main producing countries

First thing first, let's talk about how whisky is made. There

are certain variations according to the type of whisky: Scotch, Bourbon, Irish

whiskey. But we will talk about the production process of the most spread

whisky: Single Malt. The first step in whisky making is malting. Barley is

steeped in water, subject to several humidification and oxygenation phases

which allow the embryo to «leave» its dormancy stage. Barley is then

spread out on malting floors in 30 to 50 cm layers to germinate and it is

frequently turned. During this process, enzymes are stimulated, it transforms

starch into a whitish flour from which sugar will be extracted when mashing

takes place. After 6 (up to 7 days) days of germination, the barley now named

`green malt', goes for kilning (in other words, drying). Malt houses are

equipped with ovens for peat fire that will add the smoke flavour (it is not

compulsory; some distilleries won't use peat) but also with burners which

insufflate warm air. Green malt is dried, cleared out of impurities and

germination is stopped.

The second step in whisky making is mashing. The dried malt is

ground, it is called `grist' at this point, and mixed with hot water in a vat

(mash tun). There are three stages in adding the water (which becomes hotter

and hotter), allowing the starch to be converted into sugar. The obtained

liquid, quite sweet, is called `wort'. The quality as well as the flavour of

the water plays a key role in the whisky character, it will vary according to

the country and the region (in Scotland for instance with the Lowlands,

Speyside etc.).

Now comes the third step: The wort is chilled to 20°C

(which is the temperature from which yeast will start to operate) and pumped

into fermentation tanks, `washbacks', where yeast is added. It feeds on the

sugar which transforms into alcohol and carbon dioxide. The liquid, now called

`wash' (lots of names) starts bubbling. Sugar needs forty to sixty hours to be

completely transformed into alcohol, the liquid obtained is a malt beer or

distiller's beer with 6 to 8% alcohol by volume.

24

The fourth step is the distillation in pot stills. The number

of distillations, the size, the pot still shape, the distillation speed, the

heating process but also the swan's neck inclination will influence the

character of the whisky. The wash is warmed up to the point where alcohol turns

into vapour. It passes in the Swan's neck into a worm condenser which is

immersed in running cooling water in order to transform the vapour into a

liquid. For Scotch, there is a double distillation: the wash is first distilled

in wash stills to detach the alcohol from the water, yeast and remains called

`pot ale' (solids that will be saved for cow feeding). What you get from the

wash still are `low wines' (about 20 to 25% vol.) that are sent to the spirit

still for the second distillation. This process is repeated until you get the

`high wines' (which are about 68% vol.) and they are filled into oak casks of

different sizes and types. Some of them might have contained Bourbon before,

Sherry or even wine for example. The cask will of course have an influence on

the whisky. All the distillates pass by the spirit safe which allows the

stillman to control and judge the different liquids obtained.

Unlike wine production, whisky production is not as influenced

by climatic hazards (except for barley agriculture but other than that, the

whole production is usually made indoors). According to the OIV, wine

production in 2016 should reach 259,5 million hectolitres versus 274 million in

2015 which represents a 5% drop, falling to its lowest level since 2012. This

is mainly due to global warming, variously affecting harvests around the world:

France's ones fell from 12% (spring hail and frost), the Champagne region from

30%, Italy decreased from only 2%, South Africa, Chile and Argentina

respectively 19%, 21% and 35%.

Here are the main whisky producers:

- Scotland: It is the main country producing whisky and also

the most well-known. With 1.5 billion bottles every year, we understand why. It

represents two third of the world's production. The Lowlands, the peninsula

Campbeltown, the Speyside (about half of the distilleries in the country are

established there), the Highlands (it comprises the north of Scotland,

including the islands) and finally Islay, form the five regions of Scotland

producing whisky and they all have their specificity. Scotland produces Single

Malts but also Blends.

25

- The United States and Canada: North America produces Bourbon

(mainly made out of corn) with very specific elaboration methods. The Tennessee

whisky differentiate itself from the Bourbon because of the «Lincoln

Country Process», a filtration through three layers of maple charcoal. We

can of course mention Jack Daniel's as an example. Canada produces

approximately 21 million cases of whisky. The US, produces about 37 million

cases of whiskey. According to the Distilled Spirits Council of the United

States, the country exported 235 million whiskey bottles last year. France is

no exception, with 8 million litres sold in hyper/supermarkets in 2015, it

represents a 12% growth and these sales has been overtaking Scotch's ones for

the third year now. This success is explained by their «rounder»

aromatic profile, the cocktail trend and it is not going to stop anytime soon.

Important groups like Jim Beam, Brown-Forman invested in order to increase

their production capacity. Besides, the number of microdistilleries and of

smaller actors keeps growing. However, American whiskeys still have to prove

themselves. According to Thierry Benitah, La Maison du Whisky CEO, there is

usually not more than five or six American whiskey references in wine shops but

on the other hand, Bourbons and Ryes benefit from cocktails renewal success and

are more and more found in CHR (cafes, bars, hotels, restaurants), especially

in independent cocktail bars which are reaching tomorrow's consumers: 25 to 35

years old people.

- Japan: It is the 4th whisky producer in the

world. The country has been producing whisky for almost a century. The Japanese

production method is based on the Scottish model therefore their whiskies are

either Single Malts or Blends very renowned on the market thanks to the quality

of the water, very pure, just like in Scotland. Japan actually took a step

ahead in terms of Blend whiskies notably thanks to Hibiki which was awarded

several times best Blend in the world (for the 21 and 30 years old).

- Ireland: The country produces about 7 million cases of

whiskey and it keeps on growing. Irish whiskey goes through three rounds of

distillation before being bottled. There is a use of both malted but also

non-malted barley. The aromatic profile of whiskey is usually smooth, light,

floral and fruity style. It is also naturally non-peaty although peat is

omnipresent in the country. As we said earlier, Irish whiskey has been through

ups and downs but especially ups these past few years: Last year, 70 million

litres have been sold (a 12% increase compared to last year), Irish whiskey is

the category with the most important progression. In France (again),

hyper/supermarkets sales are carried by brands such as Jameson, Paddy or

Tullamore Dew, with approximately 3 million litres sold in 2015 (V&S news).

Irish whiskey's shelves are becoming more and more enriched in wine shops.

26

Why so much enthusiasm for these whiskeys? Their aromatic

profile is quite distinct, easier to drink because fruitier and more refined.

This market is not yet mature so there definitely is a good potential for the

next years.

2. «The Judgment of London» - Scotch vs Japan

The 24th of May of 1976 will forever be a cursed

date for Bordeaux wine producers. On that day, a blind tasting put an end to

their historical and famous Crus Classés supremacy because Californian

wines went straight on to the first place, not Bordeaux. This was the Judgment

of Paris. The 18th of April of 2008 feels pretty much the same for

Scotch producers.

London International Spirits Challenge, April 18th of 2008,

after a 200 samples blind tasting, a plethora of experts awarded the Yoichi 20

years old as the best single malt in the world and the Hibiki 30 years old as

the best blend in the world. Two whiskies made in Japan, something to give

shiver to Scotch producers. This is what I would propose to call the `Judgment

of London'.

Outside Scotland, press blame the distilleries to savour their

success and this consecration didn't surprise whisky amateurs. They have been

discovering this Japanes

beverage for the last couple of years. Japanese whisky is not

only successful in

competitions but also in wine merchant shelves. In France,

world's first market

for single malt, their sales double every single year: 30,000

bottles in 2006, 70,000 in 2007 and it rocketed to 800,000 bottles in 2014.

With barely 10,000

bottles ten years ago, this is quite an impressive rise.

Regarding premium

whiskies (those that you wouldn't dare mixing with Coke and

those which price is higher than 25€), it currently represents about one

twelfth of France's

Scotch imports. But the gap is slowly tightening: hypermarkets

and retailers

like Carrefour or Nicolas decided to bring Japanese whiskies

on the shelves

and they still keep on coming.

At first, it does seem a bit like David and Goliath, Scotland

being the mighty warrior with more than 110 distilleries, an old tradition and

a great awareness all around the world to such an extent that whisky and Scotch

could be synonyms. In comparison, Japan is still small: about ten distilleries

with quite a young experience in whisky making. Japanese discovered whiskies in

1853 when the American commander Matthew Perry - who ran the war fleet which

aim was to force Japan to open up its barriers for trade - distributed some

cases in order to facilitate negotiations. Nippon's first attempt to reproduce

whisky was a failure (they tried to distil it

27

with rice, corn or millet instead of barley). It was only in

1918 and only then, when Masataka Taketsuru, a graduated chemist working for an

eau-de-vie producer in Osaka, left to Scotland to discover the secrets of

Scotch making. After 2 years of internships in Speyside distilleries, he came

back to Japan in 1920, his mission accomplished and with his Scottish wife,

Rita. The former company he worked in went bankrupt but he was hired by

Shinjirô Torii, Suntory's founder. He built the first whisky distillery

`Kotobukiya' (later renamed Suntory) in Yamazaki, in Kyoto suburbs. Under his

wife influence, Taketsuru partnered with other shareholders to create Nikka

(named Dai Nippon Kaju before), he established the Yoichi distillery in

Hokkaido, the northern island (he chose Hokkaido because it reminded him of

Scotland climate and terrain).

Nowadays, Suntory and Nikka are the main Japanese whisky

makers. The first one sells his single malts under the Yamazaki label but also

Hakushu, another distillery. The second one sells its bottles under Yoichi and

Miyagikyo brands, the two distilleries names. There are many whisky varieties

just like Scotch, with peaty characters, malty etc. For top of the range

whiskies, `single casks' are much less expensive than Scottish single casks,

which became quite unaffordable. As to Japanese blends, many are commercialised

under Nikka or Suntory and their blending (going up to 30 malts, the youngest

giving the age to the bottle) integrate some Scotch. Nikka acquired Ben Nevis,

the oldest Highlands distillery, Suntory got Bowmore, Auchentoshan and Glen

Garioch, 3 renowned whiskies.

How did Japanese manage to surpass Scottish masters? It is

kind of like Toyota's approach, which allowed the company to become the world's

first automobile manufacturer: to pay an important attention to the quality and

to have a consistent follow-up of customers' expectations. Ulf Buxrud, just as

famous in the world of whisky as Robert Parker in the world of wine, highlights

the fact that Nippon's desire of perfection pushed them to take into account

the yeast biochemistry allowing barley fermentation and to create new

low-boiling distillation techniques. For certain whiskies, they even modify the

American whiskey filtration technique by using bamboo wood coal and not maple

tree in order to obtain a lighter and silkier texture. Finally, regarding the

ageing, Nikka and Suntory use - besides traditional European or American

barrels which contained Sherry or Bourbon - Japanese oak barrels, a very

aromatic wood that gives an exceptional character to the whisky.

On the marketing part, Nippon's whisky benefited since the

fifty's from specialised bar created at that time, some of them belonging to

Suntory or Nikka. The `Cask Bar' in Tokyo (Roppongi neighbourhood) or the

`Nemoto' in Sapporo, Hokkaidô for instance have a nice «Carte des

Whiskies» with 2.500 different bottles (mainly Scotch). These efforts in

terms of quality,

28

creativity by making more and more sophisticated whiskies

didn't push Suntory nor Nikka to develop an export strategy, their attitude

being really modest. Can you imagine their surprise when European journalists

came to Japan in order to discover its distilleries, were simply astonished by

the quality of whiskies. It has been conveyed to amateurs through the famous

«Whisky Magazine», to whisky blogs like Malt Maniacs and incited

Japanese to do even better. At the beginning of 2000, Nikka asked Thierry

Bénitah, head of La Maison du Whisky (who was already distributing Nikka

and Suntory's products in France), to become its agent for Europe. In 2004, the

worldwide success of Sofia Coppola's movie «Lost in Translation»,

where we saw Bill Murray shooting an advertising in Tokyo for Suntory Hibiki

had the effect of a launching campaign. It pushed Suntory to proudly

«Japanised» its label, Roman letters now appearing in small

characters.

Japan had a whisky boom especially during the seventies and

eighties, even Sake distilleries were changed to produce whisky in order to

meet the demand, the Japanese and especially the world's thirst. In other

words, Japanese whisky's future is bright.

3. New incomers

Besides the rise of American and Irish whiskeys, the

development of New World whiskies shakes up the market. Should we mention the

success of Japanese whiskies again? According to IWSR, in 2015, Nikka From The

Barrell, one of Nikka's best sellers had an audacious growth with a 50.7%

increase. Today, despite a more expensive price positioning, Nippon's whisky

brands are growing (new brands are appearing like Yamakura, Okayama for

instance).

Now, in the same area, should we consider India as a main

actor? Since the country sold 120 million bottles of their `whisky', it does

deserve some credits. As we said, what they are calling `whisky' is made

notably from molasses and (sometimes) mixed with Scotch. It is not only a huge

consumer (9th biggest drinkers in the world, 1.24 litres per capita

- Source Bonial) but also an important producer. Indeed, it also produces

whisky that meets European regulation standards: Amrut which has been awarded

several times, Paul John and both are focusing on the premium whisky market and

selling their products on the European market and the US market.

Remaining in Asia, and close to India, there is another whisky

producer: Taiwan. With the Kavalan distillery and the more recent Omar

distillery, these two deserve a special mention as well. Kavalan is

particularly getting noticed, gaining popularity thanks to several awards. In

2016, the Kavalan Solist Amontillado won the award of the best single cask

single malt of the

29

world (World Whisky Awards). The warm weather in the country

affects the maturity of the whisky. It indeed matures more quickly however the

Angels' Share is also more important. The Angels' share happens when the whisky

ages in barrels, where 2 to 3% of the liquid evaporates every year (it is

actually taken into account in distilleries' stocks). Taiwanese's Angels' Share

goes up to 15% per year. Furthermore, the country in the 20th

biggest whisky drinker in the world (0.63 litres per capita).

Back to the Old World now, France is also finding its place in

the world of whisky. Whisky consumption depends on the region (even if the

country is the world most important whisky drinker) and French distilleries

production capacity are quite modest for now. According to Philippe

Jugé, founder of the «Fédération du whisky de

France», 700,000 bottles of French whiskies were sold last year. Indeed,

from consumer, France also became a whisky producer in the eighties. Benefiting

from a certain know-how in spirits production, the country of wine couldn't

miss the opportunity to differentiate itself in whisky production as well.

In the beginning of the eighties, the Breton distillery

Warenghem was producing liquors (crème de cassis, Elixir d'Armorique),

until it decided to go on the more promising whisky market. The first French

whisky distillation occurred in 1983 for a release on the market in 1987.

Nowadays, Armorik (the name of the whisky) sells about 250.000 bottles per year

mainly in Bretagne but it is getting remarked in France and around the world.

In 2013, Armorik Double Maturation was awarded as the best European single malt

for the World Whiskies Awards (WWA). Alsatian as well as Breton whiskies even

got their own Protected Geographical Indication (PGI, IGP in French, Indication

Géographique Protégée).

France now produces approximately 700.000 bottles of whisky

per year. Why did France waited so long before producing whisky? Since the

country was already distilling other spirits like Cognac, Armagnac, Calvados,

even Rum, it is quite intricate. France currently has around 40 malt

distilleries which also pushed the creation of the French version of the Scotch

Whisky Association, the «Fédération du whisky de

France». According to Philippe Jugé, France is a wine country and

distilleries are usually in wine regions and even fruit regions. French

know-how leant towards these eaux-de-vie. With phylloxera destroying Cognac and

pretty much all wine regions in the 19th century, when Scottish were

ready to invade markets with their blends, French consumers started consuming

whisky.

Later on, Anglo-Saxons pulled it off in both World Wars,

Hollywood golden age was embellishing whisky's image and some French companies

already invested in some Scotch distilleries (like Pernod Ricard which owns 14

of them), all these factors were not really contributing to France's whisky

production development. Furthermore, distillers didn't have

30

the tools required to make whisky. For instance, French

distilleries alembics or pot-stills are smaller because more adapted to other

spirits but it made distillers think about other ways to make whisky instead of

just copying Scotch. Last but not least, and it might sound very strange but

one of the reason why France waited so long to make whisky is because of... An

Icelander volcano. France was indeed producing whisky, some old papers back in

the 18th century proved that a «grain eaux-de-vie aged in

barrel» (the definition of whisky) was produced and consumed. However, a

volcanic eruption in Iceland had dramatic consequences. Laki, a volcanic

fissure erupted for nine months until February 1784, causing lava to pour out

of the system, creating an ash cloud filled with toxic and therefore lethal

elements («poisonous hydrofluoric acid and sulfur dioxide compounds»,

Wikipedia), which caused Iceland to loose half of its livestock (mainly sheep),

causing famine and killing about a quarter of the population. But it didn't

stop there and the volcanic cloud, pushed by winds reached Europe in a couple

of days. Some consequences were even observed in North America and Asia. It

indeed blocked sun rays, causing a very harsh and difficult winter. It even

generated a climatic disorder: polar summer, violent thunderstorms, etc.

France's harvests didn't survive these weather changes which caused famine to

shake up regions. It seems that around 1789, some kind of prohibition occurred.

Barley, grain, was so scarce that distilling was forbidden. Thus, whisky

production was lost in time, forgotten and it took 200 years for France to get

back on its feet and decide to produce whisky again. According to Nicolas

Julhès, head of the «Distillerie de Paris», a French craft

whisky distillery, French whiskies will become the greatest whiskies of the

world. Why? Because producers usually distil in smaller pot stills (a quality

pledge) and above all, the country has the best ageing specialists thanks to

Cognac and wine.

As we can see, distilleries are being created all around the

world to accommodate local tastes first and potentially other markets.

Sweden is part of the movement with ten new distilleries that

started producing whisky since 2013. Sweden whisky has indeed been trending for

the past few years thanks to several distilleries. There is the Smögen

distillery, the Box distillery which opened in 2010 but is producing whisky at

a smaller scale. For instance, its 700 bottles batch was sold out in one day in

2014. Another distillery called Hven is also producing at a small scale but got

several awards notably at the International Wine & Spirit Competition since

2013. What really helped Swedish whisky to get noticed is due to Mackmyra

Distillery. It is the largest distillery in the country with a production

capacity of 1.2 million litres a year. It grew bigger and bigger since 1998,

when a group of friends decided to create the first Swedish whisky and

distillery. Where does this idea come from? One day, a group of friend (eight

to be precise) had an important meeting

31

during a cold night after a long ski day around a bottle(s?)

of single malt(s). One of them wondered why was there no whisky made in Sweden

and someone replied that since the water is so pure, barley is also cultivated,

climate is fresh and humid, why not trying to make whisky? Which they did.

Mackmyra is well-known for its innovative approach notably with

its «Gravity distillery», built in the middle of a forest, near

Mackmyra village. The 35 meters high tower is almost a 100% green with organic

waste being recycled in biofuel for example and its energy consumption reduced

to minimum thanks to the law of gravity. The distilling process runs from the

top, where the malt is pumped in, to the bottom and goes through several steps

floor by floor, from ricing to grounding, from fermentation vats where water

and yeast are added to pot ls, to finally finish its way into the barrels where

it will age. Ingredients are wedish, same goes for casks, made in Swedish oak.

The Swede distillery didn't ant to copy Scotch whisky, the group of friends

wanted to create their own

Swedish recipe. They experimented at least 170 different

formulas before getting to the final results and thus what they really wanted.

An important community gathered around the project, like friends, relatives,

strangers and they participated in elaborating the whisky recipe by tasting

different formulas, bringing their know-how, giving advices, suggestions. They

also tried different types of yeast, barley, maturation process... Until the

distillery found «its» Swedish whisky. Six different single malt

cuvées have been

released between 2005 and 2007. These batches were 3 years

old, limited editions in order to «test» the market. The enthusiasm

was immediate and it kept on growing. The innovation doesn't stop here. Indeed,

not only the five maturation warehouses are located in particular sites (old

iron mine, maturation storehouses half-buried in the middle of the forest), but

the ageing part is also quite original. Small 30 litres barrels are stacking up

in the different cellar rooms but why using these smaller casks? In comparison,

Bourbon casks can hold up to 180 litres, Hogshead 250 litres etc. The point is,

it accelerates the ageing process thanks to a tighter proximity of the alcohol

with the wood. In 2008, the «First Edition» was launched, becoming

their first regular bottled whisky, and since then, Mackmyra has grown

internationally. The company got several awards, notably the Best European

Single Malt of the world last year at the World Whiskies Awards.

Swedes are producing whisky but they are also amongst the top

whisky drinkers in the world (15th biggest drinker with 0.86 litres

per capita). For instance, Scotch exports increased by 10 million pounds

between 2003 and 2013 to 36.4 million pounds according to the Scotch Whisky

32

Association. They like peaty whiskies but they also enjoy

discovering new grounds, like Japanese whisky. With Mackmyra and other

distilleries making whiskies, some newcomers opening, Swede whisky's future

looks quite promising.

When we talk about whisky production, the first country in

your mind is not Italy, however, it can might be the case for wine. But Puni

proves us wrong by entering the single malt world. The young distillery

(created in 2010) is the only Italian distillery made in the region that locals

describe as the «Highland of Italy» is located near Switzerland and

Austrian borders, in the Italian Alps where the water is pure. Another whisky

producer to add to the list of whiskies of the world, getting bigger and

bigger.

We will finish on two other important whisky producers who

also happen to be two major rugby nations: Australia and New Zealand. For those

who missed the first half-time, whisky remained

marginal for quite a while. Thus we might wonder why British

settlers preferred imposing rugby

rules (and cricket) when they settled in the Pacific instead

of whisky distillation, although both countries have plenty of pure water,

arable lands to sow barley, even peatlands and above all,

English, Irish and Scottish emigrants even brought their pot

stills (their know-how too), whisky

still remained quite small compared to other alcoholic

beverages. When we know that New Zealand probably applies the most liberal

legislation about domestic distillation, we might find

that strange (according to the Custom Act of 1996, domestic

distillation is legal, free of

taxation). Both rugby nations got along to play the whisky

scrum together. The Food Standards Australia New Zealand Act 1991 gives a

rather general definition of a spirit (and therefore

whisky): «Spirit means an alcoholic beverage which

contains at least 37% alcohol by volume,

consisting of: a potable alcoholic distillate, including

whisky [...] produced by distillation of fermented liquor derived from food

sources, so as to have the taste, aroma and other

characteristics generally attributable to that particular

spirit; or such a distillate with any of the following added during production:

water, sugars, honey, spices.» - Food Standards Code-- Standard 2.7.5.

Kiwi whisky is getting noticed notably by Jim Murray, author

of the Whisky Bible. This «Bible» is released every year and just

like wines with Robert Parker, he grades whiskies according to the tasting. He

gave 95/100 to the Kiwi whisky South Island Single Malt 21 years old. The same

whisky got an award at the World Whiskies Award in 2013 as the best aged single

malt. Originally, New Zealand whisky was born in the South Island (where it is

the coldest), and there are (for now) few distilleries there.

33

As for Wallaby whisky, even though All Black might win the

rugby gam Australia played its whisky cards right. Tasmania is the whisky land

of the countr The floating island, south of Melbourne, with its

«Scottish» climate and thanks

to many pioneers like Sullivans Cove, Hellyer's Road, Lark who

managed to make Aussie whisky recognized worldwide. Volumes are not very

important,

for instance, around thirty distilleries were created these

past few years with

about half in Tasmania, and the «biggest» distillery

Hellyer's Road makes

100,000 litres of pure alcohol which represents a third of

Edradour's

production that is supposedly the smallest distillery in

Scotland. Wallaby

whisky is again quite confidential but has a great awareness

around the world. For example, Sullivans Cove French Oak Cask has been awarded

as the world's best single malt at the 2014 World Whiskies Award, quite

impressive. Again, Tasmanian whisky managed to get a good reputation across the

ocean thanks to several awards. Australian are also significant whisky

drinkers, with 1.3 litres per capita, it is the 4th biggest whisky

drinker in the world (versus 14th for New Zealand with 0.87 litres

per capita).

I had the chance to meet Michael Moss several times. This

professor at Northumbria University is a real whisky expert and notably wrote

`The Making of Scotch Whisky'. I asked him: - What do you think about new

incomers in the whisky industry (countries such as India, Taiwan, France,

Sweden etc.)? He answered: - «You need to distinguish between volume

producers and craft distillers. Some volume producers, such as Nikka, are

excellent. The craft distillers will need to prove themselves, there will be

successes and failures. Some may only cater for a local market, but will almost

certainly be able to make a living. Across the piece the trick will be to

position the product in such a way as to attract sales and build a market, and

not to sacrifice quality in a search for volume.»

III. Questionnaire

In order to investigate by a quantitative study, customers'

behaviours in terms of wine and whisky consumption, I have defined a list of

questions the research question «Is there a move away from wine to whisky

in the European market?».

This survey has been posted on social medias, conveyed through

emails, and thanks to the snowball effect, this questionnaire got 146

respondents. The first question being about drinking alcohol, 129 of

respondents actually answered that they do drink alcohol so those will be taken

into account for the rest of the survey.

34

Overall, we observed that spirits consumption is getting more

and more popular, and although whisky consumption is quite low compared to

wine, people are tending to drink whisky more than they used to. Furthermore,

people are also more likely to drink less wine, but better wine. You will find

the questionnaire in the appendix (Cf. appendix n°3) and also some in

depth statistics and correlation for the questionnaire in appendix 4 to 6.

Here is the descriptive analysis per question1:

Question 2: In an average month, how often would you

drink wine (red, white or sparkling), even if it's just one glass? (Answer 0 if

you don't drink wine)

|

Question 2

|

In an average month, how often would you drink wine (red,

white or sparkling), even if it's just one glass? (Answer 0 if you

don't

drink wine)

|

|

Nb.

|

Min.

|

Mean

|

Max.

|

|

Wine (Red, White, Sparkling)

|

129

|

0

|

9.36

|

30

|

As we can see, on 129 respondents and on average, people are

drinking wine (even just one glass) at least nine days in a regular month.

1 Moyenne = Mean. Cf. all graphs.

35

Question 3: In an average month, how often would you

drink whisky, even if it's just one glass? (Answer 0 if you don't drink

whisky)

|

Question 3

|

In an average month, how often would you drink whisky,

even if

it's just one glass? (Answer 0 if you don't drink

whisky)

|

|

Nb.

|

Min.

|

Mean

|

Max.

|

|

Whisky

|

129

|

0

|

1.82

|

30

|

On the other hand, on average, people are drinking whisky around

two days in a normal month.

36

Question 4: Of all the alcoholic beverage(s) you drink,

please indicate what percentage you allocate to all these categories, where the

total must equal 100%.

|

Question 4

|

Of all the alcoholic beverage(s) you drink, please

indicate what

percentage you allocate to all these categories, where the

total must

equal 100%.

|

|

Nb.

|

Min.

|

Mean

|

Max

|

|

Whisky

|

129

|

0

|

4.82

|

30

|

|

Wine and Sparkling wine

|

129

|

0

|

47.51

|

100

|

|

Rum

|

129

|

0

|

8.08

|

70

|

|

Beer

|

129

|

0

|

28.86

|

95

|

|

Other spirits

|

129

|

0

|

10.73

|

85

|

This question aims to define the «allocation»

percentage between alcohol beverages, in people's consumption: Wine and beer

are coming in first with respectively 48% and 29%. 5% is allocated to

whisky.

37

Question 5: How much do you agree with the following

statements?

|

Question 5

|

How much do you agree with the

following

statements?

|

|

Nb.

|

Min.

|

Mean

|

Max.

|

|

I drink wine more often than I used to

|

129

|

1

|

4.12

|

7

|

|

I drink whisky more often than I used to

|

129

|

1

|

2.22

|

7

|

|

I drink more spirits (vodka, gin etc.) in general more often than

I used to

|

129

|

1

|

2.8

|

7

|

|

I think that all wines are pretty much the same, regardless of

what they cost

|

129

|

1

|

2.04

|

7

|

|

I think that all whiskies are pretty much the same, regardless

of what they cost

|

129

|

1

|

2.21

|

7

|

|

Are you willing to buy less wine but better quality (assuming

that better quality means more expensive)?

|

129

|

1

|

5.02

|

7

|

People disagree on the fact that they are drinking more whisky

but also about the fact that all wines and whiskies are the same regardless of

what they cost. However, they agree about drinking more wine than before. The

key learning that comes out of this chart is that people agree on the fact that

they are willing to buy less wine but better quality, even if it's more

expensive.

38