ANNEXE 2

MARCHÉ AMÉRICAIN

Figure 9 : Corrélation USA avec portefeuille du

marché mondial CORRELATION USA

|

1 . 0 0 0 . 7 5 0 . 5 0 0 . 2 5 0 . 0 0 -0 . 2 5 -0 . 5 0 -0 .

7 5 -1 . 0 0

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

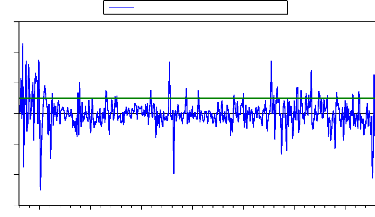

Figure 10 gain anticipé de la diversification

internationale USA

GAIN A N T IC IP É USA

|

8 6 4 2 0 -2 -4

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

MARCHÉ BRITANNIQUE

Figure 11 : Corrélation Grande Bretagne avec le

portefeuille du marché mondial CORRELATION G - B

|

1 . 0 0 0 . 7 5 0 . 5 0 0 . 2 5 0 . 0 0 -0 . 2 5 -0 . 5 0 -0 .

7 5 -1 . 0 0

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

. 1 6

. 1 2

. 0 8

. 0 4

. 0 0

-. 0 4

-. 0 8

GAIN A N T IC IP É G B

Figure 12 : gain anticipé de la diversification

internationale Grande Bretagne

MARCHÉ JAPONAIS

Figure 13 : Corrélation du Japon avec le

portefeuille du marché mondial

CORRELATION JAPAN

|

1 . 0 0 0 . 7 5 0 . 5 0 0 . 2 5 0 . 0 0 -0 . 2 5 -0 . 5 0 -0 .

7 5 -1 . 0 0

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

. 2 0

. 1 5

. 1 0

. 0 5

. 0 0

-. 0 5

-. 1 0

-. 1 5

-. 2 0

-. 2 5

GAIN A N T IC IP É J A P O N

Figure 14 : gain anticipé de la diversification

internationale Japon

MARCHÉ DE H-KONG

Figure 15 : corrélation H-Kong avec le

portefeuille du marché mondial C O R R E L A T IO N H -K O N

G

|

1 . 0 0 0 . 7 5 0 . 5 0 0 . 2 5 0 . 0 0 -0 . 2 5 -0 . 5 0 -0 .

7 5

-1 . 0 0

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

6

4

2

0

-2

-4

-6

GAIN A N T IC IP É H-KONG

Figure 16 : gain anticipé de la diversification

internationale H-Kong

MARCHÉ DE SINGAPOUR

Figure 17 : corrélation Singapour avec le

portefeuille du marché mondial C O R R E L A T IO N S IN G A P

O U R

|

1 . 0 0 0 . 7 5 0 . 5 0 0 . 2 5 0 . 0 0 -0 . 2 5 -0 . 5 0 -0 .

7 5 -1 . 0 0

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

Figure 18 : gain anticipé de la diversification

internationale Singapour

GAIN A N T IC IP É S IN G A P O U R

|

. 1 0 . 0 8 . 0 6 . 0 4 . 0 2 . 0 0 -. 0 2 -. 0 4 -. 0 6

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

VARIABLES MACROÉCONOMIQUES

Figure 19 : Indice de la production industriel

USA

IN D IC E D E PRODUCTION IN D U S T R IE L AMÉRICAN

|

1 2 0 1 1 0 1 0 0 9 0 8 0 7 0 6 0 5 0 4 0 3 0

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

Figure 20 : Prime de défaut

PRIME D E D É F A U T

|

2 .8 2 .4 2 .0 1 .6 1 .2 0 .8 0 .4

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

Figure 21 : Prime de terme

PRIME D E T E R M E

|

6 4 2 0 -2 -4

|

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

|

Figure 22 : Inflation USA

INFLATION E T A T U N IS

|

6 0 0 5 0 0 4 0 0 3 0 0 2 0 0 1 0 0

0

|

|

1 9 7 5 1 9 8 0 1 9 8 5 1 9 9 0 1 9 9 5 2 0 0 0 2 0 0 5

RÉFÉRENCES

Adler M. et Dumas B. (1983), "International portfolio section and

corporation Finance : A synthesis", Journal of finance,38 : 925-984.

Akdogan, H. (1996). "A suggested approach to country selection in

international portfolio diversification".

Jornal of Portfolio Management, 23: 33-39.

Arouri, M. (2003). "Intégration financière et

diversification internationale de portefeuille". CNRS, Université Paris

X-Nanterre.

Baba, Y., Engle, R.F., Kroner, K.F, et Kraft, D.F. (1989)."

Multivariate simulataneous generalized ARCH".

UCSD Economics Woorking Paper Series 89-57r, Department of

Economics,University of California

At San Diego.

Black, F. (1976). "Studies of stock market volatility change".

Dans Proceedings of the 1976 meetings of

American Statistical Associations, pages 498-505. American

Statistical Associations.

Bekaert G. et Harvey C. (1995)," Time varying world market

integration", Journal of finance,50(2): 403- 444

Bollerslev, T. (1986). "Generalized autoregressive conditional

heteroskedasticity". Journal of Economics, 31: 307-327.

Bollerslev, T. (1990). "Modeling the coherence in short-run

nominal exchange Rates: A multvariate generalized ARCH approach". Review of

Economics and Statistic, 72: 458-508.

Carrieri F. (2001), "The Effects of liberalisation on market and

currency risk in the Eureupean Union", European financial management,7:

259-168.

De Santis, G. (1993)."Globalization of equity market : A test

using time-varying conditional moments". Working paper, University of Southern

California.

De Santis, G. et Gerard, B.(1997). "Intenational asset pricing

and portfolio diversification with time- varying risk". Journal of Finance,

52(4): 1881-1912.

De Santis, G. et Imrohoroglun S.(1995), "Stok return and

volatility in emerging financial markets", Working paper, Departement of

finance and business economics, University of Southen California.

Engle, R. et NG K. (1993), " Measuring and testing the impact on

news on volatility" Journal of finance,48: 1749:1778

Engle, R. F. (1982)."Autoregressive conditional

heteroskedasticity with estimates of the variance of United

Kingdom inflation". Economica, 50: 987-1008.

Gourieroux, C. (1996). Modèle GARCH et application

financières. Economica, Paris.

Kroner K. et NG. K. (1998),"Modeling asymmetric comovements of

asset returs", Review of financial Studies, 11: 817:844.

Lintner J. (1965), " The valuation of risky assets and the

selection of the risky investments in stok portfolios

And capital budgets", Reviews of economics and statistics, 47:

13-37

Ramsey, J. (1996). "If nonlinear models cannot forecast, What Use

are they?" Studies in Nonlinear Dynamics and Econometrics, 1(2): 65-86.

Solnik, B., Bourcelle, C., et Le Fur, Y. (1996)."International

market correlation and volatility". Financial Analysts Journal,52(5) :17-34

Markowitz,H.M. (1952). "Portfolio selection". Journal of

Finance,7(1) : 77-91.

Nelson,D.B. (1991). " Conditional heteroskedasticity in asset

returns : A new approch"

Econometrica, 59 : 347-370.

Sharpe W. (1964), "Capital asset prices : A theory of market

equilibrium under conditions of risk",Journal of

Finance, 9 :725-742

Turgeon, M.(1998). "La diversification internationale et les

cycles économiques". Mémoire de maîtrise, Université

du Québec à Montréal.

|