|

From pricing to rating structured credit products

and

vice-versa

Quentin Lintzer

Université Paris VI - Pierre &

Marie Curie

Thesis submitted for the degree of:

Master M2 in Probability

Theory and Applications

· September 2007 ·

Abstract

Credit risk area is one of the most rapidly developing areas

in finance. A wide range of synthetic structured credit products builds on

liquid credit instruments such as Credit Default Swaps, credit indices or

Credit Synthetic Obligations (CSO) referenced on the latter. In this document,

we first recall the principles of CSO pricing in a one factor gaussian copula

model and outline two numerical procedures aimed at mapping joint loss

distributions. We also formalize the theoretical modelling framework of

Moody's, a rating agency, for rating Constant Proportion Debt Obligation (CPDO)

and Constant Proportion Portfolio Insurance (CPPI) products. We then present

our conclusions regarding an innovative Dynamic Proportion Portfolio Insurance

(DPPI) product and raise some risk management issues.

Contents

|

1

|

Structured credit products: a business review

1.1 Introduction

1.2 Elementary building blocks

|

4

4

4

|

|

|

1.2.1

|

Credit Default Swaps

|

4

|

|

|

1.2.2

|

Credit indices

|

6

|

|

|

1.2.3

|

Collateralized Synthetic Obligations

|

6

|

|

|

1.2.4

|

Structured Non-Correlation Products

|

9

|

|

2

|

Modelling and pricing CSO tranches

|

12

|

|

2.1

|

Modelling a CSO tranche payoff

|

12

|

|

2.2

|

Default and premium legs of a CSO tranche

|

12

|

|

|

2.2.1

|

Default leg

|

13

|

|

|

2.2.2

|

Premium leg

|

13

|

|

|

2.2.3

|

Fair premium

|

13

|

|

2.3

|

The semi-analytic approach: one factor Gaussian Copula model . .

.

|

14

|

|

|

2.3.1

|

Copula functions: basic properties

|

14

|

|

|

2.3.2

|

The one factor gaussian copula model

|

14

|

|

2.4

|

Back to CSO tranche pricing: computing the expected portfolio

loss

|

16

|

|

|

2.4.1

|

Monte-Carlo simulations

|

16

|

|

|

2.4.2

|

Evaluating the loss characteristic function

|

16

|

|

|

2.4.3

|

Andersen's recursive formula

|

17

|

3 Modelling and Rating Dynamic Proportion Portfolio Insurance

prod-

ucts 19

|

3.1

|

Moody's approach to rating CPDO and

|

|

|

CPPI/DPPI products

|

19

|

|

3.1.1

|

Historical vs risk-neutral probability measures

|

19

|

|

3.1.2

|

Moody's Metric and coherent risk measures

|

20

|

|

3.2

|

Modelling risk factors

|

23

|

|

3.2.1

|

Credit spread processes influenced by defaults and ratings .

.

|

23

|

|

3.2.2

|

Rating migrations and default events

|

24

|

|

3.2.3

|

Interest rates process and other parametres

|

26

|

|

3.3

|

Portfolio investment rules

|

27

|

|

3.3.1

|

Dynamic leverage function

|

27

|

|

3.3.2

|

Deferred coupons

|

29

|

|

3.3.3

|

Other key structural features

|

30

|

|

3.4

|

A study of the DPPI's sensitivities

|

30

|

|

3.4.1

|

Tailor-made structural features to achieve target rating. . .

.

|

31

|

|

3.4.2

|

Hypothetical stress-scenarios

|

35

|

3.5 DPPI: any hidden pricing issue? 36

3.5.1 From the investor's perspective 36

3.5.2 From the investment bank's perspective 36

Conclusion 37

Appendix 38

Bibliography 42

List of Figures

|

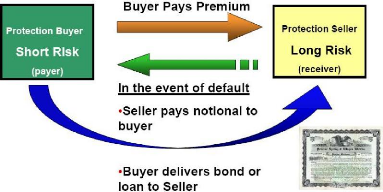

1.1

|

Cash flows of a Credit Default Swap with physical delivery

|

5

|

|

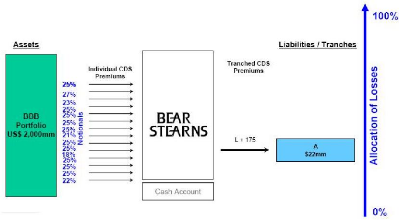

1.2

|

Structuring of a single-tranch CSO

|

7

|

|

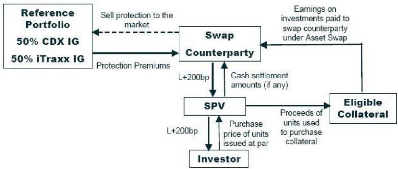

1.3

|

Structuring of a first-generation CPDO, referencing credit

indices . .

|

9

|

|

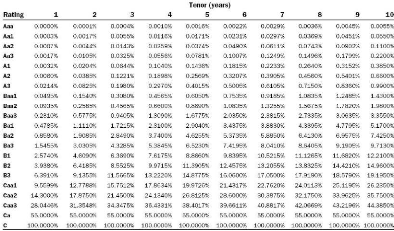

3.1

|

Moody's rating conversion table

|

21

|

|

3.2

|

Moody's idealized EL values by rating category and tenor

|

22

|

|

3.3

|

DPPI base-case loss distribution conditional on the structure

not cash-

|

|

|

ingin

|

31

|

|

3.4

|

Distribution of cash-in times

|

31

|

|

3.5

|

Estimated expected loss as a function of S.

|

32

|

|

3.6

|

Estimated expected loss as a function of è (2000

simulations per

|

|

|

coupon level)

|

33

|

|

3.7

|

Loss and Moody's Metric as a function of OL and TM, 1000

simula-

|

|

|

tions per couple of parametres

|

34

|

|

8

|

Parametres of Moody's CDS spread processes

|

39

|

|

9

|

Correlation matrix of Moody's CDS spread processes

|

39

|

|

10

|

Moody's 10Y corporate rating transition matrix

|

39

|

|

11

|

DPPI optimized structural features

|

40

|

|

12

|

DPPI reference portfolio

|

41

|

Chapter 1

Structured credit products: a

business review

1.1 Introduction

Credit derivatives markets have been consistently among the

fastest growing areas of capital markets in recent years: 2006 year-end ISDA

survey shows outstanding notionnal of 34,000 USD Bio for all credit derivatives

contracts, up from 8,000 USD Bio in 2004. Such a growth was fueled by the

appetite of various types of investors for credit risk and relied upon the

ability of investment banks to repackage credit risk into synthetic structured

products.

Before going into the details of modeling and pricing such

credit derivatives, we shall describe the principles of the main products that

can then be used as building blocks for more sophisticated ones. They share the

same underlying risk, that is the credit risk of one or several reference

entities, whether it be a corporate company, a financial institution or even a

soveriegn entity:

· Single-name Credit Default Swaps (CDS) are to credit

derivatives markets what single-name equity stocks are to equity derivatives

markets;

· Collateralized Synthetic Obligations (CSO) aim at

tranching credit risk on an entire portfolio of reference entities, hence

creating correlation risk;

· Constant Proportion Dynamic Portoflio Obligations

(CPDO) and Constant Proportion Portfolio Insurance (CPPI) products allow

investors to take credit risk on diversified portfolios of single names while

avoiding first-order correlation risk;

· Vanilla options on credit indices started trading as

liquidity in underlying CDS contracts and standardized CSO tranches was

increasing.

1.2 Elementary building blocks

1.2.1 Credit Default Swaps

A Credit Default Swap (CDS) is a contract whereby counterpart

A (the «protection

seller») receives a periodic premium from

counterpart B (the «protection buyer») and

agrees to protect the

latter against the default of entity C (the «reference entity»).

In the event of default, counterpart A would pay counterpart

B the notional amount of a reference obligation (which could be a bond or a

loan) issued by entity C and receive the reference obligation.

Figure 1.1: Cash flows of a Credit Default Swap with physical

delivery

CDS are quoted in terms of spread (measured in basis points)

over an Inter Bank Offered Rate (EURIBOR or LIBOR depending on the currency).

Assuming a constant recovery rate R for the underlying obligation, we can

easily express this spread as a function of the survival cumulative

distribution function S0(.) of the reference entity defined as follows under

the risk neutral probability measure Q. Let r be the continuous random variable

modelling the instant of default:

?t ? R+,S0(t) = Q(r = t)

By construction, for a given notional amount N, a fixed

recovery rate R, a contract maturity of Tn and risk-free bond prices

B(0, Ti), i ? {1, .., n}, the market spread at inception of a given CDS is

determined such that the present value of the premium leg (the «fixed

leg») equals that of the default leg (the «variable» leg):

Xn B(0, Ti) · EQ [N(1 -

R)1{Ti-1=ô=Ti} ~

i=1

Xn B(0,Ti) · N(1 - R) · [S0(Ti-1) -

S0(Ti)]

i=1

[ Xn ]

= EQ B(0, Ti)sN1{ô=Ti}

i=1

Xn B(0, Ti) · sN · (Ti - Ti-1) ·

S0(Ti)

i=1

As a result, the CDS spread s is given by the following formula,

where D0(Ti) := B(0, Ti)S0(Ti) denotes the risky bond price:

s = (1 - R) ·

|

>n (S0(Ti_1) )

i=1 D(0, Ti) S0(Ti) - 1

|

(1.1)

|

|

|

1.2.2 Credit indices

Credit indices are convenient proxys for taking credit

exposure on diversified portfolios of single names. They can be sorted by

geographical criteria (Europe, Asia, US, Japan, Emerging markets), by

industrial sector (e.g. Financials) or by debt riskiness criteria (investment

grade, high yield). Among all indices, one shall bear in mind the ones detailed

hereafter:

Index name

|

Debt riskiness

|

Characteristics

|

CDX.NA.IG

|

Investment grade

|

Diversified portfolio of 125 North American liquid corporate

credits

|

CDX.NA.HY

|

High Yield

|

Broad-based portfolio of 100 high yield credits, i.e.

sub-investment grade

|

ITRAXX IG

|

Investment grade

|

Diversified portfolio of 125 European liquid corporate

credits

|

ITRAXX XOVER

|

High Yield

|

Diversified portfolio of 125 European

high yield credits, i.e. sub-investment grade

|

|

Similarly to single-name CDS, they are quoted in terms of

spread (measured in basis points) over LIBOR/EURIBOR rate. Given that all

single-name components are equally weighted in credit indices, an event of

default on a single name triggers a proportionate reduction in the notional

amount of the index and a lump sum payment from the protection seller to the

protection buyer.

1.2.3 Collateralized Synthetic Obligations Basic

principles

Collateralized Synthetic Obligations (CSO) are securities

issued by a Special Purpose Vehicle (SPV) and backed by a portfolio of credit

protection-selling positions taken through several (usually over 100) CDS. The

liabilities of the SPV get sliced into several CSO tranches that get hit

sequentially in case one or more reference entities within the underlying CDS

portfolio default. As a result, the fair premium of any tranche, usually

expressed as a spread over 3-month LIBOR/EURIBOR rate, eventually depends on

the joint-loss distribution of the underlying CDS portfolio.

CSO tranches can be defined by their attachment and detachment

points:

· The attachment point l of the tranche is expressed as

a percentage of the investment notional. It is the portfolio loss lower

threshold above which the tranche's principal gets hit if one or several

reference entities default within the portfolio.

· The detachment point u > l of the tranche is

expressed as a percentage of the investment notional. It is the portfolio loss

upper threshold above which the tranche's principal gets wiped out after one or

several events of default.

CSO tranches are labelled upon their seniority in the capital

structure:

· The equity tranche has the lowest attachment point

of the structure - 0% - and usually a detachment point below 3%. Hence it is

the riskiest tranche of the structure.

· The super senior tranche has the highest attachment point

of the structure - usually around 22% - and a detachment point of 100%.

· Mezzanine tranches have an attachment point above the

equity's detachment point and a detachment point below the senior's attachment

point.

· Senior tranches have an attachment point above the

mezzanine's detachment point and a detachment point below the supersenior's

attachment point.

Unlike cash Collateralized Debt Obligations (CDO), CSOs are

not backed by a portfolio of physical bonds or loans but by a portfolio of CDS

contracts. This latter feature allows much more flexibility in structuring

tailor-made securities than cash-based CDOs:

· Physical bonds or loans only exist in limited quantity,

whereas CDS contracts

can be created as long as two counterparties agree to

trade with each other;

· Whenever a cash-CDO is structured, all tranches must

be sold to the investors, i.e. the deal must be fully syndicated, unless the

CDO-arranging bank wants to keep some risk in it books, whereas CSO tranches

can be structured independently because their payoffs can be replicated through

model-based offsetting CDS positions.

· Transaction follow-up duties are heavier for cash-CDOs

than for CSOs: for instance, loans can be subject to contingent early

repayments.

Figure 1.2: Structuring of a single-tranch CSO

CSO tranches on credit indices

As mentioned earlier, the price of a CSO tranche, which is

defined by its attachment and detachment points within the capital structure,

is a function of the joint-loss distribution of an underlying reference CDS

portfolio. This joint-loss distribution function can be modeled in terms of two

sets of parametres:

· single-name CDS spreads can be seen as proxies for

valuing the default risk of each reference entity;

· cross-asset default risk dependency parametres, i.e.

«correlation», that aim at describing the joint default-behaviour of

a portfolio of reference entities.

The rationale for setting up a liquid market for tranches

with standardized characteristics (attachment and detachment points) and

referencing standard CDS portfolios (typically ITRAXX IG or

CDX.NA.IG for 3,5,7 and 10 year-maturities)

was to make correlation tradable, thereby allowing flexible correlation hedging

for structured credit products.

Given that this market for standardized CSO tranches on

credit indices aims at pricing correlation only and not default risk on any

single name, tranches are quoted in terms of credit spread (measrued in basis

points) on a Delta-Exchange basis: in other words, tranches and offsetting CDS

positions are traded at the same time so that the resulting exposure of the

investor is only to correlation and not to single-name first-order spread risk.

Unlike other tranches which are quoted as a full running spread, the equity

tranche (0%-3%), which is the riskiest slice of the capital structure, is

quoted on a running basis assuming the protection seller on this tranche

receives a 5% upfront premium.

Bespoke Collateralized Synthetic Obligations

Bespoke CSOs are tailor-made versions of CSO tranches on

credit indices: the underlying CDS portfolio can be customized, as well as the

characteristics of the tranche. This range of products offers more flexibility

than standard tranches, for it allows the investor to choose his own credit

risk profile by playing with the shape of the joint-loss distribution function

(bespoke CDS portfolio) and choosing the attachment/detachment points that suit

his aversion to risk.

In addition to tailoring the initial underlying CDS portfolio

to the investor's needs, investment banks usually propose managed versions of

bespoke CSOs that allow the underlying CDS portfolio to be revised later on in

the transaction's life: the arranging bank appoints an external credit risk

manager whose role is to manage actively the underlying CDS portfolio by making

substitutions and weight adjustments among referenced single names.

Options on credit indices and tranches

As the liquidity of credit indices keeps improving, bid-offer

spreads decrease and investment banks start proposing swaptions on major credit

indices (ITRAXX XOVER, ITRAXX IG, CDX NA IG,...) on standard maturities (roll

dates, i.e. 20-Mar, 20- Jun, 20-Sep, 20-Dec) and tenors (3Y,5Y,7Y).

1.2.4 Structured Non-Correlation Products

Unlike CSO tranches, the value of which relies heavily on

correlation assumptions linking default probabilities on single names, a range

of «correlation-free» structured credit products has emerged since

2004. Constant Proportion Portfolio Insurance (CPPI) and Constant Proportion

Debt Obligation (CPDO) products reference CDS portfolios, but their joint-loss

distribution is not tranched among investors.

Constant Proportion Debt Obligation: «the more you lose,

the more you bet»

First introduced by ABN-Amro in S2 2006, a Constant

Proportion Debt Obligation is a security whose principal and coupons are rated

AAA by rating agencies such as S&P and Moody's and that pays to the

noteholder quarterly EURIBOR/LIBOR coupons plus a spread around 100-200 bps

depending on issuing market conditions. Such a return is achieved by selling

credit protection on credit indices or on a portfolio of single-name CDS in an

amount that is adjusted dynamically throughout the transaction's lifetime: this

dynamic «leverage» function can reach as much as 15 times the initial

notional.

Figure 1.3: Structuring of a first-generation CPDO, referencing

credit indices

Let us define the following variables at time t in order to

summarize the few investment guidelines that rule the CPDO's behaviour:

· A = Notional of the security;

· NPV = Net Present Value of the security;

· MtM = Marked-to-Market value of all long positions on

credit indices and/or single-name CDS;

· Collat = Value of the assets collateralized in the

transaction to serve the EURIBOR/LIBOR component of the coupon;

· CA = Balance of the Cash Account of the structure; in

particular, can be affected by default losses;

· TRV = Target Redemption Value of the security;

· PVNotional = Present Value of the security's Notional as

discounted per the risk-free discount curve;

· PVCoupons = Present Value of the future coupons of the

security discounted as per the risk-free discount curve;

· PVFees = Present Value of the future running fees to be

paid by the noteholder and discounted as per the risk-free discount curve;

· TNE = Target Notional Exposure in credit indices or

single-name CDS;

· F = Shortfall Multiplier, assumed to be constant in this

example;

· lb = Lower Bound cash-out threshold, expressed as a

percentage of the security's notional;

· TL = Target Leverage function.

The aim of the structure is to increase the security's NPV in

order to hit the TRV (a «lock-in» event: in this case, the credit

portfolio is unwound and the proceeds of the transaction are high enough to

cover all future promised coupon, fee and principal payments until maturity by

construction of the TRV aggregate. At the same time, the structure must avoid

any «lock-out» event, which takes place when the security's NPV hits

a fixed percentage lb, usually around 10%, of the security's notional N.

As long as no lock-in nor lock-out event has occured, the

leveraging mechanism described hereafter expresses the Target Leverage function

TL(t) as a linearly increasing function of the structure's shortfall, defined

as the difference between the TRV and the NPV:

NPV (t) = MtM(t) + Collat(t) + CA(t)

TRV (t) = PV Notional(t) + PV Coupons(t) + PV Fees(t) TNE(t) = F

· (TRV (t) - NPV (t))

T NE(t)

T L(t) = A

|

(1.2)

|

|

In other words, the CPDO's leveraging mechanism enables the

structure to increase its credit exposure when the shortfall increases, i.e.

when the security's NPV incurs MtM or default losses: «the more you lose,

the more you bet». Conversely, MtM gains translate into a reduction in the

structure's credit exposure.

Constant Proportion Portfolio Insurance: placing greedy but

secured bets

Originally designed for equity underlyings, Constant

Proportion Portfolio Insurance (CPPI) products referencing credit-linked assets

have developped in the past three years. Unlike CPDOs, CPPIs are

principal-protected at maturity. In other words, the investor will always

receive the notional of the security at its maturity, whereas the CPDO

noteholder can end up with as little as lb% of his initial investment.

The CPPI is a security whose principal is protected at

maturity and whose coupons

can be rated by S&P and/or Moody's and/or

Fitch. Similarly to CPDOs, the rated

CPPI pays to the noteholder quarterly EURIBOR/LIBOR coupons

plus a spread around 50-100 bps depending on issuing market conditions. This

return is achieved by selling protection on a portfolio of single-name CDS in

an amount that is adjusted dynamically during the transaction's lifetime. This

dynamic «leverage» function can reach as much as 10-12 times the

initial notional.

Notations introduced earlier to describe the CPDO structure

remain valid hereafter. In addition, we define the following variables at time

t:

· BF = Bond Floor: value of a risk-free zero-coupon bond

maturing at the legal maturity of the security;

· R = Reserve;

· RM = Reserve Multiplier.

A CPPI lock-out event happens whenever the security's NPV hits

the Bond Floor BF. A lock-in event is the same as for CPDOs. The leveraging

mechanism is different however: the CPPI's target leverage function TL is an

increasing function of the Reserve R, defined as the difference between the

security's NPV and BF.

|

R(t) = NPV (t) - BF(t) TNE(t) = RM · R(t)

TNE(t)

TL(t) = A

|

(1.3)

|

The CPPI's leveraging mechanism enables the structure to

increase its credit exposure when the reserve increases, i.e. when either the

security's NPV increases due to MtM gains or its BF rises as a result of lower

interest rates. The more money you make, the more you can afford losing by

increasing your bets.

Chapter 2

Modelling and pricing CSO

tranches

After choosing the pool of single-name CDS and defining the

characteristics of the CSO tranche (attachment and detachment points), we want

to determine a fair spread to be paid to the tranche buyer (i.e. the protection

seller) as a fair reward for bearing this credit risk so that the present value

of his investment is zero at inception (assuming no transaction costs nor fees

to be paid to the arranging bank). Such a fair spread will eventually depend on

the portfolio's joint loss distribution function accross time horizon L(t)

until the CSO's maturity.

2.1 Modelling a CSO tranche payoff

Given an underlying portoflio of single name CDS, we assume

that we have access to the joint loss distribution function L(t) of the

portfolio at any time t, 0 t T, where T denotes the maturity of the

transaction. We call respectively K and K the attachment and detachment

points of our tranche. Its initial nominal amount is equal to K - K and

the cumulative losses M(t) that affect that tranche at any time t is given by

the following formula:

M(t) = (L(t) - K) - (L(t) - K)

We now assume that the underlying CDS portfolio is made of N

reference obligors, each with a nominal amount An and a recovery

rate Rn for n = 1,2, .., N. Let Ln = (1 - Rn)An be the

loss given default of obligor n. Let rn be the default time of

obligor n. Let Nn(t) = 1{ôn=t} define

the counting process which jumps from 0 to 1 when the nth obligor

defaults. The portfolio loss function L(t) is then given by:

L(t) = XN LnNn(t) (2.1)

n=1

We note that the functions L(t) and therefore M(t) are pure jump

processes.

2.2 Default and premium legs of a CSO tranche

Similarly to the approach presented for valuing the fair spread

of a single-name CDS,

we determine the fair premium W * of the CSO tranche

by equalizing the present

value of the default leg DL and the premium leg PL(W) of the

tranche: by definition, W* solves the following equation:

PL(W*) - DL = 0 (2.2)

The existence of a liquid market for standard CSO tranches

based on ITRAXX and CDX indices provides us with a satisfactory framework for

pricing credit default correlation among obligors, hence CSO tranches, under

the risk-neutral probability. From now on, we assume that all expectations are

taken under the risk-neutral probability measure.

2.2.1 Default leg

Given that M(t) is an increasing function, we can define

Stieltjes-Lebesgue integrals with respect to M(t). The discounted payoff

corresponding to potential default payments can therefore be written as:

I0

T n

X ( )

B(0, t)dM(t) := B(0, ôj)Nj(T ) M(ôj) - M(ô-

j )

j=1

Using Stieltjes integration by parts formula and Fubini's

theorem, the price of the default leg under the risk neutral probability

measure can be expressed as:

I T J T

DL = E[ B(0, t)dM(t)] = B(0, T ) E[M(T )] + E[M(t)]dB(0, t)

0 0

2.2.2 Premium leg

Similarly, the price of the premium leg of the CSO tranche

under the risk neutral probability measure is given by the folowing expression,

where discrete premium payments are assumed to take place on

(Tj)j=1..m with T0 is the start date of the tranche and

Tm = T is its legal maturity date.

? ?

m J Tj

P L(W ) = E ? B(0, Tj) W (K - K - M(t))dt?

j=1 Tj-1

Xm

j=1

J Tj

B(0, Tj)W (K - K)(Tj - Tj-1) - E[M(t)]dt

Tj-1

2.2.3 Fair premium

We can now solve equation (2.2) for W * as a function of the

expected cumulative tranche loss E[M(t)]:

B(0, T ) E[M(T )] + f 0 T E[M(t)]dB(0, t)

W * = (

>m ) (2.3)

(K - K)(Tj - Tj-1) - f Tj

j=1 B(0, Tj) Tj-1 E[M(t)]dt

As soon as we can compute the expected tranche loss E[M(t)],

the calculation of the tranche fair premium becomes straightforward. In order

to do so, we then have to make further modelling assumptions on the behaviour

of the joint tranche loss distribution M(t), or equivalently L(t).

2.3 The semi-analytic approach: one factor Gaussian

Copula model

2.3.1 Copula functions: basic properties

Copula functions are useful tools for modelling dependency

between random variables, for they allow to separate the univariate margins and

the dependence structure from the multivariate distribution.

Theorem 1. Sklar's Theorem

Let F be a joint distribution function with margins F1, .., Fd.

There exists a copula function C such that for all x1, .., xd in [-8,

+8],

F(x1,..,xd) = C(F1(x1),..,Fd(xd))

Conversely, if C is a copula function and F1, .., Fd are the

margins of respectively X1, .., Xd, then the multivariate function F

of the vector (X1, ..Xd) is such that, for all x1, .., xd in [-8,

+8],

F (x1, .., xd) = C(F1(x1), .., Fd(xd))

If the margins are continuous, then the copula function C is

unique.

We shall need another key result in order to ensure copula

functions are flexible enough to model joint loss distributions:

Proposition 1. Invariance

Let C denote the copula function of continuous random vector

(X1, .., Xd). Let

f1, .., fd be strictly increasing functions

defined respectively on the support of X1, .., Xd.

Then C is also

the copula function of the continuous random vector (f(X1), .., f(Xd)).

We then recall the cumulative distribution function Ö of

a standard gaussian variable and that of a multivariate standard centered

gaussian vector with correlation matrix R:

|

x 1

Ö(x) =

f8v2ð

|

e-t2/2dt

|

x1xd11T 0-1y · dy1..dyd

ÖV xd) "

f8- f e2y

Definition 1. Gaussian Copula

Let (X1, .., Xd) be a gaussian vector with correlation matrix R,

zero mean and unit variance. We can then express its copula function

CR as follows:

CR(u1, .., ud) = Ö`V/)

(Ö-1(u1),..,Ö-1(ud))

Given the invariance property of copula functions seen in

proposition (1), CR is also the copula function of any gaussian vector with

correlation matrix R.

2.3.2 The one factor gaussian copula model

Let (ô1, .., ôN) define the random vector of

default times among the N obligors of

our reference portfolio. Given

equation (2.1) and under deterministic assumptions

for recovery rates,

determining the joint distribution of (ô1, .., ôN) is equivalent

to

determining the joint loss distribution L(t) for all t = T.

We further assume that each default time random variable

ôj, j = 1..N, follows an exponential law of parameter ëj. In other

words, the cumulative distribution function Qj of ôj can be expressed

as:

?t ? [0, T], P(ôj = t) := Q(t) = 1 - e_ëjt

We now wish to model the dependency between those default time

random variables. The current market standard for doing so is to use the

gaussian copula function CR where its correlation matrix R is defined as

follows:

?

? ? ? ? ?

R=

?

?????

1 p ... p

p 1 ..

.. ..

... ...

. .. p

p ... p 1

Applying Sklar's reciprocal theorem, we can then exhibit the

resulting cumulative distribution function Q of the random vector (ô1,

.., ôN):

P(ô1 = t1,..,ôN = tN) := Q(t1,..,tN) = CR

(Q1(t1),..,QN(tN))

A convenient way to simulate the random vector of default

times (ô1, .., ôN) related together by a gaussian copula is to use

an auxiliary random vector (X1, .., XN) modelled upon a single factor approach.

We assume that all Xj, j = 1..N, depend respectively on a common standard

gaussian factor Z and on an idiosyncratic standard gaussian factor Zj, where

all Zj are mutually independent and independent from Z. Conditionnally on the

common factor Z, all Xj, j = 1, .., N are therefore independent.

?j ? [1,..,N],Xj := vpZ + /1 - pZj

Proposition 2. The random vector (X1, .., XN) is a gaussian

vector with correlation matrix equal to R.

Proof.

v/

?

????????

=

...

0 vp

...

...

. ..

0

....

. .. ..

Z

Z1

...

·

?

???????

...

ZN

?

???????

?

????????

(X1, .., XN) = (vpZ + v/ 1 - pZ1, .., vpZ + 1 - pZN) vp -v1 - p 0

... 0

...

....

. .. .. -v1 - p

0 vp

0 . . .

We have expressed (X1, .., XN) as an affine transformation of

the gaussian vector (Z, Z1, .., ZN). Hence, (X1, .., XN) is a gaussian vector

itself. The general term of its correlation matrix (pij,1 = i, j = N), is given

by:

Cov (vpZ + v1 - pZi,vpZ + v1 - pZj) pij = V ar(Xi)V

ar(Xj)

= äij(1 - p) + p

Hence, the correlation matrix of (X1, .., XN) is also R.

Applying invariance proposition (1) to the random vector of

default times (ô1,.., ôN) Law = (Q-1

1 (Ö(X1)), .., Q-1

N (Ö(XN)), we conclude that both vectors share the same

gaussian copula function.

2.4 Back to CSO tranche pricing: computing the expected

portfolio loss

We shall now present three numerical methods in order to

evaluate the expected tranche loss function E[M(t)], Vt E [0, T]. We stress the

fact that the following methods apply within the framework of the one factor

gaussian copula model to a finite heterogeneous portfolio (i.e. in terms of

individual nominal weights and recovery rates) of obligors with deterministic

recovery rates. We shall not detail the well known analytic results that can be

derived from Large Homogeneous Portfolios (LHP).

2.4.1 Monte-Carlo simulations

The Monte-Carlo approach is probably the most straightforward

method to price a CSO tranche fair premium:

1. Simulate N +1 independent standard gaussian variables (Z,

Z1, ..ZN) by using, for instance, the Box-Müller transform, the polar

method or even by drawing in the random variable Ö-1(U), where

U is a uniform random variable; within the one factor gaussian copula model,

the random vector (X1, .., XN) = ( /ñZ + /1 - ñZ1, .., /ñZ

+ /1 - ñZN) is therefore a gaussian vector with correlation matrix R.

2. Simulate (ô1, .., ôN) by drawing in the random

vector

(Q-1

1 (Ö(X1)), .., Q-1

N (Ö(XN))

3. Evaluate the tranche loss function M(t), Vt E [0, T] along

this loss scenario;

4. Repeat steps 1 & 2 and evaluate the tranche loss function

along this new loss scenario;

5. Loop on step 4 until you feel comfortable (confidence

interval or variance criteria) with the convergence of the empirical estimate

of E(M(t)), Vt E [0, T];

6. Evaluate the CSO tranche fair premium detailed in equation

(2.3). Such a simple anf flexible method comes at a high computation cost

though, because one has to draw millions of random variables in the case of a

reasonably large portfolio (between 100 and 200 obligors).

2.4.2 Evaluating the loss characteristic function

We first determine the expression of pj(t|Z), the cumulative

distribution function of default time ôj, j = 1..N conditional on the

common factor Z.

?j ? {1, .., N}, ?t ? [0, T], pj(t|Z) : = P(ôj = t|Z)

= P (Q6 1(Ö(Xj)) t|Z)

~ = PQ-1(Ö(vñZ + ñZj)) = t|Z)

= P (Zj G 4Ö-1 (Qj(t)) v

ñZ |Z)

(Ö-1(Qj(t)) ? ?ñZ

v1 ? ñ )

- ñ

= Ö

We then derive the total loss characteristic function conditional

on the common factor Z:

?u ? R, ÖL(t)(u|V ) : = E [exp(iuL(t))|Z]

= E [exp(iu ELnNn(t))|Z1

n=1

=

E [fl exp(iuLnNn(t)) | Z1

n=1

YN E [exp(iuLnNn(t))|Z]

n=1

YN [1 + pn(t|Z)(exp(iuLn) -

1)]

n=1

where we have used that (N1(t),..,NN(t)) are mutually

independent conditionally

on the common factor Z.

We now integrate the conditional characteristic function over the

common gaussian factor Z to retrieve the unconditional characteristic function

ÖL(t):

+8

= IÖL(t)(u|z)dÖ(z)

?u ? R, ÖL(t)(u) : = E [ÖL(t)(u|Z)]

Once we have found the loss characteristic function, we can

use the Fast Fourier Transform (FFT) to recover the loss distribution function

itself, which we then plug into equation (2.3) to derive the CSO tranche fair

premium.

2.4.3 Andersen's recursive formula

The recursive approach described in [1] builds on the fact

that the portfolio loss function can only take a limited number of values. This

set of values depends in turn on the obligors' individual loss given default

levels Ln, ?n ? {1, .., N}. We now assume that all those loss levels

can be expressed as multiples of a loss unit l:

?n ? {1, .., N}, ?an ? N, Ln =

anl

|

?i ? {0,1, ..,

|

XN

k=1

|

ák}, P (L = il) = i+8 Pz--z(L(N)

=

L il)dö(z)

|

We further assume that all N obligors are ranked. The possible

values for the loss function L are restricted to the following subset:

{m

L ? E ájkl, m ? {1,..,N}, {j1,..,jm}

? {1,.., N} ? {0} k=1

The power of Andersen's recursive algorithm is that it allows

to compute the loss distribution while assuming that the pool of obligors

results from the sequential addition of all obligors upon one specific ranking

order. Let j ? {1, .., N} refer to the first j obligors added to the pool and

L(j) the discretized loss function associated

with that sub-pool. We can then express the loss distribution of

L(j) as a function of L(j-1).

Proposition 3. Andersen's recursive formula

Let j ? {1, .., N} and L(0) = 0. Assume the loss

distribution function L(j-1) conditional on the common factor Z is known. Let

QZ denote the risk neutral probability measure conditional on the

factor Z and pj the default probability of jth obligor conditional

on factor Z. Then we have the following recursive result:

?i ? {0, 1, .., XN ák},

k=1

QZ (-0) = il) = (1 - pj)QZ(L(j-1) = il) +

pjQZ(L(j-1) = (i - áj)l)

Proof. Let Dj,j?{1,..N} denote the default indicator variable

of jth obligor conditional on the factor Z. Using the conditional

independence of Dj,j?{1,..N}, we can then write for all j ? {1, ..,N} and for

all i ? {0, .., Ejk=1 ák}:

QZ(L(j) = il) =

QZ(L(j-1) = (i - áj)l,Dj = 1) + QZ(Lj-1

= il, Dj = 0)

= QZ(L(j-1) = (i - áj)l)QZ(Dj = 1)

+ QZ(L(j-1) = il)QZ(Dj = 0)

= pjQZ(L(j-1) = (i - áj)l) + (1 - pj)QZ(L(j-1) = il)

Andersen's recursive formula evaluated at rank N thus provides

the conditional loss distribution L(N). The last step in the

computation of the unconditional discretized loss distribution L is to

integrate the conditional loss distribtion against the density function of the

factor's standard gaussian law:

Chapter 3

Modelling and Rating Dynamic

Proportion Portfolio Insurance

products

Summer 2007's turmoil in global credit markets resulted in a

significant increase in volatility, thereby threatening the rating stability of

many existing structured products including CSO tranches and CPDOs. A

straightforward response to such a volatile environment is to cap the downside

Mark-to-Market risk by adding a capital protection feature to new structured

products: Constant Porportion Portfolio Insurance (CPPI) products and their

most recent offshoots, Dynamic Proportion Indurance Products (DPPI), belong to

that category.

We shall first recall the main principles of Moody's approach

for measuring risks in order to rate CPDO and CPPI/DPPI products and outline

its main assumptions in modelling risk factors. We shall then describe the

DPPI's major risk sensitivities and present some of its key structuring

features in order to mitigate those risks. Finally, we shall analyze the DPPI's

behaviour under several stress-scenarios.

3.1 Moody's approach to rating CPDO and CPPI/DPPI

products

3.1.1 Historical vs risk-neutral probability measures

Before going into the details of rating and pricing DPPI

products, we shall address the following question: why do investment banks

price their structured products under a risk neutral probability measure while

rating agencies rate them under the historical probability measure?

Rating agencies evaluate loss ditributions under the

historical probability measure because investors are mainly concerned with

knowing how likely it is that they are going to lose money in our real

«historical» world. They don't care about such a likelihood in a

risk-neutral world. Doing so requires rating agencies to estimate future

historical default probabilities and loss distributions, the parametres of

which are calibrated statistically, whenever it is possible, on past historical

data.

On the other hand, investment banks are concerned with pricing

such products by evaluating the associated hedging costs. Fundamental results

such as HarrissonPliska's no-arbitrage pricing theorem and Black-Scholes

conclusions ensure that:

· in a viable and complete market, there exists only one

probability measure Q called «risk-neutral» under which discounted

asset prices are martingales;

· there exists a self-financing portfolio that replicates

the product's payoff.

Girsanov's theorem allows us to relate historical and risk

neutral probability measures through the notion of risk premium, which in turn

can be interpreted in terms of risk aversion: under most market circumstances,

real-world investors are naturally risk-averse and hence require to be paid an

extra return for bearing default risk as compared to its true historical

insurance cost. Hence coexisting historical and risk-neutral probability

measures serve different purposes: the historical approach prevails for

weighting future real-world scenarios and building risk measures such as the

Value-at-Risk, while the risk-neutral framework allows the pricing and the

hedging of traded securities.

3.1.2 Moody's Metric and coherent risk measures

We now temporarily put the risk-neutral measure aside and

focus on the historical probability measure. Moody's uses the same methodology

to rate CPDO and CPPI/DPPI products. It estimates the expected present value of

the loss function L(M) through Monte-Carlo simulations under the historical

probability measure.

Definition 2. Moody's expected discounted loss

Let t E I = {0, ät, .., kät, .., T} describe the

discrete time scale with T the maturity of the deal. Let Xt :=

(X(1)

t , .., X(p)

t ) be the p-vector of risk factors observed as of date t. We

introduce the filtration (Ft){t?I} defined as ?t E I, Ft := ó

(Xu,u E I,u = s). We further define the three stopping times (r, r,

r):

r := inf{s = 0, NPV (s) = TRV (s)}

r := inf{s = 0, NPV (s) = BF(s)} A T r := r A r

We then express Moody's risky discount factor DF(M) as

a function of the EURIBOR/LIBOR rate curve and of the senior spread s served to

the investor:

|

?t E I, DF(M)(t) :=

|

t-1Y

i=0

|

1

|

|

1 + ät(EUR(iät, (i + 1)ät) + s)

|

|

>1p i=1 L(M) L(M) = i

p

|

+

|

ót99%

|

|

vp

|

Then, under the historical probability measure, Moody's expected

discounted loss L(M) is given below:

[ ]

L(M) := E 1{ô<ô} [A(1 - sl) - max(NP V

(r), BF (r)) + DI(r)]+ DF (M)(r)

where sl is the detachment point in % of the subordinated

note.

In practise, Moody's uses an unbiased empirical estimator of

L(M), L(M) defined as:

where t99% := Ö-1(99%), p is the number of

Monte-Carlo simulations, L(M)

i is the

loss calculatd on the ith scenario and

ó is the standard error of (L(M)

1 , .., L(M)

p ).

Moody's then maps that value L(M) and the maturity of the deal T

against a positive real scale S = [0, 21] through a function MM called

«Moody's Metric»:

MM : [0, 1] × R+ -? [0, 21]

(x,t) i-? MM(x,t)

We shall now describe how the Moody's Metric mapping function

works. We first define the letter-to-integer mapping function R:

R : {Aaa,Aa1,..,Ca,C} -? {1,..,21}

m -? R(m)

The discrete mapping table is given below:

|

Rating-Figure

|

Rating-Letter

|

|

1

|

Aaa

|

|

2

|

Aa1

|

|

3

|

Aa2

|

|

4

|

Aa3

|

|

5

|

A1

|

|

6

|

A2

|

|

7

|

A3

|

|

8

|

Baa1

|

|

9

|

Baa2

|

|

10

|

Baa3

|

|

11

|

Ba1

|

|

12

|

Ba2

|

|

13

|

Ba3

|

|

14

|

B1

|

|

15

|

B2

|

|

16

|

B3

|

|

17

|

Caa1

|

|

18

|

Caa2

|

|

19

|

Caa3

|

|

20

|

Ca

|

|

21

|

C

|

Figure 3.1: Moody's rating conversion table

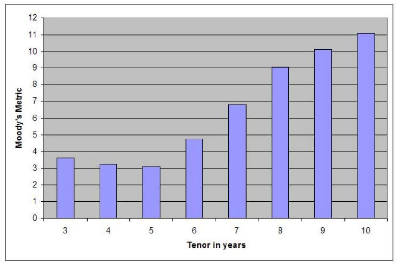

We shall now define the discrete function EL that maps the

integer equivalent of a rating category and a maturity with a percentage

expected loss:

EL : {1, .., 21} × {1, .., T} -? [0, 1]

(m, t) '-? EL(m, t)

Moody's calibrates the function EL on historical default data by

using the cohort method.

Figure 3.2: Moody's idealized EL values by rating category and

tenor

We shall then define EL, the time-continuous version

of EL function obtained by linearly interpolating EL between two discrete

integer dates:

EL : {1,..,21} x [0,T] -*[0,1]

(m, t) i-* (t + 1 - [t])EL(m, [t]) + (t - [t])EL(m, [t] + 1)

Let us now define the reverse mapping function F -1

that transforms any percentage loss level and tenor into a rating:

F -1 : [0, 1] x [0, T] -* {1, .., 21}

(x,t) -* min{m E {1,..,21}| EL(m,t) = x}

We finally give the expression of the Moody's Metric function MM:

Definition 3. Moody's Metric

?x E [0,1],?t E [0,T],

EL(F -1(x, t), t))

ln x - ln (

MM(x, t) := F -1(x, t) + ln ( EL(F

-1(x, t) + 1, t)) - ln ( EL(F-1(x, t), t))

In other words, the Moody's Metric can be seen as a

standardized continuous scale that allows to compare expected loss levels for

different tenors. We shall now take a closer look at the notion of risk measure

and understand to what extent it makes sense to use the expected loss as a

proxy for measuring risk.

Definition 4. Coherent Risk Measure

Let C denote a set of random variables representing all

possible risky positions and L E C be a random variable whose range of values

represents possible losses from any given risky position. We define the risk

measure function p as a mapping from C to R. The risk measure p is coherent if

it is:

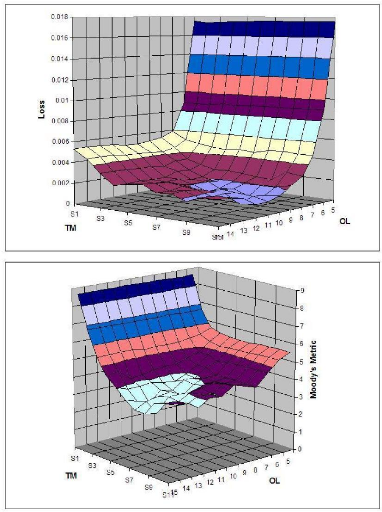

i) monotonous: ?X, Y ? G, X = Y p(X) = p(Y )

ii) positively homogeneous: ?X ? G, ?h > 0, hX ? G and p(hX)

= hp(X)

iii) sub-additive: ?X, Y ? G, X + Y ? G and p(X + Y ) = p(X) +

p(Y )

iv) translation invariant: ?X ? G, ?a ? R s.t. X + a ? G, p(X +

a) = p(X) + a

Proposition 4.

If G+ is a set of non-negative random variables,

interpreted as a loss from a risky position, then expected value is a coherent

risk measure:

?X ? G+, p(X) := E[X]

Proof. Properties (i),(ii), (iii) and (iv) immediately result

from the expectation's linearity.

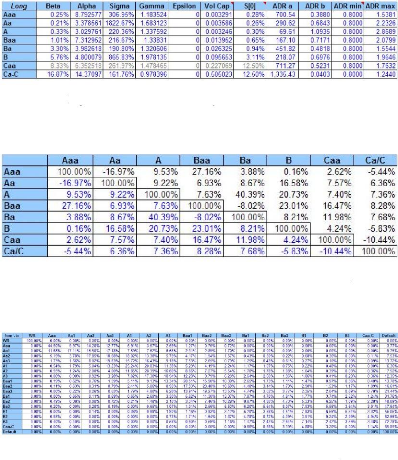

Unlike E[X], the Moody's Metric MM(X, t), where X is a

positive random variable that takes its values in [0, 1], is not a coherent

risk measure: though it is clearly monotonous and subadditive (because MM(., t)

is increasing and concave), it is neither positively homogeneous, nor

translation invariant.

3.2 Modelling risk factors

Moody's Monte-Carlo approach requires risk factors to be

modelled and simulated. The complexity of the task for rating DPPI products

comes from the fact that risk factors are numerous and can depend on each

other. We assume that the DPPI's portfolio is initially composed of long CDS

positions on N obligors. The 5Y CDS mid-spread and the rating of each obligor

n, n ? {1, .., N}, are known at the deal's inception and are equal to

(sn(0),Rn(0)).

3.2.1 Credit spread processes influenced by defaults and

ratings

Moody's assumes that individual 5Y CDS spread processes follow

a generalized Vasicek diffusion process specific to rating groups. The 21

available rating categories are grouped into 8 rating groups {Aaa, Aa, A, Baa,

Ba, B, Caa, Ca/C}. Let j ? {1, .., 8} denote the rating group's index. Then

(S(t) = (S1(t), .., S8(t)))t?[0,T] is the associated 8-dimensional spread

random process. We then give the stochastic differential

equation ruling the spread process (S(t)), where (á,

â, ã = 1, ó, ó, ADR, ADR, a, b, p)

are

historically calibrated parametres of the diffusion process and t0 is equal to

1 year:

?j ? {1, .., 8}, ?t ? [0, T], dSj(t) =

á(â - Sj(t))dt + min(ó,

óSãj (t))dW (j)

t

|

where

|

? ?????

?????

|

â = â min (ADR,max (ADR, aADR(t) + b)) if t =

t0

PN n=1 Ln(Nn(t)--Nn(t--t0))

ADR(t) = PN if t = t0

n=1 An

â = â if t < t0

?(i,j) ? {1, .., 8}2, d (W(i),

W(j)) t = pijdt

|

(3.1)

|

and Sj(0) = Sj,0

Equation (3.1) is remarkable for several reasons. First, given

that ã = 1 and that the

spread process is continuous, it doesn't

allow credit spreads to be negative. Second,

it models a dependency between

the spread process itself and default events through

the parametres (ADR, ADR) and the variable ADR(t): the

idea is to make the current long term mean 3 depend on the portfolio's Average

Default Rate ADR(t) such that 3 is stressed for a limited time period equal to

t0 after any event of default and tightens in default-free environments. Third,

it accounts for a dependency between the obligor's rating and its spread

process: whenever an obligor's rating group changes, its associated spread

process is updated accordingly. Fourth, the random noise source (Wt = (W1(t),

.., W8(t))) is a correlated 8-dimensional brownian motion.

Such dependency relationships are far from being flawless

though: one could argue that they do not account for default events occuring

outside the portfolio's pool of obligors. One could also demonstrate that

individual spread processes are not driven by their belonging to a rating

group, but more by marketwide, firm or industry specific events that are not

necessarily reflected in a rating change.

In order to simulate a CDS spread for any tenor, Moody's

assumes that the term structure of spreads is deterministic, calibrated on

historical data and specific to each one of the 8 rating groups defined above.

Though such an assumption may seem highly questionable at first and lead to

obvious arbitrage opportunities, Moody's solves the issue by requiring stress

scenarios to be run with a flat term structure while preserving a stressed

Moody's Metric level.

3.2.2 Rating migrations and default events

Moody's simulates rating migrations and default events within

a multi-factor gaussian copula framework applied to a markovian multi-period

rating transition model. The first input of this model is a square rating

transition matrix over a given time horizon T, noted MT E Mp(R),

where p denotes the number of potential rating categories of the obligors,

including one default category. Moody's assumes there are 18 of them, the

mapping of which can be derived from figure (3.1) with categories Caa - C

merged and an extra default category D with rating 18.

The rating path of the nth obligor, j E {1, .., N},

until time horizon T is given by the random process (Rn(t))t?[0,T]:

Rn : Ù × [0,T] -? {1,..,18} (ù,t)

-? Rn(t)(w)

We then recall the definitions of a generator matrix and of a

time-homogeneous Markov process

Definition 5. Generator Matrix

Assuming A E Mp(R) with general term

(ëij)(i,j)?{1,..,p}2. Then A is called a generator matrix

if:

i) Vi E {1, ..,p}, >ip j=1 ëij = 0

ii) V(i,j) E {1,..,p}2, i =6 j ëij = 0

Definition 6. Time-homogeneous Markov process

X is a time-homogeneous Markov process with generator Ë

if:

?t = 0, ?Ät > 0, ?(i, j) ? {1, .., p}2,

P(X(t + Ät) = j | X(t) = i) = (eËÄt)ij

We now assume that (Rn(t))tE[0,T] is a Markov

time-homogeneous process with generator matrix Ë. We introduce the

transition matrix MÄt over time period Ät through its general term

(pij)(i,j)<p:

?t ? [0, T, ]?(i, j) ? {1, .., p}2, pij := P

(Rn(t + Ät) = j | Rn(t) = i)

It is worth noting that pij does not depend on t because of

the time-homogeneous property of (Rn(t))tE[0,T]. As a direct

consequence of Rn's definition, we have the following property:

Proposition 5. Composition of transition matrices

Assume Ät is such that TÄt ? N*.

Then:

T } k = MTTÄt

?k ? {1, ..

Ät

We shall now describe briefly Moody's multi-factor gaussian

copula model: similarly to the one factor gaussian copula model, the idea is to

draw a random vector X = (X1, .., XN) from a gaussian law with a given

correlation matrix Ó, where the latter depends on several factors. Let

us define (ZG, ZI, ZI,R) as three independent

standard gaussian factors that account for respectively the global state of the

economy, the state of any specific industrial sector and for a combination of

both industrial and regional factors. For any given obligor n ? {1, .., N}, let

us define en as an idiosyncratic factor that follows a standard

gaussian law and that is independent from the common factors (ZG,

ZI, ZI,R) and from all other idiosyncratic factors. Then,

for all n ? {1, .., N}, one can affect the state variable Xn to

nth obligor:

qXn ñG ZG

ñInZI VñIn ,R ZI,R \

+ 1 - ñG -ñIn -ñn I,Ren

The random vector X is a gaussian vector with zero mean and a

correlation matrix Ó given below. The correlation parametres

(ñGn , ñIn, ñn

I,R) are specific to each obligor and depend on some characteristics

of their businesses in terms of industry and operations' scale. They are picked

up from a subset of values subject to Ó remaining positive definite.

?

? ? ? ? ?

Ó=

?

? ? ? ? ?

1 ñ12 . . . ñ1p

.

.

ñ21 1 .

. .

.

...

...

. ..ñp-1,p

ñp1 . . . ñp,p-1 1

with:

q? (i, i) ? { 1, .., p}2 ñij ñG

Vñi ,Rñj,R

Applying well known results on the generalized invert of the

distribution function of (Rn(t + Ät)|Rn(t)), we can

write the following proposition:

Proposition 6. Rating transition simulation

Let us assume that each obligor's rating is likely to be

confirmed or revised only on

the following dates {Ät,..,kÄt,..,mÄt}, where m :=

T/Ät ? N*. Let F -1

k,Ät, k ?

{1, ..,p} denote the generalized invert of the cumulative

distribution function of rating transitions over time period Ät starting

from initial rating category k. We recall that Ö is the

cumulative distribution function of the standard gaussian law and that

(X1,..,XN) is the gaussian vector with correlation matrix Ó

describing the state of our N obligors. We finally assume that initial

ratings (R1(0),..,RN(0)) are known. Then the rating of each obligor on

discrete dates {Ät,..,kÄt,..,mÄt} can be expressed through the

recursive formula:

?k ? {1, .., m}, ?n ? {1, .., N}, Rn(kÄt)

= FR,1:((k-1)

Ät),Ät (Ö(Xn))

Moody's uses its historical database of rating transitions and

defaults over time horizon T to build the marginal cumulative distribution

functions (Fk,T)k?{1,..,p} and MT through some cohort method. Assuming

(Rn(t))t?[0,T] is a Markov time-homogeneous process, one can infer

MÄt thanks to proposition (5) and use proposition (6) to simulate N

correlated rating paths. The rescaling of matrix MT comes at a cost however:

given the choice of the gaussian copula, one can show that when Ät --? 0,

joint default times (ô(Ät)

1 , ..,ô(Ät) N) become independent: a

way to address this issue is to stress Ó as Ät gets smaller so that

the correlation structure is somehow preserved. In the case of the DPPI, T is

equal to 10 years and Ät to 6 months.

3.2.3 Interest rates process and other parametres Interest

rates

Moody's interest rate model is based on projecting a daily

evolution of 3-month and 10-year term rates and linearly interpolating between

them for rates of other tenors. Rates with tenors shorter than 3 months are

assumed to be equal to the 3-month rate. 3-month and 10-year term rates follow

a two-dimensional correlated Cox-Ingersoll-Ross (CIR) process, where

Rs and Rl denote respectively 3-month and 10-year term

rate processes:

?

??? ?

????

dRst = ás(âs --

Rst)dt + ópRs tdW s

dRlt = ál(âl --

Rlt)dt+ó

JRltdWtl

d (Ws,Wl)t = ñdt

(Rs0, Rl 0) = (rs, rl)

In order to make sure that Euler's discretized sheme does not

generate negative values for interest rates, the natural discretized CIR

process is given below:

(Rs0, Rl0) = (rs,

rl)

?k ? {1,..,T/Ät},

?

?? ?

???

(3.2)

Rs(kÄt) = |Rs((k -- 1)Ät) +

ás(âs -- Rs((k -- 1)Ät))Ät + ..

+ ÄtRs((k -- 1)Ät)Z1|

Rl(kÄt) = |Rl((k -- 1)Ät) +

ál(âl -- Rl((k -- 1)Ät))Ät + .. +

ó0/ÄtRl ((k -- 1)Ät)(ñZ1 +

ñ2Z2)|

Recovery Rates

Default recovery rates for our N obligors are assumed to be

random and follow marginal Beta distributions correlated through a one factor

gaussian copula model. Given that the recovery rate RRn of each

obligor n follows a Beta distribution, it is characterized by its mean

lin and standard deviation ón. lin and

ón depend on the obligor's location, its type (corporate,

sovereign,..) and the seniority of the CDS underlying reference obligation. The

parameters án and On of the

Beta(án, On) distribution are given

below:

2 1-u

?n ? {1, .., N}, { án = lin

ó2 1411-un 1 \

)

On = (1 -- lin)(lin ón 2 1

Let RRG Law = N(0,1) denote the global recovery factor. The

standard normal variable Xn describing the recovery rate of obligor

n is given by:

Xn = V pGRRG + V1 -- pGen

where pG is a correlation parametre common to all

obligors and en Law = N(0,1) the idiosyncratic recovery factor independent from

the common factor RRG and from all other idiosyncratic ones. The

following proposition allows us to simulate a N-vector of recovery rates drawn

from marginal Beta distributions correlated through a one factor gaussian

copula:

Proposition 7. Recovery Rates Simulation

Let F;771 denote the invert of the

cumulative distribution function of Beta(án,

On)

law. Assume (RRG, e1, .., €N) Law = N (0,

IN+1). Then the distributions of individual recovery rates are

given by:

?n ? {1, .., N}, RRn Law= Fn 1 (Ö(V pG

RRG + V1 -- pGen))

3.3 Portfolio investment rules

We shall now present the major characteristics of the DPPI

that allow us to significantly improve the rating of the basic CPPI. The DPPI

indeed capitalizes on several structural features and investment rules in order

to achieve the target rating of Aa3 over a time horizon of 10 years.

3.3.1 Dynamic leverage function

The Target Notional Exposure at time t, noted TNE(t), is no

longer a constant multiple of the Reserve at time t, R(t), but a more

complicated function designed to take advantage of various market conditions.

For doing so, we need to define intermediary variables.

Duration of a CDS contract in a simplified intensity model

The duration D of a CDS contract of constant market spread s

and tenor T years with coupons being paid every Ät year, with

ÄtT := p ? N is given by the following formula:

p

E

i=1

D=

ÄtB(0, iÄt)S0(iÄt)

where we assume that the survival function S0(t) := 1 -

P(ô = t) is continuous,

differentiable and solves the following

ordinary differential equation with ë(t) ? R+*:

~ S0 0(t) + ë(t)S0(t) = 0

?t ? R+*,

S0(0) = 1

As a result, S0(t) = e-f0 t ë(s)ds. A way to empirically

determine the function ë is to assume that ë is piecewise constant

between all liquid tenors and to use the CDS valuation equation (1.1) to

determine ë recursively: the first step will be to determine ë(T1)

where T1 is the shortest tenor, whith ë(T1) = s(T 1)

1-R after simplifying equation (1.1) with T = T1. The second

step is to extend the maturity of equation (1.1) from T1 to T2, and express

S0(T1) and S0(T2) as a function of respectively ë(T1) and ë(T2). From

that equation, we infer ë(T2), and so on and so forth. R can then be taken

equal to 40% as as market convention and the spread s(Ti) can be read from

market quotations.

Target Notional Exposure function

We easily generalize the initial duration D of a CDS at time t

= 0 with tenor T to the duration function D(t) at time t = T and define the

average duration function D(t) of all long CDS positions in portfolio at time t

by simply taking the weighted arithmetic average of the durations of all single

CDS in portfolio. We further introduce the weighted average rating-dependent

risk function SR(t), which is homogeneous to a CDS spread:

PN n=1 An(t)C(Rn(t))

?t ? [0,T], SR(t) :=

PN n=1 An(t)

where C is an increasing mapping function from integer rating

categories {1, .., 18} to [0, 1] and where An(t) denotes the weight

of obligor n at time t expressed in units of initial notional A (>N n=1

An(t) = A).

We can then describe our dynamic target multiplier TM(t)

function:

1

?t ? [0, T ], T M(t) :=

DR + SR(t)D(t)

where DR is a risk parametre accounting for a portfolio average

default risk.

We then define the average 5-year market spread of the

portfolio at time t, S(t), by simply computing the weighted average 5-year

market spread of all obligors. We then define the piecewise constant

opportunity leverage mapping function OL(t) that maps the weighted average

5-year market spread S(t) with the leverage factor OL(S(t)).

We further introduce two path-dependent multiplying functions,

bu(t) and bd(t), that act respectively as exposure boost-up and

boost-down features:

I bu if t = tu and

max{v?[t-tu,t]}(S(v)) - min{v?[t-tu,t]}(S(v)) =

Äsu bu(t) = 1 if not

{ bd if t = td and S(t) - S(t - td) = Äsd

bd(t) = 1 if not

where (bu, tu, Asu,bd,td,

Asd) are ad-hoc structural parametres. The rationale for introducing

bu(t) and bd(t) is to make the structure proactive in both low and

high volatility spread environments.

Hence we can define the Target Notional Exposure function:

Definition 7. Target Notional Exposure

With notations introduced earlier, the Target Notional Exposure

function behaves according to the following formula:

?t ? [0, T], TNE(t) := bu(t)bd(t) min {OL(t)A, T

M(t)R(t)} Notional Exposure function

As a result, the exposure of the CDS portfolio is either

increased or decreased depending on whether the current Notional Exposure NE(t)

is far enough from the Target Notional Exposure TNE(t):

Definition 8. Notional Exposure

With notations introduced earlier, the Notional Exposure function

behaves according to the following formula:

?t ? [0, T],

NE(t+) = NE(t-)1{ TNE(t)

+ TNE(t)1{ TNE(t)

NE(t

?[(1-lb),(1+lu)]}

NE(t-) /?[(1-lb),(1+lu)]}

where lu ? [0, 1] and ld ? [0,1] are upper and lower

leverage readjustment bounds. 3.3.2 Deferred coupons

One of the core features of the DPPI is its ability to defer

interest payments to

investors when its NPV is deemed not to be high enough.

The following recursive

formula gives the potential interest payment to be

made on any coupon payment

date kAt, with TÄt ? N* and k ? {1, ..,

T Ät}.

Definition 9. Deferred Interests

Assume t ? {0, At, 2At,..,T}. Let EUR(t,t + At) denote the

EURIBOR rate observed in t with tenor At. Let us introduce the flow

variable:

x(t) := [R(t) - NE(t)u(t)]+

where u(t) is a real parametre ? [0,1]. We then define:

(IP(t), DI(t-),

DI(t+)){t?{0,Ät,2Ät,..,T}

as being respectively the interest payment on date t, the

deferred interest balance just

before t and right after t. The

following recursive formula relates all three variables:

(IP (0), DI(0-), DI(0+)) = (0,0,0)

?t ? {At, 2At, .., T},

IP(t) = min {DI(t-) + AAtEUR(t - At, t), x(t)}

DI(t+) = DI(t-) + AAtEUR(t - At, t) -

1{IP(t)=0}IP(t) DI(t-) = DI(t+ - At)(1 +

AtEUR(t - At, t))

3.3.3 Other key structural features

CDS tenor choice

Another crucial structural feature of the DPPI is the tenor

investment rule that allows to adapt CDS tenors depending on market spread

levels. Let us call e(S(t), t) the potential tenor of any CDS investment done

on date t, where e is defined below:

e : [0, 1] x [0, T] -? {3, 5, 7, 10} (x,t) 7-? e(x,t)

Removal

of downgraded assets

In order to manage the default risk inherent in owning

leveraged long CDS positions, we shall apply a specific asset-removal rule

based on rating observations: as soon as an obligor's rating has been staying

below a given threshold, say Ba2, for more than 3 straight months, then all CDS

long positions on that obligor must be removed from the portfolio and replaced

by equivalent positions on another obligor whose rating is investment grade,

i.e above or equal to Baa3.

Early cash-in events

The DPPI structure shares with earlier CPPI products an early

cash-in feature that allows the deal to be unwound before the scheduled

maturity date if the deal's NPV is high enough to cover all future liabilities,

i.e future coupons, fees, and principal payments, until the scheduled maturity

date (10 years). However, our DPPI incorporates two extra early cash-in

triggers based on shorter maturity dates, namely 5 years and 7 years. Those

three barrier conditions allow the structure to avoid adverse scenarios where

the NPV would plummet and break the bond floor, hence cash-out, after reaching

its TRV level.

Subordinated note

We add to the DPPI structure an sl := 2% thick subordinated

note, the payoff of which is similar to that of a CSO equity tranche. The

relatively high yield served on that tranche, 250 bps, compensates the

subordinated noteholder for bearing the first loss risk of the structure.

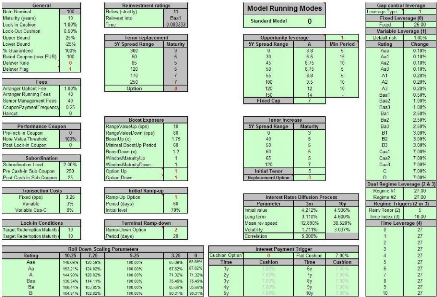

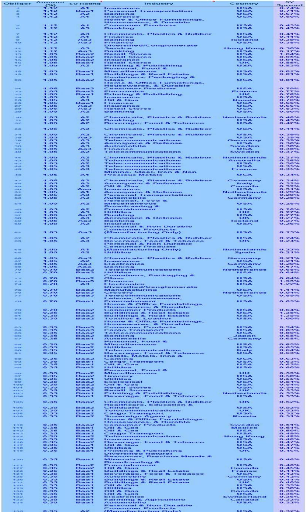

3.4 A study of the DPPI's sensitivities

Given Moody's modelling and calibrating assumptions on risk

factors, we wish to study the DPPI's behaviour as a function of its main

structural features, such as the spread over EURIBOR served to the senior

investor, the CDS tenor investment rule or the parametres of the Target

Notional Exposure function.

Unless otherwise stated, we base our analysis on the portfolio

described in figure (12), on the DPPI optimized parametres listed in figure

(11) on the set of Moody's parametres listed in figures (8), (9) and (10). All

numerical results are based on C++ code developped by both Bear Stearns and

Moody's. As a starting point we plot hereafter the DPPI's simulated discounted

loss and lock-in times distributions based on 30,000 draws..

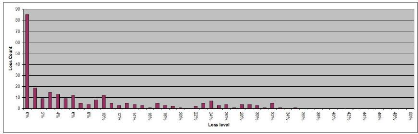

Figure 3.3: DPPI base-case loss distribution conditional on the

structure not cashing in

Figure 3.4: Distribution of cash-in times

The Moody's Metric of the base case scenario is 2.697, which is

equivalent to an Aa2 rating.

3.4.1 Tailor-made structural features to achieve target

rating

Senior rated coupon level

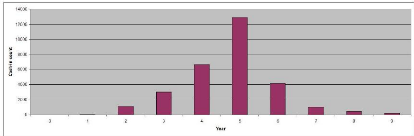

The level of the senior rated coupon is obviously a key

parametre in achieving the target rating. The graph below plots the estimated

expected loss and Moodys Metric as a function of S, the senior rated premium

paid above EURIBOR rate and measured in basis points. One shall point out the

jumps in the graph, stemming from the various triggers introduced in the

pay-off loss function L. The rather linear relationship outside jumps is also

fairly straightforward: between two jumps, the subset of cash-out scenarios is

fixed. However, given that the bulk of the loss is explained by scenarios that

cash-out at maturity without paying any single coupon, one would find that the

average loss on those scenarios is proportional to the senior coupon level, as

is the price of a bond paying EURIBOR plus the senior coupon.

Figure 3.5: Estimated expected loss as a function of S. CDS tenor

choices

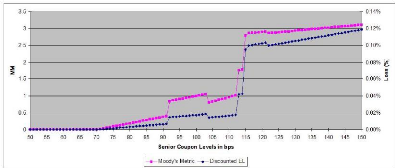

Initial and reinvestment CDS tenors have a significant impact

on the shape of the loss distribution and eventually on its expected level. We

now assume that e(.,.) is constant and equal to 0. We then plot the expected

loss level as a function of 0 E {3, 4, .., 10}. The reverse-bell shape of the

diagram accounts for the fact that:

· for short tenors, the lower MtM volatility of the DPPI

does not fully compensate for the loss in contracted CDS spread premia due to

the upward sloping shape of the term structure;

· for long tenors, the gain in contracted CDS spread premia

does not fully offset the impact of a higher MtM volatility.

Figure 3.6: Estimated expected loss as a function of è

(2000 simulations per coupon level)

Target Notional Exposure parametrization

In order to get the intuition on how the expected loss behaves

with respect to the

Target Notional Exposure function TNE(.), one shall

slightly simplify the latter and

assume that opportunity leverage and target

multiplier functions, OL(.) and TM(.),

are constant and equal to respectively OL and TM. We then plot

TNE as a function

of both parametres OL and TM. S1 stands for TM = 20 and S9 for

TM = 40 with Si+1 - Si constant.

Figure 3.7: Loss and Moody's Metric as a function of OL and TM,

1000 simulations per couple of parametres

One shall point out from the graphs that even with the best

combination of fixed

Opportunity Leverage OL and Target Multiplier TM parametres,

the structure's

Moody's Metric remains significantly higher than 2.697

obtained with dynamic OL

and TM functions. Also, we clearly see that there is a

tradeoff between OL and TM

that allows the structure to improve its rating:

too high values for both parametres

lead to a sub-optimal leverage function,

reflecting the fact the extra MtM volatility

induced by a higher leverage has a negative fat tail effect on

the loss distribution L(M).

3.4.2 Hypothetical stress-scenarios

Being aware of some obvious limitations in its modelling of

risk factors, Moody's requires the DPPI to achieve the target rating in the

base-case scenrio and to pass looser target Moody's Metrics in a series of

stress-scenarios. Major ones are analyzed hereafter: results are shown in table

(3.1).

Credit crisis: systemic brutal spread widening

In order to assess the impact of a brutal widening in CDS

spreads, Moody's requires the market spreads of initial long CDS positions to

be bumped by á = 25% immediately after the deal's inception.

Equivalently, this adverse MtM impact ÄMtM(0) can be expressed in terms of

an upfront haircut to be subtracted from the deal's initial notional A:

ÄMtM(0) = á

|

XN

n=1

|

sn(0)An(0)

A TNE(0) · Dn(0)

|

|

where 0 denotes the initial CDS tenor and Dn(0)

the initial duration of the nth CDS. Given initial market conditions

and structural features provided in figures (12) and (11), we compute

ÄMtM(0) = 3.83% and add this haircut to the initial upfront fee of 1%

charged by the arranging investment bank. Results are shown in table (3.1)

Bullish but punctually volatile credit markets: low spreads

stressed by punctual default events

The rationale for testing the DPPI in such mixed market

environments is to test whether the structure can sustain below-average market

spreads, meaning that it does not receive enough CDS premia to cover its

liabilities towards investors (the structure is then deemed to be in

«negative carry»). To do so, Moody's acts on the parametres of the

credit spread process detailed in equation (3.1): it lowers arbitrarily the

long term mean â by decreasing ADR as well as b, and divides the

volatility parametres ó and ó by two. Results are shown in table

(3.1).

Short term default risk concerns: flat credit spread term

structure

As seen earlier, the increasing term structure of credit

spreads is assumed to be deterministic and to result from a shaping function

specific to each rating group. Such an upward slope translates into a positive

time-decay when holding long CDS positions. This increasing term structure gets

attenuated as ratings get worse: it reflects the fact that conditional on the

obligor not defaulting in a near future, its survival probability in the long

run is not worse than presently. Moody's cancels that overall positive

time-decay effect by assuming a flat credit spread term structure guided by

5-year CDS spread levels. Results are shown in table (3.1).

?n E {1,..,N}, ?t E [0,T], ?0 E [0,10], sn(t,t + 0)

= sn(t,t + 5)

Hypothetical stress-scenario results

Scenario

|

L(M)

|

Moody's Metric

|

Rating

|

Base case

|

0.089%

|

2.697

|

Aa2

|

Early credit crisis

|

0.248%

|

4.219

|

A1

|

Low spreads

|

0.447%

|

5.276

|

A2

|

Flat term structure

|

0.685%

|

6.091

|

A3

|

|

Table 3.1: DPPI behaviour under base-case and stress scenarios,

20,000 simulations each except for base-case 30,000 draws

As expected, the DPPI's rating worsens in stressed scenarios.

The structure's resiliency to adverse market environments is obvious: the

magnitude of the potential rating to downgrade is limited to 4 notches in the

flat term structure scenario.

3.5 DPPI: any hidden pricing issue?

So far, we have not raised any pricing nor hedging issue

pertaining to DPPI products. We shall briefly address both points hereafter.

3.5.1 From the investor's perspective

Initially, the return served to the investor can be split

into two separate pieces: the LIBOR/EURIBOR component results from the

structure being long a risk-free bond paying an interbank 3-month rate, while

the extra risky spread of 100 bps is generated by a long leveraged CDS

portfolio. Later on though, the structure may have to realize MtM losses due to

a deleveraging signal sent by the portfolio investment rules: in that case, the

posted collateral must be partly sold in order to pay for the potential loss on

the unwound CDS positions. As a result, the structure is exposed to two major

market risks:

· one is the credit risk inherent in holding long CDS

positions;

· the other is the interest rate risk created by the

potential selling of the collateral before its due term; similarly to what is

being done for CSO structures, such a risk is hedged by entering into 3-month

forward rate agreements rolled every quarter.

As a result, the DPPI's NPV boils down to being equal to the