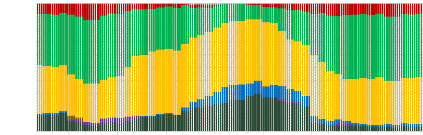

5.4. Portfolio weights analysis

As can be seen from the asset allocation weights graphs,

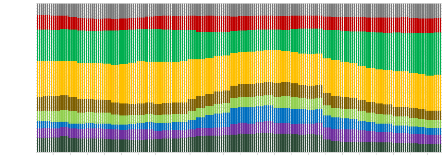

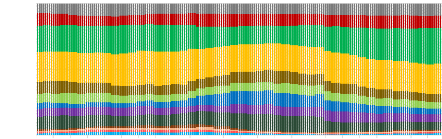

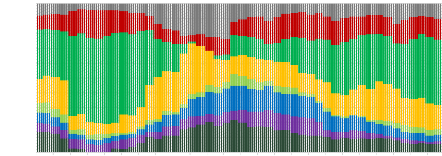

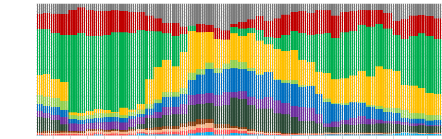

portfolios of traditional assets under inverse volatility and maximum

diversification strategies are more diversified. On the other hand, Conditional

Value at Risk strategy sets extreme weight allocations to bonds indices

followed by S&P 500 since they exhibit the least volatility. Therefore, the

C-var optimizer omits weighting other indices, which performed really bad and

were highly volatile during estimation periods. This results in the basis

portfolio exhibiting the best performance under this strategy with a Sharpe of

1.07.

When cryptocurrencies are included, I notice that the

weighting scheme of other asset classes fluctuates to compensate for the

additional volatility. Equity indices weights change the most during the sample

period. I observe a significant increase in S&P 500 proportion but also a

small position taken in gold. In addition, through the whole investment period,

optimal portfolios contain between 0 and 3% of cryptocurrencies with the higher

allocation share during the years 2016-2017, the period of tremendous growth

for cryptocurrencies. Indeed, cryptocurrencies are considered too risky for the

parameters of the optimization problem.

It is also noticeable that Bitcoin dominates over alternative

cryptocurrencies. In fact, none of the Altcoins is given more than 1% weight

during the whole optimization process.

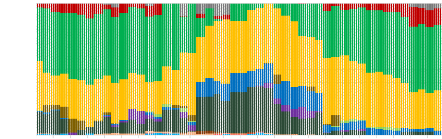

Regarding risk budgeting approaches, I observe that portfolio

assets do not fluctuate that much when adding cryptocurrencies. Moreover, the

weight allocated to cryptocurrencies is larger under those two strategies.

Until 2017, there is an increasing allocation in cryptocurrencies. However, it

decreases drastically after the Bitcoin boom.

20

Furthermore, the Maximum Diversification strategy, which

boosted the performance of investments significantly, invests between 0 and 10%

in cryptocurrencies. Thus, the higher cryptocurrency exposure had a huge impact

on maximizing the portfolio performance.

5.5. Robustness check

To assess the robustness of the trading strategies results,

tables 12, 13, 14 and 15 present performance results using weekly data and

monthly rebalancing.

The results of the study are robust with regard to the asset

allocations employed. I find that cryptocurrencies always add substantial value

when included in the stocks-bonds-alternative investments portfolio. Sharpe

ratio increases significantly under the different optimization frameworks.

However, similar results regarding the downside risk of the basis portfolio are

found when using weekly data. Alternative cryptocurrencies worsen of the

maximum drawdown of the portfolio whereas Bitcoin increases slightly the

maximum drawdown under Inverse volatility and minimum variance strategies.

Interestingly, Minimum conditional value at risk performs

better than maximum diversification and yields the highest Sharpe Ratio when

cryptocurrencies are added.

6. Conclusion

This study seeks to address the possible hedging and

diversification benefits of cryptocurrencies as an alternative investment. From

the perspective of a global investor, I investigate the market linkages between

Cryptocurrencies and global asset indices as well as the benefits of their

inclusion within these assets.

21

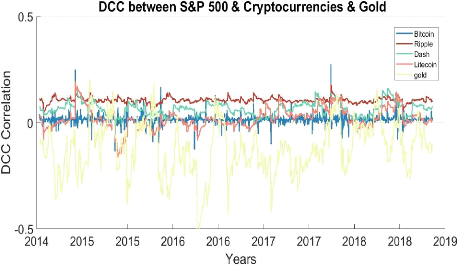

Using the dynamic conditional correlation model, I find that

block-chain assets can act as effective diversifiers for the investment period

analyzed. I also detect that the correlation of traditional assets against

Bitcoin are closer to zero and more stable than against over crypto-tokens.

Moreover, I find that Bitcoin, Dash and Litecoin do possess hedging properties

against some assets' indices. However, none of the cryptocurrencies acts as

hedge against European, American and emerging market equities.

The resulting diversification properties further endorse the

cryptocurrencies use case in a diversified portfolio. These findings are useful

for global investors seeking protection from markets downward movements. I

examine the out of sample performance of portfolios with and without

cryptocurrencies via risk-based investment strategies: minimum variance,

minimum conditional value at risk, inverse volatility and maximum

diversification.

The results are in line with previous research regarding the

inclusion of Bitcoin in a global portfolio of equities, bonds and alternative

assets. I find that the risk return efficiency is enhanced under all

strategies. The small increase in volatility was compensated with

proportionally greater returns.

Despite their extreme volatility, the addition of alternative

cryptocurrencies to a global diversified portfolio, which already contains

Bitcoin, enhances the risk return reward. However, these crypto-assets yield

higher volatility and higher maximum drawdown under all strategies. Further,

the performance of the portfolio is boosted significantly under inverse

volatility and maximum diversification. In fact, these modern risk based

strategies prompt higher risk return reward via greater cryptocurrency exposure

and especially greater alternative cryptos exposure. On the other side, due to

their volatility structure, Minimum variance and Minimum C-var strategies

invested in cryptocurrencies and particularly in Bitcoin only in certain points

of time.

22

Moreover, the hedging properties of Cryptocurrencies are

analyzed via the portfolios maximum drawdown. When adding Bitcoin, I find that

it slightly drops under minimum variance and inverse volatility strategy.

However, when Dash, Ripple and Litecoin are further added, the maximum drawdown

increases under the four optimization models.

As robustness checking, I apply the aforementioned allocation

strategies using weekly data. Results persist robustly. Cryptocurrencies

enhance the portfolio performance on risk-adjusted basis but do not really

decrease the portfolio downside risk.

In a nutshell, the study evidence suggests that

cryptocurrencies can act as outstanding diversifier tools on a global

perspective but do not offer appealing hedging properties.

However, the results of this study should be interpreted with

caution. This analysis employs only limited asset allocation strategies. The

sample period is small due to the short history of cryptocurrencies and better

alternative to the selected cryptocurrencies might exist.

23

Appendix:

Table 1: Descriptive statistics of traditional

assets.

Summary statistics of daily log returns for traditional assets

from 31 July 2014 to 30 April 2019. (N=1238 observations). Results are reported

on a percentage basis apart from skewness, kurtosis, Sharpe ratio, the JB and

LJBox tests. In addition, Sharpe ratio is annualized.

|

S&P 500 Eurostoxx 50

|

SSE A

shares

|

Nikkei 225

|

MSCI Markets EM

|

IBOXX LIG

|

S&P GSD

|

FTSE EPRA NAREIT

|

S&P GSCI GOLD

|

|

Mean

|

0.042

|

0.008

|

0.027

|

0.030

|

0.011

|

0.014

|

0.002

|

0.022

|

-0.002

|

|

Standard Deviation

|

0.833

|

1.117

|

1.507

|

1.136

|

0.897

|

0.295

|

0.354

|

0.792

|

0.815

|

|

Skewness

|

-0.448

|

-0.786

|

-1.190

|

-0.261

|

-0.311

|

-0.332

|

-0.002

|

-0.748

|

0.271

|

|

Kurtosis

|

7.068

|

12.335

|

10.063

|

7.079

|

4.721

|

3.926

|

5.312

|

9.167

|

6.036

|

|

Minimum

|

-4.184

|

-11.102

|

-8.869

|

-5.742

|

-5.101

|

-1.451

|

-1.922

|

-6.912

|

-3.418

|

|

1% percentile

|

-2.520

|

-3.037

|

-6.109

|

-3.460

|

-2.330

|

-0.741

|

-0.950

|

-2.271

|

-2.252

|

|

5% quantile

|

-1.427

|

-1.709

|

-2.221

|

-1.791

|

-1.501

|

-0.492

|

-0.580

|

-1.235

|

-1.353

|

|

25% quantile

|

-0.255

|

-0.574

|

-0.473

|

-0.486

|

-0.511

|

-0.157

|

-0.187

|

-0.373

|

-0.404

|

|

Median

|

0.029

|

0.039

|

0.032

|

0.063

|

0.060

|

0.015

|

0.000

|

0.052

|

0.000

|

|

75% percentile

|

0.445

|

0.577

|

0.606

|

0.614

|

0.540

|

0.198

|

0.197

|

0.464

|

0.411

|

|

99% percentile

|

2.103

|

2.925

|

4.183

|

3.003

|

2.172

|

0.685

|

0.939

|

1.977

|

2.176

|

|

Maximim

|

4.842

|

5.567

|

5.599

|

6.414

|

3.228

|

0.938

|

1.802

|

3.622

|

4.590

|

|

Sharpe Ratio

|

0.800

|

0.117

|

0.285

|

0.414

|

0.193

|

0.767

|

0.013

|

0.442

|

-0.044

|

|

Jarque Bera Test

|

894.984

|

4622.047

|

2865.479

|

872.227

|

172.802

|

66.976

|

275.770

|

2077.435

|

490.681

|

|

Ljung Box Test

|

18.779

|

40.143

|

69.939

|

105.296

|

69.638

|

39.657

|

24.314

|

43.257

|

20.791

|

|

Critical Value Jarque Bera Test

|

5.943

|

|

|

|

|

|

|

|

|

Critical Value Ljung Box Test

|

31.400

|

|

|

|

|

|

|

|

24

Table 2: Descriptive statistics of

cryptocurrencies.

Summary statistics of daily log returns for cryptocurrencies from

31 July 2014 to 30 April 2019. (N=1238 observations).

|

Bitcoin

|

Ripple

|

Dash

|

Litecoin

|

|

Mean

|

0.179

|

0.330

|

0.242

|

0.185

|

|

Standard Deviation

|

4.394

|

7.513

|

7.522

|

6.945

|

|

Skewness

|

-0.210

|

2.381

|

0.015

|

1.000

|

|

Kurtosis

|

8.206

|

20.257

|

27.050

|

15.789

|

|

Minimum

|

-23.874

|

-35.328

|

-86.020

|

-51.393

|

|

1% percentile

|

-13.533

|

-18.051

|

-19.343

|

-15.550

|

|

5% quantile

|

-7.056

|

-9.364

|

-9.759

|

-8.994

|

|

25% quantile

|

-1.423

|

-2.430

|

-2.845

|

-2.138

|

|

Median

|

0.222

|

-0.345

|

-0.276

|

0.000

|

|

75% percentile

|

1.890

|

2.089

|

2.990

|

1.822

|

|

99% percentile

|

13.828

|

27.293

|

23.589

|

26.831

|

|

Maximim

|

22.512

|

75.083

|

76.818

|

53.980

|

|

Sharpe Ratio

|

0.645

|

0.698

|

0.511

|

0.422

|

|

Jarque Bera Test

|

1406.84

|

16530.00

|

29834.76

|

8643.49

|

|

Ljung Box Test

|

31.76

|

91.30

|

26.56

|

36.60

|

|

Critical Value Jarque Bera Test

|

|

5.94

|

|

|

|

Critical Value Ljung Box Test

|

|

31.40

|

|

|

25

Table 3: Correlation matrix

This table shows unconditional pairwise correlation coefficients

between cryptocurrencies and traditional assets from 31 July 2014 to 30 April

2019.

|

Bitcoin

|

Ripple

|

Dash

|

Litecoin

|

S&P500

|

Eurostoxx

50

|

SSE A

Shares

|

Nikkei

225

|

MSCI

EM

|

IBOXX

LIG

|

S&P

GSD

|

FTSE

EPRA

|

S&P

GSCI

GOLD

|

|

Bitcoin

|

1.000

|

0.330

|

0.485

|

0.592

|

0.039

|

0.036

|

0.012

|

-0.037

|

0.016

|

-0.023

|

0.010

|

-0.019

|

0.023

|

|

Ripple

|

|

1.000

|

0.254

|

0.332

|

0.053

|

0.030

|

-0.007

|

0.020

|

0.063

|

0.035

|

0.033

|

0.010

|

0.026

|

|

Dash

|

|

|

1.000

|

0.431

|

0.080

|

0.068

|

0.030

|

-0.013

|

0.049

|

-0.073

|

-0.037

|

-0.017

|

-0.006

|

|

Litecoin

|

|

|

|

1.000

|

0.026

|

0.004

|

-0.015

|

-0.026

|

0.007

|

-0.006

|

0.009

|

-0.015

|

-0.016

|

|

S&P500

|

|

|

|

|

1.000

|

0.493

|

0.162

|

0.065

|

0.441

|

-0.193

|

-0.214

|

0.515

|

-0.138

|

|

Eurostoxx 50

|

|

|

|

|

|

1.000

|

0.127

|

0.160

|

0.578

|

-0.125

|

-0.026

|

0.256

|

-0.099

|

|

SSE A Shares

|

|

|

|

|

|

|

1.000

|

0.211

|

0.413

|

0.013

|

-0.101

|

0.230

|

-0.058

|

|

Nikkei 225

|

|

|

|

|

|

|

|

1.000

|

0.416

|

0.203

|

0.124

|

0.181

|

0.102

|

|

MSCI EM

|

|

|

|

|

|

|

|

|

1.000

|

0.022

|

-0.032

|

0.435

|

0.018

|

|

IBOXX LIG

|

|

|

|

|

|

|

|

|

|

1.000

|

0.446

|

0.108

|

0.280

|

|

S&P GSD

|

|

|

|

|

|

|

|

|

|

|

1.000

|

-0.373

|

0.558

|

|

FTSE EPRA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAREIT

|

|

|

|

|

|

|

|

|

|

|

|

1.000

|

-0.177

|

|

S&P GSCI

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GOLD

|

|

|

|

|

|

|

|

|

|

|

|

|

1.000

|

26

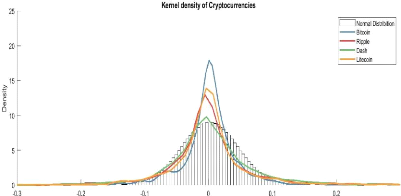

Figure 1 : Density of

Cryptocurrencies.

The following figure illustrates Gaussian kernel density

estimators of cryptocurrencies against fitted normal distribution.

The subsequent tables summarize the dynamic conditional

correlations between daily returns of the four cryptocurrencies and traditional

asset class. Standard deviations are expressed in percentage.

Table 4: DCC statistics for traditional assets against

Bitcoin

|

Mean

|

Std.deviation

|

Minimum

|

Median

|

Maximum

|

25%

quantile

|

75% quantile

|

|

S&P 500

|

0.0146

|

2.2501%

|

-0.1343

|

0.0147

|

0.2738

|

0.0099

|

0.0194

|

|

Eurostoxx 50

|

0.0648

|

0.0022%

|

0.0648

|

0.0648

|

0.0649

|

0.0648

|

0.0648

|

|

SSE_A shares

|

-0.0056

|

0.0038%

|

-0.0061

|

-0.0056

|

-0.0052

|

-0.0056

|

-0.0056

|

|

Nikkei 225

|

-0.0374

|

3.2494%

|

-0.0977

|

-0.0317

|

0.0194

|

-0.0693

|

-0.0102

|

|

MSCI EM

|

0.0196

|

0.0002%

|

0.0196

|

0.0196

|

0.0196

|

0.0196

|

0.0196

|

|

IBOXX LIG

|

-0.0149

|

0.0002%

|

-0.0150

|

-0.0149

|

-0.0149

|

-0.0149

|

-0.0149

|

|

S&P GSD

|

0.0112

|

0.2561%

|

-0.0252

|

0.0112

|

0.0243

|

0.0106

|

0.0118

|

|

FTSE EPRA

|

|

|

|

|

|

|

|

|

NAREIT

|

-0.0320

|

0.2980%

|

-0.0541

|

-0.0321

|

-0.0029

|

-0.0331

|

-0.0310

|

|

S&P GSCI gold

|

0.0166

|

0.0002%

|

0.0165

|

0.0166

|

0.0166

|

0.0166

|

0.0166

|

27

Table 5: DCC statistics for traditional assets against

Ripple

|

Mean

|

Std.deviation

|

Minimum

|

Median

|

Maximum

|

25% quantile

|

75% quantile

|

|

S&P 500

|

0.064

|

3.12%

|

-0.009

|

0.064

|

0.173

|

0.040

|

0.082

|

|

Eurostoxx 50

|

0.044

|

0.00%

|

0.044

|

0.044

|

0.044

|

0.044

|

0.044

|

|

SSE_A shares

|

0.004

|

7.65%

|

-0.255

|

-0.002

|

0.337

|

-0.040

|

0.048

|

|

Nikkei 225

|

0.013

|

2.13%

|

-0.049

|

0.011

|

0.094

|

0.000

|

0.025

|

|

MSCI EM

|

0.073

|

2.56%

|

-0.010

|

0.071

|

0.200

|

0.059

|

0.084

|

|

IBOXX LIG

|

0.018

|

0.13%

|

0.007

|

0.018

|

0.026

|

0.018

|

0.018

|

|

S&P GSD

|

0.034

|

0.00%

|

0.034

|

0.034

|

0.034

|

0.034

|

0.034

|

|

FTSE EPRA

|

|

|

|

|

|

|

|

|

NAREIT

|

0.020

|

4.48%

|

-0.312

|

0.019

|

0.338

|

0.002

|

0.037

|

|

S&P GSCI gold

|

0.026

|

0.00%

|

0.026

|

0.026

|

0.026

|

0.026

|

0.026

|

Table 6: DCC statistics for traditional assets against

DASH.

|

Mean

|

Std.deviation

|

Minimum

|

Median

|

Maximum 25% quantile 75% quantile

|

|

S&P 500

|

0.11

|

1.4%

|

0.03

|

0.10

|

0.18

|

0.10

|

0.11

|

|

Eurostoxx 50

|

0.10

|

3.1%

|

-0.08

|

0.10

|

0.27

|

0.09

|

0.11

|

|

SSE_A shares

|

0.04

|

0.0%

|

0.04

|

0.04

|

0.04

|

0.04

|

0.04

|

|

Nikkei 225

|

0.02

|

0.7%

|

-0.03

|

0.02

|

0.11

|

0.02

|

0.03

|

|

MSCI EM

|

0.08

|

2.5%

|

0.00

|

0.08

|

0.18

|

0.07

|

0.10

|

|

IBOXX LIG

|

-0.07

|

0.0%

|

-0.07

|

-0.07

|

-0.07

|

-0.07

|

-0.07

|

|

S&P GSD

|

-0.04

|

0.0%

|

-0.04

|

-0.04

|

-0.04

|

-0.04

|

-0.04

|

|

FTSE EPRA

|

|

|

|

|

|

|

|

|

NAREIT

|

-0.01

|

8.2%

|

-0.45

|

-0.01

|

0.49

|

-0.05

|

0.03

|

|

S&P GSCI gold

|

-0.02

|

2.1%

|

-0.26

|

-0.02

|

0.10

|

-0.02

|

-0.01

|

28

Table 7: DCC statistics for traditional assets against

Litecoin

|

Mean

|

Std.deviation Minimum

|

Median

|

Maximum

|

25% quantile 75% quantile

|

|

S&P 500

|

0.018

|

4.89%

|

-0.164

|

0.011

|

0.192

|

-0.010

|

0.040

|

|

Eurostoxx 50

|

0.035

|

1.88%

|

-0.036

|

0.035

|

0.120

|

0.027

|

0.043

|

|

SSE_A shares

|

-0.027

|

2.90%

|

-0.099

|

-0.029

|

0.042

|

-0.044

|

-0.014

|

|

Nikkei 225

|

-0.021

|

0.00%

|

-0.021

|

-0.021

|

-0.021

|

-0.021

|

-0.021

|

|

MSCI EM

|

0.020

|

2.47%

|

-0.086

|

0.020

|

0.110

|

0.006

|

0.033

|

|

IBOXX LIG

|

-0.010

|

4.31%

|

-0.129

|

-0.009

|

0.181

|

-0.031

|

0.012

|

|

S&P GSD

|

0.001

|

0.00%

|

0.001

|

0.001

|

0.001

|

0.001

|

0.001

|

|

FTSE EPRA

|

|

|

|

|

|

|

|

|

NAREIT

|

-0.016

|

0.00%

|

-0.017

|

-0.016

|

-0.016

|

-0.016

|

-0.016

|

|

S&P GSCI gold

|

-0.016

|

5.46%

|

-0.207

|

-0.009

|

0.154

|

-0.046

|

0.018

|

Figure 2 : Dynamic conditional correlation plot of

S&P 500 against cryptocurrencies and gold.

29

The following tables present the performance of the three

optimal portfolios: Portfolio I: a portfolio of traditional assets, which

encompasses equities, bonds and alternative investments. Portfolio II: a

portfolio of traditional assets and Bitcoin. Portfolio III: a portfolio of

traditional assets, Bitcoin and alternative cryptocurrencies. Four different

optimization frameworks are performed subsequently: Minimum variance, Minimum

Conditional Value at Risk, Inverse Volatility and Maximum Diversification

frameworks. I use a 200 days moving window and the out of sample period ranges

from May-08-2015 to April-30-2019. Sharpe ratio, mean daily return and standard

deviation are annualized.

|

Table 8: Minimum Variance strategy

|

|

|

Portfolio I

|

Portfolio II

|

Portfolio III

|

|

Mean (%)

|

3.81%

|

4.14%

|

4.60%

|

|

Standard deviation (%)

|

3.62%

|

3.62%

|

3.64%

|

|

Skewness

|

-0.45

|

-0.44

|

-0.43

|

|

Kurtosis

|

5.30

|

5.24

|

5.06

|

|

Maximum drawdown (%)

|

5.43%

|

5.37%

|

5.45%

|

|

Cumulative wealth

|

1.16

|

1.17

|

1.19

|

|

Sharpe ratio

|

1.05

|

1.14

|

1.26

|

Table 9: Minimum conditional value at risk

strategy

|

Portfolio I

|

Portfolio II

|

Portfolio III

|

|

Mean (%)

|

3.80%

|

4.51%

|

5.08%

|

|

Standard deviation (%)

|

3.64%

|

3.85%

|

3.94%

|

|

Skewness

|

-0.41

|

-0.36

|

-0.37

|

|

Kurtosis

|

5.25

|

5.13

|

5.09

|

|

Maximum drawdown (%)

|

5.50%

|

5.70%

|

6.93%

|

|

Cumulative wealth

|

1.16

|

1.19

|

1.21

|

|

Sharpe ratio

|

1.04

|

1.17

|

1.29

|

30

|

Table 10 : Inverse volatility strategy.

|

|

|

Portfolio I

|

Portfolio II

|

Portfolio III

|

|

Mean (%)

|

2.91%

|

4.42%

|

7.67%

|

|

Standard deviation (%)

|

5.17%

|

5.20%

|

5.88%

|

|

Skewness

|

-0.39

|

-0.46

|

-0.45

|

|

Kurtosis

|

5.35

|

5.53

|

5.57

|

|

Maximum drawdown (%)

|

11.85%

|

10.39%

|

11.70%

|

|

Cumulative wealth

|

1.12

|

1.18

|

1.32

|

|

Sharpe ratio

|

0.56

|

0.85

|

1.30

|

Table 11 : Maximum diversification

strategy.

|

Portfolio I

|

Portfolio II

|

Portfolio III

|

|

Mean (%)

|

3.31%

|

5.94%

|

8.75%

|

|

Standard deviation (%)

|

4.50%

|

4.86%

|

5.65%

|

|

Skewness

|

-0.37

|

-0.31

|

0.07

|

|

Kurtosis

|

5.08

|

4.91

|

7.09

|

|

Maximum drawdown (%)

|

8.15%

|

9.40%

|

9.46%

|

|

Cumulative wealth

|

1.13

|

1.24

|

1.36

|

|

Sharpe ratio

|

0.73

|

1.22

|

1.54

|

FIGURES: Weight Allocation

The following graphs display the weight allocation for

traditional assets and cryptocurrencies from 8 May 2015 until 30 April 2019

under the following strategies: minimum conditional value at risk, inverse

volatility, and maximum diversification.

Minimum Conditional Value at Risk

Portfolio of traditional

assets

08.05.2015 08.07.2015 08.09.2015 08.11.2015 08.01.2016 08.03.2016

08.05.2016 08.07.2016 08.09.2016 08.11.2016 08.01.2017 08.03.2017 08.05.2017

08.07.2017 08.09.2017 08.11.2017 08.01.2018 08.03.2018 08.05.2018 08.07.2018

08.09.2018 08.11.2018 08.01.2019 08.03.2019

1,00

0,90

0,80

0,70

Weights

0,60

0,50

0,40

0,30

0,20

0,10

0,00

Year

S&P 500 Eurostoxx 50 SSE A Shares Nikkei 225 MSCI EM

IBOXX LIG S&P GSD FTSE EPRA NAREIT S&P GSCI GOLD

Minimum Conditional Value at Risk Portfolio of tradtional assets

and cryptocurrencies

08.05.2015 08.07.2015 08.09.2015 08.11.2015 08.01.2016 08.03.2016

08.05.2016 08.07.2016 08.09.2016 08.11.2016 08.01.2017 08.03.2017 08.05.2017

08.07.2017 08.09.2017 08.11.2017 08.01.2018 08.03.2018 08.05.2018 08.07.2018

08.09.2018 08.11.2018 08.01.2019 08.03.2019

1,00

0,90

0,80

0,70

Weights

0,60

0,50

0,40

0,30

0,20

0,10

0,00

31

Year

Bitcoin Ripple Dash Litecoin S&P500

Eurostoxx 50 SSE A Shares Nikkei 225 MSCI EM IBOXX LIG

S&P GSD FTSE EPRA NAREIT S&P GSCI GOLD

Inverse Volatility

Portfolio of traditional assets

08.05.2015 08.07.2015 08.09.2015 08.11.2015 08.01.2016 08.03.2016

08.05.2016 08.07.2016 08.09.2016 08.11.2016 08.01.2017 08.03.2017 08.05.2017

08.07.2017 08.09.2017 08.11.2017 08.01.2018 08.03.2018 08.05.2018 08.07.2018

08.09.2018 08.11.2018 08.01.2019 08.03.2019

1,00

0,90

0,80

0,70

Weights

0,60

0,50

0,40

0,30

0,20

0,10

0,00

Year

S&P 500 Eurostoxx 50 SSE A Shares Nikkei 225 MSCI EM

IBOXX LIG S&P GSD FTSE EPRA NAREIT S&P GSCI GOLD

Inverse Volatility

Portfolio of traditional assets and

cryptocurrencies

08.05.2015 08.07.2015 08.09.2015 08.11.2015 08.01.2016 08.03.2016

08.05.2016 08.07.2016 08.09.2016 08.11.2016 08.01.2017 08.03.2017 08.05.2017

08.07.2017 08.09.2017 08.11.2017 08.01.2018 08.03.2018 08.05.2018 08.07.2018

08.09.2018 08.11.2018 08.01.2019 08.03.2019

1,00

0,90

0,80

0,70

Weights

0,60

0,50

0,40

0,30

0,20

0,10

0,00

32

Year

Bitcoin Ripple Dash Litecoin S&P500

Eurostoxx 50 SSE A Shares Nikkei 225 MSCI EM IBOXX LIG

S&P GSD FTSE EPRA NAREIT S&P GSCI GOLD

Maximum Diversification

Portfolio of traditional

assets

08.05.2015 08.07.2015 08.09.2015 08.11.2015 08.01.2016 08.03.2016

08.05.2016 08.07.2016 08.09.2016 08.11.2016 08.01.2017 08.03.2017 08.05.2017

08.07.2017 08.09.2017 08.11.2017 08.01.2018 08.03.2018 08.05.2018 08.07.2018

08.09.2018 08.11.2018 08.01.2019 08.03.2019

1,00

0,90

0,80

0,70

Weights

0,60

0,50

0,40

0,30

0,20

0,10

0,00

Year

S&P 500 Eurostoxx 50 SSE A shares Nikkei 225 MSCI EM

IBOXX LIG S&P GSD FTSE EPRA NAREIT S&P GSCI GOLD

Maximum Diversification

Portfolio of traditional assets and

crytocurrencies

08.05.2015 08.07.2015 08.09.2015 08.11.2015 08.01.2016 08.03.2016

08.05.2016 08.07.2016 08.09.2016 08.11.2016 08.01.2017 08.03.2017 08.05.2017

08.07.2017 08.09.2017 08.11.2017 08.01.2018 08.03.2018 08.05.2018 08.07.2018

08.09.2018 08.11.2018 08.01.2019 08.03.2019

1,00

0,90

0,80

0,70

Weights

0,60

0,50

0,40

0,30

0,20

0,10

0,00

33

Year

Bitcoin Ripple Dash Litecoin S&P500

Eurostoxx 50 SSE A Shares Nikkei 225 MSCI EM IBOXX LIG

S&P GSD FTSE EPRA NAREIT S&P GSCI GOLD

34

The subsequent tables present the results obtained from the

robustness check. It reports the performance of the optimal portfolios when

using weekly data. I use 40 weeks (Equivalent of 200 trading days) moving

window and the out of sample period ranges from May-08-2015 to April-30-2019.

Sharpe ratio, mean daily return and standard deviation are annualized.

|

Table 12: Minimum variance strategy

|

|

|

Portfolio I

|

Portfolio II

|

Portfolio III

|

|

Mean (%)

|

3.38%

|

4.08%

|

5.64%

|

|

Standard deviation (%)

|

4.29%

|

4.31%

|

4.53%

|

|

Skewness

|

-1.17

|

-1.26

|

-1.01

|

|

Kurtosis

|

10.07

|

10.31

|

8.93

|

|

Maximum drawdown (%)

|

6.97%

|

6.50%

|

7%

|

|

Cumulative wealth

|

1.13

|

1.16

|

1.22

|

|

Sharpe ratio

|

0.79

|

0.95

|

1.24

|

Table 13: Minimum conditional value at risk

strategy

|

Portfolio I

|

Portfolio II

|

Portfolio III

|

|

Mean (%)

|

3.30%

|

4.36%

|

10.40%

|

|

Standard deviation (%)

|

4.45%

|

5.15%

|

6.07%

|

|

Skewness

|

-1.30

|

-2.54

|

-1.53

|

|

Kurtosis

|

14.30

|

21.90

|

14.09

|

|

Maximum drawdown (%)

|

7.00%

|

8.74%

|

9.00%

|

|

Cumulative wealth

|

1.14

|

1.17

|

1.39

|

|

Sharpe ratio

|

0.74

|

0.85

|

1.60

|

35

|

Table 14: Inverse volatility strategy

|

|

|

Portfolio I

|

Portfolio II

|

Portfolio III

|

|

Mean (%)

|

3.00%

|

4.59%

|

8.16%

|

|

Standard deviation (%)

|

6.15%

|

6.23%

|

6.85%

|

|

Skewness

|

-0.78

|

-0.83

|

-0.66

|

|

Kurtosis

|

5.75

|

5.81

|

4.73

|

|

Maximum drawdown (%)

|

10.83%

|

9.83%

|

11.0%

|

|

Cumulative wealth

|

1.11

|

1.18

|

1.32

|

|

Sharpe ratio

|

0.49

|

0.74

|

1.19

|

|

Table 15: Maximum diversification strategy

|

|

|

Portfolio I

|

Portfolio II

|

Portfolio III

|

|

Mean (%)

|

3.11%

|

6.55%

|

11.64%

|

|

Standard deviation (%)

|

5.76%

|

6.52%

|

8.83%

|

|

Skewness

|

-1.24

|

-1.20

|

0.36

|

|

Kurtosis

|

9.39

|

8.25

|

7.40

|

|

Maximum drawdown (%)

|

8.69%

|

10.02%

|

9.57%

|

|

Cumulative wealth

|

1.12

|

1.26

|

1.45

|

|

Sharpe ratio

|

0.54

|

1.00

|

1.31

|

36

Salma Ouali

References

Bouri, E., Molnár, P., Azzi, G., Roubaud, D., Hagfors,

L.I., 2017. On the hedge and safe haven properties of Bitcoin: Is it really

more than a diversifier? Finance Research Letters 20, 192-198.

Briere, M., Oosterlinck, K., Szafrz, A., 2015. Virtual

currency, tangible return: Portfolio diversification with bitcoin. Journal of

Asset Management, 16, 6, 365-373.

Brauneis, A., Mestel, R., 2019. Cryptocurrency-portfolios in a

mean-variance framework. Finance Research Letters 28, 259-264.

Dyhrberg, A. H., 2016. Bitcoin, gold and the dollar- A GARCH

volatility analysis. Finance Research Letters, 85-92.

Eisl, A., Gasser, S.M., Weinmayer, K., 2015. Caveat emptor:

Does bitcoin improve portfolio diversification?

Engle, E., 2000. Dynamic conditional correlation - A simple

class of multivariate GARCH models.

Guesmi, K. Samir Saadi, S., Abid, I., Ftiti, Z., 2018.

Portfolio diversification with virtual currency: Evidence from bitcoin.

International Review of Financial Analysis.

Henriques, I., Sadorsky, P., 2018. Can bitcoin replace gold in

an investment portfolio? Journal of Risk and Financial Management 11, 48.

Hong, K., 2016. Bitcoin as an alternative investment vehicle.

Springer Science+ Business Media

Kajtazi, A., Moro, A., 2017. Bitcoin, portfolio

diversification and Chinese financial markets

Klein, T., Thu, H.P., Walthe, T., 2018. Bitcoin is not the new

gold, a comparison of volatility, correlation, and portfolio performance.

Working paper.

Lee, D.K.K., Li Guo, L., Yu Wang, Y., 2017. Cryptocurrency: A

new investment opportunity? Liu, W., 2018. Portfolio diversification across

cryptocurrencies. Finance Research Letters.

Lorenz, J., Strika, M., 2017. Bitcoin and cryptocurrencies -

not for the faint-hearted. International Finance and Banking 4, 1.

Petukhina, A., Trimborn, S., Härdle, W.K., Elendner, H.,

2018. Investing with cryptocurrencies - evaluating the potential of portfolio

allocation.

Platanakis, E., Urquhart, A., 2018. Should investors include

bitcoin in their portfolios? A portfolio theory approach.

Rockafellar, R.T., Uryasev, S., 1999. Optimization of

conditional value at risk. Journal of Risk, 21-41.

37

Salma Ouali

Svärd, S., 2014. Dynamic portfolio strategy using

multivariate garch model. Working Paper

Symitsi, E., Chalvatzis, K.J., 2019. The economic value of

bitcoin: A portfolio analysis of currencies, gold, oil and stocks. Research in

International Business and Finance 48, 97-110.

Urquhart, A., Zhang, H., 2016. Bitcoin a hedge or safe-haven for

currencies? An intraday analysis.

|