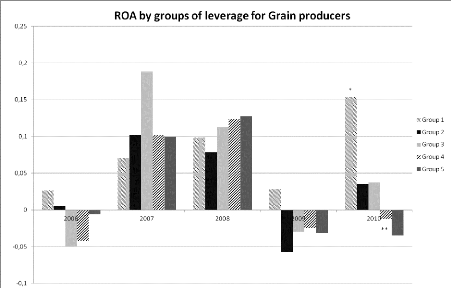

4.2.3.3 ROA for Grain Producers

Figure 23 represents the ROA medians for each group of

leverage for the grain producers. For this specialization, the results are not

really similar with what we can observe for the ROE. First of all, group 2 is

never statistically higher than any other groups, and is even the lowest

performance in 2008 and 2009 (without a statistical difference however). Only

2006 and 2010 tend to be consistent with the theory which states that

performance increases with leverage. In 2010 group 1 was

significantly higher than group 4. However, there was no

significant difference with group 5 even if its median was lower, because of

the higher standard deviation in group 5 (see appendix Appendix 13 page

111).

Figure 23: ROA for each year and each group of leverage

for grain producers * means significantly higher than **

The only statistical difference between groups tends to prove

that leverage increases ROA, but only one year out of five. Therefore, it will

be hard to make conclusions on these results for grain producers, except that

it seems that the optimal leverage range is 40-60% for this specialization.

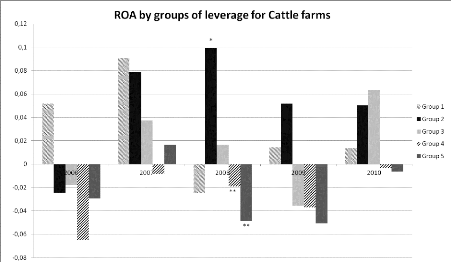

4.2.3.4 ROA for Cattle Farming

The results for the ROA are consistent with what have been

observed for the ROE for cattle farming. Group 2 has a higher median than group

4 and 5 in 2008, and performance seems to increases with the leverage (see

Figure 24). Once again, group 1 do not present stable results over the year,

which could be the consequence of financial distress for those farms which are

more leveraged than 80%. However, it will be hard to make more interpretation

from these results as only 45 farms are studied for this specialization, and

significant differences are observed only in 2008.

Figure 24: ROA for each year and each group of leverage

for cattle farming * means significantly higher than **

4.2.3.5 Results Summary for ROA by Groups of

Leverage

The median of group 2 is usually significantly higher than the

medians of groups 4 and 5 (Table 20). Group 3 in two cases over-performs group

4 or 5, and group 1 is better than group 4 in one case. The same elements are

observed for the ROA than for the ROE: the performance increases with the

leverage, even if the differences between groups are not always significant.

The high heterogeneity intragroup and between groups, illustrated by the high

standard deviations (see Appendix 11, Appendix 12 and Appendix 13 page 103, 107

and 111) explains why the differences cannot be considered as significant even

if it could have been anticipated so only by looking at the means and medians

of the different groups.

|

Year

|

|

Dairy

|

|

Grain

|

|

Cattle

|

|

Diversified

|

|

2006

|

|

-

|

|

|

-

|

|

-

|

|

-

|

|

|

2007

|

2

|

&3

|

>

|

5

|

-

|

|

-

|

|

3 >

|

4

|

|

2008

|

|

-

|

|

|

-

|

2

|

> 4 &

|

5

|

-

|

|

|

2009

|

2

|

> 4

|

&

|

5

|

-

|

|

-

|

|

2 >

|

5

|

|

2010

|

2

|

> 4

|

&

|

5

|

1 > 4

|

|

-

|

|

-

|

|

Table 20: results of the Mood's median tests summary for

ROA by groups of leverage for each years

Table 21 presents the average ROA for all specializations and

all years for the studied farms. The first point that can be noticed is that

the average ROA is 3.1% for the average farm in Isère. The ROA reaches

13% for grain farms in 2007, but fall to 1.7% in 2009 for the same

specialization. It is interesting to compare the dairy and the grain

production: both have a close weighted average for ROA, but variability is

really higher for grain than for dairy farming (standard deviation for dairy is

1.7%, but reaches 5.6% for Grain). Grain farming can be considered as a riskier

specialization. In 2008, the average farm in Isère reaches an ROA of

8.2%, 6.4% in 2007, and 6.2% in 2010. However,

the average cattle farm on the long term has an ROA close to the

level of inflation. 2010 is the exception with the best result of all

specialization with 9.0% ROA.

|

Specialization

|

2006

|

2007

|

2008

|

2009

|

2010

|

Mean

|

|

Dairy

|

3,3%

|

5,8%

|

7,3%

|

4,8%

|

3,4%

|

5,2%

|

|

Cattle

|

-3,6%

|

2,4%

|

2,5%

|

1,0%

|

9,0%

|

1,5%

|

|

Grain

|

1,1%

|

13,0%

|

11,9%

|

1,7%

|

5,1%

|

6,9%

|

|

Diversified

|

2,4%

|

5,3%

|

8,5%

|

2,5%

|

7,3%

|

5,0%

|

|

Mean

|

1,9%

|

6,4%

|

8,2%

|

2,9%

|

6,2%

|

3,1%

|

Table 21: Average ROA by specialization and by

years

Table 22 presents the results from a different perspective:

the high leverage groups obtain better results, except for group 1 which

presented strong signs of financial distress. The grain specialization on the

contrary have opposite results, with an ROA decreasing with the leverage.

However, when we consider this element year by year, this result cannot be

observed, showing that time has to be taken in consideration. Except for the

grain specialization, these results are consistent with what we observed for

the ROE, showing that the economical performance increases with the leverage,

and that 80% is a higher limit. Even cattle production obtains positive results

when the leverage is between 40% and 80% (group 2 and 3). In the case of this

specialization, the results of group 3 are better (without significant

difference however) than group 2.

|

Specialization

|

Group 1

|

Group 2

|

Group 3

|

Group 4

|

Group 5

|

Mean

|

|

Dairy

|

-1,1%

|

6,1%

|

5,7%

|

4,5%

|

3,3%

|

5,2%

|

|

Cattle

|

0,7%

|

4,0%

|

4,8%

|

0,9%

|

-4,2%

|

1,5%

|

|

Grain

|

3,8%

|

5,8%

|

6,8%

|

8,6%

|

9,0%

|

6,9%

|

|

Diversified

|

2,2%

|

6,6%

|

6,6%

|

3,2%

|

4,8%

|

5,0%

|

|

Global Mean

|

2,0%

|

6,2%

|

6,2%

|

4,3%

|

4,2%

|

3,1%

|

Table 22: Average ROA by specialization and by

groups

Finally, we can say that H0 cannot be rejected for the first

hypothesis and the second hypothesis tested:

- ROA and ROE tend to increase with the level of debt of

the farms in Isère.

- Financial distress may occur when leverage

increases, reducing ROA or ROE. Looking at the ROE, 80% seem

to be the upper limit. The results for the ROA tend to show that 60% is

probably more appropriate (except for dairy production).

|

|