|

|

X Non Confidential ? Confidential

|

|

|

Title : Using the WACC Methodology to Improve

the

Assessment of Projects in the French Farming

Industry. Empirical Evidences from Farm's

Results

of Isère

Program: MBA - PT 6 - Grenoble (2009 - 2012)

Academic Year: 2011-2012

Dissertation / Project / Internship Report:

International Management Project 2011-2012 Student Name:

Bibard Anaël

School Tutor / Evaluator Name: Lominadze

Anton

To fill in for Internship only:

Company Name:

Town:

Country:

Position occupied during internship:

Summary: The Purpose of this Thesis is to

calculate the cost of capital for a typical farm in Isère. This cost of

capital is use as an actualization rate to estimate the NPV of projects or the

value of a farm based on this profitability.

Keywords:

https://library.grenoble-em.com/Thesaurus/Thesaurus.html

CORPORATE FINANCE - INVESTMENT

COMPANY - AGRICULTURAL COMPANY

ACCOUNTING - EVALUATION OF A COMPANY

FRENCH REGION - RHONE ALPES

MBA PT 6 - Grenoble Graduate School of Business

Using the WACC Methodology to

Improve the Assessment of Projects

in the French Farming Industry

Empirical Evidences from Farm's Results of

Isère

Anaël BIBARD

30/09/2012

Final Management Project Tutor: Anton Lominadze

Table of Content

Abstract 6

Abbreviations 7

Table of Illustrations 8

Introduction 11

1 Significance of the Research 12

1.1 The Farming Business in France 13

1.2 The Profitability Heavily Relies on Subsidies, Not on

Investment Decision 14

1.3 A New Approach to Find 17

2 Literature Review 20

2.1 Risk 20

2.1.1 Risk in Agriculture 20

2.1.2 Risk Premium 20

2.2 The WACC Theory 25

2.2.1 The Importance of the WACC Theory. 25

2.2.2 The Betas for Micro-Capitalizations 25

2.3 Discount Rates and the CAPM Used in Agriculture 26

3 Research Methodology 28

3.1 Survey Construction 28

3.1.1 Questionnaire 28

3.1.2 Results Analysis 28

3.2 Historical Analysis of the Results of Farms in Isère

28

3.2.1 Data Collection 28

3.2.2 Data Processing 30

3.2.3 Research Questions 31

3.2.4 Data Analysis 31

3.3 Bond Yield Plus Risk Premium Model 33

3.3.1 Risk-Free Rate 33

3.3.2 Beta and Risk premium 33

3.4 WACC Estimation 34

4 Data Analysis 36

4.1 Results of the Survey 36

4.2 Calculation of the Historical Results Using the Data from

CERFRANCE Isère 38

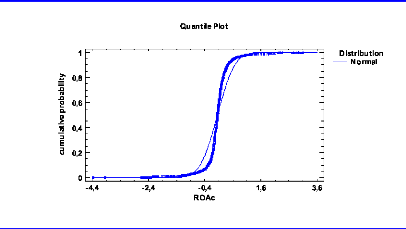

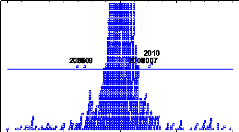

4.2.1 Normality of the Datasets 38

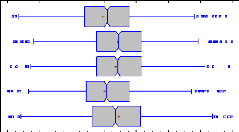

4.2.2 ROE 39

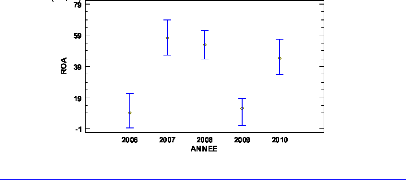

4.2.3 ROA 44

4.3 Calculation of the Capitalization Rate Using Bond Yields Plus

Risk Premium 49

4.4 Approach of the WACC for Farming in Isère 50

4.4.1 Calculation of the Betas 50

4.4.2 Calculation of the WACC for the Different Specialization

52

5 Discussion 55

5.1 Survey Results 55

5.2 ROE and ROA Analysis the Farms of Isère 55

5.3 Capitalization Using the Bond Yield Plus Risk Premium 56

5.4 The WACC Methodology 56

6 Utilization of These Results 58

6.1 Managerial Implications 58

6.2 Agricultural Policies Implications 59

7 Limitations and Further Research Implications 61

7.1 Survey Construction 61

7.2 ROE and ROA Analysis 61

7.3 Bond Yield Plus risk Premium Model 61

7.4 The WACC Methodology 62

7.5 Further Research Implications 62

Conclusion 63

Bibliography 64

Appendices 70

Abstract

The remarkable rise of the soft commodities prices in

2007/2008 represented just a reminder of the importance of agriculture for

humanity. The Arab spring found its base on this mold and pulled down many

regimes considered as stable few months before, like Tunisia or Egypt.

Eventually, these price records could be reached again in 2012, due to a severe

drought in the USA. To meet the challenge of feeding the world while developing

more sustainable forms of production, advisory services must play a great role

to help farmers in their decisions regarding their production as well as their

investments. However, it appears that some financial consultants use really low

actualization rates for agriculture, even lower than the risk-free rate. The

purpose of this paper is therefore to present the different methods that could

be used to determine more appropriate discount rates for farming businesses,

and particularly the Weighted Average Cost of Capital and the bond yield plus

risk premium model as presented by the French tax authority.

Historical results of farms from Isère over 5 years

were studied to determine if the leverage has a significant impact on the

profitability, and if signs of financial distress could be identified for the

higher leverages. The statistical tests performed confirmed the underlying

hypothesis of the WACC theory: the cost of capital is reduced by the increase

of the leverage, up to a limit where financial distress overcomes the advantage

of the lower cost of debt. The optimal capital structure for farms of

Isère seems to range between 40-60% leverage, and up to 60-80% in the

cases of the most stable production such as dairy farms.

This paper provides indications about how to establish the

actualization rates for agricultural consultants, based on the WACC methodology

and the method recommended by the tax authorities. The data analysis confirmed

that the actual rates used by practitioners are clearly undervalued, leading to

an over-valuation by two to four times in their asset valuation studies. The

WACC and the bond yield plus risk premium methodology both seem to be

applicable for small and medium farming businesses. However, further researches

are necessary to validate the robustness of the WACC methodology in the

agricultural context for non listed companies.

Abbreviations

ANOVA: Analysis Of Variance

CAP: Common Agricultural Policy

CAPM: Capital Asset Pricing Model

CNCER: Conseil National des CERFRANCE (national council of the

CERFRANCE) EBITDA: Earnings Before Interest, Taxes, Depreciation and

Amortization

EEP: Expected Equity Premium

FADN: Farm Accountancy Data Network, or RICA: Réseau

d'Information Comptable Agricole FAO: Food and Agriculture Organization

FTE: Full-Time Equivalent

GDP: Gross Domestic Product

Ha: hectare, 10 000 m2 or 2.47105 acres

HEP: Historical Equity Premium

IEP: Implied Equity Premium

IMF: International Monetary Fund

NPV: Net Present Value

NSP: Ne Se prononce Pas (No Answer)

OECD: Organization for Economic Cooperation and Development REP:

Required Equity Premium

ROA: Return On Asset

ROE: Return On Equity

SAFER: Société d'Aménagement Foncier et

d'Etablissement Rural SAS: Statistical Analysis System

SMIC: Salaire Minimum Interprofessionnel de Croissance. The

minimum salary in France. SPSS: Statistical Package for the Social Sciences

TCA: Total Cultivated Area

USD: US dollars

WACC: Weighted Average Cost of Capital

WTO: World Trade Organization

Table of Illustrations

Table 1: Subsidies and recurring net profit before tax in

France per farm, in K€Source: FADN (RICA) 16 Table 2: Assumptions and

recommendations of the 129 books that assume that REP = EEP. Source:

Fernandez 2010 21

Table 3: Equity premiums recommended and used in textbooks.

Source: Fernandez 2010 22

Table 4: Historical Equity Premium for the French market 23

Table 5: Historical Equity Premium for small and micro-cap 24

Table 6: Market capitalization effect on the beta for

micro-capitalization 26

Table 7: Primary data for the analysis of farms' results in

Isère 29

Table 8: Cost of each labor unit per month for the SMIC 30

Table 9: Social security contributions 31

Table 10: Groups of debt level 32

Table 11: Number of companies studied for the Beta estimation.

Source: Bloomberg 35

Table 12: Age and gender of the respondents 36

Table 13: answers to question 4, 5 and 6 36

Table 14: Answers of question 7: «how do you choose the

discount factors you use?» 37

Table 15: Answers of question8 «what discount factor do

you use usually for your customers? (ex given: 11%)» 37 Table 16: Answers

of question 9: «If you were proposed a tool to estimate the WACC of the

farms of your region to use it as a discount factor, how would you consider

this tool?» 37 Table 17: Results of the Mood's median tests summary for

ROE by groups of leverage for each years

43

Table 18: Weighted average ROE for all specialization and by

years 44

Table 19: Average ROE by specialization and by group 44

Table 20: results of the Mood's median tests summary for ROA by

groups of leverage for each years

48

Table 21: Average ROA by specialization and by years 49

Table 22: Average ROA by specialization and by groups 49

Table 23: Calculation of the Beta for the grain specialization

(oilseed is considered as grain farming in

France). Source: Bloomberg 51

Table 24: Calculation of the beta for the cattle ranching and

farming specialization. Source:

Bloomberg 51

Table 25: Calculation of the beta for poultry and fruits &

vegetables Source: Bloomberg 52

Table 26: Summary of the beta for the different specialization

and regions Source: Bloomberg 52

Table 27: Characteristic of each specialization in Isère

*EBITDA/total annuity 53

Table 28: WACC estimation for each specialization (leverage is

based on table 27) 53

Table 29 : WACC estimation for each specialization for group 5 (0

to 20% leverage) 54

Table 30: WACC estimation for each specialization for group 2 (60

to 80% leverage) 54

Table 31: NPV of a refinancing operation to reduce the WACC and

increase the wealth of a dairy farm

59

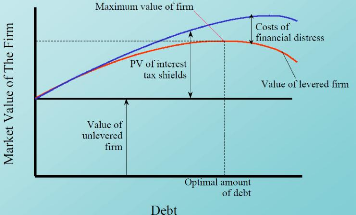

Figure 1: The optimal amount of debt to reduce the company cost

of capitalSource: Principles of

Corporate Finance 12

Figure 2: Agricultural production in France, 2010 13

Figure 3: Agricultural production in Isère, 2010 14

Figure 4: The percentage of the EU budget allocated to the CAP

Source: Eurostat, in Clipici 2011 15

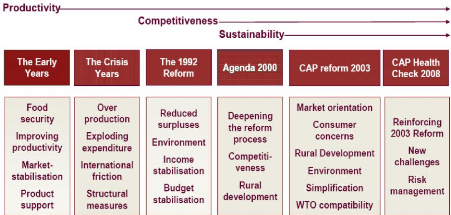

Figure 5: Historical Development of the CAP Source: Clipici E.,

2011 15

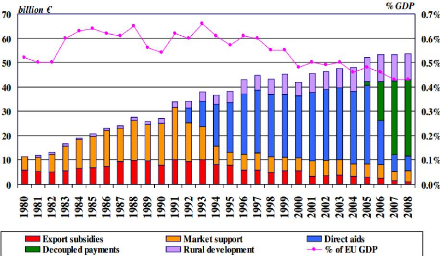

Figure 6: CAP spending evolution Source: DG Agri 16

Figure 7: Average asset value per farm by member state 2007

Source: FADN 17

Figure 8: Volatility of the price of wheat after application

of Agenda 2000Source: Offre et Demande Agricole 18 Figure 9: Fluctuation of

the share of agro-food exports by key countries in the global volume of

agrofood exports 18 Figure 10: Moving average (last 5 years) of the REP used or

recommended in 150 finance and valuation textbooks. Source: Fernandez 2010 22

Figure 11: Small firm premium (bottom 10% of market cap in US) between

1927-2010. Source:

Damodoran 2010 24

Figure 12: Number of farm for each specialization 30

Figure 13: Region of the CERFRANCE of the respondents 36

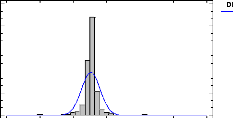

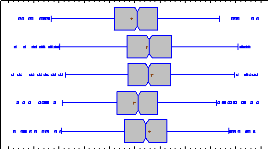

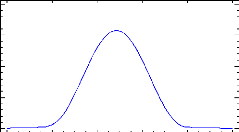

Figure 14: histogram of frequency for ROE 38

Figure 15: Histogram of frequency for ROA 39

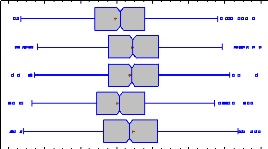

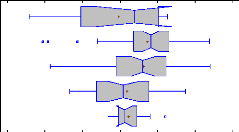

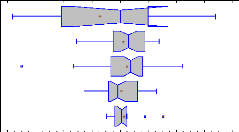

Figure 16: Box and whisker plots with median notch for ROE by

year (means are shown with a red cross) 40 Figure 17: Box and whisker plots

with median notch for ROE by specialization (means are shown with a red cross)

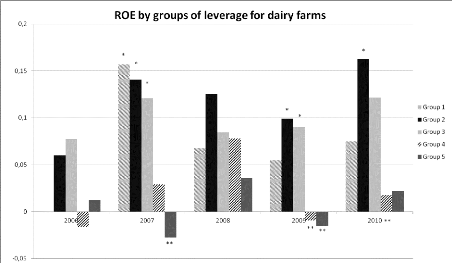

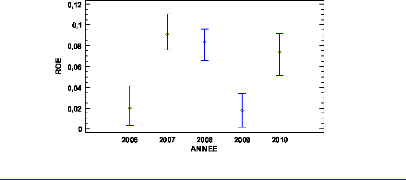

40 Figure 18: Median ROE for each year and each group of leverage for dairy*

means significantly higher than ** 41

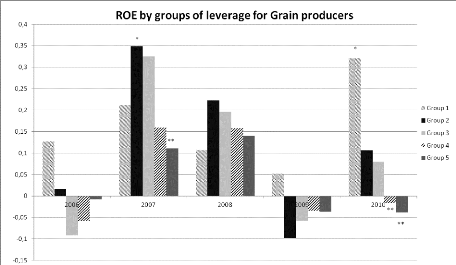

Figure 19 : Median ROE for each year and each group of leverage

for grain* means significantly

higher than ** 42

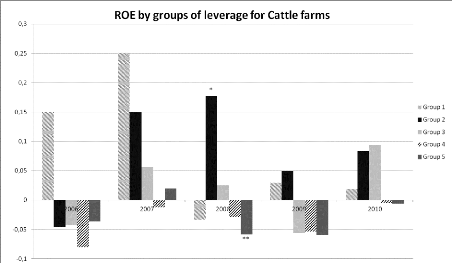

Figure 20: Median ROE for each year and each group of leverage

for cattle* means significantly

higher than ** 43 Figure 21 : Box and whisker plots with

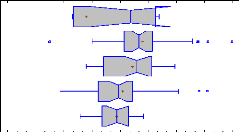

median notch for ROA by years (means are shown with a red cross) 45 Figure 22 :

ROA for each year and each group of leverage for dairy producers* means

significantly higher than ** 46 Figure 23: ROA for each year and each group of

leverage for grain producers* means significantly higher than ** 47

Figure 24: ROA for each year and each group of leverage for

cattle farming* means significantly

higher than ** 48

Appendix 1: Illustration of the database extraction. File name:

"extraction 2006_1" 70

Appendix 2: Illustration of the database extraction, balance

sheet information. File name: "extraction

2006_2" 71

Appendix 3: Questionnaire 72

Appendix 4: Normality test of the datasets for ROE, extraction

from statgraphics 75

Appendix 5: Normality tests of the datasets for ROA, extraction

from statgraphics 77

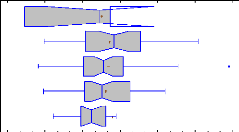

Appendix 6: ROE by year 79

Appendix 7:ROA by year 84

Appendix 8: ROE by groups for dairy production 89

Appendix 9: ROE by groups for cattle specialization 95

Appendix 10: ROE by groups for grain specialization 99

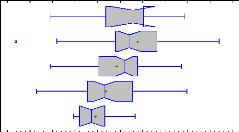

Appendix 11: ROA by groups for dairy specialization 103

Appendix 12: ROA by groups for cattle specialization 107

Appendix 13: ROA by groups for grain specialization 111

Appendix 14: Cost of debt for farms of Isère 115

Introduction

Food safety and agricultural commodities prices played a great

role in the recent Arab spring (Breisinger, Ecker, & Al-Riffai, 2011). The

Arab spring, also called the Arab revolution, is a wave of protestations that

started in Tunisia in December 2010 with the suicide of a student who couldn't

pay for the fruits he was trying to sell in the street as a subsistence job.

This situation is not a surprise for many observers, as the farming business is

facing once again one of its historical challenges: feed the world and its

increasing population. The access to the essential commodities, such as energy

and food, is taken for granted nowadays in the developed countries. However,

the land resource is finite and even subject to a regular contraction due to

urbanization and salinization. Moreover, the increasing consumption of meat is

less efficient in terms of global productivity than the direct human

consumption of grain. The remarkable rise of the soft commodities prices in

2007/08 represented just a reminder of the importance of agriculture for

humanity and the inelasticity of this market. The world market prices are

oriented in the same direction in 2012, and the records reached in 2007 are

getting closer due to a severe drought in the USA (Damgé, 2012). The

OECD and the FAO consider that these high prices will become usual in the next

decade (OECD-FAO, 2010).

Some new challenges arose more recently, and they are not easy

to meet. The public opinion demands farmers to develop new forms of production

more sustainable and respectful to the natural environment (Faure &

Compagnone, 2011). Moreover, they have to maintain an economic activity in

rural areas (Mundler, Labarthe, & Laurent, 2006). To achieve these

challenges, the advisory services play a great role to deliver the best

advices, for agronomical innovation as well as economical consulting (Faure,

Desjeux, & Gasselin, 2011).

However, some financial consultants for farming businesses use

low discount rates. This empirical observation has been made in a company

member of the network of CERFRANCE, the leading accounting network in France,

even ahead of the big four for the French accounting market. This leading

position is due to the really high market share in agriculture and small

businesses. Someone could have expected to find really innovative financial

methods to produce better financial advices for farmers, but the consultants do

not use the NPV method a lot, mainly because of the lack of information about

the calculation of appropriate discount factors. Research in the field seems to

be not sufficient to promote this method among consultants.

The purpose of this paper is therefore to do an exploratory

research about the Weighted Average Cost of Capital (WACC) methodology and its

applicability to the agricultural sector. To reach this main objective, many

other research questions are addressed:

- Which methods are used by the practitioners to determine

actualization rates for farming project in France?

- Does leverage has an impact on the financial performances of

farms?

- What is the optimal structure for a small or medium farm,

considering the risk of financial

distress linked with high leverages?

This research is based on the existing work produced by other

authors, mainly in other economic sectors, but also on primary data extracted

from the database of the CERFRANCE Isère. This exploratory work is

subject to caution, because its subject hasn't been enough covered yet for the

agricultural sector and the assumptions taken have a strong impact on the

results. However, it is essential to improve the current knowledge about the

cost of capital and the actualization rates in

agriculture. This paper aims to rough out this subject and to

improve immediately the practices of the agricultural consultants of the

CERFRANCE.

1 Significance of the Research

«Risk is like love; we all know what it is, but we don't

know how to define it»

J. STIGLITZ

According to Allen, Myers & Brealey (2008, pp. 966-967)

the capital asset pricing model (CAPM) and the Net Present Value (NPV) are ones

of the most important concepts in finance. The CAPM allows investors to

identify the non-diversifiable risks, by measuring the impact of a change in

the aggregate value of the overall economy on the value of their investments.

The NPV on the other side helps managers to choose between different projects,

or even to choose to kill or not a project. The CAPM relies on the calculation

of betas, and NPV relies on the choice of the discount factor. However, there

are many ways to evaluate this discount factor. First, when a manager has many

options or projects, he can set the discount factor at the opportunity cost of

capital which is the profitability of the best project to evaluate each

project. But this method does not take into account the risk associated with

each projects and is not helpful when a manager has only one project, or when

he just wants to evaluate the economic profitability of its company at a fair

market price. In the last case, the appropriate way to set the discount factor

is the CAPM and the calculation of the Weighted Average Cost of Capital (WACC)

formula (Brealey, Myers, & Allen, 2008).

The WACC formula is of particular interest for our concerns,

because it gives a good estimation of the company cost of capital, which can be

reduced by financing the company using the optimal amount of debt as the

traditional approach suggests (Brealey, Myers, & Allen, 2008, p. 504).

Figure 1 illustrates this theory.

Figure 1: The optimal amount of debt to reduce the

company cost of capital Source: Principles of Corporate Finance

In the French farming industry, the NPV methodology is nearly

never used. When this method is

used, discount factors are chosen without

clear explanations, and we can observe important

variations between practitioners, even in the same business

unit. Is it because everyone considers that there is merely no risk in farming

business? However, such hypothesis does not make sense considering that a farm

manager needs to handle the weather risk, the crop's pests risk and the price

volatility risk. Is the WACC methodology not applicable in farming business, or

just the NPV method is not enough known and risks related to farming business

poorly assessed?

1.1 The Farming Business in France

French agricultural exportations represent USD 17.5 billion

(€ 13.2 billion) (Agreste, 2011; IMF.Stat, 2012), making France the

14th biggest exporter of agricultural products in 2010 (WTO, 2011).

Regarding food, France is the number three exporter in 2010, with USD 47.8

billion (€ 36.2 billion)(Agreste, 2011; WTO, 2011; IMF.Stat, 2012). France

is also the number one agricultural producer in Europe, with € 62.0

billion in 2009 over a global European production of € 327 billion

(Agreste, 2010). This high level of production and exportations is allowed by

two factors: productivity and surface. The total cultivated area (TCA) in

France represents 29.3 M ha in 2009, over the total 54.9 M ha of France

(Agreste, 2010), and wheat yields of 7.04 T/ha are 88% superior to the world

average of 3.74 T/ha (FAO, 2012).

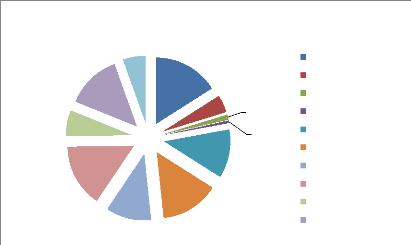

However, the high level of production in France is not due to

the size of the farms, because the average farm in France is only 55 ha in 2010

(Agreste, 2011 b) against 350 ha for US farms (Ambassade de France à

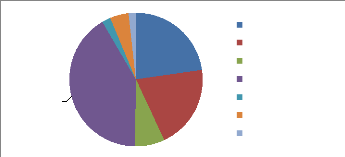

Washington, 2009). The diversity of production is really high in France as we

can see in Figure 1, as no production represent more than 16% of the overall

production in value.

Grains

Oilseeds and soyabean Sugar beet

Other plants

Fruits & vegetables Wines

Forage crops

Cattle

Poultry

Milk

Source: Insee 2011 in Billion euros

Agricultural production in France, 2010

4,1

10,1

8,8

7,3

3,6

10,5

9,4

7,8

2,8

0,8

0,4

Figure 2: Agricultural production in France,

2010

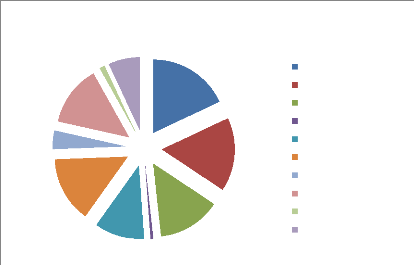

Regarding Isère, the production is also really

diversified as we can see in Figure 3. The overall production represents €

516 million for 2010, for a total GDP of around € 33 billion in

Isère for 2009 (CCI Rhône Alpes, 2011). The average size of the

farms in the department is smaller compare to France with only 38 ha in 2010

(Agreste, 2011 c), and the TCA in Isère (241 300 ha) represents only

0.8% of the national TCA.

3,0

Source: Agreste 2011 in Million euros

21,0

75,0

Agricultural production in Isère, 2010

69,0

6,0

57,0

36,0

72,0

93,0

84,0

Grains

Other plants

Fruits & vegetables Wines

Forage crops

Cattle Poultry Milk

Other animal productions Services

Figure 3: Agricultural production in Isère,

2010

1.2 The Profitability Heavily Relies on Subsidies, Not

on Investment Decision

To understand the farming business in France, it is necessary

to know the Common Agricultural Policy (CAP) and its impacts on Agriculture.

The CAP is the first and most important common policy for the European Union,

and its cost jeopardized the overall EU budget for years (Figure 4). The CAP

finds its origins in the 1950's, when European agriculture was on its knee

after World War II. Charles De Gaulle considered this policy as essential to

prevent major social events in France (Moravcsik, 1999), as he said that

agriculture was as important as the troubles in Algeria. This Policy helped to

increase the productivity, stabilized the agricultural markets, and secured

food supplies of all European countries (Clipici, 2011; Zaharia, Tudorescu,

& Zaharia, 2009; Howarth, 2000). According to Howarth (2000), its main

objectives given at its start in 1962 were:

- Agricultural productivity improvements

- Fair incomes for farmers

- Agricultural markets stability

- Secure food supplies

- Reasonable prices for customers

Figure 4: The percentage of the EU budget allocated to

the CAP Source: Eurostat, in Clipici 2011

However, the European CAP had been heavily criticized over its

history, either by European partners such as the Cairns group (Australia,

Brazil...) and the USA (Spencer, 2003), or by European countries also such as

the United Kingdom or Germany (Howarth, 2000; Elekes & Halmai, 2009;

Moravcsik, 1999). The major points of friction are the market distortions

induced by the CAP, the cost of this policy and the impact on the poorest

economies (Howarth, 2000; Spencer, 2003; Borrel & Hubbard, 2000; Rickard,

2001). Some authors even argued that world agricultural prices could rise by

38% if subsidies were turned off (Borrel & Hubbard, 2000). Many

negotiations rounds took place over the last decades to reduce these

distortions, and the CAP was reformed many times since 1992 (see Figure 5).

Figure 5: Historical Development of the CAP Source:

Clipici E., 2011

In 1992, the CAP was reformed to decrease export subsidies and

market supports to shift to coupled

direct payments. Those payments (direct

aids in Figure 6) were proportional to the surface cultivated

by farmers, but not directly to the volume of production. This

reform helped to reduce the production surpluses, and world agricultural

markets distortions were reduced. However, the distortions were still

significant after the reform as the overall amount of subsidies was really

high, around € 35 billion in 1992 (Clipici, 2011). All the other reforms

had the objective to reduce these distortions, such as the decoupled payments.

New conditions for granting were also added to the CAP such as environmental

protection, risk management, animal welfare, budget reduction, etc...

Figure 6: CAP spending evolution Source: DG

Agri

According to the Farm Accountancy Data Network (FADN), the

amount of subsidies represents 80% of the average recurring net profit for

French farms (see Table 1). Besides, grain producers depend even more on the

CAP than other types of farms.

|

2006

|

2007

|

2008

|

2009

|

2010

|

|

Subsidies

Recurring net profit before tax

Dependence on

subsidies

|

30

37

81%

|

29

46

63%

|

29

36

81%

|

29

21

138%

|

31

45

69%

|

Table 1: Subsidies and recurring net profit before tax in

France per farm, in K€ Source: FADN (RICA)

This dependence on subsidies is negative for innovation, as

all the production is oriented by the CAP and not by the market demand.

Moreover, the profitability depends on the capacity of the farmer to maximize

the subsidies. New-Zealand is an example of a country that stopped all

subsidies in 1984 (Gardner, 1994; Saunders, Wreford, & Cagatay, 2006;

Sandrey & Scobie, 1994), and enjoys nowadays an enviable situation in the

world agricultural market. This small country is the world largest milk

exporter (Evans, 2008), and the second largest sheep producer (FAO, 2012).

Another element limits the innovative capacity of French

farms, and also their adaptability: the control of the surface. As a matter of

fact the SAFERs, Societé d'Aménagement Foncier et

d'Etablissement Rural, have the power to control the land market.

According to their mission, these structures have 3 main objectives:

- Protect and revitalize agriculture: this objective means to

help young farmers to start their

activity, avoid the concentration on big farms, and develop a

peri-urban agriculture and organic farming. The major tool used here is the

preemption, which allows the SAFER to break a sale between to farmer to sell

the land to another farmer. Small and young farmers have the priority in this

system.

- Develop the vitality of the town and country planning policy:

the SAFER has the ability to

preempt some properties to help young entrepreneurs to start

their activity.

- Protect the environment: this last objective is really wide,

and goes from rehabilitation of

swamps to biodiversity protection and restructuration of the

forests...

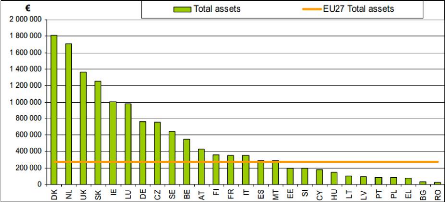

The result of this policy is easily presented in Figure 7.

More liberal countries such as Denmark, the Netherlands or the United Kingdom

have much bigger farms, with an average capital assets per farm respectively of

1 820 000 €, 1 700 000 € and 1 370 000 €. On the contrary,

French farms have an average capital asset per farm below 400 000 €.

Figure 7: Average asset value per farm by member state

2007 Source: FADN

Some investments cannot be amortized in such small structures,

like methanation units for milk farms or precision farming for field crops. For

a methanation unit, which allows to reduce the impact on the environment by

producing electricity, the total investment is around 1 200 000 € for 250

kWe (AREC, 2011). This type of unit is not very important in terms of

productivity and can be 10 to 20 times bigger, but is already out of reach for

a small farm.

1.3 A New Approach to Find

The CAP has created an artificial market for French farmers.

As seen in Figure 8, the guaranteed wheat price (in blue) was well above the

world market price (in red) before 1992. The price volatility of agricultural

commodities has always existed, with a fall from 165 €/T in 1988 to 80

€/T at the end of 1990, but French farmers were protected from this high

volatility.

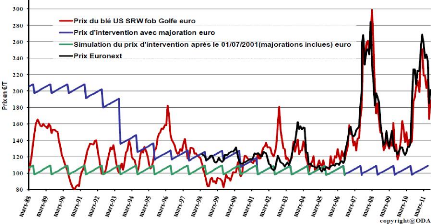

Figure 8: Volatility of the price of wheat after

application of Agenda 2000 Source: Offre et Demande Agricole

In fact, French farmers were affected by the world market

price in 1995/96, when the prices reached 180 €/T, and in 2007 when all

agricultural commodities prices soared... The price fall of 2008 and the new

peak in 2011 and 2012 illustrates well that the volatility is not coming to an

end.

Another element will modify the market for French farmers: the

end of the quotas for milk and sugar beet producers in 2015 (Pinson, 2012;

Hénin, 2011). Nowadays, the volume of production is limited for each

European milk and sugar producers, in order to avoid surpluses and price falls.

This suppression of the quotas will modify the milk and sugar market, and price

volatility will surely increase (

terrenet.fr, 2012; Hénin,

2011).

Moreover, many other countries are more competitive than

France for milk production (Rhein, 2009). The example of Germany is often cited

in France because the price of milk is lower, farms are bigger, more productive

and specialized (You, 2010; Waintrop, 2010). However, even Germany is

considered as non-competitive in the world market (Rhein, 2009). In fact, both

countries are declining in terms of market share for total agricultural

products exportation (see Figure 9). However, the case of France is more

complicated, as from the second world exporter in 1995 we lost market shares

almost continuously because of a lack of competitiveness (Momagri, 2012).

Figure 9: Fluctuation of the share of agro-food exports

by key countries in the global volume of agro-food exports

Finally, the CAP shall be reformed once more in 2014-2015: the

decoupled payments should converge at the European average and more dependant

to environmental conditions (Le Boulanger, 2011; Hénin, 2012). The

effect will be important for French producers, as the decoupled payments will

be reduced on average, particularly for grain producers. Moreover, these

payments will be conditioned to environmental obligations which are not always

respected so far.

Therefore, this is essential for farmers to analyze

the source of their actual profitability if they want to face the challenge of

a globalized agriculture combined with the reduction of subsidies! It

is necessary to evaluate each projects and farms with more accuracy

than before, because all indicators suggest that the market risk will

increase.

2 Literature Review

2.1 Risk

2.1.1 Risk in Agriculture

The risks associated with the agricultural activities can be

divided into 4 types of risks according to the OECD (Harwood, Heifner, Coble,

Perry, & Somwaru, 1999; Holzman & Jorgensen, 2001):

- Market/price risks: these risks can affect directly a farm or a

region through the variation of

the prices of land, inputs, production...

- Production risks: hail or frost can affect directly a plot, but

other climatic hazards can have a

strong impact on production. Technology evolution also can

affect the production risks, by

controlling it (dams to prevent flood, anti-hail net, drainage,

phytosanitary products...)

- Financial risks: some farmers have non agricultural

revenues. A change in these revenues may affect the profitability. Farms are

also exposed to financial risks through the interest rate on their loans.

- Institutional or legal risks: these risks are really hard to

measure, as it goes from the

responsibility risk to the legislation risk and the CAP reform

risk.

Overall, the risks in agriculture are really wide, and farmers

cannot handle them all by themselves. Production risks for example cannot be

covered only by insurance, because reinsurance companies refuse to cover the

risk of insurance companies for this type of multi-risks insurance. The

portfolio risks of these insurance is ten times higher than more conventional

sectors (Chambers, 1989; Miranda & Glauber, 1997). Therefore, policy makers

should integrate these elements into the CAP reform of 2014-2015.

On the other side, the market risks can be managed by the

farmers themselves, the futures markets can be used by farmers to reduce their

risk exposition (OECD, 2009). Actually, only 1% of all transactions made on the

futures markets are effectively physically traded, but not many farmers use

this tool (Rose, 2008). Even if the futures markets are not an efficient tool

to predict the future physical prices, they remain efficient to reduce the risk

exposure (OECD, 2009).

Regarding financial risks, it is harder to handle with

agricultural policies or tools such as the future markets. However, farmers can

with the help of their consultants estimate their financial exposition and

reduce it by choosing fixed interest rates when they subscribe new loans. It is

also possible to act on the optimal leverage level by choosing the appropriated

financing decision for new projects or equipments.

Finally, institutional or legal risks are really hard to

predict or reduce. For responsibility risk of course, it can be reduced through

insurances and the choice of equipments in accordance with the legislation.

However, institutional risks such as CAP reforms cannot be easily managed by

farmers themselves.

2.1.2 Risk Premium

The equity risk premium, also called the risk premium, represents

four different concepts according to the literature as stated by Fernandez

(2010):

- Historical equity premium (HEP): it represents the difference

between the historical results

of the stocks over government bonds or treasuries. This value

really depends on the time-frame chosen. Damodoran (2011) recommends using a

long time frame, as well as the French tax authority (2006).

- Expected equity premium (EEP): it is the expected difference

between the same elements

than the HEP. However, in this case the historical results are

not the base of the calculations. - Required equity premium (REP): this method

is used by investors to estimate the

«incremental return of a diversified portfolio (the market)

over the risk-free rate».

- Implied equity premium (IEP): it is in fact the REP assuming

the market price of the stock

represents the fair and true value of the stock.

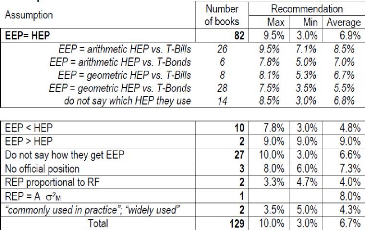

Out of the 150 textbooks studied by Fernandez (2010), 129

authors consider that REP has to be equal to EEP. This is the most common

assumption as the CAPM states this assumption too, and 119 authors recommend

using the CAPM (Fernandez, 2010). Out of those 129, 82 consider that EEP is

also equal to HEP. We can consider that this position is the most commonly

used, as 27 authors do not explain in their textbooks how they obtained their

EEP (see Table 2). The overall recommended risk premium average is 6.7%.

However, we can see than the difference between the min and max is really wide,

ranging from 3.0% to 10.0%.

Table 2: Assumptions and recommendations of the 129 books

that assume that REP = EEP. Source: Fernandez 2010

For our calculation, we will retain from this meta-analysis

the minimum and maximum average for the most common assumption which is EEP =

HEP. Therefore, the most probable range for the risk premium would be

[5.5% : 6.7%] for the geometric mean and [7.0% : 8.5%] for the arithmetic mean.

The geometric mean is presented by many authors as less dependent of the

fluctuations and somehow more reliable. Fernandez itself recommends

3.8% to 4.3% for Europe and US.

According to the famous authors Brealey & Myers with Allen

in their editions of Principles of Corporate Finance, they recommend

to use REP between 5.0% and 8.5% (see Table 3). However, the major tendency is

to use a REP between 6.0% and 8.0%.

Table 3: Equity premiums recommended and used in

textbooks. Source: Fernandez 2010

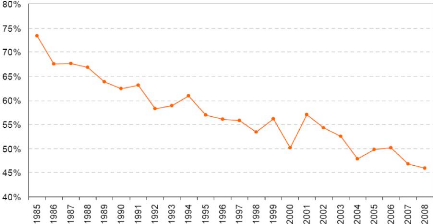

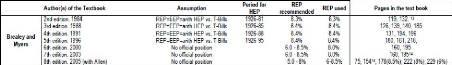

What is more interesting is the reduction in the recommended

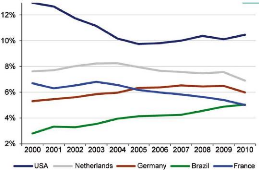

risk premium in the textbooks over the last years. Figure 10 shows that this

reduction was drastic between 1988 and 1993, and after 2002. Nowadays, the

recommendation seems to be just below 6%. It is common to see in the literature

some claims that these EEP are overvalued at 5.0 or 6.0%. Claus & Thomas

(2001) states that after 1985 it is not realistic to take long period of

centuries, and that the EEP is closer to 3.0% in reality. For France, for the

period 1985-1998, they consider that EEP should be 2.6%, basing their

calculation on the abnormal earnings approach. Quiry & Le Fur (2012) come

to a similar conclusion even with a long time frame (111 years) with a 3.2%

HEP.

Figure 10: Moving average (last 5 years) of the REP used

or recommended in 150 finance and valuation textbooks. Source: Fernandez

2010

The French tax authority does not have a clear position on the

subject (Direction Générale des Impots, 2006), however it gives

the precision that someone could use the HEP of a long-run period: 5% over the

last 100 year in France. For the French market, Damodoran (2011) and Salomons

& Grootveld (2003) recommend to use 4.91%, using a 1976-2001 timeframe. The

Credit Suisse in its Global Investment Returns Sourcebook of 2011 (Damodoran,

2011) recommends to use 6.0% for France (for a timeframe of 1900-2010,

including the 2008 crisis for short-term Governments). Table 8 summarizes the

different HEP obtained for the French market. Most of the observations are in

the range between 3.8% and 5%.

Claus & Thomas (2001)

Direction Générale des Impôts (2006)

Damodoran (2011)

Salomons & Grootveld (2003) Quiry & Le Fur (2012)

Fernandez (2010) for European markets

1985-1998 2.6%

100 years 5.0%

1900-2010 6.0%

1976-2001 4.91%

1900-2010 3.2%

Long term 3.8% to 4.3%

Average

4.26%

Table 4: Historical Equity Premium for the French

market

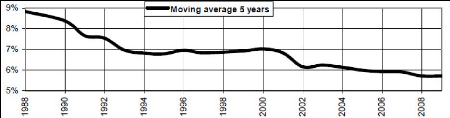

The small-capitalization premium is subject to controversies

in the early literature (Damodoran, 2011), however it seems that overall we can

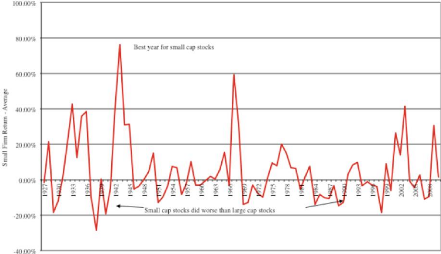

observe some significant premia for small or micro-capitalization. Figure 11

represents the premium observed for micro-capitalization compare to all-US

stocks. We can easily see that during the 1980's and the major part of the

1990's the small firms did not perform more than the overall US stocks.

However, since 1999 it seems that this small firm premium is starting again to

be observed.

The other element we can learn from Figure 11 is that the

variability is really strong. Therefore, it explains easily that we find really

different positions in the literature, ranging from no premium to extreme

values. For example Bergstrom, Frashure & Chisholm (1991) consider that for

the French market this premium is 8.8% for a timeframe of 1955 to 1984. For the

same time frame, they found only 3.0% for the German market.

Dimson & Marsh (2001) considers that the micro-cap

geometric premium is 5.4% over all equities for a time-frame of 1955-1999 in UK

(the EEP obtained is 6.2% for all equities for the same time frame). This

premium for the US market seems to be lower according to Leonard (2009), with a

premium ranging from 2.38% to 2.47% for US micro-cap stocks over the overall

market (time frame: 1938- 2007). This micro-cap US premium has increased after

the Dotcom crisis, reaching 5.63 to 5.83% for the period Oct-2002 to Sept-2007

(Leonard, 2009). Israelsen (2009) found 1.81% premium for small-cap compare to

mid-cap and 2.8% for small-cap compare to large-cap for a 1980-2008 time frame.

Switzer (2010) considers that this premium has even increased more when we

consider a 2001-2010 time frame reaching 7.74% in the US. For the 1926-2010

time frame, this premium is 2.03% for the US. For Canada, this small-cap

premium seems to be lower, ranging from 0.10% (1987-2010) to 4.12% (2001-2010).

The most important finding of this work is that small-stocks have better premia

during the periods of recoveries (after the dotcom crisis, the 2008 crisis, or

the 1975 crisis). This is particularly essential today, as the overall economy

is still recovering from the 2008 financial crisis.

Figure 11: Small firm premium (bottom 10% of market cap

in US) between 1927-2010. Source: Damodoran 2010

Overall, the small and micro-cap premium observed ranges from

0.1% to 8.8%, depending on the market and the time frame studied. However, it

seems that this premium is increasing since 2000, because the economy has

experienced two important crisis since 2001. Moreover, it seems that the

premium seems to be higher in France from what have been observed by Bergstrom,

Franshure and Chisholm (1991). Table 5 presents a summary of our findings in

the literature.

|

Authors

|

|

Time frame

|

Small and micro-cap premium

|

|

Bergstrom, Frashure

|

&

|

1955-1984, France

|

8.8 %

|

|

Chisholm (1991)

|

|

|

|

|

Israelsen (2009)

|

|

1980-2008 US

|

1.8% to 2.8%

|

|

Leonard (2009)

|

|

2001-2007 US

|

5.63% to 5.83%

|

|

Leonard (2009)

|

|

1938-2007 US

|

2.38% to 2.47%

|

|

Switzer

|

|

2001-2010 Canada

|

4.12%

|

|

Switzer

|

|

1926-2010 Canada

|

0.10%

|

|

Switzer

|

|

2001-2010 US

|

7.74%

|

|

Switzer

|

|

1926-2010 US

|

2.03%

|

|

Mean

|

|

|

3.97%

|

Table 5: Historical Equity Premium for small and

micro-cap

For the recent time frame, which is the most appropriate time

frame considering the fact that the economy is in recovery since the major

crisis of 2008, authors considers that the HEP is ranging from 4.12% to 7.74%

(Table 5, Switzer, 2010). Moreover, this choice is supported by the fact that

many analysts agree on the fact that the soft commodities prices should

remain at a higher price in the coming years (OECD-FAO, 2010).

The expected market return should increase in the following years.

2.2 The WACC Theory

2.2.1 The Importance of the WACC Theory.

The WACC is not considered easy to compute, but is one of the

fundamental elements in modern finance (Quiry & Le Fur, 2012; Brealey,

Myers, & Allen, 2008). The NPV calculation and the determination of the

value of the stock are based on the results of the WACC, which underlines its

importance (Quiry & Le Fur, 2012, p. 699). The underlying theory of the

WACC is the CAPM. This model objective is to measures capital assets value

depending on the risk and the expected return of the company. According to

Brealey, Myers & Allen (2008), the after-tax WACC represents more the

reality of the company and can be described as follow:

E

WACC = K(D) . (1 -- Tc) r, + K(E)

K(D): cost of debt, at market value.

Tc: corporate tax rate.

D/V: total debt divided by total firm value. K(E): cost of

equity.

E/V: total equity divided by firm value.

The cost of equity in the WACC theory has to be calculated using

the CAPM, which can be described as follow:

E (Re) = Rf + f3. [E (Rm) -- Rf]

E(Re): expected return on equity. It corresponds to K(E) in the

WACC formula [3: beta. It represents the risk.

E(Rm): expected return of the market in which the company

operates. See part 2.1.2 page 20 on risk premium for the literature review

dealing with risk premium. However, the risk premium is defined as the premium

obtained compare to a risk-free asset.

Rf: risk free rate of return. The risk-free rate of return can be

estimated by the long-term government bond yield (Brealey, Myers, & Allen,

2008; Quiry & Le Fur, 2012).

2.2.2 The Betas for Micro-Capitalizations

In this research, financial techniques are used to estimate

the risk for listed companies to apply it for non-listed small companies. The

bias introduced is consequent, as the beta has a negative relationship with the

size of firms (Binder, 1992; Al-Rjoub, Varela, & Hassan, 2005; Shomir, Pat,

& Jeong-gil, 2011). Therefore, small farms should have a higher Beta

compared to listed companies operating in agriculture, as smaller firms present

little or no diversification (Drew & Veeraraghavan, 2003). Table 6 presents

the results found in the literature comparing large capitalizations and

micro-capitalizations, which can be considered as the right comparison between

the listed companies operating in agriculture which have activities in many

countries and the small farms of Isère.

|

Authors

|

Time frame

|

Number of groups

|

micro-cap Beta

premium

|

|

Al-Rjoub, Varela & Hassan (2005)

|

1970-2000

|

1st decile vs 10th d

|

|

0.51

|

|

Al-Rjoub, Varela & Hassan (2005)

|

1982-2000

|

1st decile vs 10th d

|

|

0.36

|

|

Al-Rjoub, Varela & Hassan (2005)

|

1990-2000

|

1st decile vs 10th d

|

|

0.24

|

|

Shomir, Pat & Jeong-gil (2011)

|

1980-2003

|

1st quartile vs 4th q

|

|

0.21

|

|

Bhardwaj & Brooks (1993)

|

1926-1988

|

1st group vs 5th g

|

|

0.72

|

|

Chan & Chen (1988)

|

1949-1983

|

1st group vs 20th g

|

|

0.69

|

|

Dongcheol (1993)

|

1926-1990

|

1st decile vs 10th d

|

|

0.58

|

|

Jegadeesh (1992)

|

1954-1989

|

1st group vs 20th g

|

0.32

|

- 0.62

|

|

Mean

|

|

|

|

0.47

|

Table 6: Market capitalization effect on the beta for

micro-capitalization

As presented in Table 6, the effect of size is quite important

on the beta. It is important to notice that the standard deviation also

increases with the beta (Drew & Veeraraghavan, 2003; Dongcheol, 1993; Chan

& Chen, 1988). From the results found in the literature, for

micro-capitalizations compare to large capitalizations, the beta increases on

average by 0.47, which is really significant regarding the impact of the beta

on the WACC formula.

2.3 Discount Rates and the CAPM Used in Agriculture

The CAPM and the actualization rates have already been used in

agriculture long ago. The Capital Asset Pricing Model has been tested for

example to test the farm real estate market by Barry P. J. in the 1980's (Barry

P. J., 1980a). His conclusions were that the low betas (0.19 for the US)

observed for farm real estate made this investment valuable as a

diversification tool for portfolios and that the required rate of return for

the US farmland was 8.76%. Other studies have been done on the same subject to

test the interest for investors to diversify into farmland (Hanson & Myers,

1995). It seems that these conclusions remain true nowadays, as the foreign

investments in farmland increased strongly after the rise of the grain market

price in 2007.

Since then, the diversification into agricultural commodities

have been tested either. The results are interesting, because thanks to

negative correlation with other markets, this diversification reduces the risk

and are considered as profitable for investors (Sminou, 2010). The opposite

have been tested also, to see if farmers who own their lands have an interest

to diversify their investments with traditional financial tools (Nartea &

Webster, 2008). According to their results for New Zealand after the

deregulation of the market, the expected return of the farmers would increase

thanks to diversification, even if the expected return on farmland due to

capital gains (9.83%, 1988-2003) were higher than the expected returns of

ordinary shares (5.59%, for the same period). This potential gain comes from

the good diversification of the portfolio which reduces the risk but not the

overall return according to the authors.

On the other side, some studies have been done in agriculture

using the NPV method. Most of them

do not explain clearly how they chose

their discount factors. For example, investments in peach

orchards in India

have been tested with three discount rates proposed by NGOs: 6, 9 and 12% to

compare the NPV method with the amortization method (Gangwar,

Singh, & Mandal, 2008). Finally the authors retained the 12% discount

factor.

Barry P. J., at the beginning of the 1980's, has done a

research to evaluate the impacts of government support price programs on the

financial structure of the farms of US (Barry P. J., 1980b). In his

calculation, he used three pre-tax discount factors of 10%, 12% and 14%,

corresponding to an after tax discount factor of 7.8%, 8.16% and 7.0%

respectively. However, here the author selected the three pre-tax discount

factors arbitrarily.

More recently, Johnson M. R. (Johnson, 2002) presented its

method to calculate the capitalization rate for Kansas in a case study. He

starts first with the loan rate offered to farmers, and then he adds a

discretionary increase based on the risk premium and the tax effect. He obtains

a capitalization rate of 14.71% in 2000 (with a loan rate level of 8.94% and a

corporate tax rate at 30%). Using his method we would obtain around 10.5% of

capitalization rate for France (with a loan rate level of 3.5% and a corporate

tax rate at 33%). The discount factors found in the literature are therefore

ranging from 7.0% for the lowest, to 14.71% for the most recent study found

from the US. However, it would be hard to apply these methods to the French

context, because most of these discount factors are somehow based on

discretionary risk premiums or they are chosen totally arbitrarily.

3 Research Methodology

One of the main objectives of this research is to give new

decision tools for farmers' consultants to evaluate the expected profitability

of their customers' projects or farms. In this section, the preparation of this

research will be presented.

3.1 Survey Construction

A small survey designed to collect different perspectives from

accounting and consulting companies, mainly from the network CEFRANCE:

- First, the network of the CERFRANCE represents more than 50%

of the market of farming consulting. The remaining market shares are shared by

many different organizations with no comparable size to the leader.

- Then, the methodologies used in the different CERFRANCE are

based on the same recommendations from the head of the network (the CNCER).

Therefore, we can obtain a clear view of the methodologies used by consultants

without a large survey.

3.1.1 Questionnaire

The purpose of this questionnaire is twofold:

- Confirm of reject my initial observation which stands

that farm consultants use discount rates based on loan rates plus a risk

premium around 2%.

- Test the willingness of farm consultants to use the

WACC to approximate the cost of capital of their customers in their

region.

To test these hypotheses, an internet-based survey of 9

questions was sent to 25 consultants in France. In order to improve the answer

rate, the questionnaire was sent only to farm consultants who were linked to me

in a professional social network (Viadéo® or Linked

In®). As these consultants are all French, it has been written

in French (see Appendix 3).

This choice of consultants introduces a first bias: mostly

young professionals use professional social networks. However, as young

consultants are less experimented, it is common sense to believe that they are

taught with the last methods developed or chosen by their consulting companies.

Therefore, this choice of population was motivated by its efficiency to collect

up to date information at the minimal cost.

3.1.2 Results Analysis

As the number of participants was reduced, analysis of the

results was only descriptive (percentages, average and medians) and no

statistical tests were performed. However, these results were sufficient to be

conclusive.

3.2 Historical Analysis of the Results of Farms in

Isère

3.2.1 Data Collection

The data used in this part of the research have been extracted

from the database of the CERFRANCE

Isère. This database has 5 years

of results available, for 2 000 farms operating in Isère.

CERFRANCE

Isère is the leading accounting company in the area,

serving more than 50% of the 3 999 professional

farms of the department (Agreste, 2011). Therefore, we can

consider the results extracted from this sample as representative of the

population of farmers of Isère. This is why the inclusion criteria for

the extractions were as wide as possible:

- All companies which are taxed at the

«bénéfice réel», which means that they are

obligated to produce a balance sheet, a profit and loss statement and a cash

flow statement to the tax administration. All the companies with a turnover

above 76 300 € are concerned by this obligation. This inclusion criterion

is obvious because without books accounts profitability or leverage ratios

cannot be calculated.

- All companies that are taxed under the

«Bénéfice agricole» regime, which means that more than

70% of their turnover comes from agricultural activities. This inclusion

criteria has been chosen to minimize the impact of forestry, environmental

services and other activities practiced by some farmers.

The software used at the CERFRANCE Isère (Panda) cannot

produce extractions for several years at one time neither an extraction with

all the data about a year in one file. Therefore, two extractions were made for

each year:

- One excel sheet with all the balance sheet information

available (146 data per farm, from

surface, number of labor units to asset valuation. See Appendix 1

for illustration),

- A second excel sheet with all profit & loss and cash flow

statement information (143 data per farm. See Appendix 2 for illustration)

|

Years of extraction

|

|

Number of farms after extraction Number of farms

selected

|

2006 2007 2008 2009 2010

1 060 620

1 231 620

1 199 620

919 620

1 054 620

Table 7: Primary data for the analysis of farms' results

in Isère

As presented in Table 7, the number of companies available is

not constant. This effect is due to the information system structure: depending

on the way the accounting books are send to the tax administration, the results

of the farm are automatically or manually uploaded into the database. The only

exclusion criterion was to keep a constant sample over the five years.

Therefore all farms which did not have results for 1 or more year were

excluded. This exclusion criterion reduced the population of observed farms to

620.

The 620 farms have been classified into 7 specializations,

based on the production most observed in the department of Isère (see

Figure 12). A farm generating 2/3 of its turnover from one main production was

considered as specialized in this production. Cattle ranching corresponds to

the beef production (sheep or other ruminants were considered as diversified

production as they do not represent enough farms to constitute a group). Walnut

productions, vegetables and fruit growing

were not analyzed as the number of farms observed was too low to

make groups based on their financial leverage.

256

13 28 11

45

141

Dairy farming

Grain

Cattle ranching Diversified production Vegetables

126 Walnut production

Fruit growing

Figure 12: Number of farm for each

specialization

3.2.2 Data Processing

The raw data extracted from the database were to be analyzed.

First, the self-employed labor unit costs are not always taken into accounts

into the books, due to accounting regulations. Therefore, the data have been

transformed to include a labor cost for each labor unit at the SMIC (minimum

salary level in France for a FTE, Table 8):

|

Years

|

2006

|

2007

|

2008

|

2009

|

2010

|

|

SMIC before social tax per month

|

1 254.28€

|

1 280.07€

|

1 308.88€

|

1 337.70€

|

1 343.77€

|

Table 8: Cost of each labor unit per month for the

SMIC

Another element had to be transformed in order to have

reliable results: social security contributions. This cost is tax deductible,

but depending on the legal form of the company it can be treated outside of the

balance sheet and profit & loss statements. The calculation of these

contributions depends on many factors, such as the year of installation of the

farmer, his average profits for the last 3 years (an option exists to calculate

it only with last year results). An important element is that only farmers who

operate in limited liability legal form have the possibility to treat these

contributions off-balance sheet. Their results are most of the time

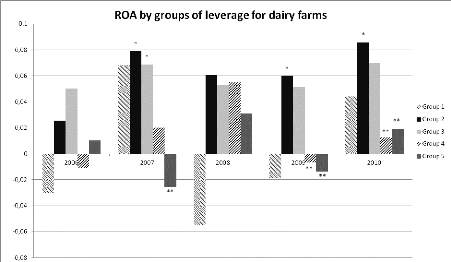

significantly higher, justifying that the added contributions should be on

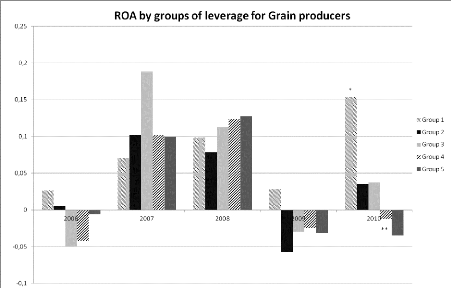

average higher than the contributions in books. The contributions were

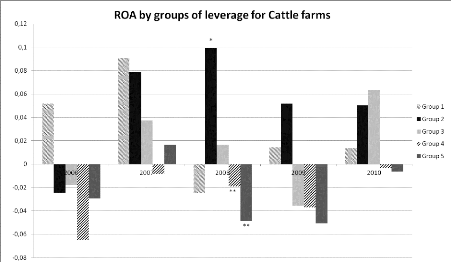

calculated based on the results of the annual accounting results (in reality,

the years' results are taxed over 3 years: N-1, N-2 and N-3 for most farms).

This recalculation introduced a bias in this research, but the accounting

principles of the company have been adapted to avoid this bias for future

researches. For 2012 and after, all social contributions will be recorded in

the database.

|

Years

|

# of companies without

social security contribution in books

|

Average contribution added

|

|

Average contribution in

books

|

Average

contribution for the population

|

|

2006

|

77

|

(12%)

|

7

|

061

|

€

|

7

|

193 €

|

7

|

176 €

|

|

2007

|

110

|

(18%)

|

11

|

871

|

€

|

7

|

009 €

|

7

|

871 €

|

|

2008

|

139

|

(22%)

|

12

|

633

|

€

|

7

|

371 €

|

8

|

551 €

|

|

2009

|

153

|

(25%)

|

10

|

124

|

€

|

8

|

230€

|

8

|

697 €

|

|

2010

|

162

|

(26%)

|

6

|

539

|

€

|

7

|

488 €

|

7

|

241 €

|

Table 9: Social security contributions

3.2.3 Research Questions

The main goal of this analysis is to test the traditionalist

approach which states that an optimal level of debt helps to reduce the WACC

(Brealey, Myers, & Allen, 2008, p. 485). If this theory holds in

agriculture, a positive link between the debt level and profitability or

productivity should be observed. Therefore, the research question can be stated

with two hypotheses.

The dependant variables tested are:

- ROA: return on asset.

- ROE: return on equity.

The Independent variables tested is:

- Level of debt of the company.

First hypothesis:

H0: ROA and ROE tend to increase with the level of debt

of the farms in Isère.

H1: ROA and ROE have no positive links with the level of

debt of the farms in Isère

Second hypothesis:

H0: Financial distress may occur when leverage increases,

reducing ROA or ROE. H1: No signs of financial distress are clearly observed

when the leverage increases.

The second hypothesis is common sense. However it has to be

tested for agriculture. Milk production was really stable for years, because

the market was controlled thanks to the system of quotas. Therefore, as the

volume of production is somehow easy to control, financial performances of the

farms are easy to predict, limiting strongly the risks of financial

distress.

3.2.4 Data Analysis

The WACC theory assumes that there is an optimal debt level to

reduce the cost of capital of the company and then increase its overall

performance (see Figure 1 page 12). Therefore, ROE and ROA were analyzed by

groups of leverage in order to verify if this theory holds in agriculture. The

groups more leveraged should have better results in terms of ROE and ROA than

low leverage groups. We should also observe more variability and/or lower

results for groups with really high leverages like group 1 or 2 (Table 10).

This observation would be considered as financial distress.

As presented in part 3.2.2, the data had to be processed to be

exploited. The ROE, ROA and leverage also have to be calculated considering the

specificity of the accounting standards used at the CEFRANCE Isère.

Therefore, ROE and ROA were calculated as follow:

E

P -- w E + P c P -- w

-- P

L

- P: Profit,

- Wc: cost of labor (each FTE self-employed unit of labor

received a cost of the SMIC),

- E: shareholders equity. As no financial market exists to

estimate a market value of farm's

equity in agriculture, the book value had

to be retained,

- Pca: partners current accounts. These amounts are considered

as debt from an accounting perspective. However, it is not considered by

convention as a debt but as shareholder's equity from a consultant perspective

because these «partners» are the shareholders,

- A: total assets,

- L: leverage,

- D: total debts. The value retained was book value, as the

database do not includes

information allowing a recalculation at market value. However,

the interest rate was analyzed at the market value,

- tl: total liabilities.

|

Leverage

|

L < 20%

|

20%= L <40%

|

40%= L <60%

|

60%= L <80%

|

80% < L

|

|

Group #

|

5

|

4

|

3

|

2

|

1

|

Table 10: Groups of debt level

In order to compare the groups, a set of statistical tests

were performed with the software Statgraphic Centurion:

- Shapiro Wilk test and Kolmogorov test for the normality of

the datasets. Density trace and histograms were also used for sample sizes

bigger than 2 000 farms (Shapiro Wilk test cannot be performed for this size of

samples). Normality was tested before each test.

- One-way ANOVA and multiple range comparison to compare the

means of the different groups when the assumptions of normality and homogeneity

of variance were verified.

- When the assumption of normality or homogeneity of variance

was rejected, a non parametric test was used (Kruskal-Wallis). As normality and

equivalence of the variance are the base-assumptions of the ANOVA, the means

cannot be compared if these two hypotheses are not verified. The Kruskal-Wallis

test compares the rank of each observation to overcome this limitation, and

tests if the medians are significantly different or not.

- Mood's and Median test to analyses the medians. It is a

non-parametric test which compares the distribution of each sample around the

overall median of all the groups. Therefore, this test can estimate if the

medians are significantly different.

First, the effect of time was tested. As time has an effect on

ROE or ROA, separate tests were performed for each year in order to isolate the

time effect and analyze the effect on leverage more accurately. Then, the

effect of specialization was tested. As specialization has an effect on ROE or

ROA, separate tests were performed for each specialization to improve the

robustness of the results. The risk error (alpha) represents the risk to reject

the null hypothesis tested when it should be

considered actually true. Because 10% is an acceptable level of

risk error in finance, this alpha was used for all statistical tests in this

research.

3.3 Bond Yield Plus Risk Premium Model

The first method to estimate the capitalization rate was the

method used by the French tax authority. Farming consultants have to keep in

mind that their valuation methods can be used as the base of the calculation

for a capital gain on the sale of a company. The tax authority therefore has

the right to modify the tax base if it considers that the results do not

represent a fair value at the time of the transaction. The most common tax

adjustment in those cases is the hidden donation, when the tax authority

considers that the company or its shares (not publicly tradable in the case of

most farms) are undervalued. This is why it is necessary to include the methods

used by the administration in this study. In reality, this method is based on

the CAPM, as the risk premium is the difference with the total expected return

minus the risk-free return. The actualization rate formula can be presented in

this way:

A: Actualization rate,

Rf: Risk free rate,

â: Beta,

Rp: Risk premium for the French market.

3.3.1

Risk-Free Rate

As presented by Sharpe (1964) it was assumed that everyone can

borrow or lend its funds at a «pure rate of interest». This risk-free

rate is considered by the tax authority as the government bonds rate (Direction

Générale des Impots, 2006), and was assumed in this paper as

equivalent to the French government debt reference rate, given by the French

central bank (a 12 month average of the 10 years bonds monthly average was

used).

3.3.2 Beta and Risk premium

The risk free rate has to be increased by a risk premium,

justified by the necessary supplementary yield that a risky asset needs to

deliver compare to a pure interest rate. The tax authority recommends using the

historical risk premium observed in the French economy, which can be increased

to consider the size of the company studied. For the calculations, the

references of the tax authority were used, and an increase to consider that we

are dealing with micro-capitalization.

The first bias that arises is easy to consider, as stated by

Damodoran (2011), would be to include 2008 stock results in our time-frame: the

major crash observed this year would diminish the results significantly,

leading investors to think that the risk would be lower after the 2008 crisis

than before. However, from a pragmatic point of view, this could be considered

as logical: there is less risk of a major historical crisis after it happens

than before, like there are less risks of a centenary flood after ones

happen.

The Beta is used to consider the risk relative to the company

and the sector in which it operates (Direction Générale des

Impots, 2006). Once again, the tax authority produced some recommendation and

we will base our calculation on it. We will compare this beta with the beta

observed by another author for agriculture in France.

3.4 WACC Estimation

Regarding the WACC estimation, 2 types of data will be used:

primary and secondary data. For primary data, we will use:

- Results of the farms from Isère extracted from the

database of the CERFRANCE Isère to calculate the weighted average

leverage by specialization. The time frame of the dataset is 2006-2010, with

620 farms. The characteristics of this dataset are presented in detail in part

3.2.

- Sample collection of 46 recent loan's rate for all

specialization in the database of the

CERFRANCE Isère, to determine the market value of the cost

of debt.

Regarding secondary data, we will use:

- The market capitalization and the beta calculated by Bloomberg

for all the companies listed

in North America and Western Europe for the following

activities: Oilseed farming, grain farming, cattle ranching and farming,

poultry, fruits & vegetables. Those activities have been chosen because

they are really close to the specialization of the farms of Isère.

- Risk-free rate of return: the 10 year government bonds yield

calculated by the French central bank will be used. The 12 month average of

this rate will be used. This choice of long term maturity was determined by the

timeframe of the investments of French farms. Even in grain production,

investments are made for 7 years on average, and the rotation timeframe for the

crops is 3 to 4 years. For dairy farms, constructions are amortized over 20

years on average.

- Risk premium for small companies, as determined in part

2.1.2.

The extraction from Bloomberg helped to identify 41 companies

specialized in agriculture in Western Europe and US (see Table 11). The grain

market is globalized today, and the meat market is really influenced by world

prices either. These statements are not so true for the dairy market, because

the cost of refrigerated transportation is quite high regarding the price of

milk. The European market is a more representative market for dairy production

therefore.

The beta of each firm will be weighted averaged with the

market capitalization, in order to obtain a beta for each specialization and

each region. However, for grain farming we will retain the beta of oilseed and

grain farming for Western Europe and the US together. The grain market is so

interconnected between Europe and US that the market-risk is really close. For

the grain farming in Isère, we will retain the beta of oilseed farming

and grain farming, because oilseed production is considered as grain production

in the French classification. For dairy and cattle farming, we will retain the

beta of cattle ranching and farming of Western Europe. For diversified

production and the average farm of Isère, we will retain the average

beta of the 41 companies extracted from the Bloomberg database.

|

Specialization

|

Total market cap

(M $)

|

# of companies in western Europe

|

# of companies in

the US

|

Total # of companies

|

|

Oilseed farming

|

5 810

|

11

|

0

|

11

|

|

Grain

|

14 421

|

9

|

4

|

13

|

|

Cattle ranching

|

8 196

|

4

|

3

|

7

|

|

poultry

|

2 321

|

1

|

2

|

3

|

|

Fruits & vegetables

|

2 224

|

3

|

4

|

7

|

|

Total

|

32 971

|

28

|

13

|

41

|

Table 11: Number of companies studied for the Beta

estimation. Source: Bloomberg

The last element of the WACC formula is the corporate tax

rate. This element is really hard to determine in agriculture, because farmers

have the choice between the corporate tax rate at 15% (up to 38 120 € of

net income and 33.33% after) and the personal income tax with its progressive

tax rate from 0% to 41%, depending on the total income per capita of the

household. Moreover, the net income is also subject to social tax, at an

average rate of 32.1%. Therefore, to simplify our calculation we will assume a

corporate tax rate at 33.33%, which is the usual corporate tax rate in France

(only companies held at 75% by persons have the benefit of the 15% tax rate up

to 38 120 €). This rate is chosen in most studies about profitability for

other industries in France. Therefore, it will simplify comparisons. As the

French farms are small companies, it is not obvious that this tax rate could

increase in the coming years. The actual government considers that SEM's are

too much taxed compare to the blue chips.

4 Data Analysis

4.1 Results of the Survey

Fourteen farm consultants answered to the survey, from almost all

regions of France (Figure 13). Therefore, the results are not influenced by

only one CERFRANCE.

1 Region of the respondents

2

1

4

1

3

West North

North west East

South east South west

Center

Figure 13: Region of the CERFRANCE of the

respondents

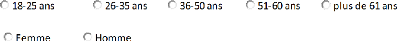

Regarding the age and the gender, the major part of the

respondents are male consultants aged between 26 and 35 years old as we can see

in Table 12.

|

18-25 y

|

26-35 y

|

35-50 y

|

51- and more y

|

|

Age

|

1

|

11

|

2

|

-

|

|

Male

|

1

|

10

|

2

|

-

|

|

Female

|

-

|

1

|

-

|

-

|

Table 12: Age and gender of the respondents

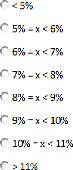

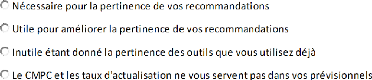

Out of the 14 respondents, 13 said that they realized project

business plans for their customers. However, only 79% said that they used

discount factors to evaluate the value of their customers' companies in

question 5. Less surprising are the answers to question 6, where 89% answered

that they used the NPV method to estimate the profitability of a project (see

Table 13).

Do you realize project business plans for your customers?

Do you use discount factors to evaluate the value of your

customers' companies?